November 2, 1956 Issue (Dig110256.Pdf)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unless Otherwise Indicated, the Declarations and Reservations Were Made Upon Definitive Signature, Ratification, Accession Or Succession.)

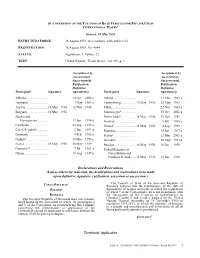

10. CONVENTION ON THE TAXATION OF ROAD VEHICLES FOR PRIVATE USE IN INTERNATIONAL TRAFFIC Geneva, 18 May 1956 ENTRY. INTO FORCE: 18 August 1959, in accordance with article 6(2). REGISTRATION: 18 August 1959, No. 4844. STATUS: Signatories: 8. Parties: 23. TEXT: United Nations, Treaty Series , vol. 339, p. 3. Acceptance(A), Acceptance(A), Accession(a), Accession(a), Succession(d), Succession(d), Ratification, Ratification, Definitive Definitive Participant Signature signature(s) Participant Signature signature(s) Albania.........................................................14 Oct 2008 a Ireland..........................................................31 May 1962 a Australia....................................................... 3 May 1961 a Luxembourg.................................................18 May 1956 28 May 1965 Austria .........................................................18 May 1956 12 Nov 1958 Malta............................................................22 Nov 1966 a Belgium .......................................................18 May 1956 Montenegro5 ................................................23 Oct 2006 d Bosnia and Netherlands6.................................................18 May 1956 20 Apr 1959 Herzegovina1..........................................12 Jan 1994 d Norway ........................................................ 9 Jul 1965 a Cambodia.....................................................22 Sep 1959 a Poland7.........................................................18 May 1956 4 Sep 1969 Czech -

Neitzey, Wilfred, 61, 65, 69, SMR Dec. 1955, 3; SMR March 1956, 3; SMR

Neitzey, Wilfred, 61, 65, 69, Outbuildings furnishings cont'd. SMR Dec. 1955, 3; SMR March 1956, 4; SMR May 1956, 5; 1956, 3; SMR June 1956, 4, SMR June 1956, 6; SMR 5; SMR July 1956, 3 July 1956, 3 New York Public Library, pastry slab (marble), 28, gift of, SMR April 1956, 5 SMR Jan. 1956, 6; SMR Niepold, Mr. Frank, SMR April Feb. 1956, 7 1956, 4 Peter Collection (certain Noerr, Mr. Karl, SMR June articles), 28 1956, 1 rolling pin, 18th century, Norris, Mr. John H., 28, SMR Sept. 1956, 4 letter of praise from, 100 tea kettle, copper, 28, SMR Sept. 1956, 4 0 see also SMR Curatorial Activities for each month; Officers of the Association, Gifts; Morse, Frank E. a-c Outbuildings-- Buildings Blacksmith Shop, 70, SMR Parke-Bernet Galleries, 5, SMR Feb. 1956, 6 March 1956, 4; SMR June 1956, Butler's House, SMR Dec. 2 1955, 3, 5 Parmer, Mr. Charles, 16 Ice House, SMR Dec. 1955, Patee, Mr. & Mrs. R. W., 4 loan of silver spoons, SMR Kitchen (Family), 66, SMR Jan. 1956, 7 July 1956, 3 Pell, Mr. John, Necessaries, SMR Feb. 1956, describes restoration & opera- 6; SMR March 1956, 3 tion of Fort Ticonderoga to School House, SMR Feb. MVLA, 13, 109 1956, 6 Pepper, Hon. George Wharton, c Seed House, 67, 68, SMR Peter, Mr. Freeland, Nov. 1955, 4; SMR Dec. collection of catalogued, SMR 1955, 3; SMR Jan. 1956, May 1956, 5 5; SMR Feb. 1956, 6 collection of unpacked at MV, Slave Quarters, SMR Dec. SMR Aug. -

Multilateral Agreement on Commercial Rights of Non-Scheduled Air Services in Europe Signed at Paris on 30 April 1956

