Inside the Swiss Stock Exchange

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Scoach Joint Venture to Be Terminated

SIX Swiss Exchange Ltd Media Release Selnaustrasse 30 P.O. Box 1758 CH-8021 Zurich T +41 58 399 5454 20 February 2013 F +41 58 499 5455 www.six-swiss-exchange.com Media Relations: T +41 58 399 2227 F +41 58 499 2710 [email protected] Scoach joint venture to be terminated The joint trading platform operated by SIX and Deutsche Börse for structured products in Switzerland and Germany is to be dissolved following a decision by SIX to terminate the cooperation agreement. The joint venture will end on 30 June 2013 as a result of the termination of the cooperation agreement. The contributing markets will return to the parent companies. Should you have any questions, please feel free to contact Stephan Meier, Media Relation SIX Phone: +41 58 399 3290 Fax: +41 58 499 2710 E-mail: [email protected] Dr. Frank Herkenhoff, Deutsche Börse Phone: +49 (0)69 2 11-1 34 80 Mobile: +49 (0)172 619 9759 Fax: +49 (069) 2 11-61 3480 E-Mail: [email protected] SIX Swiss Exchange SIX Swiss Exchange is a leading regulated securities exchange in Europe and unrivalled SIX Swiss Exchange is a leading regulated securities exchange in Europe and unrivalled in the life science area. SIX Swiss Exchange forms the efficient and transparent reference market for trading in its attractive segments of equities, bonds, Exchange Traded Funds (ETFs) and Exchange Traded Products (ETPs). SIX Swiss Exchange calculates a wide range of indices – including Switzerland’s foremost equity index, the SMI®, further benchmarks such as the SLI® and SPI® as well as industry, bond and customer indices. -

Execution Venues List

Execution Venues List This list should be read in conjunction with the Best Execution policy for Credit Suisse AG (excluding branches and subsidiaries), Credit Suisse (Switzerland) Ltd, Credit Suisse (Luxembourg) S.A, Credit Suisse (Luxembourg) S.A. Zweigniederlassung Österreichand, Neue Aargauer Bank AG published at www.credit-suisse.com/MiFID and https://www.credit-suisse.com/lu/en/private-banking/best-execution.html The Execution Venues1) shown enable the in scope legal entities to obtain on a consistent basis the best possible result for the execution of client orders. Accordingly, where the in scope legal entities may place significant reliance on these Execution Venues. Equity Cash & Exchange Traded Funds Country/Liquidity Pool Execution Venue1) Name MIC Code2) Regulated Markets & 3rd party exchanges Europe Austria Wiener Börse – Official Market WBAH Austria Wiener Börse – Securities Exchange XVIE Austria Wiener Börse XWBO Austria Wiener Börse Dritter Markt WBDM Belgium Euronext Brussels XBRU Belgium Euronext Growth Brussels ALXB Czech Republic Prague Stock Exchange XPRA Cyprus Cyprus Stock Exchange XCYS Denmark NASDAQ Copenhagen XCSE Estonia NASDAQ Tallinn XTAL Finland NASDAQ Helsinki XHEL France EURONEXT Paris XPAR France EURONEXT Growth Paris ALXP Germany Börse Berlin XBER Germany Börse Berlin – Equiduct Trading XEQT Germany Deutsche Börse XFRA Germany Börse Frankfurt Warrants XSCO Germany Börse Hamburg XHAM Germany Börse Düsseldorf XDUS Germany Börse München XMUN Germany Börse Stuttgart XSTU Germany Hannover Stock Exchange XHAN -

