10Th Annual Report for the Financial Year 2019-2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GC Influencers Have Been Chosen Following Research Among Private Practice Lawyers and Other In-House Counsel

v GC Influencers INDIA 2019 Thursday, 14th February 2019 Hyatt Regency Delhi Programme Engaging content, networking and celebration with leading General Counsel and top ranked lawyers globally. GC Influencers For more informationINDIA visit 2019 chambers.com A5-Advert-Forums.idml 1 22/10/2018 12:17 Welcome SARAH KOGAN Editor Chambers Asia-Pacific Meet the most influential General Counsel in India today. Chambers has provided insight into the legal profession for over 30 years. During this time, in-house lawyers and third-party experts have shared their views on the value and importance placed on the role of the General Counsel. No longer just the ethical and legal heart of a business, these professionals now sit as influential participants at board level. Effective mangers, industry pioneers, diversity and CSR champions: these Influencers show the way. Research Methodology: Our GC Influencers have been chosen following research among private practice lawyers and other in-house counsel. We identified the key areas in which GCs have displayed substantial influence: Engaging content, • Effective management and development of an in-house team • Navigation of substantial business projects such as M&A or strategic networking and business change. • Development of litigation strategy and understanding the pressures faced celebration with leading within industry General Counsel and top • Bringing diversity & inclusion and CSR to the forefront of industry. ranked lawyers globally. • Ability to influence and respond to regulatory change Our aim is to celebrate excellence within the legal profession. This dynamic hall of fame encourages collaboration among the in-house legal community. Our GC Influencers have created best practice pathways endorsed by both private practice and other in-house lawyers. -

Nayara Energy Annual Report 2017-18

Nayara Energy Limited (Formerly known as Essar Oil Limited) Contents Corporate Overview Ushering in a New Era 01 We are Nayara Energy 02 Nayara Energy: The Brand 04 Year in Review 06 Message from the Chairman 08 From the CEO’s Desk 10 Corporate Information 13 Board of Directors 14 Management Committee 16 Reports Directors’ Report 17 Financial Statement Standalone Independent Auditor’s Report 49 Balance Sheet 56 Statement of Profit and Loss 57 Cash Flow Statement 58 Statement of Changes in Equity 60 Notes 62 Consolidated Independent Auditor’s Report 116 Balance Sheet 120 Statement of Profit and Loss 122 Cash Flow Statement 124 Statement of Changes in Equity 126 Notes 129 Form AOC-1 195 Notice AGM Notice 197 2 Annual Report 2017-18 Corporate Overview Reports Financial Statements Ushering in a New Era The world needs energy and more of it. As economies grow, the demand for energy keeps increasing at a rapid pace. At Nayara Energy, our pursuit of excellence continues as we usher in a new era with a new brand identity and vigour. In FY 2017-18, the Refinery processed crude higher than rated capacity with our SPM registering highest ever crude intake. Our High Speed Diesel (HSD) production surpassed our previous best. This has helped us enrich our product portfolio. We have also expanded the retail network further with over 1000 new outlets opened during the year. As we continue ushering into a new era, we have re-emphasised our focus on Health, Environment, and Safety (HSE) while looking at planning for fresh investments in new assets and good governance. -

Research Journey

Impact Factor – 6.261 Special Issue - 96 A Jan. 2019 ISSN – 2348-7143 Impact Factor – 6.261 Special Issue - 96 B Jan. 2019 ISSN – 2348-7143 INTERNATIONAL RESEARCH FELLOWS ASSOCIATION’S INTERNATIONAL RESEARCH FELLOWS ASSOCIATION’S RESEARCH JOURNEY RESEARCH JOURNEY UGC Approved Journal UGC Approved Journal Multidisciplinary International E-research Journal Multidisciplinary International E-research Journal 30th National Conference of Maharashtra State Commerce Association 30th National Conference of Maharashtra State Commerce Association Commerce and Management in 21st Century 12th 13th Jan. 2019 Commerce and Management in 21st Century 12th 13th Jan. 2019 Organized by Organized by The Bodwad Sarv. Co-op. Education Society Ltd Bodwad Sanchlit The Bodwad Sarv. Co-op. Education Society Ltd Bodwad Sanchlit Arts, Commerce and Science College, Bodwad Dist- Jalgaon (M.S.) Arts, Commerce and Science College, Bodwad Dist- Jalgaon (M.S.) GUEST EDITOR GUEST EDITOR Professor Arvind N. Chaudhari Professor Arvind N. Chaudhari EXECUTIVE EDITOR ASSOCIATE EDITOR CHIEF EDITOR EXECUTIVE EDITOR ASSOCIATE EDITOR CHIEF EDITOR Dr. Parag A. Narkhede Mr. Vivek V. Yawalkar Mr. Dhanraj T. Dhangar Dr. Parag A. Narkhede Mr. Vivek V. Yawalkar Mr. Dhanraj T. Dhangar This Journal is indexed in : This Journal is indexed in : - Scientific Journal Impact Factor (SJIF) - Scientific Journal Impact Factor (SJIF) - Cosmoc Impact Factor (CIF) - Cosmoc Impact Factor (CIF) - Global Impact Factor (GIF) - Global Impact Factor (GIF) - Universal Impact Factor (UIF) - Universal Impact -