MULTILATERAL AGREEMENT ON COMMERCIAL RIGHTS OF NON-SCHEDULED AIR SERVICES IN EUROPE SIGNED AT PARIS ON 30 APRIL 1956 Entry into force: In accordance with Article 6(1), the Agreement entered into force on 21 August 1957. Status: 24 parties. State Date of signature Date of deposit of Effective date Instrument of Ratification or Adherence Austria 30 October 1956 21 May 1957 21 August 1957 Belgium 30 April 1956 22 April 1960 22 July 1960 Croatia 2 July 1999 2 October 1999 Denmark 21 November 1956 12 September 1957 12 December 1957 Estonia 4 April 2001 4 July 2001 Finland 14 October 1957 6 November 1957 6 February 1958 France 30 April 1956 5 June 1957 5 September 1957 Germany 29 May 1956 11 September 1959 11 December 1959 Hungary 16 November 1993 14 February 1994 Iceland 8 November 1956 25 September 1961 25 December 1961 Ireland 29 May 1956 2 August 1961 2 November 1961 Italy 23 January 1957 Luxembourg 30 April 1956 23 December 1963 23 March 1964 Monaco 19 January 2017 19 April 2017 Netherlands (1) 12 July 1956 20 January 1958 20 April 1958 Norway 8 November 1956 5 August 1957 5 November 1957 Portugal (2) 7 May 1957 17 October 1958 17 January 1959 Republic of Moldova 23 December 1998 23 March 1999 San Marino 17 May 2016 17 August 2016 Serbia 21 March 2017 21 June 2017 Spain 8 November 1956 30 May 1957 30 August 1957 Sweden 23 January 1957 13 August 1957 13 November 1957 Switzerland 30 April 1956 2 April 1957 21 August 1957 Turkey 8 November 1956 4 November 1958 4 February 1959 United Kingdom (3) 11 January 1960 11 April 1960 The former Yugoslav Republic of Macedonia deposited its instrument of adherence on 23 August 2002 and became a party to the Agreement on 23 November 2002. -

No. 9 May 1956

Published monthly by the University for f the information of its faculty and staff. I Non Profit Org. 1- 1 2, NO. 9 MAY 1956 The Educational Survey: Biggest Such Academic Study in the U.S. The modest little frame building at 3441 Woodland We called on Dr. Preston to bring ourselves up to date Avenue, which dates back to about 1750, houses the main on work in progress. offices of the biggest academic study of its kind ever pro- "More than a score of are in various in the United States, the Educational projects stages jected University's of completion," he said. "For example, five Surveys are Survey. so well advanced that we expect reports from them by Organized early in 1954 under the co-directorship of June 30th of this year. They include the Survey of the Dr. Joseph H. Willits, former Director of Social Sciences Social Sciences, under the general direction of Dr. Merrill of the Rockefeller Foundation and former Dean of the K. Bennett of Leland Stanford University; the Survey of Wharton School, and Dr. Malcolm G. Preston, Professor Statistics and Statistical Services, under the general direc- of Psychology, with a grant of $185,000 from the Fund tion of a committee chaired by Dr. Irwin Friend, Research for the Advancement of Education, the Survey has so far Professor of Finance; the Survey of the Engineering completed two missions, one on the University Press and Schools, under the general direction of a committee headed the other on Microbiology. The report on the Press has by the late Dr. -

