Preliminary Official Statement Dated April 1, 2010 Any Sale

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Home Sporting Events Featured Events & Shows by Venue

Metro Detroit Events: September - October 2017 Home Sporting Events DETROIT RED WINGS - LITTLE DETROT TIGERS - COMERICA CAESARS ARENA 66 Sibley St Detroit, MI 48201 PARK http://littlecaesars.arenadetroit.com 2100 Woodward Ave, Detroit (313) 962-4000 Sept 23 Preseason Wings vs Penguins 22-23 vs. Yankees Sept 25 Preseason Wings vs Penguins Sept 1-3 vs. Indians Sept 28 Preseason Wings vs. Sept 4-6 vs. Royals Blackhawks Sept 14-17 vs. White Sox Sept 29 Preseason Wings vs. Maple Sept 18- 20 vs. Athletics Leafs Sept 21-24 vs. Twins Oct 8 vs Minnesota Wild Oct 16 vs Tampa Bay Lightning DETROIT LIONS - FORD FIELD Oct 20 vs. Washington Capitals 2000 Brush St, Detroit (313) 262-2000 Oct 22 vs. Vancouver Canucks http://www.fordfield.com/ Oct 31 vs. Arizona Coyotes Sept 9 2017 Detroit Lions Season JIMMY JOHN’S FIELD Tickets 7171 Auburn Rd, Utica (248) 601-2400 Sept 10 vs. Arizona Cardinals https://uspbl.com/jimmy-johns-field/ Sept 24 vs. Atlanta Falcons Oct 8 vs. Carolina Panthers Sept 1 Westside vs Birmingham- Oct 29 vs. Pittsburg Steelers Bloomfield Sept 2 Eastside vs Westside MSU FOOTBALL Sept 3 Eastside vs Utica 325 W Shaw Ln, East Lansing (517) 355-1610 Sept 4 Birmingham- Bloomfield vs Utica http://www.msuspartans.com Sept 7 Westside vs Eastside Sept 8-10 2017 USPBL Playoffs Sept 2 Bowling Green Falcons Sept 9 Western Michigan Broncos Featured Events & Shows by Sept 23 Notre Dame Fighting Irish Venue Sept 30 Iowa Hawkeyes Oct 21 Indiana Hoosiers ANDIAMO CELEBRITY SHOWROOM 7096 E 14 Mile Road, Warren (586) 268-3200 U OF M FOOTBALL http://andiamoitalia.com/showroom/ 1201 S Main St, Ann Arbor (734) 647-2583 http://mgoblue.com/ Sept 22 Eva Evola Oct 13 Pasquate Esposito Sept 9 Cincinnati Bearcats Oct 20 Bridget Everett Sept 16 Air Force Falcons Oct 21 Peabo Bryson Oct 17 Michigan State Spartans Oct 28 Rutgers Scarlet Knights Do you have something we should add? Let us know! For additional news and happenings, follow Relevar Home Care on Facebook and LinkedIn. -

Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20

Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 1 of 54 Fill in this information to identify the case: United States Bankruptcy Court for the Southern District of Texas Case number (if known): Chapter 11 Check if this is an amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor’s name and the case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available. 1. Debtor’s name Laredo Outlet Shoppes, LLC 2. All other names debtor used N/A in the last 8 years Include any assumed names, trade names, and doing business as names 3. Debtor’s federal Employer Identification Number (EIN) 81-1563566 4. Debtor’s address Principal place of business Mailing address, if different from principal place of business 2030 Hamilton Place Blvd. Number Street Number Street CBL Center, Suite 500 P.O. Box Chattanooga Tennessee 37421 City State ZIP Code City State ZIP Code Location of principal assets, if different from principal place of business Hamilton County County 1600 Water Street Number Street Laredo Texas 78040 City State ZIP Code 5. Debtor’s website (URL) www.cblproperties.com 6. Type of debtor ☒ Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) ☐ Partnership (excluding LLP) ☐ Other. Specify: Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy Page 1 WEIL:\97969900\8\32626.0004 Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 2 of 54 Debtor Laredo Outlet Shoppes, LLC Case number (if known) 21-_____ ( ) Name A. -

