Graham & Doddsville

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Julian Robertson: a Tiger in the Land of Bulls and Bears

STRACHMAN_FM_pages 6/29/04 11:35 AM Page i Julian Robertson A Tiger in the Land of Bulls and Bears Daniel A. Strachman John Wiley & Sons, Inc. STRACHMAN_FM_pages 6/29/04 11:35 AM Page i Julian Robertson A Tiger in the Land of Bulls and Bears Daniel A. Strachman John Wiley & Sons, Inc. STRACHMAN_FM_pages 6/29/04 11:35 AM Page ii Copyright © 2004 by Daniel A. Strachman. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permis- sion of the Publisher, or authorization through payment of the appropriate per- copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400, fax 978-646-8600, or on the web at www. copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, 201-748-6011, fax 201-748-6008. Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fit- ness for a particular purpose. -

Graham & Doddsville

Graham & Doddsville An investment newsletter from the students of Columbia Business School Issue XXVI Winter 2016 Inside this issue: 25th Annual Craig Effron of Scoggin Capital Graham & Dodd Management Breakfast P. 3 Craig Effron P. 5 Craig Effron is the co-portfolio manager of Scoggin Capital Management, which he founded with partner Curtis Schenker in Jeff Gramm P. 19 1988. With approximately $1.75 billion in assets under management, Scoggin is a global, opportunistic, multi-strategy Shane Parrish P. 30 Craig Effron event-driven fund. Scoggin focuses on identifying fundamental Jon Salinas P. 39 long/short investments through three primary strategies including event driven equities with a catalyst, special situations, and distressed credit. Mr. Student Ideas P. 47 Effron began his career as a floor trader on the New York Mercantile Exchange and New York Commodity Exchange. Mr. Effron received a BS in Economics from the (Continued on page 5) Editors: Brendan Dawson Jeff Gramm ’03 Shane Parrish MBA 2016 of Bandera of Farnam Scott DeBenedett Partners MBA 2016 Street Anthony Philipp Jeff Gramm manages Shane Parrish is MBA 2016 Bandera Partners, a the curator behind Brandon Cheong value hedge fund based Shane Parrish the popular Jeff Gramm in New York City. He Farnam Street MBA 2017 teaches Applied Value Blog and founder Eric Laidlow, CFA Investing at Columbia Business School of the Re:Think Workshops on MBA 2017 and wrote the upcoming book “Dear Innovation and Decision Making. (Continued on page 19) (Continued on page 30) Benjamin Ostrow MBA 2017 Jon Salinas ’08 of Plymouth Lane Capital Management Visit us at: www.grahamanddodd.com Jonathan Salinas founded RolfPlymouth Heitmeyer Lane in April 2013 and acts www.csima.info as sole portfolio manager to the Fund. -

Cryptocurrencies Exploring the Application of Bitcoin As a New Payment Instrument

Cryptocurrencies Exploring the Application of Bitcoin as a New Payment Instrument By Shinnecock Partners in association with Sophia Bak, Jimmy Yang, Peter Shea, and Neil Liu About the Authors Shinnecock Partners undertook this study of cryptocurrencies with the authors to understand this revolutionary payment system and related technology, explore its disruptive potential, and assess the merits of investing in it. Shinnecock Partners is a 25 year old investment boutique with an especial focus on niche investments offering higher returns with less risk than more traditional investments in long equities and bonds. Sophia Bak is an analyst intern at Shinnecock Partners. She is an MBA candidate at UCLA Anderson School of Management with a focus on Finance. Prior to Anderson, she spent five years at Mirae Asset Global Investments, working in equity research, global business strategy, and investment development. She holds a B.S. in Business Administration from Carnegie Mellon University with concentration in Computing and Information Technology. Jimmy Yang is a third-year undergraduate student at UCLA studying Business Economics and Accounting. Peter Shea is a third-year undergraduate student at UCLA studying Mathematics, Economics and Statistics. Neil Liu is a third-year undergraduate student at UCLA studying Applied Mathematics and Business Economics. Acknowledgements We are grateful to the individuals who shared their time and expertise with us. We want to thank John Villasenor, UCLA professor of Electrical Engineering and Public Policy, Brett Stapper and Brian Lowrance from Falcon Global Capital, and Tiffany Wan and Max Hoblitzell from Deloitte Consulting LLP. We also want to recognize Tracy Williams and Steven Kroll for their thoughtful feedback and support. -