Washington, Thursday, June 7, 1956 TITLE 7—-AGRICULTURE CONTENTS

VOLUME 21 ^ , 1 9 3 4 C& NUMBER 110 * Wanted ^ Washington, Thursday, June 7, 1956 Kelly McCollum Ranch, intersection of TITLE 7—-AGRICULTURE Road 28 and West E, Route 1, Box G, Imperial. CONTENTS Milham Farms, Camp No. 1, located Sec. 7, Chapter II!— Agricultural Research T. 28 S., R. 23 E. Mail address Lerdo Road, Agricultural Marketing Service Page Service, Department of Agriculture Buttonwillow. Proposed rule making: Milham Farms, Camp No. 2, located Sec. 1, Milk, handling; Dayton-Spring- [P. P. C. 612, Second Rev., Supp. 5] T. 28 S., R. 22 E. Mail address Lerdo Road, field, Ohio, marketing area 3902 P art 301—Domestic Quarantine Notices Buttonwillow. Newhall Land & Farming Company, Route Raisins produced from raisin ADMINISTRATIVE INSTRUCTIONS DESIGNATING 8, Box 77, Saugus. variety grapes grown in Cali PREMISES AS REGULATED AREAS UNDER Oro Farm and Cattle Co. (Benjamin Kos- fornia____________ •_______ 3903 REGULATIONS SUPPLEMENTAL TO KHAPRA ddn, owner), located one and one-half miles Rules and regulations : northeast of Buttonwillow on west side of Peaches, fresh; grown in Geor BEETLE QUARANTINE Wasco Way, one-half mile north of Highway gia ; expenses and rate of Pursuant to § 301.76-2 of the regula 178, Box 274, Buttonwillow. assessment for 1956-57 fiscal tions supplemental to the Khapra Beetle E. J. Reinecke Chicken Ranch, 36058 N. 82d period____________________ 3899 Quarantine (7 CFR Supp. 301.76-2, 20 Street East, Littlerock. P. R. 1012) under sections 8 and 9 of the F. O. Rosenbaum Ranch, Route 2, Box 29, Agricultural Research Service Imperial. Rules and regulations: Plant Quarantine Act of 1912, as amend Rudinick Trust Feed Lot, 1 y2 miles west of ed (7 U. -

January 1956 1956 WMO Bulletin January 1956

At all modern BAROGRAPHS Recording aneroids with continous meteorological stations charts; adopted for over 40 years by the French Meteorological Service. Standard equipment in the French THE PRECISION Navy. INSTRUMENTS OF THERMOGRAPHS Which can 'be combined with our barometers a nd hygrometers. These JULES RICHARD instr uments ore outstandingly sen sitive. provide a permanent answer HYGROGRAPHS Direct recording of air humidity on ruled charts. All types of indicators and recorders, including upper-air and dew-point instruments. SOLARIMETE RS Direct reading and recording ins truments for measuring the intensity of solar radiation. Pyrheliogrophs. ANEMOGRAPHS All types of a nemometers, includi ng " Popillon" electro-magnetic ins tru ments for recording instantaneous wind speed at a distance. RAINGAUGES All types of float, balance and syphon raingauges, both recording and non-recording. upon request lit\ IS I I OFFICERS OF THE WORLD METEOROLOGICAL ORGANIZATION President : Mr. A. VIAUT First Vice-President Dr. M. A. F . BARNETT Second Vice-President : Prof. Dr. H. AMOR IM FERREIRA EXECUTIVE COMMITTEE Mr. A. VIAUT Mr. F. X . R. DE SouzA Dr. A. NYBE RG Dr. M. A. F . BARNETT Mr. A. THOMSON Dr. F. vV. REICHELDERFER Prof. Dr. H. AMORIM FERREIRA Dr. C. DEL ROSARIO Mr. A. A. SoLorouKHINE Mr. J. RAVET Prof. Dr. Ing. J. LUGEON Sir GRAHAM SurroN Mr. S. BAsu Mr. L. DE AzcARRAGA Mr. M. F. TAHA TECHNICAL COMMISSION PRESIDENTS REGIONAL ASSOCIATION PRESIDENTS Aerology: Prof. Dr. J. VAN MIEGHEM Africa (I): Mr. J. RAVET Aeronautical Meteorology : Mr. A. H. N AGLE Asia (II) : Mr. S. BASU Agricultural Meteorology : Mr. J. J. BuRGOS South America (Ill) : Bibliography and Publications: Dr. -

