Hong Kong Monthly Research

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Premium Brand Solidfoundations Customer Focus

Foundations Premium Brand Premium 2015/16 Solid Customer Focus Customer Annual Report Stock Code : 16 2015/16 Annual Report C007445 Contents 2 Board of Directors and Committees 3 Corporate Information and Information for Shareholders 4 Financial Highlights and Land Bank 6 Group Financial Summary 7 Business Structure 8 Chairman’s Statement 24 Business Model and Strategic Direction 26 Review of Operations 28 Hong Kong Property Business 54 Mainland Property Business 74 Property Related Businesses 83 Telecommunications and Information Technology 84 Infrastructure and Other Businesses 87 Corporate Finance 88 Financial Review 92 Investor Relations 94 Sustainable Development 102 Corporate Governance Report 115 Directors’ Report 140 Directors’ Biographical Information 150 Executive Committee 151 Consolidated Financial Statements Board of Directors and Committees Board of Directors Executive Directors Kwok Ping-luen, Raymond (Chairman & Managing Director) Wong Chik-wing, Mike (Deputy Managing Director) Lui Ting, Victor (Deputy Managing Director) Kwok Kai-fai, Adam Kwok Kai-wang, Christopher Kwong Chun Tung Chi-ho, Eric Fung Yuk-lun, Allen Kwok Ho-lai, Edward (Alternate Director to Kwok Ping-luen, Raymond) Non-Executive Directors Lee Shau-kee (Vice Chairman) Woo Po-shing Kwan Cheuk-yin, William Woo Ka-biu, Jackson (Alternate Director to Woo Po-shing) Independent Non-Executive Directors Yip Dicky Peter Wong Yue-chim, Richard Li Ka-cheung, Eric Fung Kwok-lun, William Leung Nai-pang, Norman Leung Kui-king, Donald Leung Ko May-yee, Margaret Committees -

Branch List English

Telephone Name of Branch Address Fax No. No. Central District Branch 2A Des Voeux Road Central, Hong Kong 2160 8888 2545 0950 Des Voeux Road West Branch 111-119 Des Voeux Road West, Hong Kong 2546 1134 2549 5068 Shek Tong Tsui Branch 534 Queen's Road West, Shek Tong Tsui, Hong Kong 2819 7277 2855 0240 Happy Valley Branch 11 King Kwong Street, Happy Valley, Hong Kong 2838 6668 2573 3662 Connaught Road Central Branch 13-14 Connaught Road Central, Hong Kong 2841 0410 2525 8756 409 Hennessy Road Branch 409-415 Hennessy Road, Wan Chai, Hong Kong 2835 6118 2591 6168 Sheung Wan Branch 252 Des Voeux Road Central, Hong Kong 2541 1601 2545 4896 Wan Chai (China Overseas Building) Branch 139 Hennessy Road, Wan Chai, Hong Kong 2529 0866 2866 1550 Johnston Road Branch 152-158 Johnston Road, Wan Chai, Hong Kong 2574 8257 2838 4039 Gilman Street Branch 136 Des Voeux Road Central, Hong Kong 2135 1123 2544 8013 Wyndham Street Branch 1-3 Wyndham Street, Central, Hong Kong 2843 2888 2521 1339 Queen’s Road Central Branch 81-83 Queen’s Road Central, Hong Kong 2588 1288 2598 1081 First Street Branch 55A First Street, Sai Ying Pun, Hong Kong 2517 3399 2517 3366 United Centre Branch Shop 1021, United Centre, 95 Queensway, Hong Kong 2861 1889 2861 0828 Shun Tak Centre Branch Shop 225, 2/F, Shun Tak Centre, 200 Connaught Road Central, Hong Kong 2291 6081 2291 6306 Causeway Bay Branch 18 Percival Street, Causeway Bay, Hong Kong 2572 4273 2573 1233 Bank of China Tower Branch 1 Garden Road, Hong Kong 2826 6888 2804 6370 Harbour Road Branch Shop 4, G/F, Causeway Centre, -

