Our 85Th Year

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Towns County Sports Towns County’S Leader in Sports

Page 11A THE TOWNS COUNTY HERALD August 15, 2012 Towns County Sports Towns County’s Leader In Sports www.townscountyherald.net • E-mail: [email protected] 15, 2012 THE TOWNS COUNTY HERALD Page 11A continued from page 10A Chatuge Shores Blairsville School of Dance to Fly-In... Ladies Golf news offer free Cardio Hip Hop Class Most have a good sense of avid water skiers and the old only to have the desire to try On Aug. 7, the Chatuge camaraderie and look forward knees get a little tender after a and a love of the water to enjoy Shores Ladies Golf Asso- On Thursday, August 16, dance and is excited to begin to sharing their sport. They are day of water-skiing. hydrofoil- this sport. ciation challenged the golf Blairsville School of Dance this program at BSoD. She course's pro, Matt Liss. Now, will offer its Cardio Hip Hop also teaches ballet technique, typically a little older than the ing is very easy on the body. If this sounds like some- of course, there were some diehard water-skiers or wake- Also, the sport is relatively thing you would like to be class for free to kick off its new pointe, lyrical and jazz classes parameters set for this tour- program. The Cardio Hip Hop at BSoD and is a fitness in- boarders and they are usually expensive so you have to be involved in then make plans to nament. Matt played his attend the Ninth Annual event class, which is for teens and structor at Hiwassee Valley open to sharing their boats and able to afford it.” scratch golf game while the adults, will be held on Thurs- Pool and Wellness Center in equipment with other Hydro- The jumps and tricks at the Ridges Resort and ask "Chatugettes" played their net days at 5:30 p.m. -

Massachusetts Licensed Motor Vehicle Damage Appraisers - Individuals September 05, 2021

COMMONWEALTH OF MASSACHUSETTS DIVISION OF INSURANCE PRODUCER LICENSING 1000 Washington Street, Suite 810 Boston, MA 02118-6200 FAX (617) 753-6883 http://www.mass.gov/doi Massachusetts Licensed Motor Vehicle Damage Appraisers - Individuals September 05, 2021 License # Licensure Individual Address City State Zip Phone # 1 007408 01/01/1977 Abate, Andrew Suffolk AutoBody, Inc., 25 Merchants Dr #3 Walpole MA 02081 0-- 0 2 014260 11/24/2003 Abdelaziz, Ilaj 20 Vine Street Lexington MA 02420 0-- 0 3 013836 10/31/2001 Abkarian, Khatchik H. Accurate Collision, 36 Mystic Street Everett MA 02149 0-- 0 4 016443 04/11/2017 Abouelfadl, Mohamed N Progressive Insurance, 2200 Hartford Ave Johnston RI 02919 0-- 0 5 016337 08/17/2016 Accolla, Kevin 109 Sagamore Ave Chelsea MA 02150 0-- 0 6 010790 10/06/1987 Acloque, Evans P Liberty Mutual Ins Co, 50 Derby St Hingham MA 02018 0-- 0 7 017053 06/01/2021 Acres, Jessica A 0-- 0 8 009557 03/01/1982 Adam, Robert W 0-- 0 West 9 005074 03/01/1973 Adamczyk, Stanley J Western Mass Collision, 62 Baldwin Street Box 401 MA 01089 0-- 0 Springfield 10 013824 07/31/2001 Adams, Arleen 0-- 0 11 014080 11/26/2002 Adams, Derek R Junior's Auto Body, 11 Goodhue Street Salem MA 01970 0-- 0 12 016992 12/28/2020 Adams, Evan C Esurance, 31 Peach Farm Road East Hampton CT 06424 0-- 0 13 006575 03/01/1975 Adams, Gary P c/o Adams Auto, 516 Boston Turnpike Shrewsbury MA 01545 0-- 0 14 013105 05/27/1997 Adams, Jeffrey R Rodman Ford Coll Ctr, Route 1 Foxboro MA 00000 0-- 0 15 016531 11/21/2017 Adams, Philip Plymouth Rock Assurance, 901 Franklin Ave Garden City NY 11530 0-- 0 16 015746 04/25/2013 Adams, Robert Andrew Country Collision, 20 Myricks St Berkley MA 02779 0-- 0 17 013823 07/31/2001 Adams, Rymer E 0-- 0 18 013999 07/30/2002 Addesa, Carmen E Arbella Insurance, 1100 Crown Colony Drive Quincy MA 02169 0-- 0 19 014971 03/04/2008 Addis, Andrew R Progressive Insurance, 300 Unicorn Park Drive 4th Flr Woburn MA 01801 0-- 0 20 013761 05/10/2001 Adie, Scott L. -

