FY2019-3Q IR Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HAKONE-YUMOTO / TONOSAWA Khakone Yumoto Hotel Bus on Foot Hakone =Hakoneji Kaiun 箱根路開雲 Shrine 35Min

INN/HOTEL Approximate travel times for major Hakone tourist spots A \Aura Tachibana あうら橘 B 7Bansuiro Fukuzumi 萬翠楼 福住 Hakone Tozan Railway Cable car Hakone Ropeway Hakone Ropeway Togendai F cFukuzumiro 福住楼 Owakudani Gora Sounzan (Lake Ashinoko) G [Gyokutei 玉庭 40min. 10 min. 8min. 16 min. H ]Hakone Airu 箱根 藍瑠 Bus Komagatake Ropeway oHakone Kamon 箱根花紋 (Owakudani) Komagatake 60min. Hakone-en 7min. 4Hakone Suimeisou 箱根水明荘 箱根湯本ホテル HAKONE-YUMOTO / TONOSAWA kHakone Yumoto Hotel Bus on foot Hakone =Hakoneji Kaiun 箱根路開雲 Shrine 35min. Motohakone-ko 15 min. aHatago Kintoen 旅籠 きんとうえん 'Hotel HATSUHANA ホテルはつはな Bus on foot Hakone Sekisho Hakone-Yumoto Station 6Hotel KAJIKASO ホテル河鹿荘 Checkpoint 40min. Hakone Sekisho-ato 2min. Area Map pHotel Maille Coeur Shougetsu ホテルマイユクール祥月 bus stop iHotel Nanpuso ホテル南風荘 uHotel Okada ホテルおかだ lHotel Okuyumoto ホテルおくゆもと eHotel Senkei ホテル仙景 Tonosawa Sta. INN / HOTEL / DAY SPA I /Ichinoyu Honkan 一の湯 本館 gItoen Hotel Hakone Yumoto 伊東園ホテル箱根湯本 Ichinoyu Honkan J rJapanese-style hotel Hakone Pax Yoshino 箱根パークス吉野 Deyama Hakone-Yumoto Sta. Railway bridge Motoyu Kansuiro to Miyanoshita, Ashinoko Tonosawa 1 Hakone Yuryo K 1Kappa Tengoku かっぱ 天 国 Yumoto-ohashi Shiunso ;Kijitei Hoeiso 雉子亭 豊栄荘 Deyama Hakone-Yumoto Sta. Sanmaibashi n Kinnotake Tonosawa Bridge Hayakawa Riv. to Odawara nKinnotake Tonosawa 金乃竹塔ノ澤 Tamano-o Chitose bashi Bridge -Kisenso 喜仙荘 m / bashi Kappa Tengoku 1 YAMA NO CHAYA Bridge Ajisaibashi Sanmaibashi Bridge Momiji bashi Hakone-Yumoto Sta. M zMamane Yu Masutomi Ryokan ままね湯ますとみ旅館 . Sakura Bridge Bridge b bashi 3 vMangoku -

IR Presentation Contents

FY2018 (For the Year Ended March 31, 2018) IR Presentation Contents Summary of Financial Statements and Progress of Mid-Term Management Plan 2 Office Building Business 17 Lifestyle Property Business 33 Residential Business 38 International Business 44 Others 49 Investment / Financial Indicator 53 MITSUBISHI ESTATE CO., LTD. 1 Summary of Financial Statements and Progress of Mid-Term Management Plan MITSUBISHI ESTATE CO., LTD. 2 Financial Highlights 1. Income Statement Results for FY2018 Resulted in overall increase mainly from building rental profits etc. while decreased in capital gains. Broke the highest record in profits. Millions of yen(rounded off Millions of yen (rounded down) Capital Gains included in Operating Income to the nearest billion) FY2018 FY2017 FY2018 FY2017 Change Change Results Results Results Results Revenue from Operations 1,194,049 1,125,405 68,644 Total 39,000 42,000 △ 3,000 Office Building Business 506,161 484,238 21,923 Office Building Business 16,000 18,000 △ 2,000 Lifestyle Property Business 105,817 88,955 16,862 Lifestyle Property Business 5,000 Residential Business 410,598 407,850 2,747 Residential Business 1,000 International Business 86,925 66,556 20,368 International Business 15,000 24,000 △ 1,000 Investment Management Business 22,665 21,323 1,342 Investment Management Business 1,000 Other* 88,876 81,301 7,574 Other 1,000 Elimination △ 26,996 △ 24,820 △ 2,175 Eliminations or corporate - Operating Income 213,047 192,495 20,551 Office Building Business 147,243 133,570 13,672 Major Factors for Changes in Lifestyle -

