Public Announcement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

23Rd Annual Report 2018 - 2019

7771st Annual Report 2018-19 Governing Board Mr Vijay Bhushan Chairman Mr Mahender Kumar Gupta Director Mr Vinod Kumar Goel Director Mr. Hans Raj Kapoor Director Company Secretary Mr Sunil Bhatia Auditors P. Bholusaria & Co. Chartered Accountants Bankers: Canara Bank HDFC Bank Registered Office: DSE House, 3/1, Asaf Ali Road New Delhi-110 002 Registrar & Transfer Agent : Abhipra Capital Limited Dilkhush Industrial Estate A-387, G. T. Karnal Road, Azadpur New Delhi-110 033 1 Delhi Stock Exchange Limited CIN:U91120DL1947PLC001239 CONTENTS Governing Board 1 Directors’ Report 3 Corporate Governance Report 6 Form AOC-2 10 MGT-9 11 Independent Auditors’ Report 20 Balance Sheet 25 Profit & Loss Account 26 Cash Flow Statement 27 Notes 28 Form AOC-1 47 Consolidated Financial Report Independent Auditors’ Report 48 Balance Sheet 54 Profit & Loss Account 55 Cash Flow Statement 56 Notes 57 Delstox Stocks And Shares Ltd. (Formerly DSE Financial Services Ltd.) Governing Board 78 Notice 79 Directors’ Report 80 Corporate Goverance Report 84 MGT-9 86 Form AOC-2 93 Independent Auditors’ Report 94 Balance Sheet 99 Profit & Loss Account 100 Cash Flow Statement 101 Notes 102 Proxy 115 Map 116 2 7771st Annual Report 2018-19 DIRECTORS’ REPORT Dear Shareholders, Your Directors take pleasure in presenting 71st Annual Report on the operations of the Company and the audited accounts for the year ended March 31, 2019. The financial highlights including consolidated results of the Company for the year are as under:- FINANCIAL HIGHLIGHTS (` in lacs) Particulars Stand-alone -

Elixir Journal

50958 Garima saxena and Rajeshwari kakkar / Elixir Inter. Law 119 (2018) 50958-50966 Available online at www.elixirpublishers.com (Elixir International Journal) International Law Elixir Inter. Law 119 (2018) 50958-50966 Performance of Stock Markets in the Last Three Decades and its Analysis Garima saxena and Rajeshwari kakkar Amity University, Noida. ARTICLE INFO ABSTRACT Article history: Stock market refers to the market where companies stocks are traded with both listed Received: 6 April 2018; and unlisted securities. Indian stock market is also called Indian equity market. Indian Received in revised form: equity market was not organized before independence due to the agricultural conditions, 25 May 2018; undeveloped industries and hampering by foreign business enterprises. It is one of the Accepted: 5 June 2018; oldest markets in India and started in 18th century when east India Company started trading in loan securities. During post-independence the capital market became more Keywords organized and RBI was nationalized. As we analyze the performance of stock markets Regulatory framework, in the last three decades, it comes near enough to a perfectly aggressive marketplace Reforms undertaken, permitting the forces of demand and delivers an inexpensive degree of freedom to Commodity, perform in comparison to other markets in particular the commodity markets. list of Deposit structure, reforms undertaken seeing the early nineteen nineties include control over problem of Net worth, investors. capital, status quo of regulator, screen primarily based buying and selling and threat management. Latest projects include the t+2 rolling settlement and the NSDL was given the obligation to assemble and preserve an important registry of securities marketplace participants and experts. -

Public Announcement

MASTEK LIMITED Registered Office : 804/805, President House, Opp-CNVidyalaya, Near Ambavadi Circle, Ahmedabad 380006. Visit us at www.mastek.com PUBLIC ANNOUNCEMENT FOR THE ATTENTION OF THE SHAREHOLDERS/BENEFICIAL OWNERS OF THE SHARES OF THE COMPANY [This Public Announcement is in compliance with the Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 1998, as amended] Offer for Buy-back of Equity Shares from Open Market through Stock Exchanges 7. SOURCES OF FUNDS 1. THE OFFER AND BUY-BACK PRICE 1.1 Mastek Limited ("the Company") hereby announces the Buy-back (" the Buy-back") of its fully paid-up equity shares of the face value Rs.5 /- each ("Shares") from the 7.1 The maximum amount, which the Company would deploy for the purposes of the Buy-back, is Rs.10.93 crores. existing owners of Shares from the open market through stock exchange using the electronic trading facilities of the Stock Exchange, Mumbai ("BSE") and The National Stock Exchange ("NSE") in accordance with the provisions of Sections 77A, 77AA and 77B of the Companies Act, 1956 ("the Act") and the Securities and 7.2 The Company has significant accumulated Free Reserves and Share Premium as well as favourable liquidity, which is reflected in the Cash and Bank balances, and Exchange Board of India (Buy-back of Securities) Regulations, 1998 ("the Buy-Back Regulations") at a price not exceeding Rs.320 per Share ("Maximum Offer Price") other liquid Investments of the Company and the same would be utilised for the Buy-back. The funds required for the Buy-back will be drawn out of the Share Premium payable in cash, for an aggregate amount not exceeding Rs.10.93 crores ("Offer Size"). -

