Hearings Committee on the Budget United States Senate

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1996 Republican Party Primary Election March 12, 1996

Texas Secretary of State Antonio O. Garza, Jr. Race Summary Report Unofficial Election Tabulation 1996 Republican Party Primary Election March 12, 1996 President/Vice President Precincts Reporting 8,179 Total Precincts 8,179 Percent Reporting100.0% Vote Total % of Vote Early Voting % of Early Vote Delegates Lamar Alexander 18,615 1.8% 11,432 5.0% Patrick J. 'Pat' Buchanan 217,778 21.4% 45,954 20.2% Charles E. Collins 628 0.1% 153 0.1% Bob Dole 566,658 55.6% 126,645 55.8% Susan Ducey 1,123 0.1% 295 0.1% Steve Forbes 130,787 12.8% 27,206 12.0% Phil Gramm 19,176 1.9% 4,094 1.8% Alan L. Keyes 41,697 4.1% 5,192 2.3% Mary 'France' LeTulle 651 0.1% 196 0.1% Richard G. Lugar 2,219 0.2% 866 0.4% Morry Taylor 454 0.0% 124 0.1% Uncommitted 18,903 1.9% 4,963 2.2% Vote Total 1,018,689 227,120 Voter Registration 9,698,506 % VR Voting 10.5 % % Voting Early 2.3 % U. S. Senator Precincts Reporting 8,179 Total Precincts 8,179 Percent Reporting100.0% Vote Total % of Vote Early Voting % of Early Vote Phil Gramm - Incumbent 837,417 85.0% 185,875 83.9% Henry C. (Hank) Grover 71,780 7.3% 17,312 7.8% David Young 75,976 7.7% 18,392 8.3% Vote Total 985,173 221,579 Voter Registration 9,698,506 % VR Voting 10.2 % % Voting Early 2.3 % 02/03/1998 04:16 pm Page 1 of 45 Texas Secretary of State Antonio O. -

Interview with Larry Pope by Andrea L’Hommedieu

Bowdoin College Bowdoin Digital Commons George J. Mitchell Oral History Project Special Collections and Archives 5-14-2008 Interview with Larry Pope by Andrea L’Hommedieu Laurence 'Larry' E. Pope Follow this and additional works at: https://digitalcommons.bowdoin.edu/mitchelloralhistory Part of the Law and Politics Commons, Oral History Commons, Political History Commons, and the United States History Commons Recommended Citation Pope, Laurence 'Larry' E., "Interview with Larry Pope by Andrea L’Hommedieu" (2008). George J. Mitchell Oral History Project. 46. https://digitalcommons.bowdoin.edu/mitchelloralhistory/46 This Interview is brought to you for free and open access by the Special Collections and Archives at Bowdoin Digital Commons. It has been accepted for inclusion in George J. Mitchell Oral History Project by an authorized administrator of Bowdoin Digital Commons. For more information, please contact [email protected]. George J. Mitchell Oral History Project Special Collections & Archives, Bowdoin College Library, 3000 College Sta., Brunswick, Maine 04011 © Bowdoin College Laurence E. Pope GMOH# 013 (Interviewer: Andrea L’Hommedieu) May 15, 2008 Andrea L’Hommedieu: This is an interview for George J. Mitchell Oral History Project. The date is May 15, 2008. I’m here at the Hawthorne-Longfellow Library at Bowdoin College with Laurence “Larry” Pope. This is Andrea L’Hommedieu. Could you start, Mr. Pope, just by giving me your full name? Laurence Pope: Yes, my name is Laurence Pope, and Laurence Everett Pope is the middle initial. AL: And where and when were you born? LP: I was born in New Haven, Connecticut, on September 24, 1945. AL: Is that the area in which you grew up? LP: No, my father was studying Japanese at Yale University at the time, and so that’s why we were there. -

