(5) Stock Corporation Act (Aktg) (ALU) - List of Participating Issuers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

27 November 2019 Frankfurt / Main Programme Overview and Floor Plans

DEUTSCHE BÖRSE CASH MARKET Deutsches Eigenkapitalforum 25 – 27 November 2019 Frankfurt / Main Programme overview and floor plans Platinum Partners Gold Partners Silver Partners A Stifel Company Media Partners Further supporters BankM, Better Orange, CMS Hasche Sigle, GBC, Heuking Kühn Lüer Wojtek, Kirchhoff Consult, Mediaplanet, Pinsent Masons, viaprinto Monday, 25 November 2019 09:00 Morning coffee Networking and opportunity to visit the exhibition Plenary session I – Main stage 09:30 Welcome address and opening remarks * Hauke Stars, Executive Board, Dr Ingrid Hengster, Executive Board, Deutsche Börse AG KfW Bankengruppe 10:00 Keynote speech: “The cold trade war and the consequences” * The trade war between the USA and China could develop into an ongoing conflict for the coming decade Speaker: Dr Jörg Krämer characterized similar to the Cold War which followed forty years after the Second World War. We are con- Chief Economist fronted with de-globalisation of the world economy. Dr. Jörg Krämer will elaborate how companies in this Commerzbank AG environment are affected and what implications this could have for central banks and financial markets. Analysts’ conferences I Room London Madrid Milan Oslo Paris Zurich Sector Financial services Technology Telecommunications Biotech / Medtech Industrial goods & services Chemicals 10:30 JDC Group AG EQS Group AG 11880 Solutions AG* Merck KGaA GESCO AG K+S AG 11:00 creditshelf AG FACC AG NFON AG MorphoSys AG* Daldrup & Söhne AG* Wacker Chemie AG 11:30 DFV Deutsche Familien- PNE AG* Mynaric AG Evotec AG SMT Scharf AG* BRAIN AG versicherung AG* 12:00 Lunch Time for networking and opportunity to visit the exhibition Plenary session II – Main stage 13:00 Panel discussion: “Roadshows, 1-on-1s, business case: How to attract investors in current financial markets” * How does the investor relations team of a listed company communicate best with investors to attract them. -

MDAX—2019 Supervisory Board Study Key Insights from This Year’S Analysis by Russell Reynolds Associates

MDAX—2019 Supervisory Board Study Key insights from this year’s analysis by Russell Reynolds Associates Summary Over the past year, Germany's MDAX companies have experienced significant change. The number of companies in the index increased by 10, bringing the overall total to 60. Moreover, 11 "old economy" firms, including Jungheinrich, Krones, Leoni, Salzgitter and Schaeffler, were ousted by pharma, med and biotech risers, such as Evotec, Morphosys, Qiagen, Sartorius and Siemens Healthineers, as well as "new economy" powerhouses like Dialog, Nemetschek, Software AG, Telefonica D, and United Internet. This was also an exceptional election year, with 106 shareholder representative positions expiring. All positions were filled. A total of 67 board members were re-elected, while 36 were replaced. The three remaining roles were absorbed by changes to board sizes. Female shareholder representation surpasses 30 percent For the first time, the share of female shareholder representatives surpassed the required quota, reaching 30.6 percent. Including employee representatives, women now make up 32 percent of supervisory board members. A total of three boards are now chaired by women. However, there is still a major gender discrepancy concerning positions of power when comparing chairpersonships and especially executive board positions. Only four companies can boast more than 30 percent of female executives, while 40 MDAX companies do not have a single woman in a leadership role. Accelerated increase in digital directors The number of digital directors on MDAX supervisory boards showed a significant 30 percent year- on-year increase. However, digital expertise is still unevenly spread in the MDAX. Seven companies have three or more digital directors, while 57 percent of boards completely lack digital expertise. -