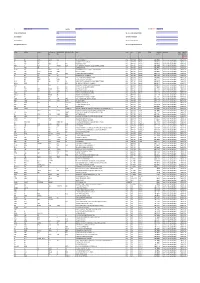

Final Dividend for the Year 2013-2014 As on 31-03-2021

Oriental Carbon & Chemicals Limited Unpaid Dividend Details for Final Dividend for the Year 2013-2014 As on 31-03-2021 -------------------------------------------------------------------------------------------------------- NAMES & ADDRESS OF THE SHARE NO. OF Amount HOLDER SHARES (RS.) SR NO FOLIO NO. WARRANTNO --------------------------------------------------------------------------------------------------------. 1 B090156 2 BANWARI LAL GOYAL 300 1500.00 C/O GOYAL OIL MILL IND. NEAR BUS STAND CHOMU DIST. JAIPUR 2 C000281 3 SURESH KUMAR PRABHUDAS 34 170.00 CHUDASAMA C/O P.N.CHUDASAMA DHANJI BLDG MANI BHAI CHOWK SAVARKUNDALA 3 G000163 5 RAM CHANDRA GAUR 8 40.00 GAYATRI NILAY 78-79,CHURCH ROAD VISHNUPURI,ALIGANJ LUCKNOW 4 M000426 6 MAHENDRA MANSUKHLAL MODY 10 50.00 B/61, GANGA NAGAR SOCIETY NR. TECKARAWALA SCHOOL PALANPUR PATIA, RANDER ROAD SURAT-9 5 M005151 7 MAFATLAL TRIBHOVANDAS PATEL 100 500.00 16A, TRIDEV PARK SOCIETY MADHEVNAGAR, TEKARA VASTRAL ROAD AHMEDABAD 6 M090099 8 JAGAT RAM MOTWANI 2000 10000.00 C/O SHARDA CYCLE AGENCY, CONGRESS COMPLEX, SHOP NO. 2, BUGHAR ROAD SHAHDOL 7 N000160 9 LALITA NATANI 4 20.00 C-56,PUNCH SHEEL COLONY BH.BAKE HOME NEAR OLD OCTROI NAKA AJMER ROAD JAIPUR 8 V000420 11 NEELU VARMA 4 20.00 C/O MR SURAJ PRAQSAD RASTOGI 2/419 KHATRANA FARURKHABAD U P 9 A000026 12 GULABCHAND AJMERA 52 260.00 RAJPATH CHHOTA BAZAR P O SAMBHAR LANE RAJASTHAN 10 A000120 13 RAVI KRISHANA AGARWAL 50 250.00 PREM KUNJ MAIN ROAD MOTIHARI CHAMPARAN 11 A000150 14 SUBASH CHANDER AGGARWAL 4 20.00 C/O KASHMIRI LALL AGGARWAL & BROS ENGINEERS -

MUTUAL FUNDS: Comparison of Various Schemes Under Equity ”

A Project Report On “MUTUAL FUNDS: Comparison of various schemes under equity ” Submitted By: Yashika Sharma In partial fulfillment of the award of the degree of Master of Business Administration University School of Management Kuruksheta University Kurukhetra CERTIFICATE This is to certify that this project report “Mutual Funds: Comparison of various schemes under equity” is the bona fide work of Yashika Sharma who carried out the project under my supervision Date: (Signature) Anil Kumar Kapoor Manager- financial Planning Master Trust Ltd. ACKNOWLEDGEMENT It gives me immense pleasure to present the project report entitled “MUTUAL FUNDS: Comparison of various schemes under equity” Preservation, inspiration and motivation have always played a key role in the success of any venture. In the present world of competition and success, training is like a bridge between theoretical and practical working; willingly I prepared this particular Project. I am highly indebited to Mr. Chawla, Ms. Rinkoo Vashisht & Mr. Kapoor for their guidance and constant supervision as well as for providing necessary information regarding the project and also for their support in completing the project. I am also thankful to all the friends and family members. Yashika Sharma TABLE OF CONTENT S.NO. PARTICULERS PAGE NUMBER 1. Executive Summary 2. Objective 3. Introduction of the company – Master Trust LTD. 4. Mutual funds : Basics, History, Types & pros and cons 5. Equity funds explained 6. Fund houses: ICICI prudential Reliance SBI 7. Comparison of Various schemes under equity 8. Conclusion 9. Latest Amendments in Mutual Funds 10. References EXECUTIVE SUMMERY The Mutual Fund is an untapped area which is bound to be the next growth story. -

