Eastern Pennsylvania Southern New Jersey Delaware

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

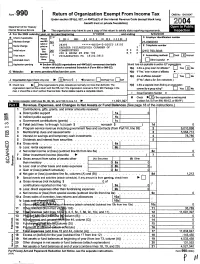

Return of Organization Exempt from Income

Form' 99'0 Return of Organization Exempt From Income Tax OMB No 1545-0047 -Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung 2j 004 benefit trust or private foundation) [L Department of the Treasury 0 • ' • " • Internal Revenue Service Jill, The organization may have to use a copy of this return to satisfy state reporting requirements. IW-Nis eilrel l. A For the 2004 calendar ear or tax year beginning 7/1/2004 and ending 6/30/2005 C N D Employer Identification number B Check if applicable. Please Illt���l�nnl�'��nlrlll Il�ll�l111111 �llln�l�l�t��rl�� Add ress change use IRS Gr! 23-0969030 label or 28395 *****"AUTO**5-DIGIT 19102 Name change print or IN E Telephone number GREATER PHILADELPHIA CEiAMBER OF I initial return type COMMERCETERS P 4 R Fj See 20( B 9 S 215 790-3646 specific 200 S BROAD ST STE 700 C F Accounti ng method : ❑Cash EX Accrual FIFinal return Instruc- PHILADELPHIA PA 19102 - 3813 dons. ► fl Amended return Phi l 31 I]Other (specify) El Application pending • Section 501 (c)(3) organizations and 4947( a)(1) nonexempt charitable H and I are not applicable to section 527 organizations. trusts must attach a completed Schedule A (Form 990 or 990-EZ). H(a) Is this a group return for affiliates? El Yes FX No H(b) If "Yes," enter number of affiliates ► _ H(c) Are all affiliates included? 0 Yes No J Organization type (check only one) ► U501(c) (6 ) -4 (insert no) U4947(aX1) or U527 (If "No," attach a list See instructions ) K Check here ►[:]d the organization's gross receipts are normally not more than $25,000. -

Philadelphia Bar Association 2013 Young Lawyers Division Executive Committee Cabinet

PHILADELPHIA BAR ASSOCIATION 2013 YOUNG LAWYERS DIVISION EXECUTIVE COMMITTEE CABINET NAME ADDRESS & PHONE NUMBERS Aneesh A. Mehta Volpe and Koenig PC Chair United Plaza, 30 South 17th Street Philadelphia, PA 19103 215-568-6400 [email protected] Edward F. Beitz White and Williams LLP Chair-Elect One Liberty Place 1650 Market Street, Suite 1800 Philadelphia, PA 19103 215-864-6277 [email protected] Maria E. Harris Martin Banks Vice Chair 1818 Market Street, 35th Floor Philadelphia, PA 19103 215-587-8417 [email protected] Eileen F. Carroll Legal Clinic for the Disabled Secretary 1513 Race Street Philadelphia, PA 19102 215-587-3461 [email protected] Daniel J. Gillin Landman Corsi Ballaine & Ford P.C. Treasurer One Penn Center 1617 John F. Kennedy Boulevard, Suite 955 Philadelphia, PA 19103 215-561-8540 [email protected] Jeffrey N. Rosenthal Blank Rome LLP Financial Secretary One Logan Square 130 North 18th Street Philadelphia, PA 19103 215-569-5553 [email protected] PHILADELPHIA BAR ASSOCIATION 2013 YOUNG LAWYERS DIVISION EXECUTIVE COMMITTEE TERM ENDING DECEMBER 31, 2013 Jo Rosenberger Altman City of Philadelphia Law Department 1515 Arch Street, 16th Floor Philadelphia, PA 19102 215-683-5174 [email protected] Edward F. Beitz White and Williams LLP One Liberty Place 1650 Market Street, Suite 1800 Philadelphia, PA 19103 215-864-6277 [email protected] Anthony H. Chwastyk Radwell International, Inc. 111 Mount Holly Bypass Lumberton, NJ 08048 800-332-4336 x 812 [email protected] Joshu Harris District Attorney's Office Three South Penn Square Philadelphia, PA 19107 215-686-5714 [email protected] Jennifer Lin District Attorney's Office Three South Penn Square Philadelphia, PA 19107 215-686-9899 [email protected] Brielle M. -

