Firm Foundations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ECON Thesaurus on Brexit

STUDY Requested by the ECON Committee ECON Thesaurus on Brexit Fourth edition Policy Department for Economic, Scientific and Quality of Life Policies Authors: Stephanie Honnefelder, Doris Kolassa, Sophia Gernert, Roberto Silvestri Directorate General for Internal Policies of the Union July 2017 EN DIRECTORATE GENERAL FOR INTERNAL POLICIES POLICY DEPARTMENT A: ECONOMIC AND SCIENTIFIC POLICY ECON Thesaurus on Brexit Fourth edition Abstract This thesaurus is a collection of ECON related articles, papers and studies on the possible withdrawal of the UK from the EU. Recent literature from various sources is categorised, chronologically listed – while keeping the content of previous editions - and briefly summarised. To facilitate the use of this tool and to allow an easy access, certain documents may appear in more than one category. The thesaurus is non-exhaustive and may be updated. This document was provided by Policy Department A at the request of the ECON Committee. IP/A/ECON/2017-15 July 2017 PE 607.326 EN This document was requested by the European Parliament's Committee on Economic and Monetary Affairs. AUTHORS Stephanie HONNEFELDER Doris KOLASSA Sophia GERNERT, trainee Roberto SILVESTRI, trainee RESPONSIBLE ADMINISTRATOR Stephanie HONNEFELDER Policy Department A: Economic and Scientific Policy European Parliament B-1047 Brussels E-mail: [email protected] LINGUISTIC VERSIONS Original: EN ABOUT THE EDITOR Policy departments provide in-house and external expertise to support EP committees and other parliamentary bodies -

Fighting Economic Crime - a Shared Responsibility!

THIRTY-SEVENTH INTERNATIONAL SYMPOSIUM ON ECONOMIC CRIME SUNDAY 1st SEPTEMBER - SUNDAY 8th SEPTEMBER 2019 JESUS COLLEGE, UNIVERSITY OF CAMBRIDGE Fighting economic crime - a shared responsibility! Centre of Development Studies The 37th Cambridge International Symposium on Economic Crime Fighting economic crime- a shared responsibility! The thirty-seventh international symposium on economic crime brings together, from across the globe, a unique level and depth of expertise to address one of the biggest threats facing the stability and development of all our economies. The overarching theme for the symposium is how we can better and more effectively work together in preventing, managing and combating the threat posed by economically motivated crime and abuse. The programme underlines that this is not just the responsibility of the authorities, but us all. These important and timely issues are considered in a practical, applied and relevant manner, by those who have real experience whether in law enforcement, regulation, compliance or simply protecting their own or another’s business. The symposium, albeit held in one of the world’s leading universities, is not a talking shop for those with vested interests or for that matter an academic gathering. We strive to offer a rich and deep analysis of the real issues and in particular threats to our institutions and economies presented by economic crime and abuse. Well over 700 experts from around the world will share their experience and knowledge with other participants drawn from policy makers, law enforcement, compliance, regulation, business and the professions. The programme is drawn up with the support of a number of agencies and organisations across the globe and the Organising Institutions and principal sponsors greatly value this international commitment. -

Whole Day Download the Hansard

Monday Volume 681 28 September 2020 No. 109 HOUSE OF COMMONS OFFICIAL REPORT PARLIAMENTARY DEBATES (HANSARD) Monday 28 September 2020 © Parliamentary Copyright House of Commons 2020 This publication may be reproduced under the terms of the Open Parliament licence, which is published at www.parliament.uk/site-information/copyright/. HER MAJESTY’S GOVERNMENT MEMBERS OF THE CABINET (FORMED BY THE RT HON. BORIS JOHNSON, MP, DECEMBER 2019) PRIME MINISTER,FIRST LORD OF THE TREASURY,MINISTER FOR THE CIVIL SERVICE AND MINISTER FOR THE UNION— The Rt Hon. Boris Johnson, MP CHANCELLOR OF THE EXCHEQUER—The Rt Hon. Rishi Sunak, MP SECRETARY OF STATE FOR FOREIGN,COMMONWEALTH AND DEVELOPMENT AFFAIRS AND FIRST SECRETARY OF STATE— The Rt Hon. Dominic Raab, MP SECRETARY OF STATE FOR THE HOME DEPARTMENT—The Rt Hon. Priti Patel, MP CHANCELLOR OF THE DUCHY OF LANCASTER AND MINISTER FOR THE CABINET OFFICE—The Rt Hon. Michael Gove, MP LORD CHANCELLOR AND SECRETARY OF STATE FOR JUSTICE—The Rt Hon. Robert Buckland, QC, MP SECRETARY OF STATE FOR DEFENCE—The Rt Hon. Ben Wallace, MP SECRETARY OF STATE FOR HEALTH AND SOCIAL CARE—The Rt Hon. Matt Hancock, MP SECRETARY OF STATE FOR BUSINESS,ENERGY AND INDUSTRIAL STRATEGY—The Rt Hon. Alok Sharma, MP SECRETARY OF STATE FOR INTERNATIONAL TRADE AND PRESIDENT OF THE BOARD OF TRADE, AND MINISTER FOR WOMEN AND EQUALITIES—The Rt Hon. Elizabeth Truss, MP SECRETARY OF STATE FOR WORK AND PENSIONS—The Rt Hon. Dr Thérèse Coffey, MP SECRETARY OF STATE FOR EDUCATION—The Rt Hon. Gavin Williamson CBE, MP SECRETARY OF STATE FOR ENVIRONMENT,FOOD AND RURAL AFFAIRS—The Rt Hon. -

