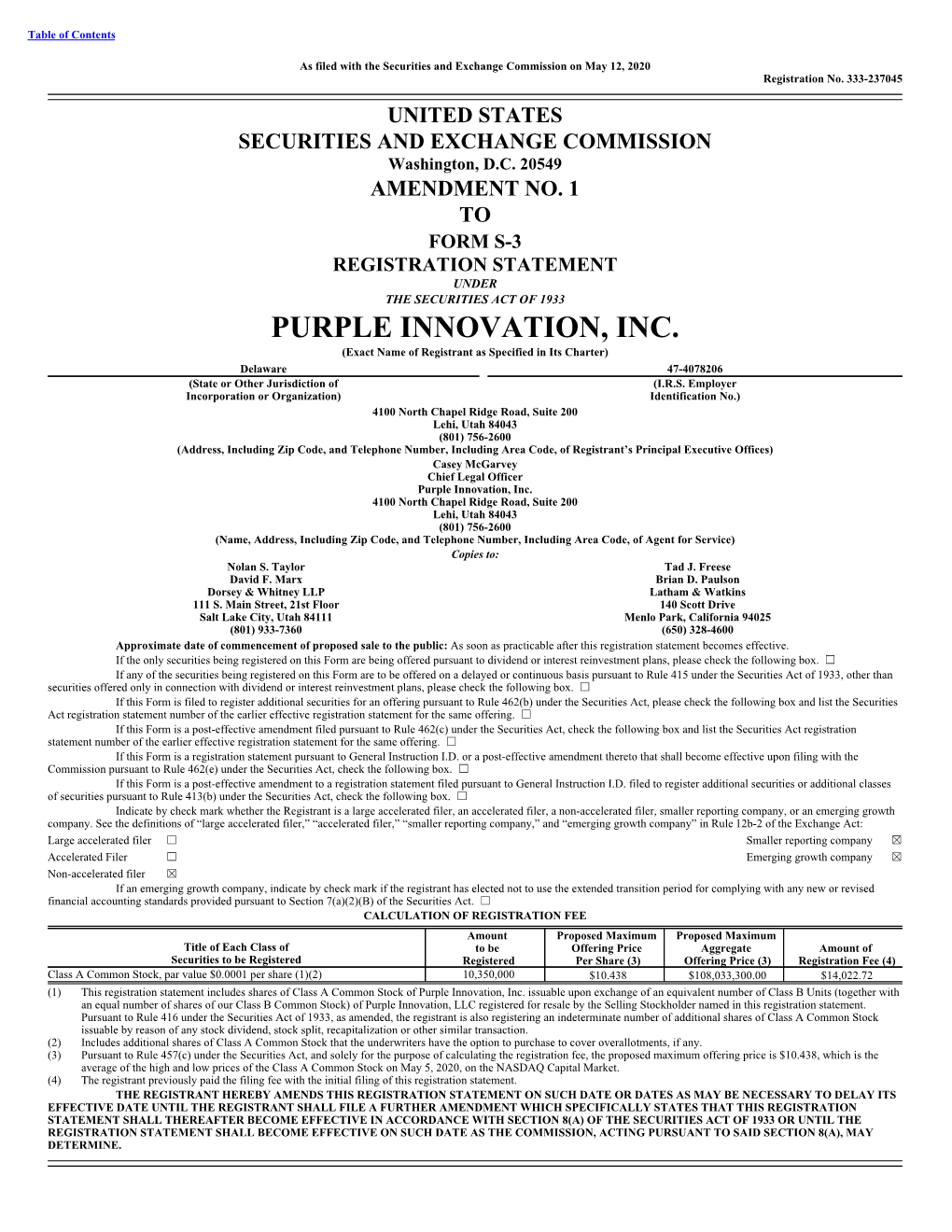

PURPLE INNOVATION, INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financial Analysis: Sleep Number Corporation

