Vijay Sales 23 November 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

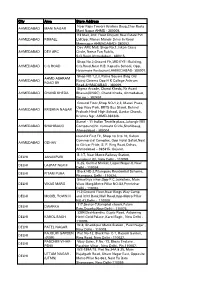

Region State City Store Name West Maharashtra Mumbai Croma Bandra West Maharashtra Mumbai Croma Juhu West Maharashtra Mumbai

Region State City Store Name West Maharashtra Mumbai Croma Bandra West Maharashtra Mumbai Croma Juhu West Maharashtra Mumbai Croma Kandivali West Maharashtra Mumbai Croma Lower Parel West Maharashtra Mumbai Croma Oberoi Mall West Maharashtra Mumbai Croma Prabhadevi West Maharashtra Mumbai Croma Infinity Malad West Maharashtra Mumbai Croma Belapur West Maharashtra Mumbai Croma Borivali West Maharashtra Mumbai Croma R City Mall West Maharashtra Mumbai Vijay Sales Chakala, Andheri West Maharashtra Mumbai Reliance Digital - Vashi West Maharashtra Mumbai Reliance Digital - Malad West Maharashtra Mumbai Reliance Digital - Viviana Mall West Maharashtra Mumbai Vijay Sales Andheri West Maharashtra Mumbai Vijay Sales Borivali West Maharashtra Mumbai Vijay Sales Chembur West Maharashtra Mumbai Vijay Sales Ghodbunder West Maharashtra Mumbai Vijay Sales Hub Mall West Maharashtra Mumbai Vijay Sales Opera House West Maharashtra Mumbai Vijay Sales Prabhadevi West Maharashtra Mumbai Hometown West Maharashtra Pune Croma Aundh West Maharashtra Pune Vijay Sales Pune Station West Maharashtra Pune Vijay Sales Pune Baner West Maharashtra Pune Vijay Sales Pune Chinchvad North Delhi Delhi Croma - City Walk Saket North Delhi Delhi Croma - Rajouri North Delhi Delhi Croma Dwarka North Delhi Delhi Croma Janakpuri North Delhi Delhi Croma South Ex North Delhi Delhi Homestop - Select City, Saket North Delhi Delhi Vijay Sales - Janakpuri North Delhi Delhi Vijay Sales - Lajpat Nagar North Delhi Delhi Vijay Sales - Rajouri North Uttar Pradesh Ghaziabad Reliance shipra mall -

380008. Ahmedabad R3mal

City Area Store Address Near Rajiv Towers Krishna Baug,Char Rasta AHMEDABAD MANI NAGAR Mani Nagar AHMD - 380008. R3 Mall, 2nd Floor Divyam Real Estate Pvt AHMEDABAD R3MALL LtdOpp. Manav Mandir Drive In Road Memnagar AHMADABAD- 380052. Dev ARC Mall, Shop No.1, Iskon Cross AHMEDABAD DEV ARC Circle, Neear Fun Rublic, S,G,Road,Ahmedabad - 380015. Shop No.2,Ground Flr,3RD EYE I Building, AHMEDABAD C G ROAD C.G.Road,Near H.B. Kapadia School, Opp. Havemore Restaurant,AHMEDABAD- 380001. Shop NO 1,2,3, Ratna Square Bldg Old AHMD ASHRAM AHMEDABAD Natraj Cinema Opp H K College Ashram ROAD BR Road,AHMADABAD - 380009. Sigma Arcade, Chand Kheda, Nr Avani AHMEDABAD CHAND KHEDA Bhavan(ONGC), Chand Kheda, Ahmedabad, Pin no :- 382424 Ground Floor,Shop NO-1,2,3, Maruti Plaza, Opp Vijay Park, BRTS Bus Stand, Behind AHMEDABAD KRISHNA NAGAR Prakash Hindi High School, Sardar Chowk, Krishna Ngr, AHMD-382346. Sumel - 11 Indian Texttile plaza,Jahangir Mill AHMEDABAD SHAHIBAUG Compound,Nr. namaste Cricle,Shahibaug, Ahmedabad - 380004 round & First Flr, Shop no 3 to 10, Kahan Commercial Complex, Opp Hotel Safari,Next AHMEDABAD ODHAV to Girivar Pride, S. P. Ring Road,Odhav, Ahmedabad – 382415. Gujarat. B-1/7, Near Metro Railway Station, DELHI JANAKPURI Janakpuri (E), New Delhi - 110058. K-25, Central Market, Lajpat Nagar-II, New DELHI LAJPAT NGR II Delhi - 110024. Block HD-2,Pitampura Residential Scheme, DELHI PITAM PURA Pitampura, Delhi - 110024. Swasthya vihar,Opp-P.C.Jewellers, Main DELHI VIKAS MARG Vikas Marg,Metro Pillar NO:83,Preetvihar Delhi - 110092. H-2,Ground Floor,Near Kings Way Camp DELHI MODEL TOWN III and ICICI Bank,Mall Road,Opp-Metro Pillar NO.41,Delhi - 110009. -

