Judiciary; Ways and Means

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State of Hawaii Office of Elections I I Election Information Services I Operators Manual I I I 1996 Elections I I I I I I I I

Date Printed: 06/16/2009 JTS Box Number: IFES 80 Tab Number: 74 Document Title: Election Information Services Operator's Manual Document Date: 1996 Document Country: United States -- Hawaii Document Language: English IFES ID: CE02160 I I I I I I State of Hawaii Office of Elections I I Election Information Services I Operators Manual I I I 1996 Elections I I I I I I I I I TABLE OF CONTENTS I General Information Objectives. ... .. 1 Reminders ...................................................................... 2 I Commonly Used Terms ........................................................... 3 Who's Who at Control Center . .. 3 I Standard Operating Procedures Buck Slip Calls . .. 4 Informational Calls. .. 6 I Commonly Asked Questions Am I registered to vote? : . .. 7 Who may register to vote? . .. 7 I Should I re-register to vote? ........................................................ 7 Willi be notified of my polling place? ............. .. 8 Where is my polling place? . .. 8 I What are the polling place hours? ................................................... 8 Do I need an 1.0. to vote on Election Day? ............................................. 8 Am I allowed to take time off from work for voting? . .. 8 Who will be running this year for the various political offices? .............................. 9 I What types of elections does Hawaii hold? ...................... :..................... 9 Registration Information I QAlAB ......................................................................... 10 Same Day Transfer of Registration -

Mailing Labels

Representative Henry J.C. Aquino Representative Della Au Belatti Representative Patrick Pihana Branco Hawaii State Capitol, Room 419 Hawaii State Capitol, Room 439 Hawaii State Capitol, Room 328 415 S. Beretania Street 415 S. Beretania Street 415 S. Beretania Street Honolulu, HI 96813 Honolulu, HI 96813 Honolulu, HI 96813 Representative Ty J.K. Cullen Representative Linda Clark Representative Stacelynn K.M. Eli Hawaii State Capitol, Room 320 Hawaii State Capitol, Room 303 Hawaii State Capitol, Room 418 415 S. Beretania Street 415 S. Beretania Street Honolulu, 415 S. Beretania Street Honolulu, HI 96813 HI 96813 Honolulu, HI 96813 Representative Sonny Ganaden Representative Cedric Asuega Representative Sharon E. Har Hawaii State Capitol, Room 330 Gates Hawaii State Capitol, Room 441 Hawaii State Capitol, Room 318 415 S. Beretania Street 415 S. Beretania Street 415 S. Beretania Street Honolulu, HI 96813 Honolulu, HI 96813 Honolulu, HI 96813 Representative Mark J. Hashem Representative Troy N. Hashimoto Representative Daniel Holt Hawaii State Capitol, Room 424 Hawaii State Capitol, Room 332 Hawaii State Capitol, Room 406 415 S. Beretania Street 415 S. Beretania Street 415 S. Beretania Street Honolulu, HI 96813 Honolulu, HI 96813 Honolulu, HI 96813 Representative Linda Ichiyama Representative Greggor Ilagan Representative Aaron Ling Johanson Hawaii State Capitol, Room 426 Hawaii State Capitol, Room 314 Hawaii State Capitol, Room 436 415 S. Beretania Street 415 S. Beretania Street 415 S. Beretania Street Honolulu, HI 96813 Honolulu, HI 96813 Honolulu, HI 96813 Representative Jeanne Kapela Representative Bertrand Kobayashi Representative Dale T. Kobayashi Hawaii State Capitol, Room 310 Hawaii State Capitol, Room 403 Hawaii State Capitol, Room 326 415 S. -