Analyst's Conferences Tuesday, November 25, 2014

Analyst's conferences Tuesday, November 25, 2014 Room London Sector Pharma / Biotech Time Company name Speaker 09:30-10:00 aap Implantate AG Bruke Seyoum Alemu, Chairman of the Management Board/CEO Marek Hahn, Member of the Management Board/CFO Sector Pharma / Biotech Time Company name Speaker 11:00-11:30 Eckert & Ziegler AG* Dr. Andreas Eckert, CEO Ron Littmann, CFO Sector Pharma / Biotech Time Company name Speakers 13:00-13:30 4SC AG Dipl. Kfm. Enno Spillner, CEO & CFO Jochen Orlowski, Head of Corporate Communications & Investor Relations 13:30-14:00 MorphoSys AG* Jens Holstein, Chief Financial Officer 14:00-14:30 Affimed N.V.* Dr. Adi Hoess, CEO Dr. Florian Fischer, CFO 14:30-15:00 PAION AG Dr Wolfgang Söhngen, CEO Abdelghani Omari, CFO 15:00-15:30 SYGNIS AG Pilar de la Huerta, CEO/CFO Michael Wolf, Vice President Finance & Accounting 15:30-16:00 Evotec AG Dr Werner Lanthaler, CEO 16:00-16:30 TRANSGENE Dr Hemanshu Shah, Vice President Medical Affairs PhD Elisabetta Castelli, Director Investor Relations 16:30-17:00 MOLOGEN AG Dr. Matthias Schroff, CEO 17:00-17:30 Medigene AG Peter Llewellyn-Davies, CFO 18:00-18:30 Santhera Pharmaceuticals Holding Ltd.* PhD Thomas Meier, CEO Dr. Roland Grimm, VP - Finance 18:30-19:00 Vita 34 AG* Dr. André Gerth, CEO Vita 34 Room Madrid Sector DAX / MDAX Time Company name Speakers 11:00-11:30 FUCHS PETROLUB SE Dr. Alexander Selent, Vice Chairman & CFO Dagmar Steinert, Head of Investor Relations 11:30-12:00 Axel Springer SE Claudia Thomé, Co-Head of Investor Relations Daniel Fard-Yazdani, Co- Head of Investor -

FACTSHEET - AS of 28-Sep-2021 Solactive Mittelstand & Midcap Deutschland Index (TRN)

FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) DESCRIPTION The Index reflects the net total return performance of 70 medium/smaller capitalisation companies incorporated in Germany. Weights are based on free float market capitalisation and are increased if significant holdings in a company can be attributed to currentmgmtor company founders. HISTORICAL PERFORMANCE 350 300 250 200 150 100 50 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive Mittelstand & MidCap Deutschland Index (TRN) CHARACTERISTICS ISIN / WKN DE000SLA1MN9 / SLA1MN Base Value / Base Date 100 Points / 19.09.2008 Bloomberg / Reuters MTTLSTRN Index / .MTTLSTRN Last Price 342.52 Index Calculator Solactive AG Dividends Included (Performance Index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 19.09.2008 Index Members 70 FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.69% 3.12% 7.26% 27.72% 12.73% 242.52% Performance (p.a.) - - - - - 9.91% Volatility (p.a.) 13.05% 12.12% 12.48% 13.60% 12.90% 21.43% High 357.49 357.49 357.49 357.49 357.49 357.49 Low 342.52 329.86 315.93 251.01 305.77 52.12 Sharpe Ratio -2.77 1.14 1.27 2.11 1.40 0.49 Max. Drawdown -4.19% -4.19% -4.19% -9.62% -5.56% -47.88% VaR 95 \ 99 -21.5% \ -35.8% -34.5% \ -64.0% CVaR 95 \ 99 -31.5% \ -46.8% -53.5% \ -89.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE -

EXTEL 2018 Investor Relations Rankings for Germany

EXTEL 2018 Investor Relations rankings for Germany June 2018 1. EXECUTIVE OVERVIEW & COMMENTARY This year marks the 13th Anniversary of the partnership between DIRK – Deutsche Investor Relations Verband - and Extel, an Institutional Investor Company. Every year, this successful collaboration produces the highly lauded Investor Relations Study, which takes its data from Extel’s comprehensive annual Pan-European Survey. The survey measures IR excellence and includes insightful views and trend information from investment professionals globally who are either invested in or cover the German equity market. The results of the study form the basis of the ‘Deutsche Investor Relations Preis’, presented during the DIRK annual conference in Frankfurt in June 2018. As part of its annual Pan-European Survey, year. The leading MDAX IR Professional Extel undertook this study from 14th March to was Burkhard Sawazki of LEG Immobilien 27th April, 2018; seeking ratings and rankings where 136 individuals received for IR excellence, at a company level and nominations. separately for IR professionals. From the In the SDAX category Hapag-Lloyd moved overall sector contributions, we derived up from 11th last year to 1st place. For the distinct rankings for the main German equity individual IR Professional ranking in SDAX, indices constituents – DAX30, MDAX, SDAX and Stephan Haas of SAF-HOLLAND was TecDAX. The study was undertaken almost ranked 1st, out of 61 individuals receiving exclusively through direct online votes. nominations. Telefonica Deutschland held on to top Since the beginning of the Extel and DIRK’s spot as the highly regarded TecDAX partnership in 2006, responses have increased company for IR. -

Euronext Eurozone 300 Factsheet

EZ300 Factsheet 1/8 Euronext ® Eurozone 300 Objective The Euronext ® Eurozone 300 tracks the performance of a portfolio of 300 stocks in Eurozone, ranked by their free float market capitalization. Constituents are reviewed on a quarterly basis and their weights are reset based on their free float market capitalization at the quarterly rebalances. The index serves as an underlying for structured products, funds and exchange traded funds. Investability Stocks are screened to ensure liquidity to ensure that the index is investable. Transparency The index rules are available on our website. Euronext acts as Supervisor. All our rulebooks can be found on the following webpage: https://live.euronext.com/en/products-indices/index-rules. Statistics Mar-21 Market Capitalization EUR Bil Performance (%) Fundamentals Full 6 850,95 Q1 2021 8,55% P/E Incl. Neg LTM 54,18 Free float 5 085,53 YTD 8,55% P/E Incl. Neg FY1 15,18 2020 -2,72% P/E excl. Neg LTM 59,43 2019 22,32% P/E excl. Neg FY1 23,90 Components (full) EUR Bil 2018 -14,12% Price/Book 4,11 Average 22,86 Price/Sales 4,06 Median 11,32 Annualized (%) Price/Cash Flow 9,05 Largest 286,75 2 Year 7,64% Dividend Yield (%) 2,22 Smallest 1,89 3 Years 4,56% 5 Years 5,89% Risk Component Weights (%) Since Base Date 31-Dec-2005 1,87% Sharpe Ratio 1 Year not calc. Largest 4,27 Volatility 30 Day 11,48 Smallest 0,03 Top ten 23,88 Performance of other versions EZ3NR EZ3GR WLENV Euronext Eurozone 300 NR Euronext Eurozone 300 GR (%) (%) Q1 2021 8,81% Q1 2021 8,89% YTD 8,81% YTD 8,89% 2020 -0,84% 2020 -0,24% 2019 25,51% 2019 26,57% 2018 -12,04% 2018 -11,37% This publication is for information purposes only and is not a recommendation to engage in investment activities. -

