Economics 100B, Midterm #2 Review Questions Chapter 11 Day Manoli 1

Total Page:16

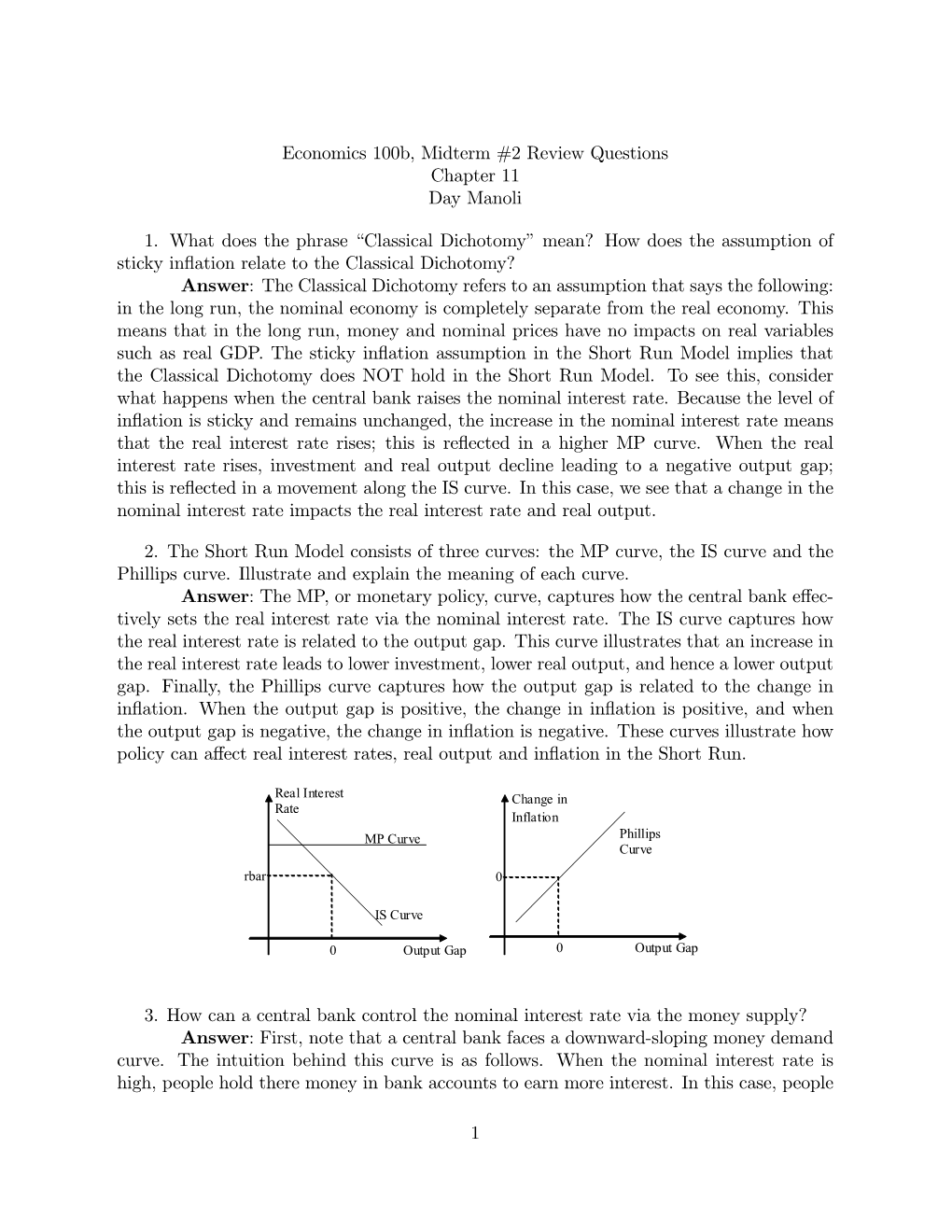

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Downward Nominal Wage Rigidities Bend the Phillips Curve