Gmos, Home Rule Top Topics of Kohala Candidate Forum

Vol.11, No. 8 August 25, 2012 GMOs, Home Rule Top Topics of Kohala Candidate Forum Story and photo by Lynda Wallach were each given three most candidates agreed that communi- On Saturday morning, August 8, questions, some sub- ties should have the right to decide for more than 60 people gathered in the mitted from the audi- themselves whether or not they wanted Kohala High School cafeteria to meet ence. The candidates GMOs, opinions on GMOs varied. some of the candidates running for state had not seen the ques- Another issue of importance to and county offices, listen to their ideas tions in advance. The Kohala is the shortage of healthcare and ask them questions. The event was questions covered a professionals in Hawai`i and what can organized by Lisa Andrews, who said wide range of subjects be done about it. This question was she wanted it to be an opportunity for from crime preven- addressed to the candidates for state all the candidates, the less well-known tion and prison over- Senate and U.S. House. Here the pro- as well as the front runners, to present crowding to penalties posed solutions varied, from Malama their platforms. for marijuana posses- Solomon’s emphasis on the University Attending the Forum were the can- sion and improving of Hawaii’s educating doctors who didates for County Council District 9: public education. might tend to stay and practice in the Robert Green, William Sanborn, Sonny The subject of islands to Lorraine Inouye’s support Shimaoka and Margaret Wille; for genetically modified for a program that sent interns to rural mayor: Share Christie, Daniel Cunning- organisms (GMOs) areas. -

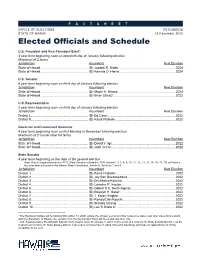

Elected Officials and Schedule

FACTSHEET OFFICE OF ELECTIONS FS104BO026 STATE OF HAWAII 23 November 2020 Elected Officials and Schedule U.S. President and Vice President Elect1 4 year term beginning noon on twentieth day of January following election Maximum of 2 terms Jurisdiction Incumbent Next Election State of Hawaii ..................................................... (D) Joseph R. Biden ............................................................... 2024 State of Hawaii ..................................................... (D) Kamala D. Harris .............................................................. 2024 U.S. Senator 6 year term beginning noon on third day of January following election Jurisdiction Incumbent Next Election State of Hawaii ..................................................... (D) Mazie K. Hirono ................................................................ 2024 State of Hawaii ..................................................... (D) Brian Schatz ..................................................................... 2022 U.S. Representative 2 year term beginning noon on third day of January following election Jurisdiction Incumbent Next Election District I ................................................................ (D) Ed Case ............................................................................ 2022 District II ............................................................... (D) Kaiali‘i Kahele ................................................................... 2022 Governor and Lieutenant Governor 4 year term beginning noon -

EH October 2012C

Volume 23, Number 4 October 2012 Price: $5.00 Dela Cruz Downplays Development Role A Case Of Misunderstanding? Of Public Land Development Corporation he Public Land Development he Public Land Development Corpora- with ideas of what he’d like to see the TCorporation may be the least Ttion state Sen. Donovan Dela Cruz envi- corporation do. popular game in town these days, if the sions may be more of a land manager than a The DLNR doesn’t have a whole lot of public outrage displayed at recent land developer, at least with regard to proper- undeveloped — and developable — land. hearings on its draft rules is any measure. ties owned by the Department of Land and The department has provided the PLDC with But it’s all misplaced, if its creator, Sen. Natural Resources. a list of all of its properties, which the corpo- Donovan Dela Cruz, is to be believed. In Amid the recent calls by state legislators ration is still combing through, looking for an interview with Environment Hawai‘i, and activists for the Legislature to dissolve potential project sites, says DLNR Land Divi- Dela Cruz provides his unique take on next session the nascent but highly controver- sion administrator Russell Tsuji. Even so, the the rights, duties, and limits of the sial development arm of the DLNR, Dela Legislature has already directed the DLNR to agency, on which he continues to ride Cruz, state Sen. Malama Solomon, and the transfer development rights for lands at herd, whipping and scolding it for not governor’s office have been working to cor- Honokohau and surrounding all of its small doing more faster. -

