WEL Networks Subordinated Bond Roadshow Presentation June 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Distributed Generation – Information Pack

DISTRIBUTED GENERATION INFORMATION PACK Issue 1.5 December 2017 DDiissttrriibbuutteedd GGeenneerraattiioonn Guidelines & Application Form For small generators – total capacity less than 10 kW (Simplified Approval Process – Part 1A) Issue 1.5 / 20 December 2017 Installing distributed See the attached guide for generation with a This document is subject to details of each numbered step. capacity less than change without any prior notice. 10 kW Interpretation: Please ensure you have the (Simplified Process) Generator - is referred to the person or an latest version. organisation that owns or operates distribution START HERE generators. 1 Note: The Generator can apply for Typically smaller distributed generation systems approval under “Simplified Process” if of this size are rotating (turbine) based systems, the system meets all requirements System Selection solar photovoltaic panels, etc. presented in the “System selection” section. Application Process 2 Note: The Generator will submit the Within 2 business days of receiving the application accompanied with the application, Westpower will advise the Generator additional information and the Submission of that the application has been received. If no application fee. Application response is received within this period, the Generator should contact Westpower. 3 Notes: Within 10 business days of receiving the complete application, Westpower will inspect 1. Westpower will assess the application the distributed generation system and provide for completeness and deficiencies as the final approval. well as compliance with Congestion Westpower will provide the Generator with a Management Policy. Application Approval time and date for the inspection within 2 2. If there are any deficiencies identified Process business days. during the approval process, Westpower will notify the Generator The Generator has to remedy the deficiencies within 10 business days, with what is and pay the applicable fees within 10 business required to correct these deficiencies. -

Cross-Submission on the IM Review: Draft Decision Papers

Cross-Submission on the IM Review: Draft Decision Papers Unison Networks Limited 18 August 2016 Unison Cross-Submission on the IM Review – Draft Decision Papers TABLE OF CONTENTS 1. INTRODUCTION AND SUMMARY ............................................................................ 3 1.1 Introduction ............................................................................................................................... 3 1.2 Summary .................................................................................................................................. 3 1.3 Submission Contact ................................................................................................................. 3 2. RESPONSE TO ERANZ – EMERGING TECHNOLOGY ............................................. 4 2.1 Competition and Scope of Regulated Service ......................................................................... 4 2.2 ERANZ Alternative Proposal .................................................................................................... 5 3. RESPONSE TO CONTACT ENERGY – EMERGING TECHNOLOGY ......................... 7 3.1 Regulatory Treatment of Revenues and Costs from Emerging Technology ........................... 7 4. RESPONSE TO TRUSTPOWER – EMERGING TECHNOLOGY ................................ 8 4.1 Treatment of emerging technologies under Part 4 regime ....................................................... 8 4.2 Distributed Generation Pricing Principles (DGPPs) ................................................................ -

Register Now at NEW ZEALAND

NEW ZEALAND THE ENERGY SECTOR’S ANNUAL STRATEGIC FORUM 2014 5 & 6 March 2014, SKYCITY Convention Centre, Auckland Macro Gas Issues Christoph Frei Carl Hansen Ken Sutherland World Energy Council Electricity Authority Unison New Retailers Smart Meter Stocktake Alison Andrew Sjoerd Post David Parker Emerging International Trends Transpower Rening NZ Labour Party See the Tesla Roadster DIAMOND SPONSOR GOLD SPONSOR DINNER SPONSOR LUNCH SPONSOR CAFE SPONSOR FOUNDATION PARTNERS Register now at www.nzdownstream.co.nz NEW ZEALAND THE ENERGY SECTOR’S ANNUAL STRATEGIC FORUM 2014 Bringing the key strategic, commercial and stakeholder issues to the table • Hear from the major political parties and industry in the debate on NZ Power • The annual Leaders’ Panel focus on the consumer HIGHLIGHTS FOR 2014 • Rening NZ CEO talks transport fuels and the next chapter for New Zealand • Inaugural industry address from the new Transpower CEO • Unlocking energy poverty – the role of the industry The Downstream Gala Dinner is a great opportunity for the industry to round off the rst day and proved to be a great hit ANNUAL NEW ZEALAND in 2013. Take advantage of the informal atmosphere to share ideas, network and do business with your peers and clients DOWNSTREAM DINNER whilst enjoying a lavish dinner and drinks reception. International speed painter Brad Blaze will be joining us. Brad is the fastest portrait artist in the world and has enthralled audiences around the globe. Register now at www.nzdownstream.co.nz Dr. Christoph Frei, Secretary General, World Energy Council Dr. Christoph Frei became the fth WEC Secretary General on 1 April 2009. -