State City Shopping Center Address

State City Shopping Center Address AK ANCHORAGE 5TH AVENUE MALL SUR 406 W 5TH AVE AL FULTONDALE PROMENADE FULTONDALE 3363 LOWERY PKWY AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA AL MOBILE BEL AIR MALL 3400 BELL AIR MALL AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE AR JONESBORO MALL @ TURTLE CREEK 3000 E HIGHLAND DR STE 516 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD AR NORTH LITTLE ROCK MC CAIN SHOPG CNTR 3929 MCCAIN BLVD STE 500 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD AZ CHANDLER MILL CROSSING 2180 S GILBERT RD AZ FLAGSTAFF FLAGSTAFF MALL 4600 N US HWY 89 AZ GLENDALE ARROWHEAD TOWNE CTR 7750 W ARROWHEAD TOWNE CENTER AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD AZ LAKE HAVASU CITY SHOPS @ LAKE HAVASU 5651 HWY 95 N AZ MESA SUPERST'N SPRINGS ML 6525 E SOUTHERN AVE AZ NOGALES MARIPOSA WEST PLAZA 220 W MARIPOSA RD AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD AZ PHOENIX CHRISTOWN SPECTRUM 1727 W BETHANY HOME RD AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 AZ TUCSON EL CON SHPG CNTR 3501 E BROADWAY AZ TUCSON TUCSON MALL 4530 N ORACLE RD AZ TUCSON TUCSON SPECTRUM 5265 S CALLE SANTA CRUZ AZ YUMA YUMA PALMS S C 1375 S YUMA PALMS PKWY CA ANTIOCH ORCHARD @SLATTEN RCH 4951 SLATTEN RANCH RD CA ARCADIA WESTFLD SANTA ANITA 400 S BALDWIN AVE CA BAKERSFIELD VALLEY PLAZA 2501 MING AVE CA BREA BREA MALL 400 BREA MALL CA CARLSBAD PLAZA CAMINO REAL 2555 EL CAMINO REAL CA CARSON SOUTHBAY PAV @CARSON 20700 AVALON -

271 Filed 01/06/21 Page 1 of 5

Case 20-13076-BLS Doc 271 Filed 01/06/21 Page 1 of 5 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x : In re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, Case No. 20-13076 (BLS) 1 : et al., : : Debtors. Jointly Administered : : Re: D.I. 45, 266 ------------------------------------------------------------ x NOTICE OF POTENTIAL ASSUMPTION AND ASSIGNMENT OF EXECUTORY CONTRACTS OR UNEXPIRED LEASES AND CURE AMOUNTS PLEASE TAKE NOTICE THAT: 1. The above-captioned debtors (collectively, the “Debtors”) each filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Court”) on December 3, 2020. 2. On December 4, 2020, the Debtors filed the Motion of Debtors for Entry of Orders (I)(A) Approving Bidding Procedures for Sale of Substantially All of the Debtors’ Assets, (B) Approving Process for Designation of Stalking Horse Bidder and Provision of Bid Protections, (C) Scheduling Auction for, and Hearing to Approve, Sale of Substantially All of the Debtors’ Assets, (D) Approving Form and Manner of Notices of Sale, Auction and Sale Hearing, (E) Approving Assumption and Assignment Procedures and (F) Granting Related Relief and (II)(A) Approving Sale of Substantially All of the Debtors’ Assets Free and Clear of All Liens, Claims, Interests and Encumbrances, (B) Approving Assumption and Assignment of Executory Contracts and Unexpired Leases -

