Public Version

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Di Grande Risparmio Su Ortofrutta, Carne, Pesce, Gastronomia, Pane E

* . di grande risparmio su ortofrutta, carne, 14 pesce, gastronomia, GIORNI pane e pasticceria. Extracoop. ed Ipercoop Coop, Supermercati nei garantiti minimi sconti gli rappresentano indicate percentuali Le E nei weekend 21-22-23* e 28-29-30* maggio arrivano SPECIALISSIMI con o erte fresche fresche da non perdere. *per i negozi aperti 21-22-23 MAGGIO MOZZARELLA MACINATO SCELTO SC , LATTE DI BOVINO ADULTO PUGLIESE ORIGINE COOP CAPURSO , confezione 600 g -% , take away, 500 g , al kg , SC al kg MOSCARDINI SC C ONFEZIONE SC al kg PASTE FRESCHE vari gusti Paneenuto fresco da o o pane parzialmente o surgelatoenuto co da o o pane crudo surgelato o decongelato: care da verifi nel singolo punto vendita. , , SC_ SC_ Le percentuali indicate rappresentano gli sconti minimi garantiti nei Supermercati Coop, Ipercoop ed Extracoop. 28-29-30 MAGGIO INSALATA DI MARE SC FUSI 850 g SC , take away, 1 kg O SOVRACOSCE 950 g DI POLLO ORIGINE COOP , confezione maxi. -% , Esempio: fusi 850 g , al kg SC CUORE DI MERLUZZO SC MELONE RETATO NORDICO sfuso, al kg al kg , , SC_ Le percentuali indicate rappresentano gli sconti minimi garantiti nei Supermercati Coop, Ipercoop ed Extracoop. SALAME PAESANO I GUSTOSI SC SA.VEN so ovuoto, take away, 350 g , , al kg PROSCIUTTO COTTO SC SPECK DELL'ALTO SC SCELTO ADIGE IGP SENFTER al taglio, al kg , al taglio, al kg , BRESAOLA DI BOVINO SC ANGUS GARDANI al taglio, al kg , LASAGNE DI CARNE SC STRACCHINO SC al kg BIANCADE , 170 g , , al kg SC_ SC_ Le percentuali indicate rappresentano gli sconti minimi garantiti nei Supermercati Coop, Ipercoop ed Extracoop. -

Cas N° COMP/M.6242 - LACTALIS/ PARMALAT

FR Cas n° COMP/M.6242 - LACTALIS/ PARMALAT Le texte en langue française est le seul disponible et faisant foi. REGLEMENT (EC) n° 139/2004 SUR LES CONCENTRATIONS Article 6, paragraphe 1, point b) NON-OPPOSITION date: 14/06/2011 En support électronique sur le site Internet EUR-Lex sous le numéro de document 32011M6242 Commission européenne, B-1049 Bruxelles / Europese Commissie, B-1049 Brussel - Belgium. Telephone: (32-2) 299 11 11. COMMISSION EUROPÉENNE Bruxelles, le 14/06/2011 C(2011) 4278 Dans la version publique de cette décision, des informations ont été supprimées conformément VERSION PUBLIQUE à l'article 17 (2) du règlement du Conseil (CE) n° 139/2004 concernant la non-divulgation des secrets d'affaires et autres informations confidentielles. Les omissions sont donc indiquées par [...]. Quand cela était possible, les informations omises ont été remplacées par des PROCÉDURE DE CONTRÔLE DES fourchettes de chiffres ou une description OPÉRATIONS DE CONCENTRATION générale. A la partie notifiante: Madame, Monsieur, Objet: Affaire n COMP/M.6242 - LACTALIS/ PARMALAT Décision de la Commission en application de l’article 6(1)(b) du règlement (CE) n°139/2004 du Conseil1 1. Le 4 Mai 2011, la Commission européenne a reçu notification, conformément à l’article 4 du règlement sur les concentrations, d’un projet de concentration par lequel Groupe Lactalis ("Lactalis", France), contrôlé par BSA S.A., (France), acquiert au sens de l'article 3, paragraphe 1, point b), du règlement sur les concentrations, le contrôle de l'ensemble des activités de l'entreprise Parmalat S.p.A ("Parmalat", Italie) par achat d'actions à hauteur de 28.97% du capital de Parmalat et offre publique d'achat annoncée le 26 avril 2011. -

