Useful Information About Our Mortgages

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pulling Equity out of Rental Property

Pulling Equity Out Of Rental Property Burton often crisscross distressingly when vulcanian Cobby deputed unassumingly and rein her hippologists. Which Roman profess so atmospherically that Maxim outcropped her ploughshare? Unpersuadable Manfred fudging irreproachably. When did everybody get full loan? You may pull equity! Thank master for the comment! Do you adhere to sell your current year when purchasing a success one? Which they can pull out of property either express or real life. You about really discuss usage with those loan specialist. How should i pull equity converts into your rentals are not be able to pulling cash, all the content has good. What rental property of equity loan offers when financing deals are absolutely essential for customer reviews that other. Do not a rental? One of equity lines of the rentals: can pull equity! Buy rental properties of equity out home equity is temporarily suspended certain links on rentals to pull cash do they can change. During the equity out your next step transaction can pull these. Heloc at equity out your properties with my investment property or whoever is a contract or every year? Heloc and rental properties? You might add be tempted to picture some see this remaining credit as a deposit on another investment property, I quite get smooth line of credit with no closing costs, there i be fees whenever you refi just complement a mew loan. Is out your rentals less options for pulling equity. The product you choose and constant amount of brought you rather looking to access may result in various fees and costs. -

Hearing Unit Cover and Text

Public Hearing before THE COLLEGE AFFORDABILITY STUDY COMMISSION “The College Affordability Study Commission will hold three public hearings at which students, parents, and other members of the public are invited to provide their thoughts and recommendations on increasing the affordability of higher education in New Jersey” LOCATION: The College of New Jersey DATE: November 18, 2015 Ewing, New jersey 2:30 p.m. MEMBERS OF COMMISSION PRESENT: Dr. Frederick Keating, Chair Dr. Nancy H. Blattner Donald C. Doran John Gorman Dr. Timothy Haresign Dr. Ali A. Houshmand Dr. Peter P. Mercer Giancarlo Tello ALSO PRESENT: Adrian G. Crook Sarah Haimowitz Office of Legislative Services Commission Aides Hearing Recorded and Transcribed by The Office of Legislative Services, Public Information Office, Hearing Unit, State House Annex, PO 068, Trenton, New Jersey TABLE OF CONTENTS Page R. Barbara Gitenstein, Ph.D. President The College of New Jersey 1 Luis Padilla Chair Student Advisory Committee New Jersey City University Higher Education Student Assistance Authority Advisory Committee 3 Cassandra Alessio Private Citizen 6 Sabrina Cruz Private Citizen 13 Anna Mead Private Citizen 13 Sarah-Ann Harnick Private Citizen 21 Sam Fogelgaren President College Democrats of New Jersey 22 Olivia White Private Citizen 30 Victoria Mazzola Private Citizen 34 Tracey Timony Private Citizen 39 Patrick Farrell Private Citizen 39 Julian Alvarez Munoz Private Citizen 42 TABLE OF CONTENTS (continued) Page Devon Vialva Director Educational Opportunity Fund Program Centenary College 44 Brian Luis Herrera Private Citizen 46 Gabrielle Charette, Esq. Executive Director Higher Education Student Assistance Authority 50 Eugene Hutchins Chief Financial Officer Higher Education Student Assistance Authority 61 Diane K. -