TRACKSIDE 2016 Welcome to the Firestone 600, the Ninth Round of the 2016 Verizon Indycar Series Season

VERIZON INDYCAR SERIES TRACKSIDE 2016 Welcome to the Firestone 600, the ninth round of the 2016 Verizon IndyCar Series season. The INDYCAR and Texas Motor Speedway communications staffs are here to assist. Direct questions and requests to a member of either staff in the media center. INDYCAR Communications Contacts Mike Kitchel, Director, Communications P: (317) 492-6453 C: (317) 716-5256 [email protected] Pat Caporali, Senior Manager, Media Relations P: (317) 492-4547 C: (317) 447-5789 [email protected] • Kate Guerra, Senior Manager, Advance Communications P: (317) 492-8577 C: (317) 800-8438 [email protected] Mark Robinson, Senior Manager, Editorial P: (317) 492-8538 C: (317) 308-1464 [email protected] Cathy Kightlinger, Manager, Lifestyle Communications P: (317) 492-8534 C: (317) 797-3490 [email protected] Arni Sribhen, Coordinator, Media Relations P: (317) 492-8531 C: (317) 506-4816 [email protected] Texas Motor Speedway Media Relations Contacts: Mike Zizzo, Vice President, Media Relations P: (817) 215-8520 C: (817) 528-4676 [email protected] Gregg Elkin, Manager, Media Relations P: (817) 215-8523; C: 817 937-9206, [email protected] Louis Mora, Manager, Media Relations P: (817) 215-8521; C: (817) 528-3769, [email protected] INDYCAR Media Website – media.indycar.com A media-only section of INDYCAR’s website is available at media.indycar.com. The site contains content about the Verizon IndyCar Series, including: INDYCAR, Verizon IndyCar Series and Mazda Road to Indy logos -

Post-Race Report

Loop Data Statistics Post-Race Report Federated Auto Parts 400 September 08, 2012 Provided by STATS LLC and NASCAR - Sunday, September 9, 2012 NASCAR Sprint Cup Series Average Running Position Sum of driver position on each lap - divided by the laps run in the race. Federated Auto Parts 400 Richmond International Raceway September 8, 2012 Car Finish Average Rk. Number Driver Team Pos. Place 1 11 Denny Hamlin FedEx Express 18 3.308 2 15 Clint Bowyer 5-hour Energy 1 3.908 3 88 Dale Earnhardt Jr. Diet Mountain Dew/National Guard 14 5.828 4 56 Martin Truex Jr. NAPA Auto Parts 21 8.068 5 48 Jimmie Johnson Lowe's 13 8.225 6 29 Kevin Harvick Budweiser 10 8.908 7 22 Sam Hornish Jr. Shell Pennzoil 11 9.005 8 5 Kasey Kahne Quaker State 12 9.022 9 55 Mark Martin Aaron's Dream Machine 3 9.485 10 14 Tony Stewart Office Depot/Mobil 1 4 10.528 11 17 Matt Kenseth Best Buy 5 11.065 12 16 Greg Biffle 3M/Owens & Minor 9 11.992 13 18 Kyle Busch M&M's 16 12.120 14 31 Jeff Burton Caterpillar 6 12.688 15 2 Brad Keselowski Miller Lite 7 12.730 16 39 Ryan Newman Quicken Loans 8 12.972 17 24 Jeff Gordon Drive to End Hunger 2 13.615 18 99 Carl Edwards Kellogg's 17 17.328 19 42 Juan Pablo Montoya Target 20 19.020 20 78 Regan Smith Furniture Row/Farm American 24 19.500 21 9 Marcos Ambrose MAC Tools 15 21.335 22 1 Jamie McMurray Bass Pro Shops/Allstate 22 21.428 23 27 Paul Menard Menards/Moen 23 22.905 24 83 Landon Cassill Burger King 19 22.990 25 47 Bobby Labonte Bush's Beans 25 24.022 26 43 Aric Almirola Smithfield 26 25.375 27 20 Joey Logano The Home Depot 30 25.902 28 93 Travis Kvapil Burger King/Dr. -

