PINCON SPIRIT LIMITED 36Thannual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Indian Whiskey Market

Indian whiskey market Continue TOKYO/MUMBAI - Japanese beverage maker Suntory Holdings will this week roll out a whisky brand that will be sold exclusively in India, the world's largest market, as it tries to gain a foothold on top distiller Diageo.The new brand, Oaksmith, will be mixed with imported bourbon and scotch. The product is classified as a foreign Indian-made liqueur that uses imported whiskey and is mixed in the country. Such products make up more than 90% of the Indian whisky market. Beam Suntory, an American subsidiary of a Japanese parent, has been selling whisky brand Teachers in India since 1994. Oaksmith will be its first product sold only in India. Suntory acquired American distiller Beam in 2014. Pune is the center of the Indian information technology industry and has a young population. It plans to roll out products in other areas later. Oaksmith will have two products targeting middle and upper income drinkers and will be priced at up to 1,375 ($19) for a 750ml bottle in Maharashtra. By next year, Suntory hopes to sell 120,000 cases, rising to more than 1 million cases by 2022.India, once a British colony, is a huge whisky market that accounts for half of the world's demand. Suntory, the world's no 3 spirits manufacturer, faces stiff competition in India from rivals such as Uk's Diageo and France's Pernod Ricard. Both have local mixed import brands. In August, Diageo announced that it was increasing its stake in Indian distiller United Spirits to 55.2%. -

Average Market Capitalization of Listed Companies During the Six Months Ended 30 June 2019

Average Market Capitalization of listed companies during the six months ended 30 June 2019 BSE 6 NSE 6 MSE 6 Average of Categorization month Avg month Avg month Avg MSE All as per SEBI Sr. No. Company name ISIN BSE Symbol Total Market NSE Symbol Total Market Total Symbol Exchanges Circular dated Cap in (Rs. Cap (Rs. Market Cap Oct 6, 2017 Crs.) Crs.) in (Rs Crs.) (Rs. Cr.) 1 RELIANCE INDUSTRIES LTD. INE002A01018 RELIANCE 8,12,140.69 RELIANCE 8,12,383.21 8,12,261.95 Large Cap 2 TATA CONSULTANCY SERVICES LTD. INE467B01029 TCS 7,73,346.96 TCS 7,73,545.65 7,73,446.30 Large Cap 3 HDFC BANK LTD. INE040A01026 HDFCBANK 6,12,627.91 HDFCBANK 6,12,047.43 6,12,337.67 Large Cap 4 HINDUSTAN UNILEVER LTD. INE030A01027 HINDUNILVR 3,78,929.46 HINDUNILVR 3,79,110.39 3,79,019.92 Large Cap 5 ITC LTD. INE154A01025 ITC 3,52,938.92 ITC 3,52,878.59 3,52,908.75 Large Cap 6 HOUSING DEVELOPMENT FINANCE CO INE001A01036 HDFC 3,45,311.65 HDFC 3,44,672.69 3,44,992.17 Large Cap 7 INFOSYS LTD. INE009A01021 INFY* 3,19,075.24 INFY 3,19,176.75 3,19,126.00 Large Cap 8 STATE BANK OF INDIA INE062A01020 SBIN 2,75,242.14 SBIN 2,75,397.44 2,75,319.79 Large Cap 9 KOTAK MAHINDRA BANK LTD. INE237A01028 KOTAKBANK 2,57,663.13 KOTAKBANK 2,57,514.20 2,57,588.67 Large Cap 10 ICICI BANK LTD. -