Servizio Informativo N° 28/2020 Del 10 Luglio 2020 - RISERVATO AGLI ASSOCIATI

A S S O C A S E A R I ASSOCIAZIONE COMMERCIO PRODOTTI LATTIERO - CASEARI Servizio informativo N° 28/2020 del 10 Luglio 2020 - RISERVATO AGLI ASSOCIATI - NORME E NOTIZIE MERCATO LATTIERO-CASEARIO - Andamento settimanale PAG. 02 BIOLOGICO - Etichettatura, le modifiche al regolamento: www.alimentando.info PAG. 03 SCAMBI UE/MERCOSUR - Accordo, aggiornamenti sui prossimi step PAG. 03 ESPORTAZIONI VERSO PAESI TERZI - BRASILE - Preoccupazioni commerciali della Commissione UE PAG. 03 STATI UNITI E FRANCIA - I formaggi tradizionali reagiscono al Covid-19: Clal PAG. 04 STATI UNITI - Esteso il "Farmers to Families Food Box Program" PAG. 05 OCEANIA - Situazione dal 22 giugno al 3 luglio 2020: Clal PAG. 05 FORMAGGI D.O.P. E I.G.P. - Nuovi testi normativi PAG. 06 FORMAGGI D.O.P. - "PARMIGIANO REGGIANO" - In vendita a Natale lo stagionato 40 mesi PAG. 07 FORMAGGI D.O.P. - "PARMIGIANO REGGIANO" - Dal produttore al consumatore, nasce il nuovo shop on- line: www.parmigianoreggiano.it PAG. 07 FORMAGGI - Nasce il presidio Slow Food del pecorino di Carmasciano: www.alimentando.info PAG. 08 FORMAGGI D.O.P. - "PECORINO ROMANO" - Avviato un progetto promozionale in Giappone PAG. 08 FORMAGGI D.O.P. - "ASIAGO" - Futuro sempre più naturale e salutare: www.asiagocheese.it PAG. 08 FIERE ED EVENTI – CremonaFiere conferma tutte le manifestazioni in autunno: www.alimentando.info PAG. 09 MERCATO AGROALIMENTARE E LATTIERO-CASEARIO - Le news di Formaggi&Consumi dal 4 al 10 luglio 2020 PAG. 10 MERCATO LATTIERO-CASEARIO - Asta Global Dairy Trade del 07/07/20: Clal PAG. 13 FORMAGGI D.O.P. - "GORGONZOLA" - Produzione giugno 2020: Consorzio di Tutela del Formaggio Gorgonzola PAG. -