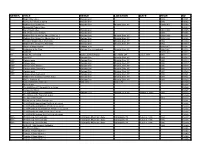

OPEN TEST CIRCUIT of the AMERICAS FEBRUARY 11-12 2020 NTT INDYCAR SERIES Schedule of Events ALL START TIMES EASTERN / SCHEDULE SUBJECT to CHANGE

OPEN TEST CIRCUIT OF THE AMERICAS FEBRUARY 11-12 2020 NTT INDYCAR SERIES Schedule of Events ALL START TIMES EASTERN / SCHEDULE SUBJECT TO CHANGE 1 March 15 Streets of St. Petersburg 3:30 pm 2 5 Barber Motorsports Park 4:15 pm 3 April 19 Streets of Long Beach 4:45 pm 4 26 Circuit of The Americas 4:10 pm 5 May 9 Indianapolis Motor Speedway Road Course 3:50 pm 6 24 Indianapolis 500 Mile Race 12:30 pm 7 30 Streets of Detroit - Race 1 3:50 pm 8 31 Streets of Detroit - Race 2 3:50 pm 9 June 6 Texas Motor Speedway 8:45 pm 10 21 Road America 12:50 pm 11 27 Richmond Raceway 8:15 pm 12 July 12 Streets of Toronto 3:40 pm 13 18 Iowa Speedway 9:00 pm 14 Aug. 16 Mid-Ohio Sports Car Course 12:45 pm 15 22 World Wide Technology Raceway at Gateway 8:45 pm 16 6 Portland International Raceway 3:40 pm 17 Sept. 20 WeatherTech Raceway Laguna Seca 3:25 pm Oval Street/Road Course NTT INDYCAR SERIES · Trackside 2020 2 Open Test at Circuit of The Americas Table of Contents THE NTT INDYCAR SERIES TRACKSIDE BOOK IS NOW AVAILABLE AS AN INTERACTIVE PDF: Along with a traditional printed version of this publication, an interactive PDF edition with active tabs and live links similar to an Internet website also will be available throughout the 2020 season. With just a click, the tabs at the top of each page will take you directly to a specific section, as well as return you to the Table of Contents. -

NASCAR Sprint Cup Series Race Number 15 Unofficial Race Results

NASCAR Sprint Cup Series Race Number 15 Unofficial Race Results for the 44Th Annual Quicken Loans 400 - Sunday, June 17, 2012 Michigan International Speedway - Brooklyn, MI - 2 Mile Paved Total Race Length - 200 Laps - 400 Miles - Purse: $5,193,706 Leader Driver Fin Str Car Driver Team Laps Pts Bns Rating Winnings Status Tms Laps 1 17 88 Dale Earnhardt Jr. DietMtnDew/TheDarkKnightRises/NtnlGuard Chev 200 48 5 138.1 $168,775 Running 5 95 2 8 14 Tony Stewart Office Depot/Mobil 1 Chevrolet 200 43 1 124.1 $179,160 Running 1 18 3 6 17 Matt Kenseth Ford EcoBoost Ford 200 42 1 116.1 $155,096 Running 1 17 4 3 16 Greg Biffle 3M/Salute Ford 200 41 1 129.8 $120,910 Running 3 38 5 10 48 Jimmie Johnson Lowe's Chevrolet 200 39 97.3 $140,496 Running 6 28 24 Jeff Gordon DuPont Chevrolet 200 39 1 100.4 $134,046 Running 2 4 7 13 15 Clint Bowyer 5-hour Energy Toyota 200 38 1 104.6 $117,649 Running 1 1 8 21 42 Juan Pablo Montoya Target Chevrolet 200 37 1 94.5 $120,176 Running 1 4 9 1 9 Marcos Ambrose Stanley Ford 200 36 1 106.2 $121,743 Running 4 15 10 2 29 Kevin Harvick Budweiser Folds of Honor Chevrolet 200 34 81.4 $134,346 Running 11 42 99 Carl Edwards Fastenal Ford 200 33 80.2 $133,426 Running 12 16 56 Martin Truex Jr. NAPA Auto Parts Toyota 200 32 89.8 $112,524 Running 13 25 2 Brad Keselowski Miller Lite Dodge 200 32 1 91.4 $118,705 Running 1 3 14 19 1 Jamie McMurray McDonald's Chevrolet 200 31 1 67.5 $115,218 Running 1 1 15 5 39 Ryan Newman US ARMY Chevrolet 199 29 83.0 $125,068 Running 16 31 47 Bobby Labonte Charter Toyota 199 28 66.8 $109,693 Running -

