Guide for Travelers to India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AIR TRANSPORT SERVICES Agreement Between the and FIJI

TREATIES AND OTHER INTERNATIONAL ACTS SERIES 9917 AIR TRANSPORT SERVICES Agreement Between the UNITED STATES OF AMERICA and FIJI Signed at Suva October 1, 1979 NOTE BY THE DEPARTMENT OF STATE Pursuant to Public Law 89-497, approved July 8, 1966 (80 Stat . 271 ; 1 U .S .C. 113)- . the Treaties and Other International Acts Series issued under the authority of the Secretary of State shall be competent evidence . of the treaties, FIJI international agreements other than treaties, and proc• lamations by the President of such treaties and inter• Air Transport Services national agreements other than treaties, as the case may be, therein contained, in all the courts of law Agreement signed at Suva October 1, 1979 ; and equity and of maritime jurisdiction, and in all the Entered into force provisionally October 1, 1979 tribunals and public offices of the United States, and ; of the several States, without any further proof or Entered into force definitively October 11, 1979 . authentication thereof." For sale by the Superintendent of Documents, U .S . Government Printing Office, Washington, D .C. 20402 . Subscription Price : $110 per year ; $27 .50 additional for foreign mailing . Single copies vary in price. This issue $2 .00. 76-9930-81 (1) TIAS 9917 2 3 E AIR TRANSPORT AGREEMENT BETWEEN . "International air service" shall mean an air service which passes through the airspace over the territory THE GOVERNMENT OF THE UNITED STATES OF AMERICA of more than one State AND THE GOVERNMENT OF FIJI . F . "Stop for non-traffic purposes" shall mean a The Government of the United States of America and the landing for any purpose other than taking on or discharging Government of Fiji, passengers, cargo or mail carried for compensation . -

Air Cargo Logistics in India

Air Cargo Logistics in India Working Group Report th 7 May , 2012 Ministry of Civil Aviation, Government of India 1 | P a g e Air Cargo Logistics in India 1 Table of Contents List of Graphs ......................................................................................................................................................................... 5 List of tables ........................................................................................................................................................................... 6 Foreword ...................................................................................................................................................................................... 7 2 Introduction ..................................................................................................................................................................... 9 2.1 Overview .................................................................................................................................................................. 9 2.2 Air Cargo Logistics Operations ..................................................................................................................... 10 2.3 Stakeholders ......................................................................................................................................................... 11 3 Role of Air Cargo in Indian Economy .................................................................................................................. -

U.S. Customs and Border Protection, DHS; Treas. § 122.25

U.S. Customs and Border Protection, DHS; Treas. Pt. 122 PART 122—AIR COMMERCE 122.44 Crew baggage declaration. 122.45 Crew list. REGULATIONS 122.46 Crew purchase list. 122.47 Stores list. Sec. 122.48 Air cargo manifest. 122.0 Scope. 122.48a Electronic information for air cargo required in advance of arrival. Subpart A—General Definitions and 122.48b Air Cargo Advance Screening Provisions (ACAS). 122.1 General definitions. 122.49 Correction of air cargo manifest or 122.2 Other Customs laws and regulations. air waybill. 122.3 Availability of forms. 122.49a Electronic manifest requirement for 122.4 English language required. passengers onboard commercial aircraft 122.5 Reproduction of Customs forms. arriving in the United States. 122.49b Electronic manifest requirement for Subpart B—Classes of Airports crew members and non-crew members on- board commercial aircraft arriving in, 122.11 Designation as international airport. continuing within, and overflying the 122.12 Operation of international airports. United States. 122.13 List of international airports. 122.49c Master crew member list and master 122.14 Landing rights airport. non-crew member list requirement for 122.15 User fee airports. commercial aircraft arriving in, depart- ing from, continuing within, and over- Subpart C—Private Aircraft flying the United States. 122.49d Passenger Name Record (PNR) infor- 122.21 Application. mation. 122.22 Electronic manifest requirement for 122.50 General order merchandise. all individuals onboard private aircraft arriving in and departing from the Subpart F—International Traffic Permit United States; notice of arrival and de- parture information. 122.51 Aircraft of domestic origin registered 122.23 Certain aircraft arriving from areas in the U.S. -

