Sustainability Report 2020 Re-Imagining Mining to Improve People’S Lives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BHP Economic Contribution Report 2017 1 Chief Financial Officer’S Introduction

Economic Contribution Report 2017 We have a long-standing commitment to transparency. We are proud of the value we generate and how this contributes to building trust with the communities in which we operate. In this Report Chief Financial Officer’s Introduction 2 Tax and our 2017 Financial Statements 20 FY2017 Total economic contribution 3 Basis of Report preparation 21 Our contribution throughout the value chain 6 Glossary 22 Approach to transparency and tax 9 Independent auditor’s report to the Directors Our payments to governments 14 of BHP Billiton Plc and BHP Billiton Limited 23 Corporate Directory 24 BHP Billiton Limited. ABN 49 004 028 077. Registered in Australia. Registered office: 171 Collins Street, Melbourne, Victoria 3000, Australia. BHP Billiton Plc. Registration number 3196209. Registered in England and Wales. Registered office: Nova South, 160 Victoria Street London SW1E 5LB United Kingdom. Each of BHP Billiton Limited and BHP Billiton Plc is a member of the Group, which has its headquarters in Australia. BHP is a Dual Listed Company structure comprising BHP Billiton Limited and BHP Billiton Plc. The two entities continue to exist as separate companies but operate as a combined Group known as BHP. The headquarters of BHP Billiton Limited and the global headquarters of the combined Group are located in Melbourne, Australia. The headquarters of BHP Billiton Plc are located in London, United Kingdom. Both companies have identical Boards of Directors and are run by a unified management team. Throughout this publication, the Boards are referred to collectively as the Board. Shareholders in each company have equivalent economic and voting rights in the Group as a whole. -

Notice of the 2021 Annual General Meeting

Notice of the 2021 Annual General Meeting Wednesday, 5 May 2021 at 14:30 This document is important and requires your immediate attention 20 Carlton House Terrace If you are in any doubt as to any of the proposals referred to in this document or London as to the action you should take, you SW1Y 5AN should immediately consult your stockbroker, bank manager, solicitor, accountant or other professional adviser authorised under the Financial Services and Markets Act 2000. If you have sold or otherwise transferred all of your shares, please send this document, together with the accompanying documents, immediately to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected, for transmission to the purchaser or transferee. Notice of Annual General Meeting Notice of Annual General Meeting Letter from the Chairman Dear Shareholder Voting 2021 Annual General Meeting Our current Articles of Association (Articles) do not allow us to hold I am pleased to invite you to the 2021 Annual General Meeting (AGM) our AGM in a combined physical and electronic format. We are of Anglo American plc which will be formally held at 20 Carlton House therefore unable to offer shareholders online voting facilities during Terrace, London SW1Y 5AN on Wednesday, 5 May 2021 at 14:30. the AGM. To address this going forward, we are seeking to amend our Articles at the 2021 AGM. Following the disruption to our 2020 AGM, caused by social distancing measures implemented by the UK government to It is important that shareholders do still cast their votes in respect manage the impact of the Covid-19 pandemic, our preference of the business of the AGM. -

Integrated Annual Report 2020

ANGLO AMERICAN PLATINUM LIMITED INTEGRATED ANNUAL REPORT 2020 REPORT ANNUAL INTEGRATED Integrated annual report 2020 Anglo American Platinum Limited Purpose: re-imagining mining to improve people’s lives We are grounded in our purpose to re-imagine mining to improve people’s lives. We are transforming the very nature of mining for a safer, cleaner, smarter future. We are using more precise technologies, less energy and less water; we are reducing our physical footprint for every ounce of PGM and base metal we produce. We are combining smart innovation with the utmost consideration for our people, their families, local communities, our customers, and the world at large – to better connect precious resources in the ground to all of us who need and value them. Our focus is on our four strategic priorities to deliver the next phase of value creation for stakeholders. – Stimulate new markets and leverage new capabilities – Embed anti-fragility across our business – Maximise value from our core – Be a leader in ESG Refers to other pages in this report Supporting documentation on the website Full annual financial statements (AFS) Full Ore Reserves and Mineral Resources report Environmental, social and governance (ESG) report Notice of annual general meeting www.angloamericanplatinum.com/investors/annual-reporting/2020 Contents 1 Our report 4 Strategy, PGM markets and 99 Our economic contribution in Zimbabwe business model in 2020 1 Approach to reporting 101 Mining and concentrator operations review 2 Reporting principles 38 Strategic priorities -