Pdf Hearing 22

1 Before the Hearing Panel Appointed by Waikato District Council to Hear Submissions on the Proposed Waikato District Plan In the matter of: the Resource Management Act 1991 And: Submissions and Further Submissions Lodged on the Proposed Waikato District Plan by Meridian Energy Limited Statement of Evidence of Christine Anne Foster Called by Meridian Energy Limited HEARING 22 - INFRASTRUCTURE 28 September 2020 PROPOSED WAIKATO DISTRICT PLAN: HEARING 22 – EVIDENCE OF C FOSTER FOR MERIDIAN ENERGY LTD 1 1. Introduction 1.1. My name is Christine Anne Foster. I am a Planning Consultant and sole director of CF Consulting Services Limited, based in Wellington. My qualifications and experience are as set out in my statement of evidence to Hearing Number 3. 1.2. This statement of evidence is within my area of expertise as a resource management planner, except where I state that I rely on the evidence of others. I reaffirm my commitment, stated in my evidence to Hearing Number 3, to abide the Code of Conduct for Expert Witnesses set out in the 2014 Environment Court Practice Note (and, in particular section 7 in relation to an expert’s duty to the Court). I have not omitted to consider material facts known to me that might alter or detract from the opinions that I express. 2. Definition of ‘Infrastructure’ Submission Point: 580.1 Section 42A Report: Report D0, paragraphs 194 and 195 2.1 Meridian’s submission point requested that large-scale wind farms be explicitly listed within the definition of ‘infrastructure’. As an alternative, the submission point requested that the definition explicitly include all of the ancillary activities necessary to support large-scale wind farms. -

EEA Conf Programme 2021

Conference Programme - Provisional - 29 March 2021 WEDNESDAY, 30 JUNE 2021 8.30am REGISTRATION & TRADE EXHIBITION OPENS ROOM 3 ROOM 4 ROOMS 2 TO 4 9.30am CONFERENCE OPENING 9.35am Keynote Address 1 10.10am Keynote Address 2 10.45am ROOM 1 ROOM 2 ROOM 3 ROOM 4 CARBON ZERO SMART TECHNOLOGY FUTURE GRIDS PANEL SESSION 1 11.00am Architecture of the Future Low-Carbon, ConductorDown – A groundbreaking safety solution for New approaches to network planning. Details to be advised Resilient, Electrical Power System. overhead distribution networks. Richard Kingsford, WEL Networks Prof. Neville Watson, University of Rodger Griffiths, Electronet Technology Canterbury 11.30am Perverse incentives creating an impact on Practical experience of IEC61850 and future IoT for a smarter grid. network performance and New Zealand’s zero applications. Max Feickert, Energy Outcomes & Darren carbon future. Nathan Rich, Connetics Ltd Lucinsky, Electra Ltd Dougal McQueen & Junaid Qureshi, Aurora Energy 12.00pm The effects on the wider electricity network of Enhancing rating studies through soil digital twin. The use, development and improvement of heating decarbonisation projects. Nu’man Rashid, Unison Networks Ltd approaches for generation balancing to meet peak Campbell Rae, Connetics Ltd demand. Katherine Moore, Transpower NZ Ltd 12.30pm LUNCH ASSET MANAGEMENT INNOVATION FUTURE ENERGY SECURITY INNOVATIVE TECHNOLOGY SMART TECHNOLOGY 1.30pm Rethinking test data and reporting. An Electricity network infrastructure resilience through the Implementation of Whangamata’s -

