Legal & General (N) Tracker Trust INTERIM 31.03.2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Annual Report

Building Long-term Wealth by Investing in Private Companies Annual Report and Accounts 12 Months to 31 January 2021 Our Purpose HarbourVest Global Private Equity (“HVPE” or the “Company”) exists to provide easy access to a diversified global portfolio of high-quality private companies by investing in HarbourVest-managed funds, through which we help support innovation and growth in a responsible manner, creating value for all our stakeholders. Investment Objective The Company’s investment objective is to generate superior shareholder returns through long-term capital appreciation by investing primarily in a diversified portfolio of private markets investments. Our Purpose in Detail Focus and Approach Investment Manager Investment into private companies requires Our Investment Manager, HarbourVest Partners,1 experience, skill, and expertise. Our focus is on is an experienced and trusted global private building a comprehensive global portfolio of the markets asset manager. HVPE, through its highest-quality investments, in a proactive yet investments in HarbourVest funds, helps to measured way, with the strength of our balance support innovation and growth in the global sheet underpinning everything we do. economy whilst seeking to promote improvement in environmental, social, Our multi-layered investment approach creates and governance (“ESG”) standards. diversification, helping to spread risk, and is fundamental to our aim of creating a portfolio that no individual investor can replicate. The Result Company Overview We connect the everyday investor with a broad HarbourVest Global Private Equity is a Guernsey base of private markets experts. The result is incorporated, London listed, FTSE 250 Investment a distinct single access point to HarbourVest Company with assets of $2.9 billion and a market Partners, and a prudently managed global private capitalisation of £1.5 billion as at 31 January 2021 companies portfolio designed to navigate (tickers: HVPE (£)/HVPD ($)). -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance BB Healthcare Trust BBH Closed End Investments — GBP 1.964 at close 20 April 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Apr-2015 1D WTD MTD YTD Absolute - - - - Rel.Sector - - - - Rel.Market - - - - VALUATION Data unavailable Trailing PE 6.0 EV/EBITDA 5.4 PB 1.1 PCF -ve Div Yield 2.6 Price/Sales 5.7 Net Debt/Equity 0.0 Div Payout 15.4 ROE 21.6 DESCRIPTION Data unavailable The Company is a closed-ended investment company which to invest in a concentrated portfolio of listed or quoted equities in the global healthcare industry. Past performance is no guarantee of future results. Please see the final page for important legal disclosures. 1 of 4 FTSE COMPANY REPORT: BB Healthcare Trust 20 April 2021 Valuation Metrics Price to Earnings (PE) EV to EBITDA Price to Book (PB) 31-Mar-2021 31-Mar-2021 31-Mar-2021 25 25 1.5 1.4 20 20 +1SD 1.3 +1SD +1SD 1.2 Avg 15 15 1.1 Avg Avg -1SD 1 10 10 0.9 -1SD -1SD 5 5 0.8 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Murray International Trust (Ord) 120.0 Murray International Trust (Ord) 100.0 CVC Credit Partners European Opportunities (GBP) 2.3 European Opportunities Trust 120.0 European Opportunities Trust 100.0 Hipgnosis Songs Fund 2.2 Law Debenture Corp 120.0 Law Debenture Corp 100.0 Pacific Horizon Investment Trust 2.0 HICL Infrastructure 64.6 HICL Infrastructure 64.5 Scottish -

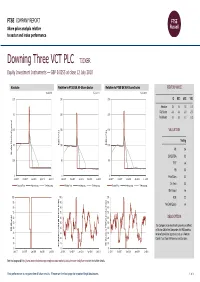

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 12 July 2018 Downing Three VCT PLC TICKER Equity Investment Instruments — GBP 0.0255 at close 12 July 2018 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 12-Jul-2018 12-Jul-2018 12-Jul-2018 0.25 250 250 1D WTD MTD YTD Absolute 0.0 0.0 0.0 0.0 Rel.Sector -0.4 -0.8 -0.5 -2.0 0.2 200 200 Rel.Market -0.7 -0.5 -0.1 0.3 0.15 150 150 VALUATION (local currency) (local Trailing 0.1 Relative Price 100 Relative Price 100 PE 0.4 Absolute Price Price Absolute EV/EBITDA 0.3 0.05 50 50 PCF -ve PB 0.0 0 0 0 Price/Sales 0.2 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Jul-2017 Oct-2017 Jan-2018 Apr-2018 Jul-2018 Div Yield 0.0 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout +ve 100 100 100 ROE 2.2 90 90 90 Net Debt/Equity -ve 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The Company is an investment company as defined 40 40 40 RSI (Absolute) RSI in Section 266 of the Companies Act 1985 and has 30 30 30 received provisional approval to act as a Venture 20 20 20 Capital Trust from HM Revenue and Customs. -