NASCAR Nationwide Series Race Number 22 Unofficial Race Results

NASCAR Nationwide Series Race Number 22 Unofficial Race Results for the 6Th Annual Napa Auto Parts 200 Presented By Dodge - Saturday, August 18, 2012 Circuit Gilles Villeneuve - Montreal, - 2.709 Mile Road Total Race Length - 81 Laps - 219.429 Miles - Purse: $1,504,348 Leader Driver Fin Str Car Driver Team Laps Pts Bns Rating Winnings Status Tms Laps 1 15 31 Justin Allgaier Brandt Chevrolet 81 47 4 103.0 $94,318 Running 1 1 2 2 12 Sam Hornish Jr. Alliance Truck Parts Dodge 81 43 1 122.6 $60,193 Running 3 4 3 3 22 Jacques Villeneuve Dodge Dodge 81 43 2 143.8 $47,893 Running 4 43 4 17 2 Elliott Sadler OneMain Financial Chevrolet 81 41 1 92.7 $43,093 Running 1 6 5 8 5 Ron Fellows Canadian Tire Chevrolet 81 39 99.3 $32,875 Running 6 6 18 Michael McDowell(i) FedEx Express Toyota 81 0 104.3 $34,118 Running 7 22 01 Mike Wallace TradeBank Chevrolet 81 37 77.6 $31,893 Running 8 9 60 Billy Johnson Roush Fenway 25 Winning Years Ford 81 36 116.1 $24,200 Running 9 19 3 Austin Dillon # Advocare Chevrolet 81 35 79.0 $31,368 Running 10 5 54 Kyle Busch(i) Monster Energy Toyota 81 0 97.5 $24,050 Running 11 11 33 Brendan Gaughan(i) South Point Hotel & Casino Chevrolet 81 0 102.6 $28,818 Running 12 16 6 Ricky Stenhouse Jr. Ford EcoBoost Ford 81 32 90.5 $29,543 Running 13 23 44 Mike Bliss TriStar Motorsports Chevrolet 81 31 75.0 $28,218 Running 14 32 19 Tayler Malsam G-Oil/Noah's Light Foundation Toyota 81 30 67.9 $28,068 Running 15 20 87 Alex Kennedy Global Barter Corporation/Dream Factory Toyota 81 29 81.7 $28,918 Running 16 34 40 Erik Darnell Key Motorsports -

