Investment, Trading, and Portfolio Management Frederick Ernest Seymour Worcester Polytechnic Institute

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Updated Index for New Trading Systems and Methods

Index A pairs trading, 530 Acceleration, 382—386 product spreads, 531—537 Accumulation—bottoms and tops, 105—110 program trading, 525—526 Accumulative average, 258 ratio chart, 529—530 Adaptive techniques, 731—751 representative subset of an index, 527 Chande’s Variable Index Dynamic Average, 736 reverse crack, 534 comparisons, 741 single stock futures and underlying stock, 527—528 correlation coefficient, r2, 739—740 soybean crush, 532—533 dynamic momentum index, 747—748 stock and futures relationships, 531 FAMA, 737—738 TED spread, 544 intraday breakout system, 748—749 ARIMA (Autoregressive Integrated Moving Average), Kaufman’s Adaptive Moving Average, 731—735 237—243 MAMA, 737—738 estimation: determining the coefficients, 240—241 Master Trading Formula, 745—746 first-order autoregression, 237 McGinley Dynamics, 742 forecast results, 241 MESA Adaptive Moving Average, 737—739 Kalman filters, 243 momentum calculations,740 second-order autoregression, 238 Parabolic Time/Price System, 742—745 trading strategies, 241—243 RSI programmed, 740—741 Arithmetic mean, 19—20, 26 process development example, 749—750 Arms’Equivolume, 490 trend-adjusted oscillator, 747 Arms Index, 504 stochastic, variable-length, 746—747 Artificial intelligence, 696—697. varying the trend period, 739—740 See also Pattern recognition, computer-based ADX (Average Directional Movement Index), 1015-1017 Aspects, planetary, 616—618 AD oscillator, 369—373 Aspray’s Demand Oscillator, 495—496 Advance-decline system, 508 Asset allocation. See Portfolio allocation Advanced techniques, 791—846 Astrology, financial, 612—625 chaotic patterns and market behavior, 826—827 Aspects, 616—618 entropy and conditional entropy, 827—829 Jupiter-Saturn cycle, 613—616 expert systems. See Expert systems lunar eclipses, 624—625 fractals. -

Elder-Disk for Tradestation CIMTR V

Elder-disk for TradeStation version 4.1 (for TradeStation v9.5 and newer) Thank you for purchasing this Elder-disk. It was originally developed in 2002 by Dr. Alexander Elder, the author of COME INTO MY TRADING ROOM, and by John Bruns, a programmer. This disk adds the indicators to TradeStation from this book, as well as the earlier book TRADING FOR A LIVING. This software is designed for use with TradeStation online. You must be a registered user of TradeStation Software to use this disk. Some of our newer studies require Radar Screen. You must have Radar Screen enabled to use them. Check with your TradeStation representative how to qualify for a complimentary Radar Screen. This Manual and software are Copyright © 2002, 2006, 2012 and 2017 by Elder.com and John Bruns. All Rights Reserved. Violators will be prosecuted. This manual is provided in PDF format, showing screen samples exactly as you will see them on your TradeStation. To view the PDF file, you need to have Acrobat Reader, a free program from Adobe. If you do not already have it installed, the viewer for PDF can be downloaded for free from www.adobe.com , look for Acrobat Reader. You can work with this manual displayed on your screen or print it out. TradeStation charts normally have a black background which looks great on a monitor but translates poorly to print. If you decide to print this manual, try a sample page with black charts first to see how they turn out. Keep in mind that this type of printing will use a lot of ink. -

A Guide to WL Indicators

A GUIDE TO WL INDICATORS GETTING TECHNICAL ABOUT TRADING: USING EIGHT COMMON INDICATORS TO How is it different from other MAs? MAKE SENSE OF TRADING While other MA calculations may weigh price or time frame differently, the SMA is calculated by weighing the closing prices equally. What’s a technical indicator and why should I use them? Traders usually use more than one SMA to determine market momentum; when an SMA with a short- term time What’s the market going to do next? It is a question that’s almost always on traders’ minds. Over time, traders period (for instance, a 15-day SMA) crosses above an SMA with a long-term time frame (a 50-day SMA), it usually have looked at price movements on charts and struggled to make sense of the ups, downs, and sometimes means that the market is in an uptrend. sideways movements of a particular market. When an SMA with a shorter time period crosses below an SMA with a longer time period, it usually means That’s given rise to technical indicators - a set of tools that use the real-time market moves of an instrument to that the market is in a downtrend. Traders also use SMAs to detect areas of support when a trend changes give traders a sense of what the market will do next. There are hundreds of different indicators that traders can direction. Generally, an SMA with a longer time period identifies a stronger level of support. use, but whether you’re a new trader or an old hand at it, you need to know how to pick one, how to adjust its settings, and when to act on its signals. -

