Pilbara Minerals (PLS) Is Exploring for And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Specialist Australian Small Companies Quarterly Investment Option Update

Specialist Australian Small Companies Quarterly Investment Option Update 31 December 2020 Aim and Strategy Sector Allocation % To provide a total return (income and capital growth) Consumer Discretionary 21.97 after costs and before tax, above the performance Materials 17.24 benchmark, the S&P/ASX Small Ordinaries Industrials 14.87 Accumulation Index, on a rolling three-year basis. The Health Care 9.90 portfolio invests in small companies listed on the Information Technology 8.64 Australian Securities Exchange (ASX). For this Financials 6.06 portfolio small companies are considered to be those Communication Services 5.61 outside the top 100 listed companies (by market Consumer Staples 5.50 value). Up to 20% of the portfolio may be invested in Real Estate 5.37 unlisted companies that the investment manager Cash 2.80 believes are likely to be listed in the next 12 months, or Energy 2.05 in companies between the top 50 and 100 listed on the ASX. Top Holdings % City Chic Collective Ltd 2.49 Investment Option Performance Lynas Rare Earths Ltd 2.43 To view the latest investment performances for each Eagers Automotive Ltd 2.07 product, please visit www.amp.com.au/performance Integral Diagnostics Ltd 2.04 Marley Spoon AG 1.89 Investment Option Overview Technology One Ltd 1.85 Investment category Australian Shares Pilbara Minerals Ltd 1.84 Suggested minimum investment Seven Group Holdings Ltd 1.83 7 years timeframe Ingenia Communities Group 1.78 Relative risk rating Very High Auckland International Airport 1.75 Investment style Active Manager style Multi-manager Asset Allocation Benchmark (%) Australian Shares 100 Cash 0 Actual Allocation % International Shares 11.61 Australian Shares 82.23 Listed Property and Infrastructure 3.36 Cash 2.80 Fund Performance The Fund posted a very strong positive absolute return and outperformed its benchmark over the December quarter. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Metals & Mining Sector Profile

Metals & Mining Sector Profile Overview The Metals & Mining sector is the largest industry sector by number of companies with over 650 involved in mineral exploration, development and production in over 100 countries. The sector comprises several of the world’s largest diversified resource companies, including global giants such as BHP Billiton and Rio Tinto, as well as a representation of potential future industry leaders in the mid-tier producers and junior miners. The sector has always been reliant on equity markets to provide the funding required for the capital intensive development of mineral projects or the funding of higher risk exploration to locate new deposits. Investors in the Australian market have supported over 290 new junior resource floats since 2009. Reasons to list Metals & Mining companies S&P/ASX 200 v S&P/ASX 300 Metals & Mining on ASX 175 • Access to capital: 150 – A global market with a wide range of institutional and retail investors 125 – Australia has the 6th largest pool of investment assets in the l world and the largest in Asia* 100 Leve • A natural destination for international mining capital - 75 a developed market in one of the world’s major mining regions Index 50 • Peer Group: list alongside key industry players • Opportunities for SMEs: a broad service offering for early 25 stage and mature companies 0 7 7 9 8 1 7 3 * Source: Austrade, Investment Company Institute, Worldwide Mutual Fund 4 Jul 1 Jul 1 Jul 1 Jul 15 Jul 12 Jul 16 Jul 1 Jul 10 Jan 11 Jul 0 Jul 0 Jan 17 Jan 13 Jan 15 Jul 0 Jan 12 Jan 16 Jan -