Trading Infosnack #08: This Time Is Different

The Swiss Stock Exchange Trading InfoSnack #08: This Time Is Different 27 May 2021 SIX Swiss Exchange AG, P.O. Box, CH-8021 Zurich Sensitivity: C1 Public This Time Is Different In this article we look at differences in order book dynamics across major European markets. We compile them together with the Swiss market during the non-equivalence period and during the last few months following the return of competition. This allows us to draw some insights about differences in order book structures across periods and venues (primary exchanges and MTFs) as well as comment on order book changes as a result of competition returning in the Swiss market. The European landscape of equity order book design has some homogenous elements across different countries. It includes a harmonized tick size regime, which plays an essential part in order book dynamics. Other aspects that are meaningful but can vary across jurisdictions are restrictions on dark pool trading, different index concentration, the level of competition (or its absence, which is relevant for the analysis of the Swiss market), the local trading community and others. We will refer to some of these aspects when analyzing our results below. In Chart 01, we compute Order-to-trade (OTR) ratios for the lit books in continuous trading. OTR is measured as the ratio of the number of resting lit orders to the number of executed orders. Chart 01 A shows OTR for primary exchanges in their respective Blue Chip indices. The Swiss Stock Exchange reports the lowest OTR ranging below 10 over most of the sample period. -

SIX Swiss Exchange

SIX Swiss Exchange SWXess Maintenance Release 7.2 (SMR7.2) Participant Readiness (Version 3.00) SSX-SMR7.2-READY-/E Version 3.00, 19.09.2018 public Table of Content 1 Introduction ...................................................................................................................................................................4 1.1 Purpose and Scope ...............................................................................................................................................................4 1.2 Changes Since Last Version.................................................................................................................................................4 1.3 Definitions and Abbreviations ............................................................................................................................................4 1.4 References .............................................................................................................................................................................6 1.5 Contacts .................................................................................................................................................................................7 2 Summary and Overview ...............................................................................................................................................8 3 Functional Changes of SMR7.2 ................................................................................................................................... -

Sponsored Access Service Description

The Swiss Stock Exchange Sponsored Access Service Description Version 1.04, 15.04.2020 1 Sponsored Access – Service Description 15.04.2020 Table of Content 1 Introduction .................................................................................................................................................... 3 1.1 Purpose and Scope ......................................................................................................................................... 3 1.2 Changes Since Last Version ............................................................................................................................ 3 1.3 Definitions and Abbreviations .......................................................................................................................... 3 2 Sponsored Access ......................................................................................................................................... 5 2.1 Submission of client orders to the Swiss Stock Exchange ............................................................................... 5 2.2 Service Overview ............................................................................................................................................. 5 3 Legal Relationship and Responsibilities ..................................................................................................... 7 3.1 Sponsoring Participant .................................................................................................................................... -

Change to Equity Derivatives Physical Delivery Settlement Cycle

Transitional Arrangements - Change to Equity Derivatives Physical Delivery Settlement Cycle 1 Exercise/Expiry/Trade 2 Underlying Stock Exchange Current Settlement Cycle New Settlement Cycle Settlement Date Date Futures/Options: Second Borsa Istanbul, Borsa Italiana, Futures/Options: Third Business Thursday 30 June Tuesday 05 July Business Day after Expiry Copenhagen Stock Exchange, Day after Expiry Day/Exercise Day/Exercise Deutsche Boerse, Euronext Amsterdam, Euronext Brussels, Friday 01 July Tuesday 05 July Euronext Lisbon, Euronext Paris, Helsinki Stock Exchange, Irish Stock Exchange, London Stock Exchange, London Stock Exchange (IOB), Oslo Stock Contingent Trades: Stock Contingent Trades: Thursday 30 June Monday 04 July Stock Exchange, SIX Swiss Exchange, Second Business Day after Trade Second Business Day after Trade Stockholm Stock Exchange, Vienna Date Date (no change) Stock Exchange Friday 01 July Tuesday 05 July Futures/Options: Second Futures/Options: Fourth Thursday 30 June Wednesday 06 July Business Day after Expiry Business Day after Expiry Day/Exercise Day/Exercise Friday 01 July Tuesday 05 July Madrid Stock Exchange Stock Contingent Trades: Thursday 30 June Tuesday 05 July Stock Contingent Trades: Third Second Business Day after Trade Business Day after Trade Date Date Friday 01 July Tuesday 05 July Thursday 30 June Thursday 07 July Futures/Options: Fourth Futures/Options: Third Business Business Day after Expiry Day after Expiry Day/Exercise Day/Exercise Friday 01 July Thursday 07 July NYSE, NASDAQ Thursday 30 June Wednesday 06 July Stock Contingent Trades: Third Stock Contingent Trades: Third Business Day after Trade Date Business Day after Trade Date (no change) Friday 01 July Thursday 07 July 1 Effective on and from Friday 01 July 2016 2 For NYSE/NASDAQ, dates reflect the 4th July U.S. -