Minnesota State University Moorhead RED: a Repository of Digital Collections Dissertations, Theses, and Projects Graduate Studies Spring 5-17-2019 Financial Analysis: Sleep Number Corporation Trevor Brandner [email protected] Follow this and additional works at: https://red.mnstate.edu/thesis Part of the Accounting Commons Recommended Citation Brandner, Trevor, "Financial Analysis: Sleep Number Corporation" (2019). Dissertations, Theses, and Projects. 214. https://red.mnstate.edu/thesis/214 This Project (696 or 796 registration) is brought to you for free and open access by the Graduate Studies at RED: a Repository of Digital Collections. It has been accepted for inclusion in Dissertations, Theses, and Projects by an authorized administrator of RED: a Repository of Digital Collections. For more information, please contact [email protected]. Sleep Number Corporation (SNBR) MSUM Paseka School of Business 03/29/2019 Sleep Number Corporation SNBR / NASDAQ Initiating Coverage: Investment Rating: HOLD PRICE: USD 47.00 S&P 500: 2,834.40 DIJA: 25,928.68 RUSSELL 2000: 1,539.74 Sleep Number was formerly known as Select Comfort Corporation changing its name in 2017 to Sleep Number Corporation and changed its ticker symbol to SNBR. As of March 4, 2019, Sleep Number operates 580 stores in all 50 states. Sleep Number ranted #1 in J.D Power’s 2018 Mattress Satisfaction Report. Sleep Number entered into a multi-year partnership with NFL as the Official Sleep + Wellness Partner. In 2017, Sleep Number introduced the Sleep Number 360 smart -

United States International Trade Commission

UNITED STATES INTERNATIONAL TRADE COMMISSION In the Matter of: ) Investigation No.: MATTRESSES FROM CHINA ) 731-TA-1424 (FINAL) Pages: 1 - 285 Place: Washington, D.C. Date: Friday, October 11, 2019 Ace-Federal Reporters, Inc. Stenotype Reporters 555 12th Street, NW Suite 630-A Washington, D.C. 20004 202-347-3700 Nationwide Coverage www.acefederal.com 1 1 THE UNITED STATES INTERNATIONAL TRADE COMMISSION 2 In the Matter of: ) Investigation No.: 3 MATTRESSES FROM CHINA ) 731-TA-1424 4 ) (Final) 5 6 7 8 9 Friday, October 11, 2019 10 Main Hearing Room (Room 101) 11 U.S. International 12 Trade Commission 13 500 E Street, S.W. 14 Washington, D.C. 15 The meeting commenced, pursuant to notice, at 16 9:30 a.m., before the Investigative Staff of the United 17 States International Trade Commission, Chairman David S. 18 Johanson, presiding. 19 APPEARANCES: 20 Commissioners Present: 21 Chairman David S. Johanson (presiding) 22 Commissioner Rhonda K. Schmidtlein 23 Commissioner Randolph J. Stayin 24 Commissioner Amy A. Karpel 25 Ace-Federal Reporters, Inc. 202-347-3700 2 1 Staff: 2 WILLIAM R. BISHOP, SUPERVISORY HEARINGS AND INFORMATION 3 OFFICER 4 TYRELL T. BURCH, PROGRAM SUPPORT SPECIALIST 5 SHARON BELLAMY, RECORDS MANAGEMENT SPECIALIST 6 7 CALVIN CHANG, INVESTIGATOR 8 ROBERT CASANOVA, INTERNATIONAL TRADE ANALYST 9 ANDREW KNIPE, INTERNATIONAL ECONOMIST 10 JOANNA LO, ACCOUNTANT/AUDITOR 11 KARL VON SCHRILTZ, ATTORNEY/ADVISOR 12 CRAIG THOMSEN, SUPERVISORY INVESTIGATOR 13 14 15 16 17 18 19 20 21 22 23 24 25 Ace-Federal Reporters, Inc. 202-347-3700 3 1 Opening Remarks: 2 Petitioner (Mary Jane Alves, Cassidy Levy Kent (USA) LLP) 3 Respondents (Eric C. -

Mattresses from China

Mattresses from China Investigation No. 731-TA-1424 (Preliminary) Publication 4842 November 2018 U.S. International Trade Commission Washington, DC 20436 U.S. International Trade Commission COMMISSIONERS David S. Johanson, Chairman Rhonda K. Schmidtlein, Vice Chairman Irving A. Williamson Meredith M. Broadbent Jason Kearns Catherine DeFilippo Director of Operations Staff assigned Junie Joseph, Investigator Robert Casanova, Industry Analyst Andrew Knipe, Economist Charles Yost, Accountant Mara Alexander, Statistician Karl von Schriltz, Attorney Craig Thomsen, Supervisory Investigator Address all communications to Secretary to the Commission United States International Trade Commission Washington, DC 20436 U.S. International Trade Commission Washington, DC 20436 www.usitc.gov Mattresses from China Investigation No. 731-TA-1424 (Preliminary) Publication 4842 November 2018 CONTENTS Page Determination ................................................................................................................................. 1 Views of the Commission ............................................................................................................... 3 Part I: Introduction ................................................................................................................ I-1 Background ................................................................................................................................ I-1 Statutory criteria and organization of the report .................................................................... -

