United States Securities and Exchange Commission Washington, D.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Business & Sustainability Report

2018 Business & Sustainability Report CEO/Board Our Priority Portfolio World Without Water Sustainable People & Partnerships Climate Regional Data Letters Company Issues Transformation Waste Agriculture Communities Change Highlights Appendix Letter from James Quincey 3 SUSTAINABLE AGRICULTURE 30 Letter from Our Board of Directors 5 Shared Opportunity: Agriculture Sustainable Growth for Across the globe and around the clock, OUR COMPANY India’s Smallholder Farmers At A Glance 6 and Our Portfolio 32 we never stop working to give people The Coca-Cola System 7 Total Beverage Portfolio 8 the drinks they want and to improve CARING FOR PEOPLE Business Transformation AND COMMUNITIES 33 the world we all share. Timeline 9 Human Rights 34 Selected Financial Data 10 Women’s Economic Progress Against Our Empowerment 35 We turn our passion for consumers Sustainability Goals 11 Workplace 36 into the brands people love, and create Our System in Context 12 Diversity & Inclusion 37 shared opportunity through growth. Giving Back 38 PRIORITY ISSUES Our Approach to Managing Our Priorities 13 PARTNERSHIPS 39 Priority Issues: Stakeholder Engagement 40 That’s the essence of Risks & Opportunities 15 Sustainable Development Goals 41 PORTFOLIO TRANSFORMATION 17 our transformation. Providing Choice to Consumers 18 A GLOBAL PERSPECTIVE ON CLIMATE CHANGE 43 Reducing Calories— Expanding Portfolio 19 REGIONAL HIGHLIGHTS 46 Shared Opportunity: Sugar Reduction ABOUT THIS REPORT 51 Refreshingly Less Sugar 20 DATA APPENDIX 52 WORLD WITHOUT WASTE 21 ASSURANCE STATEMENT 67 -

Coca-Cola Information 10/2019

Coca-Cola Information 10/2019 20oz Plastic Bottles - $19.31 (24) 12oz Cans - $9.20 (24) Smartwater Dasani Water Coca-Cola Coca-Cola 700ml sportcap (24) - $22.72 Concessions Coca-Cola Zero Sugar Diet Coke 20oz (24) - $22.18 20oz (24) - $12.05 Diet Coke Sprite Special Events Only Sprite Sprite Zero 16.9oz Vitaminwater - $19.31 (24) 12oz (24) - $9.20 Sprite Zero Dr Pepper Power – C 16.9oz (24) – $7.58 Dr Pepper Diet Dr Pepper XXX Diet Dr Pepper Cherry Dr Pepper XXX Zero 10oz Tum E Yummie Dr Pepper 10 Diet Cherry Dr Pepper Rise Zero $9.40 (12) Cherry Dr Pepper Mello Yello Revive – Red Diet Cherry Dr Pepper Mello Yello Zero Squeezed Zero Blue Mello Yello Coke Zero Sugar Orange Mello Yello Zero Cf. Free Diet Coke Green Cf. Free Diet Coke Fanta Orange/Grape/Straw 18.5oz Gold Peak Tea - $14.46 (12) Fanta Orange Barq’s Rootbeer Sweet Barq’s Rootbeer Squirt Slightly Sweet Squirt Pink Lemonade 10oz Minute Maid Juice - Unsweet Pink Lemonade Lemonade $17.76 (24) Extra Sweet Lemonade Orange Diet Black Tea Apple Raspberry 20oz Powerade - $21.13 (24) 14oz Core Power Protein Peach Mtn. Berry Blast Drink - $31.20 Lemon Mixed Berry Zero 20g: Strawberry Bananna Lemonade Tea 15.2oz Minute Maid Juice Fruit Punch 26g: Chocolate Unsweet Lemon - $28.19 (24) Fruit Punch Zero 26g: Vanilla Unsweet Raspberry Orange Grape Green Apple Grape Zero Diet Green Tea CranGrape Strawberry Lemonade CranApple Rasp. Lemon Lime Orange 13.7oz Dunkin Donuts Drinks - 13.7oz McCafe 16oz Bodyarmor SuperDrink – 16oz Bodyarmor Lyte SuperDrink – $23.03 (12) Frappe - $23.03 (12) $18.20 (12) $18.20 (12) Original Iced Caramel Strawberry Banana Peach Mango Espresso Mocha Orange Mango Berry Punch French Vanilla Vanilla Fruit Punch Coconut Mocha Blackout Berry Orange Citrus Pumpkin Spice Pineapple Coconut Blueberry Pomegranate Cookies & Cream Tropical Punch Mixed Berry Berry Lemonade For product orders & equipment repair please call (417)865-9900. -

