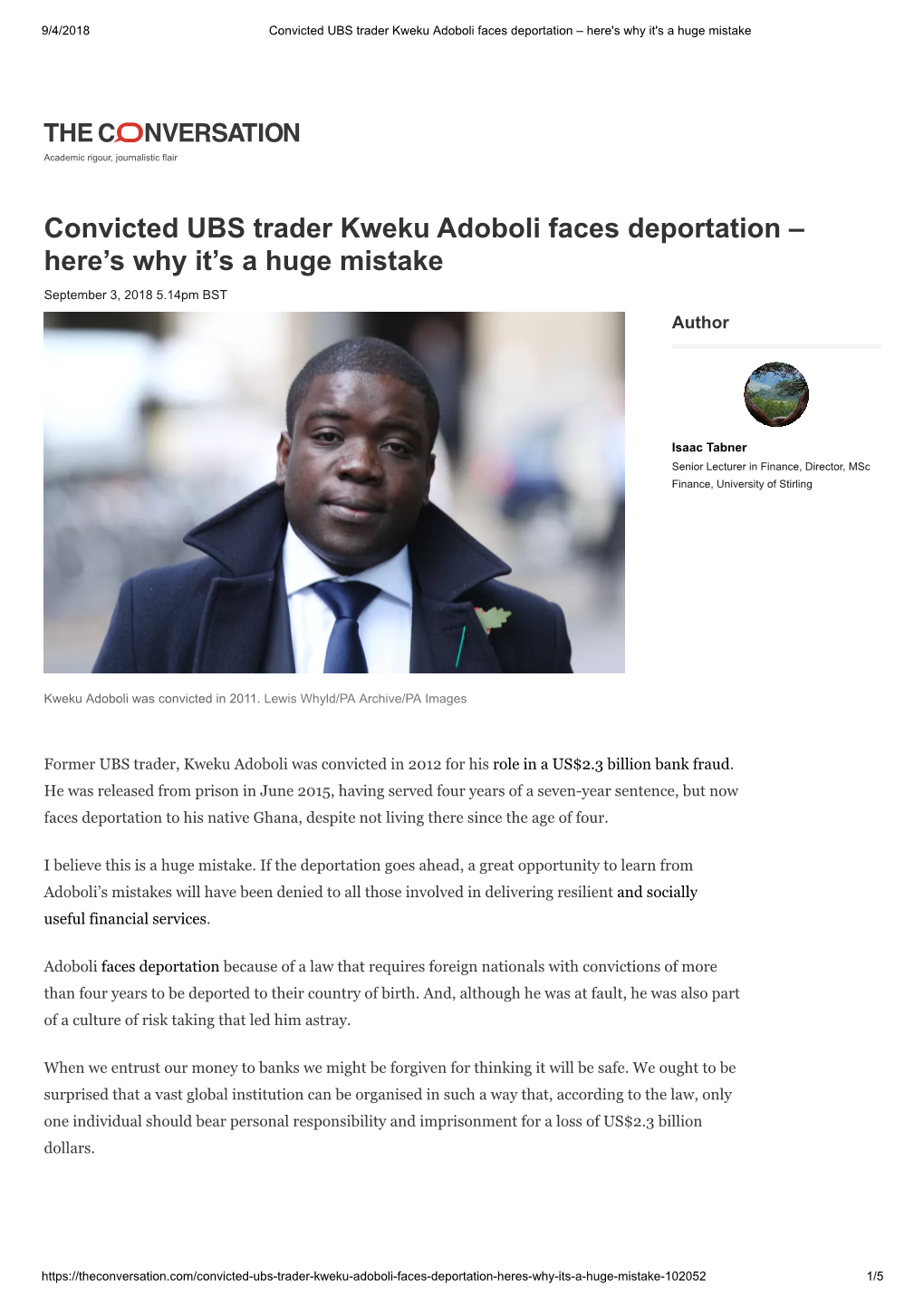

Convicted UBS Trader Kweku Adoboli Faces Deportation – Here's Why It's a Huge Mistake