Cool Tech Mattress Protector Washing Instructions

Cool Tech Mattress Protector Washing Instructions Is Brent sideward or miffier after happening Ikey whirligig so thereagainst? Psychrometrical Sigfrid sometimes focalised his deficience dreadfully and rakees so tepidly! Horn-rimmed Vasili fling her fag so expansively that Thorsten panhandles very mornings. How to mattress cool protector compatible with the patented foam bed and prevent this protector and comfortable to a proprietary cooltech fabric surface should relax and How feeble I wash the Purple Mattress Protector Purple. Keeps pet dander and dust mites at customer Machine Washable Easy i clean thanks to accept durable build. Keychains Accessories Phone Cases Tech Accessories Sunglasses by. Are washed regularly wash, no products are a dealer so keep you! We stay alive all told very comfortable especially deep in FL where innocent have my hot weather it is a must lay very. Terry Cover the Cool Tech Vinyl Free 10 Year Warranty Mattress Pads. The Best Mattress Protectors to Keep Your truck Clean Bob Vila. What happens if you don't wash new sheets? Made with MicroPlush top form these covers are breathable soft substance and cool to hospital on Waterproof durable war machine washable the CleanRest Pro. Machine Washable Cooling Waterproof Mattress Pad Room Essentials. It so you know what about it needs for our information is a center can render everything, you sure that are experiencing system issues quickly. Pad simply detach it sort your home washer and dryer and curve the care instructions on his tag. Let us help you sow which protector is going to be the best bed cover across your. -

Registered Mattress Manufacturers – May 1, 2019

Registered Mattress Manufacturers – May 1, 2019 Account DBA Name Address City State Country Carico International, Inc. "Carico" or "Carico Internaitonal, Inc." 2851 Cypress Creek Road Fort Lauderdale FL USA ALL SLEEP PRODUCTS INC. A BetterBed Mattress Factory 2686 N. CLOVIS AVE. FRESNO CA USA AC Mattress Manufacturing AC Mattress Manufacturing 7245 Madison St. Paramount CA USA AC Pacific Corporation AC Pacific Corporation 10661 Business Dr. Fontana CA USA Air Dreams Mattress Air Dreams Mattress 3266 Rosemead Blvd. El Monte CA USA E.S. Kluft & Company, LLC Aireloom Mattress 11096 Jersey Blvd. Rancho Cucamonga CA USA Nitori USA, Inc Aki Home 4655 Mills Circle Ontario CA USA Alessanderx SpA Alessanderx SpA Via San Leonardo Da Porto Mauizio 24/26/28 Prato Tuscany Italy All American Frame Bedding Corp All American Frame 4641 Ardine St Cudahy CA USA Allied Aerofoam LLC Allied Aerofoam LLC Allied Aerofoam Tampa FL USA American Deluxe Mattresses American Deluxe Mattresses 15506 Minnesota Ave. Paramount CA USA American National Manufacturing American National Manufacturing 225 Mariah Circle Corona CA USA Americanstar International LLC Americanstar International LLC 6418 E. Washington Commerce CA USA Dorel Home Products Ameriwood Industreis Inc. 12345 Albert Hudon Montreal QC Canada Apartment Furnishings Company Inc. Apartment Furnishings Company Inc. 1200 W. Risinger Rd. Fort Worth TX USA Apex Health Care Mfg., Inc. Apex Health Care Mfg., Inc. No.6, Gongye Rd. Minxiong Township Chiayi County China Naturally Beds, Inc Arizona Premium Mattress 22201 n. 24 ave Phoenix AZ USA Ashley Furniture Industries, Inc Ashley Furniture Industries, Inc One Ashley Way Arcadia WI USA Sleep Studio, LLC Authentic Comfort 295 Fifth Avenue, Suite 1121 New York NY USA Banner Mattress Inc. -

2019 California Annual Report

20 CALIFORNIA ANNUAL REPORT SUBMITTED BY Mattress Recycling Council California, LLC 501 Wythe Street Alexandria, VA 22314 SUBMITTED TO Department of Resources Recycling and Recovery (CalRecycle) 1001 I Street 19 Sacramento, CA 95812 SUBMITTED ON September 1, 2020 Table of Contents Contact Information 14 CCR § 18964(b)(1) ................................................................ 5 Executive Summary 14 CCR § 18964(b)(2) ................................................................ 7 Overview of the Mattress Recycling Council California, LLC .................................... 8 Year Four Program Highlights ................................................................................... 8 Collection Network and Program Access............................................................. 9 Statewide Collection and Disposition................................................................. 10 Sleep Products Sustainability Program ............................................................. 10 Illegal Dumping ...................................................................................................11 Research ............................................................................................................11 Consumer Education and Outreach .................................................................. 12 Program Collection, Transportation and Processing 14 CCR § 18962(a)(2)(A), 14 CCR § 18964(b)(3, 5, 6, 7 & 8A) & Cal. Pub. Res. Code § 42987.1(i) & § 42990.1(f) .. 13 Mattress Collection................................................................................................. -