Gtr Ne25 408.Pdf

Perception of High-density Living in Hong Kong by LAWRENCE H. TRAVERS, assistant professor, State University of New York, College of Arts and Science, Oswego, N. Y. ABSTRACT.-Analysis of the Hong Kong experience of adaptation to urban living can provide insights into some of the problems that can be expected to occur in the rapidly expanding cities of the Third World. Population densities in Hong Kong are among the highest in the world, exceeding 400,000 persons per square mile in parts of Kowloon. Research based upon residence in a worker's dormitory and interviews with workers reveals a variety of adaptive strategies employed by people to cope with the stress of the crowded urban environment. An understanding of the individual's ability to adjust to the stress of high-density living must consider the meaning of density as a concept in the culture in addition to social and cultural norms. DESPITEDECADES OF CONCERN informal conversations with many of the about the possible effects of high residents, and through structured inter- living densities upon human behavior, views with cooperative individuals. we know very little about mankind's ability to adapt to crowded conditions. ACTUAL POPULATION DENSITIES Fears persist that the presence of a be- Densities in Hong Kong are among havioral sink among rat populations the highest in the world. In 1971 the forced to live in very crowded quarters Mongkok area in Kowloon had a density (Calhoun 1962) might have a correlate of 154,677 persons per square kilometer in human populations. Perhaps rather (or 400,612 persons per square mile) than simply observing human behavior which is almost five times the living den- in dense conditions, we might more sity of Manhattan Island (H. -

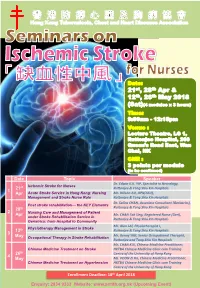

21St, 28Th Apr & 12Th, 26Th May 2018 (Sat)(4 Modules X 3 Hours)

Date: 21st, 28th Apr & 12th, 26th May 2018 (Sat)(4 modules x 3 hours) Time: 9:00am - 12:15pm Venue : Lecture Theatre, LG 1, Ruttonjee Hospital, 266 Queen’s Road East, Wan Chai, HK CNE : 3 points per module (to be confirmed) Date Topic Speaker Dr. Edwin K.K. YIP, Specialist in Neurology, Ischemic Stroke for Nurses 21st Ruttonjee & Tang Shiu Kin Hospitals 1 Apr Acute Stroke Service in Hong Kong: Nursing Mr. Wilson AU, APN(ASU), Management and Stroke Nurse Role Ruttonjee & Tang Shiu Kin Hospitals Dr. Selina CHAN, Associate Consultant (Geriatrics), Post stroke rehabilitation— the KEY Elements 28th Ruttonjee & Tang Shiu Kin Hospitals 2 Nursing Care and Management of Patient Apr Mr. CHAN Tak Sing, Registered Nurse (Geri), under Stroke Rehabilitation Service in Ruttonjee & Tang Shiu Kin Hospitals Geriatrics: from Hospital to Community Mr. Alan LAI, Physiotherapist I, Physiotherapy Management in Stroke 12th Ruttonjee & Tang Shiu Kin Hospitals 3 Mr. Benny YIM, Senior Occupational Therapist, May Occupational Therapy in Stroke Rehabilitation Ruttonjee and Tang Shiu Kin Hospitals Mr. CHAN KUI, Chinese Medicine Practitioner, Chinese Medicine Treatment on Stroke HKTBA Chinese Medicine Clinic cum Training 26th Centre of the University of Hong Kong 4 May Ms. POON Zi Ha, Chinese Medicine Practitioner, Chinese Medicine Treatment on Hypertension HKTBA Chinese Medicine Clinic cum Training Centre of the University of Hong Kong Enrollment Deadline: 18th April 2018 Enquiry: 2834 9333 Website: www.antitb.org.hk (Upcoming Event) Seminars on “Ischemic Stroke” for Nurses Objectives a) To strengthen, update and develop knowledge of nurses on the topic of endocrine system. b) To enhance the skills and technique in daily practice. -

