Equity Research Department

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Silicon Valley Tech Mobster Cartel

The Silicon Valley Tech Mobster Cartel Warped Sociopath Frat Boys Emulate The “Godfather” Films With Impunity And Epic Deviance 1 This is revision 4.2 of a draft version of this book. Check back, at the link you got this from, for updated versions) 2 Table of Contents Forward......................................................................................................................................................4 The Architecture Of A Crime Empire........................................................................................................5 The Department Of Energy Is Their Favorite Smash-And-Grab Candy Store........................................14 How The Crony Capitalism Promoted By Silicon Valley Is Destroying America...................................28 Enabling Corruption By Building Sicko Frat Boys.................................................................................40 The Psychology of The Silicon Valley Billionaire: Why So Many Of Them Are Sociopaths............55 Meet John, One Of The Godfathers Of The Mob....................................................................................60 The Silicon Valley Cartel Has Bought Every California Senator............................................................66 The Silicon Valley Cartel Uses The CIA For Dirty Tricks Schemes.......................................................71 The Venture Capital Scam Of The NVCA...............................................................................................80 Silicon Valley’s Secret Mainstream -

India Recent Split Among Various Hindu Extremist Parties Leads One to Think About Future of Extremism in Indian Politics

Report # 95 & 96 BUSINESS AND POLITICS IN THE MUSLIM WORLD East Asia, Central Asia, GCC, FC, China & Turkey Nadia Tasleem Weekly Report from 21 November 2009 to 4 December 2009 Presentation: 10 December 2009 This report is based on the review of news items focusing on political, economic, social and geo-strategic developments in various regions namely; East Asia, Central Asia, GCC, FC, China and Turkey from 21 November 2009 to 20 December 2009 as have been collected by interns. Prelude to Summary: This report tries to highlight major issues being confronted by various Asian states at political, geo-strategic, social and economic front. On one hand this information helps one to build deep understanding of these regions. It gives a clear picture of ongoing pattern of developments in various states hence leads one to find similarities and differences amid diverse issues. On the other hand thorough and deep analysis compels reader to raise a range of questions hence provides one with an opportunity to explore more. Few such questions that have already been pointed out would be discussed below. To begin with India recent split among various Hindu extremist parties leads one to think about future of extremism in Indian politics. Recently released Liberhan Commission Report has convicted BJP and other extremists for their involvement in demolition of Babri Mosque 17 years ago. In response to this report BJP has out rightly denied their involvement rather has condemned government for her efforts to shatter BJP’s image. An undeniable fact however remains that L.K. Advani; one of the key members of BJP had been an active participant in Ayodhya movement. -

Lehman Brothers: Reasons of Failure: (2007-2008) Ceos

LEHMAN BROTHERS: Lehman was a global financial services firm. Lehman Brothers started in 1844 as a small grocery and dry goods store established by Henry Lehman. Later on they traded cotton, moved to New York and established New York Cotton Exchange. After this events Lehman continued on the road of success and before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA with 26000 employees, doing business in investment banking, equity and fixed-income sales and trading (especially U.S. Treasury securities), market research, investment management, private equity, and private banking. On September 15, 2008, the firm filed for bankruptcy protection following the massive exodus of most of its clients, drastic losses in its stock, and devaluation of its assets by credit rating agencies. The filing marked the largest bankruptcy in U.S. history, which is a major cause of crisis. REASONS OF FAILURE: (2007-2008) There were many reasons behind the collapse of Lahman brothers but the main cause was technical issues and corporate governance failures. Lehman Brothers had very weak corporate governance arrangements. The main areas of weakness were board of directors, corporate risk management, remuneration scheme and nomination committees. As the crisis started in August 2007 with the failure of two funds Lehman’s stock fell sharply. During that month company eliminated 2,500 jobs and shut down its BNC unit. It also closed offices in three states. Lehman’s collapse was a seminal event that greatly intensified the 2008 crisis and contributed to the erosion of close to ten trillion in market capitalization from global equity markets in October 2008, the biggest monthly decline on record at the time. -

