Import Policy Order 2015-2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

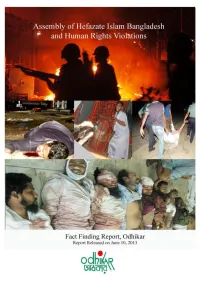

Odhikar's Fact Finding Report/5 and 6 May 2013/Hefazate Islam, Motijheel

Odhikar’s Fact Finding Report/5 and 6 May 2013/Hefazate Islam, Motijheel/Page-1 Summary of the incident Hefazate Islam Bangladesh, like any other non-political social and cultural organisation, claims to be a people’s platform to articulate the concerns of religious issues. According to the organisation, its aims are to take into consideration socio-economic, cultural, religious and political matters that affect values and practices of Islam. Moreover, protecting the rights of the Muslim people and promoting social dialogue to dispel prejudices that affect community harmony and relations are also their objectives. Instigated by some bloggers and activists that mobilised at the Shahbag movement, the organisation, since 19th February 2013, has been protesting against the vulgar, humiliating, insulting and provocative remarks in the social media sites and blogs against Islam, Allah and his Prophet Hazrat Mohammad (pbuh). In some cases the Prophet was portrayed as a pornographic character, which infuriated the people of all walks of life. There was a directive from the High Court to the government to take measures to prevent such blogs and defamatory comments, that not only provoke religious intolerance but jeopardise public order. This is an obligation of the government under Article 39 of the Constitution. Unfortunately the Government took no action on this. As a response to the Government’s inactions and its tacit support to the bloggers, Hefazate Islam came up with an elaborate 13 point demand and assembled peacefully to articulate their cause on 6th April 2013. Since then they have organised a series of meetings in different districts, peacefully and without any violence, despite provocations from the law enforcement agencies and armed Awami League activists. -

Icb Asset Management Company Limited Icb Amcl

ICB ASSET MANAGEMENT COMPANY LIMITED ICB AMCL SECOND MUTUAL FUND Rate of Dividend: Taka 0.5 per Unit FY:2013-2014 Record Date: 20-Aug-2014 BO ID/ Folio/ Name & Number of Units Tax Diduct (tk.) Allote No./DP ID Address of Unit Holders Gross Amount(tk.) Net Amount (tk.) 1201470001479472 JHARNA DAS 500 0.00 23/2 TEJKUNIPARA TEJGAON FARMGATE, 250.00 250.00 1201470021370932 JAMAL MUNSHI 53500 175.00 PO BOX # 11135, UTTARA, HOUSE# 17, ROAD# 1, LANE# 4, WORD# 7, AHALIYA, 26,750.00 26,575.00 1201470032460685 MRS. TANJEE ARA NABANA 2000 0.00 17/4, (2ND FLOOR), B/C TAJMAHAL ROAD MOHAMMADPUR 1,000.00 1,000.00 1201480001376705 NIRANJAN PAUL 500 0.00 AIR SAHARA 99 KAZI NAZRUL ISLAM AVENUE 250.00 250.00 1201480010945445 KAZI MAHMOOD KARIM 500 0.00 C/O-MD.EHSAN KHAN, APT-B/5, RANGS KARABI, ROAD-121, HOUSE-21, GULSHAN 250.00 250.00 1201500016042177 MOHD. RAHMAT ALI 500 0.00 VILL-RAUTHNAGDA PARA P.O-GOPALNAGAR P.S-FARIDPUR, DIST-PABNA, 250.00 250.00 1201500018046160 ZAHIRUL ISLAM 500 0.00 87/1, EAST, KAZIPARA, KAFRUL, 250.00 250.00 1201500018088407 ZAHIRUL ISLAM 500 0.00 87/1, EAST, KAZIPARA, KAFRUL, 250.00 250.00 1201510000243284 BILKISH HAQUE 1000 0.00 1/D, EASTREN HOUSING APT.-2215 FREE SCHOOL STREET, HATIRPOL. 500.00 500.00 1201510000356361 LUTFUN NESSA 500 0.00 JANATA BANK, OPP. G. P.O. BRA. 38 B.B. AVENUE 250.00 250.00 1201510001730026 MD. IBRAHI MKHALIL 500 0.00 429 IBRAHIMPUR, KAPRUL 250.00 250.00 1201510007582512 ZUBAIR MAHMUD 500 0.00 FLAT -31. -