Current and Future Market Conditions Q4 2017

Current and Future Market Conditions Q4 2017 Current and Future Market Conditions Q4 2017 Philadelphia’s CBD rallied with 250,000 SF of positive absorption during Q4, largely resulting from Jefferson HealthCare’s remarkable expansion. Absorption for the year was positive at 300,000 SF despite three relatively stagnant quarters to begin the year. The vacancy rate at year‐end is 8% with 3.2 million SF still available. New Leases: Jefferson Healthcare signed a new lease for 250,000 SF at 1101 Market Street. The healthcare group will initially lease 150,000 SF plus an additional total of 100,000 SF divided into 50,000 SF segments to be leased in two and four years, respectively. This new long‐term lease successfully backfills Aramark's departure, which will relocate to 2400 Walnut Street. Jefferson Healthcare’s explosive growth is a welcome addition to the city as it seeks to consolidate suburban mergers and acquisitions into its CBD portfolio. Additionally, Jefferson signed various lease term extensions ranging from 5‐10 years on 200,000 SF at 833 Chestnut Street. Hussian School of Art will relocate 20,000 SF from The Bourse Building to 1500 Spring Garden Street. The school entered a long‐term lease. Baker Tilly extended lease term at One Liberty Place for 11 years on the 44th and 45th floors. Simon & Simon will upgrade their image and location when they vacate 1515 Market Street to begin a new 5‐year, 30,000 SF lease on the 20th floor at 1818 Market Street. The law firm will backfill the space formerly occupied by Five Below. -

Ahead of COVID-19 Outbreak, Market Tightening

Greater Philadelphia Office, Q1 2020 Ahead of COVID-19 outbreak, market tightening Vacancy Overall Average Rate Asking Rent Yearly Net Absorption Under Construction 14.6% $27.71 PSF 415,265 SF 1,454,045 SF Figure 1: Vacancy vs. Asking Rents Arrows indicate change from previous quarter. 28 22 (%) $27.71 Vacancy Rate (R-Axis) 26 20 $/SF/Yr., Full Service Gross $/SF/Yr., Full Service 24 18 Asking Rent (L-Axis) 22 16 14.6% 20 14 18 12 Q1 2010 Q1 2011 Q1 2012 Q1 2013 Q1 2014 Q1 2015 Q1 2016 Q1 2017 Q1 2018 Q1 2019 Q1 2020 Source: CBRE Research, Q1 2020. MARKET ACTIVITY • Ahead of the COVID-19 outbreak, Morgan Lewis The COVID-19 pandemic has forced some state signed a lease for a 305,000-square-foot built-to-suit governments to impose strict stay-at-home to be developed by Parkway Corporation at their orders that are adversely affecting many 2222 Market Street site. industries. This is leading the U.S. economy into a recession that will result in very sharp declines • Hana committed to a site at 1818 Market Street. This in GDP for H1 2020 and in job losses, is the flexible office space operator’s first location within the greater Philadelphia market. particularly in the retail, food & beverage and transportation sectors. Office-using • Occupancy gains were significant, especially within employment may be less negatively affected the suburban Philadelphia office market where more than in recent recessions. But the unique nature than 375,000 square feet were absorbed. of this downturn should result in an unusually swift recovery that could begin as early as Q3 • Capital market sales enjoyed a spike as a result of Prologis’s acquisition of Liberty Property Trust. -

Philadelphia Bar Association 2014 Young Lawyers Division Executive Committee Cabinet