Women in the United States Congress: 1917-2012

Women in the United States Congress: 1917-2012 Jennifer E. Manning Information Research Specialist Colleen J. Shogan Deputy Director and Senior Specialist November 26, 2012 Congressional Research Service 7-5700 www.crs.gov RL30261 CRS Report for Congress Prepared for Members and Committees of Congress Women in the United States Congress: 1917-2012 Summary Ninety-four women currently serve in the 112th Congress: 77 in the House (53 Democrats and 24 Republicans) and 17 in the Senate (12 Democrats and 5 Republicans). Ninety-two women were initially sworn in to the 112th Congress, two women Democratic House Members have since resigned, and four others have been elected. This number (94) is lower than the record number of 95 women who were initially elected to the 111th Congress. The first woman elected to Congress was Representative Jeannette Rankin (R-MT, 1917-1919, 1941-1943). The first woman to serve in the Senate was Rebecca Latimer Felton (D-GA). She was appointed in 1922 and served for only one day. A total of 278 women have served in Congress, 178 Democrats and 100 Republicans. Of these women, 239 (153 Democrats, 86 Republicans) have served only in the House of Representatives; 31 (19 Democrats, 12 Republicans) have served only in the Senate; and 8 (6 Democrats, 2 Republicans) have served in both houses. These figures include one non-voting Delegate each from Guam, Hawaii, the District of Columbia, and the U.S. Virgin Islands. Currently serving Senator Barbara Mikulski (D-MD) holds the record for length of service by a woman in Congress with 35 years (10 of which were spent in the House). -

Washington Update 444 N

National Association of State Auditors, Comptrollers and Treasurers WASHINGTON UPDATE 444 N. Capitol Street NW, Suite 234 Washington, DC 20001 March 11, 2013 EXECUTIVE COMMITTEE President President Names New OMB Director issues for the MSRB. Suggested priorities MARTIN J. BENISON or initiatives should relate to any of the Comptroller Massachusetts President Barack Obama has nominated MSRB’s core activities: Sylvia Mathews Burwell, president of the First Vice President Regulating municipal securities dealers JAMES B. LEWIS Walmart Foundation, as the next director of State Treasurer the U.S. Office of Management and Budg- and municipal advisors. New Mexico et. She will take over for Jeffrey Zients, Operating market transparency sys- tems. Second Vice President who was named acting director of OMB in WILLIAM .G HOLLAND January 2012. Burwell previously worked Providing education, outreach and mar- Auditor General in the budget office as deputy director from ket leadership. Illinois 1998 to 2001 under President Bill Clinton, Secretary and she served as deputy chief of staff un- When providing feedback, the MSRB en- CALVIN McKELVOGUE der Jack Lew. Lew was confirmed as treas- courages commenters to be as specific as Chief Operating Officer possible and provide as much information State Accounting Enterprise ury secretary by the Senate two weeks ago. Iowa as possible about particular issues and top- Nunes to Resurrect Bill to Block Bond ics. In addition to providing the MSRB Treasurer with specific concerns about regulatory and RICHARD K. ELLIS Sales Without Pension Disclosure State Treasurer market transparency issues, the MSRB en- Utah Office of the State Treasurer Rep. Devin Nunes (R-CA) has indicated his courages commenters to provide input on its education, outreach and market leader- Immediate Past President intention to reintroduce his “Public Em- RONALD L. -

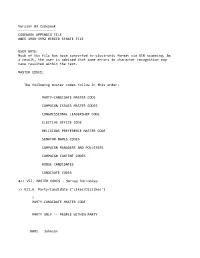

Appendix File Anes 1988‐1992 Merged Senate File

Version 03 Codebook ‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐ CODEBOOK APPENDIX FILE ANES 1988‐1992 MERGED SENATE FILE USER NOTE: Much of his file has been converted to electronic format via OCR scanning. As a result, the user is advised that some errors in character recognition may have resulted within the text. MASTER CODES: The following master codes follow in this order: PARTY‐CANDIDATE MASTER CODE CAMPAIGN ISSUES MASTER CODES CONGRESSIONAL LEADERSHIP CODE ELECTIVE OFFICE CODE RELIGIOUS PREFERENCE MASTER CODE SENATOR NAMES CODES CAMPAIGN MANAGERS AND POLLSTERS CAMPAIGN CONTENT CODES HOUSE CANDIDATES CANDIDATE CODES >> VII. MASTER CODES ‐ Survey Variables >> VII.A. Party/Candidate ('Likes/Dislikes') ? PARTY‐CANDIDATE MASTER CODE PARTY ONLY ‐‐ PEOPLE WITHIN PARTY 0001 Johnson 0002 Kennedy, John; JFK 0003 Kennedy, Robert; RFK 0004 Kennedy, Edward; "Ted" 0005 Kennedy, NA which 0006 Truman 0007 Roosevelt; "FDR" 0008 McGovern 0009 Carter 0010 Mondale 0011 McCarthy, Eugene 0012 Humphrey 0013 Muskie 0014 Dukakis, Michael 0015 Wallace 0016 Jackson, Jesse 0017 Clinton, Bill 0031 Eisenhower; Ike 0032 Nixon 0034 Rockefeller 0035 Reagan 0036 Ford 0037 Bush 0038 Connally 0039 Kissinger 0040 McCarthy, Joseph 0041 Buchanan, Pat 0051 Other national party figures (Senators, Congressman, etc.) 0052 Local party figures (city, state, etc.) 0053 Good/Young/Experienced leaders; like whole ticket 0054 Bad/Old/Inexperienced leaders; dislike whole ticket 0055 Reference to vice‐presidential candidate ? Make 0097 Other people within party reasons Card PARTY ONLY ‐‐ PARTY CHARACTERISTICS 0101 Traditional Democratic voter: always been a Democrat; just a Democrat; never been a Republican; just couldn't vote Republican 0102 Traditional Republican voter: always been a Republican; just a Republican; never been a Democrat; just couldn't vote Democratic 0111 Positive, personal, affective terms applied to party‐‐good/nice people; patriotic; etc. -