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 05 11 Reynolds Et Al Ethical Accepted

UWS Academic Portal When ethical leaders are ‘no longer at ease’ Kasonde, Mukuka; Reynolds, Kae E-pub ahead of print: 30/09/2020 Document Version Peer reviewed version Link to publication on the UWS Academic Portal Citation for published version (APA): Kasonde, M., & Reynolds, K. (2020). When ethical leaders are ‘no longer at ease’: the role of social vice in corruption through the lens of a Nigerian novel. Paper presented at British Academy of Management 2020 Conference in the Cloud, . General rights Copyright and moral rights for the publications made accessible in the UWS Academic Portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. Take down policy If you believe that this document breaches copyright please contact [email protected] providing details, and we will remove access to the work immediately and investigate your claim. Download date: 02 Oct 2021 When ethical leaders are ‘No Longer at Ease’: The role of social vice in corruption through the lens of a Nigerian novel Mukuka Kasonde*, University of Huddersfield Kae Reynolds, University of the West of Scotland Queensgate Huddersfield HD1 3DH United Kingdom *[email protected] 1 When ethical leaders are ‘No Longer at Ease’: The role of social vice in corruption through the lens of a Nigerian novel Word count: 6592 Abstract This paper addresses the social context of corruption through literary analysis of Chinua Achebe’s (1960) novel No Longer at Ease. By exploring the societal influences that may lead an individual to engage in unethical behaviour, the analysis challenges the more predominant view of ethical failure as individual vice and reframes corruption as socially embedded. -

Law and Economics Yearly Review

Volume 4 – Part 2 – 2015 ISSN 2050-9014 ISSUES ON FINANCIAL LAW AND MARKET REGULATION, ECONOMICS BUSINESS DEVELOPMENT AND YEARLY GOVERNMENT’S POLICIES ON REVIEW GLOBALIZATION Editors F. CAPRIGLIONE – R. M. LASTRA – R. MCCORMICK C. PAULUS – L. REICHLIN – M. SAKURAMOTO in association with LAW AND ECONOMICS YEARLY REVIEW www.laweconomicsyearlyreview.org.uk Mission The “Law and Economics Yearly Review” is an academic journal to promote a legal and eco- nomic debate. It is published twice annually (Part I and Part II), by the Fondazione Gerardo Capriglione Onlus (an organization aimed to promote and develop the research activity on fi- nancial regulation) in association with Queen Mary University of London. The journal faces questions about development issues and other several matters related to the international con- text, originated by globalization. Delays in political actions, limits of certain Government’s policies, business development constraints and the “sovereign debt crisis” are some aims of our studies. The global financial and economic crisis is analysed in its controversial perspectives; the same approach qualifies the research of possible remedies to override this period of progressive capitalism’s turbulences and to promote a sustainable retrieval. Address Fondazione Gerardo Capriglione Onlus c/o Centre for Commercial Law Studies Queen Mary, University of London 67-69 Lincoln’s Inn Fields London, WC2A 3JB United Kingdom Main Contact Fondazione G. Capriglione Onlus - [email protected] Editor‐ in‐ Chief F. Capriglione Editorial Board G. Alpa - M. Andenas - A. Antonucci - R. Olivares-Caminal - G. Conte - M. De Marco - M. Hirano - I. MacNeil - M. Martinez - M. Pellegrini - C. Schmid - M. Sepe - A. -