Tour the Mt. Fuji-Shizuoka Area Conveniently Using Railways, Bus and Ferry

June 14, 2016 Central Japan Railway Company Tour the Mt. Fuji-Shizuoka Area Conveniently using Railways, Bus and Ferry. Expanding the “Tourist Pass” Lineup for Foreign Visitors to Japan. The Central Japan Railway Company released the “Takayama-Hokuriku Area Tourist Pass” and “Alpine-Takayama-Matsumoto Area Tourist Pass” in the past for foreign visitors to Japan, making efforts with cooperation from the Shoryudo region to attract foreign tourists. We have commenced sales of the new “Mt. Fuji-Shizuoka Area Tourist Pass Mini” for foreign visitors to Japan that allows them to tour the Shizuoka area with a focus on Mt. Fuji. This new release will allow further expansion of cooperation with the Shoryudo region. Please enjoy your trip in Shizuoka, an area abundant with resources for tourism, feasting your eyes on the grand Mt. Fuji while freely making transfers across railway, bus and ferry. ○ Overview of the “Mt. Fuji-Shizuoka Area Tourist Pass Mini” (1) Subject sections ・JR conventional lines: Atami-Toyohashi (Tokaido Main Line) * Tokaido Shikansen cannot be boarded Numazu-Matsuda (Gotemba Line), Fuji-Shimobe-Onsen (Minobu Line) * Public transportation convenient for traveling in the Mt. Fuji-Shizuoka area such as buses granting access to Miho-no-Matsubara and the five lakes of Mt. Fuji, ferries connecting Shimizu Port and Toi Port and the Mishima-Shuzenji section of the Izuhakone Railway can be used as well. (2) Fees ・Adult 4,500 yen Children 2,250 yen * Children over six and less than 11 years of age (3) Validity period ・Three consecutive days (4) Validity ・Unlimited use of non-reserved seats on ordinary cars on all JR conventional line trains in the subject section *Limited express/rapid trains without non-reserved seats cannot be boarded. -

October 24, 2019 to All Passengers, Odakyu Hakone Group Regarding

October 24, 2019 To all passengers, Odakyu Hakone Group Regarding operation of the Hakone area transportation network and damage caused by Typhoon #19 (as of 10:00AM, Oct. 24) Odakyu Hakone Group Transportation network operations after October 23th (WED) will commence as follows: Notice 1. Transportation network operations Hakone Tozan Line 【Odawara - Hakone-Yumoto】 (Hakone Tozan Railway Co.,Ltd.) Normal operation Romancecar will also operate as scheduled. 【Hakone-Yumoto - Gora】 Operations suspended all day due to bridge structural failure, destroyed power line poles and track damage caused by landslides. Long-term suspension is expected. Rail replacement buses will run between Hakone-Yumoto and Gora stations Hakone Tozan Cable Car Normal operation (Hakone Tozan Railway Co.,Ltd.) Hakone Tozan Bus The Hakonemachi Line , Hakone Kyukaido Line , Hakone Shindo Kanko Shisetsu Meguri Bus Line , are in normal operation. (Hakone Tozan Bus Co.,Ltd.) Togendai Line ○T operates between Odawara ~ Miyagino Eigyosho- 【HP】 mae and Togendai ~ Sengoku-annaijio-mae※ https://www.hakone-tozanbus.co.jp/english/ Kanko Shisetsu Meguri Bus Lines operate between Miyagino Eigyosho-mae~Shisseikaen-mae , Buses to Gotemba Sta. and Gotemba Premium Outlets depart from Gora Sta. Temporary replacement bus service between Hakone-Yumoto~Gora Sta. is also in service. ※Please ask the staff for further details. Other areas of service will restart when safety is confirmed. Please check the Hakone Tozan Bus website for more details. Hakone Ropeway 【Ubako~Togendai】 Normal operation(Mon.-Fri. 9:45~15:15、Sat.Sun.Hol. 9:45~16:15) 【Sounzan~Ubako】 Operations suspended. Replacement buses will not operate for the time being. Hakone Sightseeing Cruise Normal operation ※The final Cruise leaving for Hakonemachi-ko at 16:20 does not have bus connection at Togendai Station. -