Single Sector Funds Portfolio Holdings

! Mercer Funds Single Sector Funds Portfolio Holdings December 2020 welcome to brighter Mercer Australian Shares Fund Asset Name 4D MEDICAL LTD ECLIPX GROUP LIMITED OOH MEDIA LIMITED A2 MILK COMPANY ELDERS LTD OPTHEA LIMITED ABACUS PROPERTY GROUP ELECTRO OPTIC SYSTEMS HOLDINGS LTD ORICA LTD ACCENT GROUP LTD ELMO SOFTWARE LIMITED ORIGIN ENERGY LTD ADBRI LTD EMECO HOLDINGS LTD OROCOBRE LTD ADORE BEAUTY GROUP LTD EML PAYMENTS LTD ORORA LTD AFTERPAY LTD ESTIA HEALTH LIMITED OZ MINERALS LTD AGL ENERGY LTD EVENT HOSPITALITY AND ENTERTAINMENT PACT GROUP HOLDINGS LTD ALKANE RESOURCES LTD EVOLUTION MINING LTD PARADIGM BIOPHARMACEUTICALS LTD ALS LIMITED FISHER & PAYKEL HEALTHCARE CORP LTD PENDAL GROUP LTD ALTIUM LTD FLETCHER BUILDING LTD PERENTI GLOBAL LTD ALUMINA LTD FLIGHT CENTRE TRAVEL GROUP LTD PERPETUAL LTD AMA GROUP LTD FORTESCUE METALS GROUP LTD PERSEUS MINING LTD AMCOR PLC FREEDOM FOODS GROUP LIMITED PHOSLOCK ENVIRONMENTAL TECHNOLOGIES AMP LTD G8 EDUCATION LTD PILBARA MINERALS LTD AMPOL LTD GALAXY RESOURCES LTD PINNACLE INVESTMENT MANAGEMENT GRP LTD ANSELL LTD GDI PROPERTY GROUP PLATINUM INVESTMENT MANAGEMENT LTD APA GROUP GENWORTH MORTGAGE INSRNC AUSTRALIA LTD POINTSBET HOLDINGS LTD APPEN LIMITED GOLD ROAD RESOURCES LTD POLYNOVO LIMITED ARB CORPORATION GOODMAN GROUP PTY LTD PREMIER INVESTMENTS LTD ARDENT LEISURE GROUP GPT GROUP PRO MEDICUS LTD ARENA REIT GRAINCORP LTD QANTAS AIRWAYS LTD ARISTOCRAT LEISURE LTD GROWTHPOINT PROPERTIES AUSTRALIA LTD QBE INSURANCE GROUP LTD ASALEO CARE LIMITED GUD HOLDINGS LTD QUBE HOLDINGS LIMITED ASX LTD -

BUY Pilbara Minerals

Metals & Mining For FCA purposes this is a Marketing Communication Pilbara Minerals 2 June 2016 Initiating Coverage BUY Mining a piece of the future Pilbara Minerals is developing the Pilgangoora lithium deposit in Western Australia Current Share Price AUc65 that should be developed into a 2Mt/year mine producing 330kt/year of high grade Target Price AUc85 spodumene. We expect initial capex of A$184 million with opex of A$252/t of Market Capitalisation AUD744.2m concentrate compared to a LOM assumed spodumene price of US$550/t. Lithium is Shares In Issue 1,145m a key component in batteries for both electric vehicles and domestic and industrial RIC/BLBG PLS.ASX/PLS.AU power storage. We value the project at 1.0x our 7% NAV and initiate coverage with Avg. Daily Volume (3M) 10,075,165 Net Cash/(Debt) (m) (06/16F) AUD165.0m a BUY recommendation and a target price of A$0.85/share. Current share price(s) timed at 4:30pm on 31/05/16 ● High grade hard rock lithium in a low risk jurisdiction - PLS owns a 100% interest SharePrice in the high grade Pilgangoora lithium tantalite project in Western Australia, which is 1.2 the world's second largest spodumene-tantalite Resource hosting more than 1Mt of 1 0.8 lithium oxide. The project is located within 120 km from Port Headland near to both rail 0.6 infrastructure and the Great Northern Highway. The project should be developed as an 0.4 open pit mine with annual production of approximately 330kt/year of 6% spodumene 0.2 0 concentrate (48kt/year Lithium Carbonate Equivalent) and 274klb of tantalite over Jun-15 Sep-15 Dec-15 Mar-16 May-16 an initial life of 15 years. -

The Lithium-Ion Battery Value Chain

THE LITHIUM-ION BATTERY VALUE CHAIN New Economy Opportunities for Australia Acknowledgment Austrade would like to express our appreciation to Future Smart Strategies, especially Howard Buckley, for his professional guidance, advice and assistance, with earlier versions of this report. We would also like to thank Adrian Griffin at Lithium Australia for his insights and constructive suggestions. And we would like to acknowledge the insights provided by Prabhav Sharma at McKinsey & Company. More broadly, we would like to thank the following companies and organisations for providing data and information that assisted our research: › Association of Mining and Exploration Australia (AMEC); › Geoscience Australia; › Albemarle; and › TianQi Australia. Disclaimer Copyright © Commonwealth of Australia 2018 This report has been prepared by the Commonwealth of Australia represented by the Australian Trade and Investment Commission (Austrade). The report is a general overview and is not intended to The material in this document is licensed under a Creative Commons provide exhaustive coverage of the topic. The information is made Attribution – 4.0 International licence, with the exception of: available on the understanding that the Commonwealth of Australia is • the Australian Trade and Investment Commission’s logo not providing professional advice. • any third party material While care has been taken to ensure the information in this report • any material protected by a trade mark is accurate, the Commonwealth does not accept any liability for any • any images and photographs. loss arising from reliance on the information, or from any error or More information on this CC BY licence is set out at the creative omission, in the report. -