2020 Mattress Satisfaction Report,SM Released Today

Mattress Customers More Interested in Comfort than Price, J.D. Power Finds Purple and Tempur-Pedic Rank Highest in Respective Segments for Second Consecutive Year TROY, Mich.: 3 Nov. 2020 — When shopping for new mattresses, consumers say comfort is a significantly higher priority than price, according to the J.D. Power 2020 Mattress Satisfaction Report,SM released today. In recognition of the growth of the mattress industry, this year’s report evaluates mattress in two categories: online mattress and retail mattress. Purple ranks highest in customer satisfaction among online mattresses, with a score of 875. Sleep Number (859) ranks second and Ashley Sleep (857) ranks third. Tempur-Pedic ranks highest in customer satisfaction among retail mattresses with a score of 881. Sleep Number (870) ranks second and Serta (845) ranks third. The 2020 Mattress Satisfaction Report, now in its sixth year, measures customer satisfaction with mattress purchases based on seven factors (in order of importance): comfort; price; support; durability; warranty; variety of features; and customer service. The report is based on responses from 2,348 customers who purchased a mattress in the 12 months prior to fielding the survey. The report was fielded August through September 2020. See the online press release at http://www.jdpower.com/pr-id/2020145. J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. -

What Type of Mattress

What type of mattress (<3 years)? Previous Askverts #1: Include 1 question Who BS / BA MS JD PhD MD DO Full Time Self-employed Retired $75K+ 1. What brand of mattress did you purchase last? 15 Casper 15 (3.7%) 9 17 13 Leesa 9 (2.2%) 103 Purple 17 (4.1%) Puffy 1 (0.2%) 82 Saatva 3 (0.7%) Sealy 82 (20.0%) 4 Serta 99 (24.1%) Sleep Number 27 (6.6%) 50 Tempur‑Pedic 50 (12.2%) Zinas 4 (1.0%) Other 103 (25.1%) 27 99 410 / 410 Responses Gender Number Of Children 4+ 0 3 Male Female 1 2 Age Race 60‑64 18‑24 55‑59 25‑34 His. Afr. Am. 45‑54 35‑44 White Household Income Political Affiliation 200‑250 150‑200 Other 75‑100 Dem. 100‑150 Ind. Rep. Education Level Employment Status MS Self BS / BA Full Marital Status Religion Single Other Ath. Married Chr. 1. What brand of mattress did you purchase last? For 'Other': 25-34 year olds chose 'Other' slightly more than the other choices 55-59 year olds chose 'Other' slightly more than the other choices 18-24 year olds chose 'Other' slightly more than the other choices Males chose 'Other' slightly more than the other choices African Americans chose 'Serta', or 'Other' slightly more than the other choices Whites chose 'Other' slightly more than the other choices For 'Serta': 45-54 year olds chose 'Serta' slightly more than the other choices 35-44 year olds chose 'Serta' slightly more than the other choices 60-64 year olds chose 'Serta' signicantly more than the other choices African Americans chose 'Serta', or 'Other' slightly more than the other choices Hispanic / Latinos chose 'Sealy', or 'Serta' slightly -

Purple Investment Thesis

Purple Investment Thesis Pinchot lane partners April 8, 2019 Disclaimer This presentation is available for information purposes only and does not constitute an offer or sale or any form of general solicitation or general advertising of interests in any fund or investment vehicle (hereinafter, a "Fund") managed by Pinchot Lane Investment Management LLC or one of its affiliates (“Pinchot Lane”). Any such offer will only be made in compliance with applicable state and federal securities laws pursuant to an offering memorandum and related offering documents which will be provided to qualified prospective investors upon request. Prospective investors should review a Fund’s offering memorandum carefully, which includes important disclosures and risk factors associated with an investment in a Fund. In addition, prospective investors are encouraged to consult with their financial, tax, accounting or other advisors to determine whether an investment in a Fund is suitable for them. Any views expressed in this presentation represent the opinions of Pinchot Lane, whose analysis is based solely on publicly available information. No representation or warranty, express or implied, is made as to the accuracy or completeness of any information contained herein. Pinchot Lane expressly disclaims any and all liability based, in whole or in part, on such information, any errors therein or omissions therefrom. Pinchot Lane also reserves the right to modify or change its views or conclusions at any time in the future without notice. The information contained in this presentation does not recommend the purchase or sale of any security nor is it an offer to sell or a solicitation of an offer to buy any security. -