Chapter 5 Role of Cognitive and Other Influences on Rogue Trader

Chapter 5 Role of Cognitive and Other Influences on Rogue Trader Behaviour: Findings from Case Studies 5.1. Introduction One of the key findings from Chapter 4 was the lack of significant difference in the financial decision-making behaviour of investment professionals compared with retail investors in the survey sample. However, there was a distinctive pattern in the odds ratio in Table 4.5 where investment professionals were seen to be more likely to be affected by behavioural biases when the choices were risky ones. The aim of the discussions and analyses of the selected case studies in this chapter (the qualitative element of the mixed methods approach), therefore, was to investigate the reasons behind the seeming inability or reluctance of investment professionals to ignore the influence of behavioural biases under high risk situations; where their actions could result in either extremely large monetary gains or losses. The discussion in this chapter consisted of three main sections. The first section was a brief account of the events behind five high-profile financial scandals caused by individuals who engaged in unauthorised trading or investment activities on behalf of their financial institutions, or rogue traders as they were popularly known. Section two highlighted some common characteristics of the rogue trading incidents, and section three was an analysis of the behavioural biases and related emotional influences behind the conduct of rogue traders. 132 5.2. Case Studies on Rogue Trading Rogue trading is the term popularly used to describe unauthorised proprietary trading activities by financial market professionals. These trading activities which resulted in significant monetary losses and severe reputational damage to the affected financial institutions more often than not involved transactions in derivative products. -

The Return of the Rogue

THE RETURN OF THE ROGUE Kimberly D. Krawiec∗ The “rogue trader”—a famed figure of the 1990s—recently has returned to prominence due largely to two phenomena. First, recent U.S. mortgage market volatility spilled over into stock, commodity, and derivative markets worldwide, causing large financial institution losses and revealing previously hidden unauthorized positions. Second, the rogue trader has gained importance as banks around the world have focused more attention on operational risk in response to regulatory changes prompted by the Basel II Capital Accord. This Article contends that of the many regulatory options available to the Basel Committee for addressing operational risk it arguably chose the worst: an enforced self- regulatory regime unlikely to substantially alter financial institutions’ ability to successfully manage operational risk. That regime also poses the danger of high costs, a false sense of security, and perverse incentives. Particularly with respect to the low-frequency, high-impact events—including rogue trading—that may be the greatest threat to bank stability and soundness, attempts at enforced self- regulation are unlikely to significantly reduce operational risk, because those financial institutions with the highest operational risk are the least likely to credibly assess that risk and set aside adequate capital under a regime of enforced self-regulation. ∗ Professor of Law, University of North Carolina School of Law. [email protected]. I thank Susan Bisom-Rapp, Lissa Broome, Bill Brown, Steve Choi, Deborah DeMott, Anna Gelpern, Mitu Gulati, Donald Langevoort, Marc Miller, Eric Posner, Steve Schwarcz, Jonathan Wiener, David Zaring, and workshop participants at the University of Arizona James E. -

Volitamata Kauplemine Finantsturgudel

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by DSpace at Tartu University Library TARTU ÜLIKOOL Majandusteaduskond Ettevõttemajanduse instituut Darja Medvedskaja VOLITAMATA KAUPLEMINE FINANTSTURGUDEL Bakalaureusetöö Juhendaja: lektor Mark Kantšukov Tartu 2012 1 Soovitan suunata kaitsmisele ………………………………….. (juhendaja allkiri) Kaitsmisele lubatud “ “........................ 2012. a. …...… õppetooli juhataja ………………………… (õppetooli juhataja nimi ja allkiri) Olen koostanud töö iseseisvalt. Kõik töö koostamisel kasutatud teiste autorite tööd, põhi- mõttelised seisukohad, kirjandusallikatest ja mujalt pärinevad andmed on viidatud. ………………………………….. (töö autori allkiri) 2 SISUKORD Sisukord ............................................................................................................................3 Sissejuhatus.......................................................................................................................4 1. Volitamata kauplemine finantsturgudel – teoreetiline käsitlus.....................................7 1.1. Volitamata kauplemine kui valgekraede kuritegude üks liikidest .........................7 1.2. Volitamata kauplemise tunnused ja põhjused......................................................18 1.3. Volitamata kauplemist puudutavad aktid ja pankade operatsiooniriski juhtimine .....................................................................................................................................24 2. Volitamata kauplemise juhtumite analüüs ..................................................................37 -