Manual Setting out Legislation to Civil Aviation

Tax and Duty Manual Civil Aviation Manual Civil Aviation Manual This document should be read in conjunction with section 6, 7, 10 and 11 of the Customs Act 2015 and SI No. 613 of 2016. This document last reviewed February 2021 Queries: [email protected] VPN 63229/63234 The information in this document is provided as a guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every case. 1 Tax and Duty Manual Civil Aviation Manual Table of Contents 1. Section 1. – Introduction and Definitions....................................................................................5 1.1 Introduction..........................................................................................................................5 1.2 Definitions ............................................................................................................................5 1.3 Doubts and difficulties..........................................................................................................7 2 Section 2. - Law, Regulations and General Procedure. ...............................................................8 2.1 Law .......................................................................................................................................8 2.2 General effect of the Customs Act .......................................................................................8 2.3 Approval of places of landing and/or departure -

COM(78)646 Final

ARCHIVES HISTORIQUES DE LA COMMISSION COLLECTION RELIEE DES DOCUMENTS "COM" COM (78) 646 Vol. 1978/0251 Disclaimer Conformément au règlement (CEE, Euratom) n° 354/83 du Conseil du 1er février 1983 concernant l'ouverture au public des archives historiques de la Communauté économique européenne et de la Communauté européenne de l'énergie atomique (JO L 43 du 15.2.1983, p. 1), tel que modifié par le règlement (CE, Euratom) n° 1700/2003 du 22 septembre 2003 (JO L 243 du 27.9.2003, p. 1), ce dossier est ouvert au public. Le cas échéant, les documents classifiés présents dans ce dossier ont été déclassifiés conformément à l'article 5 dudit règlement. In accordance with Council Regulation (EEC, Euratom) No 354/83 of 1 February 1983 concerning the opening to the public of the historical archives of the European Economic Community and the European Atomic Energy Community (OJ L 43, 15.2.1983, p. 1), as amended by Regulation (EC, Euratom) No 1700/2003 of 22 September 2003 (OJ L 243, 27.9.2003, p. 1), this file is open to the public. Where necessary, classified documents in this file have been declassified in conformity with Article 5 of the aforementioned regulation. In Übereinstimmung mit der Verordnung (EWG, Euratom) Nr. 354/83 des Rates vom 1. Februar 1983 über die Freigabe der historischen Archive der Europäischen Wirtschaftsgemeinschaft und der Europäischen Atomgemeinschaft (ABI. L 43 vom 15.2.1983, S. 1), geändert durch die Verordnung (EG, Euratom) Nr. 1700/2003 vom 22. September 2003 (ABI. L 243 vom 27.9.2003, S. -