1O1O Next GTM Around the Island Race 2009

for immediate release 7 November 2017 Turkish Airlines Around the Island Race Sunday 12 November Over 230 entries have been received for the 2017 edition of the Turkish Airlines Around the Island Race which will take place this Sunday 12 November. This year, the Title Sponsor is Star Alliance member, Turkish Airlines. The partnership between Royal Hong Kong Yacht Club (“Best Asian Yacht Club”) and Turkish Airlines (“The airline that flies to more countries than any other airline and the Skytrax award winner for four key categories in 2017”) will bring a lot of excitement to the Around the Island Race as the fleet flies around Hong Kong Island. Turkish Airlines is also sponsoring an Around the Island Race photography competition which will see one lucky person being chosen to win a return business class ticket from Hong Kong to any worldwide destination* operated by Turkish Airlines. Serhat Sari, General Manager of Turkish Airlines Hong Kong, said “we are very excited to be the Title Sponsor for Around the Island Race - the biggest public sailing event of the year in Hong Kong.” Mr. Sari continued, “This year is our 15th anniversary of operation in Hong Kong and we hope that through this sponsorship engagement with the sailing participants and a campaign with the public, will bring Turkish Airlines’ brand and service commitment even closer to this Asia’s World City. Anyone with the sight of the fleet from right at the waterfront in the harbor or from up on the Peak, or perhaps somewhere at the South Side stands a chance to snap that special photo and win.” This event is Hong Kong’s largest celebration of sail and will see Victoria Harbour filled to the brim with sailboats, before they set off on the 26nm circumnavigation of Hong Kong island. -

Newly Completed Babington Hill Residences at Mid-Levels West Now on the Market

Love・Home Newly completed Babington Hill residences at Mid-Levels West now on the market Babington Hill, the latest SHKP residential project in the traditional Island West district, is nestled amidst lush greenery in close proximity to excellent transport links and famous schools. These residences have been finished to exacting standards and boast fashionable interiors with a distinctive appearance. Units are now on the market receiving an encouraging response. The best of everything Babington Hill is a rare new development for the area offering a range of 79 quality residential units with two to four bedroom layouts, all with outdoor areas, such as a balcony, utility platform, flat roof and/or roof to create an open, comfortable living environment. The development benefits from the use of high-quality building materials. The exterior design features a large number of glass curtain walls to provide transparency and create a spacious feeling. The clean and comfortable interior includes a luxurious private clubhouse equipped with a gym and an outdoor swimming pool. Famous schools and convenient transport The Development is situated next to the University of Hong Kong and Dean's Residence in the Mid-Levels of Hong Kong Island. It is near the Lung Fu Shan hiking trails, which provides quick and easy access to nature as well as a sanctuary of peace and tranquility. The area is home to a traditional and well-established network of elite schools, such as St. Paul's College, St. Stephen's Girls' College and St. Joseph's College, all of which provide excellent scholastic environments for the next generation to learn and thrive. -

1193Rd Minutes

Minutes of 1193rd Meeting of the Town Planning Board held on 17.1.2019 Present Permanent Secretary for Development Chairperson (Planning and Lands) Ms Bernadette H.H. Linn Professor S.C. Wong Vice-chairperson Mr Lincoln L.H. Huang Mr Sunny L.K. Ho Dr F.C. Chan Mr David Y.T. Lui Dr Frankie W.C. Yeung Mr Peter K.T. Yuen Mr Philip S.L. Kan Dr Lawrence W.C. Poon Mr Wilson Y.W. Fung Dr C.H. Hau Mr Alex T.H. Lai Professor T.S. Liu Ms Sandy H.Y. Wong Mr Franklin Yu - 2 - Mr Daniel K.S. Lau Ms Lilian S.K. Law Mr K.W. Leung Professor John C.Y. Ng Chief Traffic Engineer (Hong Kong) Transport Department Mr Eddie S.K. Leung Chief Engineer (Works) Home Affairs Department Mr Martin W.C. Kwan Deputy Director of Environmental Protection (1) Environmental Protection Department Mr. Elvis W.K. Au Assistant Director (Regional 1) Lands Department Mr. Simon S.W. Wang Director of Planning Mr Raymond K.W. Lee Deputy Director of Planning/District Secretary Ms Jacinta K.C. Woo Absent with Apologies Mr H.W. Cheung Mr Ivan C.S. Fu Mr Stephen H.B. Yau Mr K.K. Cheung Mr Thomas O.S. Ho Dr Lawrence K.C. Li Mr Stephen L.H. Liu Miss Winnie W.M. Ng Mr Stanley T.S. Choi - 3 - Mr L.T. Kwok Dr Jeanne C.Y. Ng Professor Jonathan W.C. Wong Mr Ricky W.Y. Yu In Attendance Assistant Director of Planning/Board Ms Fiona S.Y. -