Trading System Development David Francis Zielinski Worcester Polytechnic Institute

Worcester Polytechnic Institute Digital WPI Interactive Qualifying Projects (All Years) Interactive Qualifying Projects June 2017 Trading System Development David Francis Zielinski Worcester Polytechnic Institute Muhaimin Islam Worcester Polytechnic Institute Obianuli Ebubechukwu Obiora Worcester Polytechnic Institute Follow this and additional works at: https://digitalcommons.wpi.edu/iqp-all Repository Citation Zielinski, D. F., Islam, M., & Obiora, O. E. (2017). Trading System Development. Retrieved from https://digitalcommons.wpi.edu/iqp- all/1892 This Unrestricted is brought to you for free and open access by the Interactive Qualifying Projects at Digital WPI. It has been accepted for inclusion in Interactive Qualifying Projects (All Years) by an authorized administrator of Digital WPI. For more information, please contact [email protected]. Trading System Development An Interactive Qualifying Project Submitted to the Faculty Of In Partial Fulfillment of the requirements for the Degree of Bachelor of Science By: David Zielinski Obi Obiora Muhaiman Islam Submitted to: Professors Michael Radzicki Fred Hutson 1 Abstract: 4 Chapter 1: 5 Introduction 5 Chapter 2: 7 Trading and Investing 7 Pros and Cons 8 Day Trading Pros and Cons 9 Swing Trading Pros and Cons 11 Pros 11 Cycle and Trend 12 Four Asset Classes and Inter Market Analysis 14 Equities: 14 Currencies: 15 Commodities: 15 Intermarket Analysis: 17 How Businesses Respond to the Business Cycle 18 Advantages and Disadvantages 19 Taxing Asset Classes: 20 Account Requirements and Position -

© 2012, Bigtrends

1 © 2012, BigTrends Congratulations! You are now enhancing your quest to become a successful trader. The tools and tips you will find in this technical analysis primer will be useful to the novice and the pro alike. While there is a wealth of information about trading available, BigTrends.com has put together this concise, yet powerful, compilation of the most meaningful analytical tools. You’ll learn to create and interpret the same data that we use every day to make trading recommendations! This course is designed to be read in sequence, as each section builds upon knowledge you gained in the previous section. It’s also compact, with plenty of real life examples rather than a lot of theory. While some of these tools will be more useful than others, your goal is to find the ones that work best for you. Foreword Technical analysis. Those words have come to have much more meaning during the bear market of the early 2000’s. As investors have come to realize that strong fundamental data does not always equate to a strong stock performance, the role of alternative methods of investment selection has grown. Technical analysis is one of those methods. Once only a curiosity to most, technical analysis is now becoming the preferred method for many. But technical analysis tools are like fireworks – dangerous if used improperly. That’s why this book is such a valuable tool to those who read it and properly grasp the concepts. The following pages are an introduction to many of our favorite analytical tools, and we hope that you will learn the ‘why’ as well as the ‘what’ behind each of the indicators. -

Indicators Nison Power Concept EAST & WEST CONFIRMATION

Instructors: Syl Desaulniers, Nison Certified Trainer™ Tracy Knudsen, Nison Certified Trainer™ Improve Your Process… Get BIG Results KAIZEN TRADING APPRENTICESHIP Bonus Session Address student trades, concerns, follow-up questions Analysis of current market conditions Awarding of Kaizen Technician™ certification Strict Candlestick Patterns Qualifications for Strict Candle Patterns: - Shape of Candle Lines or Pattern - Trend requirement is the same for strict and non-strict patterns Important Concept with Candle Lines/Patterns: - Confirmation: Using a move after the initial candle signal to validate a move - Less important with East/West Confirmation Candlestick Lines and Patterns In Order of Candle Progression - Least to Most Bullish - Least to Most Bearish - Risk/Reward Tradeoff comes with candle progression Strict Candlestick Patterns - Bullish Strict Candlestick Patterns - Bearish Trend Progression/Multiple Time Frames Monthly, Weekly, Daily, 4 Hour, 2 Hour, 60 Minute, 30 Minute, 15 Minute… • Involves monitoring the same instrument across different frequencies (or time compressions) • No real limit as to how many frequencies can be monitored or which specific ones to choose • Trades placed in direction of longer term trend have higher probability of success • There are general guidelines that most practitioners will follow Trend Progression/Multiple Time Frames • Looking at a stock through different time frames can be confusing as a new trader. Why? • Because each time frame looks different! • A stock may look great on the daily chart, but look horrible on a 5 minute chart. • How many timeframes should a trader use? • Using three different periods gives a broad enough reading on the market • using fewer than this can result in a considerable loss of data • while using more typically provides redundant analysis. -