Spl. Judge, Cbi (04) (2G Spectrum Cases), New Delhi

IN THE COURT OF O. P. SAINI: SPL. JUDGE, CBI (04) (2G SPECTRUM CASES), NEW DELHI 1. CC No: 01(B)/11 2. Case RC No: 45 (A) 2009, CBI, ACB, New Delhi. 3. Title: CBI Vs. (1) Ravi Kant Ruia (A-1); (2) Anshuman Ruia (A-2); (3) I. P. Khaitan (A-3); (4) Smt. Kiran Khaitan (A-4); (5) Vikash Saraf (A-5); (6) M/s Loop Telecom Limited (A-6); (7) M/s Loop Mobile India Limited (A-7); and (8) M/s Essar Teleholdings Limited (A-8). 4. Date of Institution : 12.12.2011 5. Date of Commencement of Final Arguments : 01.04.2015 6. Date of Conclusion of Final Arguments : 24.04.2017 7. Date of Reserving Order : 05.12.2017 8. Date of Pronouncement : 21.12.2017 Presence/ Appearance: Sh. Anand Grover Sr. Advocate/ Spl. PP with Sh. K. K. Goel & Sh. A. K. Rao Sr. PPs, Ms. Sonia Mathur Advocate, Sh. Nikhil Borwankar; Sh. Mihir Samson & Ms. Chitralekha Das Junior Counsel and Inspector Manoj Kumar for CBI. CBI Vs. Ravi Kant Ruia and others Page 1 of 526 Sh. Harish Salve Sr. Advocate with Ms. Neeha Nagpal Advocate for accused M/s Essar Teleholdings Limited (A-8); Dr. Abhishek Manu Singhvi Sr. Advocate with Sh. Mahesh Aggarwal, Ms. Neeha Nagpal and Ms. Smriti Sinha Advocates for accused Ravi Kant Ruia (A-1) and Anshuman Ruia (A-2); Sh. Dayan Krishnan Sr. Advocate with Sh. Arshdeep Singh Khurana Advocate for accused I. P. Khaitan (A-3), Ms. Kiran Khaitan (A-4) and M/s Loop Telecom Limited (A-6); Sh. -

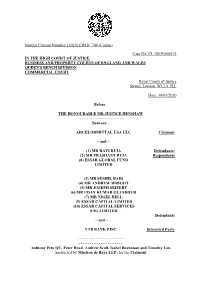

High Court Judgment Template

Neutral Citation Number: [2020] EWHC 740 (Comm) Case No: CL-2019-000674 IN THE HIGH COURT OF JUSTICE BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES QUEEN'S BENCH DIVISION COMMERCIAL COURT Royal Courts of Justice Strand, London, WC2A 2LL Date: 30/03/2020 Before : THE HONOURABLE MR JUSTICE HENSHAW - - - - - - - - - - - - - - - - - - - - - Between : ARCELORMITTAL USA LLC Claimant - and – (1) MR RAVI RUIA Defendants/ (2) MR PRASHANT RUIA Respondents (8) ESSAR GLOBAL FUND LIMITED (3) MR SUSHIL BAID (4) MR ANDREW WRIGHT (5) MR JOSEPH SEIFERT (6) MR UDAY KUMAR GUJADHUR (7) MR NIGEL BELL (9) ESSAR CAPITAL LIMITED (10) ESSAR CAPITAL SERVICES (UK) LIMITED Defendants – and – VTB BANK PJSC Interested Party - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Anthony Peto QC, Peter Head, Andrew Scott, Isabel Buchanan and Timothy Lau (instructed by Mischon de Reya LLP) for the Claimant Paul McGrath QC and Ruth Den Besten (instructed by Stephenson Harwood) for the First and Second Defendants Paul Stanley QC and David Peters (instructed by Quinn Emmanuel Urquhart & Sullivan UK LLP) for the Eighth Defendant Adrian Beltrami QC and Ian Higgins (instructed by Dechert LLP) for the Interested Party Hearing dates: 3 and 4 March 2020 Draft Judgment circulated on 19 March 2020 Approved Judgment I direct that pursuant to CPR PD 39A para 6.1 no official shorthand note shall be taken of this Judgment and that copies of this version as handed down may be treated as authentic. ............................. Covid-19 Protocol: This judgment was handed down by the judge remotely by circulation to the parties’ representatives by email and release to Bailii. The date and time for hand-down is deemed to be 30 March 2020 at 2:00 pm. -