GEO REPORT No. 282

EXPERT REPORT ON THE GEOLOGY OF THE PROPOSED GEOPARK IN HONG KONG GEO REPORT No. 282 R.J. Sewell & D.L.K. Tang GEOTECHNICAL ENGINEERING OFFICE CIVIL ENGINEERING AND DEVELOPMENT DEPARTMENT THE GOVERNMENT OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION EXPERT REPORT ON THE GEOLOGY OF THE PROPOSED GEOPARK IN HONG KONG GEO REPORT No. 282 R.J. Sewell & D.L.K. Tang This report was originally produced in June 2009 as GEO Geological Report No. GR 2/2009 2 © The Government of the Hong Kong Special Administrative Region First published, July 2013 Prepared by: Geotechnical Engineering Office, Civil Engineering and Development Department, Civil Engineering and Development Building, 101 Princess Margaret Road, Homantin, Kowloon, Hong Kong. - 3 - PREFACE In keeping with our policy of releasing information which may be of general interest to the geotechnical profession and the public, we make available selected internal reports in a series of publications termed the GEO Report series. The GEO Reports can be downloaded from the website of the Civil Engineering and Development Department (http://www.cedd.gov.hk) on the Internet. Printed copies are also available for some GEO Reports. For printed copies, a charge is made to cover the cost of printing. The Geotechnical Engineering Office also produces documents specifically for publication in print. These include guidance documents and results of comprehensive reviews. They can also be downloaded from the above website. The publications and the printed GEO Reports may be obtained from the Government’s Information Services Department. Information on how to purchase these documents is given on the second last page of this report. -

Case Sharing on BEAM Plus New Buildings V1.2 Final Platinum Project - One Taikoo Place

Organised by BEAM Society Limited (BSL) [Webinar] Case Sharing on BEAM Plus New Buildings v1.2 Final Platinum Project - One Taikoo Place Image courtesy: Swire Properties Limited Introduction One Taikoo Place (OTP) is a new and prestigious office development project of Swire Properties Ltd. Its redeveloped Somerset House at Taikoo Place in Quarry Bay, Hong Kong and start operation in the end of year 2018. The project has been constructed according to the highest standards of building sustainability, and achieved BEAM Plus Final Platinum, LEED certification Platinum and WELL certification Platinum. OTP was developed a best in class, green and sustainable building from demolition, design, construction to operation. It becomes a leader of high-performance sustainable buildings in Hong Kong. OTP also embraces modern integrated design. This positions sustainability at the heart of design and brings the design team together from the earliest project stage to jointly develop solutions. This fosters innovation and the application of new sustainable technologies and processes. With the desire of Swire Vision "Create Transformation", OTP was also transformed as new digital hub that seamlessly connects spaces, services, and people by leveraging advanced digital innovation technologies. Speakers Ir Raymond Kwok Project Manager Swire Properties Limited Raymond Kwok was trained as Mechanical Engineer and focused in HVAC and advanced engineering design after his graduation from the Hong Kong University of Science and Technology. He achieved Hong Kong professional engineer qualification in Mechanical Engineering division since year 2002. Currently, he is a project manager in Swire Properties Limited. Throughout his career, He involved in many privileged projects such as MTR Tseung Kwan O Extension, West Rail Line, One Island East, City Plaza East Hotel, Opus Hong Kong, etc. -

Residential Leasing July 2016

Savills World Research Hong Kong Briefi ng Residential leasing July 2016 Image: The Babington, Mid-Levels West SUMMARY Mainlanders are having more of an impact on the upper-end leasing market than at any time. Vacancies in the luxury apartment Housing budgets in the banking, segment remain low and budgets of insurance and legal industries are 40% "Luxury rents were broadly HK$40,000 to HK$100,000 per month below what they were at the peak in are most active. 2012 and if anything, the tendency is stable in the second quarter still to downsize. We have noticed a shift in tenant despite a lack of traditional profi les over the past few months We saw a 0.3% rise in Kowloon demand from MNCs and as Mainlanders who have recently rents but a 1.0% fall in rents in the obtained Hong Kong ID cards look for New Territories. banks." Simon Smith, Savills Research top end apartments to rent. We witnessed a stronger Luxury apartment and townhouse downward pressure on rents in the rents remained stable over Q2/2016, lower-end segment of the serviced despite a lack of traditional demand apartment market. from senior executives of MNCs and banks. savills.com.hk/research 01 Briefi ng | Hong Kong residential leasing July 2016 Market commentary GRAPH 1 Vacancies in the luxury apartment Hong Kong Island luxury rental indices by district, segment remain low and budgets of Q1/2003–Q2/2016 HK$40,000 to HK$100,000 per month are most active. We have, however, Mid-Levels Pokfulam The Peak Happy Valley/Jardine's Lookout Southside/Shouson Hill 300 noticed a shift in tenant profi les over recent months as Mainlanders who have recently obtained Hong 250 Kong ID cards look for top end apartments to rent. -