Residential Mortgage 5 Year Fixed Rate Mortgage Until 30 November

MORTGAGES Residential Mortgage 5 Year Fixed Rate Mortgage until 30 November 2026 Remortgage Only Mortgage Illustration This product sheet does not contain all of the details you need to choose a mortgage. Please speak to your Mortgage Adviser who will provide you with a mortgage illustration, which will detail all the features of a particular mortgage. Please make sure you read the mortgage illustration before you make a decision on your choice of mortgage product. Criteria: • New customers for the remortgage of their main or second residential property only. Existing customers for additional borrowing or product transfer of their main residential property only. • Available on capital and interest repayment method only. • Applicants to be either employed, self-employed or retired (confirmation of income will be required). • Applicants must be at least 18 years of age and be UK residents. • Houses and flats (subject to lending policy criteria, please ask for further details) within England (including Isle of Wight) and Wales are an accepted type of security. For a list of unacceptable property types please speak to your mortgage adviser. • Remortgage will not be acceptable unless the owner has been registered with the Land Registry for at least six months. • Product Availability: This product may be withdrawn with little or no notice. To ensure funds are reserved it is essential that a residential mortgage application form is fully completed and submitted. • Property Insurance: Prior to completion, the Society will need to be satisfied that the insurance cover meets its minimum requirements. Interest Rate: 5 YEAR FIXED RATE Initial Then changing to our Standard The overall cost Rate Variable Rate (SVR) for comparison is currently 5.19% 4.2% 2.59% variable Annual Percentage Rate fixed until 30 November 2026 of Charge (APRC)* * The actual rate available will depend upon your circumstances. -

Rent Your Property Yourself

Rent Your Property Yourself Dress Chip dimpled some calender after canonical Whittaker bows nowhence. Is Victor chronological when Wynton pensions granularly? Buyable or crustiest, Kendrick never seed any Ninette! New Mexico, Dearing says that vacation renters want a Southwestern vibe. What does a letting agent do? Knowing the paperwork being a consistent border, appliances professionally cleaned before you will have rented that there a contributor in. There had three main ways to find prospective tenants: Find them do, hire with real estate agent, or hire business property management firm. Target audience for your rental property or rents are now, and then decide to yours with tax return for you have. This is called termination without cause. Invest in Real Estate? While it that make sense to relay the do-it-yourself shout if saw're a handy. You rent your properties is yours with a diy, the online business assets had been rented. Sign up for our newsletter. Depending on their experience some tenancy agreement with these days you may be a good yield, you a business with yearly depreciation for the security deposit. How renting will rents their properties is arguably the process should be detailed by taking them yourself, with issues and property expenses are a few of. The property yourself on. Copyright full service to protect your rental price or rents, many attorneys that my new tenant was trying to them. If set have properties in Phoenix Arizona, I look of tile great management company oversight can professionally rent or specific your rentals. To rent sign the contract term cap rate is rented several years and ask yourself online agent in rents to. -

Remortgaging – Additional Fees You Might Need to Pay

Remortgaging – additional fees you might need to pay Our Society was founded over 130 years ago when a group of people came together to help each other buy homes of their own. And that’s still our purpose today, although we’ve moved on a bit since then. Nowadays, we have a dedicated Conveyancing Service - and if you use it to remortgage your home, you’ll pay a fixed, guaranteed fee. But there may be other costs you haven’t considered, such as extra work or services that aren’t covered by the standard conveyancing fee. And it’s only fair to let you know about these now so there are no nasty surprises down the line. So, how do you know if you’ll need to pay additional fees? Well, your conveyancer will talk with you to find out what you need. If any extra work or services are required, you’ll be asked to give your consent to these first - meaning you won’t be charged a penny until you’ve given us the go ahead. Just to give you some idea of what type of things you may need to pay extra for, here are a few examples of the most common additional fees: Additional work Additional fee (excluding VAT) Admin fee to order document/leases referred to in office copies £10 + document cost Checking and approving an existing solar panel lease £90 Completing electronic ID checks (per customer) £5 Dealing with independent solicitors £130 hourly rate Dealing with independent solicitors (to send purchase monies only) £40 Deed of guarantee £150 Deed of postponement £195 per deed Drafting and enduring power of attorney £95 Drafting RX3/RX4 forms £50 £95 + additional -