Mrp of Different Labels with Effect from 01.04.2016*

MRP OF DIFFERENT LABELS WITH EFFECT FROM 01.04.2016* * Please note that MRP list might contain pack sizes without Label Registration. Only Labels which are Registered with Excise Commissioner’s Office, Cuttack are eligible for supply to OSBC. MRP Supplier Name Label Name (per Bottle in INR) ABD Pvt. Ltd Officer's Choice Prestige Whisky(090) 55.00 ABD Pvt. Ltd Officer's Choice Prestige Whisky(180) 105.00 ABD Pvt. Ltd Officer's Choice Prestige Whisky(375) 215.00 ABD Pvt. Ltd Officer's Choice Prestige Whisky(750) 425.00 ABD Pvt. Ltd Officer's Choice Prestige Whisky(750)-(DEF) 235.00 ABD Pvt. Ltd Wodka Gorbatschow Vodka(180) 190.00 ABD Pvt. Ltd Wodka Gorbatschow Vodka(375) 375.00 ABD Pvt. Ltd Wodka Gorbatschow Vodka(750) 720.00 ABD Pvt. Ltd Jolly Roger Premium XXX Rum(090) 60.00 ABD Pvt. Ltd Jolly Roger Premium XXX Rum(180) 110.00 ABD Pvt. Ltd Jolly Roger Premium XXX Rum(375) 220.00 ABD Pvt. Ltd Jolly Roger Premium XXX Rum(750) 440.00 ABD Pvt. Ltd Wodka Gorbatschow Vodka(750)-(DEF) 455.00 ABD Pvt. Ltd Class 21 Grain Vodka(180) 110.00 ABD Pvt. Ltd Class 21 Grain Vodka(375) 215.00 ABD Pvt. Ltd Class 21 Grain Vodka(750) 425.00 ABD Pvt. Ltd Wodka Gorbatschow Vodka(090) 100.00 ABD Pvt. Ltd Class 21 Grain Vodka(090) 55.00 MRP OF DIFFERENT LABELS WITH EFFECT FROM 01.04.2016* * Please note that MRP list might contain pack sizes without Label Registration. Only Labels which are Registered with Excise Commissioner’s Office, Cuttack are eligible for supply to OSBC. -

Insolvency and Bankruptcy News | 1 from CHAIRPERSON’S DESK

Insolvency and Bankruptcy News | 1 FROM CHAIRPERSON’S DESK ......................................................................................02 IBBI UPDATES ..............................................................................................................04 LEGAL AND REGULATORY FRAMEWORK .....................................................................06 • Central Government • Insolvency and Bankruptcy Board of India • Other Authorities ORDERS .......................................................................................................................08 • Supreme Court • High Courts • National Company Law Appellate Tribunal • National Company Law Tribunal • Insolvency and Bankruptcy Board of India CORPORATE PROCESSES .............................................................................................14 • Insolvency Resolution • Liquidation • Voluntary Liquidation INDIVIDUAL PROCESSES .............................................................................................20 SERVICE PROVIDERS ....................................................................................................20 • Insolvency Professionals • Information Utility • Registered Valuers • Complaints and Grievances EXAMINATION ............................................................................................................23 • Limited Insolvency Examination • Valuation Examinations BUILDING ECOSYSTEM ...............................................................................................23 ADVOCACY AND -

Limited Tender Exercise Notice Inviting RFP No. DEO, WB/Valuer

Government of West Bengal Directorate of Economic Offences 5 No. Council House Street Kolkata - 700001 Email ID- [email protected] Memo No. /DEO January 11,2019. REQUEST FOR PROPOSAL (RFP)- Limited Tender Exercise Notice Inviting RFP No. DEO, WB/Valuer/2017-2018 The Director, Directorate of Economic Offences (DEO) invites sealed proposal in a single envelope system from the empanelled agencies (empanelled with Finance Department Govt. of West Bengal vide Notification No. 602-F(Y) Dated:01.02.2018. Panel of Asset and Enterprise Valuation for the cases registered under The West Bengal Protection of Interest of Depositors in Financial Establishments Act, 2013 as listed below for the work as particular given hereunder. 1) Empanelled Firms.(Panel-A:for both Asset & Enterprise valuation) i) RBSA Valuation Advisers LLP ii) MOORE STEPHENS SINGH iii) R.K, Patel & Company iv) ADROIT Technical Services Pvt. Limited. v) Pricewaterhouse & Co LLP vi) CRIS IL Risk & Infrastructure Solutions Limited. vii) LS I Financial Services Limited. (The participating agency has to produce evidential proof of valid empanelment certificate, copies of Income Tax return with acknowledgement for the last three assessment years including PAN Card, Power of Attorney/Authority to sign the Bid documents and Articles/Memorandum of Association (in case of companies) Partnership Deed- (in case of partnership firm.) & GST, Number as applicable. 2)Nameofwork:- Engagement of Asset and Enterprise Valuer upto 31/12/2019 for dealing with cases referred by the Directorate of Economic Offences from time to time. 3) The scope of Work: Valuation of all assets of Aced. companies and persons in West Bengal or outside within India as and when required. -