CBL & Associates Properties 2012 Annual Report

COVER PROPERTIES : Left to Right/Top to Bottom MALL DEL NORTE, LAREDO, TX CROSS CREEK MALL, FAYETTEVILLE, NC BURNSVILLE CENTER, BURNSVILLE, MN OAK PARK MALL, KANSAS CITY, KS CBL & Associates Properties, Inc. 2012 Annual When investors, business partners, retailers Report CBL & ASSOCIATES PROPERTIES, INC. and shoppers think of CBL they think of the leading owner of market-dominant malls in CORPORATE OFFICE BOSTON REGIONAL OFFICE DALLAS REGIONAL OFFICE ST. LOUIS REGIONAL OFFICE the U.S. In 2012, CBL once again demon- CBL CENTER WATERMILL CENTER ATRIUM AT OFFICE CENTER 1200 CHESTERFIELD MALL THINK SUITE 500 SUITE 395 SUITE 750 CHESTERFIELD, MO 63017-4841 strated why it is thought of among the best 2030 HAMILTON PLACE BLVD. 800 SOUTH STREET 1320 GREENWAY DRIVE (636) 536-0581 THINK 2012 Annual Report CHATTANOOGA, TN 37421-6000 WALTHAM, MA 02453-1457 IRVING, TX 75038-2503 CBLCBL & &Associates Associates Properties Properties, 2012 Inc. Annual Report companies in the shopping center industry. (423) 855-0001 (781) 398-7100 (214) 596-1195 CBLPROPERTIES.COM HAMILTON PLACE, CHATTANOOGA, TN: Our strategy of owning the The 2012 CBL & Associates Properties, Inc. Annual Report saved the following resources by printing on paper containing dominant mall in SFI-00616 10% postconsumer recycled content. its market helps attract in-demand new retailers. At trees waste water energy solid waste greenhouse gases waterborne waste Hamilton Place 5 1,930 3,217,760 214 420 13 Mall, Chattanooga fully grown gallons million BTUs pounds pounds pounds shoppers enjoy the market’s only Forever 21. COVER PROPERTIES : Left to Right/Top to Bottom MALL DEL NORTE, LAREDO, TX CROSS CREEK MALL, FAYETTEVILLE, NC BURNSVILLE CENTER, BURNSVILLE, MN OAK PARK MALL, KANSAS CITY, KS CBL & Associates Properties, Inc. -

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 Gamestop Dimond Center 80

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 GameStop Dimond Center 800 East Dimond Boulevard #3-118 Anchorage AK 99515 665 1703 (907) 272-7341 GameStop Anchorage 5th Ave. Mall 320 W. 5th Ave, Suite 172 Anchorage AK 99501 665 6139 (907) 332-0000 GameStop Tikahtnu Commons 11118 N. Muldoon Rd. ste. 165 Anchorage AK 99504 665 6803 (907) 868-1688 GameStop Elmendorf AFB 5800 Westover Dr. Elmendorf AK 99506 75 1833 (907) 474-4550 GameStop Bentley Mall 32 College Rd. Fairbanks AK 99701 665 3219 (907) 456-5700 GameStop & Movies, Too Fairbanks Center 419 Merhar Avenue Suite A Fairbanks AK 99701 665 6140 (907) 357-5775 GameStop Cottonwood Creek Place 1867 E. George Parks Hwy Wasilla AK 99654 665 5601 (205) 621-3131 GameStop Colonial Promenade Alabaster 300 Colonial Prom Pkwy, #3100 Alabaster AL 35007 701 3915 (256) 233-3167 GameStop French Farm Pavillions 229 French Farm Blvd. Unit M Athens AL 35611 705 2989 (256) 538-2397 GameStop Attalia Plaza 977 Gilbert Ferry Rd. SE Attalla AL 35954 705 4115 (334) 887-0333 GameStop Colonial University Village 1627-28a Opelika Rd Auburn AL 36830 707 3917 (205) 425-4985 GameStop Colonial Promenade Tannehill 4933 Promenade Parkway, Suite 147 Bessemer AL 35022 701 1595 (205) 661-6010 GameStop Trussville S/C 5964 Chalkville Mountain Rd Birmingham AL 35235 700 3431 (205) 836-4717 GameStop Roebuck Center 9256 Parkway East, Suite C Birmingham AL 35206 700 3534 (205) 788-4035 GameStop & Movies, Too Five Pointes West S/C 2239 Bessemer Rd., Suite 14 Birmingham AL 35208 700 3693 (205) 957-2600 GameStop The Shops at Eastwood 1632 Montclair Blvd. -