Post-Race Report

Loop Data Statistics Post-Race Report GEICO 400 September 16, 2012 Provided by STATS LLC and NASCAR - Sunday, September 16, 2012 NASCAR Sprint Cup Series Average Running Position Sum of driver position on each lap - divided by the laps run in the race. GEICO 400 Chicagoland Speedway September 16, 2012 Car Finish Average Rk. Number Driver Team Pos. Place 1 48 Jimmie Johnson Lowe's/Kobalt Tools 2 1.554 2 5 Kasey Kahne Farmers Insurance 3 2.981 3 2 Brad Keselowski Miller Lite 1 3.397 4 11 Denny Hamlin FedEx Ground 16 6.993 5 20 Joey Logano Dollar General 7 7.165 6 18 Kyle Busch Wrigley 4 7.479 7 15 Clint Bowyer 5-hour Energy 10 10.292 8 14 Tony Stewart Office Depot/Mobil 1 6 11.240 9 39 Ryan Newman Gene Haas Foundation Workshops For Warriors 5 11.843 10 17 Matt Kenseth Best Buy 18 13.599 11 55 Mark Martin LG Partner of the Year/Aaron's 14 13.607 12 88 Dale Earnhardt Jr. AMP Energy/7-Eleven/National Guard 8 14.045 13 99 Carl Edwards Fastenal 19 14.640 14 24 Jeff Gordon DuPont 35 15.603 15 43 Aric Almirola Farmland 17 15.742 16 16 Greg Biffle Scotch Blue 13 15.813 17 22 Sam Hornish Jr. Shell Pennzoil 11 15.925 18 56 Martin Truex Jr. NAPA Auto Parts 9 16.333 19 27 Paul Menard Menards/Libman 15 16.910 20 29 Kevin Harvick Budweiser 12 17.251 21 1 Jamie McMurray McDonald's 21 20.427 22 78 Regan Smith Furniture Row Racing/Farm American 34 21.079 23 21 Trevor Bayne Good Sam/Camping World 20 21.483 24 9 Marcos Ambrose Stanley 27 23.015 25 34 David Ragan Distraction.gov 22 23.101 26 51 Kurt Busch Phoenix Construction 32 23.775 27 31 Jeff Burton Caterpillar 24 24.891 28 42 Juan Pablo Montoya Target 23 27.101 29 47 Bobby Labonte Bubba Burger 26 29.468 30 10 Danica Patrick GoDaddy.com 25 29.704 31 38 David Gilliland 1800LoanMart 28 30.094 32 83 Landon Cassill Burger King 29 30.674 33 36 Dave Blaney Tommy Baldwin Racing 33 31.247 34 13 Casey Mears GEICO 36 31.693 35 32 T.J. -

Series Title Venue Location Date Year V

SERIES TITLE VENUE LOCATION DATE YEAR V# Ralph Miller video Watkins Glen 1949 V-0001 Twenty Five Years at Speed Watkins Glen 1972 V-0002 Watkins Glen Grand Prix Watkins Glen Watkins Glen, NY 1948-1953 V-0003 Graham Hill Tribute Video V-0004 Darrell Dean video Watkins Glen 1954-1980 V-0005 MG, Allard, Lister Banquet Watkins Glen 1998 V-0006 Watkins Glen Grand Prix (Muzzy film) vol 1 Watkins Glen Watkins Glen, NY 1948-1949 V-0007 Watkins Glen Grand Prix (Muzzy film) vol 2 Watkins Glen Watkins Glen, NY 1948-1949 V-0008 Racing in Watkins Glen (Dominick) Watkins Glen Watkins Glen, NY 1952 V-0009 Watkins Glen Grand Prix Weekend Watkins Glen Watkins Glen, NY 1952 V-0010 History of Motor Racing LeMans; et al 1934-1957 V-0011 NWC Budweiser at the Glen Watkins Glen International Watkins Glen, NY 1986-1987 V-0012 NASCAR 1987-1988 V-0013 TA Trans Am, Cleveland Burke Lakefront Airport Cleveland, OH July 2, 1988 1988 V-0014 Camel GT Watkins Glen Watkins Glen, NY 1989 V-0015 HIST Vintage races Watkins Glen Watkins Glen, NY 1995 V-0016 HIST Vintage races Watkins Glen Watkins Glen, NY 1996 V-0017 HIST Vintage races (Master) Watkins Glen Watkins Glen, NY 1996 V-0018 HIST Vintage races (Camera 2) Watkins Glen Watkins Glen, NY 1996 V-0019 HIST Vintage races Watkins Glen Watkins Glen, NY 1997 V-0020 HIST Vintage races (Camera 2) Watkins Glen Watkins Glen, NY 1996 V-0021 Watkins Glen International 50th Anniv. Watkins Glen Watkins Glen, NY 1998 V-0022 WATV Classics 30 Watkins Glen Watkins Glen, NY 1998 V-0023 Collier Automotive Museum Naples FL Naples FL V-0024 -