Empirical Inference of Related Trading Between Two Securities: Detecting Pairs Trading, Merger Arbitrage, and Strategy Rules*

Empirical inference of related trading between two securities: Detecting pairs trading, merger arbitrage, and strategy rules* Keith Godfrey The University of Western Australia Working paper: 5 September 2013 The traditional approach to studying pairs trading is to simulate profitability using ex-post historical prices. I study the actual trades reported anonymously in security pairs and build statistical inferences of related trading. The approach is based on the time differences between trades. It can distinguish intrinsically related securities from pseudo-random sets, find stocks involved in merger arbitrage in massive sets of paired index constituents, and infer dominant trading rules of mean reversion algorithms. Empirical inference of related trading can enable further studies into pairs trading, strategy rules, merger arbitrage, and insider trading. Keywords: Inferred trading, empirical inference, pairs trading, merger arbitrage. JEL Classification Codes: G00, G10, C10, C40, C60 The availability of intraday trading or “tick” data with time resolution of a millisecond or finer is opening many avenues of research into financial markets. Analysis of two or more streams of tick data concurrently is becoming increasingly important in the study of multiple-security trading including index tracking, pairs trading, merger arbitrage, and market-neutral strategies. One of the greatest challenges in empirical trading research is the anonymity of reported trades. Securities exchanges report the dates, times, prices, and volumes traded, without identifying the traders. In studies of a single security, this introduces uncertainty of whether each market order that caused a trade was the buy or sell order, and there are documented approaches of inference such as Lee and Ready (1991). -

Franklin Gold and Precious Metals Fund August 31, 2021

FTIF - Franklin Gold and Precious Metals Fund August 31, 2021 FTIF - Franklin Gold and Precious August 31, 2021 Metals Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date BK9M4K4 ADVENTUS MINING CORP 1,950,000 $1,360,069 0.32% N/A N/A 008474108 AGNICO EAGLE MINES LTD 23,000 $1,322,960 0.32% N/A N/A 011532108 ALAMOS GOLD INC 1,138,800 $8,996,520 2.15% N/A N/A 011532108 ALAMOS GOLD INC 486,071 $3,837,098 0.92% N/A N/A 6761000 ANGLO AMERICAN PLATINUM LTD 44,900 $5,092,029 1.22% N/A N/A 035128206 ANGLOGOLD ASHANTI LTD 327,620 $5,595,749 1.34% N/A N/A 6565655 -

Audited Annual Financial Statements 2020

ANGLO AMERICAN PLATINUM LIMITED AUDITED ANNUAL FINANCIAL2020 STATEMENTS Audited annual financial statements 2020 Anglo American Platinum Limited Purpose: re-imagining mining to improve people’s lives We are grounded in our purpose to re-imagine mining to improve people’s lives. We are transforming the very nature of mining for a safer, cleaner, smarter future. We are using more precise technologies, less energy and less water; we are reducing our physical footprint for every ounce of PGM and base metal we produce. We are combining smart innovation with the utmost consideration for our people, their families, local communities, our customers, and the world at large – to better connect precious resources in the ground to all of us who need and value them. Our focus is on our four strategic priorities to deliver the next phase of value creation for stakeholders. – Stimulate new markets and leverage new capabilities – Embed anti-fragility across our business – Maximise value from our core – Be a leader in ESG Supporting documentation on the website Full Ore Reserves and Mineral Resources report Environmental, social and governance (ESG) report Integrated report www.angloamericanplatinum.com/investors/annual-reporting/2020 Contents 1 Compliance and assurance 3 Annexures 2 Directors’ responsibilities and approval of the annual financial 60 Annexures statements 3 Chief executive officer and the finance officer responsibility statement 4 Anglo American Platinum Limited’s annual financial 3 Company secretary’s certificate statements 4 Independent -

“Toward Integrated Operations in the Mining and Metals Industry”