Annual Report 2019 - 20

Essar Ports Limited Annual Report 2019 - 20 INDEX 1 Corporate Information 02 2 Managing Director’s Message 03 3 Company Profile 04 4 Facility Details 06 5 Notice of Annual General Meeting 10 6 Directors’ Report 15 7 Auditor’s Report (Standalone) 38 8 Financial Statement (Standalone) 44 9 Auditor’s Report (Consolidated) 86 10 Financial Statement (Consolidated) 90 CORPORATE INFORMATION BOARD OF DIRECTORS NOMINATION AND REMUNERATION COMMITTEE Shri. P. K. Srivastava (Chairman) Shri. P. K. Srivastava Shri. Dilip J. Thakkar Chairman Shri. Nikhil Naik Shri. Rajiv Agarwal Capt. B.S. Kumar Managing Director & CEO CORPORATE SOCIAL RESPONSIBILITY COMMITTEE Shri. Dilip J. Thakkar Shri. Rajiv Agarwal (Chairman) Independent Director Shri. P. K. Srivastava Capt. B. S. Kumar Shri. Nikhil Nail Independent Director Capt. B. S. Kumar Shri. K. K. Sinha REGISTRARS & TRANSFER AGENTS Wholetime Director Data Software Research Company Private Limited Shri. Nikhil Naik 19, Pycroft Garden Road, Nominee Director Off Haddows Road Nungambakkam Chennai 600006 Tel: + 91 44 2821 3738, 2821 4487 CHIEF FINANCIAL OFFICER Fax: +91 44 2821 4636 Shri. Sanjeev Taneja e-mail: [email protected] COMPANY SECRETARY CORPORATE INFORMATION Smt. Neelam Jagdish Thanvi REGISTERED OFFICE Salaya Administrative Building ER-2 Building, Salaya, Taluka Khambhalia AUDITORS District Devbhumi Dwarka, MSKA & Associates, Chartered Accountants Jamnagar Gujarat 361 305 Floor 2, Enterprise Centre, Nehru Road, Tel: +91 2833 664440 New Domestic Airport, Fax: +91 2833 661366 Vile Parle (E), Mumbai - 400 099 e-mail: [email protected] AUDIT COMMITTEE CORPORATE OFFICE Shri. Dilip J. Thakkar (Chairman) Essar House, 11, K. K. Marg, Shri. Nikhil Naik Mahalaxmi Mumbai 400 034 Shri. -