Merchant/Company Name

Merchant/Company Name Zone Name Outlet Address A R LADIES FASHION HOUSE Adabor Shamoli Square Shopping Mall Level#3,Shop No#341, ,Dhaka-1207 ADIL GENERAL STORE Adabor HOUSE# 5 ROAD # 4,, SHEKHERTEK, MOHAMMADPUR, DHAKA-1207 Archies Adabor Shop no:142,Ground Floor,Japan city Garden,Tokyo square,, Mohammadpur,Dhaka-1207. Archies Gallery Adabor TOKYO SQUARE JAPAN GARDEN CITY, SHOP#155 (GROUND FLOOR) TAJ MAHAL ROAD,RING ROAD, MOHAMMADPUR DHAKA-1207 Asma & Zara Toy Shop Adabor TOKIYO SQUARE, JAPAN GARDEN CITY, LEVEL-1, SHOP-148 BAG GALLARY Adabor SHOP# 427, LEVEL # 4, TOKYO SQUARE SHOPPING MALL, JAPAN GARDEN CITY, BARCODE Adabor HOUSE- 82, ROAD- 3, MOHAMMADPUR HOUSING SOCIETY, MOHAMMADPUR, DHAKA-1207 BARCODE Adabor SHOP-51, 1ST FLOOR, SHIMANTO SHOMVAR, DHANMONDI, DHAKA-1205 BISMILLAH TRADING CORPORATION Adabor SHOP#312-313(2ND FLOOR),SHYAMOLI SQUARE, MIRPUR ROAD,DHAKA-1207. Black & White Adabor 34/1, HAZI DIL MOHAMMAD AVENUE, DHAKA UDDAN, MOHAMMADPUR, DHAKA-1207 Black & White Adabor 32/1, HAZI DIL MOHAMMAD AVENUE, DHAKA UDDAN, MOHAMMADPUR, DHAKA-1207 Black & White Adabor HOUSE-41, ROAD-2, BLOCK-B, DHAKA UDDAN, MOHAMMADPUR, DHAKA-1207 BR.GR KLUB Adabor 15/10, TAJMAHAL ROAD, MOHAMMADPUR, DHAKA-1207 BR.GR KLUB Adabor EST-02, BAFWAA SHOPPING COMPLEX, BAF SHAHEEN COLLEGE, MOHAKHALI BR.GR KLUB Adabor SHOP-08, URBAN VOID, KA-9/1,. BASHUNDHARA ROAD BR.GR KLUB Adabor SHOP-33, BLOCK-C, LEVEL-08, BASHUNDHARA CITY SHOPPING COMPLEX CASUAL PARK Adabor SHOP NO # 280/281,BLOCK # C LEVEL- 2 SHAYMOLI SQUARE COSMETICS WORLD Adabor TOKYO SQUARE,SHOP#139(G,FLOOR)JAPAN GARDEN CITY,24/A,TAJMOHOL ROAD(RING ROAD), BLOCK#C, MOHAMMADPUR, DHAKA-1207 DAZZLE Adabor SHOP#532, LEVEL-5, TOKYO SQUARE SHOPPING COMPLEX, JAPAN GARDEN CITY (RING ROAD) MOHAMMADPUR, DHAKA-1207. -

3.6 Bangladesh Additional Service Providers

3.6 Bangladesh Additional Service Providers Accommodation Clearing and Forwarding Agents Freight Forwarding Agents Material Handling & Power Generation Equipment Audits Firms Construction Contractors List of Consultants (on various fields) Photographers, Videographers and Media Telecom, Internet and Web Service Providers Translator Service Providers Logistics Service Providers Accommodation In Bangladesh accomodation facilities are available in all the cities in different forms, especially in Dhaka. Here hotels ranging from 5* to non-star and full furnished apartments are available. Mostly these are cheaper and secured. There are lots of guest houses, resorts and some official guest houses are also available on rental basis. All these are possible to find out from their individual webs and also through tourism service providers. Some of the prominent hotels in different cities are listed below with their details: Hotels in Dhaka (Enlisted with WFP as per October 2019) Sl Name Address Contact Details 1. Pan Pacific Sonargaon Hotel 107, Kazi Nazrul Islam Avenue, Dhaka, Tel : 880 2 5502 8008 / +880 2 912 8008 Bangladesh www.panpacific.com/Dhaka/Overview.html Email: [email protected] 2. Hotel Radisson Blue Garden Airport Rd, Dhaka Cantonment, Dhaka, 1206, Tel: 8754555, 8754554, 01917285907(Tousif) Bangladesh Web: www.radisson.com/dhakabd Email: [email protected] 3. Le Meridian 79/A Commercial Area, Airport Road, Nikunja 2, Phone: +880 2-8900089 Khilkhet, Dhaka 4. Hotel Amari Dhaka Plot # 47, Road # 17, Road No-41, Gulshan-2, Phone: +880-2-9841951, 55059620-29 Dhaka, Bangladesh Cell:01777719313 Web: http://www.amari.com/dhaka Email: [email protected]; [email protected] 5. -