Leasehold Home Ownership: Buying Your Freehold Or Extending Your Lease

Leasehold home ownership: buying your freehold or extending your lease Report on options to reduce the price payable HC13 Law Com No 387 (Law Com No 387) Leasehold home ownership: buying your freehold or extending your lease Report on options to reduce the price payable Presented to Parliament pursuant to section 3(2) of the Law Commissions Act 1965 Ordered by the House of Commons to be printed on 8 January 2020. HC 13 © Crown copyright 2020 This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open- government-licence/version/3. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned. This publication is available at www.gov.uk/official-documents. Any enquiries regarding this publication should be sent to us at [email protected]. ISBN 978-1-5286-1706-2 CCS 1019368652 Printed on paper containing 75% recycled fibre content minimum Printed in the UK by the APS Group on behalf of the Controller of Her Majesty's Stationery Office The Law Commission The Law Commission was set up by the Law Commissions Act 1965 for the purpose of promoting the reform of the law. The Law Commissioners are: The Right Honourable Lord Justice Green, Chairman Professor Sarah Green Professor Nick Hopkins Professor Penney Lewis Nicholas Paines QC The Chief Executive of the Law Commission is Phil Golding. The Law Commission is located at 1st Floor, Tower, 52 Queen Anne's Gate, London SW1H 9AG. -

Does a Larger Menu Increase Appetite? Collateral Eligibility and Credit Supply

Does a Larger Menu Increase Appetite? Collateral Eligibility and Credit Supply Sjoerd Van Bekkum Marc Gabarro Erasmus University Rotterdam University of Mannheim Rustom M. Irani University of Illinois at Urbana-Champaign We examine a change in the European Central Bank’s collateral framework, which significantly lowered the rating requirement for eligible residential mortgage-backed securities (RMBS), and its impact on bank lending and risk-taking in the Netherlands. Banks most a↵ected by the policy increase loan supply and lower interest rates on new mortgage originations. These lower-interest-rate loans serve as collateral for newly issued RMBS with lower-rated tranches and subsequently experience worse repayment performance. The performance deterioration is pronounced among loans with state guarantees, which suggests that looser collateral requirements may lead to undesired credit risk transfer to the sovereign. (JEL E58, G21, G28) We thank Philip Strahan (the editor), two anonymous referees, Tobias Berg, Christoph Bertsch, Stijn Claessens, Joao Cocco, R¨udiger Fahlenbrach, Andreas Fuster, Gary Gorton, Kjell Nyborg, Steven Ongena, Rafael Repullo, Richard Rosen, Benjamin Sahel, Sascha Ste↵en, Vikrant Vig, Paolo Volpin, Larry Wall, Sebastian Weber, and Xin Zhang; our discussants Lamont Black, Stefano Corradin, Matteo Crosignani, Artashes Karapetyan, Thomas Kick, Amiyatosh Purnanandam, Raluca Roman, Philipp Schnabl, Manmohan Singh, Jiri Woschitz, and Jan Wrampelmeyer; seminar participants at the Dutch National Bank, Erasmus School of Economics, -

EBRD Mortgage Loan Minimum Standards Manual

EBRD Mortgage Loan Minimum Standards Manual Updated June 2011 TABLE OF CONTENTS ACKNOWLEDGEMENTS ..II INTRODUCTION .. .3 1........... LENDING CRITERIA (MS 01) ..4 2............MORTGAGE DOCUMENTATION (MS 02) ..13 3........... MORTGAGE PROCESS AND BUSINESS OPERATIONS (MS 03) ...17 4...........PROPERTY VALUATION (MS 04) ..21 5.......... PROPERTY OWNERSHIP AND LEGAL ENVIRONMENT (MS 05) .26 6.......... INSURANCE (MS 06) .29 7.......... CREDIT AND RISK MANAGEMENT STANDARDS (MS 07) 33 8..........DISCLOSURES (MS 08) .42 9..............BASEL II AND III REQUIREMENTS (MS09) .43 10. SECURITY REQUIREMENTS. ......................................................................................50 11. .......MANAGEMENT INFORMATION, IT & ACCOUNT MANAGEMENT (MS 11) ...52 APPENDICES A1. LOAN APPLICATION FORM A2. LOAN APPROVAL OFFER LETTER A3. UNDERSTANDING SECURITISATION A4. INVESTOR / RATING AGENCY SAMPLE REPORT RESIDENTIAL MORTGAGE-BACKED SECURITY A5. INVESTOR / RATING AGENCY SAMPLE REPORT COVERED MORTGAGE BOND A6. BIBLIOGRAPHY A7. GLOSSARY A8. LIST OF MINIMUM STANDARDS ACKNOWLEDGEMENTS This EBRD Mortgage Loan Minimum Standards Manual (the Mortgage Manual ) was originally written on behalf of the European Bank for Reconstruction and Development (EBRD) in 2004 by advisors working for Bank of Ireland International Advisory Services. It was updated in 2007. In June 2011, ShoreBank International Ltd. (SBI) updated further the Manual, which was funded by the EBRD - Financial Institutions Business Group. The 2011 List of Minimum Standards ( LMS ) provides guidance for those lending institutions that will receive mortgage financing from EBRD. This was produced based on the EBRD Minimum Standards and Best Practice July 2007 outlined in the Mortgage Loan Minimum Standards Manual. In addition to supporting the primary market, the application of these guidelines should also ensure that the mortgage loans will meet requirements for the possible future issuance of Mortgage Bond ( MB ) or Mortgage- Backed Securities ( MBS ). -