Hedge Fund Billionaires Attack the Hudson Valley Wall Street Goes All in to Save Tax Breaks for the Wealthy

HEDGE PAPERS No.39 HEDGE FUND BILLIONAIRES ATTACK THE HUDSON VALLEY WALL STREET GOES ALL IN TO SAVE TAX BREAKS FOR THE WEALTHY Hedge funds and billionaire hedge fund managers are destroying our economy, corrupting our government, hurting families and communities and exploding inequality. It’s happening all over America, and increasingly all over the world. And now it’s happening in the Hudson Valley. A tiny group of hedge fund billionaires have targeted the congressional campaign in the 19th House District of New York, spending millions of dollars to support GOP candidate John Faso and attack Democratic candidate Zephyr Teachout. SIX HEDGE FUND BILLIONAIRES HIT THE HUDSON VALLEY WITH $5.5 MILLION IN CAMPAIGN CASH The amount of campaign cash is amazing: we’ve found that six billionaire hedge fund managers from New York City, Connecticut and Long Island have given $5,517,600 to PACs and Super PACs active in the Teachout-Faso campaign in this electoral cycle. These same six men have given $102,768,940 in federal and New York state campaign contributions in the past two decades. They’re not doing it for nothing -- they want something in return. These hedge fund billionaires and their colleagues at hedge funds and private equity firms get billions of dollars in special tax breaks under the “carried interest loophole” – and they want to keep the loophole wide open. Closing the loophole would save the federal government an estimated $18 billion per year, according to an analysis by law professor Victor Fleischer.[1] But huge sums of lobbying and campaign cash directed at Congress – and Congressional candidates – by hedge funds and private equity firms have stymied reform in Washington and fueled continued obstructionism. -

The Watershed Events of 2000

CCC-Peltz 1 (1-44) 3/12/01 6:47 PM Page 13 1 THE WATERSHED EVENTS OF 2000 Julian Robertson of Tiger Manage- ment and George Soros of Soros Fund Management had long been rec- ognized as the great hedge fund managers. For many years, Soros had been the largest hedge fund manager as determined by assets under management; but in 1998, Robertson’s assets overtook Soros’s. At their peaks, both had assets of about $22 billion. Both men had long and successful track records. Soros started his fund in 1969 and Robertson in 1980. Both evolved into global macro managers—those managers who take advantage of opportunities around the world and invest in a variety of instruments including stocks, bonds, commodities, currencies, and futures, and typically take large leveraged positions. By midyear 2000, the situation had changed drastically. Robertson had retired and Soros had significantly changed his organization and fund objectives. TIGER UNRAVELS I met Julian H. Robertson Jr. for the first time in August 1998. We had breakfast in his office on the top floor of 101 Park Avenue. He fit the image of the Southern gentleman that I had heard about so often. Dur- ing the breakfast, he mentioned the problems that he had with Business 13 CCC-Peltz 1 (1-44) 3/12/01 6:47 PM Page 14 14 THE NEW INVESTMENT SUPERSTARS Week. (Business Week wrote an April 1996 cover piece on him called “The Fall of the Wizard of Wall Street.” It focused on his results in 1994 and 1995. The following March, Robertson initiated a libel lawsuit in New York State courts against Business Week; McGraw-Hill, the pub- lisher of the magazine; Gary Weiss, the author of the story; and Stephen Shepherd, the editor of Business Week, seeking to recover $1 billion in damages. -

Fit to Be King: How Patrimonialism on Wall Street Leads to Inequality Megan Tobias Neely*