PHILADELPHIA BAR ASSOCIATION 2014 YOUNG LAWYERS DIVISION EXECUTIVE COMMITTEE CABINET NAME ADDRESS & PHONE NUMBERS Edward F. Beitz White and Williams LLP Chair One Liberty Place 1650 Market Street, Suite 1800 Philadelphia, PA 19103 215-864-6277 [email protected] Maria E. Bermudez Martin LLC Chair-Elect 1818 Market Street, 35th Floor Philadelphia, PA 19103 215-587-8417 [email protected] Erin Lamb First Judicial District Vice Chair 673 City Hall Philadelphia, PA 19107 215-686-2961 [email protected] Eileen F. Carroll Legal Clinic for the Disabled Secretary 1513 Race Street Philadelphia, PA 19102 215-587-3461 [email protected] James R. Nixon, Jr. Superior Court of Pennsylvania Treasurer 530 Walnut Street Suite 311 Philadelphia, PA 19106 (215) 560-5760 [email protected] Matthew S. Olesh Fox Rothschild LLP Financial Secretary 2000 Market Street, 20th Floor Philadelphia, PA 19103 (215) 299-3836 [email protected] 12807135v.1 PHILADELPHIA BAR ASSOCIATION 2014 YOUNG LAWYERS DIVISION EXECUTIVE COMMITTEE TERM ENDING DECEMBER 31, 2014 Eileen F. Carroll Legal Clinic for the Disabled 1513 Race Street Philadelphia, PA 19102 215-587-3461 [email protected] Courtenay R. Dunn Phelan Hallinan, L.L.P. 1617 John F. Kennedy Boulevard Suite 1400 Philadelphia, PA 19103 (215) 563-7000 [email protected] Daniel J. Gillin Landman Corsi Ballaine & Ford P.C. One Penn Center 1617 John F. Kennedy Boulevard, Suite 955 Philadelphia, PA 19103 215-561-8540 [email protected] Maria E. Bermudez Martin LLC 1818 Market Street, 35th Floor Philadelphia, PA 19103 215-587-8417 [email protected] Benjamin F. Johns Chimicles & Tikellis LLP 361 W. -

Enid H. Adler Attorney at Law 110-A N

Enid H. Adler Kenneth Ahl, Esq. Attorney At Law Archer & Greiner, P.C. 110-A N. 21st Street One Liberty Place Philadelphia, PA 19103-1301 Suite 3200 (215) 761-9925 Philadelphia, PA 19103 (215) 246-3132 Licia M. Ano Marrone, Esq. Paul C. Astor, Esq. Teeters Harvey Marrone & Kaier LLP Astor Weiss Kaplan & Mandel, LLP 1835 Market Street The Bellevue, 6th Floor Philadelphia, PA 19103-2968 200 South Broad Street (215) 567-2030 Philadelphia, PA 19102 (215) 790-0100 Sheryl L. Axelrod, Esq. Leonard Barrack, Esq. The Axelrod Firm, P.C. Barrack, Rodos & Bacine The Beasley Building Two Commerce Square 1125 Walnut Street 2001 Market Street, Suite 3300 Philadelphia, PA 19107 Philadelphia, PA 19103 (215) 461-1770 (215) 963-0600 Mary Jane Barrett, Esq. Hal A. Barrow, Esq. Mary Jane Barrett, LLC 65 W. Street Road 123 S. Broad Street Suite B102 Suite 2102 Warminster, PA 18974 Philadelphia, PA 19109-1090 (215) 956-9099 (215) 546-1800 Keelin S. Barry, Esq. Michael Bassett, Esq. 1518 Walnut Street Karafin & Gruenstein, P.C. Suite 800 1717 Arch Street Philadelphia, PA 19102 Suite 1320 (215) 546-2535 Philadelphia, PA 19103 (215) 587-0003 Daniel J. Baum, Esq. Martin Belisario, Esq. 2400 Chestnut Street Panitch Schwarze Belisario & Nadel LLP Apt. 1102 One Commerce Square Philadelphia, PA 19103 2005 Market Street, Suite 2200 (914) 656-4031 Philadelphia, PA 19103 (215) 965-1303 Thomas J. Bender, Esq. Brett N. Benton, Esq. Littler Mendelson P.C. Richard M. Ochroch & Associates, P.C. Three Parkway 318 S. 16th Street 1601 Cherry Street, Suite 1400 Philadelphia, PA 19102 Philadelphia, PA 19102 (215) 735-2707 (267) 402-3001 Daniel Berger, Esq. -