Partial List Ex Conference 20

Artemis Health Institute Bharat Serums & Vaccines Carrier CP Milk & Food Products Discovery FCDO GlaxoSmithkline Henkel India Shelter Finance Corporation Kadtech Infraprojects LSEG MIND NIIT Paytm Money PT Bank BTPN RTI Shyam Spectra Stryker ThoughtWorks ValueMined Technologies Y-Axis Solutions Arth Group Bharti Axa Life Insurance Cars24 CP Plus Dksh FE fundinfo Glenmark Pharmaceuticals Herbalife Nutition IndiaMART Kaivalya Educatiion Foundation LTI MindTickle Nineleaps technology solutions PayU PT. Media Indra Buana Ruby Seven Studios Shyam Spectra STT Global Data Centres Thryve Digital Valuex Technologies Yamaha Motor Arvind Fashions Bhel Caterpillar CP Wholesale DLF Fedex GlobalEdge Here Technologies Indigo Kalpataru Luminous Power Technologies Mindtree Nippon Koei PCCPL PTC Network Rustomjee Sidel Successive Technologies Tierra Agrotech Varroc Engineering Yanbal Asahi India Glass BIC CDK Global CPI DMD ADVOCATES Ferns n Petals GlobalLogic Herman Miller Indmoney Kama Ayurveda Luthra Group MiQ Digital NISA Global PCS Publicis Media S P Setia Siemens Sulzer Pumps Tifc Varuna Group Yanmar TAKE A LOOK AT LIST OF Ashirvad Pipes Bidgely Technologies CEAT Creditas Solutions DP World Ferrero GMR Hero Indofil industries Kanishk Hospital Luxury Personified Mizuho Bank Nissan Peak Infrastructure Management PUMA Group S&P Global Sigma AVIT Infra Services Summit Digitel Infrastructure TIL Vastu Housing Finance Corpora- Yara COMPANIES WHO WILL JOIN Asian paints Bigtree Entertainment Celio Cremica Dr Reddy's Ferring Pharmaceuticals Godrej & Boyce -

Complete Book of Banking & Computer Awareness by Debarati

IBPS Examinations Banking Awareness tips for recruitment as clerks and officers in banks e-book (Banking Awareness) PART: 01 Prepared by Debarati Mukherjee meetdebaratimukherjee.wordpress.com Follow in Facebook https://www.facebook.com/bforbureaucracy 1 BULLET POINTS - PART: 001 Reserve Bank of India 01. Central bank is a bank which acts as a banker to the government; has monopoly of note issue and controls the entire banking system 02. RBI is the central bank in India 03. RBI was established by an act of Parliament in 1934 04. The initial share capital for RBI was Rs. 5 crores 05. RBI was nationalized under (transfer of public ownership) act 1948 06. Its affairs are regulated by central board of directors 07. It has four regional centres at Mumbai, Kolkatta, Chennai and Delhi 08. The central office of the bank is at Mumbai 09. RBI is note issuing authority; banker, agent and financial adviser to the government; custodian of cash reserves of banks; custodian of nation's reserves of foreign exchange; lender of the last resort; controller of credit etc. 10. Currency notes other than one rupee notes are issued by RBI 11. RBI has credit control ± regulation of cash reserves of commercial banks, regulating the flow of credit, qualitative control and open market operations 12. Handles all government transactions 13. It is a banker's bank 14. It maintains the exchange rate for the Indian rupee; hold the country's reserves in foreign currencies and administration of the exchange management regulations Scheduled commercial banks 15. They are included in the second schedule to the RBI act, 1934 16. -