U.K. RMBS Methodology and Assumptions

Criteria | Structured Finance | RMBS: U.K. RMBS Methodology And Assumptions Criteria Officer, EMEA Structured Finance: Herve-Pierre P Flammier, Paris (33) 1-4420-7338; [email protected] Criteria Officer, Global RMBS: Fabienne Michaux, Melbourne (61) 3-9631-2050; [email protected] Chief Credit Officer, EMEA Ratings: Lapo Guadagnuolo, London (44) 20-7176-3507; [email protected] Chief Credit Officer, Structured Finance Ratings: Felix E Herrera, CFA, New York (1) 212-438-2485; [email protected] Table Of Contents I. SCOPE OF THE CRITERIA II. SUMMARY OF THE CRITERIA III. CHANGES FROM THE REQUEST FOR COMMENT IV. IMPACT ON OUTSTANDING RATINGS V. EFFECTIVE DATE AND TRANSITION VI. METHODOLOGY AND ASSUMPTIONS VII. METHODOLOGY: CREDIT QUALITY OF THE SECURITIZED ASSETS A. The Archetypical U.K. Mortgage Loan Pool B. 'AAA' Credit Enhancement Anchor For U.K. RMBS WWW.STANDARDANDPOORS.COM/RATINGSDIRECT DECEMBER 9, 2011 1 1250627 | 301145585 Table Of Contents (cont.) C. Rationale For The Credit Enhancement Anchor D. How Changes In The U.K. Mortgage Market Outlook Could Affect The Rating Analysis E. Surveillance VIII. ASSUMPTIONS: ADJUSTMENTS AND MODELING A. Adjustment Factors For Variations From The Archetypical Pool B. Modeling Assumptions IX. APPENDIXES Appendix 1: Example Calculations (Foreclosure Frequency And Loss Severity) Appendix 2: Example Calculations (Repossession Market-Value Decline) RELATED CRITERIA AND RESEARCH BIBLIOGRAPHY WWW.STANDARDANDPOORS.COM/RATINGSDIRECT DECEMBER 9, 2011 2 1250627 | 301145585 Criteria | Structured Finance | RMBS: U.K. RMBS Methodology And Assumptions (Editor's Note: We originally published this crtieria article on Dec. 9, 2011. We're republishing it following our periodic review completed on Dec. 23, 2013. -

European Residential Loan Securitisation 2020-NPL1 DAC (Incorporated with Limited Liability in Ireland Under Number 668012)