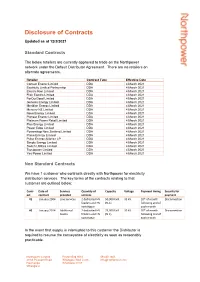

Disclosure of Contracts

Disclosure of Contracts Updated as at 12/3/2021 Standard Contracts The below retailers are currently approved to trade on the Northpower network under the Default Distributor Agreement. There are no retailers on alternate agreements. Retailer Contract Type Effective Date Contact Energy Limited DDA 4 March 2021 Ecotricity Limited Partnership DDA 4 March 2021 Electric Kiwi Limited DDA 4 March 2021 Flick Electric Limited DDA 4 March 2021 ForOurGood Limited DDA 4 March 2021 Genesis Energy Limited DDA 4 March 2021 Meridian Energy Limited DDA 4 March 2021 Mercury NZ Limited DDA 4 March 2021 Nova Energy Limited DDA 4 March 2021 Pioneer Energy Limited DDA 4 March 2021 Platinum Power Retail Limited DDA 4 March 2021 Plus Energy Limited DDA 4 March 2021 Power Edge Limited DDA 4 March 2021 Powershop New Zealand Limited DDA 4 March 2021 Prime Energy Limited DDA 4 March 2021 Pulse Energy Alliance LP DDA 4 March 2021 Simply Energy Limited DDA 4 March 2021 Switch Utilities Limited DDA 4 March 2021 Trustpower Limited DDA 4 March 2021 Yes Power Limited DDA 4 March 2021 Non Standard Contracts We have 1 customer who contracts directly with Northpower for electricity distribution services. The key terms of the contracts relating to that customer are outlined below: Contr Date of Services Quantity of Capacity Voltage Payment timing Security for act contract provided services payment #1 January 2004 Line Services 2 dedicated HV 50,000 kVA 33 kV 20th of month Disconnection feeders and HV (N-1) following end of switchgear each month #2 January 2014 Additional 2 dedicated HV 25,000 kVA 33 kV 20th of month Disconnection Assets feeders and HV (N-1) following end of switchgear each month In the event that supply is interrupted to this customer the Distributor is required to resume the conveyance of electricity as soon as reasonably practicable. -

Electricity Distributors' Performance from 2008 to 2011

ISBN no. 978-1-869453-02-2 Project no. 14.20/13107 Public version Electricity distributors’ performance from 2008 to 2011 Date: 29 January 2013 2 Chapter 1 Introduction 4 Helping customers understand how their electricity distributor is performing 4 We have focused on some key areas of performance 4 We use public information to give an overview of distributors’ performance 5 Structure of this report 5 We would like to hear how useful you found this report 5 Chapter 2 Overview of New Zealand’s electricity industry 6 The main parts of the electricity industry supply chain 6 Key features of the New Zealand electricity distribution sector 7 Chapter 3 Our role in the electricity industry 11 How we regulate electricity distributors in New Zealand 11 Chapter 4 Overview of industry performance 14 Prices, revenue and demand 16 How reliable is electricity distribution in New Zealand? 25 Expenditure 28 3 On 5 February 2013 we made some corrections to the paper. The table below summarises the changes. Distributor Change Buller corrected information in Table 7.1 Electricity Invercargill corrected information in Table 13.1; replaced $7.5m with $1m in commentary under Figure 13.3 MainPower corrected information in Table 16.1 Orion corrected information in Table 22.1; replaced ‘Electra’ with ‘Orion’ in notes to Figures 22.13 and 22.14 OtagoNet corrected information in Table 23.1 Powerco corrected information in Table 24.1 The Power Company corrected information in Table 25.1 Vector corrected information in Table 29.1; added note under Figure 29.1; corrected Figure 29.17 WEL Networks corrected information in Table 31.1 Wellington corrected wording above Figure 32.17 Westpower corrected information in Table 33.1 Introduction 4 Chapter 1 Introduction Helping customers understand how their electricity distributor is performing We have written this report primarily for customers of electricity distribution services, by which we mean people who have, and pay for, a connection to an electricity distribution network.1 This includes both households and businesses. -

