Payment Formatting Guidelines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Country Code Country Name National Client Identifier Format

Country Country National client Format of the identifier Potential source of the information code name identifier AT Austria CONCAT Belgian National Number 11 numerical digits where the first 6 are the date of birth (YYMMDD), the next 3 are an BE Belgium (Numéro de registre National ID ordering number (uneven for men, even for women) and the last 2 a check digit. national - Rijksregisternummer) CONCAT It consists of 10 digits. The first 6 are the date of birth (YYMMDD). The next 3 digits Bulgarian Personal have information about the area in Bulgaria and the order of birth, and the ninth digit is BG Bulgaria Passport, National ID, Driving Licence Number even for a boy and odd for a girl. Seventh and eighth are randomly generated according to the city. The tenth digit is a check digit. CONCAT The number for passports issued before 13/12/2010 consists of the character 'E' The passport is issued by the Civil National Passport CY Cyprus followed by 6 digits i.e E123456. Biometric passports issued after 13/12/2010 have a Registry Department of the Ministry Number number that starts with the character 'K', followed by 8 digits. i.e K12345678 of Interior. CONCAT It is a nine or ten-digit number in the format of YYXXDD/SSSC, where XX=MM (month of birth) for male, i.e. numbers 01-12, and XX=MM+50 (or exceptionally XX=MM+70) for female, i.e. numbers 51-62 (or 71-82). For example, a number 785723 representing the It is assigned to a person shortly after first six digits is assigned to a woman born on 23rd of July 1978. -

Dominican Republic

Required Report: Required - Public Distribution Date: June 29,2020 Report Number: DR2020-0012 Report Name: Retail Foods Country: Dominican Republic Post: Santo Domingo Report Category: Retail Foods Update on the Dominican Republic Retail Sector Prepared By: Mayra Carvajal Approved By: Elizabeth Autry Report Highlights: Report Highlights: The Dominican Republic (DR) is one of the most dynamic economies in the Caribbean region. With U.S. consumer-oriented product exports reaching US$600 million in 2019, the country represents the fifth-largest market in Latin America. The DR’s modern retail sector is growing rapidly and offers a wide variety of U.S. products. However, despite the prominence and growth of local supermarket chains, they only account for 20-25 percent of total retail sales. Most sales are still in the traditional channel, which includes neighborhood stores (colmados) and warehouses, which offer largely local products. THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Market Fact Sheet: Dominican Republic Quick Facts CY 2019 List of Top 10 Growth Products The Dominican Republic (DR) is an upper middle-income country with low and stable inflation. It is the second-largest economy in 1) Cheese 6) Meat (Beef) the Caribbean, just behind Cuba, and the third-largest country in 2) Wine 7) Seafood terms of population (behind Cuba and Haiti). In 2019, the DR’s 3) Beer 8) Snack foods GDP reached approximately US$89 billion, a 5.1 percent increase 4) Pork 9) Frozen potatoes/veg from 2018. The DR’s major export growth has shifted away from 5) Chicken parts 10) Fresh fruit its traditional products (raw sugar, green coffee, and cacao) to gold, Ferro-nickel, sugar derivatives, free-trade zone products, Consumer-Oriented Trade (U.S. -

Oracle Financial Services Regulatory Reporting 2.1 Web Service Guide

Oracle Financial Services Compliance Regulatory Reporting Web Service Guide Release 2.5.6 May 2016 Oracle Financial Services Compliance Regulatory Reporting Web Service Guide Release 2.5.6 December 2016 Part Number: E70640-01 Oracle Financial Services Software, Inc. 1900 Oracle Way Reston, VA 20190 Part Number: E70640-01 First Edition (May 2016) Copyright © 2016 Oracle and/or its affiliates. All rights reserved. Printed in U.S.A. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission. Trademarks Oracle is a registered trademark of Oracle Corporation and/or its affiliates. Other names may be trademarks of their respective owners. Oracle Financial Services Software, Inc. 1900 Oracle Way Reston, VA 20190 Phone: 703-478-9000 Fax: 703-318-6340 Internet: www.oracle.com/financialservices Contents Contents About This Guide ............................................................................................................ III Who Should Use this Guide .............................................................................................................................................III Scope of this Guide............................................................................................................................................................III How this Guide is Organized...........................................................................................................................................III -