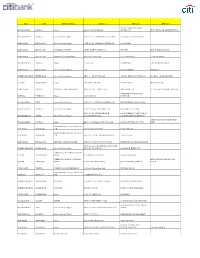

State City Store Front Name Address 1 Address 2 Address 3 MAHARASHTRA MUMBAI Imagine 001-002, KOTIA NIRMAN, NEXT to MERCEDEZ

State City Store Front Name Address 1 Address 2 Address 3 NEXT TO MERCEDEZ BENZ MAHARASHTRA MUMBAI iMagine 001-002, KOTIA NIRMAN, SHOWROOM NEW LINK ROAD, ANDHERI WEST, MAHARASHTRA MUMBAI iStore by Reliance Digital SHOP NO G 37, GF,R CITY CENTER MALL, LBS MARG, GHATKOPAR (W), KARNATAKA BENGALURU iStore by Reliance Digital 46TH CROSS, 11TH MAIN, 5TH BLOCK, JAYANAGAR KARNATAKA BENGALURU IMAGINE @ U.B.CITY LEVEL 2 THE COLLECTION U.B. CITY, VITTAL MALLYA ROAD KARNATAKA BENGALURU IMAGINE @ FORUM MALL #210, SECOND FLOOR THE FORUM MALL 21 HOSUR ROAD MAHARASHTRA MUMBAI iMagine F-58,LEVEL 1, INORBIT MALL LINK ROAD, MALAD (W) KARNATAKA BENGALURU iStore by Reliance Digital #87, ALMAS CENTER MG ROAD ANDHRA PRADESH HYDERABAD iStore by Reliance Digital SHOP # 1, GROUND FLOOR ASHOKA METROPOLITAN MALL ROAD NO 1, BANJARA HILLS GUJARAT AHMEDABAD iMagine 104,HIMALAYA MALL, NEAR GURUKUL DRIVE-IN ROAD TAMIL NADU CHENNAI IMAGINE @ AMPA SKYWALK SHOP NO. 101A, FIRST FLOOR AMPA SKYWALK NO. 1, NELSON MANICKAM ROAD, MGF METROPOLITAN MALL HARYANA GURGAON iMagine 36-37,II FLOOR, ,M.G.ROAD MAHARASHTRA PUNE iStore by Reliance Digital SHOP NO G 3, UPPER GROUND FLOOR, MILLENNIUM PLAZA,FC ROAD, MAHARASHTRA MUMBAI iStore by Reliance Digital SHOP NO S 12B, SECOND FLOOR, HIGH STREET PHOENIX, SHOP NO UG 2,UPPER GROUND NEAR CADBURY COMPOUND,OFF MAHARASHTRA THANE iStore by Reliance Digital FLOOR,KORUM MALL, EASTERN EXPRESS HIGHWAY, LINKING ROAD,T P S III, BANDRA MAHARASHTRA MUMBAI Maple SHOP NO. SB0102 & C2,PLOT NO. 284, KAMAL APT,( BELOW C.C.D.), WEST IWORLD BUSINESS SOLUTIONS PVT NEW DELHI NEW DELHI LTD UB-2 BUNGLOW ROAD, KAMLA NAGAR IWORLD BUSINESS SOLUTIONS PVT NEW DELHI NEW DELHI LTD SHOP NO. -