COVID-19 Response – Updated 6/3/20 on June 4Th, Von Maur Will Have 100% of Our Stores Open in the Communities That We Serve

COVID-19 Response – Updated 6/3/20 On June 4th, Von Maur will have 100% of our stores open in the communities that we serve. I am grateful for the response we have received from customers and appreciate your ongoing support of Von Maur. Together, we are upholding the practices that we know will help to ensure the safety of everyone in our communities. Just as we had to weigh the decision to open, individuals have to weigh their personal decision to visit our stores. Your patience has been instrumental as we adapt to our changed shopping environment. Social distancing, limited occupancy and hours, and altered high touch services like makeovers and lingerie fittings have all contributed to the safety measures taken for both employees and customers. I’m sure in the coming months, more changes will be made to support the new way we must do business. However, our commitment to customer service will remain steadfast. No matter how long before you feel comfortable to shop with Von Maur again, be confident in knowing that we will be right here, in your community, waiting to greet you with a smile. Warm Regards, Jim von Maur Updated List of Store Openings: State City Location Opening Date Returns Accepted Alabama Hoover Riverchase Galleria Friday, 5/1/20 Monday, 6/1/20 Georgia Alpharetta North Point Mall Friday, 5/1/20 Monday, 6/1/20 Atlanta Perimeter Mall Friday, 5/1/20 Monday, 6/1/20 Buford Mall of Georgia Friday, 5/1/20 Monday, 6/1/20 Illinois Forsyth Hickory Point Mall Friday, 5/29/20 Monday, 6/8/20 Glenview The Glen Town Center Friday, 5/29/20 Monday, 6/8/20 Lombard Yorktown Center Friday, 5/29/20 Monday, 6/8/20 Moline SouthPark Mall Friday, 5/29/20 Monday, 6/8/20 Normal The Shoppes at College Hills Friday, 5/29/20 Monday, 6/8/20 Orland Park Orland Square Friday, 5/29/20 Monday, 6/8/20 St. -

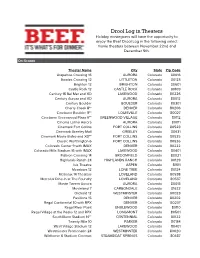

Drool Log in Theaters

Drool Log in Theaters Holiday moviegoers will have the opportunity to enjoy the Beef Drool Log in the following select movie theaters between November 22nd and December 5th. On-Screen Theater Name City State Zip Code Arapahoe Crossing 16 AURORA Colorado 80016 Bowles Crossing 12 LITTLETON Colorado 80123 Brighton 12 BRIGHTON Colorado 80601 Castle Rock 12 CASTLE ROCK Colorado 80109 Century 16 Bel Mar and XD LAKEWOOD Colorado 80226 Century Aurora and XD AURORA Colorado 80012 Century Boulder BOULDER Colorado 80301 Cherry Creek 8** DENVER Colorado 80206 Cinebarre Boulder 11** LOUISVILLE Colorado 80027 Cinebarre Greenwood Plaza 6** GREENWOOD VILLAGE Colorado 80112 Cinema Latino Aurora AURORA Colorado 80011 Cinemark Fort Collins FORT COLLINS Colorado 80528 Cinemark Greeley Mall GREELEY Colorado 80631 Cinemark Movie Bistro and XD** FORT COLLINS Colorado 80525 Classic Worthington 6 FORT COLLINS Colorado 80526 Colorado Center 9 with IMAX DENVER Colorado 80222 Colorado Mills Stadium 16 with IMAX LAKEWOOD Colorado 80401 Flatiron Crossing 14 BROOMFIELD Colorado 80021 Highlands Ranch 24 HIGHLANDS RANCH Colorado 80129 Isis Theatre ASPEN Colorado 81611 Meadows 12 LONE TREE Colorado 80124 Metrolux 14 Theaters LOVELAND Colorado 80538 Metrolux Dine-In at The Foundry LOVELAND Colorado 80537 Movie Tavern Aurora AURORA Colorado 80013 Movieland 7 CARBONDALE Colorado 81623 Orchard 12 WESTMINSTER Colorado 80023 Pavilions 15 DENVER Colorado 80202 Regal Continental 10 with RPX DENVER Colorado 80237 Regal River Point ENGLEWOOD Colorado 80110 Regal Village at the -