Custom Guides for Indian Passengers

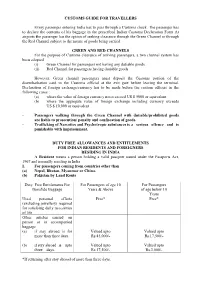

CUSTOMS GUIDE FOR TRAVELLERS Every passenger entering India has to pass through a Customs check. The passenger has to declare the contents of his baggage in the prescribed Indian Customs Declaration Form At airports the passenger has the option of seeking clearance through the Green Channel or through the Red Channel subject to the nature of goods being carried. GREEN AND RED CHANNELS For the purpose of Customs clearance of arriving passengers, a two channel system has been adopted (i) Green Channel for passengers not having any dutiable goods. (ii) Red Channel for passengers having dutiable goods. However, Green channel passengers must deposit the Customs portion of the disembarkation card to the Customs official at the exit gate before leaving the terminal. Declaration of foreign exchange/currency has to be made before the custom officers in the following cases : (a) where the value of foreign currency notes exceed US $ 5000 or equivalent (b) where the aggregate value of foreign exchange including currency exceeds US $ 10,000 or equivalent - Passengers walking through the Green Channel with dutiable/prohibited goods are liable to prosecution/ penalty and confiscation of goods. - Trafficking of Narcotics and Psychotropic substances is a serious offence and is punishable with imprisonment. DUTY FREE ALLOWANCES AND ENTITLEMENTS FOR INDIAN RESIDENTS AND FOREIGNERS RESIDING IN INDIA A Resident means a person holding a valid passport issued under the Passports Act, 1967 and normally residing in India I. For passengers coming from countries other than (a) Nepal, Bhutan, Myanmar or China. (b) Pakistan by Land Route Duty–Free Entitlements For For Passengers of age 10 For Passengers Bonafide Baggage Years & Above of age below 10 Years Used personal effects Free* Free* (excluding jewellery) required for satisfying daily necessities of life Other articles carried on person or in accompanied baggage (a) if stay abroad is for Valued upto Valued upto more than three days. -

698 Part 122—Air Commerce Regulations

Pt. 122 19 CFR Ch. I (4–1–11 Edition) (c) Effect of suspension or revocation. 122.36 Responsibility of aircraft com- Once a suspension or revocation action mander. takes effect, the CES operator must 122.37 Precleared aircraft. cease CES operations. However, when 122.38 Permit and special license to unlade CES operations are suspended or re- and lade. voked and cancelled by Customs, it is the CES operator’s responsibility to Subpart E—Aircraft Entry and Entry Docu- ensure that merchandise already at the ments; Electronic Manifest Require- CES is properly consigned to another ments for Passengers, Crew Members, location for inspection, as directed by and Non-Crew Members Onboard the importer and approved by the port Commercial Aircraft Arriving In, Con- director. tinuing Within, and Overflying the United States [T.D. 96–57, 61 FR 39071, July 26, 1996] 122.41 Aircraft required to enter. PART 122—AIR COMMERCE 122.42 Aircraft entry. 122.43 General declaration. REGULATIONS 122.44 Crew baggage declaration. 122.45 Crew list. Sec. 122.46 Crew purchase list. 122.0 Scope 122.47 Stores list. Subpart A—General Definitions and 122.48 Air cargo manifest. 122.48a Electronic information for air cargo Provisions required in advance of arrival. 122.1 General definitions. 122.49 Correction of air cargo manifest or 122.2 Other Customs laws and regulations. air waybill. 122.3 Availability of forms. 122.49a Electronic manifest requirement for 122.4 English language required. passengers onboard commercial aircraft 122.5 Reproduction of Customs forms. arriving in the United States. 122.49b Electronic manifest requirement for Subpart B—Classes of Airports crew members and non-crew members on- board commercial aircraft arriving in, 122.11 Designation as international airport. -

An Appraisal of the Bilateral Air Service Agreements: Towards a Liberal Legal Framework for International Air Transport

