DFA INVESTMENT TRUST CO (Form: N-Q, Filing Date: 04/29/2005)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

178S ASMS Directory of Members DAVID AASERUD the Lubrizol

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Elsevier - Publisher Connector 178S ASMS Directory of Members DAVID AASERUD SUZANNE ACKLOO WILLIAM ADAMS The Lubrizol Corporation MDS Sciex Philip Morris USA 29400 Lakeland Blvd. 71 Four Valley Drive RD&E/OC-T3W Wickliffe, OH 44092 Concord, ON L4K 4V8 Canada 615 Maury Street Tel: 440 347 4776 Tel: 905 660 9005 Richmond, VA 23224 [email protected] [email protected] Tel: 804 274 2093 [email protected] SUSAN ABBATIELLO EUREKA ACOLATSE University of Florida 7237 Causeway Dr. #3B GARY E. ADAMSON Department of Chemistry Indianapolis, IN 46214 Merck and Co. PO Box 117200 Tel: 317 433 4016 Merch Research Laboratories Gainesville, FL 32611 [email protected] P.O. Box 4 Tel: 352 392 0536 West Point, PA 19486 [email protected] CHRIS ADAMS Tel: 215 652 1174 Uppsala University [email protected] LARRY ABBEY Biological & Medical Mass Spec Waters Corporation Box 583, BMC JULIE ADAMSON 4026 Oak Crest Drive Uppsala, SE-751 23 Sweden University of Michigan Tucker, GA 30084 Tel: 46 18 471 5729 930 N. University Tel: 770 414 5089 [email protected] Ann Arbor, MI 48109-1055 [email protected] Tel: 734-763-6535 GREG ADAMS [email protected] FRANK S. ABBOTT Diosynth Biotechnology University of British Columbia 3000 Weston Parkway TOM ADDISON Faculty of Pharmaceutical Science Cary, NC 27513 Covance-11 2146 East Mall Tel: 919 388 5690 6002/11 Vancouver, BC V6T 1Z3 Canada [email protected] 3301 Kinsman Boulevard Tel: 604 822 2566 Madison, WI 53704-2523 [email protected] LUKE ADAMS Tel: 608 242 2639 University of Washington, Chemistry [email protected] FADI ABDI Box 351700 Applied Biosystems Seattle, WA 98195 TERRI ADDONA 500 Old Connecticut Path Tel: 206 543 7656 Broad Instritute Framingham, MA 01702 [email protected] 320 Charles Street Tel: 508 383 7921 Cambridge, MA 02141 [email protected] NIGEL G. -

Dfa Investment Trust Co

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2004-10-27 | Period of Report: 2004-08-31 SEC Accession No. 0001104659-04-032148 (HTML Version on secdatabase.com) FILER DFA INVESTMENT TRUST CO Business Address 1299 OCEAN AVE CIK:896162| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1130 11TH FLOOR Type: N-Q | Act: 40 | File No.: 811-07436 | Film No.: 041100436 SANTA MONICA CA 90401 3103958005 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-7436 THE DFA INVESTMENT TRUST COMPANY (Exact name of registrant as specified in charter) 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, Vice President and Secretary The DFA Investment Trust Company, 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 (Name and address of agent for service) Registrant's telephone number, including area code: 310-395-8005 Date of fiscal year end: November 30 Date of reporting period: August 31, 2004 ITEM 1. SCHEDULE OF INVESTMENTS. The DFA Investment Trust Company Form N-Q August 31, 2004 (Unaudited) Table of Contents Schedules of Investments The U.S. Large Company Series The Enhanced U.S. Large Company Series The U.S. Large Cap Value Series The U.S. -