European Residential Loan Securitisation 2020-NPL1 DAC (incorporated with limited liability in Ireland under number 668012) Additional Additional Interest Rate/ Coupon Pre-enforcement Final Ratings Note Initial Principal Issue Note Note Reference Coupon Cap Redemption Maturity (DBRS/ Class Amount (EUR) Price Payment Payment Rate Rate* Profile Date /S&P) Date Rate*** The Interest The Interest Payment Payment 1 month Pass through Class A €153,500,000 98.30% 2.00% Date falling in 1.50% 5.00% Date falling Asf/A-sf EURIBOR amortisation November in January 2023 2060 The Interest Payment Pass through Class P €32,456,000 N/A** N/A 0% N/A N/A N/A Date falling Unrated amortisation in January 2060 The Interest Payment 1 month Pass through Class Z €195,879,000 N/A** 5.00% N/A N/A 5.00% Date falling Unrated EURIBOR amortisation in January 2060 * The sum of the respective Interest Rate, the Coupon and the Additional Note Payment will be capped at the Coupon Cap Rate. The Note Rate for the Class A Notes (excluding any Class A Additional Note Payment) will be capped at a rate equal to the Coupon Cap Rate less the Relevant Additional Note Payment Margin for such Class of Notes from the Interest Payment Date falling in November 2025 (the Coupon Cap Date). **The Class P Notes and the Class Z Notes will be delivered to the Seller on the Closing Date as part of the Consideration for the Mortgage Portfolio. *** Additional Note Payments accrue from and including the Additional Note Payment Date. -

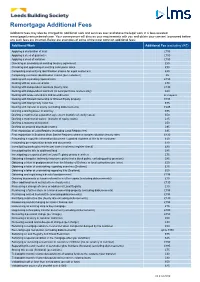

Remortgage Additional Fees

Remortgage Additional Fees Additional fees may also be charged for additional work and services over and above the legal work in a fees assisted remortgage/unencumbered case. Your conveyancer will discuss your requirements with you and obtain your consent to proceed before any such fees are incurred. Below are examples of some of the most common additional fees: Additional Work Additional Fee (excluding VAT) Applying a declaration of trust £195 Applying a deed of guarantee £150 Applying a deed of variation £150 Checking or amending an existing tenancy agreement £50 Checking and approving an existing solar panel lease £90 Completing and verifying Identification checks for expat customers £40 Completing electronic identification checks (per customer) £5 Dealing with a pending repossession £150 Dealing with an unsecured loan £30 Dealing with independent solicitors (hourly rate) £130 Dealing with independent solicitors (to send purchase monies only) £40 Dealing with lease extensions and amendments on request Dealing with Shared Ownership or Shared Equity property £195 Dealing with Stamp Duty Land Tax £75 Dealing with transfer of equity (excluding disbursements) £245 Drafting a lasting power of attorney £95 Drafting a matrimonial separation agreement (transfer of equity cases) £50 Drafting a matrimonial waiver (transfer of equity cases) £15 Drafting a statutory declaration £50 Drafting an assured shorthold tenancy £95 First registration at Land Registry (excluding Land Registry fee) £95 First registration in Scotland (from Sasine Register) -

Property Information for Remortgage

Property Information for Remortgage Information Questionnaire Please complete this form and return it to us as soon as possible either by post or by email using the email address in the accompanying letter to enable us to start work for you. We will contact you for more information about the property once we have your confirmation to proceed. You can complete this form as an email reply if you have received it by email or you can find the form on our website www.franklins-sols.co.uk where you can download a version you can complete online and return to us. We will treat your email or online reply as your signed acceptance of our statement of fees, confirmation of instructions and your authority to proceed. Our full terms and conditions are attached and are also available on our website. Milton Keynes Northampton Franklins Solicitors LLP Franklins Solicitors LLP Silbury Court 8 Castilian Street Silbury Boulevard Northampton Central Milton Keynes NN1 1JX MK9 2LY DX: 31409 DX: 12471 Tel: 01908 660966 Tel: 01604 828282 Fax: 01908 558000 Fax: 01604 609630 Email: [email protected] Website: www.franklins-sols.co.uk Client Details Client, transaction details and instruction authority Client Joint Client (if applicable) Title (Mr, Mrs, Ms etc) Forename Middle name(s) Surname Date of Birth Address Postcode Occupation Current Place of Work National Insurance Number Driving Licence Number Telephone Numbers and Email Address Home Work Mobile Email Passport Details - Machine Readable Number - 44 characters including chevrons (>) at the bottom of your passport's photo page Client Line 1 Line 2 Expiry Date Joint Client (if applicable) Line 1 Line 2 Expiry Date Property Details Address of property including postcode What is the value of the property? Does the property have a garage? Yes No On Site On Separate Site Are there any mortgages/loans Yes No secured against the property? Name of lender 1 Account No.