05.29.2012 Entertainment Update +++ NEW Goodmans

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

July 5, 2017 SHARON VAN ETTEN SCORES FIRST FEAUTURE FILM

July 5, 2017 For Immediate Release SHARON VAN ETTEN SCORES FIRST FEAUTURE FILM, STRANGE WEATHER, IN THEATERS JULY 28TH Starring Holly Hunter, Carrie Coon, Kim Coates and Glenne Headly Written anD DirecteD by Katherine Dieckmann Official Selection, Toronto International Film Festival Official Selection, Hamptons International Film Festival Official Selection, Provincetown International Film Festival WATCH TRAILER HERE Screeners available on request. “The authentic-feeling Southern ambience, enhanced by Sharon Van Etten's low-key, country-inflected score, is one of the film's most potent assets” -- Hollywood Reporter Sharon Van Etten continues her foray into film and television with the original score for her first feature film, Strange Weather, in theaters July 28th. This follows Van Etten’s acting debut in Netflix’s The OA and her performance of “Tarifa” in Twin Peaks: The Return, both of which “draw on Van Etten’s music as well as her presence . At its most powerful, her music evokes the risky, shaky moment when a secret is exposed” (The Cut). Steeped in a strong sense of place and peopled by convention-defying characters, Katherine Dieckmann’s Strange Weather is a story of a woman’s quest for rectitude in the wake of harrowing loss. It draws you into its sultry Southern milieu and takes you on an unforgettable back-roads trek. Strange Weather stars Holly Hunter and features Carrie Coon (The Leftovers, Fargo, Gone Girl), Kim Coates (Sons of Anarchy, Bad Blood, Goon), Glenne Headly (Hulu’s Future Man, Villa Capri, The Night Of). In discussing the Strange Weather score, Van Etten comments, “I couldn't have asked for a better collaborator on my first score than Katherine Deickmann, the writer/director herself. -

Paragons Promotion Sponsorship Packages

Paragons Promotion Sponsorship Packages Program Overview 2020: 13 Events 7 Cities 130,000 Attendees Over 10 Million Targeted Advertising Exposures Exposure on up to 6 Websites with a combined: 10k page views/month . Previous Celebrities have included Billy the Exterminator from A&E TV, Michelle Smith Former Playboy Playmate and Host of Two Wheel Thunder on Discovery HD Theater, Sons of Anarchy Cast Members, Ryan Hurst (Oppie), Theo Rossi (Juice), Kim Coates (Tig), Tommy Flanagins (Chibs), Emilio Rivera ( Alveraz), Michael Orntein, Mark Boone Jr (Bobby) Previous Sponsors: Event Calendar 2020 Events Show Date Venue Attendance 9th Annual Hastings MI January 5 Barry County Expo Center 3,000 Motorcycle Swap Meet Hastings MI 36th Peotone Motorcycle January Will County Fairgrounds 5,000 Show & Parts Expo (Indoor 19th Peotone IL Event) 36th Annual Chicago Jan 31st – Tinley Park Convention Center, 10,000 Motorcycle Show & Parts Feb 1st Tinley Park, IL (Chicago Land) Expo 47th annual Kalamazoo March Wings Event Center 5,000 Motorcycle Swap Meet & 22nd Kalamazoo MI Parts Expo 17th annual Wexford April 11th Wexford County Civic Center 5,000 County Motorcycle Swap Cadillac MI Meet & Parts Expo 38th Annual Grand Rapids April 26th 4 Mile Show Place 5,000 Motorcycle Swap Meet 36th Peotone Motorcycle May 3th Will County Fairgrounds 5,000 Show & Parts Expo (Indoor Peotone IL & Outdoor Event) 48th Annual Blessing of May Baldwin, Michigan 40,000 Bikes Festival 15th - 17th 32nd Annual Spring Valpo- May 24th Porter County Expo Centre 5,000 Fest Motorcycle-Car -