115410 Sprintcup2012mg:Layout 1.Qxd

NASCAR SPRINT CUP SERIES Teams 61 NASCAR SPRINT CUP SERIES / 2012 MEDIA GUIDE NASCAR SPRINT CUP SERIES Earnhardt Ganassi Racing with Felix Sabates Drivers: Jamie McMurray – No. 1 Bass Pro Shops/McDonald’s Chevrolet Juan Pablo Montoya – No. 42 Target Chevrolet Crew Chiefs: Kevin Manion (McMurray) Chris Heroy (Montoya) Engine Builder: Earnhardt Childress Racing Technologies Year: 4th First Full Season: 2009 Career Wins: 4 Career Poles: 15 Career Starts: 223 Best Points Finish: 8th (2009) First Win: Feb. 14, 2010 (Daytona) First Pole: Feb. 8, 2009 (Daytona) OWNERS: Teresa Earnhardt, Public Relations Contact: John Olguin Chip Ganassi, Felix Sabates 8500 Westmoreland Drive Concord, NC 28027 HIGHLIGHTS Tel: (704) 662-9642 Fax: (704) 663-0848 • Earnhardt Ganassi Racing had three poles, Email: [email protected] four top-five and 12 top-10 finishes in the Shop Address: 2011 NASCAR Sprint Cup Series 8500 Westmoreland Drive • Chip Ganassi’s five teams run in the Concord, NC 28027 NASCAR Sprint Cup Series, the IZOD IndyCar Series and GRAND-AM Rolex Series. In total, Team Twitter Account: @EGRTeams the teams finished the 2011 season with 11 Driver Twitter Accounts: @JamieMcMurray, @jpmontoya wins overall and two championships, in the IZOD IndyCar Series and the GRAND-AM Rolex Series – the organization’s 13th and 14th overall titles. • Third-year team formed by the partnership of Dale Earnhardt Inc., and Chip Ganassi Racing with Felix Sabates on Nov. 12, 2008. • In 2010 Chip Ganassi became the first owner in history to win all three of the major American auto races – the Daytona 500, the Indianapolis 500 and the Brickyard 400. -

OFFICIAL RACE REPORT No

NASCAR SPRINT CUP SERIES OFFICIAL RACE REPORT No. 1 54TH ANNUAL DAYTONA 500 DAYTONA INTERNATIONAL SPEEDWAY Daytona Beach, FL - February 27, 2012 2.5-Mile Paved Tri-Oval 200 Laps - 500 Miles Purse: $19,142,601 TIME OF RACE: 3 hours, 36 minutes, 2 seconds AVERAGE SPEED: 140.256 mph MARGIN OF VICTORY: 0.21 second(s) Fin Str Car Bns Driver Lead Pos Pos No Driver Team Laps Pts Pts Rating Winnings Status Tms Laps 1 4 17 Matt Kenseth Best Buy Ford 202 47 4 100.9 $1,588,887 Running 2 50 2 5 88 Dale Earnhardt Jr Diet Mountain Dew/National Guard Chevrolet 202 42 99.5 1,103,150 Running 3 2 16 Greg Biffle 3M Ford 202 42 1 126.2 804,163 Running 8 44 4 31 11 Denny Hamlin FedEx Express Toyota 202 42 2 124.7 702,091 Running 3 57 5 9 31 Jeff Burton Caterpillar Chevrolet 202 40 1 117.7 564,550 Running 2 24 6 37 27 Paul Menard Menards/Peak Chevrolet 202 39 1 90.4 427,900 Running 1 2 7 13 29 Kevin Harvick Budweiser Chevrolet 202 37 83.0 415,261 Running 8 1 99 Carl Edwards Fastenal Ford 202 36 81.1 403,466 Running 9 12 20 Joey Logano The Home Depot Toyota 202 36 1 104.4 346,063 Running 1 2 10 22 55 Mark Martin Aaron's Toyota 202 35 1 90.5 323,313 Running 1 2 11 30 15 Clint Bowyer 5-hour Energy Toyota 202 33 91.6 339,002 Running 12 26 56 Martin Truex Jr NAPA Auto Parts Toyota 202 33 1 106.7 535,052 Running 2 7 13 7 9 Marcos Ambrose Stanley Ford 202 31 93.8 342,358 Running 14 32 47 Bobby Labonte Kroger Toyota 202 30 67.2 331,196 Running 15 24 36 Dave Blaney Ollie's Bargain Outlet Chevrolet 202 30 1 70.2 296,513 Running 1 6 16 3 14 Tony Stewart Office Depot/Mobil 1 Chevrolet 202 29 1 82.6 377,775 Running 1 2 17 14 18 Kyle Busch M&M's Brown Toyota 202 27 80.2 341,821 Running 18 43 32 Terry Labonte C&J Energy Ford 202 27 1 63.6 316,150 Running 1 3 19 41 26 Tony Raines Front Row Motorsports Ford 202 25 51.8 317,676 Running 20 21 6 Ricky Stenhouse Jr(i) Ford EcoBoost Ford 202 0 64.9 353,063 Running 21 18 39 Ryan Newman U.S. -