India Halts UK Flights Over Deadly Strain of Covid-19

Follow us on: @TheDailyPioneer facebook.com/dailypioneer RNI No. TELENG/2018/76469 Established 1864 ANALYSIS 7 MONEY 8 SPORTS 12 Published From HYDERABAD DELHI LUCKNOW NO POWER IN THESE NEW MUTATION OF VIRUS PULLS DOWN BOXING DAY TEST WILL BHOPAL RAIPUR CHANDIGARH REFORMS INVESTOR WEALTH BY RS 6.59 LAKH-CR DECIDE SERIES FATE: BURNS BHUBANESWAR RANCHI DEHRADUN VIJAYAWADA *LATE CITY VOL. 3 ISSUE 63 HYDERABAD, TUESDAY DECEMBER 22, 2020; PAGES 12 `3 *Air Surcharge Extra if Applicable AVIKA GOR ON A ROLL { Page 11 } www.dailypioneer.com ‘RELATIONSHIP OVER’: BJP MP SAYS WORST DAY IN 7 MONTHS FOR SENSEX AS CONGRESS LEADER, GANDHI FAMILY ‘BJP BENT ON DIVIDING THE COUNTRY, WILL DIVORCE WIFE WHO JOINED TMC MUTANT VIRUS SPOOKS GLOBAL MARKETS LOYALIST, MOTILAL VORA DIES AT 92 CANCELLED XMAS HOLIDAY: MAMATA olitical acrimony in Bengal appeared to threaten a marriage today as a omestic stock markets suffered their worst single-day loss in more than eteran Congress leader Motilal Vora, a staunch Gandhi family est Bengal Chief Minister Mamata Banerjee Monday hit out at the BJP- PBJP MP said he would file for a divorce after his wife joined Chief Dseven months on Monday tracking a selloff across global equities over Vloyalist who had a political career spanning almost five decades, Wled government at the Centre saying it is only bent on dividing the Minister Mamata Banerjee's Trinamool Congress, going upstream in a tidal fears of a new coronavirus strain that shut much of the United Kingdom. died at a hospital here on Monday following country and has cancelled public holidays on festivals like Christmas. -