Silent Hill Production Notes

SILENT HILL PRODUCTION NOTES A child’s mysterious ailment. A desperate mother. An eerie, deserted city shrouded in mist, plagued by secrets. The mysteries are only beginning to deepen. When young mother Rose (Radha Mitchell) -- desperate to find a cure for her daughter Sharon’s bizarre illness -- refuses to accept a medical recommendation of psychiatric institutionalization, she flees with Sharon and heads for SILENT HILL, the town that her daughter continuously names in her sleep. Although her husband Christopher (Sean Bean) adamantly opposes, Rose is convinced the mysterious town will hold all the answers. But as her car approaches the deserted city’s limits, a mysterious figure appears in the road, forcing Rose to swerve and crash. When she comes to, Sharon is gone, and suddenly Rose – accompanied by a determined police officer (Laurie Holden) from a nearby town -- is on a desperate quest in Silent Hill to find her child. It’s immediately clear that her destination – left alone since devastating coal fires ravaged Silent Hill -- is unlike any place she's ever been: smothered by fog, inhabited by a variety of strange, haunted beings, and periodically overcome by a living Darkness that literally transforms everything it touches. As Rose searches for her daughter, she begins to learn the history of Silent Hill – its violent, puritanical past and the origins of its accursed state -- and realizes that her daughter is just part of a larger, more terrifying destiny. Silent Hill stars Radha Mitchell (Melinda and Melinda, Finding Neverland, Man on Fire), Sean Bean (North Country, National Treasure, Lord of the Rings), Laurie Holden (Fantastic Four, The Majestic), Deborah Kara Unger (White Noise, The Game, Crash), Kim Coates (Assault on Precinct 13, Pearl Harbor, Black Hawk Down), Tanya Allen (Starhunter), with Alice Krige (Star Trek: First Contact, Reign of Fire) and Jodelle Ferland (Tideland). -

Donald Sutherland All Aboard As Producer, Screenwriter and Star of Pirate’S Passage!

For Immediate Release Donald Sutherland All Aboard as Producer, Screenwriter and Star of Pirate’s Passage! Production Begins on Animated Movie Based on Award- Winning Adventure Novel — High seas, historical adventure to air on CBC Television — Toronto, ON (November 4, 2013) — Donald Sutherland’s production company, Martin’s River Ink, Inc., announces start of production of a new, animated movie, Pirate’s Passage, with animation work by PIP Animation Services Inc. in Ottawa. Upon completion it will air on CBC Television. “Pirate’s Passage is a thrillingly exhilarating adventure, a glorious coming-of- age-story, rich in both imagination and history, in perception and truth,” said producer, screenwriter and star Donald Sutherland. “I couldn’t put the book down. It resonated with the clearest image of the man inside every boy’s being that I could imagine. It was life writ true and I knew Jim and Captain Johnson’s marvelous journey had to be seen on screen.” Pirate’s Passage is based on William Gilkerson’s critically acclaimed novel, which won Canada’s Governor General's Award for Children's Literature in 2006. Hollywood icon Donald Sutherland (Crossing Lines, The Hunger Games, Pride & Prejudice) and his partner and co-writer, Brad Peyton (Journey 2: The Mysterious Island, Cats & Dogs: The Revenge of Kitty Galore), will produce the film. Sutherland will voice the lead character, Captain Johnson. Peyton will co-direct alongside Mike Barth of PIP Animation. Cast alongside Sutherland is Gage Munroe (The Immortals, One Week), as the young hero -

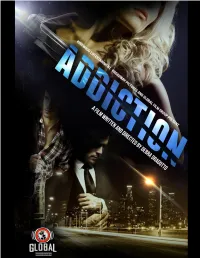

Addiction-ATL-Creative-Summary-2017.Pdf

Contact: Global Film Group Raja Collins [email protected] 310.728.5689 Kirkwood Entertainment Pat Asanti [email protected] 323.646.1027 LOGLINE: A 91/2 Weeks meets Unfaithful erotic thriller where a beautiful and emotionally vulnerable woman married to an emotionally repressed workaholic share an idyllic life, but all is unraveled when she becomes entangled in an addictive sexual relationship with a relentless and charismatic ex-street junkie. GENRE: Erotic Thriller COMPARISONS: Unfaithful, The Perfect Guy, Fatal Attraction that generated $53MM to $157MM at the domestic box office PLUS $66MM to $164MM at the foreign box office SYNOPSIS DeAnn is a beautiful, upscale professional woman married to Mark, an emotionally repressed workaholic. Their seemingly idyllic life, that includes a home in an affluent suburb, is shattered when DeAnn becomes entangled in an addictive sexual relationship with Vic, a charismatic ex-street junkie, whom she meets as a passenger in his commercial sedan. Vic is “reformed” and in “program.” Yet, his addictive tendencies emerge, praying on DeAnn’s vulnerability, manipulating her into obsessive erotic acts. DeAnn attempts to break off the relationship before it becomes too out of hand. But, she loses all control as her own addictive tendencies are uncovered. Mark becomes suspicious and hires a private detective. Once Mark discovers the affair and confronts his wife, DeAnn makes another attempt to end the relationship. However, Vic is relentless in his obsession. Finally, at the end of a long day, DeAnn, who is home alone, finds Vic in her suburban bedroom. Although she tries to resist his advances, she melts to his will as they make love in her marital bed. -