Finvasia Securities Private Limited

SET OF ACCOUNT OPENING DOCUMENT FINVASIA SECURITIES PRIVATE LIMITED SEBI REGN NO.: INZ000176037 MCX Member Code : 55135 NCDEX Member Code : 01259 Clearing Member : Globe Commodities Ltd. (MCX & NCDEX 8550) Regd. Address : 802, Ansal Bhawan, 16 K.G. Marg, C.P., New Delhi-1 Corporate Office : FINVASIA CENTRE, D 179, Phase 8 B (Sector 74) Mohali, Punjab 160055 (India) Phone : +91-172-6670000, Fax : +91-172-6670070, E-mail : [email protected] Registered Office : #1108, Sector 21-B, Chandigarh - 160022 Trading Member with MCX & NCDEX Compliance Officer's Details : Ramanjeet Kaur, E-mail : [email protected], Ph.: +91-172-6670000, Fax : +91-172-6670070 INDEX OF DOCUMENTS MANDATORY DOCUMENTS AS PRESCRIBED BY SEBI & EXCHANGES S.No. Name of the Document Brief Significance of the Document Page No. 1. KYC (Account Opening) KYC form - Document captures the basic information about the constitute and an 1-3 Application Form instruction / check list. 2. Uniform Risk Disclosure Documents detailing Risk associated with dealing in the Commodities Market. By Email Document (RDD) 3. Rights and Obligations of Document stating the Rights & Obligation of Member, Authorized Person and client for Trading on exchanges Members, AP and Clients (including additional Rights and Obligations in case of Internet/Wireless Technology based Trading) By Email 4. Do's and Don'ts for the Document detailing Do's & Don'ts for Trading on exchange, for the education for the investors. By Email Investors 5. Policies & Procedures Policies and procedures as per Exchange. By Email 6. Other Details Past Action, Dealing Through Other Member, Introducer Details etc. 4-6 7. Tariff Sheet Document detailing the rate/amount of brokerage and other charges levied on the client for 7-7 trading on the Commodity Exchange & Intimation for Proprietary Trading. -

3. Collective Investment Vehicles

Indian Securities Market A Review Volume XX 2017 This publication reviews the developments in the securities market in India. Online: www.nseindia.com NATIONAL STOCK EXCHANGE OF INDIA LIMITED Indian Securities Market A Review Copyright © 2017 by National Stock Exchange of India Ltd. (NSE) Exchange Plaza, Bandra Kurla Complex Bandra (East), Mumbai 400 051 INDIA All rights reserved. No part of this publication may be produced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise without the written permission of NSE, except as stated below. Single photocopies of single chapters may be made for private study or research. Illustrations and short extracts from the text of individual chapters may be copied provided that the source is acknowledged and NSE is notified. This publication reviews the recent developments in the Indian Securities Market. The views expressed herein do not necessarily reflect those of NSE. The information and/ or content (collectively ‘Information’) provided herein is general information. While reasonable care has been exercised to ensure that the Information is adequate and reliable, no representation is made by NSE as to its accuracy or completeness and NSE, its affiliates and subsidiaries accept no liability of whatsoever nature for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this Information. Any Information provided herein is not intended to, nor does it constitute as financial, tax, legal, investment, or any other advice. The readers are expected to undertake their own diligence and are advised not to solely rely on this document. -

70Th Annual Report 2017-18 Governing Board

70th Annual Report 2017-18 Governing Board Mr Vijay Bhushan (Chairman) Mr Mahender Kumar Gupta Director Mr Vinod Kumar Goel Director Mr. Hans Raj Kapoor Director Company Secretary Mr Sunil Bhatia Auditors P. Bholusaria & Co. Chartered Accountants Bankers: Canara Bank HDFC Bank Registered Office: DSE House, 3/1, Asaf Ali Road New Delhi-110 002 Registrar & Transfer Agent : Abhipra Capital Limited Dilkhush Industrial Estate A-387, G. T. Karnal Road, Azadpur New Delhi-110 033 1 Delhi Stock Exchange Limited CIN:U91120DL1947PLC001239 CONTENTS Governing Board 1 Notice 3 Directors’ Report 5 Corporate Governance Report 8 Form AOC-2 12 MGT-9 13 Independent Auditors’ Report 22 Balance Sheet 27 Profit & Loss Account 28 Cash Flow Statement 29 Notes 31 Form AOC-1 49 Consolidated Financial Report Independent Auditors’ Report 50 Balance Sheet 55 Profit & Loss Account 56 Cash Flow Statement 57 Notes 58 DSE Financial Services Ltd. (A subsidiary of Delhi Stock Exchange) Governing Board 78 Notice 79 Directors’ Report 81 Corporate Goverance Report 84 MGT-9 87 Form AOC-2 94 Independent Auditors’ Report 95 Balance Sheet 100 Profit & Loss Account 101 Cash Flow Statement 102 Notes 103 Map 116 2 70th Annual Report 2017-18 NOTICE TO SHAREHOLDERS NOTICE is hereby given that 70th Annual General Meeting of the shareholders of Delhi Stock Exchange Limited will be held on Saturday, , September 29, 2018 at 11:30 AM at DSE House, 3/1, Asaf Ali Road, New Delhi – 110002 to transact the following business: Ordinary Business: 1. To receive, consider and adopt: a. the Audited Financial Statements of the Company for the financial year ended March 31, 2018, together with the Reports of the Board of Directors and the Auditors thereon; and b. -