Export Controls

Financial Management Office Fiscal Administrator's Meeting Thursday, March 16, 2017 University of Hawaii Financial Management Office Topics • Welcome - Susan Lin, Director of Financial Management and Controller • Legislative and Budget Review 101 - Stephanie Kim, Director of Government Relations Office • Export Control Research and Travel - Ben Feldman, Export Control Officer University of Hawaii Financial Management Office Fiscal Administrators' Town Hall Forum Legislative and Budget Review 101 March 16, 2017 by Stephanie Kim Government Relations Office University Of Hawai‘i System UH Government Relations Office Works closely with the Board of Regents, President, VPs, Chancellors, departments/units and legislative coordinators across the UH System Reads all legislation and tracks legislation that pertains to the University of Hawai‘i Processes all official legislative testimony from the UH System Legislative Package, Annual Reports Attends hearings, briefings Manages communication between UH and the Legislative and Executive branches of government Conducts Legislative Workshops Role of the Legislative Coordinator Draft Campus/Unit’s legislative proposal(s) Coordinate the testimony on administrative proposals as well as other relevant legislation Assists the GRO in engaging internal and external support for proposals important to the UH Administration Annual and requested reports to the Legislature Keeps their campus or unit informed of all legislative developments Follows through on measures Attends legislative coordinators’ -

2014 Political Corporate Contributions 2-19-2015.Xlsx

2014 POLITICAL CORPORATE CONTRIBUTIONS Last Name First Name Committee Name State Office District Party 2014 Total ($) Alabama 2014 PAC AL Republican 10,000 Free Enterprise PAC AL 10,000 Mainstream PAC AL 10,000 Collins Charles Charlie Collins Campaign Committee AR Representative AR084 Republican 750 Collins‐Smith Linda Linda Collins‐Smith Campaign Committee AR Senator AR019 Democratic 1,050 Davis Andy Andy Davis Campaign Committee AR Representative AR031 Republican 750 Dotson Jim Jim Dotson Campaign Committee AR Representative AR093 Republican 750 Griffin Tim Tim Griffin Campaign Committee AR Lt. Governor AR Republican 2,000 Rapert Jason Jason Rapert Campaign Committee AR Senator AR035 Republican 1,000 Rutledge Leslie Leslie Rutledge Campaign Committee AR Attorney General AR Republican 2,000 Sorvillo Jim Jim Sorvillo Campaign Committee AR Representative AR032 Republican 750 Williams Eddie Joe GoEddieJoePAC AR Senator AR029 Republican 5,000 Growing Arkansas AR Republican 5,000 Senate Victory PAC AZ Republican 2,500 Building Arizona's Future AZ Democratic 5,000 House Victory PAC AZ Republican 2,500 Allen Travis Re‐Elect Travis Allen for Assembly 2014 CA Representative CA072 Republican 1,500 Anderson Joel Tax Fighters for Joel Anderson, Senate 2014 CA Senator CA038 Republican 2,500 Berryhill Tom Tom Berryhill for Senate 2014 CA Senator CA008 Republican 2,500 Bigelow Frank Friends of Frank Bigelow for Assembly 2014 CA Representative CA005 Republican 2,500 Bonin Mike Mike Bonin for City Council 2013 Officeholder Account CA LA City Council -

Vol 27 No 10

‘Okakopa (October) 2010 | Vol. 27, No. 10 THE LIVING WATER OF OHA www.oha.org/kwo AT THE inside decision 2010 HEAD special election pull-out section Party politics aside, the Chairmen of Hawai‘i’s Democratic and Republican parties share a common goal of wanting the best for Native Hawaiians OF THE PARTY The GOP’s Jonah Ka‘auwai and Democrats’ Dante Carpenter at the state Capitol. - Photo: John De Mello can we help you smell sweet success? “First Hawaiian Bank’s OHA Ma¯lama Loan helped strengthen our company’spany’s foundation during a time of economic uncertainty. We’ve always believedved in collaboration and in working with Hawaii-based businesses to create productsducts using our lavender. With OHA’s help we were able to purchase productsducts and fuel money back into Hawaii’s economy. We purchased lavender seasonings,nings, truffl es, scones, jellies, candles and so much more. The OHA Ma¯lama Loan had a much needed economic ripple effect that was felt from Kauai ttoo the Big Island. It truly takes a “village” to raise a business, just like it did iinn tthehe “ole days” and gratefully, OHA Ma¯lama Loan made that possible!”ible!” — Ali‘i A. Chang, PRESIDENT & LAVENDER GROWEROWER Lani Medina Weigert, CEO & MARKETING GURU OHA Ma-lama Loan Kahuaa Waiwai (Foundation(Foundation for Wealth)Wealth) In order to havee choiceschoices andand a sustainasustainableble ffuture,uture, Native HawaiHawaiiansians % must progressgress toward greater economic self-suffi self sufficiency ciency. 5.00 ✽ ✽ ✽ Annual Percentage Rate With the OHA M¯alama Loan, you can start-up or improve your business, Fixed for 5 Years • Loan up to $75,000 make home improvements or fulfi ll educational or vocational needs Quick and Easy Application for you and your children. -