Socio-Economic Review, 2018, Vol. 16, No. 2, 365–385 doi: 10.1093/ser/mwx058 Article Article Fit to be king: how patrimonialism on Wall Street leads to inequality Megan Tobias Neely* The Michelle R. Clayman Institute for Gender Research, Stanford University, 450 Serra Mall, Stanford, CA, 94025-2047, USA *Correspondence: [email protected] Abstract The hedge fund industry is one of the most lucrative and powerful industries in the USA, yet it mostly comprises white men. To understand why, I turn to Weber’s theory of patrimonialism, which primarily has been applied to historical or non- Western societies. I argue that patrimonialism—activated through trust, loyalty and tradition—restricts access to financial rewards and facilitates the reproduction of the white male domination of this industry. Using data from 45 in-depth interviews com- bined with field observations at industry events over a 4-year period, I investigate how hiring, grooming and seeding practices within and among firms enable certain elites to maintain monopolies over financial resources. Applying the theory of patri- monialism to a context with few women and minority men in power-holding posi- tions demonstrates how practices that reproduce elite structures are directly connected to inequality in the workplace. Key words: patrimonialism, trust, loyalty, social capital, elites, gender, race and ethnicity, social class, work and occupations, finance JEL classification: G24, J44, J62, J70, J71 1. Introduction Inequality in the USA has returned to levels unprecedented since the years before World War II. The rising incomes of the top 10% of earners are driving this increasing inequality (Piketty, 2014). -

Bain Capital Specialty Finance, Inc

SUBJECT TO COMPLETION, DATED NOVEMBER 7, 2018 PRELIMINARY PROSPECTUS 7,500,000 SHARES BAIN CAPITAL SPECIALTY FINANCE, INC. Common Stock We are an externally managed specialty finance company focused on lending to middle market companies that has elected to be regulated as a business development company (‘‘BDC’’), under the Investment Company Act of 1940, as amended (together with the rules and regulations promulgated thereunder, the ‘‘1940 Act’’). Our primary focus is capitalizing on opportunities within our Senior Direct Lending strategy, which seeks to provide risk-adjusted returns and current income to our stockholders by investing primarily in middle market companies with between $10.0 million and $150.0 million in annual earnings before interest, taxes, depreciation and amortization. We focus on senior investments with a first or second lien on collateral and strong structures and documentation intended to protect the lender. We may also invest in mezzanine debt and other junior securities, including common and preferred equity, on an opportunistic basis, and in secondary purchases of assets or portfolios, but such investments are not the principal focus of our investment strategy. We are managed by our investment adviser, BCSF Advisors, LP, a subsidiary of Bain Capital Credit, LP. This is an initial public offering of shares of our common stock. All of the shares of common stock offered by this prospectus are being sold by us. Shares of our common stock have no history of public trading. We currently expect that the initial public offering price per share of our common stock will be between $20.25 and $21.25. -

Greenblatt Briefing Book

BRIEFING BOOK Data Information Knowledge WISDOM JOEL GREENBLATT Location: Forbes, New York, New York About Joel Greenblatt ......................................................................... 2 Debriefing Greenblatt ......................................................................... 3 Greenblatt in Forbes "Books Can Make You Rich,” 12/21/09………………………… 7 "Value In Construction, Not Housing," 09/30/09………………. 9 “Five Little Book Stocks That Beat The Market," 03/31/09…… 12 "Beat The Market With Magic Stocks,” 01/30/07……………… 19 The Greenblatt Interview ………………………………………………… 19 ABOUT JOEL GREENBLATT Intelligent Investing with Steve Forbes Joel Greenblatt is the founder and managing partner of the hedge fund Gotham Capital. He is also the co- founder of Formula Investing, an investment system that offers a value-based investment strategy chronicled in one of Greenblatt’s books called The Little Book That Beats The Market . Greenblatt is chairman of Harlem Success Academy I and III and the Success Charter Network, which is a chain of charter schools in New York City. He is also the former chairman of the board of Alliant Techsystems, an aerospace and defense company. Greenblatt has been an adjunct professor at the Columbia Business School since 1996 where he teaches value and special situation investing. Greenblatt also wrote You Can Be A Stock Market Genius . Greenblatt received his bachelors degree and MBA from the Wharton School at the University of Pennsylvania. - 2 - DEBRIEFING GREENBLATT Intelligent Investing with Steve Forbes Interview conducted by Alexandra Zendrian January 22, 2010 Forbes : Can you describe the magic formula for investing and how you came up with it? Joel Greenblatt: This is what I wrote the book about five years ago. It follows the principles I’ve used in investing since I started my firm in 1985 and I’ve been teaching at Columbia for the past 14 years and these are the principles I’ve used to teach. -