Register of Members' Interests

Tees Valley Combined Authority: Register of Members’ Interests As a Member of the Tees Valley Combined Authority, I declare that I have the following disclosable pecuniary and/or non-pecuniary interests. (Please state ‘None’ where appropriate, do not leave any boxes blank). Name: …… Jonathan Munby ……………………………………………… NOTIFICATION OF CHANGE OF CIRCUMSTANCES Each Member shall review their individual register of interests before each, submitting any necessary revisions to the Monitoring Officer at the start of the meeting. Any recorded interests relevant to the meeting should also be declared at this point. Even if a meeting has not taken place a Member must, within 28 clear working days of becoming aware of any change to the interests specified below, provide written notification to the Monitoring Officer, of that change. *SPOUSE/PARTNER – In the notice below my spouse or partner means anyone who meets the definition in the Localism Act, i.e. my spouse or civil partner, or a person with whom I am living as a spouse or a person with whom I am living as if we are civil partners, and I am aware that that person has the interest having carried out a reasonable level of investigation. Where your spouse or partner has recently been involved in any activity which would have been declarable, this should be mentioned, with the date the activity ended. SECTION 1 ANY EMPLOYMENT, OFFICE, TRADE, MYSELF SPOUSE/PARTNER* PROFESSION OR VOCATION CARRIED ON FOR PROFIT OR GAIN 1.1 Name of: Teesside University Middlesbrough Council o your employer(s) o any business carried on by you o any other role in which you receive remuneration(this includes remunerated roles such as councillors). -

General Election 2019: Mps in Wales

Etholiad Cyffredinol 2019: Aelodau Seneddol yng Nghymru General Election 2019: MPs in Wales 1 Plaid Cymru (4) 5 6 Hywel Williams 2 Arfon 7 Liz Saville Roberts 2 10 Dwyfor Meirionnydd 3 4 Ben Lake 8 12 Ceredigion Jonathan Edwards 14 Dwyrain Caerfyrddin a Dinefwr / Carmarthen East and Dinefwr 9 10 Ceidwadwyr / Conservatives (14) Virginia Crosbie Fay Jones 1 Ynys Môn 13 Brycheiniog a Sir Faesyfed / Brecon and Radnorshire Robin Millar 3 Aberconwy Stephen Crabb 15 11 Preseli Sir Benfro / Preseli Pembrokeshire David Jones 4 Gorllewin Clwyd / Clwyd West Simon Hart 16 Gorllewin Caerfyrddin a De Sir Benfro / James Davies Carmarthen West and South Pembrokeshire 5 Dyffryn Clwyd / Vale of Clwyd David Davies Rob Roberts 25 6 Mynwy / Monmouth Delyn Jamie Wallis Sarah Atherton 33 8 Pen-y-bont ar Ogwr / Bridgend Wrecsam / Wrexham Alun Cairns 34 Simon Baynes Bro Morgannwg / Vale of Glamorgan 9 12 De Clwyd / Clwyd South 13 Craig Williams 11 Sir Drefaldwyn / Montgomeryshire 14 15 16 25 24 17 23 21 22 26 18 20 30 27 19 32 28 31 29 39 40 36 33 Llafur / Labour (22) 35 37 Mark Tami 38 7 34 Alyn & Deeside / Alun a Glannau Dyfrdwy Nia Griffith Gerald Jones 17 23 Llanelli Merthyr Tudful a Rhymni / Merthyr Tydfil & Rhymney Tonia Antoniazzi Nick Smith Chris Bryant 18 24 30 Gwyr / Gower Blaenau Gwent Rhondda Geraint Davies Nick Thomas-Symonds Chris Elmore Jo Stevens 19 26 31 37 Gorllewin Abertawe / Swansea West Tor-faen / Torfaen Ogwr / Ogmore Canol Caerdydd / Cardiff Central Carolyn Harris Chris Evans Stephen Kinnock Stephen Doughty 20 27 32 38 Dwyrain Abertawe / -

Agenda, Tuesday 3Rd March 2020

Bishop Auckland Town Council The Four Clocks Centre, 154a Newgate Street, Bishop Auckland, Co. Durham DL14 7EH Tel: 01388 609852 Email: [email protected] Website: www.bishopauckland-tc.gov.uk Town Clerk: David Anderson TO: ALL MEMBERS OF THE COUNCIL 26th February 2020 Dear Councillor, I hereby give you notice that the next meeting of Bishop Auckland Town Council will be held in the Wesley Room at The Four Clocks Centre on Tuesday, 3rd March 2020 at 6.00 p.m. Yours sincerely David Anderson Clerk to the Council AGENDA 1. Apologies for absence 2. Declarations of Interest To invite members to declare any interest they may have. 3. Public Participation (Subject to Public Participation Policy) Presentations Time Allocation* *The Mayor will be flexible with the amount of time allocated where it is helpful to the debate. 4. Town Team 1. Core Team (Chairman, Nigel Bryson) 10 mins presentation 2. Events Team (Chairman, Clive Auld) 5 mins questions 5. Minutes To approve the Minutes of the following meetings:- Town Council 21st January 2020 Planning Committee 21st January 2020 Human Resources Committee 11th February 2020 Town Council 18th February 2020 Finance Committee 25th February 2020 6. Matters Arising To receive any matters arising from the above Minutes which are not included elsewhere on the agenda (for information only). 1 - 39 7. Report of Mayor To receive a report from the Mayor detailing activities attended to represent the Council since the Annual Meeting. 8. Report of Town Clerk 1. Bishop Auckland Town Team, Request to Draw Down Funds 2. Bishop Auckland Town Team, Request for Funding 3. -

Brexit and the Future of the US–EU and US–UK Relationships

Special relationships in flux: Brexit and the future of the US–EU and US–UK relationships TIM OLIVER AND MICHAEL JOHN WILLIAMS If the United Kingdom votes to leave the European Union in the referendum of June 2016 then one of the United States’ closest allies, one of the EU’s largest member states and a leading member of NATO will negotiate a withdrawal from the EU, popularly known as ‘Brexit’. While talk of a UK–US ‘special relation- ship’ or of Britain as a ‘transatlantic bridge’ can be overplayed, not least by British prime ministers, the UK is a central player in US–European relations.1 This reflects not only Britain’s close relations with Washington, its role in European security and its membership of the EU; it also reflects America’s role as a European power and Europe’s interests in the United States. A Brexit has the potential to make a significant impact on transatlantic relations. It will change both the UK as a country and Britain’s place in the world.2 It will also change the EU, reshape European geopolitics, affect NATO and change the US–UK and US–EU relationships, both internally and in respect of their place in the world. Such is the potential impact of Brexit on the United States that, in an interview with the BBC’s Jon Sopel in summer 2015, President Obama stated: I will say this, that having the United Kingdom in the European Union gives us much greater confidence about the strength of the transatlantic union and is part of the corner- stone of institutions built after World War II that has made the world safer and more prosperous. -