February 23, 2021 the Honorable Karl Rhoads Chair, Hawaii Senate Judiciary Committee Hawaii State Capitol 415 S

February 23, 2021 The Honorable Karl Rhoads Chair, Hawaii Senate Judiciary Committee Hawaii State Capitol 415 S. Beretania St., Room 204 Honolulu, HI 96813 The Honorable Jarrett Keohokalole Vice Chair, Hawaii Senate Judiciary Committee Hawaii State Capitol 415 S. Beretania St., Room 231 Honolulu, HI 96813 The Honorable Rosalyn H. Baker Chair, Hawaii Senate Committee on Commerce and Consumer Protection Hawaii State Capitol 415 S. Beretania St., Room 230 Honolulu, HI 96813 The Honorable Stanley Chang Vice-Chair, Hawaii Senate Committee on Commerce and Consumer Protection Hawaii State Capitol 415 S. Beretania St., Room 226 Honolulu, HI 96813 RE: ATA SUPPORT FOR SENATE BILL 970 On behalf of the American Telemedicine Association (ATA) and the over 400 organizations we represent, I am writing to express our support for Senate Bill 970, which clarifies that a patient-practitioner relationship may be established during a telehealth appointment. The ATA is the only national organization completely focused on advancing telehealth. We are committed to ensuring that everyone has access to safe, affordable, and high-quality care whenever and wherever they need it. This empowers the health care system to provide services to millions more patients every year in an efficacious manner. The ATA represents a broad and inclusive coalition of technology solution providers and payers, as well as partner organizations and alliances, working to advance industry adoption of telehealth, promote responsible policy, advocate for government and market normalization, and provide education and resources to help integrate virtual care into emerging, value-based modalities. Senate Bill 970 serves as an important and rational expansion of Hawaii’s state telehealth policy. -

Mccully/MOʻILIʻILI NEIGHBORHOOD BOARD NO. 8

McCULLY/MOʻILIʻILI NEIGHBORHOOD BOARD NO. 8 c/o NEIGHBORHOOD COMMISSION 530 SOUTH KING STREET ROOM 406 HONOLULU, HAWAII, 96813 TEL: (808) 768-3710 FAX: (808) 768-3711 INTERNET: http://www.honolulu.gov/nco DRAFT REGULAR MEETING MINUTES THURSDAY, OCTOBER 1, 2015 WASHINGTON MIDDLE SCHOOL CAFETERIA CALL TO ORDER: Chair Ron Lockwood called the meeting to order at 6:36 p.m. A quorum was established with 13 members present. Note: this 15-member Board requires eight (8) members to establish a quorum and to take official Board action. Board Members Present: Antonia Agbannawag, Bryan Choe, Tamara Edwards, Juanita Kawamoto, Klement Kondratovich, Ron Lockwood, Larie Manutai, David Nash, Timothy Streitz, Thomas Tomita, Raytan Vares, Masahisa Yamaguchi, and Emmanuel Zibakalam. Board Members Absent: Marijane Carlos and Jay Yano. Guests: Captain Kahekili Kealoha (Honolulu Fire Department); Sergeant Raymond Lurbe (Honolulu Police Department, District 1); Lieutenant Clinton Sukekane (Honolulu Police Department, District 7); Carolee Kubo (Mayor Kirk Caldwell’s Representative); James Larson (Councilmember Ann Kobayashi’s Office); Chelsea Okamoto (Representative Scott Nishimoto’s Office); Tom Heinrich (Senator Brian Taniguchi’s Office); Senator Les Ihara Jr.; Larke A. Gulaski; Janet Inamine; Bob Kern; Clifton Takamura; Les Yamashita; Kathy Uehara; videographer (DVDmodo); and Jordan Ozaki (Neighborhood Commission Office). Rules: At this time, Chair Lockwood read the Board rules as stated on the agenda. FILLING OF VACANCIES ON BOARD: There were no vacancies on the Board. PUBLIC SAFETY AND COMMUNITY LIAISON Honolulu Fire Department (HFD): Captain Kahekili Kealoha reported the following: September 2015 Fire Statistics: There was 1 structural, 2 rubbish, and 0 vehicle fire(s). There were 58 medical, 3 search and rescues, and 53 miscellaneous emergency calls. -