What Hedge Funds Really Do: an Introduction to Portfolio Management Copyright © Business Expert Press, LLC, 2014

ROMERO THE BUSINESS What Hedge Funds Really Do E C EXPERT PRESS Philip J. Romero and Jeffrey A. Edwards, Editors DIGITAL LIBRARIES An Introduction to Portfolio • Management BALCH EBOOKS FOR BUSINESS STUDENTS Philip J. Romero • Tucker Balch Curriculum-oriented, born- When I managed a hedge fund in the late 1990s, computer- digital books for advanced based trading was a mysterious technique only available to the business students, written by academic thought largest hedge funds and institutional trading desks. We’ve come What Hedge leaders who translate real- a long way since then. With this book, Drs. Romero and Balch lift world business experience the veil from many of these once-opaque concepts in high-tech into course readings and nance. We can all bene t from learning how the cooperation reference materials for Funds between wetware and software creates tter models. This book students expecting to tackle does a fantastic job describing how the latest advances in nan- management and leadership cial modeling and data science help today’s portfolio managers challenges during their solve these greater riddles. —Michael Himmel, Managing Really Do professional careers. Partner, Essex Asset Management POLICIES BUILT I applaud Phil Romero’s willingness to write about the hedge An Introduction BY LIBRARIANS DO HEDGE FUNDS REALLY WHAT • Unlimited simultaneous fund world, an industry that is very private, often amboyant, usage and easily misunderstood. As with every sector of the invest- to Portfolio • Unrestricted downloading ment landscape, the hedge fund industry varies dramatically and printing from quantitative “black box” technology, to fundamental re- • Perpetual access for a search and old-fashioned stock picking. -

Application of Synthesis of Several Methods in Stock Valuation

ISSN: 0798-1015 Vol. 41 (34) 2020 • Art. 19 Recibido/Received: 22/06/2020 • Aprobado/Approved: 19/08/2020 • Publicado/Published: 10/09/2020 Application of synthesis of several methods in stock valuation Aplicación de síntesis de varios métodos en valuación de existencias SEDOVA, Nadezhda V.1 BUZULUTSKIY, Mikhail I.2 MISHAGINA, Marina V.3 ROMANOV, Ilia P.4 Abstract: Stock analysis is a complex and relevant topic in modern theory of financial management. In our time, many different stock analysis methods have been developed based on various theories. The article proposes the use of best practices of stock analysis using a method that combines principles developed by American investors Benjamin Graham and Joel Greenblatt. The proposed method is based on the theory of value investing, which remains stable and efficient investment strategy in our days. The main purpose of this article is to provide essential points of assessing the quality of companies and explain the decision making process behind the stock investments. The article presents data and excerpts from researches confirming the effectiveness of the principles taken as a basis. A description of the proposed method is presented, as well as the rationale of the used ratios. After familiarization with the proposed method, an analysis of several companies of various sectors was done in order to implement the theory in practice and determine the best company for the possible purchase of its stocks. Keywords: Investment strategy, Stock analysis, Value investing, Margin of safety Extracto: El análisis de la reserva es un tema complejo y relevante en la teoría moderna de la gestión financiera. -