FINAL DISTRIBUTION.Xlsx

Annexure-1B 1)Taxpayers with turnover above Rs 1.5 Crores b) Taxpayers falling under the jurisdiction of the State Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 NATIONAL INSURANCE COMPANY LIMITED NATIONAL INSURANCE COMPANY LTD 19AAACN9967E1Z0 2 WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD 19AAACW6953H1ZX 3 INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) 19AAACI1681G1ZM 4 THE W.B.P.D.C.L. THE W.B.P.D.C.L. 19AABCT3027C1ZQ 5 ITC LIMITED ITC LIMITED 19AAACI5950L1Z7 6 TATA STEEL LIMITED TATA STEEL LIMITED 19AAACT2803M1Z8 7 LARSEN & TOUBRO LIMITED LARSEN & TOUBRO LIMITED 19AAACL0140P1ZG 8 SAMSUNG INDIA ELECTRONICS PVT. LTD. 19AAACS5123K1ZA 9 EMAMI AGROTECH LIMITED EMAMI AGROTECH LIMITED 19AABCN7953M1ZS 10 KOLKATA PORT TRUST 19AAAJK0361L1Z3 11 TATA MOTORS LTD 19AAACT2727Q1ZT 12 ASHUTOSH BOSE BENGAL CRACKER COMPLEX LIMITED 19AAGCB2001F1Z9 13 HINDUSTAN PETROLEUM CORPORATION LIMITED. 19AAACH1118B1Z9 14 SIMPLEX INFRASTRUCTURES LIMITED. SIMPLEX INFRASTRUCTURES LIMITED. 19AAECS0765R1ZM 15 J.J. HOUSE PVT. LTD J.J. HOUSE PVT. LTD 19AABCJ5928J2Z6 16 PARIMAL KUMAR RAY ITD CEMENTATION INDIA LIMITED 19AAACT1426A1ZW 17 NATIONAL STEEL AND AGRO INDUSTRIES LTD 19AAACN1500B1Z9 18 BHARATIYA RESERVE BANK NOTE MUDRAN LTD. BHARATIYA RESERVE BANK NOTE MUDRAN LTD. 19AAACB8111E1Z2 19 BHANDARI AUTOMOBILES PVT LTD 19AABCB5407E1Z0 20 MCNALLY BHARAT ENGGINEERING COMPANY LIMITED MCNALLY BHARAT ENGGINEERING COMPANY LIMITED 19AABCM9443R1ZM 21 BHARAT PETROLEUM CORPORATION LIMITED 19AAACB2902M1ZQ 22 ALLAHABAD BANK ALLAHABAD BANK KOLKATA MAIN BRANCH 19AACCA8464F1ZJ 23 ADITYA BIRLA NUVO LTD. 19AAACI1747H1ZL 24 LAFARGE INDIA PVT. LTD. 19AAACL4159L1Z5 25 EXIDE INDUSTRIES LIMITED EXIDE INDUSTRIES LIMITED 19AAACE6641E1ZS 26 SHREE RENUKA SUGAR LTD. 19AADCS1728B1ZN 27 ADANI WILMAR LIMITED ADANI WILMAR LIMITED 19AABCA8056G1ZM 28 AJAY KUMAR GARG OM COMMODITY TRADING CO. -