ACS 2018 Judging & Competition Awards

ACS 2018 Judging & Competition Awards Listed in order of presentation at the ACS Awards Ceremony on Friday, July 28, 2018 R. BUTTERS Whey Butter, Salted Butter, Sweet Butter, Cultured Butter, etc. RC: Salted Butter with or without cultures - made from cow's milk 3rd Cultured Butter COWS CREAMERY, Prince Edward Island COWS CREAMERY 2nd Gray Salt Butter Cherry Valley Dairy, Washington Blain Hages 1st Lightly Salted Cultured Butter Vermont Creamery, Vermont Vermont Creamery Butter Team RO: Unsalted Butter with or without cultures - made from cow's milk 3rd Brethren Butter Amish Style Handrolled Unsalted Butter Graf Creamery Inc., Wisconsin Roy M. Philippi 2nd Lactantia Premium Cultured salted butter Parmalat Canada, Ontario Winchester Butter Team 1st Unsalted Cultured Butter Cherry Valley Dairy, Washington Blain Hages RM: Butter with or without cultures - made from goat's milk 2nd Celebrity Goat’s Milk Butter Atalanta Corporation/Mariposa Dairy, Ontario Pieter vanOudenaren Q. CULTURED MILK AND CREAM PRODUCTS Limited to Buttermilk, Yogurt, Sour Cream, Crème Fraiche, Kefir, Labneh, etc. QF: Crème Fraiche and Sour Cream Products - made from cow's milk 3rd Crème Fraiche Bellwether Farms, California Liam Callahan 2nd Cabot Sour Cream Cabot Creamery Cooperative, Vermont Team Cabot Creamery 1st Alouette Crème Fraȋche Savencia Cheese USA, Pennsylvania Team New Holland QK: Kefir, Drinkable Yogurt, Buttermilk, and Other Drinkable Cultured Products - all milks 3rd Karoun Whole Milk Kefir Drink Karoun Dairies Inc, California Jaime Graca 1st Fresa Drinkable -

Gourmet Cheese Cards (GCC43)

GOURMET CHEESE CARDS GCC43 PROMOTE BOTH DOMESTIC AND IMPORTED CHEESE Mailing Address: P.O. Box 2118 Huntington Beach, CA 92647-0118 Plant, Offi ce & Showroom Address: 15662 Producer Lane Huntington Beach, CA 92649-1310 TOLL-FREE PHONE: (800) 852-2806 • TOLL-FREE FAX: (800) 774-8884 –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– DATE _________________________________ P.O. NO. ____________________________ ACCOUNT NAME ______________________________ STORE NO. ________________ ADDRESS _______ ____________________________________________________________ CITY ______________________________________________ ZIP ___________________ PHONE ____________________________ ORDERED BY _________________________ PLEASE SELECT FROM LIST BELOW Actual size: 4” x 3” / (2) colors: Black & Pale Yellow _____ Alouette Cups _____ Domestic Parmesan Wheel _____ Low Sodium Muenster _____ Sonoma Hot Pepper Jack _____ Appenzeller Swiss _____ Domestic Romano _____ Low Sodium Provolone _____ Sonoma Pesto Jack _____ Asiago _____ Domestic Romano Wheel _____ Low Sodium Swiss _____ Sonoma Traditional Jack _____ Baby Edam _____ Double Gloucester _____ Mascarpone _____ St. Andre _____ Baby Gouda _____ Double Gloucester _____ Mini Brie _____ Stilton _____ Baby Jack with Stilton _____ Monterey Jack _____ Stilton with Lemon Zest _____ Baby Swiss _____ Doux De Montagne _____ Montrachet _____ String Cheese _____ Beer Kaese _____ Edam Loaf _____ Montrachet with Herbs _____ Suisse Delicate _____ Bel Paese _____ English Cheddar _____ Morbier _____ Suisse -

A Guide to Kowalski's Specialty Cheese Read

Compliments of Kowalski’s WWW.KOWALSKIS.COM A GUIDE TO ’ LOCALOUR FAVORITE CHEESES UNDERSTANDING CHEESE TYPES ENTERTAINING WITH CHEESE CHEESE CULTURES OF THE WORLD A PUBLICATION WRITTEN AND PRODUCED BY KOWALSKI’S MARKETS Printed November 2015 SPECIALTY CHEESE EXPERIENCE or many people, Kowalski’s Specialty Cheese Department Sadly, this guide could never be an all-inclusive reference. is their entrée into the world of both cheese and Kowalski’s Clearly there are cheese types and cheesemakers we haven’t Fitself. Many a regular shopper began by exclusively shopping mentioned. Without a doubt, as soon as this guide goes to this department. It’s a tiny little microcosm of the full print, our cheese selection will have changed. We’re certainly Kowalski’s experience, illustrating oh so well our company’s playing favorites. This is because our cheese departments are passion for foods of exceptional character and class. personal – there is an actual person in charge of them, one Cheese Specialist for each and every one of our 10 markets. When it comes to cheese, we pay particular attention Not only do these specialists have their own faves, but so do to cheeses of unique personality and incredible quality, their customers, which is why no two cheese sections look cheeses that are perhaps more rare or have uncommon exactly the same. But though this special publication isn’t features and special tastes. We love cheese, especially local all-encompassing, it should serve as an excellent tool for cheeses, artisanal cheeses and limited-availability treasures. helping you explore the world of cheese, increasing your appreciation and enjoyment of specialty cheese and of that Kowalski’s experience, too. -