FEDERAL RESERVE BANK OF SAN FRANCISCO WORKING PAPER SERIES Downward Nominal Wage Rigidities Bend the Phillips Curve Mary C. Daly Federal Reserve Bank of San Francisco Bart Hobijn Federal Reserve Bank of San Francisco, VU University Amsterdam and Tinbergen Institute January 2014 Working Paper 2013-08 http://www.frbsf.org/publications/economics/papers/2013/wp2013-08.pdf The views in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Federal Reserve Bank of San Francisco or the Board of Governors of the Federal Reserve System. Downward Nominal Wage Rigidities Bend the Phillips Curve MARY C. DALY BART HOBIJN 1 FEDERAL RESERVE BANK OF SAN FRANCISCO FEDERAL RESERVE BANK OF SAN FRANCISCO VU UNIVERSITY AMSTERDAM, AND TINBERGEN INSTITUTE January 11, 2014. We introduce a model of monetary policy with downward nominal wage rigidities and show that both the slope and curvature of the Phillips curve depend on the level of inflation and the extent of downward nominal wage rigidities. This is true for the both the long-run and the short-run Phillips curve. Comparing simulation results from the model with data on U.S. wage patterns, we show that downward nominal wage rigidities likely have played a role in shaping the dynamics of unemployment and wage growth during the last three recessions and subsequent recoveries. Keywords: Downward nominal wage rigidities, monetary policy, Phillips curve. JEL-codes: E52, E24, J3. 1 We are grateful to Mike Elsby, Sylvain Leduc, Zheng Liu, and Glenn Rudebusch, as well as seminar participants at EIEF, the London School of Economics, Norges Bank, UC Santa Cruz, and the University of Edinburgh for their suggestions and comments. -

1 the Scientific Illusion of New Keynesian Monetary Theory

The scientific illusion of New Keynesian monetary theory Abstract It is shown that New Keynesian monetary theory is a scientific illusion because it rests on moneyless Walrasian general equilibrium micro‐foundations. Walrasian general equilibrium models require a Walrasian or Arrow‐Debreu auction but this auction is a substitute for money and empties the model of all the issues of interest to regulators and central bankers. The New Keynesian model perpetuates Patinkin’s ‘invalid classical dichotomy’ and is incapable of providing any guidance on the analysis of interest rate rules or inflation targeting. In its cashless limit, liquidity, inflation and nominal interest rate rules cannot be defined in the New Keynesian model. Key words; Walrasian‐Arrow‐Debreu auction; consensus model, Walrasian general equilibrium microfoundations, cashless limit. JEL categories: E12, B22, B40, E50 1 The scientific illusion of New Keynesian monetary theory Introduction Until very recently many monetary theorists endorsed the ‘scientific’ approach to monetary policy based on microeconomic foundations pioneered by Clarida, Galí and Gertler (1999) and this approach was extended by Woodford (2003) and reasserted by Galí and Gertler (2007) and Galí (2008). Furthermore, Goodfriend (2007) outlined how the ‘consensus’ model of monetary policy based on this scientific approach had received global acceptance. Despite this consensus, the global financial crisis has focussed attention on the state of contemporary monetary theory by raising questions about the theory that justified current policies. Buiter (2008) and Goodhart (2008) are examples of economists who make some telling criticisms. Buiter (2008, p. 31, fn 9) notes that macroeconomists went into the current crisis singularly unprepared as their models could not ask questions about liquidity let alone answer them while Goodhart (2008, p. -

Chapter 33: Aggregate Demand and Aggregate Supply Principles of Economics, 8Th Edition N

Chapter 33: Aggregate Demand and Aggregate Supply Principles of Economics, 8th Edition N. Gregory Mankiw Page 1 1. Introduction a. We now turn to a short term view of fluctuations in the economy. b. This is the chapter that made this book controversial as Mankiw tends to ignore the Keynesian framework contained in most Principles textbooks. c. I personally find that to be a substantial improvement over those earlier books. d. Here we use the aggregate demand-aggregate supply model to explain short term economic fluctuations around the long term trend of the economy. e. On average over the past 50 years, the production of the US economy as measured by real GDP has grown by about 3 percent per year. i. While this has to be adjusted for population growth, one has to wonder why people tend to view their economic position so negatively. ii. Recession is a period of declining real incomes and rising unemployment. P. 702. iii. A depression is a severe recession. P. 702. 2. Three Key Facts about Economic Fluctuations a. Fact 1: Economic fluctuations are irregular and unpredictable i. They are called the business cycle, which can be misleading. ii. Figure 1: A Look at Short-run Economic Fluctuations. P. 703. iii. Every time that you hear depressing economic news–and they are reported often, remember Figure 1(a). iv. The last 25 years has observed steady real growth with only minor reversals. b. Fact 2: Most macroeconomic quantities fluctuate together c. Fact 3: As output falls, unemployment rises 3. Explaining Short Run Economic Fluctuations a. -