20170808 富士箱根パスリニューアル Enー 2

August 2017 The convenient “Fuji Hakone Pass” discount tourist ticket has been upgraded! Available as of August 1 (Tue), 2017 The prices are still the same but it now offers even better access around the Mount Fuji area ODAKYU ELECTRIC RAILWAY Co.,Ltd., Fuji Kyuko Co., Ltd., and Keio Dentetsu Bus Co.,Ltd. will upgrade and begin sales of the Fuji Hakone Pass as of August 1 (Tue), 2017. The Fuji Hakone Pass is a single convenient discount pass that lets you travel through the popular Fuji- Hakone area and is still currently used by many visitors from abroad. Access with public transportation in the Fuji area has been expanded to include places such as the popular tourist spot Grinpa amusement park at the second station of Mount Fuji, Snowtown Yeti, Fuji Flower Village, and the approach to the new fifth station of Mount Fuji at Gotemba. *There will be no changes in the prices after the upgrades. Please be sure to use the Fuji Hakone Pass, which has become even more convenient with the upgrades, and enjoy two grand popular tourist sites. Below is an outline of the upgrades and sales of the Fuji Hakone Pass. 1. Name Fuji Hakone Pass 2. Date of availability As of August 1 (Tue), 2017 3. Term of validity 3 days 4. Prices (1) Departing from Shinjuku: 8,000 yen for adults, 4,000 yen for children (2) Departing from Odawara: 5,650 yen for adults, 2,820 yen for children 5. Ticket outlets Odakyu Sightseeing Service Center, Shinjuku Odakyu Sightseeing Service Center, Odawara *Passes for trips departing from Shinjuku Station are only available at the Odakyu Sightseeing Service Center, Shinjuku *Please see the website for details http://www.odakyu.jp/english/center/ 6. -

Fuji-San in Support of Y Camp Challenge

presents CORPORATE ADVENTURE CHALLENGE: FUJI-SAN IN SUPPORT OF Y CAMP CHALLENGE “We rise by lifting others." Robert Ingersoll UNPLUG AND UNWIND THROUGH ZEN-HIKING ABOUT MOUNT FUJI - SUBASHIRI TRAIL This is not your usual Fuji climb; take a contemplative walk through Japanese forests to ascend up Japan's highest peak at 3,776m to be embraced by one of Asia's enamoured Sunrises. In partnership with YMCA Tozanso, this inaugural adventure fundraiser is in support of Y Camp Challenge, a quarterly outdoor adventure camp for persons with special needs. Mount Fuji's exceptionally symmetrical cone, is a well-known geographical, cultural and spiritual symbol of Japan, frequently depicted in art and photographs, as well as visited by sightseers and climbers. Our base camp will be YMCA Tozanso, nestled at the foot of Mount Hakone, surrounded by lush green forest, and blessed with a stunning view of Mount Fuji. We will access the mountain via the 5th Station of Subashiri route at an altitude of 1,970m, accompanied by beautiful Japanese forests up to 2,700m. Enjoy 'Zen-hiking' as we learn from and follow our local guides up to the summit! SUMMIT FOR SOMEONE ABOUT Y CAMP CHALLENGE Persons with special needs face a mountain of challenges in living as equal members of our community as a result of their physical, intellectual or developmental impairments. Give them the gift of acquiring life skills at YMCA of Singapore’s Y Camp Challenge, a quarterly outdoor adventure camp designed to increase their level of independence through confidence building and camp activities ranging from adrenaline-rushing high rope elements and dragon-boating, to opportunities for making a choice of food and washing their own utensils after meals. -