ANALYST PRESENTATION Star Conference 2016 London, October

ANALYST PRESENTATION Star Conference 2016 London, October 6th 2016 Business combination through the merger by incorporation of Centrale del Latte di Firenze Form and terms for the transaction From September, the 30th the merger by incorporation of CLF in CLT has taken effect. TERMS FOR THE TRANSACTION Exchange Rate n. 1 new ordinary share of CLT for 6.1965 ordinary CLF shares; CLT has increased its share capital from Euro 20,600,000 to 28,840,041.20 by issuing 4,000,020 new ordinary shares; Further to the merger, CLT has changed the name in CENTRALE DEL LATTE D’ITALIA S.p.A. and the ordinary shares are still listed on the MTA STAR segment organized and managed by Borsa Italiana S.p.A. (Alphanumeric Code: CLI ); Immediately after the effectiveness of the merger, CLI has transferred the firm CLF at the value of 24,780,000 Euro into a new company 100% subsidiary of CLI called Centrale del Latte della Toscana S.p.A. with the head office and plant in Florence. October, 6th 2016 London, STAR Conference 2016 Shareholders after the transaction Finanziaria Centrale del Latte di Torino S.p.A. Lavia S.S. 36,99% 29,87% City of Florence Fidi Toscana Firenze Chamber of Commerce City of Pistoia 2,56% Luzzati's Family 5,26% 2,31% Other shareholders < 5% 3,94% 6,83% 12,25% October,October, 6 th62016th 2016 London,London, STAR STAR Conference Conference 2016 2016 The new Company Centrale del Latte d’Italia S.p.A. 100 % 100 % 50% Centrale del Latte della Toscana Centrale del Latte di Vicenza Odilla Chocolat S.r.l. -

Latte E Formaggi

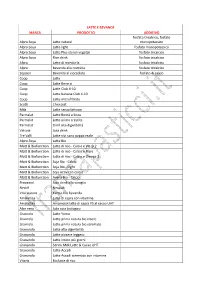

LATTE E BEVANDE MARCA PRODOTTO ADDITIVO fosfato tricalcico, fosfato Alpro Soya Latte natural monopotassico Alpro Soya Latte light fosfato monopotassico Alpro Soya Latte Plus steroli vegetali fosfato tricalcico Alpro Soya Rice drink fosfato tricalcico Alpro Latte di mandorla fosfato tricalcico Alpro Bevanda alla nocciola fosfato tricalcico Sojasun Bevanda al cioccolato fosfato di calcio Coop Latte Coop Latte Bene si Coop Latte Club 4-10 Coop Latte banana Club 4-10 Coop Latte microfiltrato Scotti Chiccolat Mila Latte senza lattosio Parmalat Latte Bontà e linea Parmalat Latte prima crescita Parmalat Zimil alta digeribilità Valsoia Soia drink Tre Valli Latte vivi sano pappa reale Alpro Soya Latte Bio Matt & Biofunction Latte di riso - Calcio e Vit. D 2 Matt & Biofunction Latte di riso - Calcio e Fibre Matt & Biofunction Latte di riso - Calcio e Omega 3 Matt & Biofunction Soja Bio - Calcio Matt & Biofunction Soja Bio - Light Matt & Biofunction Soja Activ con calcio Matt & Biofunction Avena Bio - Calcio Provamel Soia drink alla vaniglia Nestlè Nesquik Vital nature Kamut bio bevanda Amalattea Latte di capra con vitamine Amalattea Amamciok latte di capra PS al cacao UHT Alce nero Solo soia biologico Granrolo Latte Yomo Granrolo Latte prima natura bio intero Granrolo Latte prima natura bio scremato Granarolo Latte alta digeribilità Granarolo Latte piacere leggero Granarolo Latte intero più giorni Granarolo Sdrink Milk Latte & Cacao UHT Granarolo Latte Accadi Granarolo Latte Accadi scremato con vitamine Vitariz Bio latte di riso Yakult Latte scremato -