Bank Account Information Form Payee

Bank Account Information Form The payee is responsible for the accuracy and completeness of the data entered in this form. The IAEA is not responsible for any delay in payments resulting from incorrectly supplied banking information. Bank charges resulting from incorrectly supplied information may be deducted from any subsequent payment. Only one bank account, per currency, per payee can be active for payment purposes. Please complete all required fields electronically. If not possible, please complete by hand using BLOCK CAPITALS. Please refer to the numbered instructions for help completing this form. Bank Account to which payment should be made: 01 Account Name (required) You MUST complete the Account Name above or else the IAEA cannot process the payment to your account. It is the name of the bank account; this may not be the same as the payee name and is never the account type. If unsure check a bank statement or ask your bank. The IAEA requires this information to help comply with controls on the movement of funds. Valid Examples: Person • AF E and J Z Abbas • ALing Hong • AMr Peter Smith and Ms Jane Hoff Organization • ARutherford Nuclear Institute • AIndian NMI No2 Payment Account 02 IBAN (for locations listed on reverse) or Account Number 03 SWIFT/BIC 04 Non IBAN Reference (Branch Number or Routing Number) (ABA, BSB, ACH, IFSC etc; see Instructions) 05 Bank Account Currency (if account accepts only one currency) 06 Bank Name 07 Bank Code (required if you do not have SWIFT/BIC) 08 Branch Address (Street, City, Country) Payee: Person 09 Is the above account for a Person or Organization? Organization Family Name First Name Middle Name 10 Person Information (only if you indicated Person above) 11 Organization Name (only if you indicated Organization above) 12 Payee Address (Street, City, Country, as held by your bank) 13 Remittance email address Please email, mail or fax the completed form to your IAEA contact: (For IAEA Use only) Julie Zellinger AIPS Supplier Number P.O. -

I. the ECONOMIC and TRADE ENVIRONMENT (1) Major Features

Dominican Republic W/TPR/S/11 Page 1 I. THE ECONOMIC AND TRADE ENVIRONMENT (1) Major Features of the Economy1 1. The Dominican Republic is located in the eastern half of the Caribbean island of Hispaniola (with Haiti on the western half). It has an area of 48,442 km2. In 1993, the population was around 7.5 million; population growth has declined to around 2 per cent in the 1990s from 2.7 per cent in the early 1970s. The urban population is increasing, amounting to 63 per cent of the total in 1993 (Table I.1). The Dominican Republic is endowed with different types of soil suitable for agriculture and is rich in minerals; its traditional production structure has been in agricultural goods such as sugar, coffee, cocoa, and tobacco and in the exploitation of minerals such as nickel, doré (a gold and silver alloy) and bauxite. The abundance of labour and the proximity to the United States have been important elements in the rapid growth of exports, mainly of clothing, from free zones (Chapter V(4)); furthermore, a buoyant tourist industry has developed around the many attractive beaches (Chapters V(5)). Table I.1 Major features of the Dominican Republic economy (1987 prices) 1970 1975 1980 1985 1990 1991 1992 1993 Population (thousands) 4,423 5,049 5,697 6,376 7,110 7,247 7,387 7,543 urban population (per cent) 40.0 45.3 50.5 55.7 60.4 61.2 62.1 62.9 Current GNP per capita (US$) 340 720 1160 760 890 1010 1170 1230 Labor force (thousands) 1,157 1,340 1,571 1,862 2,187 2,251 2,317 2,384 Female participation (per cent) 11.0 11.7 12.4 13.7 15.0 15.3 15.6 15.9 GDP at constant market prices GDP (US$ million) 2,184 3,345 4,240 4,588 5,493 5,545 5,975 6,151 Share in GDP Agriculture 27.6 20.9 20.0 20.3 16.0 16.5 16.2 15.8 Industry 23.7 29.2 28.4 26.2 24.6 23.5 24.6 24.2 Manufacturing 15.4 15.7 15.3 13.7 12.5 12.3 12.9 12.6 Services 48.6 49.9 51.6 53.5 59.4 60.1 59.2 60.0 School enrollment ratio Primary 100 104 118 126 .. -