Annual Report 2009-10

BOARD OF DIRECTORS Shashi Ruia REGISTERED OFFICE Chairman Administrative Building Essar Refinery Complex Anshuman Ruia Okha Highway (SH-25) Director Taluka Khambalia District Jamnagar, Gujarat 361 305 Sanjay Mehta Managing Director REGISTRAR & TRANSFER AGENT Rajiv Agarwal Data Software Research Company Private Limited Wholetime Director “Sree Sovereign Complex” 22, 4th Cross Street, Trustpuram A. R. Ramakrishnan Kodambakkam, Chennai 600 024 Wholetime Director e-mail: [email protected] V. Ashok Wholetime Director AUDIT COMMITTEE Anshuman Ruia R. N. Bansal R. N. Bansal Independent Director N. Srinivasan N. Srinivasan S. V. Venkatesan Independent Director K. V. Krishnamurthy SHAREHOLDERS’ GRIEVANCE COMMITTEE Independent Director Anshuman Ruia Rajiv Agarwal Dilip J. Thakkar A. R. Ramakrishnan Independent Director V. Ashok R. N. Bansal S. V. Venkatesan K. V. Krishnamurthy Independent Director Deepak Kumar Varma Independent Director SHARE TRANSFER COMMITTEE Rajiv Agarwal A. R. Ramakrishnan V. Ashok COMPANY SECRETARY Manoj Contractor COMPENSATION COMMITTEE Shashi Ruia AUDITORS Anshuman Ruia Deloitte Haskins & Sells R. N. Bansal CORPORATE OFFICE Essar House 11, Keshavrao Khadye Marg Mahalaxmi, Mumbai 400 034 1 34th Annual Report 2009-10 NOTICE Notice is hereby given that the Thirty-fourth Annual General authority, as may be required, consent of the Company Meeting of the Members of Essar Shipping Ports & Logistics be and is hereby accorded to the appointment of Limited will be held at the Registered Office of the Company Mr. Rajiv Agarwal as the Wholetime Director of the at Administrative Building, Essar Refinery Complex, Okha Company for a period of three years commencing Highway (SH-25), Taluka Khambalia, District Jamnagar, Gujarat from May 27, 2010 to be designated as Managing 361 305 at 3.00 p.m. -

Essar Oil Limited (Registered Office Address: Khambhalia Post, Post Box

ESSAR OIL LIMITED (REGISTERED OFFICE ADDRESS: KHAMBHALIA POST, POST BOX. NO.24, DIST. JAMNAGAR – 361305, GUJARAT) REVISED FINANCIAL STATEMENTS 2010 - 11 AMENDMENT TO THE DIRECTORS’ REPORT FOR THE FINANCIAL YEAR 2010-11 To the Members of Essar Oil Limited The Board of Directors had adopted its report on the financial statements for financial year ended March 31, 2011 on July 11, 2011. Sales Tax Incentive The Hon’ble Supreme Court of India, on January 17, 2012, allowed an appeal filed by the Gujarat Government and set aside a judgment of the Gujarat High Court dated April 22, 2008, thus denying the Company benefits under the sales tax incentive scheme of the Government of Gujarat. Hence, the sales tax amount collected and retained by the Company from May 1, 2008 to January 17, 2012 became payable and the income arising out of defeasement of sales tax liability need to be reversed. The Company proposes to re-open the books of accounts for three financial years 2008-09, 2009-10 and 2010-11 for the limited purpose of reflecting a true and fair view in the books of account. The Company has received approval from the Ministry of Corporate Affairs for the purpose. Necessary resolution seeking approval of shareholders for re-opening of the said financial statements has been incorporated in the Notice dated November 9, 2012 convening the 22nd Annual General Meeting on December 20, 2012. Abridged, reopened and revised financial statements for the financial year ended on March 31, 2011 form part of the annual report. Consequent to reopening of books -

Sustainability Report

Sustainability – Our Propelling Force Sustainability Report April, 2010 – March, 2011 Essar Shipping Limited Contents 1. Message from the Managing Director 2-3 2. Our Vision and Mission 4 3. Company at a Glance 5-6 4. Our Pedigree 7 5. Our Credentials 8 6. The year at a Glance 9 9. Sustainability Performance Highlights 10 10. Our Sustainability Approach 11-25 11. Corporate Governance 26-34 12. Our People 35-47 13. Health & Safety 48-58 14. Environment 59-67 15. Product Responsibility 68-71 16. Community 72-76 17. Memberships 77 18. Participation in External Forums / Committees 78-80 19. Alignment with National Guidelines 81-84 20. Acronyms 85 21. GRI G3.1 Content Index 86-99 22. Independent Assurance Statement 100-102 23. GRI Application Level 103 24. GRI Application Level Check Statement 104 01 Message from the Managing Director Message from A R Ramakrishnan Managing Director, Essar Shipping Limited It gives me great pleasure to present the first sustainability the next financial year. Our Logistics business, currently report of Essar Shipping Limited. operating a fleet of over 5,000 trucks for the movement of petroleum and steel products all across the country will This is a step towards consolidating our sustainability efforts acquire more assets in the future to augment its inter-modal and communicating our economic, social and governance cargo movement capabilities. performance, strategy and outlook to our stakeholders on an annual basis. Although the shipping sector moves more than 90% of the world's trade and is considered to be the most environment - We have come a long way since the time we invested, over friendly, the sector is facing a lot of challenges and there is the years, in a diverse shipping fleet and oilrigs, to being an pressure for long term sustainability.