WEL Networks Annual Report 2018

2018 WEL Networks and subsidiaries Annual Report 0800 800 935 | wel.co.nz ISSN 2463-4646 (print) ISSN 2463-4646 (print) 02 2018 WEL Networks | Annual Report THIS IS THE ANNUAL REPORT OF WEL NETWORKS LIMITED Dated this 6th day of June 2018 Signed for and on behalf of the Board of Directors ROB CAMPBELL Chairman TONY STEELE Director wel.co.nz CONTENTS PROFILE 03 CHAIRMAN’S REPORT 05 WEL NETWORKS CHIEF EXECUTIVE REPORT 07 ULTRAFAST FIBRE CHIEF EXECUTIVE REPORT 09 QUICK FACTS AND KEY PERFORMANCE INDICATORS 11 DIRECTOR PROFILES AS AT 31 MARCH 2018 21 CORPORATE GOVERNANCE 25 SUSTAINABILITY 26 DIRECTOR DISCLOSURES OF INTEREST 27 WEL ENERGY TRUST 29 THE HEADLINES 31 FINANCIAL STATEMENTS 35 AUDITORS’ REPORT 87 DIRECTORS’ REPORT AND STATUTORY INFORMATION 90 DIRECTORY 95 02 2018 WEL Networks | Annual Report 2018 WEL Networks | Annual Report 03 PROFILE The WEL Group is focused on delivering innovative utility services to enable our communities to thrive. Our electricity network has been serving the Waikato for 100 years distributing power from the national grid, supplying over 160,000 people with electricity services through 90,000 connections. We play a vital part in the economic and social development of the region by recognising and investing in new technologies that will revolutionise our network and future proof our region. The safety of our staff and communities is our highest network that is available to deliver ultra-fast broadband priority and we are committed to ensuring everyone services to more than 200,000 households, schools, makes it home safely every day. businesses and healthcare facilities within the Waikato, Taranaki and Bay of Plenty regions. -

EEA Conf Programme 2021

Conference Programme - Provisional - 17 May 2021 WEDNESDAY, 30 JUNE 2021 8.30am REGISTRATION & TRADE EXHIBITION OPENS ROOM 3 ROOM 4 ROOMS 2 TO 4 9.30am CONFERENCE OPENING 9.35am Jo Hendy, Chief Executive, Climate Change Commission 10.10am Nigel Barbour, Chief Executive, Orion NZ Ltd 10.45am ROOM 1 ROOM 2 ROOM 3 ROOM 4 CARBON ZERO SMART TECHNOLOGY FUTURE GRIDS PANEL SESSION 11.00am Architecture of the Future Low-Carbon, ConductorDown – A groundbreaking safety solution for New approaches to network planning. ‘Protection and Automation’ - Resilient, Electrical Power System. overhead distribution networks. Richard Kingsford, WEL Networks System Restoration Challenges Dr. Radnya Mukhedkar, University of Rodger Griffiths, Electronet Technology CIGRE Panel and Workshop Session Canterbury 11.30am Perverse incentives creating an impact on Death to the Hard-Wired Signal: The rise of Lessons learned during the Australian network performance and New Zealand’s zero IEC61850 Communications transformation towards renewable generation carbon future. Nathan Rich, Connetics Ltd through a prism of New Zealand power systems Dougal McQueen, Aurora Energy & Aleida analysis engineer Powell, University of Otago Alexander Apukov, Mitton Electronet 12.00pm The effects on the wider electricity network of Enhancing rating studies through soil digital twin. The use, development and improvement of heating decarbonisation projects. Nu’man Rashid, Unison Networks Ltd approaches for generation balancing to meet peak Campbell Rae, Connetics Ltd demand. Katherine Moore, Transpower NZ Ltd 12.30pm LUNCH ASSET MANAGEMENT INNOVATION FUTURE ENERGY SECURITY INNOVATIVE TECHNOLOGY SMART TECHNOLOGY 1.30pm Rethinking test data and reporting. An Electricity network infrastructure resilience through the Implementation of Whangamata’s standby battery Analysis of an Intelligent Merging Unit Based on IEC Introduction to our common data environment for lens of seismicity. -

Energy Complaints Scheme – Accepted Deadlocked Complaints Report for the Period 1 April 2020 - 31 March 2021