FEROCIOUS Releases Trailer and Movie Poster

FEROCIOUS Releases Trailer and Movie Poster Director Robert Cuffley released the trailer for FEROCIOUS today, a nail-biting thriller about a popular television actress, Leigh Parrish (Amanda Crew) who tries to secretly retrieve a sexually incriminating videotape from a seedy nightclub. September 6, 2012 (Calgary) -- Director Robert Cuffley released the trailer for FEROCIOUS today, a nail-biting thriller about a popular television actress, Leigh Parrish (Amanda Crew) who tries to secretly retrieve a sexually incriminating videotape from a seedy nightclub. The film premiered at World Film Festival in Montreal last week and 'had people cringing and jumping at shadows,' observed Robert Cuffley. 'It was great. Seeing it with audience is, in a sense, seeing it for the first time. So I consider this the first time I've 'seen' the movie. And it really works nicely. Acting is top notch.' Fantasia Film Festival's Mitch Davis emphatically comments: 'If you want to see one hell of an eccentrically evil Kim Coates performance, not to mention a typically powerhouse turn by Michael Eklund, be sure to check out Robert Cuffley's aptly-titled Ferocious!' Ferocious plays again at the Calgary International Film Festival (calgaryfilm.com) Saturday September 22 at 9:30pm at Calgary's Globe Theatre. The entire cast will be in attendance including Amanda Crew (Jobs, Charlie St. Cloud), Kim Coates (Sons of Anarchy, Black Hawk Down), Michael Eklund, Dustin Milligan and Katie Boland. Ferocious is the story of the dark side of ambition, the high price of fame and the blindness caused by desire. Ferocious was produced by Carolyn McMaster, CHAOS a film company and Anand Ramayya, Karma Film. -

KIM COATES: TOUGH GU Y Draws Strength from Mom, Two Brothers, Childhood Pals, and the Old Green and White

HOLLYWOODKIM COATES: TOUGH GU Y draws strength from Mom, two brothers, childhood pals, and the old green and white BY KARIN MELBERG SCHWIER hen he comes back to Saskatoon, the only “I love coming home to see Mom,” Coates says. “I thing deadly about Hollywood kickass lost my dad a few years ago, so seeing her is top bad guy Kim Coates is his mom’s killer priority. She’s an Energizer bunny.” He happily rattles cinnamon buns and his take-a-bullet love off childhood buddies like Jim Lindsay, Larry Harley, Wfor his hometown, his alma mater, and his old school and Murray Totland, Saskatoon’s city manager. buddies. The prolific movie and television actor, on a Coates talks about them with the same warmth short hiatus while wrapping the fifth season of the and admiration as he does industry pals like William critically acclaimed FX cable hit Sons of Anarchy, Fichtner, Kevin Costner, Matt Craven, Eric Bana, even came home in September to see Mom and lend Christopher Plummer. You get the idea that if you support to the institution that inspired his calling. gave them all hockey sticks in front of Coates’ old house, there would be one wicked game of shinny. Kim Coates is a really nice guy. Unless you haven’t watched TV or movies in past two decades, that may “Murray Totland was my first buddy,” recalls Coates. be a bit hard to grasp. The actor has a propensity “I was four, he was five. We used to walk to Thornton to play scary dudes — gun-toting killers, vampires, Elementary on Lorne Avenue every day. -

'The Young Pope'