Radio Shack Closing Locations

Radio Shack Closing Locations Address Address2 City State Zip Gadsden Mall Shop Ctr 1001 Rainbow Dr Ste 42b Gadsden AL 35901 John T Reid Pkwy Ste C 24765 John T Reid Pkwy #C Scottsboro AL 35768 1906 Glenn Blvd Sw #200 - Ft Payne AL 35968 3288 Bel Air Mall - Mobile AL 36606 2498 Government Blvd - Mobile AL 36606 Ambassador Plaza 312 Schillinger Rd Ste G Mobile AL 36608 3913 Airport Blvd - Mobile AL 36608 1097 Industrial Pkwy #A - Saraland AL 36571 2254 Bessemer Rd Ste 104 - Birmingham AL 35208 Festival Center 7001 Crestwood Blvd #116 Birmingham AL 35210 700 Quintard Mall Ste 20 - Oxford AL 36203 Legacy Marketplace Ste C 2785 Carl T Jones Dr Se Huntsville AL 35802 Jasper Mall 300 Hwy 78 E Ste 264 Jasper AL 35501 Centerpoint S C 2338 Center Point Rd Center Point AL 35215 Town Square S C 1652 Town Sq Shpg Ctr Sw Cullman AL 35055 Riverchase Galleria #292 2000 Riverchase Galleria Hoover AL 35244 Huntsville Commons 2250 Sparkman Dr Huntsville AL 35810 Leeds Village 8525 Whitfield Ave #121 Leeds AL 35094 760 Academy Dr Ste 104 - Bessemer AL 35022 2798 John Hawkins Pky 104 - Hoover AL 35244 University Mall 1701 Mcfarland Blvd #162 Tuscaloosa AL 35404 4618 Hwy 280 Ste 110 - Birmingham AL 35243 Calera Crossing 297 Supercenter Dr Calera AL 35040 Wildwood North Shop Ctr 220 State Farm Pkwy # B2 Birmingham AL 35209 Center Troy Shopping Ctr 1412 Hwy 231 South Troy AL 36081 965 Ann St - Montgomery AL 36107 3897 Eastern Blvd - Montgomery AL 36116 Premier Place 1931 Cobbs Ford Rd Prattville AL 36066 2516 Berryhill Rd - Montgomery AL 36117 2017 280 Bypass -

Greenbrier Mall Norfolk (Chesapeake), VA

Greenbrier Mall Norfolk (Chesapeake), VA Location I-64 and Greenbrier Parkway South Anchors Dillard’s, Macy’s, JCPenney and Sears Size 896,582 square feet Website GreenbrierMall.com Mall Facts Greenbrier Mall is an enclosed, two-level, regional shopping center featuring more than 120 specialty stores including Aéropostale, American Eagle Outfitters, Bath & Body Works, Charlotte Russe, Coastal Edge/ Coastal Kids, Express/Express Men, Hot Topic, Journeys, Lane Bryant, New York & Company, PacSun, Papaya, The Limited, Victoria’s Secret and Wet Seal. New specialty retail shops include Coffee Beanery, Justice, Kay Jewelers (new prototype store) and Street Corner News. Entertainment and dining venues offered at Greenbrier Mall include a more than 21,000 square-foot Jillian’s, Greene Turtle Sports Bar and Grille, Abuelo’s Mexican Food Embassy and a 4-screen Cinema Cafe. Trade Area Chesapeake is one of the fastest growing locations in the Norfolk/Virginia Facts Beach MSA. Greenbrier Mall is centrally located off I-64 with convenient access to I-264, I-464, and Rt. 168 which serves the densely-populated cities of Chesapeake and Virginia Beach, as well as the northeastern counties of North Carolina and the Outer Banks. New development has increased in neighborhoods immediately adjacent to the Greenbrier district in the center of Greenbrier Mall’s primary market. In addition, the Greenbrier corridor offers more than 25 premier hotels. Greenbrier Mall is located at the heart of the Greenbrier business district which has a total business population of more than 96,000 and a greater daytime worker population than downtown Norfolk. The Greenbrier area of Chesapeake is home to several corporate headquarters including major employers Cox Communication, QVC, HSBC, MCI, EDS, Canon, Mitsubishi, Chesapeake Regional Medical Center and Dollar Tree Stores. -