Remuneration Report (Australasia) Participating Organisations | October 2019 Proprietary and Confidential

Remuneration Report (Australasia) Participating organisations | October 2019 Proprietary and Confidential Participating organisations 1. Aeris Resources Limited 37. Karara Mining Ltd 2. Alcoa of Australia Limited 38. Kirkland Lake Gold 3. Alkane Resources Limited 39. Macmahon Holdings Limited 4. AngloGold Ashanti Australasia 40. Metals X Limited Limited 41. Mid West Ports Authority 5. Aurelia Metals Ltd 42. Millennium Minerals Limited 6. Beatons Creek Gold Pty Ltd 43. Mineral Resources Limited 7. BGC Contracting Pty Ltd 44. Minjar Gold Pty Ltd 8. BHP Group Limited 45. Minotaur Exploration Limited 9. Billabong Gold Pty Ltd 46. Mitsui & Co. (Australia) Ltd 10. Bis Industries 47. MMG Limited 11. Breaker Resources NL* 48. Mount Isa Mines Ltd 12. Byrnecut Australia Pty Ltd 49. Nautilus Minerals Inc 13. Calibre Group Ltd 50. Newcrest 14. Capricorn Copper Pty Ltd 51. Newmont Australia 15. Carey Mining 52. Northern Star Resources Limited 16. Castlemaine Goldfields Limited 53. Northparkes Mines 17. CBH Resources Limited 54. Norton Gold Fields Limited 18. CBH Resources Operations 55. NRW Pty Ltd 19. Centrex Metals Limited 56. NT Mining Operations Pty Ltd 20. CITIC Pacific Mining Management (Kirkland Gold) Pty Ltd 57. OceanaGold Corporation 21. Cobar Management Pty Ltd 58. Oz Minerals Limited 22. Copper Mines of Tasmania 59. Pacifico Minerals 23. Covalent Lithium Pty Ltd 60. PanAust Limited 24. Downer EDI Mining Pty Ltd 61. Panoramic Resources 25. Evolution Mining Limited 62. Perenti Group 26. Fortescue Metals Group Ltd 63. Perilya Limited 27. Glencore Australia Holdings 64. Pilbara Minerals Limited 28. Global Advanced Metals Pty Ltd 65. PT Agincourt Resources 29. Gold Fields Australia Pty Ltd 66. -

Deloitte WA Index 2021 Diggers & Dealers Special Edition

Deloitte WA Index 2021 Diggers & Dealers Special Edition A review of Western Australian companies listed on the Australian Securities Exchange 1 Deloitte WA Index 2021 | Diggers & Dealers Special Edition 2 Deloitte WA Index 2021 | Diggers & Dealers Special Edition Contents Executive summary 4 Deloitte WA Index Top Movers 2021 6 Commodity review 13 Celebrating 30 years – Congratulations to Diggers & Dealers 21 Lithium and the shift to renewables and electric vehicles 23 WA Index Q&A with Peter Bradford, Managing Director and CEO, IGO 26 Does it pay to play it clean? 28 WA’s top 100 listed companies 31 Contact us 34 3 Deloitte WA Index 2021 | Diggers & Dealers Special Edition Executive summary Welcome to the 2021 Diggers & Dealers edition of the Deloitte WA Index. This year the market capitalisation of Western Australian listed entities closed at AU$293.9 billion, increasing a staggering 46% from 12-months prior. This year’s WA Index performance has iron ore, as well as battery-associated markets achieved growth this year, again been a standout on so many fronts. The metals with more environmentally the WA Index outperformed the broader market capitalisation growth highlights conscious applications. ASX All Ordinaries, US S&P 500, FTSE 100 a buoyant economic recovery from the and the Nikkei 225 through the year to 30 initial shocks of the COVID-19 pandemic, Our weighting to the commodity price June 2021. with the comeback clearly aided by the upswing has seen Western Australian strength of commodity prices, particularly companies fair well, -