Topic 7: Import Quotas and Other Non-Tariff Barriers Introduction and Small-Country Quota Analysis a Quota Is a Limit on Trade, Usually Imports

Topic 7: Import quotas and other non-tariff barriers Introduction and small-country quota analysis A quota is a limit on trade, usually imports. They remain reasonably common in agricultural goods (for example, the US constrains imports of dairy goods, sugar, meats, and other foods). A quota may be imposed either on quantity (a limit on the number of goods that may be imported) or on value (a limit on the dollar value of imports of a particular good). Let’s first see how a quota works, analyzing a small importing nation, which imports textiles (T). Consider this diagram, 1 1 where the quota is distance QT CT = AB. The standard welfare effects are much like a tariff: Domestic price rises to make the amount of the quota equal to the difference in domestic supply and demand. The quota has engineered a shortage on the market, requiring price to rise. There is a loss in consumer surplus of –(a + b +c + d). There is a gain in producer surplus of + a. The area c is what we call “quota rents”. In economics, a “rent” is the payment to owners of a scarce asset in excess of what is required to supply the good. Here, the amount imported under the quota could be imported at the world price D pT* but those goods command a domestic price pT . PT S A B D PT a b c d * * PT S D T 0 1 1 0 QT QT CT CT Quota rents The important question here is how are these quota rents allocated? This will determine the net welfare impacts. -

10Chapter Trade Policy in Developing Countries

M10_KRUG3040_08_SE_C10.qxd 1/10/08 7:26 PM Page 250 10Chapter Trade Policy in Developing Countries o far we have analyzed the instruments of trade policy and its objectives without specifying the context—that is, without saying much about the Scountry undertaking these policies. Each country has its own distinctive history and issues, but in discussing economic policy one difference between countries becomes obvious: their income levels. As Table 10-1 suggests, nations differ greatly in their per-capita incomes. At one end of the spectrum are the developed or advanced nations, a club whose members include Western Europe, several countries largely settled by Europeans (including the United States), and Japan; these countries have per-capita incomes that in many cases exceed $30,000 per year. Most of the world’s population, however, live in nations that are substantially poorer. The income range among these developing countries1 is itself very wide. Some of these countries, such as Singapore, are in fact on the verge of being “graduated” to advanced country status, both in terms of official statistics and in the way they think about themselves. Others, such as Bangladesh, remain desperately poor. Nonetheless, for virtually all developing countries the attempt to close the income gap with more advanced nations has been a central concern of economic policy. Why are some countries so much poorer than others? Why have some coun- tries that were poor a generation ago succeeded in making dramatic progress, while others have not? These are deeply disputed questions, and to try to answer them—or even to describe at length the answers that economists have proposed over the years—would take us outside the scope of this book. -

The Effects of Biotechnology Policy on Trade and Growth

Volume 3 Number 1, 2002/p. 46-61 esteyjournal.com The Estey Centre Journal of International Law and Trade Policy Normalizing Trade Relations with Cuba: GATT-compliant Options for the Allocation of the U.S. Sugar Tariff-rate Quota Devry S. Boughner and Jonathan R. Coleman∗ Office of Industries, U.S. International Trade Commission Even after 40 years of sanctions, there remain huge differences of opinion on U.S.- Cuba relations. One point all sides agree on, however, is that sooner or later sanctions will be removed. Lifting sanctions raises several issues concerning sugar trade between the two countries. With U.S. sugar prices kept significantly higher than world levels, the U.S. market would be highly attractive for Cuban sugar exporters upon the removal of sanctions. Cuba almost certainly would request access to the U.S. sugar market based on U.S. trade obligations under the World Trade Organization (WTO). The purpose of this paper is to suggest the legal context of U.S. obligations under the WTO with respect to sugar imports from Cuba and to present several options for allocation of the U.S. sugar tariff-rate quota to Cuba under a normalized trade relationship. Keywords: allocation options; General Agreement on Tariffs and Trade (GATT); historical base period; Most-Favoured-Nation (MFN); substantial interest; tariff-rate quota (TRQ); World Trade Organization (WTO). Editorial Office: 410 22nd St. E., Suite 820, Saskatoon, SK, Canada, S7K 5T6. Phone (306) 244-4800; Fax (306) 244-7839; email: [email protected] 46 D.S. Boughner and J.R. Coleman Introduction .S. -

