Reasons and Decision: in the Matter of 3Iq Corp. and the Bitcoin Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Central Banks and Digital Currencies a Revolution in Money

Central banks and digital currencies A revolution in money omfif.org Wednesday 28 April 2021, 12:00 UK/07:00 ET All sessions will take place live unless stated otherwise. 12:00-12:05 Welcome address: OMFIF 12:05-12:30 Keynote in-conversation: The first retail CBDC John Rolle, Governor, Central Bank of the Bahamas 12:30-13:30 Panel I: Retail CBDCs: policy implications and rollout strategies • The need for retail CBDC from a policy perspective • Programmability and its potential impact on monetary and fiscal policy • Addressing disintermediation concerns • Implementation strategies: bringing in banks and fintechs • Legal implications and common standards Speakers: Hanna Armelius, Senior Adviser, Payments Department Analysis and Policy Division, Sveriges Riksbank Neha Narula, Director, Digital Currency Initiative, Massachusetts Institute of Technology Jose Fernandez da Ponte, Vice President, General Manager Blockchain, Crypto and Digital Currencies, PayPal Atul Bhuchar, Executive Director & Group Payments Head, DBS Bank 13:30-13:45 BREAK: On-demand presentation: CBDCs and digital identity 13:45-14:45 Private roundtable: Introducing a digital yuan (invite only) Mu Changchun, Director, Digital Currency Research Institute, People’s Bank of China 14:45-15:00 BREAK: On-demand presentation: Solving offline functionality omfif.org 15:00-16:00 Panel II: The payments revolution from the consumer’s perspective • PsPs and CBDC landscape: How best to combat financial exclusion • Addressing consumers, merchants and sectors that lack digital infrastructures -

Beauty Is Not in the Eye of the Beholder

Insight Consumer and Wealth Management Digital Assets: Beauty Is Not in the Eye of the Beholder Parsing the Beauty from the Beast. Investment Strategy Group | June 2021 Sharmin Mossavar-Rahmani Chief Investment Officer Investment Strategy Group Goldman Sachs The co-authors give special thanks to: Farshid Asl Managing Director Matheus Dibo Shahz Khatri Vice President Vice President Brett Nelson Managing Director Michael Murdoch Vice President Jakub Duda Shep Moore-Berg Harm Zebregs Vice President Vice President Vice President Shivani Gupta Analyst Oussama Fatri Yousra Zerouali Vice President Analyst ISG material represents the views of ISG in Consumer and Wealth Management (“CWM”) of GS. It is not financial research or a product of GS Global Investment Research (“GIR”) and may vary significantly from those expressed by individual portfolio management teams within CWM, or other groups at Goldman Sachs. 2021 INSIGHT Dear Clients, There has been enormous change in the world of cryptocurrencies and blockchain technology since we first wrote about it in 2017. The number of cryptocurrencies has increased from about 2,000, with a market capitalization of over $200 billion in late 2017, to over 8,000, with a market capitalization of about $1.6 trillion. For context, the market capitalization of global equities is about $110 trillion, that of the S&P 500 stocks is $35 trillion and that of US Treasuries is $22 trillion. Reported trading volume in cryptocurrencies, as represented by the two largest cryptocurrencies by market capitalization, has increased sixfold, from an estimated $6.8 billion per day in late 2017 to $48.6 billion per day in May 2021.1 This data is based on what is called “clean data” from Coin Metrics; the total reported trading volume is significantly higher, but much of it is artificially inflated.2,3 For context, trading volume on US equity exchanges doubled over the same period. -