Vijay-Sales---Store-List.Pdf

MERCHANT STORE STORE ADDRESS CITY STATE_NAME Vijay Sales VS KALKAJI M-62, Block , Guru Ravidas Marg, Kalkaji, Near Axis bank Delhi Delhi Vijay Sales VSSATARA ARCADEPUNE Jai Tirth Society, Opposite Sharada Arcade, PUNE Maharashtra Vijay Sales VS JOGESHWARI WEST Vs House Patel Estate Road, Next To Siddheshwar Mahadev Temple, Jogeshwari West MUMBAI Maharashtra Vijay Sales Vijay Sales M Cube Mall Baroda Gujarat M Cube Mall, Jetalpur Road, Chakli Circle, BARODA Gujarat Vijay Sales VSHUDA CITY CENTREGURGAON Sco 315, Sector 29 Main Market, GURGAON Haryana Vijay Sales DELHI GPRS PITAMPURA Hd 2 Black Hd Pitampura Residential Scheme Delhi Delhi Vijay Sales VSSHANTINIKETANPIPLODSURAT Opp Shantiniketan App Dumas Road, Piplod SURAT Gujarat Vijay Sales VSR3 MALLMEMNAGARAHMEDABAD R 3, The Mall,2 Ed Floor, AHMEDABAD Gujarat Vijay Sales VSORANGE COUNTYINDIRAPURAMGZB Ugf, 114/115, Nd Anchor Store 2, Oc Square, GHAZIABAD Uttar Pradesh Vijay Sales VSNAGAR RDPUNE Survey No 482, Plot No9 , Prabhakar Heights, PUNE Maharashtra Vijay Sales VIJAY SALES BANDRA EAST MUMBAI Plot No 17, Bandra Kurla Complex, Opp. Diamond Market Bldg, Bandra East, MUMBAI Maharashtra Vijay Sales VS RAJOURI GARDEN DELHI Block No C 1 12 Outer Ring Road Opp Gurudwara & Mercedes Showroom Rajouri Garden Delhi Delhi Vijay Sales VS JACABPURAM Plot no.10 & 11, sector Jailland Urban Estate, Nr. Sohna Road, Jacabpuram, GURGAON Haryana Vijay Sales VS UTTAM NAGAR DELHI Wz 189/A/18 Plot No 24 A 25, Village Hatsal, Uttam Nagar Delhi Delhi Vijay Sales Vijay Sales WEB Western Express Highway Near Thakur Complex Near MUMBAI Maharashtra Vijay Sales MUMBAI GPRS V Mall, 3Rd Floor, Thakur Complex, MUMBAI Maharashtra Vijay Sales VS SEASON MALL MAGARPATTA CITY HADAPSAR G13 15 Season Mall Magarpatta City Hadapsar PUNE Maharashtra Vijay Sales VIJAY SALES THE PLAZA MALL GUR Sh no. -

S.NO Outlet State City Store Name Store Address 1 Spice New Delhi

S.NO Outlet State City Store Name Store Address 1 Spice New Delhi New Delhi 356-KALKAJI UNIT NO 1 6 , G 31LOWER GRD FLOOR , KALKAJI SHOP NO 112 , MATHURAROAD HARI NAGAR , ASHRAM 2 Spice New Delhi New Delhi 361-ASHRAM PASCHIM VIHAR PASCHIM VIHAR 3 Spice New Delhi New Delhi 345-TAGORE GARDEN SHOP DE 85 , NAZAFGARHMAIN ROAD , TAGORE GARDEN 4 Spice New Delhi New Delhi 285-WESTPATEL NAGAR SHOP NO X , 45 , WESTPATEL NAGAR SHOP NO 3 4 , PROPERTY NO C1 AM S CHAMBERS ARUNA 5 Spice New Delhi New Delhi 332-LAXMI NAGAR PARK , LAXMI NAGAR SHOP NO 1606 , GRD FLR QUTRAM LINES , MUKHERJEE 6 Spice New Delhi New Delhi 315-MUKHERJEE NAGAR NAGAR 7 Spice New Delhi New Delhi 284-NEW ROHTAK ROAD PLOT NO 17 , BLOCK 59 , NEW ROHTAK ROAD SHOP NO G 47 , JAINATOWERS II DISTRICTCENTRE , 8 Spice New Delhi New Delhi 296-JANAPURI JANAPURI 2286 87 G3 G4 , ESSEL MENTIONARYA SAMAJ ROAD , 9 Spice New Delhi New Delhi CJ5-KAROLBAGH KAROLBAGH 10 Spice New Delhi New Delhi 101-JANAKPURI B1 1 , B BLOCK COMMUNITY CENTRE , JANAKPURI 11 Spice New Delhi New Delhi ROHINI C 8 , 386 SEC 8 , ROHINI 12 Spice New Delhi New Delhi SHALIMAR BAGH BLDG NO 90 B , K BLOCKWEST , SHALIMAR BAGH 13 Spice New Delhi New Delhi 105-LAXMI NAGAR D 60 , MAIN VIKAS MARG , LAXMI NAGAR 14 Spice New Delhi New Delhi 106-LAJPAT NAGAR K 2 B , LAJPAT NAGAR , 11 15 Spice New Delhi New Delhi 110-RAJOURI GARDEN RAJOURI GARDEN , SHOPNO 15 , A 2 40 113-OPP POCKET 1 MAYUR VIHAR SHOP NO 3 , LOCALSHOPPING COMPLEX , OPP POCKET 1 16 Spice New Delhi New Delhi PHAS MAYUR VIHAR PHAS SHOP NO 35 , COMMUNITYCENTRE , NEW 17 Spice -