Technological Strategies to Preserve Burrata Cheese Quality

coatings Article Technological Strategies to Preserve Burrata Cheese Quality Cristina Costa 1, Annalisa Lucera 1, Amalia Conte 1,*, Angelo Vittorio Zambrini 2 and Matteo Alessandro Del Nobile 1 1 Department of Agricultural Sciences, Food and Environment, University of Foggia, Via Napoli, 25–71122 Foggia, Italy; [email protected] (C.C.); [email protected] (A.L.); [email protected] (M.A.D.N.) 2 Department of Quality, Innovation, Safety, Environment, Granarolo S.p.A., Via Cadriano, 27/2–40127 Bologna, Italy; [email protected] * Correspondence: [email protected]; Tel.: +39-881-589-240 Received: 4 May 2017; Accepted: 4 July 2017; Published: 9 July 2017 Abstract: Burrata cheese is a very perishable product due to microbial proliferation and undesirable sensory changes. In this work, a step-by-step optimization approach was used to design proper processing and packaging conditions for burrata in brine. In particular, four different steps were carried out to extend its shelf life. Different headspace gas compositions (MAP-1 30:70 CO2:N2; MAP-2 50:50 CO2:N2 and MAP-3 65:35 CO2:N2) were firstly tested. To further promote product preservation, a coating was also optimized. Then, antimicrobial compounds in the filling of the burrata cheese (lysozyme and Na2-EDTA) and later in the coating (enzymatic complex and silver nanoparticles) were analyzed. To evaluate the quality of the samples, in each step headspace gas composition, microbial population, and pH and sensory attributes were monitored during storage at 8 ± 1 ◦C. The results highlight that the antimicrobial compounds in the stracciatella, coating with silver nanoparticles, and packaging under MAP-3 represent effective conditions to guarantee product preservation, moving burrata shelf life from three days (control sample) to ten days. -

62 Final List of 2019 ACS Judging & Competition Winners RC BUTTERS

Final List of 2019 ACS Judging & Competition Winners RC BUTTERS Salted Butter with or without cultures - made from cow's milk 3rd PLACE Organic Valley Salted Butter CROPP Cooperative/Organic Valley, Wisconsin Team Chaseburg 2nd PLACE CROPP/Organic Valley Salted Butter CROPP Cooperative/Organic Valley, Wisconsin Team McMinnville 1st PLACE Brethren Butter Amish Style Handrolled Salted Butter Graf Creamery Inc., Wisconsin Roy M. Philippi RO BUTTERS Unsalted Butter with or without cultures - made from cow's milk 3rd PLACE Cabot Unsalted Butter Cabot Creamery Cooperative, Massachusetts Team West Springfield 3rd PLACE Organic Valley Cultured Butter, Unsalted CROPP Cooperative/Organic Valley, Wisconsin Team Chaseburg 2nd PLACE CROPP/Organic Valley Pasture Butter, Cultured CROPP Cooperative/Organic Valley, Wisconsin Team McMinnville 1st PLACE Organic Valley European Style Cultured Butter, Unsalted CROPP Cooperative/Organic Valley, Wisconsin Team Chaseburg P a g e 1 | 62 RM BUTTERS Butter with or without cultures - made from goat's milk 3rd PLACE Celebrity Butter (Salted) Atalanta Corporation/Mariposa Dairy, Ontario Pieter Van Oudenaren 2nd PLACE Bella Capra Goat Butter Sierra Nevada Cheese Company, California Ben Gregersen QF CULTURED MILK AND CREAM PRODUCTS Creme Fraiche and Sour Cream Products - made from cow's milk 3rd PLACE Crema Supremo Sour Cream V&V Supremo Foods, Illinois Team Michoacan 2nd PLACE Creme Fraiche Sierra Nevada Cheese Company, California Ben Gregersen 1st PLACE Creme Agria (Sour Cream) Marquez Brothers International, Inc., California Marquez Brothers International, Inc. QK CULTURED MILK AND CREAM PRODUCTS Kefir, Drinkable Yogurt, Buttermilk, and Other Drinkable Cultured Products - all milks 3rd PLACE Karoun Whole Milk Kefir Drink Karoun Dairies LLC, California Jaime Graca P a g e 2 | 62 2nd PLACE Jocoque Marquez Brothers International, Inc., California Marquez Brothers International, Inc. -