Approved List of Confirmation and Witdrawals January 2018

LIST OF CONFIRMATIONS AND WITHDRAWALS APPROVED BY THE 117TH STANDARDS APPROVAL COMMITTEE MEETING ON 11TH JANUARY 2018 CHEMICAL DEPARTMENT WITHDRAWALS 1. KS 1104:1992 Kenya Standard — Specification for iron pigments for paints, To be replaced by KS ISO 1248:2006, KS ISO 2495:1995, KS ISO 3549:1995, KS ISO 4620:1986 and KS ISO 4621:1986 2. KS 1941-1:2005 Kenya Standard — Scouring compounds — Specification Part 1: Dishwashing paste, To be replaced by KS 1941-1:2018 3. KS 1941-2:2005 Kenya Standard — Scouring compounds — Specification Part 2: Antibacterial dishwashing paste, To be replaced by KS 1941-2:2018 4. KS 815:2012 Kenya Standard — Retro-reflective and fluorescent warning triangles for motor vehicles — Specification, To be replaced by KS 815:2018 ELECTROTECHNICAL DEPARTMENT CONFIRMATIONS 5. KS 2411:2012 Kenya Standard — Leather — Fashion handbags — Specification 6. KS 2412:2012 Kenya Standard — Leather — Men’s and women’s leather belts 7. KS 1730:2012 Kenya Standard — Leather — Sports shoes 8. KS ISO 16131:2012 Kenya Standard — Leather — Upholstery leather characteristics — Selection of leather for furniture 9. KS ISO 14930:2012 Kenya Standard — Leather — Leather for dress gloves — Specification 10. KS IEC 60051-2:1984 Kenya Standard — Direct acting indicating analogue electrical measuring instruments and their accessories Part 2: Special requirements for ammeters and voltmeters 11. KS IEC 60051-3:1984 Kenya Standard — Direct acting indicating analogue electrical measuring instruments and their accessories Part 3: Special requirements for watt- meters and varmeters 12. KS IEC 60051-4:1984 Kenya Standard — Direct acting indicating analogue electrical measurements and their accessories Part 4: Special requirements for frequency 13. -

RSA Adaptive Authentication (Hosted) 11 Programmer's Guide

RSA Adaptive Authentication (Hosted) Programmer's Guide Contact Information Go to the RSA corporate web site for regional Customer Support telephone and fax numbers: www.rsa.com Trademarks RSA, the RSA Logo and EMC are either registered trademarks or trademarks of EMC Corporation in the United States and/or other countries. All other trademarks used herein are the property of their respective owners. For a list of RSA trademarks, go to www.rsa.com/legal/trademarks_list.pdf. License agreement This software and the associated documentation are proprietary and confidential to EMC, are furnished under license, and may be used and copied only in accordance with the terms of such license and with the inclusion of the copyright notice below. This software and the documentation, and any copies thereof, may not be provided or otherwise made available to any other person. No title to or ownership of the software or documentation or any intellectual property rights thereto is hereby transferred. Any unauthorized use or reproduction of this software and the documentation may be subject to civil and/or criminal liability. This software is subject to change without notice and should not be construed as a commitment by EMC. Note on encryption technologies This product may contain encryption technology. Many countries prohibit or restrict the use, import, or export of encryption technologies, and current use, import, and export regulations should be followed when using, importing or exporting this product. Distribution Use, copying, and distribution of any EMC software described in this publication requires an applicable software license. EMC believes the information in this publication is accurate as of its publication date. -