Title a CRITICISM of MONETARISM : with SOME POINTS from THE

Title A CRITICISM OF MONETARISM : WITH SOME POINTS FROM THE JAPANESE EXPERIENCE Sub Title Author BRAGUINSKY, Serguey Publisher Keio Economic Society, Keio University Publication year 1988 Jtitle Keio economic studies Vol.25, No.2 (1988. ) ,p.41- 48 Abstract The paper attempts at unifying the criticism of "classical dichotomy" made by J. A. Schumpeter and J. M. Keynes. Though Schumpeter's vision was that of the developing economy, with money being an important source of that development, while Keynes dealt primarily with an economy in a state of depression, Keynes's criticism is conjectured to presuppose the existence of the Schumpeterian world in the background, because only in this case can money play an active role by linking the past, present, and future. When the situation is that of Schumpeterian "circular flow", there is indeed a case for "classical dichotomy". Examples from the Japanese economy are cited to illustrate the theoretical points. Notes Genre Journal Article URL https://koara.lib.keio.ac.jp/xoonips/modules/xoonips/detail.php?koara_id=AA00260492-1988000 2-0041 慶應義塾大学学術情報リポジトリ(KOARA)に掲載されているコンテンツの著作権は、それぞれの著作者、学会または出版社/発行者に帰属し、その権利は著作権法によって 保護されています。引用にあたっては、著作権法を遵守してご利用ください。 The copyrights of content available on the KeiO Associated Repository of Academic resources (KOARA) belong to the respective authors, academic societies, or publishers/issuers, and these rights are protected by the Japanese Copyright Act. When quoting the content, please follow the Japanese copyright act. Powered by TCPDF (www.tcpdf.org) A CRITICISM OF MONETARISM—WITH SOME POINTS FROM THE JAPANESE EXPERIENCE Serguey BRAGUINSKY* Abstract. The paper attempts at unifying the criticism of "classical dichotomy" made by J. -

Ch 30 Money Growth and Inflation

LECTURE NOTES ON MACROECONOMIC PRINCIPLES Peter Ireland Department of Economics Boston College [email protected] http://www2.bc.edu/peter-ireland/ec132.html Copyright (c) 2013 by Peter Ireland. Redistribution is permitted for educational and research purposes, so long as no changes are made. All copies must be provided free of charge and must include this copyright notice. Introduction Remember Ch our 30 previous Money example from Chapter Growth 23, “Measuring and the Inflation Cost of Living.” In 1931, the Yankees paid Babe Ruth an annual salary of $80,000. But then again, in 1931, an ice cream cone cost a nickel and a movie ticket cost a quarter. The overall increase in the level of prices, as measured by the CPI or the GDP deflator, is called inflation. Although most economies experience at least some inflation most of the time, in the 19th century many economies experienced extended periods of falling prices, deflation or . And deflation became a threat once again in the US during the recession of 2008 and 2009. Further, over recent decades, there have been wide variations in the inflation rate as well: from rates exceeding 7 percent per year in the 1970s to the current rate of about 2 percent per year. And in some countries during some periods, extremely high rates of inflation have been experienced. In Germany after World War I, for instance, the price of a newspaper rose from 0.3 marks in January 1921 to 70,000,000 marks less than two years later. These episodes of extremely high inflation are called hyperinflations. -

2002.Neutrality of Money.Pdf

526 Net capitalflows Neutrality of money 527 Keynes, J.M. (1936), The General Theory of Employment, Interest and Money, London: recurrent themes in the economics debate over the last two-and-a-half cen- Macmillan. turies. The use of the term 'neutral', however, is of more recent origin. To Keynes J.M. (1937), 'The General Theory of Employment', Quarterly Journalof Economics, 51, February, pp.209-23. all appearances it was fi.rstused by Wicksell to describe a situation where Klein, L.R. and A.S. Goldberger (1955), An Econometric Model ofthe United States: 1929-52, the market rate of interest is equal to the natural rate, that is the rate that New York: John Wiley. would be found in a barter economy (Wicksell, 1898, p.93; 1936, p.l02). Leijonhufvud, A. (1968), On Keynesian Economics and the Economics of Keynes: A Study of Monetmy Theory, New York: Oxford University Press. Wicksell actually did not discuss neutral money but neutral interest. The Lucas, R.E. Jr (1980), 'Methods and Problems in Business Cycle Theory', Journalof Money, idea, however, also implies neutral money in the sense that it describes a Credit and Banking, 12, November, pp.696-715. situation where money is indeed no more than a veil. Koopmans (1933 p. Modigliani, F. (1944), 'Liquidity Preference and the Theory of Interest and Money', Econometrica, 12, January, pp.45-88. 228, n. 1) tells us that the term 'neutral money' was coined in 1919 by the Patinkin, D. (1948), 'Price Flexibility and Full Employment', American Economic Revue, 38, German economist L. von Bortkiewicz and that at the end of the 1920sit September, pp.543-64. -