Post-Race Report

Loop Data Statistics Post-Race Report Quicken Loans 400 June 17, 2012 Provided by STATS LLC and NASCAR - Sunday, June 17, 2012 NASCAR Sprint Cup Series Average Running Position Sum of driver position on each lap - divided by the laps run in the race. Quicken Loans 400 Michigan International Speedway June 17, 2012 Car Finish Average Rk. Number Driver Team Pos. Place 1 16 Greg Biffle 3M/Salute 4 4.150 2 14 Tony Stewart Office Depot/Mobil 1 2 4.565 3 17 Matt Kenseth Ford EcoBoost 3 6.805 4 88 Dale Earnhardt Jr. Diet Mtn.Dew/The Dark Knight Rises/National Guard 1 6.865 5 9 Marcos Ambrose Stanley 9 7.080 6 15 Clint Bowyer 5-hour Energy 7 7.100 7 55 Mark Martin Aaron's Dream Machine 29 8.030 8 24 Jeff Gordon DuPont 6 11.150 9 42 Juan Pablo Montoya Target 8 11.500 10 2 Brad Keselowski Miller Lite 13 13.810 11 48 Jimmie Johnson Lowe's 5 14.500 12 39 Ryan Newman US ARMY 15 14.985 13 27 Paul Menard Menards/Duracell 22 15.730 14 56 Martin Truex Jr. NAPA Auto Parts 12 15.990 15 43 Aric Almirola Medallion 17 16.600 16 99 Carl Edwards Fastenal 11 16.670 17 29 Kevin Harvick Budweiser Folds of Honor 10 16.675 18 20 Joey Logano The Home Depot 35 17.945 19 78 Regan Smith Furniture Row 28 18.845 20 47 Bobby Labonte Charter 16 19.265 21 22 A J Allmendinger Shell Pennzoil 19 20.650 22 1 Jamie McMurray McDonald's 14 20.970 23 31 Jeff Burton Caterpillar 21 21.485 24 5 Kasey Kahne Farmers Insurance 33 21.835 25 33 Austin Dillon American Ethanol 24 21.900 26 11 Denny Hamlin FedEx Office 34 22.935 27 13 Casey Mears Valvoline NEXTGEN 20 25.035 28 83 Landon Cassill Burger King 18 25.600 29 18 Kyle Busch Snickers 32 26.475 30 34 David Ragan 23 26.675 31 36 Dave Blaney Seal Wrap 25 26.720 32 38 David Gilliland Long John Silver's 27 29.035 33 93 Travis Kvapil Burger King 26 29.930 34 51 Kurt Busch Phoenix Construction Services, Inc.