NZX Limited NZX Participant Rule Procedures

NZX Limited NZX Participant Rule Procedures Contents Section A: Interpretation and Construction ...................................................................... 3 A.1 Interpretation ................................................................................................................ 3 A.2 Construction ................................................................................................................. 3 Section 1: Error Trade Cancellation Procedure .............................................................. 4 1.1 Notice by Trading Participant ........................................................................................ 4 1.2 NZX Action ................................................................................................................... 4 1.3 Information to be provided to NZX ................................................................................ 5 1.4 Trading Error Register .................................................................................................. 5 Section 2: Capital Adequacy and Monthly Reporting ....................................................... 9 Capital Adequacy and Monthly Reporting Procedure ...................................................... Error! Bookm 2.1 Recognised Market Index ............................................................................................. 9 2.2 Recognised Market ..................................................................................................... 10 2.3 Monthly Reporting ........................................................ -

List of Execution Venues Made Available by Societe Generale

List of Execution Venues made available by Societe Generale January 2018 Note that this list of Execution Venues is not exhaustive and will be kept under review and updated in accordance with Societe Generale’s execution practices. Societe Generale reserves the right to use other Execution Venues in addition to those listed below where it deems it appropriate in accordance with execution practices. Where Societe Generale acts as the Execution Venue, it will consider all sources of reasonably available information to obtain the best possible outcome. Fixed Income . The main Execution Venue is Societe Generale SA (and its affiliates) . When the trading obligation for derivatives applies, execution will take place on MiFID trading venues (Regulated Markets, or MTF or OTF or all equivalent venues as SEF) Alternative Venues include: BGC Bloomberg Bloomberg FIET Brokertec GFI Marketaxess MTP MTS TP ICAP Tradeweb Tradition Forex . The main Execution Venue is Societe Generale SA (and its affiliates) Alternative Venues include: 360T Alpha BGC Bloomberg Currenex EBS Equilend FX Connect FX Spotstream FXall Hotpspot ICAP Integral FX inside Reuters Tradertools Cash Equities Abu Dhabi Securities Exchange EDGEA Exchange NYSE Amex Alpha EDGEX Exchange NYSE Arca AlphaY EDGX NYSE Stock Exchange Aquis Equilend Omega ARCA Stocks Euronext Amsterdam OMX Copenhagen ASX Centre Point Euronext Block OMX Helsinki Athens Stock Exchange Euronext Brussels OMX Stockholm ATHEX Euronext Cash Amsterdam OneChicago Australia Securities Exchange Euronext Cash Brussels Oslo -

ICE Global Network Global Content Coverage List

ICE Global Network Global Content Coverage List North America North America EMEA APAC Activ Financial ICE TMC Aquis Exchange ASX (NTP Derivatives) Aequitas NEO Exchange ICE Swap Trade BME - Bolsas y Mercados Españoles CXA (CHI-X Australia) ATG Americas IEX (Investors Exchange) Borsa Italiana Group CXJ (CHI-X Japan) Barclays Capital IIROC Börse Stuttgart (SID platform) HKEX (OMD C Securities & D Derivatives) BGC Fenics Itiviti (NYFIX, ULLink PTRMS (Canada)) CBOE Europe ICE Clear Singapore BOX (Boston Stock Exchange) Jane Street Capital CME (BrokerTech EU) ICE Futures Singapore Broadridge (ADP) JP Morgan Chase Deutsche Börse Group (Xetra, Eurex) JPX (TSE Flex Standard/Full, OSE) Broadridge Financial Solutions Lime Brokerage Equiduct KRX - Korea Stock Exchange Canadian Imperial Bank of Commerce - CIBC LTSE (Long Term Stock Exchange) Euronext Group SBI Japanext CBOE US MEMX (Members Exchange) Fastmatch (Euronext FX) SGX (Equities, Derivatives) CBOE FX (Hotspot NY4) MIAX Options, MIAX Pearl Options, Miax Pearl Equities FIS Global (Sungard London-Paris) TAIFEX – Taiwan Futures Exchange CME (CME, NYMEX, COMEX, CBOT) Morgan Stanley Unicast Services Goldman Sachs Sigma-X TPEX – Taipei Exchange CME (BME, DME, MGEX, Indexes, Bitcoin) MSCI Indexes ICE Benchmark Administration TWSE - Taiwan Stock Exchange CME (BrokerTec US) MT Newswires ICE Clear Europe LATAM Credit Suisse NASDAQ Canada (CXC, CX2, CXD, Basic) ICE Clear Netherlands B3 - BM&F & Bovespa Creditex NASDAQ US (All Markets) ICE Futures Europe BCS - Bolsa de Santiago CSE - Canadian Securities -