Fibrolase: Trials and Tribulations

Toxins 2010, 2, 793-808; doi:10.3390/toxins2040793 OPEN ACCESS toxins ISSN 2072-6651 www.mdpi.com/journal/toxins Review Fibrolase: Trials and Tribulations Francis S. Markland 1,2,* and Steve Swenson 1,2 1 Department of Biochemistry and Molecular Biology, Cancer Research Laboratory, Keck School of Medicine, University of Southern California, 1303 N. Mission Rd., Los Angeles, CA 90033, USA 2 USC/Norris Comprehensive Cancer Center, Keck School of Medicine, University of Southern California, Los Angeles, CA 90033, USA; E-Mail: [email protected] * Author to whom correspondence should be addressed; E-Mail: [email protected]; Tel.: +1-(323) 224-7981; Fax: +1-(323) 224-7679. Received: 11 March 2010; in revised form: 31 March 2010 / Accepted: 19 April 2010 / Published: 20 April 2010 Abstract: Fibrolase is the fibrinolytic enzyme isolated from Agkistrodon contortrix contortrix (southern copperhead snake) venom. The enzyme was purified by a three-step HPLC procedure and was shown to be homogeneous by standard criteria including reverse phase HPLC, molecular sieve chromatography and SDS-PAGE. The purified enzyme is a zinc metalloproteinase containing one mole of zinc. It is composed of 203 amino acids with a blocked amino-terminus due to cyclization of the terminal Gln residue. Fibrolase shares a significant degree of homology with enzymes of the reprolysin sub-family of metalloproteinases including an active site homology of close to 100%; it is rapidly inhibited by chelating agents such as EDTA, and by alpha2-macroglobulin (). The enzyme is a direct-acting thrombolytic agent and does not rely on plasminogen for clot dissolution. Fibrolase rapidly cleaves the A()-chain of fibrinogen and the B()-chain at a slower rate; it has no activity on the -chain. -

European Citizen Information Project FINAL REPORT

Final report of the study on “the information of the citizen in the EU: obligations for the media and the Institutions concerning the citizen’s right to be fully and objectively informed” Prepared on behalf of the European Parliament by the European Institute for the Media Düsseldorf, 31 August 2004 Deirdre Kevin, Thorsten Ader, Oliver Carsten Fueg, Eleftheria Pertzinidou, Max Schoenthal Table of Contents Acknowledgements 3 Abstract 4 Executive Summary 5 Part I Introduction 8 Part II: Country Reports Austria 15 Belgium 25 Cyprus 35 Czech Republic 42 Denmark 50 Estonia 58 Finland 65 France 72 Germany 81 Greece 90 Hungary 99 Ireland 106 Italy 113 Latvia 121 Lithuania 128 Luxembourg 134 Malta 141 Netherlands 146 Poland 154 Portugal 163 Slovak Republic 171 Slovenia 177 Spain 185 Sweden 194 United Kingdom 203 Part III Conclusions and Recommendations 211 Annexe 1: References and Sources of Information 253 Annexe 2: Questionnaire 263 2 Acknowledgements The authors wish to express their gratitude to the following people for their assistance in preparing this report, and its translation, and also those national media experts who commented on the country reports or helped to provide data, and to the people who responded to our questionnaire on media pluralism and national systems: Jean-Louis Antoine-Grégoire (EP) Gérard Laprat (EP) Kevin Aquilina (MT) Evelyne Lentzen (BE) Péter Bajomi-Lázár (HU) Emmanuelle Machet (FR) Maria Teresa Balostro (EP) Bernd Malzanini (DE) Andrea Beckers (DE) Roberto Mastroianni (IT) Marcel Betzel (NL) Marie McGonagle (IE) Yvonne Blanz (DE) Andris Mellakauls (LV) Johanna Boogerd-Quaak (NL) René Michalski (DE) Martin Brinnen (SE) Dunja Mijatovic (BA) Maja Cappello (IT) António Moreira Teixeira (PT) Izabella Chruslinska (PL) Erik Nordahl Svendsen (DK) Nuno Conde (PT) Vibeke G. -

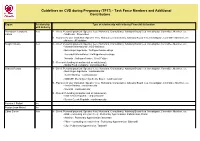

Guidelines on CVD During Pregnancy (TF17) - Task Force Members and Additional Contributors