Keeping Rogue Traders at Bay

Portfolio Media. Inc. | 860 Broadway, 6th Floor | New York, NY 10003 | www.law360.com Phone: +1 646 783 7100 | Fax: +1 646 783 7161 | [email protected] Keeping Rogue Traders At Bay Law360, New York (October 04, 2011, 4:27 PM ET) -- On Sept. 16, 2011, Kweku Adoboli, a native of Ghana and UBS AG employee, was charged with fraud arising out of unauthorized trading. UBS estimates that Adoboli’s rogue trading continued for three years and caused it to incur losses of $2.3 billion. Banks, lawyers and other industry specialists are all posing the same question: Given UBS’ sophisticated risk procedures, how did Adoboli’s rogue trading go undetected for so long? And what lessons can the industry learn? A Little Background Adoboli joined UBS’ London investment banking division as an analyst in 2003 after graduating, with honors, from the University of Nottingham in England. Adoboli served a so-called “back-office” function: He entered and confirmed trades, handled accounting issues and transmitted payments. In September 2006, he began trading exchange-traded funds (ETFs) on UBS’ “Delta-One” trading desk. The trading involves two steps. First, a client initiates a trade in an ETF that bets on the direction of a group of stocks, such as European or U.S. stocks. The trader executes the trade and acquires the basket for UBS. Second, the trader hedges the trade by creating a mirror trade of the bet. Adoboli skipped the second step and made unauthorized unhedged trades on the direction of European and U.S. stock markets using UBS funds. -

The Motivations for the Behavior of Rogue Traders

The motivations for the behavior of rogue traders Thesis By Zuzana Dančová Submitted in Partial fulfillment Of the Requirements for the degree of Bachelor of Science In Business Administration State University of New York Empire State College 2020 Reader: Tanweer Ali Statutory Declaration / Čestné prohlášení I, Zuzana Dančová, declare that the paper entitled: What are the motivations for the behavior of rogue traders? was written by myself independently, using the sources and information listed in the list of references. I am aware that my work will be published in accordance with § 47b of Act No. 111/1998 Coll., On Higher Education Institutions, as amended, and in accordance with the valid publication guidelines for university graduate theses. Prohlašuji, že jsem tuto práci vypracoval/a samostatně s použitím uvedené literatury a zdrojů informací. Jsem si vědom/a, že moje práce bude zveřejněna v souladu s § 47b zákona č. 111/1998 Sb., o vysokých školách ve znění pozdějších předpisů, a v souladu s platnou Směrnicí o zveřejňování vysokoškolských závěrečných prací. In Prague, 23.4.2020 Zuzana Dančová Acknowledgement I wish to thank all the people whose assistance was a milestone in the completion of this project. I wish to express my sincere appreciation to my mentor, Tanweer Ali, who convincingly guided and encouraged me through the process of completing this project. I also wish to acknowledge my family – my caring parents, great brothers, and my patient partner. They kept me going on and this work would not have been possible without their support. I would like to recognize the invaluable assistance that you all mentioned provided during my study. -

Quotes on Financial Services Topics by Our CMS Team in the National and Trade Press

Quotes on financial services topics by our CMS team in the national and trade press January 2014 Humiliation for UK as Europe overrules finance veto City AM, 23/01/14, Ash Saluja comments on the ECJ decision with regard to ESMA’s powers to ban short selling. December 2013 EC fines banks record sums for interest rate rigging International Bank Association, 17/12/13, Simon Morris comments on the EC’s recent enforcement action against banks for benchmark rigging. November 2013 FCA to crack down on fund manager fees to brokers Reuters, 25/11/13, Simon Morris comments on FCA’s proposals with regard to dealing commission. October 2013 Crowd-Funding Sites Will Be Forced to Boost Capital by U.K. 24/10/13, Bloomberg, Simon Morris discusses FCA’s proposals on crowdfunding. UK finance watchdog to warn earlier on suspected wrongdoing Is FCA move to name & shame firms just a publicity stunt? FCA may warn sooner when wrongdoing is suspected Fca's decision to name firms under investigation slated as "unfair" FT, Citywire, Reuters, 15/10/2013, Insurance Age 16/10/13, Simon Morris comments on FCA’s policy on the publication of enforcement warning notices. July 2013 Swinton fined £7.4m for mis-selling FT 17/07/13, Paul Edmondson comments on the implications of FCA’s enforcement action for the insurance sector. EU: More UK bankers paid above 1m euros Bonuses shrink for top UK bankers Bank pay falls but UK still has 77 per cent of €1m financiers UK Wired News 15/0713, FT 16/07/13, City AM 16/07/13, Nicholas Stretch comments on an EBA report on bankers’ bonuses. -