5 Days 4 Nights Charming Nagoya, Shizuoka and Hakone Tour *

* 5 Days 4 Nights Charming Nagoya, Shizuoka and Hakone Tour * Private Tour Min. 10 Pax Travel Daily Departure Day 1 Arrival in Nagoya (No Meal) Welcome to Nagoya Arrive in Nagoya airport, welcome and assist by our local representative for your transfer to hotel. Day 2 Nagoya – Makinohara – Shizuoka City (Breakfast, Lunch, Dinner) The world-famous Japan Tea Start your day with a tour to Nagoya Castle, Japan’s first castle to be designated a National Treasure. The castle was completed in 1615 by the shogun Tokugawa Ieyasu during the Edo period. However, it was burned down in the 1945 air raids during the bombing of Nagoya in World War II and was rebuilt in steel reinforced concrete in 1959. The two Kinshachi (Golden Tiger-Carp) that sit on top of the castle roof are a famous symbol of Nagoya city. They were employed in traditional Japanese architecture as a talisman to prevent fires. Next, visit the Atsuta Shrine (Atsuta Jingu), a Shinto shrine that was founded to house the sacred sword Kusanagi-no-tsurugi, one of the Three Sacred Imperial Treasures, about 1,900 years ago. Unfortunately, the sword has never been shown to the public. Atsuta Shrine has been especially revered since ancient times, worshipped by members of the Imperial Court and samurai warriors. Formerly built in the style of Owari-zukuri, the shrine was remodeled in 1893 in the Shimei-zukuri style, the same as Ise Shrine. Then, proceed to Makinohara, the most renowned tea-producing region which 20% of Japan’s tea leaves are cultivated. Tea has been grown in the area by family-run plantations for over 800 years. -

Simon Property Group Expands Gotemba Premium Outlets(R)

Simon Property Group Expands Gotemba Premium Outlets(R) March 25, 2008 INDIANAPOLIS, March 25 /PRNewswire-FirstCall/ -- Simon Property Group, Inc. (NYSE: SPG) announced today that its Chelsea outlet division opened the third phase of Gotemba Premium Outlets(R), near Tokyo, Japan. The 95,000 square-foot expansion brings the property to a total of 485,000 square feet of gross leasable area (GLA) containing 200 retail and restaurant tenants. The largest outlet center in Japan, Gotemba Premium Outlets is located approximately 60 miles west of Tokyo on the Tomei Expressway, midway between Mount Fuji and the Hakone resort area. Its primary trade area extends from west Tokyo and Yokohama to Shizuoka prefecture, and includes approximately seven million people living within a 90-minute drive. The surrounding Mount Fuji-Hakone region is one of Japan's top tourist destinations, receiving more than 45 million visitors annually. Gotemba Premium Outlets opened in 2000 and has had a strong following of domestic and international shoppers ever since. Widely considered the leading outlet center in Asia, it was expanded by 170,000 square feet of GLA in 2003. Existing international tenants include Adidas, Anna Molinari, Armani, Bally, Banana Republic, BCBG Max Azria, Benetton, Bottega Veneta, Brooks Brothers, Bruno Magli, Bvlgari, Coach, Cole Haan, Cynthia Rowley, Diesel, Dolce & Gabbana, Dunhill, Escada, Etro, Furla, Gap, Gucci, Hugo Boss, J.Crew, Jimmy Choo, Kate Spade, Kenzo, Laura Ashley, L.L. Bean, Loro Piana, Meleze (LVMH Group), Nike, The North Face, Polo Ralph Lauren, Reebok, Royal Copenhagen, Salvatore Ferragamo, Space (Prada, Miu Miu), S.T. Dupont, Taylor Made, Theory, Timberland, Tod's, Tommy Hilfiger, Triumph, Tumi, Versace, Vivienne Westwood, Wedgwood, Yves Saint Laurent and Zegna. -