Explaining Inflation with a Classical Dichotomy Model and Switching Monetary Regimes: Mexico 1932-2013

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Garcés Díaz, Daniel G. Working Paper Explaining inflation with a classical dichotomy model and switching monetary regimes: Mexico 1932-2013 Working Papers, No. 2017-20 Provided in Cooperation with: Bank of Mexico, Mexico City Suggested Citation: Garcés Díaz, Daniel G. (2017) : Explaining inflation with a classical dichotomy model and switching monetary regimes: Mexico 1932-2013, Working Papers, No. 2017-20, Banco de México, Ciudad de México This Version is available at: http://hdl.handle.net/10419/174473 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Banco de México Documentos de Investigación Banco de México Working Papers N° 2017-20 Explaining Inflation with a Classical Dichotomy Model and Switching Monetary Regimes: Mexico 1932-2013 Daniel G. -

Long-Run Money and Inflation Neutrality Test in Indonesia 75

Long-Run Money and Inflation Neutrality Test in Indonesia 75 LONG-RUN MONEY AND INFLATION NEUTRALITY TEST IN INDONESIA Arintoko 1 Abstract This paper investigates long-run neutrality of money and inflation in Indonesia, with due consideration to the order of integration, exogeneity, and cointegration of the money stock-real output and the money stock-price, using annual time-series data. The Fisher-Seater methodology is used to do the task in this research. The empirical results indicate that evidence rejected the long-run neutrality of money (both defined as M1 and M2) with respect to real GDP, showing that it is inconsistent with the classical and neoclassical economics. However, the positive link between the money and price in long run holds for money defined as M1 rather than M2, which consistent with these theories. In particular, besides the positive effect to long-run inflation, monetary expansions have long-run positive effect on real output in the Indonesian economy. JEL: C32, E31, E51 Keywords: long-run neutrality of money, inflation, unit root, exogeneity, cointegration 1 Lecturer Staff of Faculty of Economic of Jenderal Soedirman University, and a PHD student at Postgraduate Program of Economic Science, UGM. e-mail: [email protected]. 76 Bulletin of Monetary, Economics and Banking, July 2011 I. INTRODUCTION The existing money neutrality and the positive correlation between money and price have been very well admitted in economic literature. In classical monetary theory, the change in money supply will affect the nominal variables, but will not affect the real variables because according to classical dichotomy, the power affecting real and nominal variables is different. -

Reading 1: Scarth

1 Keynes and the Classics 1.1 Introduction Over 70 years have elapsed since the publication of Keynes's The Gencral Theory of Bmployment, intercst and Money (1936), yet the controversies between his followers and those macroeconomists who favour a more Classical approach have remained active. One purpose of this book is to examine some of these controversies, to draw attention to developrnents that have led to a synthesis of important ideas from both traditions, and to illustrate in some detail how this integrated approach can inform policy debates. At the policy level, the hallmarks of Keynesian analysis are that involun tary unemployment can exist and that, without government assistance, any adjustment of the system back to the 'natural' unemployment rate is likely to be slow and to involve cycles and overshoots. In its extreme form, the Keynesian view is that adjustment back to equilibrium simply does not take place without policy assistance. This view can be defended by maintaining either of the following positions: (1) the economy has multiple equilibria, only one of which involves 'full' employmentj or (2) there is only one equi librium, and it involves 'full' employment, but the economic system is unsta ble without the assistance ofpolicy, so it cannot reach the 'full' employment eqUilibrium on its own. We shall consider the issue of multiple equilibria in Chapter 9. In earlier chapters, we focus on the question of convergence to a full equilibrium. To simplify the exposition, we concentrate on stability versus outright instabil ity, which is the extreme form ofthe issue. We interpret any tendency toward outright instability as analytical support for the more general proposition that adjustment behveen full equilibria is protracted. -