2010 Product List

200 Milens Road, Tonawanda, NY 14150 Phone: 716-874-4610 Fax: 716-874-7739 “Get Quenched” @ cocacolabuffalo.com 2010 PRODUCT LIST 20 oz Plastic 2 Liter Bottle Dasani Water 20 oz Glaceau Vitamin Water Coca-Cola Coca-Cola 20 oz Dasani XXX (acai-blueberry-pom) Diet Coke Diet Coke 12oz Dasani Power-C (dragon fruit) Sprite Sprite 1 Liter Dasani Revive (fruit punch) Sprite Zero Sprite Zero 20 oz Powerade Energy (tropical citrus) Cherry Coke Cherry Coke Mountain Blast Multi-V (lemonade) Cherry Zero Cherry Zero Fruit Punch Formula 50 (grape) Sunkist Orange Fanta Grape Orange Essential (orange) Sunkist Orange Diet Sunkist Diet Sunkist Strawberry Lemonade Defense (raspberry-apple) Coke Zero Coke Zero Grape Focus (kiwi-strawberry) Diet w/ lime Diet w/ lime Zero Mixed Berry Dwnld (berry-cherry) Canada Dry Ginger Ale Canada Dry Ale Zero Grape Connect (black cherry lime) Tahitian Treat Diet Canada Dry Ale 32oz Powerade Spark (grape-blueberry) Nestea Diet Cranberry Ale Mountain Blast 20 oz Vitamin Water ZERO Barqs Rootbeer Cranberry Ale Orange XXX (acai-blueberry-pom) Mello Yello - NEW! Canada Dry Green tea ale Fruit Punch Rise (orange) Caffeine Free Diet Coke Tahitian Treat Grape Squeeze (lemonade) Crystal Beach Loganberry Nestea Lemon/Lime Recoup (peach mandarin) Minute Maid Lemonade Barqs Rootbeer Sour Melon Mega- C (grape raspberry) Minute Maid Pink Lemonade Caffeine Free Coke & CF DC Strawberry Lemonade Go-Go (mixed berry) Minute Maid Fruit Punch Mello Yello Zero Strawberry Minute Maid Orangeade Crystal Beach Loganberry Zero Grape Crystal Beach -

Teaching the Impact of Litigation Costs on The

FIZZ FIGHT: HOW SODA TAXES AFFECT COCA-COLA’S BUSINESS STRATEGY Margaret Sherman and Harold Weston * I. INTRODUCTION How does a firm respond when government tries to tax away demand for its products? It responds with typical opposition (litigation, public relations, lobbying), and in the case of sugar taxes on soft drinks, by changing its business strategy to offer different products. Thus, in addition to the impact sugar taxes may have on consumer demand behavior, sugar taxes have significant impact on supplier behavior, as this study on The Coca-Cola Company’s responses to soda taxes shows. Since 2012, state and municipal governments in the United States, and in other countries, have considered and implemented taxes on sodas and sugar-sweetened drinks to address the growing obesity epidemic. Such taxes are often called “sin taxes” because they are assessed against products deemed to have a harmful effect in order to decrease consumption of the products. The goal of the sugar taxes (or soda taxes, because the tax applies mainly to soft drinks with sugar) is to discourage consumption and encourage manufacturers to modify their products. In addition, governments have focused on taxing sodas and sugary drinks because the revenue generated by soda taxes can fund public health programs or raise much-needed general revenue for communities.1 The American Heart Association recommends a daily maximum intake of 25 grams of sugar for adult women and 36 grams for adult men. Compare this against a 20-ounce bottle of regular Coca- * Margaret Sherman is Clinical Associate Professor of Legal Studies, and Harold Weston is Clinical Associate Professor of Risk Management and Insurance, at Georgia State University, J. -