UK Investment Trusts Index This Listing Aims to Help Readers to Locate an Investment Trust in the AIC Sectors

UK Investment Trusts Index This listing aims to help readers to locate an investment trust in the AIC sectors. Funds are presented in alphabetical order by provider. Fund name Sector Fund name Sector Fund name Sector 3i Group Plc Private Equity Blackstone/GSO Loan Financing Limited Debt - Structured Finance Energiser Investments PLC Unclassified 3I Infrastructure Plc Infrastructure Blue Planet Investment Trust PLC ORD 1P Global High Income EP Global Opportunities Trust PLC Global Aberdeen Asian Income LTd Asia Pacific Income Blue Star Capital PLC Unclassified EPE Special Opportunities Unclassified Ab Div Inc & Grw Trt Flexible Investment Bluefield Solar Income Limited Renewable Energy Infrastructure European Assets Trust PLC European Smaller Companies AbrEmrMrInvCmpLtd Global Emerging Markets BMO Cap & Inc IT PLC UK Equity Income F&C Investment Trust Plc Global Abr Frn Mr Inv CmpLtd Global Emerging Markets BMO Commercial Property Trust Limited Property - UK Commercial F&C UK Real Estate Investments Limited Property - UK Commercial Aberdeen Japan IT PLC Japan BMO Global Smaller Companies Plc Global Smaller Companies Fair Oaks Income Limited 2017 SHS Debt - Structured Finance Aberdeen Latin American Income Ltd Latin America BMO Managed Portfolio Trust Plc Growth Flexible Investment FastForward Innovations Limited Ord 1P Private Equity Abrdn New Dawn IT PLC Asia Pacific BMO Managed Portfolio Trust Plc Inc Flexible Investment Fidelity Asian Values PLC Asia Pacific Aberdeen New Ind IT PLC Ord Country Specialist: Asia Pacific ex Jap BMO Private -

List of British Entities That Are No Longer Authorised to Provide Services in Spain As from 1 January 2021

LIST OF BRITISH ENTITIES THAT ARE NO LONGER AUTHORISED TO PROVIDE SERVICES IN SPAIN AS FROM 1 JANUARY 2021 Below is the list of entities and collective investment schemes that are no longer authorised to provide services in Spain as from 1 January 20211 grouped into five categories: Collective Investment Schemes domiciled in the United Kingdom and marketed in Spain Collective Investment Schemes domiciled in the European Union, managed by UK management companies, and marketed in Spain Entities operating from the United Kingdom under the freedom to provide services regime UK entities operating through a branch in Spain UK entities operating through an agent in Spain ---------------------- The list of entities shown below is for information purposes only and includes a non- exhaustive list of entities that are no longer authorised to provide services in accordance with this document. To ascertain whether or not an entity is authorised, consult the "Registration files” section of the CNMV website. 1 Article 13(3) of Spanish Royal Decree-Law 38/2020: "The authorisation or registration initially granted by the competent UK authority to the entities referred to in subparagraph 1 will remain valid on a provisional basis, until 30 June 2021, in order to carry on the necessary activities for an orderly termination or transfer of the contracts, concluded prior to 1 January 2021, to entities duly authorised to provide financial services in Spain, under the contractual terms and conditions envisaged”. List of entities and collective investment -