Intermediate Macroeconomics (ECON 311) Exam 2 Review

Intermediate Macroeconomics (ECON 311) Exam 2 Review Key Terms Aggregate Demand Inflation Price Stickiness Aggregate Supply (SR & LR) Labor Force & participation rate Quantity Theory of Money Business Cycles & Indicators Monetary Base Real Money Balances Classical Dichotomy Money & Money functions Reserves-to-Deposit ratio Currency-to-Deposit ratio Money Demand Seignorage Efficiency Wages Money Multiplier Structural Unemployment Fisher Decomposition Money Neutrality Velocity of Money Fractional Reserve Banking Money Supply Wage Rigidities Frictional Unemployment Open Market Operations True/False Determine if the question is true or false (answer key at end of document) 1. Money is said by economists to be neutral in the short-run. 2. If velocity is stable, changes in the money supply should exert proportional changes in price levels in the longer run. 3. Increases in retirement rates and in numbers of discouraged workers have contributed to increases in the labor force participation rate in recent years. 4. A 5% reduction in the money supply will, according to most economists, reduce prices by 5% in the long-run but lead to unemployment and a reduction in output in the short run. 5. Other things equal, a decline in job finding rates will raise the unemployment rate. Multiple Choice Select the best answer from among the available choices 6. Along the aggregate demand curve, which of the following are held constant? a) real output and prices. b) nominal output and velocity. c) the money supply and real output. d) the money supply and velocity. 7. Discouraged workers are counted as: a) part of the labor force b) out of the labor force c) employed d) unemployed 8. -

Explaining Inflation with a Classical Dichotomy Model and Switching Monetary Regimes: Mexico 1932-2013

Banco de México Documentos de Investigación Banco de México Working Papers N° 2017-20 Explaining Inflation with a Classical Dichotomy Model and Switching Monetary Regimes: Mexico 1932-2013 Daniel G. Garcés Díaz Banco de México December 2017 La serie de Documentos de Investigación del Banco de México divulga resultados preliminares de trabajos de investigación económica realizados en el Banco de México con la finalidad de propiciar el intercambio y debate de ideas. El contenido de los Documentos de Investigación, así como las conclusiones que de ellos se derivan, son responsabilidad exclusiva de los autores y no reflejan necesariamente las del Banco de México. The Working Papers series of Banco de México disseminates preliminary results of economic research conducted at Banco de México in order to promote the exchange and debate of ideas. The views and conclusions presented in the Working Papers are exclusively the responsibility of the authors and do not necessarily reflect those of Banco de México. Documento de Investigación Working Paper 2017-20 2017-20 Explaining Inflation with a Classical Dichotomy Model and Switching Monetary Regimes: Mexico 1932-2013* Daniel G. Garcés Díazy Banco de México Abstract: This paper applies a novel approach to study the impact of different shocks on the price level. It uses a classical dichotomy model with monetary policy regime shifts at known dates. First, there was a regime dominated by money, afterwards a regime driven by the exchange rate and a third one with inflation targeting. The result is a CVAR with constant long-run parameters but regime-dependent adjustment coefficients. This overcomes the challenge of explaining, within a single theoretical framework, inflation dynamics in Mexico since the country abandoned the gold standard. -

Chapter 4: Money and Inflation (Long-Run Theory of Monetarism)

Chapter 4: Money and Inflation (Long-Run Theory of Monetarism) The overall increase in prices is called inflation A price is the rate at which money is exchanged for a good or a service. In reality, the general price level is measured by either CPI or GDP deflator. The inflation rate is defined as the percentage change in the price level. In this chapter we study a long run theory called Monetarism. Monetarism assumes price is flexible and it shows the relationship between money and inflation. Monetarism is advocated by Milton Friedman. Basic facts about money Money is defined as the stock of assets that can be readily used to make transaction. For example, because a shell can be used for transaction in certain island countries, shell is money. A brief history of Money: Gold (commodity money) → gold coins → gold certificates → fiat money (without intrinsic value) Money can perform the functions of (1) store of value; (2) unit of account; and (3) medium of exchange. 1 Legal restriction gives the government (central bank) a monopoly on controlling the money. The US central bank is Federal Reserve (Fed). The Open Market Committee under Fed is in charge of monetary policy. Fed changes the money supply through open-market operation. More explicitly, Feb increases money supply by purchasing government bonds from the public. Fed decreases money supply by selling government bonds to the public. There are several measures of Money: (1) Currency is the sum of outstanding paper money (banknotes) and coins (2) M1 = currency + demand deposits, traveler’s check and other checkable deposit.