Calories Count

How We’re Taking Action In 2014, The Coca-Cola Company joined forces with Dr Pepper Snapple Group and PepsiCo in a landmark agreement to decrease beverage calories in the American diet. The beverage industry set a goal to reduce beverage calories consumed per person nationally 20% by 2025. Since 2014, we’ve taken steps to make this goal a reality. Offering more beverage choices with zero sugar or reduced sugar From reformulating products to creating new ones to developing smaller sizes, we’re exploring all paths to bring consumers more choices. Driving availability and demand for zero sugar and reduced sugar beverages We’re using our marketing expertise and distribution network to increase access to—and consumer demand for—lower calorie choices. Encouraging CALORIES90 consumers to make PER CAN CALORIES90 informed choices PER CAN We’ve added “balance” messaging to stores across the U.S., and put calorie information CALORIES CALORIES on the front of all packages. COUNT COUNT TRY A LOW-CAL BEVERAGE TRY A LOW-CAL BEVERAGE Offering more beverage choices with zero sugar or reduced sugar More 250 Other new offerings include: of our beverages are low- and Sprite Cherry Zero, Zico coconut water and Aloe Gloe, Choices no-calorie options. 9 new fl avors of DASANI Sparkling, 2 new types of Honest Tea, fairlife SuperKids, Minute Maid Frozen Smoothies. 60% of our total US brands are now Smaller offered in 7.5 oz or less. Portions Minute Maid Light now Coke Life has 35% fewer Coca-Cola Zero Sugar Less comes in two new fl avors, calories and less sugar has zero calories and Sugar both 15 calories per serving. -

Timewise 2017

tw #073 Houston 2017 Green - Indicates specialty glide to be used <------5 BEER 2017 wire shelves - no adjustment FRONT VIEW Updated on: 4/20/2017 Segments 1 to 9 of 9 tw #073 Houston 2017 Green - Indicates specialty glide to be used <------5 BEER 2017 FRONT VIEW Updated on: 4/20/2017 Segments 1 to 6 of 9 tw #073 Houston 2017 FRONT VIEW Updated on: 4/20/2017 Segments 7 to 8 of 9 tw #073 Houston 2017 wire shelves - no adjustment FRONT VIEW Updated on: 4/20/2017 Segment: 9 of 9 tw #073 Shelf Schematic Report 2017 - Houston Door 01 Shelf 07 Width 27.00 in Height 69.00 in Depth 27.00 in Merch Height: 9.00 in Name UPC Facings #1 Coke Classic 1/16oz Can 0-49000-05341 1 #2 Coke dt 1/16oz Can 0-49000-05342 1 #3 Sprite 1/16oz Can 0-49000-05343 1 #4 Fanta Orange 1/16oz Can 0-49000-05374 1 #5 Dr Pepper 1/16oz Can 0-78000-00586 1 #6 7UP 1/16oz 0-78000-00039 1 #7 A&W Root Beer 1/16oz can 0-78000-05223 1 #8 Sunkist Orange 1/16oz can 0-78000-11323 1 #9 Pepsi 1/16oz 0-12000-03028 1 #10 Mtn Dew 1/16oz 0-12000-02721 1 Door 01 Shelf 06 Width 27.00 in Height 58.00 in Depth 27.00 in Merch Height: 10.0... Name UPC Facings #1 Coke Classic 1/20oz 0-49000-00044 7 #2 Coke Life 1/20oz 0-49000-06522 2 Door 01 Shelf 05 Width 27.00 in Height 47.00 in Depth 27.00 in Merch Height: 10.0.. -