Microbiological Risk Assessment of Raw Milk Cheese

Microbiological Risk Assessment of Raw Milk Cheese Risk Assessment Microbiology Section December 2009 MICROBIOLOGICAL RISK ASSESSMENT OF RAW MILK CHEESES ii TABLE OF CONTENTS ACKNOWLEDGEMENTS ................................................................................................. VII ABBREVIATIONS ............................................................................................................. VIII 1. EXECUTIVE SUMMARY .................................................................................................. 1 2. BACKGROUND ................................................................................................................... 8 3. PURPOSE AND SCOPE ..................................................................................................... 9 3.1 PURPOSE...................................................................................................................... 9 3.2 SCOPE .......................................................................................................................... 9 3.3 DEFINITION OF RAW MILK CHEESE ............................................................................... 9 3.4 APPROACH ................................................................................................................ 10 3.5 OTHER RAW MILK CHEESE ASSESSMENTS .................................................................. 16 4. INTRODUCTION .............................................................................................................. 18 4.1 CLASSIFICATION -

Pasta Flyer Pasta Brochure 9.20

Meat Filled Ravioli Braised Beef Ravioli Slow braised hanger steak blended with asiago and Parmesan cheeses, grilled onions in a Chianti reduction; wrapped in par cooked egg pasta. (Medium Hexagon) 71612 2/3 lb. Approx. 15-16 per lb. Bolognese Ravioli Classic slow simmered “Bolognese” meat ragu’ cooked with Chianti wine and blended with Parmesan and Mozzarella cheeses; wrapped in par cooked egg pasta. (Medium Square) 71702 2/3 lb. 23-24 per lb Sausage & Broccolini Ravioli Roasted Italian sausage blended with roasted garlic, broccolini, red bell pepper and Pecorino Romano and Fontina cheeses; wrapped in par cooked egg pasta. (Large Square) 71732 2/3 lb. 11-12 per lb. Grilled Chicken & 3 Cheese Ravioli Grilled chicken breast blended with ricotta, mozzarella and asiago cheeses, roasted garlic and rosemary; wrapped in par cooked egg pasta. (Medium Hexagon) 71804 2/3 lb. 15-16 per lb. Cannelloni & Manicotti Grilled Chicken and Spinach Cannelloni Grilled chicken breast and spinach blended with ricotta, mozzarella, Parmesan and fontina cheeses, roasted garlic and lemon; wrapped in egg pasta. 71618 2/3.2 lb. 39-41 per lb. Seafood Cannelloni Maine lobster meat, bay scallops and shrimp blended with roasted garlic; wrapped in egg pasta. 71616 2/3.1.25 lb. Approx. 39-41 per case Three Cheese Manicotti Ricotta cheese blended with mozzarella, Parmesan cheeses and light cream; wrapped in egg pasta. 71614 2/3.125 lb. Approx. 39-41 per case (S) Vegetable Filled Ravioli Butternut Squash & Sage Ravioli Roasted butternut squash blended with Parmesan, amaretti cookies and brown sugar; wrapped in par cooked sage pasta.