RATING RATIONALE 7 Sept 2020 BGR Energy Systems Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2017–18

Printed at Chennai Micro Print Pvt Ltd. CONTENTS MANGEMENT STANDALONE CONSOLIDATED REPORTS FINANCIAL FINANCIAL STATEMENTS STATEMENTS 02 46 90 Financial Highlights Auditors’ Report Auditors’ Report 03 52 94 Corporate Balance Sheet Balance Sheet Information 04 53 95 Board’s Report Statement of Profit and Statement of Profit and Loss Loss 54 96 Cash flow Statement Cash flow Statement 56 98 Notes to Financial Notes to Financial Statements Statements 131 Financial Information of Subsidiaries Annual Report 2017 - 18 1 FINANCIAL HIGHLIGHTS (` Crores except per share data) DESCRIPTION 2013-14 2014-15 2015-16 2016-17 2017-18 SALES AND EARNINGS Sales 3296 3365 3188 3448 3299 Other Income 1 2 6 0 21 EBIDTA 393 309 314 355 362 PAT 110 42 33 44 40 ASSETS Fixed Assets 198 183 179 173 178 Investments 364 364 364 364 364 Other Asset (Net) 3272 3256 3457 3094 3344 Total Assets 3834 3803 4000 3631 3886 FUNDED BY Equity Share Capital 72 72 72 72 72 Reserves and Surplus 1232 1272 1305 1306 1345 Networth 1304 1344 1377 1378 1417 Deferred Taxes 511 347 374 327 344 Borrowings 2019 2112 2249 1926 2125 Total Liabilities 3834 3803 4000 3631 3886 EPS (`) 15.24 5.84 4.57 6.12 5.49 C 3447.943448 393.18393 354.65355 361.86362 3365.003365 308.90309 314.30314 3295.603296 3298.723299 3187.893188 2013-142013-142013-142014-152014-15 2014-152015-162015-162015-16 2016-172016-172016-17 2017-182017-18 2017-18 2013-142013-142014-15 2014-152015-16 2015-162016-17 2016-172017-18 2017-18 C SalesSales (C .( in` Crores) Crores) EBIDTAEBIDTAC (C .( in` Crores) Crores) 109.95110 14171416.98 1377.271377 1377.651378 1344.291344 44.1544 42.1542 39.6040 32.9833 13041303.77 2013-142013-142014-15 2015-162015-162016-17 2016-17 2017-18 2017-18 2013-142013-142014-15 2014-152015-16 2015-162016-17 2016-172017-18 2017-18 PATPAT (C (. -

Aviva Investor February 2012 Life Unit Linked

^sfs^=fksbpqlo February, 2012 IN ULIP PRODUCTS THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO SHALL BE BORNE BY THE POLICY HOLDER MARKET REVIEW (Equity and Fixed Income Outlook) More PORTFOLIO RETURNS SINCE INCEPTION More FUND PERFORMANCE Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Bond Fund Index Fund Protector Fund ll Secure Fund PSU Fund Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Secure Fund PSU Fund Balanced Fund ll Protector Fund Protector Fund ll Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Protector Fund Infra Fund Growth Fund ll Balanced Fund Balanced Fund ll Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Balanced Fund Wealth Builder Fund Enhancer Fund ll Growth Fund Growth Fund ll Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Growth Fund Dynamic P/E Fund Index Fund ll Index Fund Index Fund ll Life unit Linked Life unit Linked Pension unit Linked Enhancer Fund Bond Fund ll Infra Fund Disclaimer Disclosure Aviva Life Insurance Company India Limited Aviva Towers, Sector Road, Opp. Golf Course, DLF Phase‐V, Sector 43, Gurgaon, Haryana‐122 003 Tel: +91(0)1242709000‐01, Fax : +91(0)124 257 1214 Registered office : 2nd Floor, Prakashdeep Building, 7, Tolstoy Marg, New Delhi ‐ 110 001 www.avivaindia.com As on February Life Unit Linked Life Unit Linked Life Unit Linked Pension Unit Linked Pension Unit Linked -