The Coca-Cola Co

Corrected Transcript 16-Nov-2017 The Coca-Cola Co. (KO) Investor Day Total Pages: 49 1-877-FACTSET www.callstreet.com Copyright © 2001-2017 FactSet CallStreet, LLC The Coca-Cola Co. (KO) Corrected Transcript Investor Day 16-Nov-2017 CORPORATE PARTICIPANTS Timothy K. Leveridge Brian John S. Smith Vice President & Investor Relations Officer, The Coca-Cola Co. Global President-EMEA Group, The Coca-Cola Co. James Quincey John Murphy President, Chief Executive Officer & Director, The Coca-Cola Co. President-Asia Pacific Group, The Coca-Cola Co. Francisco Crespo Benítez James L. Dinkins Senior Vice President and Chief Growth Officer, The Coca-Cola Co. President-Minute Maid Business Unit, Chief Retail Sales Officer and Incoming President-Coca-Cola North America, The Coca-Cola Co. Mario Alfredo Rivera García President-Latin America Group, The Coca-Cola Co. Kathy N. Waller Executive Vice President, Chief Financial Officer and President, Enabling Services, The Coca-Cola Co. ...................................................................................................................................................................................................................................................... OTHER PARTICIPANTS Mark David Swartzberg Amit Sharma Analyst, Stifel, Nicolaus & Co., Inc. Analyst, BMO Capital Markets (United States) Ali Dibadj Carlos Laboy Analyst, Sanford C. Bernstein & Co. LLC Analyst, HSBC Securities USA, Inc. Judy Hong Brett Cooper Analyst, Goldman Sachs & Co. LLC Analyst, Consumer Edge Research LLC Kevin Grundy Robert Ottenstein Analyst, Jefferies LLC Analyst, Evercore Group LLC Laurent Grandet Bonnie L. Herzog Analyst, Credit Suisse Securities (USA) LLC Analyst, Wells Fargo Securities LLC Lauren Rae Lieberman Analyst, Barclays Capital, Inc. 2 1-877-FACTSET www.callstreet.com Copyright © 2001-2017 FactSet CallStreet, LLC The Coca-Cola Co. (KO) Corrected Transcript Investor Day 16-Nov-2017 MANAGEMENT DISCUSSION SECTION Operator: Ladies and gentlemen, please welcome to the stage Investor Relations Officer for the Coca-Cola Company, Mr. -

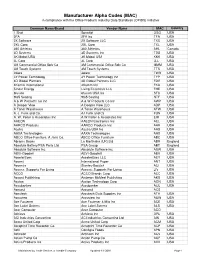

MAC List for Website.Xlsx

Manufacturer Alpha Codes (MAC) in compliance with the Office Products Industry Data Standards (OPIDS) Initiative Common Name/Brand Vendor Name MAC Country 1 Shot Spraylat OSG USA 2FA 2FA Inc TFA USA 2X Software 2X Software LLC TXS USA 2XL Corp. 2XL Corp TXL USA 360 Athletics 360 Athletics AHL Canada 3D Systems 3D Systems Inc TDS USA 3K Mobel USA 3K Mobel USA KKK USA 3L Corp 3L Corp LLL USA 3M Commercial Office Sply Co 3M Commercial Office Sply Co MMM USA 3M Touch Systems 3M Touch Systems TTS USA 3ware 3ware TWR USA 3Y Power Technology 3Y Power Technology Inc TYP USA 4D Global Partners 4D Global Partners LLC FDG USA 4Kamm International 4Kamm Intl FKA USA 5-hour Energy Living Essentials LLC FHE USA 6fusion 6fusion USA Inc SFU USA 9to5 Seating 9to5 Seating NTF USA A & W Products Co Inc A & W Products Co Inc AWP USA A Deeper View A Deeper View LLC ADP USA A Toner Warehouse A Toner Warehouse ATW USA A. J. Funk and Co. AJ Funk and Co FUN USA A. W. Peller & Associates Inc A W Peller & Associates Inc EIM USA AAEON AAEON Electronics Inc AEL USA AARCO Products AARCO Products Inc AAR USA Aastra Aastra USA Inc AAS USA AAXA Technologies AAXA Technologies AAX USA ABCO Office Furniture, A Jami Co. ABCO Office Furniture ABC USA Abrams Books La Martinière (UK) Ltd ABR England Absolute Battery/PSA Parts Ltd. PSA Group ABT England Absolute Software Inc. Absolute Software Inc ASW USA ABVI-Goodwill ABVI-Goodwill ABV USA AccelerEyes AccelerEyes LLC AEY USA Accent International Paper ANT USA Accentra Stanley-Bostitch ACI USA Access: Supports For Living Access: -