2010 Annual Report Table of Contents

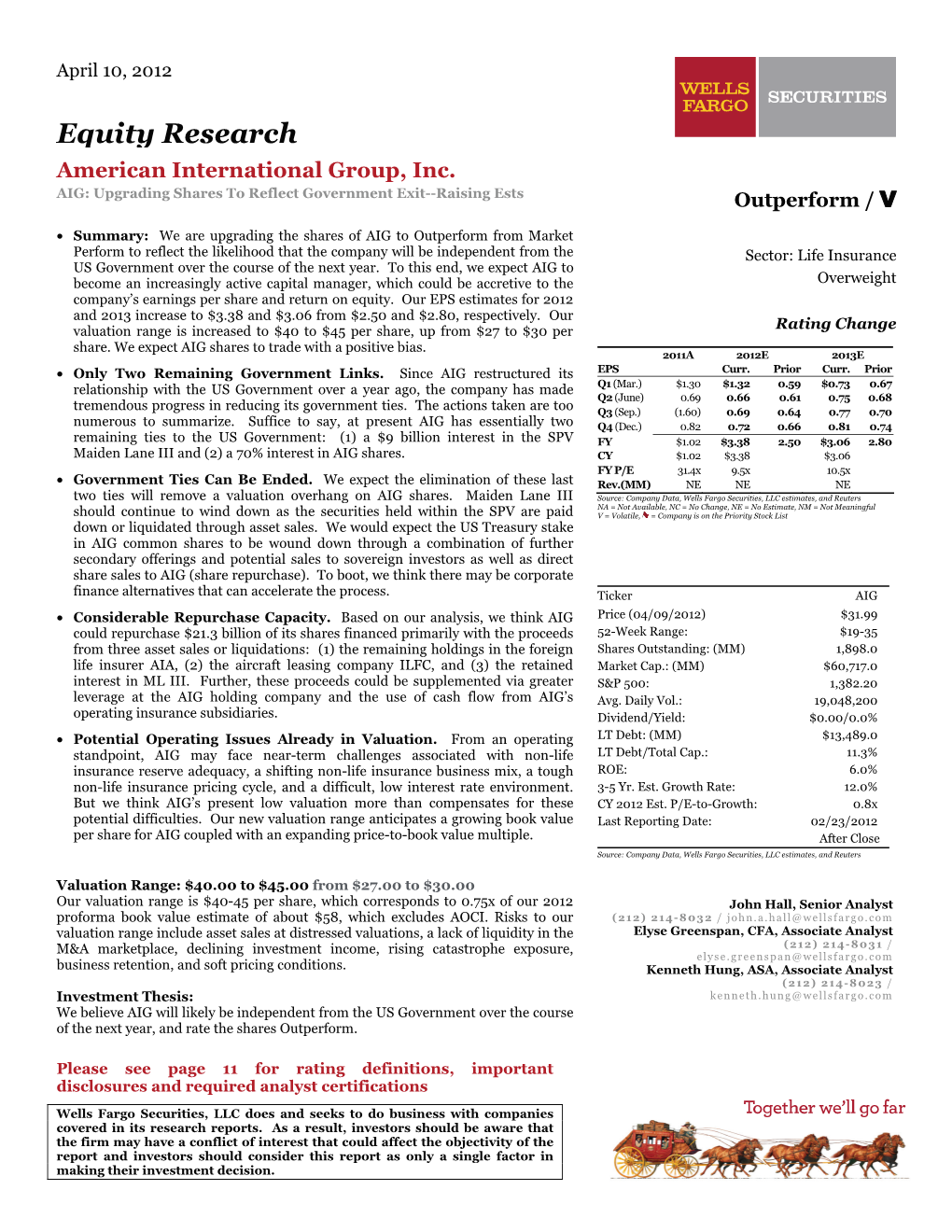

American International Group, Inc. 2010 Annual Report Table of Contents AIG at a Glance 1 Chairman’s Message 2 Letter to Shareholders 3 A Conversation with AIG Chairman Steve Miller and AIG President and CEO Bob Benmosche 7 Board of Directors 12 Form 10-K 13 Shareholder Information Inside back cover About AIG American International Group, Inc. (AIG) is a leading international insurance organization serving customers in more than 130 countries. AIG companies serve commercial, institutional, and individual customers through one of the most extensive worldwide property-casualty networks of any insurer. In addition, AIG companies are leading providers of life insurance and retirement services in the United States. AIG common stock is listed on the New York Stock Exchange, as well as the stock exchanges in Ireland and Tokyo. American International Group 2010 Annual Report AIG at a Glance Chartis Inc. Chartis is a world-leading property-casualty and general insurance organization serving more than 45 million clients worldwide. With a 90-year history, one of the industry’s most extensive ranges of products and services, deep claims expertise, and excellent financial strength, Char- tis enables its commercial and personal insurance clients alike to manage virtually any risk with confidence. Chartis had $31.6 billion in net premiums written in 2010. SunAmerica Financial Group The companies that make up SunAmerica Financial Group have been keeping their promises for more than 150 years. They remain focused on what really matters — advising customers and helping them secure a safe and strong financial future. This has been, and always will be, what you can count on from SunAmerica Financial Group.With over 13,000 employees, over 300,000 financial professionals appointed to sell its insurance and retirement products, and sales locations in every state in the nation, SunAmerica Financial Group is one of the largest life insurance and retirement services organizations in the United States. -