Interim Report Charitrak Common Investment Fund

Interim report ChariTrak Common Investment Fund For the six months ended 12 October 2017 Contents General Information Manager, Registrar and Alternative Investment Fund Manager General Information 2 BlackRock Fund Managers Limited About the Fund 3 12 Throgmorton Avenue, London EC2N 2DL Switchboard: 020 7743 3000 Trustee 3 Charities Helpline (Freephone): 0800 44 55 22 Corporate Governance 4 Member of The Investment Association and authorised and regulated by the Financial Conduct Authority Common Investment Funds 4 pursuant to the requirements of The Alternative Investment Fund Managers Regulations 2013. Charity Trustees’ Investment Responsibilities 4 Directors of the Manager Fund Manager 4 G D Bamping* C L Carter (appointed 7 September 2017) R A Damm N C D Hall* (resigned 31 May 2017) R A R Hayes A M Lawrence E E Tracey M T Zemek* Significant Events 5 * Non-executive Director. Investment Objective & Policy 6 Trustee Performance Table 7 BNY Mellon Trust & Depositary (UK) Limited 160 Queen Victoria Street, London EC4V 4LA Investment Report 8 Authorised and regulated by the Financial Conduct Authority. Performance Record 9 Portfolio Statement 11 Investment Manager BlackRock Advisors (UK) Limited Statement of Total Return 28 12 Throgmorton Avenue, London EC2N 2DL Statement of Change in Net Assets Attributable to Unitholders 28 Authorised and regulated by the Financial Conduct Authority. Balance Sheet 29 Auditor Notes to Financial Statements 30 Ernst & Young LLP 1 More London Place, London SE1 2AF Custodian The Bank of New York Mellon (International) Limited 1 Canada Square, London E14 5AL Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. -

Investec Global Strategy Fund R.C.S

GSF Investec Global Strategy Fund R.C.S. Luxembourg B139420 Investment Fund under Luxembourg Law Annual report and accounts | For the year ended 31 December 2012 Investec Global Strategy Fund Registered address 49 Avenue J.F. Kennedy, L-1855 Luxembourg Grand Duchy of Luxembourg Correspondence address – Global Distributor c/o Investec Asset Management Guernsey Limited P.O. Box 250, Glategny Court, Glategny Esplanade St. Peter Port, Guernsey GY1 3QH Channel Islands Investment Fund under Luxembourg Law Annual report and accounts For the year ended 31 December 2012 Contents Market overview 2-3 Material changes to the Fund 4 Annualised performance over 5 years 5-8 Calendar year performance over 5 years 9-10 The Fund 11-13 Directors of the Fund 14 Report of the Directors 15 Statistical Information 16-22 Portfolio details – Schedule of Investments 23-231 Statement of Operations 232-239 Statement of Changes in Shareholders’ Equity 240-247 Statement of Assets and Liabilities 240-247 Notes forming part of the financial statements 248-297 Independent Auditor’s report to the Shareholders 298 Performance Records 300-317 Investment objectives and policy 318-327 Risk considerations 328-334 Risk Management 335-338 Fair Value Hierarchy 339-347 Additional Information for Investors in the Federal Republic of Germany 348 Notice to investors in Switzerland 348 Notice of Meeting 349 Portfolio Turnover 350 European Union Savings Directive 351 Report of the custodian 351 Administration of the Fund 352 How to contact Investec 353 Investec Global Strategy Fund | 1 Market overview All returns and indices are in US dollar terms, 1 January 2012 to 31 December subsequent eleventh hour deal to avoid the fi scal cliff, helped 2012, unless otherwise stated. -

Annual Report and Accounts 2016

Pantheon International Plc Annual Report and Accounts 2016 Pantheon International Plc (”PIP” or the “Company”) invests in a diversified portfolio of private equity assets managed by third party managers across the world. Private equity funds purchase large equity stakes in private companies. This gives investors access to a broader universe of opportunities than that offered by public markets. Private equity managers are long-term, disciplined investors who can bring about beneficial changes to businesses and align shareholder interests with those of company management through majority ownership. The Manager, Pantheon, is one of the world’s foremost private equity specialists. With more than 30 years’ experience, and a team of over 70 investment professionals globally, Pantheon is well positioned to guide PIP towards its objective of maximising capital growth. Contents Strategic Report Year at a Glance 1 Performance Summary 2 Chairman’s Statement 6 Investment Rationale & Company Strategy 9 Our Business Model 10 Objective and Investment Policy 12 Principal Risks and Uncertainties 13 Manager’s Review 17 The Directors’ Report 60 Statement on Corporate Governance 70 Audit Committee Report 77 Directors’ Remuneration Report 79 Statement of Directors’ Responsibilities 82 Independent Auditor’s Report 83 Income Statement 86 Statement of Changes in Equity 87 Balance Sheet 88 Cash Flow Statement 89 Notes to the Financial Statements 90 AIFMD Disclosures 102 Notice of Annual General Meeting 104 Glossary of Terms 108 Directors and Contacts 109 Year -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore