Third Avenue Real Estate Value Fund | As of June 30, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Taylor Woodrow Plc Report and Accounts 2006 Our Aim Is to Be the Homebuilder of Choice

Taylor Woodrow plc Report and Accounts 2006 Our aim is to be the homebuilder of choice. Our primary business is the development of sustainable communities of high-quality homes in selected markets in the UK, North America, Spain and Gibraltar. We seek to add shareholder value through the achievement of profitable growth and effective capital management. Contents 01 Group Financial Highlights 54 Consolidated Cash Flow 02 Chairman’s Statement Statement 05 Chief Executive’s Review 55 Notes to the Consolidated 28 Board of Directors Financial Statements 30 Report of the Directors 79 Independent Auditors’ Report 33 Corporate Governance Statement 80 Accounting Policies 37 Directors’ Remuneration Report 81 Company Balance Sheet 46 Directors’ Responsibilities 82 Notes to the Company Financial Statement Statements 47 Independent Auditors’ Report 87 Particulars of Principal Subsidiary 48 Accounting Policies Undertakings 51 Consolidated Income Statement 88 Five Year Review 52 Consolidated Statement of 90 Shareholder Facilities Recognised Income and Expense 92 Principal Taylor Woodrow Offices 53 Consolidated Balance Sheet Group Financial Highlights • Group revenues £3.68bn (2005: £3.56bn) • Housing profit from operations* £469m (2005: £456m) • Profit before tax £406m (2005: £411m) • Basic earnings per share 50.5 pence (2005: 50.6 pence) • Full year dividend 14.75 pence (2005: 13.4 pence) • Net gearing 18.6 per cent (2005: 23.7 per cent) • Equity shareholders’ funds per share 364.7 pence (2005: 338.4 pence) Profit before tax £m 2006 405.6 2005 411.0 2004 403.9 Full year dividend pence (Represents interim dividends declared and paid and final dividend for the year as declared by the Board) 2006 14.75 2005 13.4 2004 11.1 Equity shareholders’ funds per share pence 2006 364.7 2005 338.4 2004 303.8 * Profit from operations is before joint ventures’ interest and tax (see Note 3, page 56). -

Disclaimer Strictly Not to Be Forwarded to Any

DISCLAIMER STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS IMPORTANT: You must read the following disclaimer before reading, accessing or making any other use of the attached document relating to SEGRO plc (the “Company”) dated 10 March 2017. In accessing the attached document, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached document is confidential and intended for you only and you agree you will not forward, reproduce, copy, download or publish this electronic transmission or the attached document (electronically or otherwise) to any other person. The attached document has been prepared solely in connection with the proposed rights issue and offering of nil paid rights, fully paid rights and new ordinary shares (the “Securities”) of the Company (the “Transaction”). The Prospectus has been published in connection with the admission of the Securities to the Official List of the UK Financial Conduct Authority (the ‘‘Financial Conduct Authority’’) and to trading on the London Stock Exchange plc’s main market for listed securities (together, ‘‘Admission’’). The Prospectus has been approved by the Financial Conduct Authority as a prospectus prepared in accordance with the Prospectus Rules made under section 73A of the Financial Services and Markets Act 2000, as amended. NOTHING IN THIS ELECTRONIC TRANSMISSION AND THE ATTACHED DOCUMENT CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. -

NYCHA Facilities and Service Centers

NYCHA Facilities and Service Centers BOROUGH DEVELOPMENT NAME ADDRESS Manhattan Baruch 595- 605 FDR Drive Staten Island Berry Houses 44 Dongan Hills Brooklyn Farragut 228 York Street Manhattan Harborview Terrace 536 West 56th Street Brooklyn Howard 1620 E N Y Avenue Manhattan Lexington 115 East 98th Steet Brooklyn Marcus Garvey 1440 E N Y Avenue Bronx Monroe 1802 Story Avenue Bronx Pelham Parkway 975 Waring Avenue Brooklyn Pink 2702 Linden Boulevard Queens Ravenswood 34-35A 12th Street Queens Ravenswood 34-35A 12th Street Brooklyn Red Hook East 110 West 9th Street Brooklyn Saratoga Square 930 Halsey Street Manhattan Washington Hts Rehab (Groups I and II) 500 West 164th Street Manhattan Washington Hts Rehab (Groups I and II) 503 West 177th Street Manhattan Wilson 405 East 105th Steet Manhattan Wise Towers/WSURA 136 West 91st Steet Brooklyn Wyckoff Gardens 266 Wyckoff Street Page 1 of 148 10/01/2021 NYCHA Facilities and Service Centers POSTCO STATUS SPONSOR DE Occupied Henry Street Settlement, Inc. Occupied Staten Island Mental Health Society, Inc. 10306 Occupied Spanish Speaking Elderly Council - RAICES Occupied NYCHA 10019 NYCHA HOLD NYCHA 11212 Occupied Lexington Children's Center 10029 Occupied Fort Greene Senior Citizens Council 11212 Vacant NYCHA Occupied Jewish Association Services For the Aged Occupied United Community Centers Occupied HANAC, Inc. 11106 Occupied HANAC, Inc. Occupied Spanish Speaking Elderly Council - RAICES Occupied Ridgewood-Bushwick Sr Citizens Council, Inc. Vacant NYCHA Occupied Provider Name Unknown Occupied -

