Royal Bank of Canada Annual Report 2020 1 Some 2020 Highlights Across Our Balanced Scorecard

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

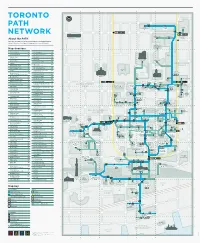

PATH Underground Walkway

PATH Marker Signs ranging from Index T V free-standing outdoor A I The Fairmont Royal York Hotel VIA Rail Canada H-19 pylons to door decals Adelaide Place G-12 InterContinental Toronto Centre H-18 Victory Building (80 Richmond 1 Adelaide East N-12 Hotel D-19 The Hudson’s Bay Company L-10 St. West) I-10 identify entrances 11 Adelaide West L-12 The Lanes I-11 W to the walkway. 105 Adelaide West I-13 K The Ritz-Carlton Hotel C-16 WaterPark Place J-22 130 Adelaide West H-12 1 King West M-15 Thomson Building J-10 95 Wellington West H-16 Air Canada Centre J-20 4 King West M-14 Toronto Coach Terminal J-5 100 Wellington West (Canadian In many elevators there is Allen Lambert Galleria 11 King West M-15 Toronto-Dominion Bank Pavilion Pacific Tower) H-16 a small PATH logo (Brookfield Place) L-17 130 King West H-14 J-14 200 Wellington West C-16 Atrium on Bay L-5 145 King West F-14 Toronto-Dominion Bank Tower mounted beside the Aura M-2 200 King West E-14 I-16 Y button for the floor 225 King West C-14 Toronto-Dominion Centre J-15 Yonge-Dundas Square N-6 B King Subway Station N-14 TD Canada Trust Tower K-18 Yonge Richmond Centre N-10 leading to the walkway. Bank of Nova Scotia K-13 TD North Tower I-14 100 Yonge M-13 Bay Adelaide Centre K-12 L TD South Tower I-16 104 Yonge M-13 Bay East Teamway K-19 25 Lower Simcoe E-20 TD West Tower (100 Wellington 110 Yonge M-12 Next Destination 10-20 Bay J-22 West) H-16 444 Yonge M-2 PATH directional signs tell 220 Bay J-16 M 25 York H-19 390 Bay (Munich Re Centre) Maple Leaf Square H-20 U 150 York G-12 you which building you’re You are in: J-10 MetroCentre B-14 Union Station J-18 York Centre (16 York St.) G-20 in and the next building Hudson’s Bay Company 777 Bay K-1 Metro Hall B-15 Union Subway Station J-18 York East Teamway H-19 Bay Wellington Tower K-16 Metro Toronto Convention Centre you’ll be entering. -

Promoting Canada's Economic and Financial Well-Being

Bank of Canada: Promoting Canada’s Economic and Financial Well-Being Remarks to the Greater Sudbury Chamber of Commerce Sudbury, Ontario 10 February 2014 John Murray Deputy Governor Bank of Canada Table of Contents . Bank of Canada’s mandate . Four main activities . Economic outlook . Introduction of Bank of Canada Regional Directors and representatives 2 Mandate 3 Mandate The Bank of Canada’s mandate is to contribute to the economic and financial well-being of Canadians We do this by: . aiming to keep inflation low, stable, and predictable . promoting a stable and efficient financial system . supplying secure, quality bank notes . providing banking services to the federal government and key financial system players 4 The Bank’s approach In each of these four core areas, we follow the same consistent approach: . a clear objective . accountability and transparency . a longer-term perspective 5 Key responsibilities: Monetary policy Our objective: To foster confidence in the value of money by keeping inflation at or near the 2 per cent inflation target This is important because: . it allows consumers, businesses, and investors to read price signals clearly, and to make financial decisions with confidence . it reduces the inequity associated with arbitrary redistributions of income caused by unexpected changes in inflation . it also makes the economy more resilient to shocks and enhances the effectiveness of monetary policy 6 Monetary policy: Low and stable inflation 12-month rate of increase, monthly data % 14 12 10 8 6 4 2 0 -2 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Inflation target CPI Sources: Statistics Canada and Bank of Canada calculations Last observation: December 2013 7 Central bank policy rates dropped to historic lows during the recession Policy interest rates, daily data % 5.0 4.0 3.0 2.0 1.0 0.0 2008 2009 2010 2011 2012 2013 2014 Canada United States Euro area Japan Sources: Bank of Canada, U.S. -