WAW Product and Services Terms and Conditions

PRODUCTS & SERVICES TERMS AND CONDITIONS THE WAW CREDIT UNION PRODUCTS & SERVICES TERMS AND CONDITIONS CONSISTS OF: WAW CREDIT UNION PRODUCTS AND SERVICES TERMS AND CONDITIONS BOOKLET; WAW CREDIT UNION FEES AND CHARGES SCHEDULE; WAW CREDIT UNION SAVINGS AND INVESTMENT RATES SCHEDULES; WAW CREDIT UNION DISCONTINUED ACCOUNTS FEATURES, FEES AND CHARGES SCHEDULE. THE WAW CREDIT UNION PRODUCT & SERVICES TERMS AND CONDITIONS SHOULD BE READ IN CONJUNCTION WITH THE WAW CREDIT UNION FINANCIAL SERVICES GUIDE. WAW Credit Union Co-Operative Ltd. ABN 48 087 651 787 Australian Financial Service Licence 247298 Australian Credit Licence 247298 Version 44 - dated 17 February 2021 replaces Version 43 - dated 15 June 2020 Page | 1 CONTENTS PAGE TOPIC NUMBER Introduction 4 Customer Owned Banking Code of Practice 4 Section 1 Words Used in this Brochure - Definitions 5 Section 2 Changes to the Terms and Conditions 6 Section 3 Deposits (including Financial Claims Scheme protections) 6 Section 4 Withdrawals 6 Section 5 Future Payments & Direct Debits 7 Section 6 Electronic Credits 7 Section 7 Electronic Payment Processing Times 7 Section 8 Interest, Fees & Charges 8 Section 9 Statement of Account 8 Section 10 Electronic Statements (eStatements) & Notices 8 Section 11 Joint Accounts 8 Section 12 WAW’s Right to Combine Accounts 9 Section 13 Foreign Currency Transactions 9 Section 14 Closing an Account 9 Section 15 Inactive Accounts 9 Section 16 Dormant Accounts 9 Section 17 Anti-Money Laundering & Counter-Terrorism Financing Act 2006 10 Section 18 Phone Banking/Internet -

Réussissez Votre Migration S€PA Les Bonnes Pratiques Pour Un Projet À Valeur Ajoutée

LES GUIDES SAGE POUR LA GESTION DE VOTRE ENTREPRISE Réussissez votre migration SEPA Les bonnes pratiques pour un projet à valeur ajoutée Sommaire Introduction . 4 Le SEPA Qu’est-ce que le SEPA ? ......................................................6 La zone SEPA ................................................................. 7 Les grandes dates à retenir .................................................. 8 Quelles sont les mesures issues du SEPA ? . 9 Quels sont les impacts du SEPA sur votre entreprise ? .................. 12 Témoignage AFTE ........................................................... 13 Quels sont les impacts du SEPA sur les instruments de paiement ? ..... 14 La fin programmée du protocole ETEBAC . 16 Quelles sont les actions engagées en France ? ........................... 17 Témoignage BNP Paribas . 18 Quelle est la démarche adoptée par Sage ? . 19 Réussir sa migration dans les délais . 20 Témoignage Société Générale .............................................. 25 Témoignage Client Tel and Com . 26 Lexique . 28 L’offre Sage . 30 Les bonnes pratiques pour un projet à valeur ajoutée 3 e SEPA (Single Euro Payment Area) est un espace européen représentant près de 480 millions d’habitants, 9000 banques et 25 Lmillions d’entreprises, à l’intérieur duquel les paiements vont être harmonisés en remplaçant progressivement les outils dématérialisés de transferts de fonds actuellement utilisés. Le but : que chaque entreprise et chaque particulier puisse effectuer des paiements en euro aussi facilement dans ces 32 pays que sur leur territoire national. Dans ce guide, nous vous donnons toutes les clés pour comprendre cette réglementation, analyser ses impacts au sein de votre entreprise et préparer de manière efficace votre entrée dans le SEPA. La naissance de l’Europe des paiements Si le SEPA est important, c’est qu’il marque l’avènement de l’Europe des paiements. -