Rising to the Challenge a Review of Risk and Viability Disclosures in September 2015 Annual Reports January 2016 Contents

Rising to the challenge A review of risk and viability disclosures in September 2015 annual reports January 2016 Contents 1. Introduction 0105 2. Acid test 02 3. Have companies improved their risk disclosures? 03 4. Have boards risen to the viability statement challenge? 07 5. How well do companies explain their monitoring of risk management and internal control systems and the review of their effectiveness? 12 6. Conclusion 15 7. Appendix: companies reviewed 16 8. Contacts 17 1. Introduction Since the Financial Reporting Council (FRC) updated the UK Our sample of 14 ARAs is relatively small as we reviewed only Corporate Governance Code (the ‘2014 Code’) in September 2014, those FTSE 350 companies that had published their ARAs by 6 the new provisions on risk management and viability have been the January 2016.1 We scoped our review in this way in the interests subject of widespread discussion. of providing our observations as quickly as possible, so that they may be of help to premium listed companies with December 2015 In particular, and unsurprisingly, the new viability statement has year-ends as they finalise their processes to comply with the 2014 taken centre stage. With its roots in the findings of the Sharman Code and draft their ARA disclosures. Inquiry, this new requirement represents a shift in the way companies and their boards need to publicly articulate their view Our review focused on the disclosures companies made, but as of the company’s prospects and, for some, in the way they think we have emphasised previously,2 the viability statement is the end about and prepare for the future. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

XINT F UK Real Estate P GBP Index

As of December 30, 2020 XINT F UK Real Estate P GBP Index DE000A13PXZ5 GBP The XINT F UK Real Estate P GBP Index is a free-float adjusted index, designed to track the performance of real estate companies and REITS listed on the London Stock Exchange. INDEX PERFORMANCE - PRICE RETURN 120 115 110 105 100 95 90 85 80 75 70 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Returns (p.a) Standard Deviation (p.a) Maximum Drawdown 3M 69.43% 3M 23.80% From 14.02.2020 6M 21.90% 6M 21.90% To 19.03.2020 1Y -17.08% 1Y -17.08% Return -38.63% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com Top 10 Constituents FFMV (GBPm) Weight % Industry Sector Segro PLC 11,298 19.84 Real Estate Land Securities Group PLC 4,910 8.62 Real Estate British Land Company PLC 4,630 8.13 Real Estate Unite Group PLC 3,341 5.87 Real Estate Derwent London PLC 3,136 5.51 Real Estate Tritax Big Box REIT Plc 2,866 5.03 Real Estate LondonMetric Property PLC 2,059 3.61 Real Estate Assura PLC 2,021 3.55 Real Estate Primary Health Properties PLC 1,989 3.49 Real Estate Grainger PLC 1,900 3.34 Real Estate Total 38,151 66.99 This information has been prepared by Index Intelligence GmbH (“IIG”). All information is provided "as is" and IIG makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included herein. -

Supersized Billboards in Times Square Command Ever-Increasing Rents

MARKETVIEW MANHATTAN RETAIL Manhattan Retail, Q1 2015 Supersized billboards in Times Square command ever-increasing rents U.S. Consumer Confidence Index U.S. Retail Sales U.S. Unemployment Rate U.S Retail Trade Employment (Mar 2015) 101.3 (Mar 2015) 0.9% (Mar 2015) 5.5% (Mar 2015) 26,000 *Arrows indicate month-over-month change Figure 1: Key Economic Indicators NYC NYC Manhattan NYC Unemployment Rate Retail Job Count Retail Sales Volume Private Sector Job Count 6.6% i352.3 K i1.5 B h23 K (March 2015) (March 2015) (Q1 2015) (March 2015) *Arrows indicate month-over-month change, except for Manhattan Retail Sales Volume, Sources: The Conference Board; U.S. Department of Commerce; U.S. Department of Labor; which is quarter-over-quater. New York State Department of Labor; Real Capital Analytics. RETAIL NEWS • Brookfield place celebrated its grand • Bloomingdale’s will debut its first outlet store opening after undergoing a $250 million located in an urban center, at 2085 redevelopment. With 375,000 sq. ft. of retail Broadway. Slated to open by fall 2015, the space, the luxury mall features Diane von company’s 14th outlet store will occupy Furstenberg, Tory Burch, Omega and Vince 25,000 sq. ft. across three stories. among its tenant roster, as well as innovative • General Growth Properties Inc. recently dining destinations Le District and Hudson purchased the retail co-op at 85 Fifth Avenue Eats. for $86 million. Located one block west of Union Square, the building contains 12,946 • Set to become the second largest residential sq. ft. of retail space across the ground floor building in Manhattan, 606 W. -