Philadelphia Office Market

RESEARCH 3Q 2019 PHILADELPHIA OFFICE MARKET NO SUMMER SLUMP: THE CURRENT CONDITIONS THIRD QUARTER IS 2019’S The Philadelphia office market accumulated 259,000 square feet of net STRONGEST YET absorption in 3Q19, the strongest quarterly total YTD Coworking and new-to-market tenants drove leasing activity in the CBD; A collection of large occupancies across the market drove net existing tenant relocations and expansions marked suburban growth absorption to total 259,000 square feet in the third quarter of 2019, a Overall asking rents grew quarter over quarter due primarily to strong big boost up from the past two quarters where absorption netted out to increases in the CBD essentially zero. New-to-market tenants and headquarter relocation/expansions were the primary engines of this quarter’s stellar MARKET ANALYSIS performance. Market-wide, vacancy was trimmed by 20 basis points to Asking Rent and Availability 13.6%, and average asking rents continued to escalate, growing a full dollar year-over-year to $29.58/SF. Asking Rent and Vacancy Philadelphia Central Business District (CBD) $3 0 20 % The trend of new-to-market tenants flocking to the CBD has been a $2 9 18 % $2 8 significant driver of the city’s office market resurgence for years, and 16 % this quarter’s activity was again highlighted by a continuation of this $2 7 14 % trend. Two of the three largest deals in the CBD were firms new to the $2 6 $2 5 12 % city – coworking provider CommonGrounds and Munich Reinsurance $2 4 10 % Company, which both leased at 1700 Market Street (62,000 and 31,000 3Q 09 3Q 10 3Q 11 3Q 12 3Q 13 3Q 14 3Q 15 3Q 16 3Q 17 3Q 18 3Q 19 square feet, respectively). -

1Q18 Philadelphia Office Market

RESEARCH PHILADELPHIA 1Q18 OFFICE MARKET THE SUBURBS START 2018 HOT Current Conditions Philadelphia Central Business District (CBD) • Suburban Philadelphia posted its highest quarterly Occupancy was slow at the start of 2018, but absorption is expected to absorption since 2007. pick up over the next several months as the new Comcast Tower delivers • The rise in CBD and suburban rental rates is expected in April, and companies from the suburbs and southern New Jersey to continue. secure additional outpost offices in the Central Business District. Overall • Outside investors continued their activity in the Greater vacancy rose 30 basis points from year-end 2017 to 13.3%, although Philadelphia area. several large blocks of space were leased to companies both new and familiar to Philadelphia. The consulting firm McCormick Taylor leased • Suburban owners are renovating older properties with 55,000 square feet of space at 1818 Market Street, while the law firms amenities attractive to the millennial workforce. Kleinbard LLC and Gordon & Rees took 21,000 and 17,000 square feet, respectively, at 3 Logan Square. Additionally, Neumann Finance, a newly Greater Philadelphia Market Analysis created equipment leasing firm in partnership with Beneficial Bank, leased 21,695 square feet at 123 South Broad Street. Asking Rent and Vacancy $29 20% The CBD recorded 107,812 square feet of lost occupancy, driven mainly by negative absorption among Class A buildings in the West Market $28 18% submarket. For instance, Brandywine Global will leave 48,006 square feet $27 16% at Cira Centre North, a Class A building, to move to 1735 Market Street, $26 14% another Class A building, in July. -

Presale Report Barclays Commercial Mortgage Pass-Through Certificates, Series 2021-1818

Presale Report Barclays Commercial Mortgage Pass-Through Certificates, Series 2021-1818 DBRS Morningstar Capital Structure March 18, 2021 Description Rating Action Balance ($) BLTV (%) DBRS Morningstar Rating Trend Class A New Rating - Provisional 75,440,000 66.16 AAA (sf) Stable Class X-CP New Rating - Provisional 75,440,000 n/a AAA (sf) Stable Nadeem Nizamuddin Class X-EXT New Rating - Provisional 75,440,000 n/a AAA (sf) Stable Analyst, Credit Ratings Class B New Rating - Provisional 16,760,000 58.64 AA (sf) Stable +1 332 205-0964 Class C New Rating - Provisional 12,580,000 52.99 A (high) (sf) Stable [email protected] Class D New Rating - Provisional 32,720,000 38.31 BBB (low) Stable Class E New Rating - Provisional 18,500,000 30.01 BB (low) Stable Chandan Banerjee Class E New Rating - Provisional 19,250,000 21.38 B (low) Stable Senior Vice President, North American CMBS Class G NR 26,650,000 9.42 NR n/a +1 212 806-3901 Class H NR 9,800,000 5.03 NR n/a [email protected] Class JRR NR 11,200,000 0 NR n/a Class R NR n/a n/a n/a n/a Brandon Olson Senior Vice President, North American CMBS +1 312 332-0889 [email protected] Erin Stafford Managing Director +1 312 332-3291 [email protected] DBRS Viewpoint Click here to see this deal. DBRS Viewpoint is an interactive, data- driven, loan and property level platform that provides users with access to DBRS Morningstar presale reports, surveillance updates, transaction information, and contextual comparable data in a user-friendly manner. -