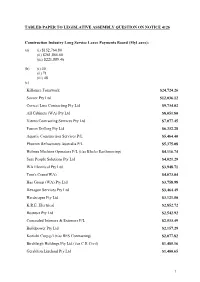

Tabled Paper to Legislative Assembly Question on Notice 4126

TABLED PAPER TO LEGISLATIVE ASSEMBLY QUESTION ON NOTICE 4126 Construction Industry Long Service Leave Payments Board (MyLeave): (a) (i) $152,764.80 (ii) $261,866.60 (iii) $221,889.46 (b) (i) 40 (ii) 71 (iii) 48 (c) Killarnee Formwork $24,724.26 Savcor Pty Ltd $12,036.12 Correct Line Contracting Pty Ltd $9,734.02 All Cabinets (WA) Pty Ltd $8,051.80 Viento Contracting Services Pty Ltd $7,077.45 Fusion Drilling Pty Ltd $6,332.28 Aquatic Construction Services P/L $5,464.40 Phoenix Refractories Australia P/L $5,375.08 Holmes Machine Operators P/L (t/as Blacks Earthmoving) $4,116.74 Sure People Solutions Pty Ltd $4,021.29 WA Electrical Pty Ltd $3,948.71 Tom's Crane(WA) $4,073.04 Has Group (WA) Pty Ltd $3,758.98 Hexagon Services Pty Ltd $3,464.49 Hardscapes Pty Ltd $3,121.50 K.R.E. Electrical $2,852.72 Rostruct Pty Ltd $2,542.92 Concealed Interiors & Exteriors P/L $2,533.49 Buildpower Pty Ltd $2,157.29 Kozicki Corp.p/l (t/as RFS Contracting) $2,077.82 Birchleigh Holdings Pty Ltd (t/as C R Civil) $1,485.16 Geraldton Linehaul Pty Ltd $1,400.65 1 G. & O. Civil Pty Ltd $1,146.28 Cityvic Pty Ltd $1,050.86 Redline Contracting Pty Ltd $901.81 Souwest Carpentery $873.30 Baramba Security (t/as Davey Glass) $636.50 A.G. Property Maintenance $364.00 Daniel Parker $255.53 GWF Retail Pty Ltd $187.54 Skyhi Pty Ltd $128.19 Formerly Savannah Engineering (WA) Pty Ltd (t/as Savannah Engineers (WA) Pty Ltd Newman) $24,222.83 3pt Construction $17,195.37 Savcor Pty Ltd $13,898.52 Seven G Engineering Pty Ltd $12,393.00 Andec Fire Systems Australia p/l $11,529.47 Digital Hub Pty Ltd $9,517.87 B.L.D. -

Minerals 1 April to 30 June 2017

Approvals by Mineral Field – Environment Minerals 1 April to 30 June 2017 Mining Proposals and Mine Closure Plans You can view mining proposals on-line using the department’s MINEDEX system. Select ‘Environmental Registrations’, enter the ‘Registration ID’ number listed below in the relevant field, then press ‘Execute Search’. Mineral Field Operator Project Tenements Type Registration ID Ashburton Austwide Mining Title J04505 - Barradale Sand / Boyle L 08/108, M 08/497 Mining Proposal 64254 Management Pty Ltd Rocky Crossing Contracting Pty J01843 - Mt Mortimer M 08/105, M 08/66, M 08/71 Mine Closure Plan 66130 Ltd Stone Dimensions Australia Pty J02225 - Nanutarra Marbles M 08/149 Mine Closure Plan 64114 Ltd Broad Arrow Dawson Mining Pty Ltd J00133 - Grace Darling M 24/372 Mining Proposal 62527 with Mine Closure Plan Eureka Mines Pty Ltd J01885 - Eureka, M 24/189 Mining Proposal 64885 J00135 - Grants Patch Norton Gold Fields Ltd G 24/11, G 24/12, L 24/54, M 24/102, M 24/155, Mine Closure Plan 58989 M 24/16, M 24/165, M 24/166, M 24/172, M 24/182, M 24/211, M 24/223, M 24/227, M 24/229, M 24/234, M 24/236, M 24/256, M 24/265, M 24/266, M 24/267, M 24/302, M 24/304, M 24/321, M 24/390, M 24/393, M 24/432, M 24/433, M 24/60, M 24/645, M 24/705, M 24/708, M 24/709, M 24/710, M 24/79, M 24/796, M 24/80, M 24/81, M 24/810, M 24/811, M 24/82, M 24/838 Norton Gold Fields Ltd L 24/119, L 24/144, L 24/145, L 24/163, L 24/164, Mine Closure Plan 58992 L 24/19, L 24/196, L 24/20, L 24/207, L 24/29, L 24/34, L 24/63, M 24/101, M 24/180, M 24/181, M -

(Australia) Participating Organisations | June 2017 Aon Hewitt Talent, Rewards & Performance Proprietary and Confidential