AIG Chief, Alumnus Benmosche 2013 Commencement Speaker 4/29/13

AIG chief, alumnus Benmosche 2013 Commencement speaker 4/29/13 Robert H. Benmosche Robert H. Benmosche, a 1966 graduate of Alfred University with a degree in mathematics and now chief executive officer of American International Group Incorporated (AIG), will deliver the commencement address and receive an honorary Doctor of Business degree during Alfred University&s (AU) annual commencement exercises, scheduled for 10 a.m. Saturday, May 18, at McLane Center on the AU campus. “We are delighted Bob Benmosche agreed to return to Alfred University to deliver this year&s commencement address,” said AU President Charles M. Edmondson. “He has an extraordinary reputation as a person who can turn a company around. First, he is credited with rescuing MetLife, and taking it public, and then he was called out of retirement to lead AIG back to solvency after the crisis of 2008.” The University will also bestow an honorary Doctor of Humane Letters on Peter Cuneo, a 1967 alumnus of Alfred University who is completing his second three-year term as chairman of the AU Board of Trustees. Like Benmosche, Cuneo is also regarded as a rescuer of failing corporations, including Marvel Comics, which he took from a struggling publisher of comic books to an entertainment company worth billions. Benmosche joined AIG as president and chief executive officer in August, 2009. He was also elected to the AIG Board of Directors. Under his leadership, AIG succeeded in paying back the federal government for the funds it received to keep the corporation from failing and bringing down the global economic system. -

Company Executive Title Since Accenture Pierre Nanterme CEO 2011 ACE Limited Evan G

Company Executive Title Since Accenture Pierre Nanterme CEO 2011 ACE Limited Evan G. Greenberg CEO and President[1] 2004 Aditya Birla Group Kumar Birla Chairman[2] 1995[3] Adobe Systems Shantanu Narayen President and CEO[4] 2007 Agenus Garo H. Armen Founder, Chairman, CEO[5] 1994 American International Group Bob Benmosche CEO 2009 Alcatel-Lucent Ben Verwaayen CEO 2008 Alcoa Klaus Kleinfeld Chairman and CEO[6] 2008 Altria Group Michael Szymanczyk Chairman and CEO[7] 2008 Amazon.com Jeff Bezos Founder, President, CEO, and Chairman[8]1994 AMD Rory Read CEO 2011 American Express Kenneth Chenault Chairman and CEO 2001 Amgen Kevin W. Sharer President and CEO 2000 AMR Corporation Thomas W. Horton CEO 2011 Analog Devices Jerald G Fishman CEO and President 1996 Anheuser-Busch Dave Peacock CEO 2008 Anil Dhirubhai Ambani Group Anil Ambani Chairman 1983 AOL Inc. Tim Armstrong CEO and Chairman 2009 Apple Inc. Tim Cook CEO 2011 Arcelor Mittal Lakshmi Niwas Mittal Chairman and CEO 2006 Archer Daniels Midland Patricia Woertz President and CEO, chairman of the board[9]2006 AT&T Randall L. Stephenson Chairman, CEO and President[10] 2007 BAE Systems Plc Ian King CEO[11] 2008 Banco Bilbao Vizcaya Argentaria Francisco González Chairman and CEO 2000 Bank of America Brian Moynihan President and CEO 2009 Barclays Robert Diamond CEO 2010 Berkshire Hathaway Warren Buffett Chairman and CEO 1970 Best Buy Brian J. Dunn CEO 2009 Bharti Enterprises Sunil Bharti Mittal Founder, Chairman and Managing Director1985 Blackstone Group Stephen A. Schwarzman Chairman, CEO and Co-Founder[13] 1985 BHP Billiton Marius Kloppers CEO 2007 BMW Norbert Reithofer Chairman of the Board of Management 2006 Boeing W. -

2009 Annual Report American International Group, Inc

American International Group, Inc. 2009 Annual Report American International Group, Inc. (AIG) is a leading international insurance organization with operations in more than 130 countries and jurisdictions. AIG companies serve com- mercial, institutional, and individual customers through one of the most extensive worldwide property casualty networks of any insurer. In addition, AIG companies are leading providers of life insurance and retirement services around the world. AIG common stock is listed on the New York Stock Exchange, as well as the stock exchanges in Ireland and Tokyo. Chairman’s Johnson, George Miles, and Morris Offi t, Message represents a collective vote of confi dence in the company, its many talented people, Harvey Golub and its strategy going forward, and a Non-Executive personal willingness to deal with one of Chairman of the Board the most complicated restructurings in business history. They have been working extraordinarily hard and will continue to do so under very challenging conditions. I thank them all for their support. During the year, Stephen Bollenbach, n behalf of AIG’s Board of Martin Feldstein, James Orr, Virginia Directors, I am pleased to be Rometty, Michael Sutton, Edmund Tse, able to report to you that and Ed Liddy retired after a period of O the company and the Board have time spent dealing with the liquidity crisis made substantial progress over the past and the initial work on the government year in addressing and resolving a number bailout. We thank them for their service. of the critical issues facing the company. Most notably, in 2008, Ed Liddy joined the In addition to the positive developments company as Chairman and Chief Execu- concerning AIG that Bob Benmosche tive Offi cer as a public service and did so discusses in his letter, including reorganiz- at the behest of the U.S. -

AIG CEO Robert H. Benmosche Interview Inside

SPECIAL EDITION OCTOBER MDS GROUP MAGAZINE 2012 Special Feature AIG CEO Robert H. Benmosche interview inside BrokersLink Discover the history of the global alliance Spain ARTAI PRESIDENT Jaime Borrás shares his thoughts Catastrophes Today An interview with Erwann Michel-Kerjan 01 COVER.indd 1 26/09/2012 02:57 A SPECIAL EDITION FOR A SPECIAL POINT IN TIME I see great hroughout my tenure as the CEO of MDS, I’ve had the things on the opportunity to meet and work with bright people from around “horizon for MDS T the world, to appreciate a variety of new perspectives and to and all its work towards the strengthening of BrokersLink, a truly innovative and partners and powerful international alliance we helped found. While there have been clients, and hope many moments along the MDS time line that have been cause for excitement, our current progress and accomplishments give me great those who share pride and make me more confident than ever that together, we can our passion will achieve remarkable things in the world of risk management. be there with us. This special edition of Full Cover is a testament to the gravity and potential of this moment. Front and center is a captivating interview of Robert Benmosche, CEO of American International Group, Inc. (AIG), which helps answer some of the most pressing questions in insurance today and lend insight into one of the world’s largest and most storied firms. The issue also features interviews with Dr Erwann Michel-Kerjean and Manuel Padilla, touching on many important issues and giving readers a closer look at some of today’s top risk management executives. -

Asia Pacific ______38 Europe, Middle East, and Africa ______42 Contributing to Society Is the Very Nature of Our Business

American International Group, Inc. 2014 Corporate Citizenship Report American International Group, Inc. 2014 Corporate Citizenship Report AIG 2014 Corporate Citizenship Report Letter from the President and CEO__________ 1 Q & A ______________________________ 3 Environmental Responsibility ______________ 4 Sustainable Investments _________________ 8 Investing in Our People __________________ 12 Diversity and Inclusion __________________ 17 Access to Financial Services _____________ 20 Corporate Giving ______________________ 22 Disaster and Safety Management __________ 27 Corporate Governance and Compliance ____ 32 World Regions: Americas ____________________________ 35 Asia Pacific ___________________________ 38 Europe, Middle East, and Africa ___________ 42 Contributing to society is the very nature of our business. Peter D. Hancock President and Chief Executive Officer Dear Colleagues: At AIG each and every day, we see the value that insurance happen. From drivers to pedestrians, everywhere from Asia plays in the lives of our customers in communities across the Pacific to the Americas, we are using these insights to promote globe. Our company pays hundreds of millions of dollars in road safety. claims each week, a testament to how important we feel it is to keep the promises we make to our customers. Insurance helps Through our volunteerism: AIG last year saw a 76 percent ease the fears that can hold people back from taking opportu- increase in participation in our Global Volunteer Weeks. nities or making investments to improve their lives – such as Employees from 46 countries participated in 170 community expanding a business or paying for a child to go to college. service projects, volunteering more than 20,000 hours of their time. Contributing to society is the very nature of our business. -