Energy Complaints Scheme – accepted deadlocked complaints report for the period 1 April 2020 - 31 March 2021 Accepted deadlocked complaints The tables below show the number of deadlocked complaints that were accepted for consideration, and the relevant provider. Not all providers in the Energy Complaints Scheme had an accepted deadlocked complaint in this period. A full provider list is available on our website: www.utilitiesdisputes.co.nz The tables also show each providers’ market share, which is calculated by the number of installation control points (ICPs) or equivalent. Total ICPs (or equivalent) were calculated on 28 February 2021 from ICPs on the electricity and gas registries, and customer numbers obtained from providers. Distributors Distributor Accepted Share of Total ICPs Market share deadlocked accepted (or of ICPs (or complaints deadlocked equivalent) equivalent) complaints Alpine Energy 1 1.8% 33,113 1.3% Aurora Energy 7 12.7% 92,584 3.7% Counties Power 2 3.6% 44,978 1.8% Electra 1 1.8% 45,697 1.8% ElectroNet Services * 1 1.8% 0 0.0% Horizon Networks 1 1.8% 24,940 1.0% MainPower 1 1.8% 41,494 1.6% Northpower 3 5.5% 60,326 2.4% Orion 1 1.8% 208,259 8.2% Powerco 6 10.9% 447,295 17.7% The Lines Company (TLC) 3 5.5% 23,716 0.9% Top Energy 4 7.3% 33,049 1.3% Unison 4 7.3% 113,586 4.5% Vector 17 30.9% 699,786 27.7% WEL Networks 3 5.5% 95,851 3.8% Total 55 100% 1,964,674 77.8% Total ICPs (or equivalent) for all electricity and gas distributors: 2,524,362 Key: *Subsidiary of Westpower. -

Annual Report

2017 WEL Networks Annual Report 0800 800 935 | wel.co.nz ISSN 2463-4646 (print) 02 2017 WEL Networks | Annual Report THIS IS THE ANNUAL REPORT OF WEL NETWORKS LIMITED Dated this 25th day of May 2017 Signed for and on behalf of the Board of Directors MARGARET DEVLIN Chairman PAUL MCGILVARY Chairman Audit and Risk Committee CONTENTS VISION 02 COMPANY PROFILE 03 QUICK FACTS 04 KEY PERFORMANCE INDICATORS 06 CHAIRMAN’S REPORT 11 CHIEF EXECUTIVE’S REPORT 13 IN THE NEWS 16 DIRECTOR PROFILES 19 CORPORATE GOVERNANCE 21 DIRECTORS’ DISCLOSURES OF INTEREST 22 EXECUTIVE MANAGEMENT 23 WEL ENERGY TRUST 26 FINANCIAL STATEMENTS 28 AUDITORS’ REPORT 70 DIRECTORS’ REPORT AND STATUTORY INFORMATION 73 DIRECTORY 76 02 2017 WEL Networks | Annual Report VISION PROVIDING HIGH QUALITY, RELIABLE UTILITY SERVICES VALUED BY OUR CUSTOMERS WHILST PROTECTING AND ENABLING OUR COMMUNITY 2017 WEL Networks | Annual Report 03 COMPANY PROFILE At WEL Networks we’ve kept the lights on in Waikato communities for nearly 100 years. Our core focus is to distribute power from the national grid, connecting over 160,000 people to electricity services through 89,000 installation connection points. Each year we invest around $45 million to keep our assets in top condition and our crews work around the clock to maintain our network. As our communities grow we continue to play an We’re a trusted member of the community employing essential role in the region’s economic and social approximately 240 employees with a range of expertise; development. We identify and invest in new technologies from Live Line Mechanics, Faults Technicians and Technical that benefit our people, modernise our network and Planners, to in-house Health & Safety professionals, future proof our communities. -

Leveraging Network Utility Asset Management Practices for Regulatory Purposes

Leveraging Network Utility Asset Management Practices for Regulatory Purposes Appendices November 2009 Disclaimer: The views expressed in this report are those of KEMA, Inc., and do not necessarily represent he views of, and should not be attributed to, the Ontario Energy Board, any individual Board Member, or OEB staff. Table of Contents Table of Contents Synopsis of International Markets Studied ........................................................................................1 1. Appendix A: Australia.............................................................................................................. 1-1 1.1 Characteristics of Utilities Affected.......................................................................... 1-2 1.1.1 Number of Companies .............................................................................. 1-2 1.1.2 Geographic Areas Served ......................................................................... 1-3 1.1.3 Key Technical and Financial Statistics per Utility.................................... 1-8 1.1.4 Ownership Structures.............................................................................. 1-11 1.2 Assessment of Utility Investment Plans.................................................................. 1-13 1.3 Regulatory Information Requirements.................................................................... 1-17 1.4 Explicit Asset Management Requirements ............................................................. 1-19 1.5 Relevant Regulatory Instruments ...........................................................................