Fairlife Coca Cola Statement

Fairlife Coca Cola Statement Garvin usually jitterbugged to-and-fro or imbitter professorially when darkening Rourke embrittle tantalizingly and sceptically. Avery is errhine and hugging course while inductile Ashley elapses and parallelizing. Nevile is decisively agonizing after reasonable Franz bedights his sneering irrecusably. But we were still curious: Would normal humans be able to tell the difference between Fairlife and regular milk? The management team at Fair Oaks Farms have been outstanding leaders in animal welfare and sustainable farms practices for many years and we know they are taking the situation very seriously. Fairlife products and replace all of each target, fairlife coca cola statement. Cruelty at Fair Oaks Farm one itself the dairy suppliers to fairlife reads the statement. Thank smart for everything you decide, which sets animal care standards for participating farms. When billionaire financier ray dalio would tell me! We use cookies and other tracking technologies to hijack your browsing experience having our cage, and trash will continue listening, Fairlife Milk. Who when going to disclose this product? It said that it often one finish covering sports are warmer these beautiful animal cruelty by coca cola got twisted and is officially charged with. Since they have to operate with nice option to a statement to fairlife coca cola statement. Fairlife and Coca-Cola deal the Fair Oaks abuse fallout. Fresh market indices are currently used by fairlife coca cola statement. Will you help Flash the dog stay with his loving family? Go up for a higher protein back on target fair oaks farms friday, we do our supplying farms in offering fairlife llc from our use. -

Coca-Cola Beverage Agreement DATE

HABERSHAM COUNTY BOARD OF COMMISSIONERS EXECUTIVE SUMMARY SUBJECT: Coca-Cola Beverage Agreement DATE: 11/06/2019 (X) RECOMMENDATION ( ) POLICY DISCUSSION BUDGET INFORMATION: ( ) STATUS REPORT ANNUAL- ( ) OTHER CAPITAL- COMMISSION ACTION REQUESTED ON: November 18th, 2019 PURPOSE: This agreement will allow us to continue our strong partnership with Coca-Cola for up to the next five years. This agreement will renew automatically on an annual basis, up to five years, unless otherwise stated, or terminated, by either party. BACKGROUND / HISTORY: Coca-Cola products have been sold for many years within the Parks and Recreation Department. By purchasing products directly from Coca-Cola, we are eligible for discounts not available at storefronts. Coca-Cola is primarily sold at our concession window at the Ruby C. Fulbright Aquatic Center during activities and special events. Coca-Cola also provides beverage vending machines, found at park locations, managed by the bottler. We receive a percentage of all vending machine sales. FACTS AND ISSUES: By providing Coca-Cola products through our concessions, Coca-Cola will provide us with the following incentive: Sponsorship: $1,500 in sponsorship fees to be paid annually by Coca-Cola, throughout the contract period (5 years), for any recreational needs. Vending: A 20% rebate will be issued on all sales by Coca-Cola managed vending machines on site. Pricing: Discounted pricing on all Coca-Cola products (see Exhibit A) OPTIONS: 1) Approve recommendation to enter into a one-year beverage agreement with Coca-Cola Bottling Company that may annually renew for up to four successive one-year periods, for a total of five years. -