A Study on Risk and Return Analysis of Selected Stocks in BSE Sensex by ABHISHEK.V (1AZ16MBA04)

A Project report (16MBAPR407) A Study on Risk and Return analysis of Selected Stocks in BSE Sensex BY ABHISHEK.V (1AZ16MBA04) Submitted to VISVESVARAYA TECHNOLOGICAL UNIVERSITY, BELGAUM In partial fulfilment of the requirements for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under the guidance of INTERNAL GUIDE EXTERNAL GUIDE Dr.Prakash B Yargol Meghesh.M Professor Business Head Acharya Institute of Technology J WINGS Department of MBA Acharya Institute of Technology Soladevanahalli, Bangalore-560 107 May 2018 CERTIFICATE TO WHOl\l SO EVER IT MAY CONCERN I. This is to certify that Mr. Abhishek.\", a student of Acharya Institute of Technology - th Bangal01:e, Pursued 03 (Three) months of Internship with us from 15 January 2018 to 24'h March 2018 2. During the Summer Internship. he has successfully completed the project titled "A ~tudy on Risk and Re-turn analysis of selected stocks in BSE Sensex" under the guidance of Mr. Megesh. M. 3. The Students performance during the Internship and comments on his project work are as under:- Mr. Abhishek.V completes ass1gnmcnls in a timely manner. performs quality work that is accurate and thorough, and manages time effectively. Student is responsible, punctual. ha~ good attendance. Student expresses thoughts clearly and is professional in dealing with both co-workers and the clients. Initiative asks for work if not assigned and is able to work independently. We wish him all the very best in foturt' endeavors (Signature of the Autl10rized Company Official) Name Me~esh. M Designation: Business I lead Date 2-l-03 -2018 No. -

CIN Company Name Date of AGM(DD-MON-YYYY)

CIN L99999MH1937PLC002726 Company Name MUKAND LIMITED Date Of AGM(DD-MON-YYYY) 12-AUG-2015 Sum of unpaid and unclaimed dividend 539325 Sum of interest on unpaid and unclaimed dividend 0 Sum of matured deposit 0 Sum of interest on matured deposit 0 Sum of matured debentures 0 Sum of interest on matured debentures 0 Sum of application money due for refund 0 Sum of interest on application money due for refund 0 First Name Middle Name Last Name Father/Husband First Father/Husband Middle Father/Husband Last Name Address Country State District PINCode Folio Number of Investment Type Amount Proposed Date Name Name Securities Due(in Rs.) of transfer to IEPF (DD-MON- YYYY) DATA RAM AGARWAL JAGANNATH PRASAD KC-67 KAVI NAGAR GHAZIABAD U P INDIA UTTAR PRADESH GHAZIABAD 201002 D0000403 Amount for unclaimed and unpaid dividend 135.00 02-AUG-2017 JAI KISHAN BANSAL MANI LAL C/O S K BANSAL R-9/248 RAJNAGAR GHAZIABAD INDIA UTTAR PRADESH GHAZIABAD 201002 J0000450 Amount for unclaimed and unpaid dividend 14.00 02-AUG-2017 JUGAL KISHORE BATRA HAKIM RAI BATRA KC-48, KAVI NAGAR GHAZIABAD INDIA UTTAR PRADESH GHAZIABAD 201002 J0002386 Amount for unclaimed and unpaid dividend 24.00 02-AUG-2017 NANDINI N HEBBAR K NARASIMHA HEBBAR C/O K N HEBBAR SYNDICATE BANK DIVISIONAL OFFICE 5/120 NEW RAJNAGAR GHAZIABAD U P INDIA UTTAR PRADESH GHAZIABAD 201002 N0000510 Amount for unclaimed and unpaid dividend 39.00 02-AUG-2017 OM PRAKASH SAHA NA R 13/86 RAJNAGAR GHAZIABAD INDIA UTTAR PRADESH GHAZIABAD 201002 O0000423 Amount for unclaimed and unpaid dividend 20.00 02-AUG-2017 SULOCHNA