LARGEST RETAIL Centersranked by Gross Leasable Area

CRAIN'S LIST: LARGEST RETAIL CENTERS Ranked by gross leasable area Shopping center name Leasing agent Address Gross leasable area Company Number of Rank Phone; website Top executive(s) (square footage) Center type Phone stores Anchors Twelve Oaks Mall Daniel Jones 1,515,000 Super-regional Joe Maiorana 200 Nordstrom, Macy's, Lord & Taylor, J.C. Penney, Sears 27500 Novi Road, Novi 48377 general manager The Taubman Co. 1. (248) 348-9400; www.shoptwelveoaks.com (248) 258-6800 Lakeside Mall Ed Kubes 1,506,000 Super-regional Niki Cordell 180 Macy's, Macy's Men & Home, Sears, J.C. Penney, Lord & 14000 Lakeside Circle, Sterling Heights 48313 general manager General Growth Properties Inc. Taylor 2. (586) 247-1590; www.shop-lakesidemall.com (312) 960-5270 Oakland Mall Peter Light 1,500,000 Super-regional Jennifer Jones 128 Macy's, Sears, J.C. Penney 412 W. 14 Mile Road, Troy 48083 general manager Urban Retail Properties LLC 3. (248) 585-6000; www.oaklandmall.com (248) 585-4114 Northland Center Casey Conley 1,449,719 Super-regional Amanda Royalty 102 Macy's, Target 21500 Northwestern Hwy., Southfield 48075 assistant general manager AAC Realty 4. (248) 569-6272; www.shopatnorthland.com (317) 590-7913 Somerset Collection John Myszak 1,440,000 Super-regional The Forbes Co. 180 Macy's, Neiman Marcus, Nordstrom, Saks Fifth Avenue 2800 W. Big Beaver Road, Troy 48084 general manager (248) 827-4600 5. (248) 643-6360; www.thesomersetcollection.com Eastland Center Brent Reetz 1,393,222 Super-regional Casey Conley 101 Target, Macy's, Lowe's, Burlington Coat Factory, K&G 18000 Vernier Road, Harper Woods 48225 general manager Ashkenazy Acquisition Corp. -

List of Creditors

Yatsen Group of Companies Inc. and Other Applicants Identified in the Initial Order (collectively, “YGC”) List of Creditors Please note the following: 1. This list of creditors has been prepared from information contained in the books and records of YGC. All balances are as at December 31, 2020. 2. The amounts included in this list of creditors do not take into consideration any un-invoiced amounts, nor have the amounts been adjusted for any amounts that may also be receivable from creditors. 3. This list of creditors has been prepared without admission as to the liability for, or quantum of, any of the amounts shown. 4. To date, a claims procedure has not been approved by the Court, and creditors are NOT required to file a statement of account or proof of claim at this point in time. If, at a later date, a claims procedure is approved by the Court, all known creditors will be notified and claim forms will be posted to the Monitor's website. It is through such a claims procedure that creditor claims will be reviewed and determined. Page 1 of 5 Yatsen Group of Companies Inc., et. al. (collectively, "YGC") List of Creditors Please note the following: 1. This list of creditors has been prepared from information contained in the books and records of YGC. All balances are as at December 31, 2020. 2. The amounts included in this list of creditors do not take into consideration any un-invoiced amounts, nor have the amounts been adjusted for any amounts that may also be receivable from creditors.