\N AN APPRAISAL OF THE BILATERAL AIR SERVICE AGREEMENTS: TOWARDS A LIBERAL LEGAL FRAMEWORK FOR INTERNATIONAL AIR TRANSPORT By MERCY WAMBUllKAJVlAU - REG: NO. G/62/P/8198/03 A PROJECT PAPER SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE MASTERS OF LAW (LLM) DEGREE, UNIVERSITY OF NAIROBI, FACULTY OF LAW HHIVERSiTY GF NAIROBI LJ&RAR* f. Q Box 3019? WAIRGBI I University of Nairobi, September 2005 DEDICATION Dedicated to my late Brother Master Samuel Mbatia Kamau, may God rest your soul in Eternal Peace. ACKNOWLEDGEMENT To my supervisor Dr. Kithure Kindiki, thank you for accepting to supervise this project. To my research assistant Henry Waweru Njuru, thank you for your hard work. To my Secretary Anne Wanjiku Muchemi thank you for your support. To the following persons who offered access to their research materials: Mr. Kuria Waithaka of Kenya Civil Aviation Authority; Mr. Samuel Githaiga of International Civil Aviation Organization; Mr. William Yagomba of Ministry of Transport and Communications; Mr. Ano and Ms Mercy Awori both of Kenya Civil Aviation Authority. - iii - DECLARATION I Mercy Wambui Kamau do declare that this is my original work and has not been submitted and is not currently being submitted for a degree in any other University, CUaaA/J ' ercy Wambui Kamau This thesis is submitted for examination with approval as university supervisor. L Dr. Klthure Kindiki (Ph.D) - iv - TABLE OF CONTENTS DEDICATION II ACKNOWLEDGEMENT Ill DECLARATION IV TABLE OF CONTENTS V CHAPTER ONE: INTRODUCTION 1.0 Introduction to the Study 1 1.1.1 Nature of Production and Trade in International Air Service.... -

Introduction

AIP AD 1.1-1 JORDAN 01 MAY 2008 AD 1. AERODROMES - INTRODUCTION AD 1.1 AERODROME AVAILABILIT 1. General conditions under which aerodrome and associated facilities are available for use Commercial flights are not permitted to take off from or land at any aerodrome not listed in this AIP except in cases of real emergency or when special permissions has been obtained from Chief Commissioner of Civil Aviation Regulatory Commission. Other aerodromes not listed in this AIP may be used only after permission has been obtained from the Chief Commissioner of Civil Aviation Regulatory Commission. Military aerodromes in the Hashemite Kingdom of Jordan are the responsibility of the Royal Jordanian Air Force. Prior Permission is required before use by civil operators. 1.1 Landing made other than at an international aerodrome or a designated alternate aerodrome. 1.1.1 All aircraft entering Jordan territory shall land at a customs airport and shall on departing from the territory leave from a customs airport unless authorized to fly over the territory without landing. If an aircraft not being authorized to land in Jordanian territory is compelled to land due to bad weather or any other force majeure, it must land at the nearest customs airport. If any aircraft is compelled to land outside a customs airport, the pilot in command shall report the landing as soon as practicable to the health, customs and immigration authorities at the international aerodrome at which the landing was scheduled to take place. This notification may be made through any available communication link. 1.1.2 The pilot in command shall be responsible for ensuring that: a) if pratique has not been granted to the aircraft to the previous landing, contact between other persons on the one hand and passengers and crew on the other is a voided; b) Cargo, baggage and mail are not removed from the aircraft except as provided below; c) Any foodstuff of overseas origin or any plant material is not removed from the aircraft except where local food is unobtainable. -

S Ubmission to the J Oint C Ommittee on P Ublic a Ccounts and a Udit R Eview

UNCLASSIFIED UNCLASSIFIED S UBMISSION TO THE J OINT C OMMITTEE ON P UBLIC A CCOUNTS AND A UDIT R EVIEW OF A VIATION S ECURITY 8 July 2005 UNCLASSIFIED UNCLASSIFIED TABLE OF CONTENTS 1. INTRODUCTION ...................................................................................................... 3 2. CUSTOMS ROLE IN AVIATION SECURITY ..................................................... 3 3. CUSTOMS PROCESSES AND CAPABILITIES................................................... 5 3.1 PASSENGER CLEARANCE PROCESSES AT AIRPORTS ............................................. 5 3.2 CUSTOMS AT INTERNATIONAL AIRPORTS............................................................. 6 3.3 CUSTOMS LEGISLATIVE POWERS........................................................................ 12 3.4 CUSTOMS PASSENGER ENFORCEMENT OPERATIONS ......................................... 13 3.5 CUSTOMS RISK ASSESSMENT PROCESSES .......................................................... 14 3.6 CUSTOMS AIR BORDER SECURITY FUNCTION .................................................... 15 3.7 TECHNOLOGY..................................................................................................... 17 CUSTOMS RELATIONSHIP WITH DOTARS ................................................................... 22 3.9 TRANSPORT SECURITY COMMITTEES ................................................................. 23 4. CUSTOMS INTELLIGENCE APPROACH AND OPERATIONAL OUTCOMES................................................................................................................ -