Foresight Hindsight

Hindsight, Foresight ThinkingI Aboutnsight, Security in the Indo-Pacific EDITED BY ALEXANDER L. VUVING DANIEL K. INOUYE ASIA-PACIFIC CENTER FOR SECURITY STUDIES HINDSIGHT, INSIGHT, FORESIGHT HINDSIGHT, INSIGHT, FORESIGHT Thinking About Security in the Indo-Pacific Edited by Alexander L. Vuving Daniel K. Inouye Asia-Pacific Center for Security Studies Hindsight, Insight, Foresight: Thinking About Security in the Indo-Pacific Published in September 2020 by the Daniel K. Inouye Asia-Pacific Center for Security Studies, 2058 Maluhia Rd, Honolulu, HI 96815 (www.apcss.org) For reprint permissions, contact the editors via [email protected] Printed in the United States of America Cover Design by Nelson Gaspar and Debra Castro Library of Congress Cataloging-in-Publication Data Name: Alexander L. Vuving, editor Title: Hindsight, Insight, Foresight: Thinking About Security in the Indo-Pacific / Vuving, Alexander L., editor Subjects: International Relations; Security, International---Indo-Pacific Region; Geopolitics---Indo-Pacific Region; Indo-Pacific Region JZ1242 .H563 2020 ISBN: 978-0-9773246-6-8 The Daniel K. Inouye Asia-Pacific Center for Security Studies is a U.S. Depart- ment of Defense executive education institution that addresses regional and global security issues, inviting military and civilian representatives of the United States and Indo-Pacific nations to its comprehensive program of resident courses and workshops, both in Hawaii and throughout the Indo-Pacific region. Through these events the Center provides a focal point where military, policy-makers, and civil society can gather to educate each other on regional issues, connect with a network of committed individuals, and empower themselves to enact cooperative solutions to the region’s security challenges. -

THE 422 Mps WHO BACKED the MOTION Conservative 1. Bim

THE 422 MPs WHO BACKED THE MOTION Conservative 1. Bim Afolami 2. Peter Aldous 3. Edward Argar 4. Victoria Atkins 5. Harriett Baldwin 6. Steve Barclay 7. Henry Bellingham 8. Guto Bebb 9. Richard Benyon 10. Paul Beresford 11. Peter Bottomley 12. Andrew Bowie 13. Karen Bradley 14. Steve Brine 15. James Brokenshire 16. Robert Buckland 17. Alex Burghart 18. Alistair Burt 19. Alun Cairns 20. James Cartlidge 21. Alex Chalk 22. Jo Churchill 23. Greg Clark 24. Colin Clark 25. Ken Clarke 26. James Cleverly 27. Thérèse Coffey 28. Alberto Costa 29. Glyn Davies 30. Jonathan Djanogly 31. Leo Docherty 32. Oliver Dowden 33. David Duguid 34. Alan Duncan 35. Philip Dunne 36. Michael Ellis 37. Tobias Ellwood 38. Mark Field 39. Vicky Ford 40. Kevin Foster 41. Lucy Frazer 42. George Freeman 43. Mike Freer 44. Mark Garnier 45. David Gauke 46. Nick Gibb 47. John Glen 48. Robert Goodwill 49. Michael Gove 50. Luke Graham 51. Richard Graham 52. Bill Grant 53. Helen Grant 54. Damian Green 55. Justine Greening 56. Dominic Grieve 57. Sam Gyimah 58. Kirstene Hair 59. Luke Hall 60. Philip Hammond 61. Stephen Hammond 62. Matt Hancock 63. Richard Harrington 64. Simon Hart 65. Oliver Heald 66. Peter Heaton-Jones 67. Damian Hinds 68. Simon Hoare 69. George Hollingbery 70. Kevin Hollinrake 71. Nigel Huddleston 72. Jeremy Hunt 73. Nick Hurd 74. Alister Jack (Teller) 75. Margot James 76. Sajid Javid 77. Robert Jenrick 78. Jo Johnson 79. Andrew Jones 80. Gillian Keegan 81. Seema Kennedy 82. Stephen Kerr 83. Mark Lancaster 84. -

Daily Report Thursday, 14 January 2021 CONTENTS

Daily Report Thursday, 14 January 2021 This report shows written answers and statements provided on 14 January 2021 and the information is correct at the time of publication (06:29 P.M., 14 January 2021). For the latest information on written questions and answers, ministerial corrections, and written statements, please visit: http://www.parliament.uk/writtenanswers/ CONTENTS ANSWERS 7 Police and Crime BUSINESS, ENERGY AND Commissioners: Elections 15 INDUSTRIAL STRATEGY 7 Schools: Procurement 16 Additional Restrictions Grant 7 Veterans: Suicide 16 Business: Coronavirus 7 DEFENCE 17 Business: Grants 8 Armed Forces: Health Conditions of Employment: Services 17 Re-employment 9 Defence: Expenditure 17 Industrial Health and Safety: HMS Montrose: Repairs and Coronavirus 9 Maintenance 18 Motor Neurone Disease: HMS Queen Elizabeth: Research 10 Repairs and Maintenance 18 Podiatry: Coronavirus 11 DIGITAL, CULTURE, MEDIA AND Public Houses: Coronavirus 11 SPORT 19 Wind Power 12 British Telecom: Disclosure of Information 19 CABINET OFFICE 13 Broadband: Elmet and Civil Servants: Business Rothwell 20 Interests 13 Broadband: Greater London 20 Coronavirus: Disease Control 13 Chatterley Whitfield Colliery 21 Coronavirus: Lung Diseases 13 Data Protection 22 Debts 14 Educational Broadcasting: Fisheries: UK Relations with Coronavirus 23 EU 14 Events Industry and Iron and Steel: Procurement 14 Performing Arts: Greater National Security Council: London 23 Coronavirus 15 Football: Dementia 24 Football: Gambling 24 Organic Food: UK Trade with Freedom of Expression -