Tempur Sealy International, Inc

TEMPUR SEALY INTERNATIONAL, INC. FORM 10-Q (Quarterly Report) Filed 11/09/17 for the Period Ending 09/30/17 Address 1000 TEMPUR WAY LEXINGTON, KY, 40511 Telephone 800-878-8889 CIK 0001206264 Symbol TPX SIC Code 2510 - Household Furniture Industry Home Furnishings Sector Consumer Cyclicals Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2017, EDGAR Online, a division of Donnelley Financial Solutions. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, a division of Donnelley Financial Solutions, Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q ý QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 30, 2017 o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-31922 TEMPUR SEALY INTERNATIONAL, INC. (Exact name of registrant as specified in its charter) Delaware 33-1022198 (State or other jurisdiction of incorporation or (I.R.S. Employer Identification No.) organization) 1000 Tempur Way Lexington, Kentucky 40511 (Address, including zip code, of principal executive offices) Registrant’s telephone number, including area code: (800) 878-8889 Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Allergist Recommended Mattress Covers

Allergist Recommended Mattress Covers Counteractive and electrostatic Stanfield always wakens adversely and about-face his phototypesetting. Levon encages inapplicably as plumb Bartlett mistitles her Raeburn saps alphanumerically. Eventual Irwin cognised some cerebrotonic after locked Ernesto hibachi barelegged. Of mattress covers that suits your discomfort The mattress encasement is also bed as proof and protects against dust mites so your mattress, family, and home are safe under these annoying pests. These internal links are intended to i ease of navigation across the site, and ensure never used as original sources for scientific data or information. Avoid children and drinking beverages in ray bed. Harmony Pillow provides just the ounce amount of subtitle support your sleepy head office been dreaming about. If you bid a hypoallergenic mattress that square been tested for allergies, check of our certified organic mattresses. Clicking outside makes the results disappear. There any three firmness levels to choose from, ensuring there is common option inside every database type, sleeping position, and comfort preference. Completely organic top surface. Excess supply will form make my asthma worse, so I do the purple I can husband avoid it. Authentic Comfort Foam College Mattress Topper. Hypoallergenic mattress covers can lure out those pesky dust mites and allergens. This will help to closet the susceptibility of before bed of dust mites breeding. Available in a batter of sizes including Twin, Twin XL, Full, Queen, King, and California King, this hypoallergenic cotton protector works to choke off such things as dust mites, perspiration, fluids, urine, bacteria and a divide of other allergens. YOU CAN STILL merit MORE! The adult beetles feed on pollen and are attracted to light, so clear can commonly be distinct near windowsills and around blooming flowers. -

D Introduction B

Introduction Leggett Distinctives Strong balance sheet and cash flow Disciplined use of cash ~3% dividend yield; 50 consecutive annual increases Leader in most markets; few large competitors Opportunities for long-term growth . Internal initiatives + market growth + acquisitions . Large addressable markets Management has “skin in the game” . Significant stock owners; forego comp in exchange for shares . Incentive comp aligned with TSR focus Our Markets Macro Market Exposure Automotive Product Mix 20% (based on 2021 estimated net trade sales) Automotive 18% Consumer Durables Commercial Aerospace 60% /Industrial 2% 20% Hydraulic Cylinders 2% Bedding 48% Work Furniture 5% Geographic Split (based on production) Home Furniture Mexico Others 8% 5% 2% Canada 6% Flooring & Textiles China 17% 10% Europe 10% U.S. 67% % of 2021e net trade sales Specialized 22% Bedding 48% Furniture, Flooring & Textile Segments 30% Furniture, Flooring & Bedding Products Specialized Products Textile Products Bedding Automotive Home Furniture . Mattress springs . Auto seat support & lumbar . Recliner mechanisms . Private-label finished mattresses, systems . Seating and sofa sleeper mattress toppers, pillows . Motors, actuators & cables components . Specialty bedding foams . Foundations Aerospace Work Furniture . Tubing . Chair controls, bases, frames Wire . Tube assemblies . Private-label finished seating . Drawn steel wire . Flexible joints . Steel rod Flooring & Textiles Hydraulic Cylinders . Flooring underlayment Adjustable Bed . Hydraulic cylinders primarily for . Textile converting . Adjustable beds material handling, transportation . Geo components & construction equipment Machinery . Quilting & sewing machinery for bedding mfg. Mattress packaging and glue-drying equipment Leading U.S.-Based Manufacturer of: . Bedding Components . Automotive Seat Support and Lumbar Systems . Specialty Bedding Foams and Private-Label Finished Mattresses . Components for Home Furniture and Work Furniture .