RATING RATIONALE 05 Mar 2021 BGR Energy Systems Ltd

RATING RATIONALE 05 Mar 2021 BGR Energy Systems Ltd. Brickwork Ratings revises the ratings for the Bank Loan Facilities aggregating to Rs. 8305.00 Crs of BGR Energy Systems Ltd. Particulars Amount ( Cr) Rating* ₹ Facilities/ Tenure Previous Instrument** Previous Present Present (Sep 2020) Fund Based Cash Credit Existing 2188.00 2111.00 BWR BBB BWR BBB Long Term (Negative) (Stable) Cash Credit – 800.00 800.00 Reaffirmation with Proposed change in Outlook Non-fund Based Letter of Credit 95.00 85.00 BWR A3 Bank Guarantee 4145.00 4109.00 Short Term BWR A3+ Downgrade LC/BG Proposed 1200.00 1200.00 INR Eight Thousand Three Hundred and Five Total 8428.00 8305.00 Crores Only *Please refer to BWR website www.brickworkratings.com/ for the definition of the ratings ** Details of Bank Loan facilities are provided in Annexures-I RATING ACTION / OUTLOOK The change in outlook and revision of short term rating has taken into account slow project execution rate during the 9M FY21 due to COVID related disruptions leading to significant fall in revenue and incurrence of losses. The rating continues to factor the experience of promoters, company’s established market position in the BTG (Boiler, Turbine and Generator) and BOP (Balance of Plant) segments of power sector with long operational track record; order book position of Rs.7356 Crs at the end of Dec’20, which can be sustainable for next 2-3 years; its execution capabilities of large and long-term power projects (BOP) which has been demonstrated by the company over the years. Furthermore, BGR Energy Systems Ltd. -

R Ramesh Kumar

BGR ENERGY SYSTEMS LIMITED 443 ANNA SALAI, TEYNAMPET, CHENNAI 600018 INDIA TEL: 91 44 24301000 FAX: 91 44 24360576 E-mail: [email protected] Web site: w w w.bgrcorp.com BeSec/2019 July 18, 2019 Listing Department Department of Corporate Services National Stock Exchange of India Limited BSE Limited Exchange Plaza, Bandra Kurla Complex P.J. Towers, Dalal Street Bandra (E), Mumbai – 400051 Mumbai – 400001 NSE Symbol: BGRENERGY BSE Scrip Code: 532930 Dear Sirs, Sub: Annual Report of the Company for the Financial Year ended March 31, 2019. Further to our letter dated July 04, 2019, intimating the date of 33rd Annual General Meeting, we are pleased to forward the Annual Report of the Company along with the Notice of the 33rd Annual General Meeting to be held on August 14, 2019, Pursuant to Regulation 34 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. We request you to take the same on record. Thanking you, Yours truly, for BGR Energy Systems Limited R. Ramesh Kumar President – Corporate & Secretary Encl : a.a. REGISTERED OFFICE: A-5 PANNAMGADU INDUSTRIAL ESTATE, RAMAPURAM POST, SULURPET TALUK, NELLORE DISTRICT, ANDHRA PRADESH 524401 INDIA. TEL: 91 44 27948249 Corporate Identity Number: L40106AP1985PLC005318 660 MW Super Critical Steam Generator - NTPC Solapur Thermal Power Plant Main Plant Electrical Package for 2 x 700 MWe Kakrapar Nuclear Power Project Contents Financial Highlights 2 Corporate Information 3 Board’s Report and Annexures 4 STANDALONE FINANCIAL STATEMENTS Auditors’ Report 47 Balance Sheet -

Aviva Investor

AVIVA INVESTOR January, 2012 IN ULIP PRODUCTS THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO SHALL BE BORNE BY THE POLICY HOLDER MARKET REVIEW (Equity and Fixed Income Outlook) More PORTFOLIO RETURNS SINCE INCEPTION More FUND PERFORMANCE Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Bond Fund Index Fund Protector Fund ll Secure Fund PSU Fund Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Secure Fund PSU Fund Balanced Fund ll Protector Fund Protector Fund ll Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Protector Fund Infra Fund Growth Fund ll Balanced Fund Balanced Fund ll Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Balanced Fund Wealth Builder Fund Enhancer Fund ll Growth Fund Growth Fund ll Life unit Linked Life unit Linked Life unit Linked Pension unit Linked Pension unit Linked Growth Fund Dynamic P/E Fund Index Fund ll Index Fund Index Fund ll Life unit Linked Life unit Linked Pension unit Linked Enhancer Fund Bond Fund ll Infra Fund Disclaimer Disclosure Aviva Life Insurance Company India Limited Aviva Towers, Sector Road, Opp. Golf Course, DLF Phase‐V, Sector 43, Gurgaon, Haryana‐122 003 Tel: +91(0)1242709000‐01, Fax : +91(0)124 257 1214 Registered office : 2nd Floor, Prakashdeep Building, 7, Tolstoy Marg, New Delhi ‐ 110 001 www.avivaindia.com As on January 31, Life Unit Linked Life Unit Linked Life Unit Linked Pension Unit Pension Unit Pension Unit -

BGR Energy Systems Limited by a Resolution of Our Shareholders on June 25, 2007

CMYK RED HERRING PROSPECTUS Dated: November 21, 2007 Please read Section 60B of the Companies Act, 1956 100% Book Building Issue (We were incorporated as GEA Energie Systems India Private Limited on February 18, 1985. Our name was changed to GEA Energy System (India) Private Limited by a resolution of our shareholders on October 17, 1986, and a fresh certificate of incorporation consequent on change of name was issued to us on April 3, 1987 by the Registrar of Companies, Andhra Pradesh at Hyderabad (the “RoC”). Our status was subsequently changed to a public limited company by a special resolution of our shareholders passed at the annual general meeting held on December 10, 1993. The fresh certificate of incorporation consequent on conversion was issued to our Company on March 3, 1994. Our name was changed to BGR Energy Systems Limited by a resolution of our shareholders on June 25, 2007. The fresh certificate of incorporation consequent to the change in name was issued to our Company on June 28, 2007 by the RoC. For details of changes in name refer to “History and Certain Corporate Matters” on page 115). Registered Office: A-5, Pannamgadu Industrial Estate, Ramapuram Post, Sullurpet Village, Nellore District, Andhra Pradesh 524 401, India Tel: (91 44) 2794 8249; Fax: (91 44) 2794 8359 Corporate Office: 443, Anna Salai, Teynampet, Chennai 600 018, Tamil Nadu, India Tel: (91 44) 2432 6171; Fax: (91 44) 2436 0576 Email: [email protected]; Website: www.bgrcorp.com Company Secretary and Compliance Officer: Mr. R. Ramesh Kumar PUBLIC ISSUE OF 9,136,000 EQUITY SHARES OF Rs. -

Third Party Material Inspection for Opgc Ii 2X660mw Supercritical Coal Fired

BID DOCUMENT NAME OF WORK: THIRD PARTY MATERIAL INSPECTION FOR OPGC II 2X660MW SUPERCRITICAL COAL FIRED POWER PLANT. CONTENTS DESCRIPTION NO. OF PAGES COVER PAGE 01 PAGE NOTICE INVITING TENDER (NIT) 02 PAGE REQUEST FOR PROPOSAL 1 BOOKLET ODISHA POWER GENERATION CORPORATION LTD. IB Thermal Power Station, Banaharpali, Jharsuguda – 768234 (ODISHA) Email: [email protected] Page 1 of 126 ODIHA POWER GENERATION CORPORATION LIMITED IB THERMAL POWER STATION At/PO: BANHARPALI, DIST: JHARSUGUDA – 768 234 (ODISHA) TELEPHONE: 7735020001 Email: [email protected] NOTICE INVITING TENDER NIT No. ITPS Unit -3&4 /F-2/2014/01 Date: 20.06.2014 Sealed bids in prescribed format are invited from bonafide, reputed and registered Agencies / Firms / Companies for execution of the following works at Ib Thermal Power Station, Banharpali: Cost of Last date Date of Name of the works each Duration of of Sale of submission Sl. EMD Tender the Job Tender & Bid paper document Opening Third Party Inspection 15.07.2014 Services for OPGC II (3.00P.M) & 1 Rs.6000/- Rs. 6 lac 4 Yrs. 14.07.2014 2x660MW Supercritical Coal 15.07.2014 Fired Power Plant (3.30P.M.) NB: For the works at Sl. No.1 bidders having the requisite qualifying criteria specified in the bid documents shall only be considered. Bid documents can be obtained from Contract Cell Unit 3&4, ITPS, Banharpali during office days & hours on submission of tender cost as mentioned above. Bid documents can also be downloaded from our website www.opgc.co.in and used as tender document. Cost of bid documents (non-refundable) shall be paid by Demand Draft in favour of OPGC Ltd. -