January 13 - 19, 2017 2 x 2" ad 2 x 2" ad M E L B O T E R S E R A B A M 2 x 3" ad A S E A R T B I R S E L O R U B R H S G O G G I N S X N I T WHY JUDE A G O B C S T R K V C A P C U C O R B A P M H E C U A X H E 2 x 3.5" ad S G D X E F T E E M E J E A D LAW IS C H E I F R E A A R D X H R S F L X R C S T R S C H M I D A A F S T I C A X L A P O D B M SMOKIN' AS R S G L J H O R B P H J O A D K E D H O D G E I T E D I D E H A X K C A P D C U H A H E B S L O R J S N G E R I C K Y V A B S K O N L E R E S A C H A 'THE R G E L E X W C E D U P I F H “Six” on History (Words in parentheses not in puzzle) Richard (Taggart) (Walton) Goggins SEAL (Team Six) Solution on page 13 Joe (Graves) (Barry) Sloane Brotherhood Alex (Caulder) (Kyle) Schmid Boko Haram YOUNG 2 x 3" ad Ricky (Ortiz) (Juan Pablo) Raba Captured 1 x 4" ad Word Search Robert (Chase) (Edwin) Hodge Rescue (Mission) © Zap2it POPE' "The Young Pope," premiering Sunday on HBO. -

What's Inside

WINTER 2014 Volume 4, Issue 2 What’s Inside: Sons of Anarchy star Kim Coates supports Creative Kids Hazlet welcomes international students Culture Days races ahead in Kindersley WINTER 2014 Contents Volume 4, Issue 2 General manager’s message . 3 Engage Competition unites community theatre in saskatchewan . 4 Published by CARFAC bridges gap with Aboriginal artists . 6 SaskCulture Inc. , 8 The world meets in Hazlet . 8 is designed to Junior curators helping preserve the past in meacham . 10 highlight saskatoon’s street meet Festival: challenging perceptions of public art . 12 the work of cultural leaders, 12 Creative Kids descends into Creative Mayhem . 14 volunteers Culture Days includes ‘amazing race’: how one town got everyone running for culture! . 16 and the entertainment, eating, education and engagement create diversity recipe for success at Folkfest’s Indian & métis Pavilion . 18 of activities 18 memory boxes and art engage seniors . 20 supported by the language festival promotes cultural pride . 22 Culture Section of Saskatchewan Lotteries multiculturalism from north to south . 24 Trust Fund for Sport, Culture and Recreation. Popular touring workshop engages artists and saskatchewan 24 students . 26 Direct Inquires to: Graphic Design: Diane ell, editor J. lauder Publishing & Design [email protected] [email protected] shaunna Grandish, Publishing Coordinator Contributing Writers: [email protected] shawn Bauche, michelle Brownridge, marian 404, 2125 11th Avenue, Regina sK s4P 3X3 Donnelly, sarah Ferguson, shaunna Grandish, Tel: (306) 780.9284 Damon Badger Heit, Danica lorer, Paul spasoff www.saskculture.sk.ca ON THE COVER: Sons of Anarchy star, Kim Print copies of this publication are circulated for free to saskCulture members, partners and through community Coates, helps host Creative Mayhem along with outreach activities as determined by saskCulture Inc. -

SPRING 2017 JUNE 5 – 8 Convocation Procession in the Bowl, May 1928

15 th INSTALLATIONChancellor Convocation SPRING 2017 JUNE 5 – 8 Convocation procession in the Bowl, May 1928. A-1666 UNIVERSITY OF SASKATCHEWAN 1 Spring Convocation 2016 The graduation lists shown in this program were prepared prior to convocation and may not reflect final college decisions regarding each student’s eligibility for graduation. As a result, some of the students listed in this program may not have been formally approved to receive the degree or diploma indicated. The registrar maintains the official list of graduates. PRESIDENT’S MESSAGE PETER STOICHEFF Today is a celebration of all you have direction you take, your time at the U of S accomplished as a student at the University has prepared you to face adversity and of Saskatchewan. The countless hours spent opportunity with equal measures of success, in labs, libraries and classrooms culminates confidence and creativity. Because of that, with you walking across the stage, in front awaiting you is a fulfilling and rewarding of student colleagues, university and family life in which you can contribute to what is supporters, to receive your U of S degree. important to you and to the world. This is a significant milestone in, not only When you look at your degree, remember your life, but the lives of all of those who that you are backed by a rich and rigorous have supported you during your academic university education. Also remember the pursuits. On this occasion, I offer you my people, supporters and experiences that were sincerest congratulations. a part of your time at the U of S, because those memories are as valuable as the degree With your degree in hand, you join more itself. -