Vijaysales-Storelist.Pdf

Merchant Name Store Name Store Address1 Store Address2 State City PinCode Ground Floor, Tania Planet, Tania Shopping Babula Naka, Near D - Mart, Vijay Sales Vijay sales Tania Shopping Mall Vashi Maharashtra NAVI MUMBAI 400703 Mall, Opposite Bhabola Vijay Sales VSSVROADANDHERIMUMBAI 1, Abhishek Plot No 65, Opp Irla Fire Brigade, S V Road, Andheri West Maharashtra MUMBAI 400058 Vijay Sales VSSVROADBORIVALIMUMBAI Plot No 57 ,2, Shastri Nagar Bus Stop, S V Rd Dattani Nagar, Borivali West Maharashtra MUMBAI 400092 Vijay Sales VSTIPTOPTHANEMUMBAI L B S Marg, Thane West Maharashtra THANE 400601 Mama Parmanand Road, Near Roxy Cinema, Vijay Sales VSOPERAHOUSEMUMBAI House,Charni Road Maharashtra MUMBAI 400004 Opera Siddhivinayak Hall, Opposite Shreyas Vijay Sales VSLBSMRGGHATKOPERMUMBAI L B S Marg, Ghatkopar West Maharashtra MUMBAI 400086 Cinema, Near HB Kapadia School, Opp Vijay Sales VSCG RDKAPADIAAHMEDABAD Shop No2, Ground Floor, 3Rd Eye I Building Gujarat AHMEDABAD 380001 Havmore Restaurant 384, Veer Savarkar Marg, Opp Sidivinayak Vijay Sales VSSAVARKARMRGPRABHADEVIMUMBAI Prabhadevi Maharashtra MUMBAI 400025 Temple, Vijay Sales VSINDRAPURISIONMUMBAI Indrtapuri Society, Sion Circle, Sion Maharashtra MUMBAI 400022 Vijay Sales VSJANAKPURINEW DELHI B17, Near Amar Leela Hospital, Janakpuri Delhi Delhi 110058 Vijay Sales VSLAJPAT NAGARNEW DELHI K25, Central Market, Lajpat Nagar Delhi Delhi 110024 Shop No 1, Ground Floor, Iskon Circle, S G Vijay Sales VSDEV ARC MALLAHEMEDABAD Gujarat AHMEDABAD 380015 Road Bezzola Complex, Sion Trombay Road, Vijay Sales -