Technical Indicators Defined & Explained

Technical Indicators Defined & Explained A guide to understanding and applying the most popular technical indicators by BDSwiss Trading Academy Any information appearing on this graph or text is based solely on reasonable assumptions and does not December 2020 represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. Index Page 01 RSI - Relative Strength Index 03 02 Average Directional Index 07 03 Parabolic SAR 10 04 Moving Average Convergence and Divergence MACD 13 05 Bollinger Bands® 16 06 Linearly Weighted Moving Average 19 07 Exponential Moving Average 22 08 Simple Moving Average 25 09 Stochastic Oscillator 28 Any information appearing on this graph or text is based solely on reasonable assumptions and does not represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. 2 01 RSI Relative Strength Index Any information appearing on this graph or text is based solely on reasonable assumptions and does not represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. 3 Indicator Profile • RSI was developed in 1978 by J. Welles Wilder Jr. • It is among the most widely used trading indicators in technical analysis. • RSI is a momentum indicator, which means it helps measure the velocity of a particular assets price changes. • In its initial form, the RSI was designed for stock trading. As it started proving efficient, traders began applying it to other assets as well. The Relative Strength Index is an indicator that helps traders capture market momentum by measuring the magnitude of price fluctuations. -

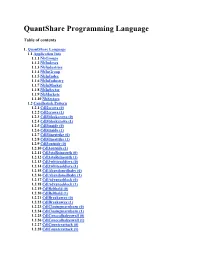

Timeframeset

QuantShare Programming Language Table of contents 1. QuantShare Language 1.1 Application Info 1.1.1 NbGroups 1.1.2 NbIndexes 1.1.3 NbIndustries 1.1.4 NbInGroup 1.1.5 NbInIndex 1.1.6 NbInIndustry 1.1.7 NbInMarket 1.1.8 NbInSector 1.1.9 NbMarkets 1.1.10 NbSectors 1.2 Candlestick Pattern 1.2.1 Cdl2crows (0) 1.2.2 Cdl2crows (1) 1.2.3 Cdl3blackcrows (0) 1.2.4 Cdl3blackcrows (1) 1.2.5 Cdl3inside (0) 1.2.6 Cdl3inside (1) 1.2.7 Cdl3linestrike (0) 1.2.8 Cdl3linestrike (1) 1.2.9 Cdl3outside (0) 1.2.10 Cdl3outside (1) 1.2.11 Cdl3staRsinsouth (0) 1.2.12 Cdl3staRsinsouth (1) 1.2.13 Cdl3whitesoldiers (0) 1.2.14 Cdl3whitesoldiers (1) 1.2.15 CdlAbandonedbaby (0) 1.2.16 CdlAbandonedbaby (1) 1.2.17 CdlAdvanceblock (0) 1.2.18 CdlAdvanceblock (1) 1.2.19 CdlBelthold (0) 1.2.20 CdlBelthold (1) 1.2.21 CdlBreakaway (0) 1.2.22 CdlBreakaway (1) 1.2.23 CdlClosingmarubozu (0) 1.2.24 CdlClosingmarubozu (1) 1.2.25 CdlConcealbabyswall (0) 1.2.26 CdlConcealbabyswall (1) 1.2.27 CdlCounterattack (0) 1.2.28 CdlCounterattack (1) 1.2.29 CdlDarkcloudcover (0) 1.2.30 CdlDarkcloudcover (1) 1.2.31 CdlDoji (0) 1.2.32 CdlDoji (1) 1.2.33 CdlDojistar (0) 1.2.34 CdlDojistar (1) 1.2.35 CdlDragonflydoji (0) 1.2.36 CdlDragonflydoji (1) 1.2.37 CdlEngulfing (0) 1.2.38 CdlEngulfing (1) 1.2.39 CdlEveningdojistar (0) 1.2.40 CdlEveningdojistar (1) 1.2.41 CdlEveningstar (0) 1.2.42 CdlEveningstar (1) 1.2.43 CdlGapsidesidewhite (0) 1.2.44 CdlGapsidesidewhite (1) 1.2.45 CdlGravestonedoji (0) 1.2.46 CdlGravestonedoji (1) 1.2.47 CdlHammer (0) 1.2.48 CdlHammer (1) 1.2.49 CdlHangingman (0) 1.2.50 -