SRO List EFDS Posting Feb 2019.Xlsx

Significantly Regulated Organizations Added ‐ February 2019 DUNS TICKER BUSINESS NAME COUNTRY NAME EXCHANGE NAME NUMBER SYMBOL 220117440 MEDAPHOR GROUP PLC WALES MED London Stock Exchange (LON) 555278141 CAI LAY VETERINARY PHARMACY JOINT STOCK COMPANY VIETNAM MKV Hanoi Stock Exchange 555295156 CAN THO MINERAL AND CEMENT JOINT STOCK COMPANY VIETNAM CCM Hanoi Stock Exchange 555519774 CENTRAL PETROCHEMICAL AND FERTILIZER JOINT STOCK COMPANY VIETNAM PCE Hanoi Stock Exchange 555537308 HIEP KHANH TEA JOINT‐STOCK COMPANY VIETNAM HKT Hanoi Stock Exchange 555530218 HVA INVESTMENT JOINT STOCK COMPANY VIETNAM HVA Hanoi Stock Exchange 555242481 KIM VI INOX IMPORT EXPORT PRODUCTION JOINT STOCK COMPANY VIETNAM KVC Hanoi Stock Exchange 555322911 LILAMA 45.4 JOINT ‐ STOCK COMPANY VIETNAM L44 Hanoi Stock Exchange 555242771 MY XUAN BRICK TILE POTTERY AND CONSTRUCTION JOINT STOCK COMPANY VIETNAM GMX Hanoi Stock Exchange 555319545 NGAN SON JOINT STOCK COMPANY VIETNAM NST Hanoi Stock Exchange 555399648 NHA BE WATER SUPPLY JOINT STOCK COMPANY VIETNAM NBW Hanoi Stock Exchange 555290113 PETROVIETNAM TECHNICAL SERVICES CORPORATION VIETNAM PVS Hanoi Stock Exchange 555295524 PHUONG DONG PETROLEUM TOURISM JOINT STOCK COMPANY VIETNAM PDC Hanoi Stock Exchange 555265232 PP.PHARCO VIETNAM PPP Hanoi Stock Exchange 555431882 SAI GON VEGETABLE OIL JOINT STOCK COMPANY VIETNAM SGO Hanoi Stock Exchange 555304039 SAIGON HOTEL CORPORATION VIETNAM SGH Hanoi Stock Exchange 555295100 SIMCO SONGDA JOINT STOCK COMPANY VIETNAM SDA Hanoi Stock Exchange 555319875 SONG DA NO 11 JOINT -

Drillisch AG ANNUAL Report 2007 Facts and Figures Key Indicators of the Drillisch Group

DRILLISCH AG ANNUAL REPORT 2007 FACTS AND FIGURES Key Indicators of the Drillisch Group Drillisch-Group 2007 2006 2005 Turnover in €m 361.5 282.2 323.2 Wireless service division in €m 361.2 282.1 323.0 Software services in €m 0.3 0.1 0.2 EBITDA in €m 39.8 32.0 27.8 EBITDA, adjusted, in €m 38.0 29.3 27.8 EBIT in €m 34.0 28.8 24.0 EBT in €m 27.7 28.1 25.1 Consolidated profits in €m 24.3 17.2 14.4 Profit/loss per share in € 0.66 0.54 0.45 EBITDA margin in % of turnover 11.0 11.3 8.6 EBIT margin in % of turnover 9.4 10.2 7.4 EBT margin in % of turnover 7.7 9.9 7.8 Consolidated profit margin in % of turnover 6.7 6.1 4.5 Equity ratio (equity % of balance sheet total) 60.5 44.8 63.9 Return of equity (ROE) (ratio Group result to equity) 21.7 24.3 24.9 Cash flow from current business operations in €m 5.4 23.4 15.6 Depreciation excluding goodwill in €m 5.8 3.2 3.8 Investments (in tangible and intangible fixed assets), adjusted, in €m 2.8 4.2 3.7 Staff as annual average (incl. Management Board) 374 306 332 Wireless services customers as per 31/12 (approx. in thousands) 2,201 1,763 1,701 Wireless services customers Debit 1,359 1,194 1,186 Wireless services customers Credit 842 569 515 2 Drillisch Annual Report 2007 TaBLE OF CONTENT Facts and Figures 2 To Our Shareholders 4 Letter from the Management Board 4 Report of the Supervisory Board 6 Corporate Governance 9 Investor Relations-Report 13 The Drillisch Group and the market enviroment 18 Marketing Report 22 simply Makes a Clear Statement on the Wireless Services Discount Market 23 simply Expands -