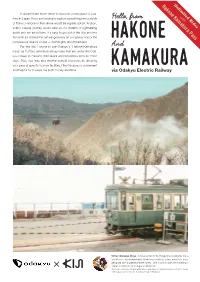

Hello, from of Tokyo, Hakone Or Kamakura Would Be a Great Option

Hakone KamakuraUnlimited PassRides It doesn’t take much effort to discover a new place or pas- with time in Japan. If you are looking to explore something new outside Hello, from of Tokyo, Hakone or Kamakura would be a great option. A short, scenic railway journey would take you to dozens of sightseeing spots and fun attractions. It’s easy to get out of the city and into the fresh air. Admire the natural greenery on a ropeway ride or the hakone picturesque lake by cruise — both highly recommended! For this trip, I chose to use Odakyu’s “Hakone Kamakura And Pass” as it offers unlimited railway rides that are under the Oda- kyu Group in Hakone, Kamakura and Enoshima area for three days. Plus, you may also receive special discounts by showing your pass at specific tourism facilities. I find this pass is convenient kamakura and helpful for it saves me both money and time. via Odakyu Electric Railway Writer: Kataleya Pinyo...A travel writer for KIJI Magazine & Website, Kata- leya Pinyo is into independent bookstores and chic cafés, especially those designed with a palette of earth tones. She is also in love with traveling in Japan. Follow her on Instagram: @bobokp *KIJI is an online media and publication dedicated to featuring travel content in Japan, from Japanese food to art. A popular read in Thailand. Our three day trip with Hakone Kamakura Pass y exciting trip started in the outskirt of the Kanagawa Prefecture: M Hakone. Located not far from Tokyo, Hakone is only around 80 Day minutes from Shinjuku Station. -

Regarding Hakone Area Transportation Network and Damage Caused by Typhoon 19 (Hagibis)(As of 11/18~)

Regarding Hakone Area Transportation Network and Damage Caused by Typhoon 19 (Hagibis)(as of 11/18~) Odakyu Hakone Group transportation network operation from November 18th will commence as written below. If there is a change in the operation information, we will inform you again. Notice 1 Regarding Transportation Network Operations (1)Transportation Network Status Hakone Tozan Line 【Odawara ~ Hakone-Yumoto】 (Hakone Tozan Railway Co.,Ltd.) Normal operation 【Hakone-Yumoto ~ Gora】 Operations suspended indefinitely due to bridge structural failure, destroyed power line poles and track damage caused by landslides. LongLong----termterm suspension is expected. Rail replacement busebusess will run between HakoneHakone----Yumoto and Gora stations FFForFor details, see subsection 2. Hakone Tozan Cable Car Normal operation (Hakone Tozan Railway Co.,Ltd.) Hakone Tozan Bus Hakonemachi Line , Hakone Kyukaido Line , Hakone Shindo Line , Kanko Shisetsu-Meguri Bus are in normal operation. (Hakone Tozan Bus Co.,Ltd.) Togendai Line ○T operates between Odawara ~ Miyagino Eigyosho-mae and Togendai ~ Hakone Garasu-no-mori※ Kanko Shisetsu-Meguri buses operate between Miyagino Eigyosho-mae and Shissei-kaen-mae・Gotemba Sta.・Gotemba Premium Outlets. Miyagino Eigyosho-mae~Gora Sta.~Ten-yu buses will operate once per hour. For details, please see the Hakone Tozan Bus website. ※Togendai~Hakone Garasu-no-mori buses operate only from 9AM to 5PM, due to this limited operation, boarding may not always be possible.(buses run about every 30~60min.) Hakone Ropeway Normal operation (9AM~5PM) ※Please arrive at Togendai Sta. by 4:50PM in order to ride the last Ropeway to Sounzan. Hakone Sightseeing Cruise Normal operation ※Last operation from Hakonemachi-ko (4:20PM) has no bus connection for Odawara direction at Togendai, so passengers are advised to purchase a round-trip ticket. -