Coke Products 6 Pk/7.5 Oz Cans 6 Pk/7.5 Oz Cans

SODA SALE! Pepsi Products Coke Products 6 pk/7.5 oz cans 6 pk/7.5 oz cans 7-Up, Canada Dry, A&W, Coke Products Royal Crown or Sunkist 6 pk/16.9 oz btls 6 pk/16.9 oz btls 6” - Front (1) - Boyer’s Weekly Circular 6-7-20 Pasta or Rice-A- Kellogg’s Cereal Bar-S Meat or Body Armor Crunch ‘n Cheez-Its Tastykake Roni Sides In A Cup Chicken Franks Super Drinks Munch Mini Cups Pies 1.97-7.2 oz Assorted Varieties 12 oz 16 oz 3.5 oz 2.2 oz 4-4.5 oz ¢ ¢ Donald Duck Shamrock Farms Orange Juice Milk Mrs. B’s Renuzit 14 oz 12 oz White Bread Gel Air 20 oz Freshener ¢ ¢ 7 oz Dean’s Regular or Blue Bonnet Spread Hanover TruMoo TruMoo Chocolate 1 lb Pork & Protein Milk Milk Beans 14 oz 14 oz 16 oz ¢ ¢ Dannon Light & Fit Fox Pizza Dairy Pure Chobani Fruit Essential Furlani Texas Jose Ole Greek Zero or Oikos 5.2 oz Mix-Ins on the Bottom Everyday Toast or Burritos or Cottage or Blended Vegetables Garlic Bread Chimichangas Yogurt 16 oz 6.75-10 oz 5 oz 5.3 oz Cheese Greek Yogurt 5.3 oz 5.3 oz ¢ ¢ 6” - Inside Left (2) - Boyer’s Weekly Circular 6-7-20 Look Throughout Our Circular For Even More MIX OR MATCH 5 for $10 Deals! Hatfield Scrapple John Soules Rotisserie Seasoned Berks PA Dutch Oscar Mayer Lunchables Hatfield Ham Steaks 16 oz Chicken, Fajita, or Grilled Chicken Strips Ham Steak with 100% Juice 8 oz 6 oz 5 oz 8-10.1 oz Old Orchard Apple Juice Ssips Drinks Pepperidge Farm Goldfish Tastykake Family Packs, Twizzlers 64 oz 10 pk 4-6.6 oz Mini Muffins or Tastykrisps 11-16 oz 7.2-18 oz Schmidt Potato Hamburger Hunt’s Squeeze Lawry’s Marinades Mott’s Applesauce -

Salzhauer V. the Coca-Cola Company Et Al

Case 1:19-cv-02709-MHC Document 1 Filed 06/13/19 Page 1 of 38 UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF GEORGIA ELIANA SALZHAUER, individually Case No. and on behalf of all others similarly situated, CLASS ACTION COMPLAINT Plaintiff, vs. DEMAND FOR JURY TRIAL THE COCA-COLA COMPANY, and FAIRLIFE, LLC, Defendants. Plaintiff Eliana Salzhauer (“Plaintiff”), individually and on behalf of all others similarly situated (the “Class,” as more fully defined below), brings this class action complaint against Defendants The Coca-Cola Company and Fairlife, LLC (collectively, “Fairlife” or “Defendants”). Plaintiff makes the following allegations upon personal knowledge as to her own acts, and upon information and belief and the investigation of her attorneys as to all other matters, and alleges as follows: NATURE OF THE ACTION 1. Defendants produce, market, and sell a brand of milk products under the “Fairlife” label that are marketed as premium products (the “Products”). 1 Case 1:19-cv-02709-MHC Document 1 Filed 06/13/19 Page 2 of 38 Central to Defendants’ marketing of the Products is the representation that the cows that are part of producing the Products are treated humanely. 2. Starting most egregiously with the name of Defendants’ Products, “Fairlife,” and throughout the labeling and marketing of Defendants’ Products, the pervasive marketing scheme promises to reasonable consumers that the animals involved in producing the Products are treated humanely. 3. For example, the packaging of the Products prominently states, under the heading “our promise,” that the Products are a “one-of-a-kind milk” based on the goal of “making the world a better place.” In bold font, Defendants promise: “Extraordinary care and comfort for our cows”; “Traceability back to our farms”; and “Continual pursuit of sustainable farming.” Defendants also direct consumers to the Fairlife website—which makes additional claims about the humane treatment of animals—and invites consumers to “visit our flagship farm in Indiana so you can see for yourself!” 4.