The Hongkong and Shanghai Banking Corporation Branch Location

The Hongkong and Shanghai Banking Corporation Bank Branch Address 1. Causeway Bay Branch Basement 1 and Shop G08, G/F, Causeway Bay Plaza 2, 463-483 Lockhart Road, Causeway Bay, Hong Kong 2. Happy Valley Branch G/F, Sun & Moon Building, 45 Sing Woo Road, Happy Valley, Hong Kong 3. Hopewell Centre Branch Shop 2A, 2/F, Hopewell Centre, 183 Queen's Road East, Wan Chai, Hong Kong 4. Park Lane Branch Shops 1.09 - 1.10, 1/F, Style House, Park Lane Hotel, 310 Gloucester Road, Causeway Bay, Hong Kong 5. Sun Hung Kai Centre Shops 115-117 & 127-133, 1/F, Sun Hung Kai Centre, Branch 30 Harbour Road, Wan Chai, Hong Kong 6. Central Branch Basement, 29 Queen's Road Central, Central, Hong Kong 7. Exchange Square Branch Shop 102, 1/F, Exchange Square Podium, Central, Hong Kong 8. Hay Wah Building Hay Wah Building, 71-85 Hennessy Road, Wan Chai, Branch Hong Kong 9. Hong Kong Office Level 3, 1 Queen's Road Central, Central, Hong Kong 10. Chai Wan Branch Shop No. 1-11, Block B, G/F, Walton Estate, Chai Wan, Hong Kong 11. Cityplaza Branch Unit 065, Cityplaza I, Taikoo Shing, Quarry Bay, Hong Kong 12. Electric Road Branch Shop A2, Block A, Sea View Estate, Watson Road, North Point, Hong Kong 13. Island Place Branch Shop 131 - 132, Island Place, 500 King's Road, North Point, Hong Kong 14. North Point Branch G/F, Winner House, 306-316 King's Road, North Point, Hong Kong 15. Quarry Bay Branch* G/F- 1/F, 971 King's Road, Quarry Bay, Hong Kong 16. -

LC Paper No. CB(2)740/18-19(01)

LC Paper No. CB(2)740/18-19(01) 財經事都及庫 5 局 FINANCIAL SERVICES AND THE TREASURY BUREAU (庫都科) (The Treasury Branch) 香港添馬添美道二號 24/F, Central Government Offices 2 Tim Mei Avenue, Tamar 政府總部二十四樓 Hong Kong 傳真號碼 Fax No. 25240567 電話號碼 T e l. No. 28103755 本函檔號 Our Ref. TsyB E 173/675-1011116/0 Pt.7 來函檔號 Your Ref. 29 January 2019 扎1iss Betty Ma Clerk to Panel on Security Legislative Council Complex 1 Legislative Council Road Central HongKong Dear Miss ~在a , Follow up to Panel on Security meeting held on 4 December 2018 一 Relocation of the Wan Chai Government Offices Compound (WCGOC) At the meeting of the Panel on Security (the Panel) held on 4 December 2018, the Panel requested the Government to provide information on the Govemment's plan to relocate the three office buildings at WCGOC to facilitate the consideration of the funding proposal for the Immigration Headquarters project by the Public Works Sub-commi ttee. - 2 - 1 attach the relevant supplementary information at Annex for Members' reference. Yours sincerely, (Herman So) for Secretary for Financial Services and the Treasury c.c. Secretary for Security (Fax: 2147 3165) Secretary for Commerce and Economic Development (Fax: 2918 1273) Govemment Property Administrator (Fax: 2827 1891) Director of Architectural Services (Fax: 2523 4693) Govemment ChiefInformation Officer (Fax: 2824 3208) Commissioner ofInland Revenue (Fax: 2802 7597) Director ofImmigration (Fax: 24464333) Director ofWater Supplies (Fax: 28242757) Commissioner ofCorrectional Services (Fax: 28249130) Director ofDrainage Services (Fax: 3103 0023) Judiciary Administrator (Fax No. 2413 8737) Annex Relocation of the Wan Chai Government Offices Compound This note gives an overview of the relocation exercise of the Wan Chai Government Offices Compound (WCGOC).