Movies 1859 Songs, 139 Days, 1,907.91 GB

Page 1 of 52 Movies 1859 songs, 139 days, 1,907.91 GB Name Time Album Artist 1 The Abandoned 1:39:13 Anastasia Hille, Karel Roden, Valentin Ga… 2 Abandoned 1:28:04 Brittany Murphy, Dean Cain, Mimi Roger… 3 Abduction 1:45:59 Taylor Lautner, Lily Collins, Alfred Molina, … 4 Abraham Lincoln: Vampire Hunter 1:45:14 Benjamin Walker, Dominic Cooper, Anth… 5 Accepted 1:33:03 Justin Long, Jonah Hill, Adam Herschma… 6 The Accidental Husband 1:27:04 Colin Firth, Uma Thurman, Jeffrey Dean … 7 Ace Ventura: Pet Detective 1:27:01 Jim Carrey, Courteney Cox, Sean Young,… 8 Across the Universe 2:13:16 Evan Rachel Wood, Jim Sturgess, Joe An… 9 The Adjustment Bureau 1:45:36 Matt Damon, Emily Blunt, John Slattery, … 10 Admission 1:47:07 Tina Fey, Ann Harada, Ben Levin, Dan Lev… 11 Adore 1:51:15 Naomi Watts, Robin Wright, Xavier Samu… 12 Adventureland 1:46:51 Jesse Eisenberg, Michael Zegen, Kristen … 13 The Adventures of Bob & Doug McKenzi… 1:30:20 Dave Thomas, Rick Moranis, Max von Sy… 14 The Adventures of Sharkboy and Lavagirl … 1:32:33 Taylor Lautner 15 The Adventures of Tintin 1:42:31 Daniel Craig, Simon Pegg, Cary Elwes, Ja… 16 Afghan Knights 1:42:48 Steve Bacic, Gary Stretch, Francesco Quin… 17 African Cats 1:28:58 Samuel L. Jackson 18 After Earth (2013) 1:40:03 19 After the Sunset 1:37:23 Pierce Brosnan, Salma Hayek, Woody Ha… 20 Air Force One 2:04:00 Harrison Ford, Gary Oldman, Glenn Close… 21 The Air I Breathe 1:35:06 Brendan Fraser, Andy Garcia, Sarah Mich… 22 Airplane! 1:27:40 Robert Hays, Julie Hagerty, Kareem Abdu… 23 Akeelah and the Bee 1:52:53 -

Tickets On-Sale August 22Nd for 4Th Annual Boot Ride and Rally Boot

Tickets on-sale August 22nd for 4th Annual Boot Ride and Rally Boot Ride Presented by Low T Center & HerKare Benefitting Boot Campaign, with Cast from FX’s Sons of Anarchy Austin, Texas (August 20, 2014) – It’s one of the hottest tickets to score and it’s going on sale this Friday, August 22nd on www.BootRide.com. The 4th Annual Boot Ride and Rally presented by Low T Center & HerKare is Sunday, November 2, 2014 in San Antonio, TX. This annual motorcycle ride and after party benefits the nonprofit, Boot Campaign, which is dedicated to cultivating awareness, promoting patriotism, and providing assistance to military, past and present, and their families. Kim Coates and Theo Rossi are among the Sons of Anarchy cast members riding in the 4th Annual Boot Ride. Cast from FX’s Sons of Anarchy hosted Boot Ride in Los Angeles, CA for the past three years, but this year the event is moving to be closer to the charity’s home base of Austin, Texas. “As the 4th Annual Boot Ride comes to Texas, it is a great opportunity for Low T Center and Her Kare to partner with the Boot Campaign. We are proud of their work to raise awareness and dedication to help Texas Veterans.” Mike & Mickala Sisk, Founders of Low T Center and Her Kare. The Boot Ride and Rally is a sell-out event, so be sure to grab your tickets while you can! Ride starts: at Caliente Harley Davidson, 7230 NW Interstate 410 Loop Frontage Rd, San Antonio, TX 78245.