8/3/13 Iphone2 Emi

8/3/13 iphone2_emi List of Outlets Brand Name Address City Pincode # 80 GANDHI BAZAR MAIN ROAD BASAVANAGUDI DEVENDRA TELECOM BANGALORE 560004 BANGALORE-560004 94/95 KG MAHARAJA COMPLEX, BVK IYENGER RD, RIDHI SIDHI MOBILES BANGALORE 560009 BANGALORE 560009 SHOP NO 1 , NEAR DYANPRABODHINI, SADASHIV PETH, TELEPHONE SHOPEE PUNE 411030 PUNE WEST END PLAZA, NEXT TO CONVERGYS, NEW D P ROAD, TELEPHONE SHOPEE PUNE 411027 AUNDH, PUNE KAILASHDEEP KAILASHDEEP MOBILES, ARYA SAMAJ CHOWK, PMPRI PUNE 411017 SHIVAJINAGAR, SAGAR ARCHADE, F C ROAD, GOODLUCK ALPHA PUNE PUNE 411004 CHOWK, PUNE DELHI ELETRONICS K-10, QUTUB PLAZA MARKET, DLF PHASE I GURGAON 122001 SKY CONNECT SCF-48-50, THE MALL BASEMENT, SECTOR 15 FARIDABAD SURYA COMMUNICATION OLD DELHI ROAD GURGAON 122001 PRIYA CELLULAR HUT SECTOR-14, GURGAON GURGAON 122001 AASHREY COMM SHOP NO-128, CENTRAL ACRACDE, DLF PH II GURGAON 122001 IMPERIAL ELETRICALS SHOP NO-129, CENTRAL ARCADE, DLF PHASE II GURGAON 122001 XELERATE/LIVEWIRE SG-38, GALLERIA MARKET, DLF PHASE IV GURGAON 122001 DELHI ELETRONICS SF-21, GALLERIA MARKET, DLF PHASE IV GURGAON 122001 ART ENTERPRISE SF- 44, 1ST FLOOR, GALLERIA MARKET, DLP PH V GURGAON 122001 SHRI RAM COMMUNICATION 5L/172, NEAR 4-5 CHOWK, NIT, FARIDABAD FARIDABAD MOBILE PEOPLE MODEL TOWN, SHASTRI MARKET LUDHIANA LUDHIANA 141002 S. K. ENTERPRISES SARABHA NAGAR, KIPS MKT LUDHIANA 141002 STUDIO CELL NO7 , VENKATNARAYANAN ROAD,T NAGAR CHENNAI 600017 NO 4/3 GROUND FLOOR MEGA MART, SARDAR PATEL ROAD, HELLO WORLD CHENNAI 600020 ADYAR, CHENNAI - 600020 SHOP NO F63 2ND PHASE 1ST FLOOR, -

Dealer Name City Area Location Vijay Sales Mumbai Prabhadevi Vijay

WEST Dealer Name City Area Location MUMBAI Vijay Sales Mumbai Prabhadevi Vijay Sales Mumbai Opera House Vijay Sales Mumbai Mahim Vijay Sales Mumbai Santacruz(w) Vijay Sales Mumbai Andheri(w) Vijay Sales Mumbai Andheri(w)-Infinity Vijay Sales Mumbai Goregaon (w) Vijay Sales Mumbai Goregaon (E),The Hub Vijay Sales Mumbai Borivali ( W ) Vijay Sales Mumbai Chembur Vijay Sales Mumbai Ghatkopar Vijay Sales New Mumbai Vashi Panan Electronics Mumbai Andheri (W) Sursangam Electronics Mumbai Jogeshwari ( E) Virani Elec Mumbai Kandivali ( W ) Shiva Electronics Mumbai Kandivali ( E ) Gandhi Electronics Mumbai Borivali ( W ) Gala Electronics Mumbai Borivali ( W ) Gohel Electronics Mumbai Dahisar (E) Pandya Electronics Mumbai Dahisar (E) Anil Audio Video Mumbai Chembur (E) Starvision Mumbai Chembur (W) Embassy Mumbai Chembur (E) Leebha Sales Mumbai Vikhroli (E) Jivotronics Mumbai Vikhroli (W) Rahul Electronics Mumbai Kurla (W) Sonigara Electronics Mumbai Lower Parel Fine Collection Mumbai Andheri (E) Mauli Electronics Mumbai Malad ( E) Vardhaman Watch Mumbai Kandivli ( W) Malaika Appliances Mumbai Andheri ( E) Fairdeal Electronics Mumbai Manish Market Shivram Enterprises Mumbai Charni Rd Deluxe Electronics Mumbai Byculla Sahyadri Electronics Mumbai Masjid Bunder La-Kozy Electronics Mumbai Chowpatty Yashoma Electronics Mumbai Andheri ( E) Delta Electronics Mumbai Andheri ( W ) Ashish Electronics Raigad Pen Parmar Agencies Raigad Rasayani Ujwal Radio Raigad Karjat Mahavir Electronics Thane Bhyander ( E ) Apravas Distributor Thane Vasai ( E ) Rana Electronics -