Guidelines on CVD during Pregnancy (TF17) - Task Force Members and Additional Contributors Expert Relationship Type of relationship with industry Financial declaration with Industry Blomstrom-Lundqvist Yes A - Direct Personal payment: Speaker fees, Honoraria, Consultancy, Advisory Board fees, Investigator, Committee Member, etc. Carina - Medtronic : Pacemaker B - Payment to your Institution: Speaker fees, Honoraria, Consultancy, Advisory Board fees, Investigator, Committee Member, etc. - Atricure : AF ablation Borghi Claudio Yes A - Direct Personal payment: Speaker fees, Honoraria, Consultancy, Advisory Board fees, Investigator, Committee Member, etc. - Menarini International : ACE-inhibitors - Boheringer Ingelheim : Antihypertensive drugs - Recordati International : Antihypertensive drugs - Novartis : Antihypertensive, Heart Failure D - Research funding (departmental or institutional). - Barilla Food Company : Lactotripeptides Cifkova Renata Yes A - Direct Personal payment: Speaker fees, Honoraria, Consultancy, Advisory Board fees, Investigator, Committee Member, etc. - Boehringer-Ingelheim : cardiovascular - Daiichi Sankyo : cardiovascular - MSD-SP, Boehringer Ingelheim, Bayer : cardiovascular B - Payment to your Institution: Speaker fees, Honoraria, Consultancy, Advisory Board fees, Investigator, Committee Member, etc. - Daiichi Sankyo : cardiovascular - Novartis : cardiovascular D - Research funding (departmental or institutional). - Krka Czech Republic : cardiovascular - Servier Czech Republic : cardiovascular Ferreira J Rafael No -

Scotland's Digital Media Company

Annual Report and Accounts 2010 Annual Report and Accounts Scotland’s digital media company 2010 STV Group plc STV Group plc In producing this report we have chosen production Pacific Quay methods which aim to minimise the impact on our Glasgow G51 1PQ environment. The papers chosen – Revive 50:50 Gloss and Revive 100 Uncoated contain 50% and 100% recycled Tel: 0141 300 3000 fibre respectively and are certified in accordance with the www.stv.tv FSC (Forest stewardship Council). Both the paper mill and printer involved in this production are environmentally Company Registration Number SC203873 accredited with ISO 14001. Directors’ Report Business Review 02 Highlights of 2010 04 Chairman’s Statement 06 A conversation with Rob Woodward by journalist and media commentator Ray Snoddy 09 Chief Executive’s Review – Scotland’s Digital Media Company 10 – Broadcasting 14 – Content 18 – Ventures 22 KPIs 2010-2012 24 Performance Review 27 Principal Risks and Uncertainties 29 Corporate Social Responsibility Corporate Governance 34 Board of Directors 36 Corporate Governance Report 44 Remuneration Committee Report Accounts 56 STV Group plc Consolidated Financial Statements – Independent Auditors’ Report 58 Consolidated Income Statement 58 Consolidated Statement of Comprehensive Income 59 Consolidated Balance Sheet 60 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Financial Statements 90 STV Group plc Company Financial Statements – Independent Auditors’ Report 92 Company Balance Sheet 93 Statement -

Johnston Press and the Crisis in Ireland's Local Newspaper Industry

1 Johnston Press and the Crisis in Ireland’s Local Newspaper Industry, 2005-14 Anthony Cawley Lecturer in Media, Department of Media and Communication, Liverpool Hope University, L16 9JD [A version of this article was published by Journalism.] Reflecting international trends, Ireland’s local newspaper industry has suffered steep circulation and advertising revenue falls since the late-2000s, and has struggled to reshape traditional business models for the digital era. In harsh trading conditions, local titles are operating on reduced editorial resources and are weakened in their capacity to fulfil their traditional watchdog and informed-citizenry functions. Perhaps no company better encapsulates the industry’s recent difficulties than UK media group Johnston Press. In 2005, it paid more than €200m to acquire fourteen local titles in Ireland, but nine years later sold them for just €8.5m. The article draws on this case-study to consider wider issues related to the corporatisation of local news provision, the sustainability of local news industries in small media markets such as Ireland’s, and the increasing disconnect between local journalism’s commodity value and its public good value. KEYWORDS: Johnston Press, Ireland, local newspapers, local journalism, market sustainability Introduction The local newspaper industry in the Republic of Ireland, reflecting the broader international experience, has suffered steep falls in circulation and revenues since the late-2000s, and has struggled to recalibrate its traditional business models for the digital era. In some cases, 2 local news publishers are reorganising and reducing their editorial resources to maintain operating profitability. In other cases, they are doing so to survive. -