Independent Auditor's Report and Audited Consolidated & Separate Financial Statements for the Year Ended 31 December 2016

Dhaka Bank Limited and its subsidiaries Independent Auditor's Report and Audited Consolidated & Separate Financial Statements For the year ended 31 December 2016 BDBL Bhaban (Level -13 & 14), 12 Kawran Bazar Commercial Area, Dhaka - 1215, Bangladesh. ACNABIN Cbartered Accowntants BDBL Bhaban (Level-13 & 14) Telephone: (88 02) 81.44347 ro 52 1.2 Kawran Bazar Commercial Area (88 02) 8189428 to 29 Dhaka-121.5, Bangladesh. Facsimile: (88 02) 8144353 e-mail: <[email protected]> Web: www.acnabin.com INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF DHAKA BANK LIMITED Report on the Financial Statements We have audited the accompanying consolidated financial statements of Dhaka Bank Limited and its subsidiaries namely Dhaka Bank Securities Limited and Dhaka Bank Investment Limited ("the Group") as well as the separate financial statements of Dhaka Bank Limited ("the Bank"), which comprise the consolidated balance sheet of the Group and the separate balance sheet as at 31" December 2016 and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash flow statements for the year then ended and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Financial Statements and Internal Controls Management is responsible for the preparation of consolidated financial statements of the Group and also the separate financial statements of the Bank that give a true and fair view in accordance with Bangladesh -

International Trade Restrictions

International Trade Restrictions Governments restrict international trade to protect domestic producers from competition. Governments use four sets of tools: Tariffs Import quotas Other import barriers Export subsidies © 2010 Pearson Education Canada How Global Markets Work Figure 7.1(a) shows Canadian demand and Canadian supply with no international trade. The price of a T-shirt at $8. Canadian firms produce 4 million T-shirts a year and Canadian consumers buy 4 million T-shirts a year. © 2010 Pearson Education Canada How Global Markets Work Figure 7.1(b) shows the market in Canada with international trade. World demand and world supply of T-shirts determine the world price of a T-shirt at $5. The world price is less than $8, so the rest of the world has a comparative advantage in producing T-shirts. © 2010 Pearson Education Canada How Global Markets Work With international trade, the price of a T-shirt in Canada falls to $5. At $5 a T-shirt, Canadian garment makers produce 2 million T-shirts a year. At $5 a T-shirt, Canadians buy 6 million T-shirts a year. Canada imports 4 million T-shirts a year. © 2010 Pearson Education Canada International Trade Restrictions Tariffs A tariff is a tax on a good that is imposed by the importing country when an imported good crosses its international boundary. For example, the government of India imposes a 100 percent tariff on wine imported from Canada. So when an Indian wine merchant imports a $10 bottle of Ontario wine, he pays the Indian government $10 import duty. -

List of Trainees of Egp Training

Consultancy Services for “e-GP Related Training” Digitizing Implementation Monitoring and Public Procurement Project (DIMAPPP) Contract Package # CPTU/S-03 Central Procurement Technical Unit (CPTU), IMED Ministry of Planning Training Time Duration: 1st July 2020- 30th June 2021 Summary of Participants # Type of Training No. of Participants 1 Procuring Entity (PE) 876 2 Registered Tenderer (RT) 1593 3 Organization Admin (OA) 59 4 Registered Bank User (RB) 29 Total 2557 Consultancy Services for “e-GP Related Training” Digitizing Implementation Monitoring and Public Procurement Project (DIMAPPP) Contract Package # CPTU/S-03 Central Procurement Technical Unit (CPTU), IMED Ministry of Planning Training Time Duration: 1st July 2020- 30th June 2021 Number of Procuring Entity (PE) Participants: 876 # Name Designation Organization Organization Address 1 Auliullah Sub-Technical Officer National University, Board Board Bazar, Gazipur 2 Md. Mominul Islam Director (ICT) National University Board Bazar, Gazipur 3 Md. Mizanoor Rahman Executive Engineer National University Board Bazar, Gazipur 4 Md. Zillur Rahman Assistant Maintenance Engineer National University Board Bazar, Gazipur 5 Md Rafiqul Islam Sub Assistant Engineer National University Board Bazar, Gazipur 6 Mohammad Noor Hossain System Analyst National University Board Bazar, Gazipur 7 Md. Anisur Rahman Programmer Ministry Of Land Bangladesh Secretariat Dhaka-999 8 Sanjib Kumar Debnath Deputy Director Ministry Of Land Bangladesh Secretariat Dhaka-1000 9 Mohammad Rashedul Alam Joint Director Bangladesh Rural Development Board 5,Kawranbazar, Palli Bhaban, Dhaka-1215 10 Md. Enamul Haque Assistant Director(Construction) Bangladesh Rural Development Board 5,Kawranbazar, Palli Bhaban, Dhaka-1215 11 Nazneen Khanam Deputy Director Bangladesh Rural Development Board 5,Kawranbazar, Palli Bhaban, Dhaka-1215 12 Md. -