Store Name Address Pincode Contact No. City AHMEDABAD ODHAV

Store Name Address PinCode Contact No. City Ground Flr, Shop no 3 to 10, Kahan Commercial Complex, Opp Hotel Safari, S. AHMEDABAD ODHAV P. Ring Road, Odhav 382415 9909926160 AHMEDABAD Ground & First Flr, Sumel 11, Namaste AHMEDABAD SHAHI BAUG Circle, ShahiBaug 380004 8588846942 AHMEDABAD IICF EXHIBITIONPLOT NO 17 BANDRAKURLA COMPLEX MMRDA BKC EXHIBITION MUMBAI GROUND BANDRA EAST 400051 9820915005 MUMBAI Hd 2 Black Hd Pitampura Residential DELHI GPRS PITAMPURA Scheme 110088 9820915007 Delhi DELHI ROHINI Plot F-19/6 & F- 19/7, Sector 8, Rohini 110085 9582221721 Delhi NEAR SHREYAS VIDYALAYA,JANSHAKTI MANJALPUR MANJALPUR RELIANCE CIRCLE,LALBAUG ROAD MANJALPUR ROAD 390004 8588846942 VADODARA MUMBAI GPRS V Mall, 3Rd Floor, Thakur Complex, 400101 9930262648 MUMBAI Ground Floor Tania Horizon Station Road NALLASOPARA Nallasopara West 401203 8879990620 THANE Nr Ajit Mill,Amts Bus Stop,Opp.Yash RAKHIAL Plaza,Gomtipur Rakhial 380004 8588846942 AHMEDABAD VIJAY SALES BANDRA Iicf Exhibition, Bkc, Plot No-C-14/15Bandra EAST East 400601 9930262602 MUMBAI VIJAY SALES BANDRA Plot No 17, Bandra Kurla Complex, Opp. EAST MUMBAI Diamond Market Bldg, Bandra East, 400051 9930262648 MUMBAI SHOP NO - 3, FILIX BLDG, GROUND VIJAY SALES BHANDUP W FLOOR, LBS ROAD,OPP ASIAN PAINTS, MUMBAI BHANDUP west 400078 7506513406 MUMBAI Shop No - S02,03, 2Nd Floor, Gorva Road, Vijay Sales Gorva Road Near Gunjan Tower 390016 7506240669 BARDOLI Vijay Sales M Cube Mall M Cube Mall, Jetalpur Road, Chakli Circle, Baroda Gujarat Alkapuri, Near Kalyan Jewellers 390007 9727476947 BARODA VIJAY SALES MEHSANA Shop No - 1,2 & 3, Sigma Arcade, Mehsana ROAD SABARMATI Road, Chandkheda, Near Ongc Complex 382424 9099912467 AHMEDABAD VIJAY SALES PASCHIM 13 BHERA ENCLAVE MAIN OUTER RING VIHAR DELHI RD 110087 9643331531 Delhi Ground Floor, Tania Planet, Tania Shopping Vijay sales Tania Shopping Mall, Babula Naka, Near D - Mart, Opposite Mall Vashi Bhabola 400703 9820914978 NAVI MUMBAI VIJAY SALES THE PLAZA Sh no. -