Technical Indicators Defined & Explained

Technical Indicators Defined & Explained A guide to understanding and applying the most popular technical indicators by BDSwiss Trading Academy Any information appearing on this graph or text is based solely on reasonable assumptions and does not December 2020 represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. Index Page 01 RSI - Relative Strength Index 03 02 Average Directional Index 07 03 Parabolic SAR 10 04 Moving Average Convergence and Divergence MACD 13 05 Bollinger Bands® 16 06 Linearly Weighted Moving Average 19 07 Exponential Moving Average 22 08 Simple Moving Average 25 09 Stochastic Oscillator 28 Any information appearing on this graph or text is based solely on reasonable assumptions and does not represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. 2 01 RSI Relative Strength Index Any information appearing on this graph or text is based solely on reasonable assumptions and does not represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. 3 Indicator Profile • RSI was developed in 1978 by J. Welles Wilder Jr. • It is among the most widely used trading indicators in technical analysis. • RSI is a momentum indicator, which means it helps measure the velocity of a particular assets price changes. • In its initial form, the RSI was designed for stock trading. As it started proving efficient, traders began applying it to other assets as well. The Relative Strength Index is an indicator that helps traders capture market momentum by measuring the magnitude of price fluctuations. -

By the Wall Street Daily Research Team the 3 BEST TECHNICAL INDICATORS on EARTH

by The Wall Street Daily Research Team THE 3 BEST TECHNICAL INDICATORS ON EARTH “Those who cannot remember the past are condemned to repeat it.” This oft-quoted warning also forms the basis for technical analysis. Only I’d tweak it to say, “Those who do remember the past are likely to profit from it.” THAT’S TECHNICAL ANALYSIS IN A NUTSHELL. After all, technical analysis is based on the idea that all the information is represented in price and volume. So by comparing what’s happening in the market today to what’s happened in the past, you can tell what will (most likely) occur in the future. The Three Best Technical Indicators on Earth How to Start Killing the Market and Never Look Back 2 In other words, while fundamental analysis involves screening businesses’ balance sheets, earnings reports and economic conditions to try to predict stock returns, technical analysis relies on the participants in the market to distill all that information into meaningful data. And by watching price and volume, you can interpret the emotions driving the market. Some believe that technical analysis is simply about drawing lines on a chart – and that it’s essentially the equivalent of Hogwash!financial astrology. Granted, some methods have failed to produce real returns. And I agree that not all technical indicators are worthy of your attention. That’s why it’s important to focus only on the key indicators that have proven successful – time after time. Lucky for you, we’ve found the top three, best of breed, technical rundown of each… indicators that you can use to maximize your profits. -

Indicators; the Basics

Indicators; The Basics www.jamesgoulding.com Indicators 1.1....................................................................................................................... 1 Basics .................................................................................................................................. 1 Introduction......................................................................................................................... 1 Categorizing Indicators by Trend and Direction ................................................................ 1 Trend............................................................................................................................... 1 MACD................................................................................................................................. 2 Moving Average Convergence Divergence.................................................................... 2 DMA ................................................................................................................................... 3 Displaced Moving Averages........................................................................................... 3 Direction ......................................................................................................................... 4 3x3 MA ....................................................................................................................... 4 3-Bar Displaced Moving Average used as a Directional Indicator ............................... -

Forex Trend Line Trading Strategy

Forex Trend line Trading Strategy (It is hard to win without knowing the trend) Rich Finegan Disclamer: Foreign exchange trading carries a high level of risk and may not be suitable for you, please carefully consider your risk appetite and do not invest money that you cannot afford to lose Copyright © 2014 Rich Finegan All rights reserved. DEDICATION: To those who are serious in forex trading CONTENTS Preface Chapter 1 Trend line is one of the most important tools Chapter 2 Setting up trend lines Chapter 3 Trend line trading strategy Chapter 4 Time frame and money management Chapter 5 Currencies selection Chapter 6 Exercises and answers Chapter 7 Question and answers Preface What do you think when a mobile phone trader still accumulates old model phones while the trend now is smartphone with bigger screen? Yes, the trader will lose money and need to sell them cheap or execute a ‘cut loss’ action as the trend now is smartphone. Same in foreign exchange trading, you need to know and monitor the market trend too; you will go against the market if you’re still in buying position while the market trend is selling. It is a big mistake if you go against the market with your confidence. As a trader, understanding the market trend is more important than understanding technical skills. Market trend provides price movement information on macro perspective while technical skills are more on taking advantage on the macro situation. Without knowing the market trend, it is hard to win. Imagine that you are a soldier with special assignment to free a hostage, what will you do first? First you may learn enemy’s macro situation such as: the location, enemy’s habits/activities, concentration of soldiers, etc.