“Toward Integrated Operations in the Mining and Metals Industry” Laura Mottola, Flow Partners, President and CEO Ezequiel Muñoz, Codelco, Director Safety and Business Continuity, TICA Management Alberto Caneo, Codelco, Head of Unit, Automation Dept., TICA Management Héctor Cerda, Codelco, Head of Emerging Technologies Department, TICA Management Ricardo Aguilera, Barrick, Regional Technological Projects and Innovation Manager Dylan Bennett, Teck, Head of Operational Technology, Chile, IS+T Sergio Silva, FMI, Regional MIS Manager Gustavo Arriagada, Anglo American, Senior Business Improvement Advisor Fernando Romero, Anglo American, Operational Technologies and Systems Manager Confidentiality of the presentation All information contained in this document is of a confidential nature and as such is protected. For that reason, it can only be used by the people who directly participated in the Automining 2014 event and who necessarily require having access to its contents. The improper use, duplication and revelation of this information to third parties, without prior written authorisation from the author companies will entitle them, separately and jointly, to initiate the applicable legal actions and to pursue any compensatory action established by current law in the Republic of Chile. Therefore, any recipient of this information must watch over compliance with this obligation, providing all the safeguards necessary for that purpose. If authorisation is required for other, non-commercial purposes, that authorisation must be separately requested from all the authors, making due reference to the name of the document, date, event and company, and the names of all the authors. From where did this collaboration initiative arise? “Global mining Researchers OTM’s collaboration on Regulators OEM’s solutions to common industry problems, needs and technology Mining Companies Service through standards, Providers guidelines and best Standards Organizations practices” ISO, IEEE, SAE …. -

Chapter 8: Colombia

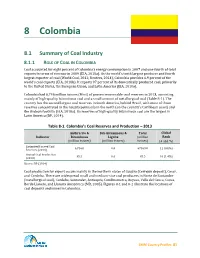

8 Colombia 8.1 Summary of Coal Industry 8.1.1 ROLE OF COAL IN COLOMBIA Coal accounted for eight percent of Colombia’s energy consumption in 2007 and one-fourth of total exports in terms of revenue in 2009 (EIA, 2010a). As the world’s tenth largest producer and fourth largest exporter of coal (World Coal, 2012; Reuters, 2014), Colombia provides 6.9 percent of the world’s coal exports (EIA, 2010b). It exports 97 percent of its domestically produced coal, primarily to the United States, the European Union, and Latin America (EIA, 2010a). Colombia had 6,746 million tonnes (Mmt) of proven recoverable coal reserves in 2013, consisting mainly of high-quality bituminous coal and a small amount of metallurgical coal (Table 8-1). The country has the second largest coal reserves in South America, behind Brazil, with most of those reserves concentrated in the Guajira peninsula in the north (on the country’s Caribbean coast) and the Andean foothills (EIA, 2010a). Its reserves of high-quality bituminous coal are the largest in Latin America (BP, 2014). Table 8-1. Colombia’s Coal Reserves and Production – 2013 Anthracite & Sub-bituminous & Total Global Indicator Bituminous Lignite (million Rank (million tonnes) (million tonnes) tonnes) (# and %) Estimated Proved Coal 6,746.0 0.0 67469.0 11 (0.8%) Reserves (2013) Annual Coal Production 85.5 0.0 85.5 10 (1.4%) (2013) Source: BP (2014) Coal production for export occurs mainly in the northern states of Guajira (Cerrejón deposit), Cesar, and Cordoba. There are widespread small and medium-size coal producers in Norte de Santander (metallurgical coal), Cordoba, Santander, Antioquia, Cundinamarca, Boyaca, Valle del Cauca, Cauca, Borde Llanero, and Llanura Amazónica (MB, 2005). -

Annual Review and Summary Financial Statements 2010 Shareholder Information Continued