C.D.T.S. No. 1 and A.T.U. Local 1321 Pension Plan, Et Al. V. UBS AG, Et Al

Case 1:12-cv-04924-KBF Document 46 Filed 03/04/13 Page 1 of 138 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK x C.D.T.S. NO. 1 AND A.T.U. LOCAL 1321 : Civil Action No. 1:12-cv-04924-KBF-HBP PENSION PLAN, Individually and on Behalf of All Others Similarly Situated, : CLASS ACTION : Plaintiff, : FIRST AMENDED CONSOLIDATED : COMPLAINT FOR VIOLATIONS OF THE vs. : FEDERAL SECURITIES LAWS : UBS AG, et al., : Defendants. : x 819129_1 Case 1:12-cv-04924-KBF Document 46 Filed 03/04/13 Page 2 of 138 1. Lead Plaintiffs, Westchester Teamsters Pension Fund and Teamsters Local 456 Annuity Fund (collectively “Plaintiffs”), on behalf of themselves and all other persons similarly situated, allege the following based upon personal knowledge as to themselves and their own acts, and on information and belief as to all other matters, based upon, inter alia, the investigation conducted by and through their attorneys. NATURE OF THE ACTION 2. This is a federal securities class action brought against UBS AG (“UBS” or the “Company”) and certain of its officers for violations of the Securities Exchange Act of 1934 (the “1934 Act”). This action is brought on behalf of all purchasers of UBS securities on any domestic exchange and/or in any domestic transaction, during the period from November 17, 2009 through September 15, 2011 (the “Class Period”), who were damaged as a result of defendants’ violations of the federal securities laws. This action seeks to pursue remedies for violations of the anti-fraud provisions of the federal securities laws. -

How a Rogue Trader Crashed

SPECIAL REPORT Workers assemble a Swiss bank UBS sign at the Marina Bay Street Circuit of the Singapore Formula One Grand Prix September 21, 2011. REUTERS/ TIM CHONG HOW A ROGUE TRADER CRASHED UBS Alleged illegal trades at the Swiss bank have left it bruised and made it more likely that investment banks will face much tougher regulations BY EMMA THOMASSON AND ceiling, and made their way to the gold- For UBS chief Oswald Gruebel -- and EDWARD TAYLOR coloured lifts that whisk guests up to rooms perhaps for UBS as it is currently constituted ZURICH/SINGAPORE, SEPT 27 that overlook the Marina Bay street circuit. -- it was more like the end of the road. The As the bankers sped past works of art by bank’s board had met in Singapore that ATE LAST FRIDAY afternoon, as the likes of Henry Moore, David Hockney afternoon to discuss the loss of $2.3 billion Formula One teams readied their cars and Frank Stella, some made their way by an alleged rogue trader in its London- forL a practice session ahead of the Singapore straight to a lounge UBS had hired to based investment banking arm. Though Grand Prix, the entrance hall of the nearby entertain clients during the race weekend. the board had not yet gone public with the Ritz-Carlton buzzed with activity. At its entrance stood three Singaporean news, it had decided to accept Gruebel’s One by one, senior executives of Swiss women wearing red and white polo shirts, resignation and appoint an interim bank UBS entered the lobby, which is each holding a sign emblazoned with the replacement. -