Chase Coleman Makes a Killing

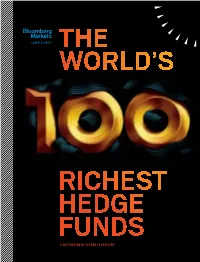

COVER STORieS THE WORLD’S RICHEST HEDGE FUNDS ILLUSTRATION BY ISTVÁN SZUGYICZKY Month 2012 BLOOMBERG MARKETS 29 CHASE COLEMAN’S TIGER GLOBAL FUND SCORED A 45 PERCENT GAIN AND THE NO. 1 SPOT. OtHER ACOLYTES OF TIGER MANAGEMENT FOUNDER JULIAN ROBERTSON ALSO THE DISTINGUISHED THEMSELVES IN A YEAR WHEN PERFORMANCE WAS GENERALLY DISMAL. THE WORLD’S 100 RICHEST HEDGE FUNDS TIGER CUBS ROAR BY ANTHONY EFFINGER, KATHERINE BURTON AND ARI LEVY ILLUSTRATION BY DAVID JOHNSON Left to right, Bill Hwang of Tiger Asia, Chase Coleman of Tiger Global, Julian Robertson of Tiger Management and Philippe Laffont of Coatue Management February 2012 BLOOMBERG MARKETS 31 THE WORLD’S 100 RICHEST HEDGE FUNDS TOP-P100ERFORMING LARGE HEDGE FUNDS CHARLES PAYSON ASSETS, IN YTD TOTAL 2010 Fund, Manager(s) Management Firm, Location Strategy BILLIONS RETURN RETURN COLEMAN III, KNOWN AS CHASE, 1 Tiger Global, Chase Coleman, Feroz Dewan Tiger Global Management, U.S. Long/short 6.0 45.0% 18.0% IS AS CLOSE AS ONE 2 Renaissance Institutional Equities, Peter Brown, Robert Mercer Renaissance Technologies, U.S. Quantitative 7.0 33.1 16.4 GETS TO AMERICAN 3 Pure Alpha II, Ray Dalio Bridgewater Associates, U.S. Macro 53.0 23.5 44.8 ARISTOCRACY. 4 Discus Managed Futures Program, Team managed Capital Fund Management, France Managed futures 2.5 20.9 –6.7 A descendent of Peter Stuyvesant, 5 Providence MBS, Russell Jeffrey Providence Investment Management, U.S. Mortgage-backed arbitrage 1.3 20.6 30.3 the last Dutch governor of New York, 6 Oculus, David E. Shaw D.E. -

Where the Money's Really Made

Where the Money http://bear.cba.ufl.edu/demiroglu/fin4504fall2004/Articles/article21.htm Where the Money's Really Made Hedge funds are raking in hundreds of billions while you're losing your shirt. Is this the next bubble? Andy Serwer; reporter associates Julia Boorstin and Melanie Shanley 03/31/2003 Fortune Magazine Time Inc. Page 106 (Copyright 2003) Across this quiet, snowy field, through the trees and over the fence, lurks a Wall Street monster. The locale is Westport, Conn., about a mile inland from Long Island Sound across I-95. The beast within those stark walls is Pequot Capital, a superpowerful $7 billion hedge fund that along with a dozen or so other mega--hedge funds--many sprinkled among towns nearby--is rocking mainstream Wall Street to its core. Here in Fairfield County, the richest county in the richest state in the richest country in the world, vast fortunes are being created, and rules of finance are being rewritten. Don't for a minute think that this doesn't apply to you. The hedge fund boom has sweeping implications not just for Wall Street traders and a few thousand well-heeled investors, but increasingly for every American businessperson, investor, and retiree. You know the $7 trillion--plus of stock market value that has evaporated over the past three miserable years? Well, guess what: The money didn't simply disappear. Some folks, often short-sellers at hedge funds, profited mightily from the decline. Nothing wrong with that. A hedge fund is supposed to make money in markets bull and bear.