Crypto Coverdell Education Savings Account (ESA) by Directed IRA

T: 602.899.9396 www.directedira.com Crypto Coverdell Education Savings Account (ESA) by Directed IRA Step 1: Open Crypto ESA account with Directed IRA. Sign account agreement and provide government ID (such as driver’s license or passport). Step 2: Transfer or rollover existing retirement account funds or make a new contribution. Step 3: As part of your Crypto account application, you will authorize us to setup a Gemini trading account for your IRA. You will also authorize the initial investment amount from your Directed IRA account to fund your Gemini trading account. Step 4: You will receive an email from Gemini with login and onboarding instructions to access and use your Gemini crypto trading account where you can buy Bitcoin, Ether, Litecoin, and 40+ other Cryptocurrencies. This must be a unique email that is not already used with a personal Gemini account. Step 5: You will trade and store your cryptocurrency with your IRA owned Gemini account. INVESTMENTS: NOT FDIC INSURED . NO GUARANTEE . MAY LOSE VALUE Secure File Upload: Email Forms to: Send Mail to: Phone: (602) 899-9396 www.directedira.com/secureupload [email protected] 3033 N. Central Ave. Ste. 400 Fax: (602) 899-9641 Phoenix, AZ 85012 Directed IRA is a tradename of Directed Trust Company, an Arizona Corporation Frequently Asked Questions (FAQs) What are the fees for a Crypto Coverdell ESA? The Crypto ESA fees consist of an Annual Account Fee charged by Directed IRA of $295, a 1% per trade fee, and a one-time $50 Asset Processing Fee to fund your Gemini account. -

Blockchain & Cryptocurrency Regulation

Blockchain & Cryptocurrency Regulation Third Edition Contributing Editor: Josias N. Dewey Global Legal Insights Blockchain & Cryptocurrency Regulation 2021, Third Edition Contributing Editor: Josias N. Dewey Published by Global Legal Group GLOBAL LEGAL INSIGHTS – BLOCKCHAIN & CRYPTOCURRENCY REGULATION 2021, THIRD EDITION Contributing Editor Josias N. Dewey, Holland & Knight LLP Head of Production Suzie Levy Senior Editor Sam Friend Sub Editor Megan Hylton Consulting Group Publisher Rory Smith Chief Media Officer Fraser Allan We are extremely grateful for all contributions to this edition. Special thanks are reserved for Josias N. Dewey of Holland & Knight LLP for all of his assistance. Published by Global Legal Group Ltd. 59 Tanner Street, London SE1 3PL, United Kingdom Tel: +44 207 367 0720 / URL: www.glgroup.co.uk Copyright © 2020 Global Legal Group Ltd. All rights reserved No photocopying ISBN 978-1-83918-077-4 ISSN 2631-2999 This publication is for general information purposes only. It does not purport to provide comprehensive full legal or other advice. Global Legal Group Ltd. and the contributors accept no responsibility for losses that may arise from reliance upon information contained in this publication. This publication is intended to give an indication of legal issues upon which you may need advice. Full legal advice should be taken from a qualified professional when dealing with specific situations. The information contained herein is accurate as of the date of publication. Printed and bound by TJ International, Trecerus Industrial Estate, Padstow, Cornwall, PL28 8RW October 2020 PREFACE nother year has passed and virtual currency and other blockchain-based digital assets continue to attract the attention of policymakers across the globe. -

Bitcoin and Cryptocurrencies Law Enforcement Investigative Guide

2018-46528652 Regional Organized Crime Information Center Special Research Report Bitcoin and Cryptocurrencies Law Enforcement Investigative Guide Ref # 8091-4ee9-ae43-3d3759fc46fb 2018-46528652 Regional Organized Crime Information Center Special Research Report Bitcoin and Cryptocurrencies Law Enforcement Investigative Guide verybody’s heard about Bitcoin by now. How the value of this new virtual currency wildly swings with the latest industry news or even rumors. Criminals use Bitcoin for money laundering and other Enefarious activities because they think it can’t be traced and can be used with anonymity. How speculators are making millions dealing in this trend or fad that seems more like fanciful digital technology than real paper money or currency. Some critics call Bitcoin a scam in and of itself, a new high-tech vehicle for bilking the masses. But what are the facts? What exactly is Bitcoin and how is it regulated? How can criminal investigators track its usage and use transactions as evidence of money laundering or other financial crimes? Is Bitcoin itself fraudulent? Ref # 8091-4ee9-ae43-3d3759fc46fb 2018-46528652 Bitcoin Basics Law Enforcement Needs to Know About Cryptocurrencies aw enforcement will need to gain at least a basic Bitcoins was determined by its creator (a person Lunderstanding of cyptocurrencies because or entity known only as Satoshi Nakamoto) and criminals are using cryptocurrencies to launder money is controlled by its inherent formula or algorithm. and make transactions contrary to law, many of them The total possible number of Bitcoins is 21 million, believing that cryptocurrencies cannot be tracked or estimated to be reached in the year 2140. -