WHY DID the BANK of in Financial Markets and Monetary Economics

NBER WORKING PAPER SERIES WHY DIDTHEBANK OF CANADA EMERGE IN 1935? Michael Bordo Angela Redish Working Paper No. 2079 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 November 1986 The research reported here is part of the NBER's research program in Financial Markets and Monetary Economics. Any opinions expressed are those of the authors and not those of the National Bureau of Economic Research. NBER Working Paper #2079 November 1986 Why Did the Bank of Canada Emerge in 1935? ABSTRACT Three possible explanations for the emergence of the Canadian central bank in 1935 are examined: that it reflected the need of competitive banking systems for a lender of the last resort; that it was necessary to anchor the unregulated Canadian monetary system after the abandonment of the gold standard in 1929; and that it was a response to political rather than purely economic pressures. Evidence from a variety of sources (contemporary statements to a Royal Comission, the correspondence of chartered bankers, newspaper reports, academic writings and the estimation of time series econometric models) rejects the first two hypotheses and supports the third. Michael D. Bordo Angela Redish Department of Economics Department of Economics College of Business Administration University of British Columbia University of South CArolina Vancouver, B.C. V6T lY2 Columbia, SC 29208 Canada Why Did the Bank of Canada Emeroe in 1935? Michael D. Bordo and Angela Redish Three possible explanations for the emergence of the Canadian central bank in 1935 are examined: that it reflected the need of competitive banking systems for a lender of last resort; that it was necessary to anchor the unregulated Canadian monetary system after the abandonment of the gold standard in 1929; and that it was a response to political rather than purely economic pressures. -

PATH Network

A B C D E F G Ryerson TORONTO University 1 1 PATH Toronto Atrium 10 Dundas Coach Terminal on Bay East DUNDAS ST W St Patrick DUNDAS ST W NETWORK Dundas Ted Rogers School One Dundas Art Gallery of Ontario of Management West Yonge-Dundas About the PATH Square 2 2 Welcome to the PATH — Toronto’s Downtown Underground Pedestrian Walkway UNIVERSITY AVE linking 30 kilometres of underground shopping, services and entertainment ST PATRICK ST BEVERLEY ST BEVERLEY ST M M c c CAUL ST CAUL ST Toronto Marriott Downtown Eaton VICTORIA ST Centre YONGE ST BAY ST Map directory BAY ST A 11 Adelaide West F6 One King West G7 130 Adelaide West D5 One Queen Street East G4 Eaton Tower Adelaide Place C5 One York D11 150 York St P PwC Tower D10 3 Toronto 3 Atrium on Bay F1 City Hall 483 Bay Street Q 2 Queen Street East G4 B 222 Bay E7 R RBC Centre B8 DOWNTOWN Bay Adelaide Centre F5 155 Wellington St W YONGE Bay Wellington Tower F8 RBC WaterPark Place E11 Osgoode UNIVERSITY AVE 483 Bay Richmond-Adelaide Centre D5 UNIVERSITY AVE Hall F3 BAY ST 120 Adelaide St W BAY ST CF Toronto Bremner Tower / C10 Nathan Eaton Centre Southcore Financial Centre (SFC) 85 Richmond West E5 Phillips Canada Life Square Brookfield Place F8 111 Richmond West D5 Building 4 Old City Hall 4 2 Queen Street East C Cadillac Fairview Tower F4 Roy Thomson Hall B7 Cadillac Fairview Royal Bank Building F6 Tower CBC Broadcast Centre A8 QUEEN ST W Osgoode QUEEN ST W Thomson Queen Building Simpson Tower CF Toronto Eaton Centre F4 Royal Bank Plaza North Tower E8 QUEEN STREET One Queen 200 Bay St Four -