Press Release

Press Release Pincon Spirit Limited 16 December, 2017 Amount Name of the Instruments Rating/Outlook (Rs. Crore) SMERA BB/Negative Proposed Non-Convertible 35.00 (Removed from rating watch and rating Debentures downgraded) SMERA BB/Negative Cash Credit 245.00 (Removed from rating watch and rating downgraded) SMERA had placed PSL’s ratings on Watch with negative implication vide its rationale dated 10 November, 2017. SMERA has now downgraded the ratings on the Rs. 245.00 crores bank facilities of PSL and the Rs. 35.00 crore Proposed Non- Convertible Debenture Issue of Pincon Spirit Limited (PSL) to ‘SMERA BB‘(read as SMERA double B) from ‘SMERA BBB-’ (read as SMERA triple B minus) of Pincon Spirits Limited (PSL). The outlook is ‘Negative’. The downgrade revision is driven by the recent adverse developments in respect of PSL. PSL had informed exchanges (BSE and NSE) vide its letter dated 07th November, 2017 that Mr. Manoranjan Roy (earlier Chairman and Managing Director) was arrested by Special operations group (SOG), Rajasthan Police on 02nd November, 2017. PSL has informed exchanges (BSE and NSE) vide its letter dated 11th December, 2017 that Mr. Monoranjan Roy has tendered his resignation from the Board of Directors of PSL. The company is in the process of filing the necessary forms with the ROC (Registrar of Companies) for giving effect to his resignation at the earliest. PSL is presently in the process of appointing new Managing Director. The operations of the company have been significantly impacted and some of the bankers have initiated steps to curtail the fresh drawings in the accounts. -

Outperforming

Outperforming PINCON SPIRIT LIMITED www.pinconspirit.in PINCON SPIRIT LIMITED 39th ANNUAL REPORT 2016-17 Forward-looking statement In this annual report, we have disclosed forward looking information to enable investors to comprehend our prospects and take investment decisions. This report and other statements- written and oral- that we periodically make contain forward looking statements that set out anticipated results based on the management plans and assumptions. We have tried wherever possible to identify such statements by using words such as ‘anticipate’, ‘estimate’, ‘expects’, ‘projects’, ‘intends’, ‘plans’, ‘beliefs’ and ‘words of similar substance in connection with any discussion of future performance. We cannot guarantee that these forward looking statements will be realised, although we believe we have been prudent in our assumptions. The achievements of results are subject to risk, uncertainties and even inaccurate assumptions. Should known or unknown risk or uncertainties materialise, or should underlying assumptions prove inaccurate, actual; results could vary materially from those anticipated, estimated or projected. Readers should bear this in mind. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Contents Corporate Information ......................................................................................1 Directors’ Report.....................................................................................................2 -

Pincon Spirit Limited (Formerly Sarang Viniyog Limited) (A Pincon Group of Companies)