Centrica plc Registered office: Millstream, Maidenhead Road, Windsor, Berkshire SL4 5GD Company registered in England and Wales No. 3033654 www.centrica.com Annual Review and Summary Financial Statements 2010 Shareholder Information continued SHAREHOLDER SERVICES Centrica shareholder helpline To register for this service, please call the shareholder helpline on 0871 384 2985* to request Centrica’s shareholder register is maintained by Equiniti, a direct dividend payment form or download it from which is responsible for making dividend payments and www.centrica.com/shareholders. 01 10 updating the register. OVERVIEW SUMMARY OF OUR BUSINESS The Centrica FlexiShare service PERFORMANCE If you have any query relating to your Centrica shareholding, 01 Chairman’s Statement please contact our Registrar, Equiniti: FlexiShare is a ‘corporate nominee’, sponsored by Centrica and administered by Equiniti Financial Services Limited. It is 02 Our Performance 10 Operating Review Telephone: 0871 384 2985* a convenient way to manage your Centrica shares without 04 Chief Executive’s Review 22 Corporate Responsibility Review Textphone: 0871 384 2255* the need for a share certificate. Your share account details Write to: Equiniti, Aspect House, Spencer Road, Lancing, will be held on a separate register and you will receive an West Sussex BN99 6DA, United Kingdom annual confirmation statement. Email: [email protected] By transferring your shares into FlexiShare you will benefit from: A range of frequently asked shareholder questions is also available at www.centrica.com/shareholders. • low-cost share-dealing facilities provided by a panel of independent share dealing providers; Direct dividend payments • quicker settlement periods; Make your life easier by having your dividends paid directly into your designated bank or building society account on • no share certificates to lose; and the dividend payment date. -

Country by Country Reporting

COUNTRY BY COUNTRY REPORTING PUBLICATION REPORT 2018 (REVISED) Anglo American is a leading global mining company We take a responsible approach to the management of taxes, As we strive to deliver attractive and sustainable returns to our with a world class portfolio of mining and processing supporting active and constructive engagement with our stakeholders shareholders, we are acutely aware of the potential value creation we operations and undeveloped resources. We provide to deliver long-term sustainable value. Our approach to tax is based can offer to our diverse range of stakeholders. Through our business on three key pillars: responsibility, compliance and transparency. activities – employing people, paying taxes to, and collecting taxes the metals and minerals to meet the growing consumer We are proud of our open and transparent approach to tax reporting. on behalf of, governments, and procuring from host communities – driven demands of the world’s developed and maturing In addition to our mandatory disclosure obligations, we are committed we make a significant and positive contribution to the jurisdictions in economies. And we do so in a way that not only to furthering our involvement in voluntary compliance initiatives, such which we operate. Beyond our direct mining activities, we create and generates sustainable returns for our shareholders, as the Tax Transparency Code (developed by the Board of Taxation in sustain jobs, build infrastructure, support education and help improve but also strives to make a real and lasting positive Australia), the Responsible Tax Principles (developed by the B Team), healthcare for employees and local communities. By re-imagining contribution to society. -

Jacobs MCM- Quantitative Cost Analysis and Business Case Of

Radi oacti ve Waste S tor age and Dispos al F acilities in S out h A ustr alia – Quantit ati ve C ost A nal ysis and Business C as e Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Project no: IW104700 Document title: Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Revision: Draft Report V1 Date: 09 February 2016 Client name: South Australian Nuclear Fuel Cycle Royal Commission Client no: Jacobs Report (0.4) Project manager: Tim Johnson Authors: Darron Cook, Charles McCombie, Neil Chapman, Nigel Sullivan, Rohan Zauner, Tim Johnson File name: J:\IE\Projects\03_Southern\IW104700\21 Deliverables\Reformatted Docs for Client Release\09022016 Combined Papers V1.0.docx Jacobs Group (Australia) Pty Limited ABN 37 001 024 095 Floor 11, 452 Flinders Street Melbourne VIC 3000 PO Box 312, Flinders Lane Melbourne VIC 8009 Australia T +61 3 8668 3000 F +61 3 8668 3001 www.jacobs.com COPYRIGHT: The concepts and information contained in this document are the property of Jacobs Group (Australia) Pty Limited. Use or copying of this document in whole or in part without the written permission of Jacobs constitutes an infringement of copyright. Document history and status Revision Date Description By Review Approved V0 19 Jan 2016 For Client review Darron Darron Cook Darron Cook, team Cook V1 9 February For public consultation Tim Johnson Darron Cook Darron Cook IW104700 i Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Contents Executive Summary .............................................................................................................................................. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47