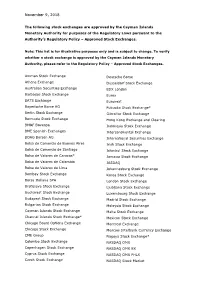

The List of Approved Stock Exchanges

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

SIX Annual Report 2019

Annual Report 2019 Annual Report 2019 Foreword 4 Letter to the shareholders from Dr Romeo Lacher and Jos Dijsselhof Group Report 8 Report on the Business Year 2019 16 Strategic Framework Corporate Governance 19 Management Structure and Shareholders 20 Internal Organization and Competency Rules 23 Board of Directors 24 Executive Board Financial Statements 27 SIX Key Figures 28 Table of Contents 30 SIX Consolidated Financial Statements 2019 125 SIX Group Ltd Financial Statements 2019 six-group.com/annual-report 4 SIX Annual Report 2019 Dr Romeo Lacher, Chairman of the Board of Directors (left), and Jos Dijsselhof, CEO (right). Annual Report 2019 5 Dear readers SIX has changed within the past two years. We have streamlined our organi - zation and realigned it from strategic and operational perspective to respond even better to changing customer needs. With the transfer of the cards business to Worldline in November 2018 our reported operating income dropped by almost half. In 2019, we generated a stable operating income at our continuing business “Those who units and, with continued cost discipline, recorded an increase in EBITDA of 4.4%. This is a solid performance in a difficult environment. want to shape In the years to come, we want to keep growing and improving our operational the change efficiency. In times of fast-paced technological revolution, new competition must change and sinking margins, investments both in our existing infrastructure as well as themselves.” in visionary services such as the SIX Digital Exchange are becoming more and more indispensable. Innovation capacity and expertise in terms of blockchain Dr Romeo Lacher, and digital assets constitute an essential part of the value proposition of a Chairman of the modern financial market infrastructure. -

How to Make Your IPO More Efficient and Effective

How to Make Your IPO More Efficient and Effective IPO Guide of the Swiss Stock Exchange 01 Contents Contents Contents P.05 Foreword 5 Foreword The Importance of the Financial Sector 7 Raising Capital Efficiently for a Successful IPO 8 P.07–P.13 Reasons to Go Public 11 Prerequisites for a Successful IPO 12 Financial Strength as the Basis for Raising An IPO Requires Professional Partners 15 Capital Efficiently Phases of the IPO Process 18 Listing Without Placement of Shares 24 P.15 –P. 33 Underwriting Agreement and Offering/Listing Prospectus 26 Strong Partners Provide Selected Aspects Relating to Financial Reporting 29 Peace of Mind The Equity Story – the Core of Investor Relations 31 Listing Requirements 35 P. 35 –P.49 After-Market and the Importance of Research 39 Investors’ Expectations of Listed Companies 41 It’s the Little Things That Set Us Apart – Capital Increases in Switzerland 43 Lots of Them Case Study: Glarner Kantonalbank 45 Case Study: Investis Holding SA 47 P. 51–P. 54 IPO Checklist 51 Solution-Oriented in Selected IPO Partners 53 Every Situation 03 Foreword Foreword Welcome to the Swiss Financial Center According to the World Economic Forum, Switzerland The decision to go public is one of the most significant has been one of the world’s most competitive economies decisions a company can take. The sheer number of for several years. It has also occupied a top spot in the aspects that need to be taken into account in this heart of Europe in terms of innovation and political and context may make going public seem challenging.