Analysing the Cases of Nick Leeson, Jérôme Kerviel, and Kweku Adoboli in Light of the Control Balance Theory

Behavioural patterns in rogue trading: Analysing the cases of Nick Leeson, Jérôme Kerviel, and Kweku Adoboli in light of the control balance theory Hagen Rafeld (Vice President, Divisional Control Office, Global Markets Division at a Frankfurt based Financial Institution) Dr. Sebastian Fritz-Morgenthal (Expert Principal, Bain & Company, Inc.) Agenda 1 Introduction p. 3 2 Charles Tittle’s Control Balance Theory (CBT) p. 5 3 The Rogue Traders Leeson, Kerviel, and Adoboli p. 7 4 Applying CBT p. 11 5 Conclusions p. 13 References & Further Reading p. 15 Rafeld & Fritz-Morgenthal Behavioural Patterns in Rogue Trading 2 1 _ Rogue Trading: Historic Overview Rafeld & Fritz-Morgenthal Behavioural Patterns in Rogue Trading 3 1 _ Rogue Trading: Historic Overview (cont.) Source: Hornuf and Haas (2014), Skyrm (2014), and Wexler (2010, p. 6); enriched with own research. Source: Hornuf and Haas (2014), Skyrm (2014), and Wexler (2010); enriched with own research. Global nature & reoccurring phenomenon rogue trading; appearance in various markets and jurisdictions Re-occurring typology/profile: Average rogue trader is male, in its mid-thirties, un- detected for more than 2 and a half years, creates a financial damage of more than $ 1.5bn, and is sentenced to jail for about 5 years Rafeld & Fritz-Morgenthal Behavioural Patterns in Rogue Trading 4 2 _ Tittle’s Control Balance Theory (CBT) Integrated criminological theory, drawing elements from learning, anomie, conflict, social control, labelling, utilitarian, and routine activities theories Equipped with interdisciplinary components, CBT is designed to explain and account for all types of deviant behaviour but also for conforming behaviour (Piquero 2010, p. -

How to Lose Money in Derivatives: Examples from Hedge Funds and Bank Trading Departments Sebastien Lleo William T

How to Lose Money in Derivatives: Examples From Hedge Funds and Bank Trading Departments Sebastien Lleo William T. Ziemba SRC Special Paper No 2 May 2014 ISSN 2055-0375 Abstract What makes futures hedge funds fail? The common ingredient is over betting and not being diversified in some bad scenarios that can lead to disaster. Once troubles arise, it is difficult to take the necessary actions that eliminate the problem. Moreover, many hedge fund operators tend not to make decisions to minimize losses but rather tend to bet more doubling up hoping to exit the problem with a profit. Incentives, including large fees on gains and minimal penalties for losses, push managers into such risky and reckless behavior. We discuss some specific ways losses occur. To illustrate, we discuss the specific cases of Long Term Capital Management, Niederhoffer’s hedge fund, Amaranth and Société Genéralé. In some cases, the failures lead to contagion in other hedge funds and financial institutions. We also list other hedge fund and bank trading failures with brief comments on them. JEL classification: G01, G21, G23, G33 Keywords: hedge fund trading disasters, over betting, Long Term Capital Management, Amarath and Société Genéralé This paper is published as part of the Systemic Risk Centre’s Special Paper Series. The support of the Economic and Social Research Council (ESRC) in funding the SRC is gratefully acknowledged [grant number ES/K002309/1]. Sebastien Lleo is Associate Professor of Finance at NEOMA Business School William T. Ziemba is Alumni Professor (Emeritus) of Financial Modeling and Stochastic Optimization at the Sauder School of Business, University of British Columbia and Research Associate, Systemic Risk Centre, London School of Economics and Political Science Published by Systemic Risk Centre The London School of Economics and Political Science Houghton Street London WC2A 2AE All rights reserved.