GGD-83-4 a Strategy Is Needed to Deal with Peaking Problems At

Report To The Chairman, Subcommittee On Trade, House Committee On Ways And Means OF THE UNITEDSTATES A Strategy Is Needed To Deal With Peaking Problems At International Airports The Subcommittee asked GAO to examine the role that controlling the timing of flight arrivals could play in coping with the problem of peaking--multiple arrivals of in- ternational flights within a limited time period--which causes traveler delays in clearing the Federal inspection process. In addressing this question, GAO concluded that because of competition, international relations, and other implications of con- trolling the timing of flight arrivals, this course of action should only be considered when all else fails in coping with peaking problems. There is a need to establish criteria for identifying current and anticipated peaking problems affecting international travelers and a concomitant need to gauge the cur- rent and potentially enhanced capacity of the Federal inspection operations to over- come these problems. Only then will there be a logical basis for determining the need to control flight arrivals as part of an overall strategy to speed the entry of international travelers. 111lllllllllllll 120928 GAO/GGD-83-4 MARCH 24,1983 Request for copies of GAO reports should be sent to: U.S. General Accounting Office Document Handling and Information Services Facility P.O. Box 6015 Gaithersburq, Md. 70760 Telephone (202) 275-6241 The first five copies af individual reports are free of charge. Additional copies of bound audit reports are $3.25 each. Additional copies of unbound report (i.e., letter reports) and most other publications are $1.00 each. -

Z4wamf Z4wamf

Duplicate E-Ticket Itinerary, Receipt and Tax Invoice This document contains your flight details. Please carry it with you during your trip as you may be required to present it. We recommend that you also retain a copy for your records. International passengers will need this information for Immigration, Customs, Airport Security checks and Duty Free purchases. Thank you for choosing to fly with us and we hope you enjoy your trip. Your Booking Reference Your Details Z4WAMF Customer Name Frequent Flyer Number Doctor Fabrizio Bianchi Your Itinerary Date Flight Number Departing Arriving Status Check-In 29 Jul 2009 QF924 Sydney Cairns Economy Class Quickcheck self service 0925 1230 Confirmed kiosks are available at Terminal 3 29 Jul 2009 Sydney(T3), Melbourne, Brisbane, Canberra, Perth Domestic Terminal D and Adelaide domestic airports 08 Aug 2009 QF1859 Cairns Ayers Rock Economy Class Quickcheck self service Operated by 1035 1255 Confirmed kiosks are available at Qantaslink - Terminal D 08 Aug 2009 Sydney(T3), Melbourne, Brisbane, Canberra, Perth National Jet Domestic and Adelaide domestic Systems airports 14 Aug 2009 QF791 Alice Springs Sydney Economy Class Quickcheck self service 1330 1645 Confirmed kiosks are available at Sydney(T3), Melbourne, 14 Aug 2009 Brisbane, Canberra, Perth Domestic Terminal 3 and Adelaide domestic airports Your Receipt Payment Details E-Ticket Details Fare $694.10 Payment Type Mastercard E-Ticket Number Charges/Taxes $77.45 Amount $848.71 081 2478590166 GST $77.16 Date 04 Feb 2009 Date Issued Fare/Tax Total $848.71 04 Feb 2009 Airport Levy $0.00 Issued by Total Price $848.71 AUD Total Balance $848.71 AUD QANTAS AIRWAYS Tax Information Tax Invoice Issue Date 04 Feb 2009 Fare Restrictions NON-END/NO CHANGESSPECIAL CONDITIONS APPLY Important Information: Fees [may apply to some bookings] for booking changes, ticket reissues and consultant-assisted services.