Victory Hashdex Nasdaq Crypto Index Fund Broad-Based Digital Asset Exposure for the New Age of Investing

Victory Hashdex Nasdaq Crypto Index Fund Broad-based digital asset exposure for the new age of investing Opportunities in Crypto Assets Crypto assets offer a unique opportunity for sophisticated investors looking Victory Capital’s forward- for growth, diversification, potential stores of value and possible hedges thinking crypto asset against inflation. With more than 10,000 crypto assets in existence today1 approach embraces the and with the potential to power decentralized transactions using blockchain technologies, crypto assets present a new and evolving approach to captur- power of diversification. ing these highly sought-after benefits. By offering exposure to an The evolution of the asset class is not yet complete; however, given its investible basket of coins increasing liquidity and expectations of clearer regulatory frame-works and in a dynamic, adaptable growth, crypto assets warrant investment consideration. Notably, crypto way, investors can gain assets have historically experienced exponential growth with the top three currencies accounting for over $1 trillion worth of assets today.1 broad-based access to the digital asset class A Definitive Benchmark for Crypto Assets across a core set of ex- Together with renowned index provider Nasdaq, Inc. and crypto-focused as- changes and custodians. set manager Hashdex Asset Management Ltd., Victory Capital has created a way for investors to gain broad-based market exposure to an emerging asset class for a relatively low cost and without lockups. INDEX CONSTITUENTS As of 06/01/21 -

3Rd Global Cryptoasset Benchmarking Study

3RD GLOBAL CRYPTOASSET BENCHMARKING STUDY Apolline Blandin, Dr. Gina Pieters, Yue Wu, Thomas Eisermann, Anton Dek, Sean Taylor, Damaris Njoki September 2020 supported by Disclaimer: Data for this report has been gathered primarily from online surveys. While every reasonable effort has been made to verify the accuracy of the data collected, the research team cannot exclude potential errors and omissions. This report should not be considered to provide legal or investment advice. Opinions expressed in this report reflect those of the authors and not necessarily those of their respective institutions. TABLE OF CONTENTS FOREWORDS ..................................................................................................................................................4 RESEARCH TEAM ..........................................................................................................................................6 ACKNOWLEDGEMENTS ............................................................................................................................7 EXECUTIVE SUMMARY ........................................................................................................................... 11 METHODOLOGY ........................................................................................................................................ 14 SECTION 1: INDUSTRY GROWTH INDICATORS .........................................................................17 Employment figures ..............................................................................................................................................................................................................17 -

Trading and Arbitrage in Cryptocurrency Markets

Trading and Arbitrage in Cryptocurrency Markets Igor Makarov1 and Antoinette Schoar∗2 1London School of Economics 2MIT Sloan, NBER, CEPR December 15, 2018 ABSTRACT We study the efficiency, price formation and segmentation of cryptocurrency markets. We document large, recurrent arbitrage opportunities in cryptocurrency prices relative to fiat currencies across exchanges, which often persist for weeks. Price deviations are much larger across than within countries, and smaller between cryptocurrencies. Price deviations across countries co-move and open up in times of large appreciations of the Bitcoin. Countries that on average have a higher premium over the US Bitcoin price also see a bigger widening of arbitrage deviations in times of large appreciations of the Bitcoin. Finally, we decompose signed volume on each exchange into a common and an idiosyncratic component. We show that the common component explains up to 85% of Bitcoin returns and that the idiosyncratic components play an important role in explaining the size of the arbitrage spreads between exchanges. ∗Igor Makarov: Houghton Street, London WC2A 2AE, UK. Email: [email protected]. An- toinette Schoar: 62-638, 100 Main Street, Cambridge MA 02138, USA. Email: [email protected]. We thank Yupeng Wang and Yuting Wang for outstanding research assistance. We thank seminar participants at the Brevan Howard Center at Imperial College, EPFL Lausanne, European Sum- mer Symposium in Financial Markets 2018 Gerzensee, HSE Moscow, LSE, and Nova Lisbon, as well as Anastassia Fedyk, Adam Guren, Simon Gervais, Dong Lou, Peter Kondor, Gita Rao, Norman Sch¨urhoff,and Adrien Verdelhan for helpful comments. Andreas Caravella, Robert Edstr¨omand Am- bre Soubiran provided us with very useful information about the data. -