Current and Future Market Conditions Q4 2012

Current and Future Market Conditions Q4 2012 After a positive end to 2011, 2012 was a disappointment with 212,000 SF of negative absorption in the Current and Future Market Conditions Q4 2012 CBD. Vacancy has increased from 13.5% in Q 3, to 14.5% to conclude 2012. This brings the total vacancy in the CBD to 5.8 M SF. For comparison purposes, at the conclusion of 2011 vacancy was 13.7%, and the total vacancy in the CBD was 5.45 M SF. 2012’s setbacks are due in large part to sizable tenants downsizing. At the peak of the market in 2007 vacancy was sub 10% and the total vacant space was just under 4M SF. Perception vs. Reality: The asking rates in the CBD are $25.50 SF for Class A space, $23.00 SF for Class B space and $19.00 SF for Class C space. The asking rates are the weighted average of the published rate from all vacant space per building class. Aggressively negotiated transactions continue to be discounted in the 80% - 85% of asking range. Landlord Concessions: Free rent is extremely prevalent in today’s market with tenants receiving one month or more for every year of lease term. A once reluctant landlord community has slowly come to the realization that contraction, termination and expansion rights are essential to any new lease document. Tenant improvement allowances have ranged from $30/$35 SF in Class B buildings to $40/$50 SF in Class A buildings. Renewal vs. Relocation: The most attractive transaction to a landlord is a renewal. -

Current and Future Market Conditions Q2 2018

Current and Future Market Conditions Q2 2018 Current and Future Market Conditions Q2 2018 Philadelphia’s office market remained flat in Q2. Small to medium size users of space continued to grow. This growth, offset the shedding of excess space by larger users. 5.5M SF is now available and the CBD has a 12% vacancy rate as of the end of Q2. Noteworthy Points: After the departure of FMC, Sunoco, and Bank of New York, Mellon Bank Center was left with 500,000 SF of vacancy in 2014. Fast forward to Q 2 2018, the building is now 95% leased. Kudos to Equity Common Wealth and their leasing team. However, with the inevitable departure of Aberdeen Asset Management, Melon Bank Center will have 50,000 SF of contiguous vacant space located on floors 31‐33. This space represents the highest available contiguous vacancy in the CBD. The space will become available in September 2019, though it is likely to be leased well before the end of 2018. “The Heat Is On” as rental rates continue to rise in the CBD. Growth occurred across virtually all business sectors with very few firms contracting their operations (excepting Towers Watson). As a result of this growth, the CBD’s asking rates continued to move upward in the quarter resulting in a $30.18/SF overall citywide average. Full service rates currently range from $30.50/SF for Class A, $27.25/SF for Class B, and $23.50/SF for Class C. As would be expected, the most expensive space at $39.50/SF is found in the Trophy Towers of West Market Street. -

Current and Future Market Conditions Q1 2016

Current and Future Market Conditions Q1 2016 Current and Future Market Conditions Q1 2016 Philadelphia’s office market gave back some of its 2015 gains in the First Quarter of 2016 as absorption turned negative at 300,000 SF. In the past, absorption trends have been known to change within one quarter. In this case, I believe the 1st quarter will be an isolated event and absorption will not only return to positive again in the second quarter but also remain positive for all of 2016. The CBD’s vacancy rate surged to 8.5%, with 3.4 million SF available. New Leases: NASDAQ inked a new lease at the new FMC Tower. The Philadelphia Stock Exchange will vacate 25,000 SF from 1900 Market Street, and occupy 3 floors (75,000 SF) at the new tower. Aon Risk downsized from 60,000 SF by signing a new 7‐year lease for 50,000 SF in One Liberty Place. The law firm of Saltz Mongeluzzi Barrett & Bendesky PC committed to a new 12‐year lease atop One Liberty Place for 35,000 SF. CDI Corporation leased 35,000 SF for 14 years at Mellon Bank Center. The engineering & technology company will vacate 70,000 SF divided between 10 Penn Center and Three Logan Square. Langan Engineering & Environmental Services will relocate from 30 S 17th Street, where they occupied 30,000 SF, to 1818 Market Street. The engineering firm leased 20,000 SF committing to a new 12‐year lease. Cigna returned 125,000 SF then signed a new lease for 320,000 SF at Two Liberty Place.