Section Ii Geographical List / Liste Géographique 1

SECTION II GEOGRAPHICAL LIST / LISTE GÉOGRAPHIQUE 1 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 100 MILE HOUSE, BC 000108270 08270-001 BANK OF MONTREAL Cariboo Mall, P.O. Box 10, 100 Mile House, BC V0K 2E0 001000550 00550-010 CANADIAN IMPERIAL BANK OF COMMERCE 100 Mile House Banking Centre, 1-325 Birch Ave, Box 98, 100 Mile House, BC V0K 2E0 000304120 04120-003 ROYAL BANK OF CANADA 100 Mile House Branch, 200 Birch Ave-PO Box 700, 200 Birch Ave, 100 Mile House, BC V0K 2E0 ABBEY, SK 000300118 00778-003 ROYAL BANK OF CANADA Abbey Branch, Wayne & Cathedral, c/o 120 Centre St, Abbey, SK S0N 0A0 (Sub to 00778) ABBOTSFORD, BC 000107090 07090-001 BANK OF MONTREAL Abbotsford Main, 101-32988 South Fraser Way, Abbotsford, BC V2S 2A8 000107490 07490-001 Highstreet Branch, 3122 Mt.Leham Rd, Abbotsford, BC V2T 0C5 000120660 20660-001 Lower Sumas Mountain, 1920 North Parallell Road, Abbotsford, BC V3G 2C6 000200240 00240-002 THE BANK OF NOVA SCOTIA Abbotsford, #100-2777 Gladwin Road, Abbotsford, BC V2T 4V1 (Sub to 11460) 000211460 11460-002 Clearbrook, PO Box 2151, Clearbrook Station, Abbotsford, BC V2T 3X8 000280960 80960-002 Ellwood Centre, #1-31205 Maclure Road, Abbotsford, BC V2T 5E5 (Sub to 11460) 000251680 51680-002 Glenn Mountain Village, Unit 106 2618 McMillan Road, Abbotsford, BC V3G 1C4 001000420 00420-010 CANADIAN IMPERIAL BANK OF COMMERCE Abbotsford, 2420 McCallum Rd, Abbotsford, BC V2S 6R9 (Sub to 08820) 001001720 01720-010 McCallum Centre, Box 188, Abbotsford, -

Canadian National Railway Company 2012 Annual

CANADIAN NATIONAL RAILWAY COMPANY 2012 ANNUAL INFORMATION FORM February 1, 2013 TABLE OF CONTENTS Annual Management's Information Discussion & Form Analysis (as filed on February 1, 2013) Incorporated by Reference Item 1 General Information 3 Item 2 Incorporation 4 2.1 Incorporation of the Issuer 4 2.2 Subsidiaries 4 Item 3 General Development of the Business 5 3.1 General Development of the Business During the Last Three Years 5 3.2 Anticipated Developments 13 46-49 Item 4 Description of the Business 13 4.1 Overview 13 4.2 Commodity Groups 13 52-56 4.3 Competitive Conditions 14 87 4.4 Labor 14 88-89 4.5 Social Policies 14 4.6 Regulation 14 89-92 4.7 Environmental Matters 16 79-80, 87-88 4.8 Legal Matters 18 76-78 4.9 Risk Factors 18 87-95 Item 5 Dividends 19 Item 6 Description of Capital Structure 19 6.1 General Description of Capital Structure 19 6.2 Share Ownership Constraints 19 6.3 Ratings of Debt Securities 20 Item 7 Transfer Agent and Registrar 21 Item 8 Market for Securities 21 8.1 Trading Price and Volume 21 8.2 Prior Sales 22 Item 9 Escrowed Securities 22 Item 10 Directors and Executive Officers 22 10.1 Directors 22 10.2 Audit Committee Disclosure 25 10.3 Executive Officers 27 10.4 Cease Trade Orders, Bankruptcies, Penalties or Sanctions 29 Item 11 Interest of Experts 29 Item 12 Additional Information 30 Schedule A Charter of the Audit Committee 31 AAAA 2012 Annual Information Form Item 1 GENERAL INFORMATION Except as otherwise indicated in this Annual Information Form (“AIF”), the information contained herein is given as of December 31, 2012. -

Join Us at an Upcoming Event!