Annual Report 2018–19

Contents Financial Highlights 2 Corporate Information 3 Board’s Report and Annexures 4 STANDALONE FINANCIAL STATEMENTS Auditors’ Report 47 Balance Sheet 56 Statement of Profit and Loss 57 Cash flow Statement 58 Notes to Financial Statements 60 CONSOLIDATED FINANCIAL STATEMENTS Auditors’ Report 95 Balance Sheet 102 Statement of Profit and Loss 103 Cash flow Statement 104 Notes to Financial Statements 106 Financial Information of Subsidiaries 141 Annual Report 2018 - 19 Contents 1 Financial Highlights (` Crores except per share data) DESCRIPTION 2014-15 2015-16 2016-17 2017-18 2018-19 SALES AND EARNINGS Sales 3365 3188 3448 3299 3229 Other Income 2 6 0 21 1 EBIDTA 309 314 355 374 338 PAT 4233443229 ASSETS Fixed Assets 183 179 172 178 177 Investments 364 364 364 364 364 Other Asset (Net) 3256 3457 3094 3332 3334 Total Assets 3803 4000 3631 3874 3875 FUNDED BY Equity Share Capital 72 72 72 72 72 Reserves and Surplus 1272 1305 1305 1333 1334 Networth 1344 1377 1378 1405 1406 Deferred Taxes 347 374 327 344 344 Borrowings 2112 2248 1926 2125 2124 Total Liabilities 3803 4000 3631 3874 3875 EPS (`) 5.84 4.57 6.12 4.49 4.03 34483448 374362 355 33653365 338338 32993299 32293229 314 3188 309 2014-15 2015-16 2016-17 2017-18 2018-19 2014-152014-15 2015-162015-16 2016-172016-17 2017-182017-18 2018-192018-19 Sales ( ` Crores) EBIDTA ( ` Crores) 1417 44 1405 42 44 1406 40 33 32 29 1377 13781378 1344 2014-15 2015-16 2016-17 2017-18 2018-19 2014-15 2015-16 2016-17 2017-18 2018-19 PAT ( ` Crores) Networth ( ` Crores) 2 Financial Highlights Annual Report 2018 - 19 Corporate Information BOARD OF DIRECTORS REGISTERED OFFICE STATUTORY AUDITOR N. -

PSG Placement Bookk.Pdf

INSTITUTION PROFILE INSTITUTION PROFILE CONTENT Ÿ PSG & Sons’ Charities Trust Ÿ About PSG College Of Technology Ÿ Programmes Offered Ÿ Department Of Automobile Engineering Ÿ Department Of Bio Technology Ÿ Department Of Biomedical Engineering Ÿ Department Of Civil Engineering Ÿ Department Of Computer Science And Engineering Ÿ Department Of Electrical And Electronics Engineering Ÿ Department Of Electronics And Communication Engineering Ÿ Department Of Fashion Technology Ÿ Department Of Information Technology Ÿ Department Of Instrumentation And Control Systems Engineering Ÿ Department Of Mechanical Engineering Ÿ Department Of Metallurgical Engineering Ÿ Department Of Production Engineering Inside Page of Back Cover Ÿ Department Of Robotics And Automation Engineering Ÿ Department Of Textile Technology Ÿ Department Of Applied Science Ÿ Department Of Computer Applications Ÿ Department Of Applied Mathematics And Computational Sciences Ÿ PSG Tech In News This Year Ÿ Collaborations Ÿ Research Ÿ International Exposure Ÿ Few Achievements Of Our Alumni During 2016-17 Ÿ Extra Curricular Activities Ÿ Entrepreneurship Activities Ÿ Placement Procedure Ÿ Our Patrons PSG & SONS’ CHARITIES TRUST Shri P.S.Govindaswamy Naidu, the Founder Trustee, a Legendary Man of Vision, Faith and Integrity gave the initials "PSG" its immortal glory. The 82 year old legacy of the PSG Institutions founded by Shri P.S. Govindaswamy Naidu has been handed down through several generations. Each time the baton was handed down to the successor of the Trust, the golden words, "Let there be charity, so others can share my family's prosperity" are embedded firmly and hence the Founder's vision has only grown richer and more profound. Education, one of the most treasured clauses in the Trust deed, attained sharper focus each growing year while each succeeding Trust head, carried the dreams of the Founders on their shoulders towards fulfillment of the Vision and the betterment of the future. -