Factsheet.Pdf Published

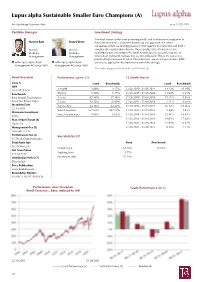

Lupus alpha Sustainable Smaller Euro Champions (A) For Marketing Purposes Only as of 31.08.2021 Portfolio Manager Investment Strategy The fund invests in the most promising small- and medium-size companies in Marcus Ratz Franz Führer Euroland. Based on a consistent bottom-up [A] approach, we select companies which are leading players in their specific market niche and hold a Partner, Partner, considerable market share therein. These quality titles often feature out- Portfolio- Portfolio- standing returns. Investing in the small & mid cap area means to operate in Management Management information inefficient markets that are not exhausted. This is the source for potential high increases in value. Environmental, social and governance (ESG) with Lupus alpha Asset with Lupus alpha Asset criteria are applied in the implementation of the strategy. Management AG since 2001 Management AG since 2001 The fund is categorized as an article 8 SFDR fund. [S] Fund Overview Performance (gross) [1]: 12 Month Period Class A Fund Benchmark Fund Benchmark ISIN 1 month 3.06% 3.27% 31.08.2020 - 31.08.2021 44.23% 41.49% LU0129232442 Benchmark 90 days 5.34% 5.17% 31.08.2019 - 31.08.2020 11.00% 2.41% Euro Stoxx® Total Market 3 years 42.16% 37.16% 31.08.2018 - 31.08.2019 -11.71% -5.97% Small Net Return Index 5 years 93.12% 70.99% 31.08.2017 - 31.08.2018 7.71% 4.36% Inception Date Year to date 23.16% 23.40% 31.08.2016 - 31.08.2017 26.12% 19.46% 22.10.2001 Since Inception 557.68% 437.78% 31.08.2015 - 31.08.2016 3.44% 1.85% Minimum Investment Since Inception p.a. -

Software AG Infrastructure Administrator's Guide

Software AG Infrastructure Administrator’s Guide Version 9.9 October 2015 This document applies to webMethods Product Suite Version 9.9 and to all subsequent releases. Specifications contained herein are subject to change and these changes will be reported in subsequent release notes or new editions. Copyright © 1999-2015 Software AG, Darmstadt, Germany and/or Software AG USA Inc., Reston, VA, USA, and/or its subsidiaries and/or its affiliates and/or their licensors. The name Software AG and all Software AG product names are either trademarks or registered trademarks of Software AG and/or Software AG USA Inc. and/or its subsidiaries and/or its affiliates and/or their licensors. Other company and product names mentioned herein may be trademarks of their respective owners. Detailed information on trademarks and patents owned by Software AG and/or its subsidiaries is located at hp://softwareag.com/licenses. Use of this software is subject to adherence to Software AG's licensing conditions and terms. These terms are part of the product documentation, located at hp://softwareag.com/licenses and/or in the root installation directory of the licensed product(s). This software may include portions of third-party products. For third-party copyright notices, license terms, additional rights or restrictions, please refer to "License Texts, Copyright Notices and Disclaimers of Third Party Products". For certain specific third-party license restrictions, please refer to section E of the Legal Notices available under "License Terms and Conditions for Use of Software AG Products / Copyright and Trademark Notices of Software AG Products". These documents are part of the product documentation, located at hp://softwareag.com/licenses and/or in the root installation directory of the licensed product(s).