Leia Aqui O Relatório

Prontos para o amanhã American International Group, Inc. Relatório de Cidadania Corporativa de 2014 American International Group, Inc. Relatório de Cidadania Corporativa de 2014 Relatório de Cidadania Corporativa de 2014 da AIG Carta do Presidente e CEO ______________ 1 Perguntas e Respostas __________________ 3 Responsabilidade Ambiental _____________ 4 Investimentos Sustentáveis _______________ 8 Investindo em Nossos funcionários _________ 12 Diversidade e Inclusão __________________ 17 Acesso a Serviços Financeiros ____________ 20 Doação Corporativa ___________________ 22 Gestão de Catástrofes e Segurança ________ 27 Governança Corporativa e Compliance _____ 32 Regiões do Mundo: Américas ____________________________ 35 Ásia-Pacífico _________________________ 38 Europa, Oriente Médio e África ___________ 42 Contribuir para a sociedade é a essência do nosso negócio. Peter D. Hancock Presidente e CEO Prezados colegas: Na AIG a cada dia, vemos o valor que o seguro desempenha na Por meio do nosso voluntariado: a AIG no ano passado vida de nossos clientes em comunidades ao redor do mundo. assistiu a um crescimento de 76 por cento na participação em Nossa empresa paga centenas de milhões de dólares em sinistros nossas Semanas de Voluntariado Global. Funcionários a cada semana, uma prova da importância que damos para manter de 46 países participaram de 170 projetos de serviço as promessas que fazemos aos nossos clientes. O seguro ajuda comunitário, oferecendo mais de 20 mil horas de seu tempo. a aliviar os temores que podem abster as pessoas de aproveitar oportunidades ou fazer investimentos para melhorar suas vidas, Por meio de nossos esforços de sustentabilidade como expandir um negócio ou pagar a faculdade de um filho. ambiental: a AIG foi uma das primeiras do setor a reconhecer o papel do seguro na proteção do meio ambiente para as futuras Contribuir para a sociedade é a essência do nosso negócio. -

Your Strategy Needs a Strategy

1 2 3 4 YOUr 5 6 7 STRATEGY 8 9 10 NEEDS a 11 12 13 STRATEGY 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 FM.indd 1 3/23/15 11:33 AM 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 FM.indd 2 3/23/15 11:33 AM 1 2 3 4 5 YOUR 6 7 8 9 STRATEGY 10 11 12 13 NEEDS a 14 15 16 17 STRATEGY 18 19 20 How to 21 22 Choose and Execute 23 24 the Right Approach 25 26 27 28 29 MARTIN REEVES : KNUt HAANÆS : JANMEJAYa SINHA 30 31 32 HARVARD BU SINE SS R EVIEW PRE SS 33 BOS TON , MA SSACHUS ETTS 34 FM.indd 3 3/23/15 11:33 AM 1 2 3 4 5 6 7 8 9 10 11 12 13 HBR Press Quantity Sales Discounts 14 Harvard Business Review Press titles are available at significant quantity discounts when purchased in bulk for client gifts, sales promotions, and premiums. Special editions, 15 including books with corporate logos, customized covers, and letters from the company or 16 CEO printed in the front matter, as well as excerpts of existing books, can also be created 17 in large quantities for special needs. 18 For details and discount information for both print and ebook formats, contact [email protected], 19 tel. -

The Levinson *411

Volume 2, Issue 7 & 8 July & August 2009 THE LEVINSON *411 CARY A. LEVINSON & ASSOCIATES, INC. BREAKING NEWS IN THE INSURANCE INSIDE THIS ISSUE: WORLD MetLife Retention up to $20 million MetLife is pleased to intro- 1 John Hancock on permanent cases ($15 million duce a new sales campaign to help producers stay in term). WCL Underwriting Sweet Spots touch 2 Fidelity Life Life is sweet with competi- • Additional capacity up to with clients during these diffi- tive, responsible underwriting $114 million may be available cult economic times. The Our 3 Promise is for Life Prudential solutions that include world- through facultative reinsurance. campaign highlights the flexi- class foreign travel guide- • Underwriting Credit and bility of life insurance to help Banner lines and enormous reinsur- accumulate, protect and 4 Assurity ance capacity. Consideration opportunities transfer wealth – backed by that take into account your cli- guarantees. The campaign ent’s entire medical history and American General 5 MetEdge facultative reinsurance materials provide financial Genworth 6 advances in clinical medicine professionals the tools to program, which could improve some engage clients in: Transamerica 6 Table B and C cases to Standard.* Now • Life Insurance Reviews LTC 7 available for all products, including • Estate Planning Survivorship, for up to $10 million in • Business Planning Annuity Division 8 Put the promise of MetLife to Company Info 9 coverage. work for you with materials • Foreign travel guidelines that that can be co-branded with are among the industry’s best! your firm’s logo and contact information. • A leader in financial underwrit- For more information, please ing — from income replacement Term Conversion Check- list Updated contact the Life Insurance and autobinding to jumbo limits.