ISSUE 52 July 5, 2016 JOIN US AT AN UPCOMING EVENT! TSX TRUST—REBRANDING OUR CORPORATE TRUST, SECURITIES TRANSFER BUSINESS TMX Equity Transfer Services has changed its name to TSX Trust in a move that better reflects our corporate trust and securities transfer services for public and private companies. There has been no change in the overall organizational structure, and we continue to provide the same full suite of services with reliability and efficiency. For more information, please click here. INTRODUCING TSXV LIQUIDITYPRO™ TSX Venture Exchange will launch a new service in September aimed at helping venture companies enhance liquidity. The TSXV LiquidityPro™ program is optional and introduces issuer-sponsored market making services to TSXV companies under the oversight and governance of TSXV. Market making offers several benefits to growing companies during their formative years. Having a committed market maker can promote market stability when there are gaps in natural liquidity, help to mitigate price volatility, and enhance the trading experience for investors. In fact, based on recent analysis by TSXV conducted between January 1, 2014 and August 2015, companies that engaged professional market maker services experienced a $0.02 decline in their average spread, an 18% increase in the number of days when a trade occurred, and a 6% decline in price volatility measured by the closing price against the 10-day moving average price. Through the program, TSXV companies can select from a pool of pre-qualified TSXV LiquidityPro™ Providers (LPPs), each of which submits a bid across a standardized set of market making metrics along with their related monthly fee. -

RBC Insurance Financial Strength Information

RBC Insurance Financial Strength Information Insurance offered by Liberty Life Insurance Company N1102Kit (1-09) Thank you for your interest in RBC. This booklet contains financial information and other facts about RBC and RBC Insurance. It is designed to help you familiarize yourself with our company. To learn more, please visit our web site, www.rbcinsurance.com\us or contact your insurance advisor. Discover RBC Insurance in the U.S. and create more for your future Integrity of Investment Portfolio Financial Strength Ratings > High quality, diversified and conservatively Fitch: A+ (Strong), 5th highest of 21 managed A.M. Best: A (Excellent), 3rd highest of 16 > Quality of bond portfolio significantly above One of only 39 U.S. life insurance companies to average for our industry maintain a Best rating of “A” or higher for 50 or more years > Diversification among a broad range of companies across many industries Product Offerings > Commercial mortgage loan portfolio well • Traditional annuities • Index annuities diversified by geography and type • Life insurance • Variable annuities Total Investment Portfolio Quality of Bond Portfolio $3.303 billion Average Quality = AA GAAP Book Value 12/31/08 12/31/08 Cash 2.6% Commercial 55.8% Mortgage Loans 17.1% Bonds 22.5% 80.3% 16.6% 4.4% .6% AAA AA A BBB <BBB RBC Insurance® is the brand name for Liberty Life Insurance Company, a part of the global insurance operations of Royal Bank of Canada. Liberty Life Insurance Company is solely responsible for its financial obligations. ®Registered trademarks of Royal Bank of Canada. Used under license. Products not available in all states. -

The National Bank of Canada Accelerates Deployments at Scale

The National Bank of Canada Accelerates Deployments at Scale About National Bank Executive Summary of Canada The National Bank of Canada (NBC), the country’s sixth-largest commercial bank, set out to transform its infrastructure for speed and scale. NBC’s ultimate goal was to dedicate more of the organization’s time and resources to business innovation instead of infrastructure management. By shifting away from an on-premises installation of its core trading solution, Murex’s MX.3 platform, the bank was able to provision new instances in minutes instead of months and gain better visibility into costs. NBC now runs its non-production MX.3 environments exclusively on Amazon EC2 instances. A Commercial Bank Seeks an Easier-to-Manage Solution The National Bank of Canada (NBC), one of Canada’s largest financial services organizations, wanted to optimize its existing on-premises installation of MX.3, an open platform from Murex that supports trading, treasury, risk, and post-trade operations. The National Bank of Canada Across the numerous projects in parallel, MX.3 ran on more than 100 servers in the bank’s own data center. NBC spent significant time and resources managing and upgrading this (NBC) is the sixth-largest on-premises infrastructure, making deployments of new installations a complex, nearly commercial bank in Canada, impossible process. “We wanted to scale the infrastructure to provision environments to with 2.4 million customers meet growing business needs. The business continued to enhance MX.3 and create new and branches in most projects, but it typically took weeks or months to order, procure, and implement new Canadian provinces. -