Building Excellence

Barratt Developments PLC Building excellence Annual Report and Accounts 2017 Annual Report and Accounts 2017 Inside this report 1 45 113 175 Strategic Report Governance Financial Statements Other Information 1 Key highlights 46 The Board 114 Independent Auditor’s Report 175 KPI definitions and why we measure 2 A snapshot of our business 48 Corporate governance report 119 Consolidated Income Statement 176 Glossary 4 Our performance and financial highlights 60 Nomination Committee report 119 Statement of Comprehensive Income 177 Other Information 6 How we create and preserve value 65 Audit Committee report 120 Statement of Changes in 8 Chairman’s statement 74 Safety, Health and Environment Shareholders’ Equity – Group 10 Key aspects of our market Committee report 121 Statement of Changes in 76 Remuneration report Shareholders’ Equity – Company 12 Chief Executive’s statement Notice regarding limitations on Directors’ liability under 106 Other statutory disclosures 122 Balance Sheets English law 17 Our Strategic priorities Under the Companies Act 2006, a safe harbour limits the 112 Statement of Directors’ 123 Cash Flow Statements liability of Directors in respect of statements in, and omissions from, the Strategic Report contained on pages 1 to 44 and the Our principles Responsibilities 124 Notes to the Financial Statements Directors’ Report contained on pages 45 to 112. Under English Law the Directors would be liable to the Company (but not to 34 Keeping people safe any third party) if the Strategic Report and/or the Directors’ Report contains errors as a result of recklessness or knowing 35 Being a trusted partner misstatement or dishonest concealment of a material fact, 36 Building strong but would not otherwise be liable. -

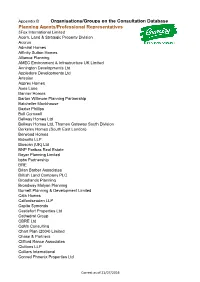

Organisations/Groups on the Consultation Database Planning

Appendix B Organisations/Groups on the Consultation Database Planning Agents/Professional Representatives 3Fox International Limited Acorn, Land & Strategic Property Division Acorus Admiral Homes Affinity Sutton Homes Alliance Planning AMEC Environment & Infrastructure UK Limited Annington Developments Ltd Appledore Developments Ltd Artesian Asprey Homes Axes Lane Banner Homes Barton Willmore Planning Partnership Batcheller Monkhouse Baxter Phillips Bell Cornwell Bellway Homes Ltd Bellway Homes Ltd, Thames Gateway South Division Berkeley Homes (South East London) Berwood Homes Bidwells LLP Bioscan (UK) Ltd BNP Paribas Real Estate Boyer Planning Limited bptw Partnership BRE Brian Barber Associates British Land Company PLC Broadlands Planning Broadway Malyan Planning Burnett Planning & Development Limited Cala Homes Calfordseaden LLP Capita Symonds Castlefort Properties Ltd Cathedral Group CBRE Ltd CgMs Consulting Chart Plan (2004) Limited Chase & Partners Clifford Rance Associates Cluttons LLP Colliers International Conrad Phoenix Properties Ltd Correct as of 21/07/2016 Conrad Ritblat Erdman Co-Operative Group Ltd., Countryside Strategic Projects plc Cranbrook Home Extensions Crest Nicholson Eastern Crest Strategic Projectsl Ltd Croudace D & M Planning Daniel Watney LLP Deloitte Real Estate DHA Planning Direct Build Services Limited DLA Town Planning Ltd dp9 DPDS Consulting Group Drivers Jonas Deloitte Dron & Wright DTZ Edwards Covell Architecture & Planning Fairclough Homes Fairview Estates (Housing) Ltd Firstplan FirstPlus Planning Limited -

Sidewalk Clock, 1501 Third Avenue and the Proposed Designation of the Related Landmark Site (Item No

Landmarks Preservation Commission August 25, 1981, Designation List 147 LP-1169 SIDEWALK CLOCK, I501Third Avenue, Borough of Manhattan. Manufacturer: E. Howard Clock Company. Landmark Site: The portion of the sidewalk on which the described improvement is situated adjacent to Borough of Manhattan, Tax Map Block 1530, Lot 47. On May 13, 1980, the Landmarks Preservation CoIIIDlission held a public hearing on the proposed designation as a Landmark of the Sidewalk Clock, 1501 Third Avenue and the proposed designation of the related Landmark Site (Item No. 41). The hearing had been duly advertised in accordance with the provisions of law. Four witnesses spoke in favor of designation. There were no speakers in opposition to des ignation. DESCRIPTION AND ANALYSIS One of the most important and essential parts of New York's historical fabric is its "street furniture" -- Jiamp posts, street clocks, sign posts, and benches that enhance and maintain the intimacy and scale of neighborhood blocks. Perhaps the most striking of these street amenities are the oversize cast-iron post or sidewalk clocks that proudly dominate city sidewalks. These clocks proliferated in American cities well after the turn of the twentieth century but many have since fallen prey to automobile accidents and sidewalk ordinances. One of the few that existsin New York t oday is the clock at No. 1501 Third Avenue. Introduced in the 1860s, cast-iron street clocks we re popular both as everyday conveniences and as novel advertising devices. A small business concern that stayed in the same location year aft er year would buy a street clock and ins tall it directly in front of the store, often painting the name of the business onto the clock face.