Pincon Spirit Limited (Formerly Sarang Viniyog Limited) (A Pincon Group of Companies) PINCON SPIRIT LIMITED (FORMERLY SARANG VINIYOG LIMITED) rd 33 Annual Report www.reportjunction.com Pincon Spirit Limited (Formerly Sarang Viniyog Limited) (33rd Annual Report 2010-11) AN EXECUTIVE SNAPSHO T O F PINCON SPIRIT LIMITED Directors 1. Mr. Monoranjan Roy, Chairman and Managing Director 2. Mrs. Mousumi Roy, Director 3. Mr. Rajkumar Roy, Director & CEO 4. Mr. Bahadur Singh Kathoria, Independent Director CFO Mr. Arup Thakur Auditor CA. Anupam Sarkar, Chartered Account, 81/2, Regent Estate, Kolkata – 700 092 Registered Office P-223, CIT Road, Scheme VI M, Kolkata , West Bengal – 700 054. India. Corporate Office 3 Dacres Lane, 3rd Floor, Kolkata-700 069. India. R&T Agent Niche Technologies Pvt. Ltd. D-511, Bagree Market, 71, B.R.B. Basu Road, Kolkata 700 001. Phones: 2235-7270/ 7271. 2234-3576 Fax : 2215-6823 Email : [email protected] URL : www.nichetechpl.com Bankers 1. Punjab National Bank, 2. Tamilnadu Mercantile Bank Limited, 3. Oriental Bank of Commerce Legal Advisor Khaitan & Partners, Advocates & Notaries, Express Tower, 6th Floor, 42A, Shakespeare Sarani, Kolkata – 700 017. (33rd Annual Report 2010-11) 2 www.reportjunction.com Pincon Spirit Limited (Formerly Sarang Viniyog Limited) (33rd Annual Report 2010-11) DIRECTORS’ REPORT To, The Members, Pincon Spirit Limited, (Formerly Sarang Viniyog Limited), P-223, C.I.T. Road, Scheme VI M, Kolkata – 700 054 Your Directors take pleasure in presenting the 33rd Annual Report together with the Audited Accounts of your Company for the Financial Year ended March 31, 2011. FINANCIAL RESULTS PARTICULARS Rs. -

Information Memorandum of Pincon Spirit Limited

INFORMATION MEMORANDUM OF PINCON SPIRIT LIMITED Regd. Office: 7, Red Cross Place, Wellesley House, 3 Floor, Kolkata – 700 001 INFORMATION MEMORANDUM PINCON SPIRIT LIMITED {CIN NO: L67120WB1978PLC031561} Registered Office 7, Red Cross Place, “Wellesley House” 3rd Floor, Kolkata – 700 001, West Bengal Phone Number 033 - 2231 9135, 033 – 2262 4943/44 E-Mail [email protected] Website www.pinconspirit.in Company Secretary and Mr. Aditya Karwa Compliance Officer Registrar and Niche Technologies Pvt . Ltd . Share Transfer Agent D-511, Bagree Market, 71, B.R.B.Basu Road, Kolkata – 700 001, West Bengal Tel. No.: 033 2235-7270/7271 Fax No.: 033 2215-6823 Email: [email protected] Website: www.nichetechpl.com Contact Person: Mr. S. Abbas 49, 04,800 EQUITYINFORMATION SHARES OF RS. MEMORANDUM 10/- EACH FULLY FOR LISTING PAID UP OF 10,021,500 EQUITY SHARES OF RS. 10/- EACH FULLY PAID UP NO EQUITY SHARES ARE PROPOSED TO BE SOLD / OFFERED PURSUANT TO THIS INFORMATION MEMORANDUM 1 Information Memorandum- Pincon Spirit Limited GENERAL RISKS Investments in equity and equity related securities involve a degree of risk and investors should not invest in equity of Pincon Spirit Limited unless they can afford to take the risk of losing their investment. Investors are advised to read the risk factors carefully before taking an investment decision in the shares of the Company. For taking an investment decision, investors must rely on their own examination of the Company including the risks involved. ABSOLUTE RESPONSIBILITY OF PINCON SPIRIT -

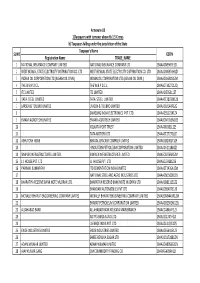

OFFER PRICE APPROVED by PRICE FIXATION COMMITTEE with EFFECT from 12.09.2016* Offer Price Supplier Name Label Name (Per Case in INR)