Tue) ~Daily Operation Will Make Visiting the Outlets Even More Convenient For

To: Members of the Press October 2, 2014 Mitsubishi Estate-Simon Co., Ltd Gotemba Premium Outlets ○R Direct Bus Service Departing From Shinagawa Station ○R “Gotemba Premium Outlets Bus” Running on weekdays starting November 4 (Tue) ~Daily operation will make visiting the outlets even more convenient for both domestic and international visitors~ Starting on November 4 th (Tuesday), Mitsubishi Estate-Simon Co., Ltd (Chiyoda-ku, Tokyo), which operates the Gotemba Premium Outlets ○R (Gotemba, Shizuoka Prefecture), will commence daily operation of the direct bus “Gotemba Premium Outlets ○R Bus” departing from Shinagawa Station Konan Exit (East Exit). Limited operation of this bus service on weekends, holidays, and during Premium Oultes Bargain at the Gotemba Premium Outlets ○R was started in August 2012. It is used by many customers as a transportation method other than cars that allows direct access from the bay area, from Tokyo to Kanagawa Prefecture. In addition, as the departing station is a Shinkansen stop as well as a major terminal station of the Tokyo Metropolitan district located close to Haneda Airport, which is serving an increasing number of international flights, this service is also used by individual travelers to Japan. Following increasing demand, we started to offer multilingual support on our advance reservation website starting in July 2014. By starting daily operation, following the bus services offered from Shinjuku Station (2 lines), Tokyo Station, and Yokohama Station, it will be even more convenient for customers in Japan as well as customers from abroad to use this service. ■Overview of the direct bus “Gotemba Premium Outlets ○R Bus” departing from Shinagawa Station Operating Keihin Kyuko Bus Co., Ltd. -

Fujino Kirameki – Fuji Gotemba Overview ◎Facility Overview Guest Rooms: 20 (Approx

Fujino Kirameki – Fuji Gotemba Overview ◎Facility Overview Guest Rooms: 20 (approx. 54x153 ㎡) Room Specifications: Separate buildings Capacity: Approximately 100 people Total Area: Approximately 16,500 ㎡ Opened: April 27th, 2018 Location: 3373-25 Higashitanaka, Gotemba-shi, Shizuoka-ken 412-0026 Public Area ・ Central Station (Admin Building) ・ Play Area (Playground) ・ S-Park (Grassy Field) ・ Dog Run ・ Beverage Station (Café/Bar) Cabins ・ Deluxe Cabin 53.7㎡ (29.5㎡ interior, 24.2㎡ deck) ・ Grande Cabin 68.5㎡ (44.3㎡ interior, 24.2㎡ deck) ・ Deluxe Universal Cabin (Wheelchair-accessible Deluxe Cabin) ・ Grande Universal Cabin (Wheelchair-accessible Grande Cabin) ・ Grande Dog-Friendly Cabin (Grande Cabin w/Dog Run; small dogs allowed) ・ Deluxe Dog-Friendly Cabin (Deluxe Cabin; small dogs allowed) ・ Fujino Suite 153.4㎡ (44.3㎡ interior, 109.1㎡ terrace) 1 ◎What Makes Our Facilities Special □Take in the splendor of majestic Mt. Fuji from the resort’s 20 individual cabins. □Fully equipped with air conditioner, shower room, and toilet. The outdoor terrace features a retractable roof, fireplace, dining table, hammock, and jacuzzi. Dine beside a roaring campfire, and bathe beneath the stars. □Premises include a playground with Bornelund-designed equipment, and a spacious dog run. □A convenient 1 ½ hour drive from the city, 3 minutes from the Gotemba Interchange, and only 10 minutes from Gotemba Premium Outlets. 2 ACCESS By Train By Bus By Car From Tokyo Station Expressway Bus Terminal From Shinjuku Station Expressway Bus Terminal From JR Shinjuku Station to JR Gotemba Station From Tomei Expressway Tokyo Tollgate 1 hr. 25 min. 1 hr. 50 min. 1 hr. 40 min. Approx. 1 hr.