Merger Control in the United Kingdom

MERGER CONTROL IN THE UNITED KINGDOM MERGER CONTROL IN THE UNITED KINGDOM By Dr Andrew Scott Senior Lecturer in Law, University of East Anglia Prof Morten Hviid Professor of Competition Law, University of East Anglia Prof Bruce Lyons Professor of Economics, University of East Anglia Mr Christopher Bright Partner, Shearman and Sterling LLP, London Consultant Editor 1 3 Great Clarendon Street, Oxford ox2 6dp Oxford University Press is a department of the University of Oxford. It furthers the University’s objective of excellence in research, scholarship, and education by publishing worldwide in Oxford New York Auckland Cape Town Dar es Salaam Hong Kong Karachi Kuala Lumpur Madrid Melbourne Mexico City Nairobi New Delhi Shanghai Taipei Toronto With offices in Argentina Austria Brazil Chile Czech Republic France Greece Guatemala Hungary Italy Japan Poland Portugal Singapore South Korea Switzerland Thailand Turkey Ukraine Vietnam Oxford is a registered trade mark of Oxford University Press in the UK and in certain other countries Published in the United States by Oxford University Press Inc., New York © Nicolas Squire, Kathleen Mealy, Joanna Broadbend The moral rights of the authors have been asserted Database right Oxford University Press (maker) Crown copyright material is reproduced under Class Licence Number C01P0000148 with the permission of OPSI and the Queen’s Printer for Scotland First published 2005 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, without the prior permission in writing of Oxford University Press, or as expressly permitted by law, or under terms agreed with the appropriate reprographics rights organizations. -

Oral Presentation Disclosures

Oral Presentation Disclosures Adler, Lenard – Alcobra Pharma, APSARD/Pond Foundation, Major League Baseball, Major League Baseball Players Association, National Football League, New York University School of Medicine, Novartis Bioventures, Shire Pharmaceuticals, Sunovion, SUNY Upstate, Theravance, US Department of Veterans Affairs Cooperative Studies Program Anton, Raymond – Abbvie, Alkermes, Eli Lilly, Ethypharm, Lundbeck, Pfizer, Sunpharma Baker, Ross – Otsuka Pharmaceutical Development & Commercialization, Inc. Baldwin, David – Lundbeck Beaver, Jessica – Targacept, Inc. Bencherif, Merouane – Targacept, Inc. Bertolino, Alessandro – F. Hoffmann-La Roche, Ltd. Bradshaw, Mark – Euthymics Bioscience, Neurovance, Inc. Burdick, Katherine – Dainippon Sumitomo Pharma Bymaster, Frank – Euthymics Bioscience, Neurovance, Inc. Calabrese, Joseph – Sunovion, Teva (Cephalon) Cantillon, Marc – Forest, Kyowa, Lilly, Merck, Pfizer, Reviva Caroff, Stanley – Sunovion Chen, Yinzhong – Takeda Development Center Americas, Inc. Chengappa, Roy – Pfizer, Inc. Childress, Ann – Abbott Laboratories, Bristol Myer Squibb, GlaxoSmithKline, Ironshore, Janssen (Ortho-McNeil), Johnson & Johnson PRD, Lilly, Neos Therapeutics, Neurovance Inc., NextWave, Novartis, Noven, Otsuka, Pfizer, Rhodes, Sepracor, Shionogi, Shire, Somerset, Sunovion, Theravance Christine, Mazzucco – Janssen Cohen, Lee – Astra-Zeneca Pharmaceuticals, Bristol-Myers Squibb, Cephalon, Inc., GlaxoSmithKline, National Institute of Mental Health, National Institute on Aging, Noven Pharmaceuticals, Ortho-McNeil -

In Re Nuvelo, Inc. Securities Litigation 07-CV-04056-Declaration of Mark

BERGER & MONTAGUE, P.C. Sherrie R. Savett Carole A. Broderick Phyllis M. Parker 1622 Locust Street Philadelphia, PA 19103 Tel: (215) 875-3000 Fax: (215) 875-4604 Email: [email protected] cbroderick@bm ,net [email protected] IZARD NOBEL LLP ROBBINS GELLER RUDMAN Jeffrey S. Nobel & DOWD LLP Mark P. Kindall, Bar No 138703 Darren J. Robbins Nancy A. Kulesa Dennis J. Herman 29 South Main Street Eli R. Greenstein Suite 215 S. Ashar Ahmed West Hartford, Ct 06107 Post-Montgomery Center Tel: (860) 493-6292 One Montgomery Street, Suite 1800 Fax: (860) 493-6290 San Francisco, CA 94104 Email: [email protected] Tel: (415) 288-4545 [email protected] Fax: (415) 288-4534 [email protected] Email: [email protected] dennisb@rgrdlaw,corn [email protected] aahmed@rgrdlaw com Co-Lead Counsel for Plaintiffs Liaison Counsel UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF CALIFORNIA SAN FRANCISCO DIVISION In re NUVELO, INC. SECURITIES Master File No 07-CV-04056-VRW LITIGATION CLASS ACTION DECLARATION OF MARK P. KINDALL IN SUPPORT OF PLAINTIFFS' MOTION FOR CLASS CERTIFICATION DATE: March .3, 2011 I TIME: 10:00 a.rn. I COURTROOM: 6 DECLARATION OF MARK P KINDALL IN SUPPORT OF PLArNTIFFS' MOTION FOR CLASS CERTIFICATION - 07-CV-04056-VRW DECLARATION OF MARK P. KINDALL IN SUPPORT OF PLAINTIFFS' MOTION FOR CLASS CERTIFICATION 2 3 I, Mark P. Kindall, hereby declare as follows: 4 1. I am a partner at the law firm of Izard Nobel LLP, which was appointed Co-Lead 5 Counsel for Plaintiffs in this litigation on September 19, 2007. I have personal knowledge of the 6 facts set forth herein. -