Congressional Directory TEXAS

252 Congressional Directory TEXAS TEXAS (Population 2000, 20,851,820) SENATORS PHIL GRAMM, Republican, of College Station, TX; born in Fort Benning, GA, July 8, 1942, son of Sergeant and Mrs. Kenneth M. Gramm; education: B.B.A. and Ph.D., economics, Univer- sity of Georgia, Athens, 1961–67; professor of economics, Texas A&M University, College Sta- tion, 1967–78; author of several books including: ‘‘The Evolution of Modern Demand Theory’’ and ‘‘The Economics of Mineral Extraction’’; Episcopalian; married Dr. Wendy Lee Gramm, of Waialua, HI, 1970; two sons: Marshall and Jeff; coauthor of the Gramm-Latta I Budget, the Gramm-Latta II Omnibus Reconciliation Act, the Gramm-Rudman-Hollings balanced budget bill and the Gramm-Leach-Bliley Financial Services Act; committees: ranking member, Banking, Housing and Urban Affairs; Budget; Finance; elected to the U.S. House of Representatives as a Democrat in 1978, 1980 and 1982; resigned from the House on January 5, 1983, upon being denied a seat on the House Budget Committee; reelected as a Republican in a special election on February 12, 1983; chairman, Republican Senate Steering Committee, 1997–2001; elected chairman, National Republican Senatorial Committee for the 1991–92 term, and reelected for the 1993–94 term; elected to the U.S. Senate on November 6, 1984; reelected to each suc- ceeding Senate term. Office Listings http://www.senate.gov/senator/gramm.html 370 Russell Senate Office Building, Washington, DC 20510–4302 .......................... (202) 224–2934 Chief of Staff.—Ruth Cymber. Legislative Director.—Steve McMillin. Press Secretary.—Lawrence A. Neal. State Director.—Phil Wilson. Suite 1500, 2323 Bryan, Dallas, TX 75201 ................................................................ -

Couch's “Physical Alteration” Fallacy: Its Origins And

COUCH’S “PHYSICAL ALTERATION” FALLACY: ITS ORIGINS AND CONSEQUENCES Richard P. Lewis,∗ Lorelie S. Masters,∗∗ Scott D. Greenspan*** & Chris Kozak∗∗∗∗ I. INTRODUCTION Look at virtually any Covid-19 case favoring an insurer, and you will find a citation to Section 148:46 of Couch on Insurance.1 It is virtually ubiquitous: courts siding with insurers cite Couch as restating a “widely held rule” on the meaning of “physical loss or damage”—words typically in the trigger for property-insurance coverage, including business- income coverage. It has been cited, ad nauseam, as evidence of a general consensus that all property-insurance claims require some “distinct, demonstrable, physical alteration of the property.”2 Indeed, some pro-insurer decisions substitute a citation to this section for an actual analysis of the specific language before the court. Couch is generally recognized as a significant insurance treatise, and courts have cited it for almost a century.3 That ∗ Partner, ReedSmith LLP, New York. ∗∗ Partner, Hunton Andrews Kurth LLP, Washington D.C. *** Senior Counsel, Pillsbury Winthrop Shaw Pittman LLP, New York. ∗∗∗∗ Associate, Plews Shadley Racher & Braun, LLP, Indianapolis. 1 10A STEVEN PLITT, ET AL., COUCH ON INSURANCE 3D § 148:46. As shown below, some courts quote Couch itself, while others cite cases citing Couch and merely intone the “distinct, demonstrable, physical alteration” language without citing Couch itself. Couch First and Couch Second were published in hardback books (with pocket parts), in 1929 and 1959 respectively. As explained below (infra n.5), Couch 3d, a looseleaf, was first published in 1995.. 2 Id. (emphasis added); Oral Surgeons, P.C. -