Chapter 11 ) LAKELAND TOURS, LLC, Et Al.,1 ) Case No

20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 1 of 105 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ) In re: ) Chapter 11 ) LAKELAND TOURS, LLC, et al.,1 ) Case No. 20-11647 (JLG) ) Debtors. ) Jointly Administered ) AFFIDAVIT OF SERVICE I, Julian A. Del Toro, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned case. On September 25, 2020, at my direction and under my supervision, employees of Stretto caused the following document to be served via first-class mail on the service list attached hereto as Exhibit A, via electronic mail on the service list attached hereto as Exhibit B, and on three (3) confidential parties not listed herein: Notice of Filing Third Amended Plan Supplement (Docket No. 200) Notice of (I) Entry of Order (I) Approving the Disclosure Statement for and Confirming the Joint Prepackaged Chapter 11 Plan of Reorganization of Lakeland Tours, LLC and Its Debtor Affiliates and (II) Occurrence of the Effective Date to All (Docket No. 201) [THIS SPACE INTENTIONALLY LEFT BLANK] ________________________________________ 1 A complete list of each of the Debtors in these chapter 11 cases may be obtained on the website of the Debtors’ proposed claims and noticing agent at https://cases.stretto.com/WorldStrides. The location of the Debtors’ service address in these chapter 11 cases is: 49 West 45th Street, New York, NY 10036. 20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 2 of 105 20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 3 of 105 Exhibit A 20-11647-jlg Doc 205 Filed 09/30/20 Entered 09/30/20 13:16:46 Main Document Pg 4 of 105 Exhibit A Served via First-Class Mail Name Attention Address 1 Address 2 Address 3 City State Zip Country Aaron Joseph Borenstein Trust Address Redacted Attn: Benjamin Mintz & Peta Gordon & Lucas B. -

Enwave's District Cooling Service

ENWAVE’S DISTRICT COOLING SERVICE Enwave has been in the outsourced air conditioning business since 1997. District cooling was a natural extension of the company’s core steam distribution business as the same customers that required heating, also required air conditioning. While Enwave’s foray into the air conditioning business had always been premised on using natural cooling from the depths of Lake Ontario, the early stages of the business made use of conventional technology. With two 1,500-ton absorption chillers at its newly constructed Chilled Water Plant, Enwave began supplying the expanded Metro Toronto Convention Center (MTCC) with 2600 tons of cooling in 1997. In 1999, plant capacity was expanded to 7700 tons with the addition of a 4,700-ton steam-driven centrifugal chiller as the customer base expanded to include the Air Canada Centre, the Steam Whistle Brewery and the telecommunications centre at 151 Front Street West, which was signed in 2000. With the commissioning of the company’s signature Deep Lake Water Cooling project (DLWC), the chillers were retained for emergency backup and peak shaving on the hottest days of the year. However, the primary source of cooling would now be the cold water of Lake Ontario. To date, over $110 million has been expended to bring in colder, cleaner drinking water for the City of Toronto and environmentally friendly cooling for downtown buildings. An additional $80 million will be spent by the time the system is fully built-out. The Deep Lake Water Cooling (DLWC) system is a sustainable energy project, which replaces conventional air conditioning. -

Présentation Powerpoint

A Capital Opportunity A Global Market for Companies Disclaimer This document is for information purposes only. While the information herein is collected and compiled with care, neither TMX Group Limited nor any of its affiliated companies represents, warrants or guarantees the accuracy or the completeness of the information. You agree not to rely on the information contained herein for any trading, legal, accounting, tax, investment, business, financial or other purpose. This information is provided with the express condition, to which by making use thereof you expressly consent, that no liability shall be incurred by TMX Group Limited and/or any of its affiliates as a result of any errors or omissions herein or any use or reliance upon this information. 2 © 2015 TSX Inc. All rights reserved. Do not sell or modify without the prior written consent of TSX Inc. Canada and TSX: Strong Fundamentals Economically stable • Canada is the fourth largest equity market by float capitalization in the MSCI World Index • World’s soundest banking system • Lowest debt-to-GDP among G7 • Strong equity culture • ~$2.5 trillion in market cap • $263 billion in equity capital raised in last 5 years A dynamic marketplace • Robust marketplace • Access to capital • History of innovation • Committed to growth 3 Canadian Markets… Global Leaders 1st 1st 1st In Listed Mining In Listed Oil and Gas In Listed Clean Technology Companies Worldwide Companies Worldwide Companies Worldwide 1st 1st 4th In Global Mining and Global Gold In Exchange-Traded Funds (ETFs) In the World by Number S&P/TSX Indices Originator of the World’s First ETF of New Listings 2nd 6th 8th In the World by Number In Equity Financing In Market Capitalization of Listed Companies 4 Source: World Federation of Exchanges, December 2014, TSX and TSXV Market Intelligence Group.