Survey of Current Business September 1956

SEPTEMBER 1956 U. S. DEPARTMENT OF COMMERCE OFFICE OF BUSINESS ECONOMICS SURVEY OF CURRENT BUSINESS DEPARTMENT OF COMMERCE FIELD SERVICE 9 Albuquerque, N. Mex. Memphis 3, Tenn. 321 Post Office Bldg. 22 North Front St. SEPTEMBER 1956 Atlanta 23, Ga. Miami 32, Fla. 50 Seventh St. NE. 300 NE. First Ave. Boston 9, Mass. Minneapolis 2, Minn. U. S. Post Office and 2d Ave. South and Courthouse BMg. 3d St. Buffalo 3, N. Y. New Orleans 12, La. 117 Ellicott St. 333 St. Charles Ave. Charleston 4, S. C. New York 17, N. Y. Area 2, 110 E. 45th St. PAGE Sergeant Jasper Bldg. THE BUSINESS SITUATION. 1 Cheyenne, Wyo. Philadelphia 7, Pa. 307 Federal Office Bldg. 1015 Chestnut St. Increased Business Investment Ahead. *...... 3 Second Quarter Balance of Payments Re- Chicago 6, 111. Phoenix, Ariz. 137 N. Second Ave. flects Further Expansion in International 226 W. Jackson Blvd. Business „ 6 Cincinnati 2, Ohio Pittsburgh 22, Pa. 442 U. S. Post Office 107 Sixth St. anil Courthouse Portland 4, Oreg. Cleveland 14, Ohio * * * 520 SW. Morrison St. 1100 Chester Ave. SPECIAL ARTICLE Dallas 2, Tex. Reno, Nev. 1114 Commerce St. 1479 Wells Ave. Regional Trends in Retail Trade 11 Denver 2, Colo, Richmond 19, Va. j 42 New Customhouse 1103 East Main St. * * * Detroit 26, Mich. St. Louis 1, Mo. 1114 Market St. MONTHLY BUSINESS STATISTICS S-l to S-40 438 Federal Bldg. Houston 2, Tex. Salt Lake City 1, Utah Statistical Index ,,........ Inside back cover 430 Lamar Ave. 222 SW. Temple St. Jacksonville 1, Fla. San Francisco 11, Calif. -

'Soviet Union' 1956 No. 1 (71) January 1956 Front Cover: Back Cover

‘Soviet Union’ 1956 No. 1 (71) January 1956 Front Cover: Back Cover: Editor-in-Chief: P. N. Kuznetsov Designers: Contents: Fourth Session of the USSR Supreme Soviet (1) On Eve of 20th Party Congress (2) Here and There (4) Lenin’s Study (5) Friendship Between Two Great Peoples (6) Five Questions to Academician Bardin (10) Lenin Came to See Us (12) What’s New in Your Line? (14) John Bernal Congratulates Hudu Mamedov. By Hudu Surkhal ogli Mamedov, Candidate of Geologo-Mineralogical Science. Photographed by Y. Bagryansky (18) The Leningrad Metro (20) The Road to Life (22) Mechanical Heart. By M. Ananyev, Director of the Research Institute of Experimental Surgical Apparatus and Instruments. Photographed by K. Yuryev (24) A Wedding (26) Report From the Tundra (28) Première in a Workers’ Club (30) Riddle of the Mayas (32) In the Mountains of Kazakhstan (33) A Taxi Driver’s Day (34) Stamp-Collector’s Page (36) Mission of Peace and Friendship (37) No. 2 (72) February 1956 Front Cover: Back Cover: Editor-in-Chief: N. M. Gribachov Designers: Contents: Kliment Yefremovich Voroshilov, President, Presidium of Supreme Soviet of USSR. On 75th Birthday (1) Sixth Five-Year Plan (2) Back at the Old Plant (5) The Changing Map (6) In the Altai Steppe (8) Business Contacts. By I. Bolshakov, USSR Deputy Minister of Foreign Trade (12) Makers of Turbines (14) What 100 Hectares Can Yield (16) At the Two Poles (18) Thirty-Three Days in USA (20) Let’s Visit This Flat (22) Semi-Conductors (26) Kirghiztan (28) Good Books Make Good Envoys (30) Folk Art of Kubachi (32) Films. -

Country Term # of Terms Total Years on the Council Presidencies # Of

Country Term # of Total Presidencies # of terms years on Presidencies the Council Elected Members Algeria 3 6 4 2004 - 2005 December 2004 1 1988 - 1989 May 1988, August 1989 2 1968 - 1969 July 1968 1 Angola 2 4 2 2015 – 2016 March 2016 1 2003 - 2004 November 2003 1 Argentina 9 18 15 2013 - 2014 August 2013, October 2014 2 2005 - 2006 January 2005, March 2006 2 1999 - 2000 February 2000 1 1994 - 1995 January 1995 1 1987 - 1988 March 1987, June 1988 2 1971 - 1972 March 1971, July 1972 2 1966 - 1967 January 1967 1 1959 - 1960 May 1959, April 1960 2 1948 - 1949 November 1948, November 1949 2 Australia 5 10 10 2013 - 2014 September 2013, November 2014 2 1985 - 1986 November 1985 1 1973 - 1974 October 1973, December 1974 2 1956 - 1957 June 1956, June 1957 2 1946 - 1947 February 1946, January 1947, December 1947 3 Austria 3 6 4 2009 - 2010 November 2009 1 1991 - 1992 March 1991, May 1992 2 1973 - 1974 November 1973 1 Azerbaijan 1 2 2 2012 - 2013 May 2012, October 2013 2 Bahrain 1 2 1 1998 - 1999 December 1998 1 Bangladesh 2 4 3 2000 - 2001 March 2000, June 2001 2 Country Term # of Total Presidencies # of terms years on Presidencies the Council 1979 - 1980 October 1979 1 Belarus1 1 2 1 1974 - 1975 January 1975 1 Belgium 5 10 11 2007 - 2008 June 2007, August 2008 2 1991 - 1992 April 1991, June 1992 2 1971 - 1972 April 1971, August 1972 2 1955 - 1956 July 1955, July 1956 2 1947 - 1948 February 1947, January 1948, December 1948 3 Benin 2 4 3 2004 - 2005 February 2005 1 1976 - 1977 March 1976, May 1977 2 Bolivia 3 6 7 2017 - 2018 June 2017, October -

NSC Series, Subject Subseries

WHITE HOUSE OFFICE, OFFICE OF THE SPECIAL ASSISTANT FOR NATIONAL SECURITY AFFAIRS: Records, 1952-61 NSC Series, Subject Subseries CONTAINER LIST Box No. Contents 1 Arms Control, U.S. Policy on [1960] Atomic Energy-The President [May 1953-March 1956] (1)(2) [material re the function of the special NSC committee to advise the President on use of atomic weapons] Atomic Weapons, Presidential Approval and Instructions for use of [1959-1960] (1)- (5) Atomic Weapons, Correspondence and Background for Presidential Approval and Instructions for use of [1953-1960] (1)-(6) Atomic Energy-Miscellaneous (1) [1953-1954] [nuclear powered aircraft; Nevada atomic weapons tests; Department of Defense participation in the weapons program] Atomic Energy-Miscellaneous (2) [1952-54] [custody of atomic weapons] Atomic Energy-Miscellaneous (3) [1953-54] [transfer and deployment of nuclear weapons; operation TEAPOT] Atomic Energy-Miscellaneous (4) [1953-54] [safety tests; weapons program; development of fuel elements for nuclear reactors] Atomic Weapons and Classified Intelligence-Misc. (1) [1955-1957] [test moratorium on nuclear weapons; development of a high yield weapon] Atomic weapons and Classified Intelligence-Misc. (2) [1954-1960] [disclosures of classified intelligence; downgrading, declassification and publication of NSC papers] 2 Base Rights [November 1957-November 1960] (1)-(4) [U.S. overseas military bases] Study of Continental Defense, by Robert C. Sprague [February 26, 1954] Continental Defense, Study of-by Robert C. Sprague (1953-1954) (1)-(8) 3 Continental Defense, Study of-by Robert C. Sprague (1953-1954) (9)-(12) Continental Defense, Study of-by Robert C. Sprague (1955) (1)-(9) Continental Defense, Study of-by Robert C. -

NATO in the Beholder's Eye: Soviet Perceptions and Policies, 1949-1956

WOODROW WILSON INTERNATIONAL CENTER FOR SCHOLARS Christian Ostermann, Lee H. Hamilton, NATO in the Beholder’s Eye: Director Director Soviet Perceptions and Policies, 1949-56 BOARD OF ADVISORY TRUSTEES: COMMITTEE: Vojtech Mastny Joseph A. Cari, Jr., William Taubman Chairman (Amherst College) Steven Alan Bennett, Working Paper No. 35 Chairman Vice Chairman PUBLIC MEMBERS Michael Beschloss (Historian, Author) The Secretary of State Colin Powell; The Librarian of James H. Billington Congress (Librarian of Congress) James H. Billington; The Archivist of the United States Warren I. Cohen John W. Carlin; (University of Maryland- The Chairman of the Baltimore) National Endowment for the Humanities Bruce Cole; John Lewis Gaddis The Secretary of the (Yale University) Smithsonian Institution Lawrence M. Small; The Secretary of James Hershberg Education (The George Washington Roderick R. Paige; University) The Secretary of Health & Human Services Tommy G. Thompson; Samuel F. Wells, Jr. (Woodrow Wilson PRIVATE MEMBERS Washington, D.C. Center) Carol Cartwright, John H. Foster, March 2002 Sharon Wolchik Jean L. Hennessey, (The George Washington Daniel L. Lamaute, University) Doris O. Mausui, Thomas R. Reedy, Nancy M. Zirkin COLD WAR INTERNATIONAL HISTORY PROJECT THE COLD WAR INTERNATIONAL HISTORY PROJECT WORKING PAPER SERIES CHRISTIAN F. OSTERMANN, Series Editor This paper is one of a series of Working Papers published by the Cold War International History Project of the Woodrow Wilson International Center for Scholars in Washington, D.C. Established in 1991 by a grant from the John D. and Catherine T. MacArthur Foundation, the Cold War International History Project (CWIHP) disseminates new information and perspectives on the history of the Cold War as it emerges from previously inaccessible sources on “the other side” of the post-World War II superpower rivalry. -

9. CUSTOMS CONVENTION on CONTAINERS Geneva, 18 May 1956

9. CUSTOMS CONVENTION ON CONTAINERS Geneva, 18 May 1956 ENTRY. INTO FORCE: 4 August 1959 by the exchange of the said letters, in accordance with article 13[Note: Article 20(1) of the Customs Convention on Containers 1972 (see chapter XI.A-15), provides that, upon its entry into force, it shall terminate and replace, in relations between the Parties to the latter Convention, the present Convention. The said Convention of 1972 came into force on 6 December 1975.]. REGISTRATION: 4 August 1959, No. 4834. STATUS: Signatories: 12. Parties: 44.1 TEXT: United Nations, Treaty Series , vol. 338, p. 103. Ratification, Ratification, Accession(a), Accession(a), Participant Signature Succession(d) Participant Signature Succession(d) Algeria .........................................................31 Oct 1963 a Japan ............................................................14 May 1971 a Antigua and Barbuda...................................25 Oct 1988 d Luxembourg.................................................18 May 1956 25 Oct 1960 Australia....................................................... 6 Jan 1967 a Malawi.........................................................24 May 1969 a Austria .........................................................18 May 1956 13 Nov 1957 Mauritius......................................................18 Jul 1969 d Belgium .......................................................18 May 1956 27 May 1960 Montenegro6 ................................................23 Oct 2006 d Bosnia and Netherlands7.................................................18