OFFER PRICE APPROVED BY PRICE FIXATION COMMITTEE WITH EFFECT FROM 12.09.2016* Offer Price Supplier Name Label Name (per Case in INR) ABD Pvt. Ltd Officer's Choice Prestige Whisky(090) 991.78 ABD Pvt. Ltd Officer's Choice Prestige Whisky(180) 946.69 ABD Pvt. Ltd Officer's Choice Prestige Whisky(375) 910.25 ABD Pvt. Ltd Officer's Choice Prestige Whisky(750) 907.44 ABD Pvt. Ltd Officer's Choice Prestige Whisky(750)-(DEF) 919.64 ABD Pvt. Ltd Jolly Roger Premium XXX Rum(090) 1052.83 ABD Pvt. Ltd Jolly Roger Premium XXX Rum(180) 1024.65 ABD Pvt. Ltd Jolly Roger Premium XXX Rum(375) 986.33 ABD Pvt. Ltd Jolly Roger Premium XXX Rum(750) 976.94 ABD Pvt. Ltd Class 21 Grain Vodka(180) 964.54 ABD Pvt. Ltd Class 21 Grain Vodka(375) 926.22 ABD Pvt. Ltd Class 21 Grain Vodka(090) 977.69 ABD Pvt. Ltd Jolly Roger Premium XXX Rum(750)-(DEF) 992.19 ABD Pvt. Ltd Officer Choice Blue Deluxe Grain Whisky(090) 1323.44 ABD Pvt. Ltd Officer Choice Blue Deluxe Grain Whisky(180) 1323.44 ABD Pvt. Ltd Officer Choice Blue Deluxe Grain Whisky(375) 1317.48 ABD Pvt. Ltd Officer Choice Blue Deluxe Grain Whisky(750) 1292.01 ABD Pvt. Ltd Officer's Choice Prestige Whisky(090) 991.78 ABD Pvt. Ltd Officer's Choice Prestige Whisky(090) 991.78 ABD Pvt. Ltd Officer's Choice Prestige Whisky(180) 946.69 OFFER PRICE APPROVED BY PRICE FIXATION COMMITTEE WITH EFFECT FROM 12.09.2016* Offer Price Supplier Name Label Name (per Case in INR) ABD Pvt. -

Wtm/Mpb/Isd/ 111 /2017

WTM/MPB/ISD/ 111 /2017 BEFORE THE SECURITIES AND EXCHANGE BOARD OF INDIA CORAM: MADHABI PURI BUCH, WHOLE TIME MEMBER INTERIM ORDER Under Sections 11, 11(4), 11A and 11B of the Securities and Exchange Board of India Act, 1992 in the matter of M/s Pincon Spirit Limited (PAN: AAHCS8354B) ________________________________________________________________________ Background of case: 1. Securities and Exchange Board of India (hereinafter referred to as “SEBI”) was in receipt of a letter no. F. No. 03/73/2017-CL-II dated June 9, 2017 from the Ministry of Corporate Affairs (hereinafter referred to as “MCA”) vide which MCA has annexed a list of 331 shell companies for initiating necessary action as per SEBI laws and regulations. MCA has also annexed the letter of Serious Fraud Investigation Office (hereinafter referred to as “SFIO”) dated May 23, 2017 which contained the data base of shell companies along with their inputs. 2. SEBI as a market regulator is vested with the duty under section 11(1) of the SEBI Act, 1992 (hereinafter referred to as “SEBI Act”) of protecting the interests of the investors in securities and to promote the development of and regulations of securities markets by appropriate measures as deemed fit. 3. SEBI was of the view that companies whose names are included as shell companies by SFIO and MCA, were potentially involved in (a) Misrepresentation including of its financials and its business and possible violation of SEBI (Listing Obligation and Disclosure Requirements) Regulation, 2015 (hereinafter referred to as “LODR Regulations”) and/or Interim Order in the matter of M/s Pincon Spirit Limited Page 1 of 24 (b) Misusing the books of accounts/funds of the company including facilitation of accommodation entries to the detriment of minority shareholders and therefore reneging on the fiduciary responsibility cast on the board, controlling shareholders and key management person (KMP) 4.