Trading and Arbitrage in Cryptocurrency Markets

Trading and Arbitrage in Cryptocurrency Markets Igor Makarov1 and Antoinette Schoar∗2 1London School of Economics 2MIT Sloan, NBER, CEPR July 7, 2018 ABSTRACT We study the efficiency and price formation of cryptocurrency markets. First, we doc- ument large, recurrent arbitrage opportunities in cryptocurrency prices relative to fiat currencies across exchanges that often persist for weeks. The total size of arbitrage prof- its just from December 2017 to February 2018 is above $1 billion. Second, arbitrage opportunities are much larger across than within regions, but smaller when trading one cryptocurrency against another, highlighting the importance of cross-border cap- ital controls. Finally, we decompose signed volume on each exchange into a common component and an idiosyncratic, exchange-specific one. We show that the common component explains up to 85% of bitcoin returns and that the idiosyncratic compo- nents play an important role in explaining the size of the arbitrage spreads between exchanges. ∗Igor Makarov: Houghton Street, London WC2A 2AE, UK. Email: [email protected]. An- toinette Schoar: 62-638, 100 Main Street, Cambridge MA 02138, USA. Email: [email protected]. We thank Yupeng Wang for outstanding research assistance. We thank seminar participants at the Bre- van Howard Center at Imperial College, EPFL Lausanne, HSE Moscow, LSE, and Nova Lisbon, as well as Simon Gervais, Dong Lou, Peter Kondor, Norman Sch¨urhoff,and Adrien Verdelhan for helpful comments. Andreas Caravella, Robert Edstr¨omand Ambre Soubiran provided us with very useful information about the data. The data for this study was obtained from Kaiko Digital Assets. 1 Cryptocurrencies have had a meteoric rise over the past few years. -

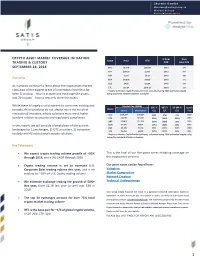

Crypto Asset Market Coverage Initiation: Trading

Sherwin Dowlat [email protected] Michael Hodapp [email protected] CRYPTO ASSET MARKET COVERAGE INITIATION: % from Days Name Price ATH TRADING & CUSTODY ATH Since ATH SEPTEMBER 18, 2018 BTC $6,270 $20,089 (69%) 274 ETH $197.86 $1,432 (86%) 247 XRP $.273 $3.84 (93%) 256 Overview BCH $420.06 $4,330 (90%) 271 EOS $4.90 $22.89 (79%) 141 As investors continue to learn about the cryptoasset market LTC $52.34 $375.29 (86%) 272 class, two of the biggest areas of uncertainty have thus far * Refers to Market Capitalization estimate, calculated using 2050 estimated supply using respective network inflation schedules been 1) trading – how to acquire and exchange the assets, and 2) custody – how to securely store the assets. While there is largely a solid market for consumer trading and Market Cap ($MM) 30D % 90D % 52-Wk % Launch Name custody, these products do not always meet the needs of Current 2050 Implied* G/L G/L G/L Year institutional investors, whose solutions must meet higher BTC $108,304 $131,567 (3%) (7%) 45% 2009 burdens relative to security and regulatory compliance. ETH $20,186 $29,081 (35%) (62%) (30%) 2015 XRP $10,874 $27,316 (19%) (50%) 38% 2013 In this report, we will provide a breakdown of the current BCH $7,290 $8,814 (27%) (53%) (2%) 2017 $4,438 $7,150 (6%) (54%) 643% 2018 landscape for 1) exchanges, 2) OTC providers, 3) consumer EOS LTC $3,053 $4,390 (10%) (47%) (4%) 2011 custody and 4) institutional custody solutions. * Refers to Market Capitalization estimate, calculated using 2050 estimated supply using respective network inflation schedules. -