(Australia) Participating organisations | June 2017 Aon Hewitt Talent, Rewards & Performance Proprietary and Confidential Participating organisations MCap 1 year avg. Revenue Contributed Disclosed Organisations ASX ticker 31st Mar ‘17 $M data data $M Abacus ALS Pty Ltd N/A - - Y N/A Abacus Property Group ASX:ABP 1,712 340 N Y Abbott Australasia Pty Ltd N/A - - Y N/A ABBVIE N/A - - Y N/A Aconex Ltd ASX:ACX 1,135 145 N Y Adani Mining Pty Ltd N/A - - Y N/A Adelaide Brighton ASX:ABC 3,506 1,396 Y Y Adshel Street Furniture N/A - - Y N/A AECOM N/A - - Y N/A Aeris Resources ASX:AEI 62 3 Y N Agilent Technologies Australia N/A - - Y N/A Pty Ltd AIA Australia Ltd N/A - - Y N/A AIG Australia Limited N/A - - Y N/A Ajilon Consulting N/A - - Y N/A Alcon Australia N/A - - Y N/A Alere N/A - - Y N/A Alexion Pharmaceuticals N/A - - Y N/A Align Technology N/A - - Y N/A Alkane Resources Limited ASX:ALK 159 91 Y N Allens N/A - - Y N/A Alliance Contracting N/A - - Y N/A Alphapharm Pty Ltd N/A - - Y N/A ALS Limited ASX:ALQ 2,794 1,272 N Y Altium Ltd ASX:ALU 986 100 N Y AMEC Foster Wheeler Australia N/A - - Y N/A Pty Ltd Anglo American Metallurgical N/A - - Y N/A Coal Pty Ltd AngloGold Ashanti Australasia N/A - - Y N/A Limited Ansell ASX:ANN 3,173 1,564 N Y Aon Corporation Australia N/A - - Y N/A AP Eagers Ltd ASX:APE 1,958 3,833 N Y APN Outdoor ASX:APO 1,015 331 Y Y APT - Australian Pacific Touring N/A - - Y N/A Pty Ltd Arab Bank Australia Ltd N/A - - Y N/A ARB Corporation Ltd ASX:ARB 1,320 367 N Y Ardent Leisure Limited ASX:AAD 1,023 677 N Y Arup Pty Ltd N/A - - Y N/A Asahi Premium Beverages N/A - - Y N/A Asaleo Care Limited ASX:AHY 923 607 N Y Ashurst N/A - - Y N/A Asia Iron Australia Pty Ltd N/A - - Y N/A Assetinsure N/A - - Y N/A Asurion Australia Pty Ltd N/A - - Y N/A Executive Data Service (Australia) | Participating organisations | June 2017 1 Aon Hewitt Talent, Rewards & Performance Proprietary and Confidential MCap 1 year avg. -

Mineral Approvals by Mineral Field

Approvals by Mineral Field – Environment Minerals 1 July to 30 September 2017 Mining Proposals and Mine Closure Plans You can view mining proposals on-line using the department’s MINEDEX system. Select ‘Environmental Registrations’, enter the ‘Registration ID’ number listed below in the relevant field, then press ‘Execute Search’. Mineral Field Operator Project Tenements Type Registration ID Ashburton BC Iron Ltd J03830 - Buckland - Bungaroo South L 08/104, L 08/105 Mining Proposal 67932 D & G Spralja Pty Ltd J04846 - Glen Florrie White Rocks M 08/513 Mining Proposal MLA 59123 Jasper Kelwin Spiers J04201 - Exmouth Sand / Exmouth Civil M 08/470 Mining Proposal With 67680 Mine Closure Plan Northern Star Resources Ltd J01511 - Paulsen, J00242 – Paulsens M 08/515 Mining Proposal MLA 58234 Onslow Resources Ltd J04144 - Ashburton Sand and Shingle / L 08/143 Mining Proposal 68829 Onslow Resources Black Range Middle Island Resources Ltd J02278 - Sandstone / Middle Island M 57/128, M 57/129 Mine Closure Plan 67869 Broad Arrow Paddington Gold Pty Ltd J00292 - Paddington - Mt Pleasant M 24/962 Mining Proposal MLA 60976 Rose Dam Resources NL J02780 - Rose Dam M 24/451 Mining Proposal With 64964 Mine Closure Plan Siberia Mining Corporation Pty Ltd J00084 - Davyhurst - Lady Ida - Mulline - L 24/224, M 24/208, M 24/39, M 24/960 Mining Proposal 67925 Riverina - Siberia Gold J00317 - Siberia - Sand King Bulong Silver Lake Resources Ltd J00184 - Aldiss - Karonie M 25/71 Mining Proposal 69196 Silver Lake Resources Ltd J00251 - Randalls - Mt Monger M 25/125