Policy Analysis Unit* (PAU)

Policy Analysis Unit* (PAU) Policy Note Series: PN 0703 Recent Experiences in the Foreign Exchange and Money Markets Md. Habibur Rahman, Ph. D Shubhasish Barua Policy Analysis Unit Research Department Bangladesh Bank September 2006 Copyright © 2006 by Bangladesh Bank * The Bangladesh Bank (BB), in cooperation with the World Bank Institute (WBI), has formed the Policy Analysis Unit (PAU) within its Research Department in July 2005. The aim behind this initiative is to upgrade the capacity for research and policy analysis at BB. As part of its mandate PAU will prepare and publish, among other, several Policy Notes on macroeconomic issues every quarter. The precise topics of these Notes are chosen by the Resident Economic Adviser in consultation with the senior management of the Bangladesh Bank. These papers are primarily intended as background documents for the policy guidance of the senior management of BB. Neither the Board of Directors nor the management of the Bangladesh Bank, nor WBI, nor any agency of the Government of Bangladesh or the World Bank Group necessarily endorses any or all of the views expressed in these papers. The latter reflect the judgment based on professional analysis carried out by the staff of the Policy Analysis Unit, and hence the usual caveat as to the veracity of research reports applies. [An electronic version of this paper is available at www.bangladeshbank.org.bd] i Recent Experiences in the Foreign Exchange and Money Markets Md. Habibur Rahman, Ph. D∗ and Shubhasish Barua∗ September 2006 Abstract Over the last two fiscal years both the foreign exchange and the money markets in Bangladesh experienced notable volatility, which resulted in substantial depreciation of BDT against major currencies and a temporary rise in the interest rate in the money market. -

Unclaimed Deposit Statement for Bank's Website-As on 31.12.2020

SL Name of Branch Present Address Permanent Address Account Type Name of Account/ Beneficiary Account/Instrument No. Father's Name Amount BB Cheque Amount Date of Transfer Remarks No. 1 SKB Branch Law Chamber, Amin Court, 5th Floor, 62-63 Motijheel C/A, Dhaka. NA Current Account Graham John Walker 0003-0210001547 NA 130,569.00 130,569.00 18-Aug-14 2 SKB Branch NA NA NA Grafic System Pvt. Ltd. PAA00014522 NA 775.00 3 SKB Branch NA NA NA Elesta Security Services Ltd. PAA00015444 NA 4,807.00 5,582.00 22-Nov-15 4 SKB Branch 369,New North Goran Khilgaon,Dhaka. Vill-Maziara, PO-Jibongonj Bazar, Nabinagar, Brahman Baria Savings Account Farida Iqbal 0003-0310010964 Khondokar Iqbal Hossain 1,212.00 5 SKB Branch Dosalaha Villa, Sec#6,Block#D,Road#9, House# 11,Mirpur ,Dhaka. Vill-Balurchar, PO-Baksha Nagar,PS-Nababgonj,Dist-Dhaka. Savings Account Md. Shah Alam 0003-0310009190 Late Abdur Razzak 975.00 6 SKB Branch H#26(2nd floor)Road# 111,Block-F,Banani,Dhaka. Vill- Chota Khatmari,PO-Joymonirhat, PS-Bhurungamari,Dist-Kurigram. Savings Account S.M. Babul Akhter 0003-0310014077 Md. Amjad Hossain 782.00 7 SKB Branch 135/1,1st Floor Malibag,Dhaka. Vill-Bhairabdi,PO-Sultanshady,PS-Araihazar,Dist-Narayangonj. Savings Account Mohammad Mogibur Rahman 0003-0310012622 Md. Abdur Rashid 416.00 14,951.00 6-Jun-16 8 SKB Branch A-1/16,Sonali Bank Colony, Motijheel,Dhaka. 12/2,Nabin Chanra Goshwari Road, Shampur, Dhaka. Savings Account Salina Akter Banu 0003-0310012668 Md. Rahmat Ali 966.00 9 SKB Branch Cosmos Center 69/1,New Circular Road,Malibage,Dhaka.