February 1 2017 Issue to Print.Pmd

PAGE 2 • THE FIL-AM COURIER • FEBRUARY 1-15, 2017 STATEWIDE COMMUNITY CALENDAR Compiled by AMELIA CASAMINA CABATU Amelia Casamina Cabatu is a community leader and a familiar face, often hosting community events and celebrations. She is a veteran radio announcer and hosts the “FIL-AM COURIER COMMUNITY HOUR on 1270 KNDI Radio every 1st Sunday of the month. In addition to other affiliations, Amelia is the former Chair of the Philippine Celebrations Coordinating Committee of Hawaii. She owns and operates an adult daycare business and is happily married to Arnold Cabatu. They live in Salt Lake and are blessed with one daughter, Armay. Please send your event information to [email protected] or call her at (808) 282-2033. OAHU FEBRUARY 16-26, 2017 FilCom Center for a bigger, colorful, and MAY 13, 2017 outstanding achievements of graduating high Filipino Chamber of Commerce of Hawaii culturally-rich Philippine participation. For Filipino Chamber of Commerce of Hawaii school valedictorians in public and private FEBRUARY 1, 2017 27th (FCCH) Annual Filipino Trade Mission more information visit their website at http:/ Filipino Entrepreneur of the Year and the schools & presentation of the continuing Job Quest Job Fair hosted by WorkForce/ to the Philippines. The trade mission aims /www.honolulufestival.com Filipino Young Entrepreneur of the Year and scholar recipients, Empress Restaurant, JobQuest Hawaii. 10:00 AM-3:00 PM; Neal to strengthen the business opportunities Scholarship Awards Gala Fil-Com Center. 100 N. Beretania St. 6:00 PM. We are Blaisdell Center 777 Ward Avenue, Honolulu, between Hawaii and the Philippines. Planned MARCH 24, 2017 94-428 Mokuola Street Waipahu, HI. -

Hawaii Clean Energy Final PEIS

1 APPENDIX A 2 3 Public Notices Notices about the Draft Programmatic EIS Appendix A The following Notice of Availability appeared in the Federal Register on April 18, 2014. Hawai‘i Clean Energy Final PEIS A-1 September 2015 DOE/EIS-0459 Appendix A Hawai‘i Clean Energy Final PEIS A-2 September 2015 DOE/EIS-0459 Appendix A DOE-Hawaii placed the following advertisement in The Garden Island on May 5 and 9, 2014. Hawai‘i Clean Energy Final PEIS A-3 September 2015 DOE/EIS-0459 Appendix A DOE-Hawaii placed the following advertisement in the West Hawaii Today on May 6 and 12, 2014. Hawai‘i Clean Energy Final PEIS A-4 September 2015 DOE/EIS-0459 Appendix A DOE-Hawaii placed the following advertisement in the Hawaii Tribune Herald on May 7 and 12, 2014. Hawai‘i Clean Energy Final PEIS A-5 September 2015 DOE/EIS-0459 Appendix A DOE-Hawaii placed the following advertisement in the Maui News on May 8, 2014. Hawai‘i Clean Energy Final PEIS A-6 September 2015 DOE/EIS-0459 Appendix A DOE-Hawaii placed the following advertisement in the Maui News on May 13, 2014. Hawai‘i Clean Energy Final PEIS A-7 September 2015 DOE/EIS-0459 Appendix A DOE-Hawaii placed the following advertisement in the Maui News on May 18, 2014. Hawai‘i Clean Energy Final PEIS A-8 September 2015 DOE/EIS-0459 Appendix A DOE-Hawaii placed the following advertisement in the Molokai Dispatch on May 7 and 14, 2014. Hawai‘i Clean Energy Final PEIS A-9 September 2015 DOE/EIS-0459 Appendix A DOE-Hawai‘i placed the following advertisement in the Star-Advertiser on May 14 and 19, 2014.