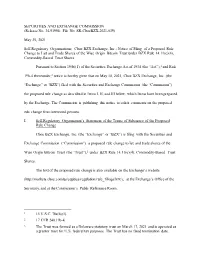

Notice of Filing of a Proposed Rule Change to List and Trade Shares of the Wise Origin Bitcoin Trust Under BZX Rule 14.11(E)(4), Commodity-Based Trust Shares

SECURITIES AND EXCHANGE COMMISSION (Release No. 34-91994; File No. SR-CboeBZX-2021-039) May 25, 2021 Self-Regulatory Organizations; Cboe BZX Exchange, Inc.; Notice of Filing of a Proposed Rule Change to List and Trade Shares of the Wise Origin Bitcoin Trust under BZX Rule 14.11(e)(4), Commodity-Based Trust Shares Pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (the “Act”),1 and Rule 19b-4 thereunder,2 notice is hereby given that on May 10, 2021, Cboe BZX Exchange, Inc. (the “Exchange” or “BZX”) filed with the Securities and Exchange Commission (the “Commission”) the proposed rule change as described in Items I, II, and III below, which Items have been prepared by the Exchange. The Commission is publishing this notice to solicit comments on the proposed rule change from interested persons. I. Self-Regulatory Organization’s Statement of the Terms of Substance of the Proposed Rule Change Cboe BZX Exchange, Inc. (the “Exchange” or “BZX”) is filing with the Securities and Exchange Commission (“Commission”) a proposed rule change to list and trade shares of the Wise Origin Bitcoin Trust (the “Trust”),3 under BZX Rule 14.11(e)(4), Commodity-Based Trust Shares. The text of the proposed rule change is also available on the Exchange’s website (http://markets.cboe.com/us/equities/regulation/rule_filings/bzx/), at the Exchange’s Office of the Secretary, and at the Commission’s Public Reference Room. 1 15 U.S.C. 78s(b)(1). 2 17 CFR 240.19b-4. 3 The Trust was formed as a Delaware statutory trust on March 17, 2021 and is operated as a grantor trust for U.S. -

List of Bitcoin Companies

List of bitcoin companies This is a list of Wikipedia articles about for-profit companies with notable commercial activities related to bitcoin. Common services are cryptocurrency wallet providers, bitcoin exchanges, payment service providers[a] and venture capital. Other services include mining pools, cloud mining, peer-to-peer lending, exchange-traded funds, over-the-counter trading, gambling, micropayments, affiliates and prediction markets. Headquarters Company Founded Service Notes Refs Country City bitcoin exchange, wallet Binance 2017 Japan Tokyo [1] provider bitcoin exchange, wallet Bitcoin.com [data unknown/missing] Japan Tokyo provider bitcoin exchange, digital Hong currency exchange, Bitfinex 2012 Kong electronic trading platform United San multisignature security BitGo 2013 States Francisco platform for bitcoin ASIC-based bitcoin BitMain 2013 China Beijing miners cryptocurrency BitMEX 2014 derivatives trading Seychelles platform United payment service BitPay 2011 Atlanta States provider Bitstamp 2011 bitcoin exchange Luxembourg bitcoin debit card, Bitwala 2015 Berlin international transfers, [2] Germany bitcoin wallet Blockchain.com 2011 wallet provider Luxembourg United San Blockstream 2014 software States Francisco shut down by the United BTC-e 2011 Russia bitcoin exchange States government in July 2017 Canaan ASIC-based bitcoin 2013 China Beijing Creative miners United Circle 2013 Boston wallet provider States United San wallet provider, bitcoin Coinbase 2012 States Francisco exchange bitcoin/ether exchange, wallet provider,