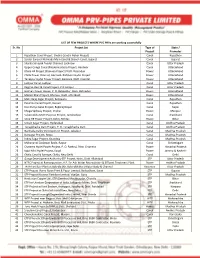

LIST of FEW PROJECTS WHERE PVC Prvs Are Working Successfully Sr

LIST OF FEW PROJECTS WHERE PVC PRVs are working successfully Sr. No. Project List Type of State / Project Promoter 1 Rajasthan Canal Project ‐(Indira Gandhi Nahar Project) Canal Rajasthan 2 Sardar Sarovar Narmada Main Canal & Branch Canal, Gujarat Canal Gujarat 3 Sharda Sahayak Feedar Channel, Lucknow Canal Uttar Pradesh 4 Upper Ganga Canal (Modernisation) Project, Hardwar Canal Uttarakhand 5 Khara HE Project (Yamuna Project) Distt. Dehradun Power Uttarakhand 6 Chilla Power Channel, Garhwal‐ Rishikesh Hydel Project Power Uttarakhand 7 Tanakpur Hydel Power Project, Banbasa, Distt. Nainital Power Uttarakhand 8 Lalitpur Canal, Lalitpur Canal Uttar Pradesh 9 Rajghat Dam & Canal Project, P O Lalitpur Canal Uttar Pradesh 10 Hathiari Power House, P. O. Dakpathar, Distt. Dehradun Power Utterakhand 11 Maneri Bhali Project, Dharasu, Distt. Utterkashi Power Uttarakhand 12 Mahi Bajaj Sagar Project, Banswara Canal Rajasthan 13 Panchna Canal Project, Karauli Canal Rajasthan 14 Kosi Pump Canal Project, Rajbiraj Nepal Canal Nepal 15 Khuga Spillway Project, Imphal Power Manipur 16 Subernekha Multi Purpose Project, Jamshedpur Canal Jharkhand 17 Sone HE Power Project, Dehri, Rohtas Power Bihar 18 Sriram Sagar Project, Hyderabad Canal Andhra Pradesh 19 Tunagbhadra Dam Project, P. O. Tunagbhadra Dam Canal Andhra Pradesh 20 Narmada Valley Development Project, Jabalpur Canal Madhya Pradesh 21 Bansagar Project, Rewa Canal Madhya Pradesh 22 Indira Sagar Project, Khandwa Canal Madhya Pradesh 23 Mahanandi Godawari Basin, Raipur Canal Chhattisgarh 24 Chamera Hydel Power Project, P. O. Bathrui, Distt. Chamera Power Himachal Pradesh 25 Iqbal Mini Hydel Project, Kargil Power Jammu & Kashmir 26 Okhla Canal & Barrage, Okhla, New Delhi Canal Delhi 27 Ganga Development Authority‐STP Project, Naini, Distt. -