OAKLAND COUNTY DIRECTORY 2016 Oakland County Directory Lisa Brown - Oakland County Clerk/Register of Deeds Experience Oakgov.Com/Clerkrod 2016

OAKLAND COUNTY DIRECTORY 2016 Oakland County Directory Lisa Brown - Oakland County Clerk/Register of Deeds Experience oakgov.com/clerkrod 2016 Get Fit! Seven parks offer natural and paved trails for hiking, biking and equestrians. From Farm to Family Oakland County Market offers grower-direct fresh produce and flowers year-round from more than 140 farmers and artisans representing 17 Michigan counties. Get Outdoors Cool Off Camp Learn to golf at five courses! Season Passes for two waterparks. With Family and friends. Visit DestinationOakland.com About the Front Cover An art contest was held by Oakland County Clerk/Register of Deeds Lisa Brown that was open to all high school students who live and attend school in Oakland County. Students made original works of art depicting the theme of “The Importance of Voting.” The winning art piece, shown on the cover, was created by Kate Donoghue of Sylvan Lake. “Through my picture, I tried to portray that if you have the ability to vote but do not take the opportunity to do it, your thoughts and opinions will never be represented,” said Kate. She added, “I think that it is very important to vote if you have the chance to do so because your beliefs and the decision making ability of others could determine your future.” Kate used Sharpies and watercolor pencils to create her artwork. Congratulations, Kate! Lisa Brown OAKLAAND COUNTY CLERK/REGISTER OF DEEDS www.oakgov.com/clerkrod Dear Oakland County County Resident: Resident: II’m'm honoredhonored toto serveserve as as your your Clerk/Register Clerk/Register of ofDeeds. -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 111 CONGRESS, SECOND SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 111 CONGRESS, SECOND SESSION Vol. 156 WASHINGTON, MONDAY, NOVEMBER 29, 2010 No. 153 House of Representatives The House met at 2 p.m. and was PALLONE) come forward and lead the tives, the Clerk received the following mes- called to order by the Speaker pro tem- House in the Pledge of Allegiance. sage from the Secretary of the Senate on No- pore (Ms. RICHARDSON). Mr. PALLONE led the Pledge of Alle- vember 22, 2010 at 2:53 p.m.: giance as follows: That the Senate passed with amendments f H.R. 4783. DESIGNATION OF THE SPEAKER I pledge allegiance to the Flag of the That the Senate concurs in House amend- United States of America, and to the Repub- PRO TEMPORE ment to Senate amendment H.R. 5566. lic for which it stands, one nation under God, That the Senate concurs in House amend- The SPEAKER pro tempore laid be- indivisible, with liberty and justice for all. ments S. 3689. fore the House the following commu- f That the Senate passed S. 3650. nication from the Speaker: That the Senate passed with amendment COMMUNICATION FROM THE WASHINGTON, DC, H.R. 6198. November 29, 2010. CLERK OF THE HOUSE That the Senate agreed to without amend- I hereby appoint the Honorable LAURA The SPEAKER pro tempore laid be- ment H. Con. Res. 327. RICHARDSON to act as Speaker pro tempore fore the House the following commu- With best wishes, I am on this day. -

CARRY on STREAMIN from EDINBURGH FOLK CLUB Probably the Best Folk Club in the World! Dateline: Wednesday 24 February 2021 Volume 1.18