The Development of Stroke Therapeutics: Promising Mechanisms and Translational Challenges

Neuropharmacology 56 (2009) 329–341 Contents lists available at ScienceDirect Neuropharmacology journal homepage: www.elsevier.com/locate/neuropharm Review The development of stroke therapeutics: Promising mechanisms and translational challenges Margaret M. Zaleska a, Mary Lynn T. Mercado a, Juan Chavez b, Giora Z. Feuerstein b, Menelas N. Pangalos a, Andrew Wood a,* a Discovery Neuroscience, Wyeth Research, CN8000, Princeton, NJ 08543, USA b Translational Medicine, Wyeth Research, Collegeville, PA, USA article info abstract Article history: Ischemic stroke is the second most common cause of death worldwide and a major cause of disability. Received 8 August 2008 Intravenous thrombolysis with rt-PA remains the only available acute therapy in patients who present Received in revised form within 3 h of stroke onset other than the recently approved mechanical MERCI device, substantiating the 29 September 2008 high unmet need in available stroke therapeutics. The development of successful therapeutic strategies Accepted 6 October 2008 remains challenging, as evidenced by the continued failures of new therapies in clinical trials. However, significant lessons have been learned and this knowledge is currently being incorporated into improved Keywords: pre-clinical and clinical design. Furthermore, advancements in imaging technologies and continued Ischemia Neuroprotection progress in understanding biological pathways have established a prolonged presence of salvageable Regeneration penumbral brain tissue and have begun to elucidate the natural repair response initiated by ischemic Inflammation insult. We review important past and current approaches to drug development with an emphasis on Neuroimaging implementing principles of translational research to achieve a rigorous conversion of knowledge from Translational medicine bench to bedside. We highlight current strategies to protect and repair brain tissue with the promise to Drug development provide longer therapeutic windows, preservation of multiple tissue compartments and improved clinical success. -

Beyond Borders Global Biotechnology Report 2009 “It Is Different This Time Because This Crisis Is Deep-Rooted, Systemic and Persistent

For media use only Under embargo until 5:01 UK time on 5 May 2009 Beyond borders Global biotechnology report 2009 “It is different this time because this crisis is deep-rooted, systemic and persistent. But, in spite of that, the industry has been here before, in that biotech companies have overcome seemingly insurmountable challenges in the past, bucking trends and defying odds.“ Glen T. Giovannetti and Gautam Jaggi, Ernst & Young Global Biotechnology Center To our clients and friends As the shockwaves from the global financial crisis rippled across the emphasizes the need for partnering models that allow companies world economy in late 2008 and 2009, they left little untouched. the flexibility to evolve, while Samantha Du of Hutchison The reverberations leveled long-standing institutions, triggered MediPharma discusses how China can offer firms advantages that unprecedented policy responses and revealed new risks. For the address weaknesses in the Western business model. biotechnology industry, the impact of these turbulent times has But turbulent times can make the unimaginable possible, and deepened the divide between the sector’s haves and have-nots. sweeping disruptions have often redrawn maps, changed playing Many small-cap companies are scrambling to raise capital and fields and altered rules and regimes. In “Beyond business as contain spending, while a select few continue to attract favorable usual?” — our Global introduction article — we present four valuations from investors and strategic partners. paradigm-shifting trends that have the potential to reshape the A number of this year’s articles focus on the acute challenges healthcare landscape and create new opportunities: high-quality created by the funding crisis.