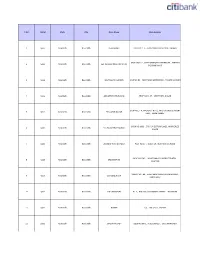

Press Release Vijay Sales (India) Private Limited

Press Release Vijay Sales (India) Private Limited February 03, 2021 Ratings Amount Facilities Rating1 Rating Action (Rs. crore) CARE A+; Stable / CARE A1+ Long Term / Short Term Bank 100.00 (Single A Plus ; Outlook: Stable / Reaffirmed Facilities A One Plus) 100.00 Total Facilities (Rs. One hundred crore only) Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The reaffirmation of rating assigned to long term/short-term facilities of Vijay Sales (India) Private Limited (VSIPL) derives strength from the experienced promoters, brand’s established track record in consumer electronic retail industry along with key presence in Maharashtra, Gujarat, Delhi, Haryana and Uttar Pradesh, ownership model of operation for majority of stores, increase in revenue & profitability during FY20 (April 1 to March 31), comfortable financial risk profile, de-risked inventory holding model and efficient working capital management. The above ratings are constrained by stiff competition from online and offline channels in consumer electronic retail industry and susceptibility of operating margins on performance of new stores. Rating Sensitivities Positive Factors - Maintaining the capital structure with overall gearing (including guaranteed debt) less than 0.5x PBILDT margin of more than 8% on a sustained basis Significant diversification of geographical presence Negative Factors- Increase in operating cycle to over 50 days due to stretched inventory cycle. Increase in overall gearing above 1.00x on sustained basis on account of higher working capital requirement or capex funded through term loans Significant Increase in support to OVOT Pvt. Ltd. Detailed description of the key rating drivers Experienced Promoters VSIPL is established by Mr. -

City Store Name Address Pin Code ABOHAR RELIANCE RETAIL 6585

City Store Name Address Pin Code 6585, Western Circular Rd,Opp Ex MLA Dr Ram ABOHAR RELIANCE RETAIL Kumar Goyal,Nr Haqiqat,Rai Chowk,Abohar Dist 152116 Fazilka ADILABAD RELIANCE RETAIL ADILABAD 504001 ADONI RELIANCE RETAIL Door No 18/157 -1, Prabhakar Talkies Road 518301 Prasun Ghosh L N Bari Road, Dag No 11447 Khatian AGARTALA RELIANCE RETAIL 799001 No 4297 Agartala To, Mouza Sadar Dist West, AGRA Reliance Fresh 119 , 8 And 120 , 8, Ashok Cosmos Mall 282002 AGRA RELIANCE RETAIL Shop No - 7,LGF, Karim Complex, Fatehabad Road 282001 AGRA RELIANCE RETAIL Shop No 5, UGF, Kailash Plaza, Shah Market 282001 AGRA RELIANCE RETAIL Shop No 22, UGF, Bhawna Multiplex, Sikandra 282007 AGRA RELIANCE RETAIL Shop No G1 On Gf, B 504, Sangam Palace 282004 AGRA RELIANCE RETAIL Ground Floor,6/230, Jagan Plaza, 282004 AGRA RELIANCE RETAIL Shop -Ugf, 9, Laxman Nagar, Arjun Nagar 282008 AGRA RELIANCE RETAIL Shop No 9 and 10 At UGF, Rana Market, Parshuram 282002 AGRA RELIANCE RETAIL Shop No B5, Lgf, Rajdeep Apartment, Dayalbagh 282005 AGRA RELIANCE RETAIL Shop No- B5, GF, 20/ 213 B, Silky Mandi, Jaipur 282002 "119/8 & 120/8, 2nd floor, Ashok Cosmos Mall, AGRA RELIANCE RETAIL 282002 Chilli Int Road, Sanjay Place 3719 Ground Floor Station Road, Mainpuri Near AGRA RELIANCE RETAIL 205001 PNB Bank,Opposite Axis Bank Mainpuri,Mainpuri TU17Upper Ground Floor,4 Taj RoadSuraj AGRA Reliance Digital 282001 Complex,Sadar BazarAgra-282001 AHMEDABAD Croma Himalaya Mall, Near Indraprasth Tower, 380052 AHMEDABAD Croma Dev Arcade Mall Junction Of S G Road Satellite Road 380050