CARRY ON STREAMIN from EDINBURGH FOLK CLUB Probably the best folk club in the world! Dateline: Wednesday 24 February 2021 Volume 1.18 INEXORABLY MOVING TOWARDS ‘NORMALITY’ SANDY BELL’S BAR, the world- renowned – nay, famous - haunt for many folkies over many years and many other ordinary folk (non-folk muggles(?) as the mighty Rowling might have said), has just posted some great news on Facebook (February 24 2021) … “Excellent news! Received a £10k grant from Grassroots Music this morning, so that will help immensely going forward. The sooner we open the better but as we are a ‘wet led’ only pub and small in capacity we will be among the last to open along with night clubs etc. Once we are open (which we are confident now we will Sandy Bell's Bar: re-opening … hoping, sometime in 2021. be) the hard part begins (as we had to take on a £50k business loan to keep us along with you, our loyal customers afloat and still have a deferred VAT arriving back in full force we're confident payment to settle amongst another few we will prevail. Thank you for your bills that had been put on hold). Loans support, looking forward welcoming you and bills will have to be paid but with a all back.” few sacrifices and careful budget control Having reported on the cancellation of CONTENTS Glastonbury and HebCelt in the last COS Page 1 Lead story a couple of weeks ago, this announcement Page 2-3-5, 7 The First Whammy (by Fish) (prophesy?) from Sandy Bell’s boss Stevie Page 7 Edinburgh Fringe President Hannah is a most welcome indication that Page 8-9 Keeping Gaelic Traditions things are perhaps, just perhaps, turning a Vibrant In Edinburgh corner at last. -

The ARCHAEOLOGIST

Summer 2007 Number 64 The ARCHAEOLOGIST This issue: POST-MEDIAEVAL ARCHAEOLOGY Images of change p16 Residues of industry and empire p28 What’s happening to Scotland’s rural past? p32 Institute of Field Archaeologists Finding and SHES, University of Reading, Whiteknights losing the PO Box 227, Reading RG6 6AB tel 0118 378 6446 fortifications of fax 0118 378 6448 Antwerp email [email protected] website www.archaeologists.net p47 C ONTENTS 1 Contents 2 Editorial 3 From the Finds Tray 5 Heritage Protection for the 21st century Peter Hinton 6 Merger with IHBC? Your views are needed Peter Hinton 7 Introducing IFA’s Membership Team Beth Asbury 8 News from CWPA Patrick Clay and Kate Geary page 26 9 Names and agenda: industrial and post-mediaeval archaeology today Marilyn Palmer 12 Post-medieval archaeology in Ireland: a 2007 perspective Audrey Horning 14 After ‘The Change’: recent military heritage in Europe John Schofield page 28 16 Images of change Sefryn Penrose 18 The Van: Screws and Christmas Crackers… Adrian Myers 20 Beetles from the Van Steve Davis 21 Edinburgh’s Tron Kirk Martin Cook and John A Lawson 22 Atherstone: The decline of a Warwickshire industrial town David Gilbert 24 The Portwall Lane Glassworks, Bristol Reg Jackson 26 Excavating the Bow Porcelain Factory of London Tony Grey and Jacqui Pearce 28 Residues of industry and empire: urban archaeology in the post-colonial age James Symonds 30 Living at the Edge: the Alderley Sandhills Project Eleanor Conlin Casella 32 What’s happening to Scotland’s rural past? Tertia Barnett -

Investment Managememt Process

WELCOME TO: Movie & Market A Night of Bond Update Event 248.648.8598 www.hfgllc.com ANNOUNCEMENT: NAME & LEGAL STRUCTURE CHANGES We are proud to announce we have transitioned from “Timothy Herbert Financial Group” to simply HFG. This name change and logo rebrand aims to deliver our corporate mission of building meaningful, long- New Website Address term relationships with our clients by providing them www.hfgllc.com with a TEAM experience, thereby enhancing the overall level of service each of you receives. 248.648.8598 www.hfgllc.com WHY WE MADE THESE CHANGES? • Continuity • Growth • Succession 248.648.8598 www.hfgllc.com MEET THE HFG TEAM 248.648.8598 www.hfgllc.com S&P Chart Dow Jones Industrial Average = -0.73% S&P 500 = 0.82% All Countries Excluding U.S. = -2.36% 248.648.8598 www.hfgllc.com S&P Declines 1975-2014 Type of Decline Total Number Average Frequency -5% or more 120 About three times a year -10% or more 31 About once every 1.3 years -15% or more 11 About once every 3.6 years -20% or more 5 About once every 8 years Source: American Funds 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com 248.648.8598 www.hfgllc.com A Diversified Portfolio is not the same as an Index VS.