Script Mf Name Isin Code Margin 3M India Ltd

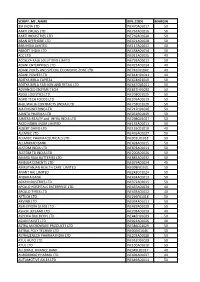

SCRIPT_MF_NAME ISIN_CODE MARGIN 3M INDIA LTD INE470A01017 50 AARTI DRUGS LTD INE767A01016 50 AARTI INDUSTRIES LTD INE769A01020 50 ABAN OFFSHORE LTD INE421A01028 50 ABB INDIA LIMITED INE117A01022 40 ABBOTT INDIA LTD INE358A01014 50 ACC LTD INE012A01025 40 ACCELYA KALE SOLUTIONS LIMITD INE793A01012 50 ADANI ENTERPRISES LTD INE423A01024 40 ADANI PORTS AND SPECIAL ECONOMIC ZONE LTD INE742F01042 40 ADANI POWER LTD INE814H01011 40 ADITYA BIRLA CAPITAL INE674K01013 50 ADITYA BIRLA FASHION AND RETAIL LTD INE647O01011 50 ADVANCED ENZYME TECH INE837H01020 50 AEGIS LOGISTICS LTD INE208C01025 50 AGRO TECH FOODS LTD INE209A01019 50 AHLUWALIA CONTRACTS (INDIA) LTD INE758C01029 50 AIA ENGINEERING LTD INE212H01026 50 AJANTA PHARMA LTD INE031B01049 50 AJMERA REALTY and INFRA INDIA LTD INE298G01027 50 AKZO NOBEL INDIA LIMITED INE133A01011 50 ALBERT DAVID LTD INE155C01010 40 ALEMBIC LTD INE426A01027 50 ALEMBIC PHARMACEUTICALS LTD INE901L01018 50 ALLAHABAD BANK INE428A01015 50 ALSTOM INDIA LTD INE878A01011 50 ALSTOM TD INDIA LTD INE200A01026 50 AMARA RAJA BATTERIES LTD INE885A01032 50 AMBUJA CEMENTS LTD INE079A01024 40 AMRUTANJAN HEALTH CARE LIMITED INE098F01031 50 ANANT RAJ LIMITED INE242C01024 50 ANDHRA BANK INE434A01013 50 APAR INDUSTRIES LTD INE372A01015 50 APOLLO HOSPITALS ENTERPRISE LTD INE437A01024 40 APOLLO TYRES LTD INE438A01022 40 APTECH LTD INE266F01018 50 ARVIND LTD INE034A01011 50 ASAHI INDIA GLASS LTD INE439A01020 50 ASHOK LEYLAND LTD INE208A01029 40 ASHOKA BUILDCON LTD INE442H01029 50 ASIAN PAINTS LTD INE021A01026 40 ASTRA MICROWAVE PRODUCTS -

Building for Hindalco at Hirakud 380 M3 Blast Furnace Stove for Usha Martin Ltd., Jamshedpur

Building Value for You Gannon Dunkerley & Co., Ltd. Brief History of Gannon Dunkerley & Co., Ltd. annon Dunkerley & Company initially incorporated as a Private GLtd. Company in 1924 was converted to Public Ltd. Company in 1948, after taking over by Indian Management. Gannon carved out its name in the Civil Construction arena, after diversification and gradually made its presence felt in all major sectors of construction throughout the country to match the Clients’ aspirations in all Major Industries, Building sectors, Infrastructure, Water Treatment, etc. GDCL developed confidence with successful completion of several major Civil Construction projects including RCC Bowstring girder bridges in South India with own in-house design. The Company also constructed major irrigation and hydroelectric projects, water works and large factory buildings. The Company pioneered in precast RCC Construction. From 1950 onwards Civil Engineering Construction became the main thrust in the Company’s business. In order to undertake turnkey projects, the Company started its Mechanical and Electrical Division in mid 50s, to provide an integrated solution for industries, as a preferred partner of large business houses. In mid 70s the Company diversified into environment sector by building water treatment plants on turnkey basis. In 1990, the Company proudly contributed to the modernization of Indian Railways by establishing a pre-stressed concrete sleeper factory at Rayagada (Odisha). The Company has also taken keen interest in providing efficient material handling systems viz. the baggage conveyor belts at all major airports across the country. The Company re-entered Infrastructure Sector in Highways, Railways, Bridges/Flyovers across the country. With the confidence and experience gained over the years, the Company also took up irrigation projects viz.