EGON for Anacredit EGON for Anacredit

EGON for AnaCredit EGON for AnaCredit The AnaCredit project involves creating a new database for the regulation of bank loans at European level. AnaCredit The European Central Bank thus requires individual Banks, through their National Central Banks, to collect a very detailed and granular set of data, including master data and addresses. This request is currently limited to legal entities, but it will also be extended to private individuals. EGON offers specific tools to support banks in transmitting this information to the ECB in a unique, codified manner in accordance with established European standards. In particular, EGON for AnaCredit is able to manage and standardize the following information: Address with NUTS encoding attribution National Identifier (e.g. tax codes, tax IDs, or other national identifiers) Legal Forms (Legal Forms of Each EU Country) LEI (Legal entities identifier) Classification of economic activities (transcoded in NACE coding) Managed information Address National Identifier The address must be provided according to the structure The National Identifier is a national identification code that below, with the attribution of the NUTS3 encoding, allowing uniquely identifies a physical or legal entity. The composition of EGON to manage at EU level: National Identifiers is different for each country. EGON allows • street validating all National Identifiers by applying specific logic and • city/town/village algorithms for each country. • county/admin. division standard NUTS 3 • postal code • country Legal Form LEI Classification of economic activities The classification of legal forms takes on a The LEI code is a unique and global 20-byte The transmission of information on the unified European coding according to the alphanumeric identifier assigned to classification of economic activities in the standard defined by the ECB. -

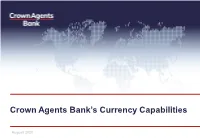

Crown Agents Bank's Currency Capabilities

Crown Agents Bank’s Currency Capabilities August 2020 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Majors Australia Australian Dollar AUD ✓ ✓ - - M Canada Canadian Dollar CAD ✓ ✓ - - M Denmark Danish Krone DKK ✓ ✓ - - M Europe European Euro EUR ✓ ✓ - - M Japan Japanese Yen JPY ✓ ✓ - - M New Zealand New Zealand Dollar NZD ✓ ✓ - - M Norway Norwegian Krone NOK ✓ ✓ - - M Singapore Singapore Dollar SGD ✓ ✓ - - E Sweden Swedish Krona SEK ✓ ✓ - - M Switzerland Swiss Franc CHF ✓ ✓ - - M United Kingdom British Pound GBP ✓ ✓ - - M United States United States Dollar USD ✓ ✓ - - M Africa Angola Angolan Kwanza AOA ✓* - - - F Benin West African Franc XOF ✓ ✓ ✓ - F Botswana Botswana Pula BWP ✓ ✓ ✓ - F Burkina Faso West African Franc XOF ✓ ✓ ✓ - F Cameroon Central African Franc XAF ✓ ✓ ✓ - F C.A.R. Central African Franc XAF ✓ ✓ ✓ - F Chad Central African Franc XAF ✓ ✓ ✓ - F Cote D’Ivoire West African Franc XOF ✓ ✓ ✓ ✓ F DR Congo Congolese Franc CDF ✓ - - ✓ F Congo (Republic) Central African Franc XAF ✓ ✓ ✓ - F Egypt Egyptian Pound EGP ✓ ✓ - - F Equatorial Guinea Central African Franc XAF ✓ ✓ ✓ - F Eswatini Swazi Lilangeni SZL ✓ ✓ - - F Ethiopia Ethiopian Birr ETB ✓ ✓ N/A - F 1 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Africa Gabon Central African Franc XAF ✓ ✓ ✓ - F Gambia Gambian Dalasi GMD ✓ - - - F Ghana Ghanaian Cedi GHS ✓ ✓ - ✓ F Guinea Guinean Franc GNF ✓ - ✓ - F Guinea-Bissau West African Franc XOF ✓ ✓ - - F Kenya Kenyan Shilling KES ✓ ✓ ✓ ✓ F Lesotho Lesotho Loti LSL ✓ ✓ - - E Liberia Liberian -

PAYMENT FORMATS STP Rules

PAYMENT FORMATS STP Rules © VTB Bank (Europe) SE – Payment Formats – STP Rules Page 1 / 10 List of Contents General Information ............................................................................................................... 3 Requirements of the regulations of the Anti Money Laundering Act ....................................... 3 Transaction quality and price ................................................................................................. 3 Account number format ......................................................................................................... 4 BIC (SWIFT address) ............................................................................................................ 4 Customer payment order MT 103 .......................................................................................... 4 Customer payment order MT 103+ ........................................................................................ 8 Bank-to-Bank payments MT 200/202/202Cov ....................................................................... 8 Appendix I ........................................................................................................................... 10 © VTB Bank (Europe) SE – Payment Formats – STP Rules Page 2 / 10 General Information The costs of international payment transactions can be considerably reduced by the observation of prevailing standard rules. The term „Straight Through Processing“ (STP) refers to the highly automated and standardised processing of payment