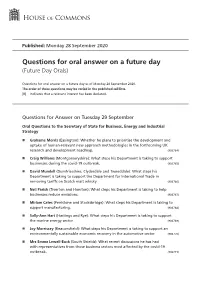

View Future Day Orals PDF File 0.11 MB

Published: Monday 28 September 2020 Questions for oral answer on a future day (Future Day Orals) Questions for oral answer on a future day as of Monday 28 September 2020. The order of these questions may be varied in the published call lists. [R] Indicates that a relevant interest has been declared. Questions for Answer on Tuesday 29 September Oral Questions to the Secretary of State for Business, Energy and Industrial Strategy Grahame Morris (Easington): Whether he plans to prioritise the development and uptake of human-relevant new approach methodologies in the forthcoming UK research and development roadmap. (906764) Craig Williams (Montgomeryshire): What steps his Department is taking to support businesses during the covid-19 outbreak. (906765) David Mundell (Dumfriesshire, Clydesdale and Tweeddale): What steps his Department is taking to support the Department for International Trade in removing tariffs on Scotch malt whisky. (906766) Neil Parish (Tiverton and Honiton): What steps his Department is taking to help businesses reduce emissions. (906767) Miriam Cates (Penistone and Stocksbridge): What steps his Department is taking to support manufacturing. (906768) Sally-Ann Hart (Hastings and Rye): What steps his Department is taking to support the marine energy sector. (906769) Joy Morrissey (Beaconsfield): What steps his Department is taking to support an environmentally sustainable economic recovery in the automotive sector. (906770) Mrs Emma Lewell-Buck (South Shields): What recent discussions he has had with representatives from those business sectors most affected by the covid-19 outbreak. (906771) 2 Monday 28 September 2020 QUESTIONS FOR ORAL ANSWER ON A FUTURE DAY Neale Hanvey (Kirkcaldy and Cowdenbeath): What recent discussions he has had with (a) Cabinet colleagues and (b) the Scottish Government on the economic effect on businesses of the UK Internal Market Bill. -

Members of the House of Commons December 2019 Diane ABBOTT MP

Members of the House of Commons December 2019 A Labour Conservative Diane ABBOTT MP Adam AFRIYIE MP Hackney North and Stoke Windsor Newington Labour Conservative Debbie ABRAHAMS MP Imran AHMAD-KHAN Oldham East and MP Saddleworth Wakefield Conservative Conservative Nigel ADAMS MP Nickie AIKEN MP Selby and Ainsty Cities of London and Westminster Conservative Conservative Bim AFOLAMI MP Peter ALDOUS MP Hitchin and Harpenden Waveney A Labour Labour Rushanara ALI MP Mike AMESBURY MP Bethnal Green and Bow Weaver Vale Labour Conservative Tahir ALI MP Sir David AMESS MP Birmingham, Hall Green Southend West Conservative Labour Lucy ALLAN MP Fleur ANDERSON MP Telford Putney Labour Conservative Dr Rosena ALLIN-KHAN Lee ANDERSON MP MP Ashfield Tooting Members of the House of Commons December 2019 A Conservative Conservative Stuart ANDERSON MP Edward ARGAR MP Wolverhampton South Charnwood West Conservative Labour Stuart ANDREW MP Jonathan ASHWORTH Pudsey MP Leicester South Conservative Conservative Caroline ANSELL MP Sarah ATHERTON MP Eastbourne Wrexham Labour Conservative Tonia ANTONIAZZI MP Victoria ATKINS MP Gower Louth and Horncastle B Conservative Conservative Gareth BACON MP Siobhan BAILLIE MP Orpington Stroud Conservative Conservative Richard BACON MP Duncan BAKER MP South Norfolk North Norfolk Conservative Conservative Kemi BADENOCH MP Steve BAKER MP Saffron Walden Wycombe Conservative Conservative Shaun BAILEY MP Harriett BALDWIN MP West Bromwich West West Worcestershire Members of the House of Commons December 2019 B Conservative Conservative