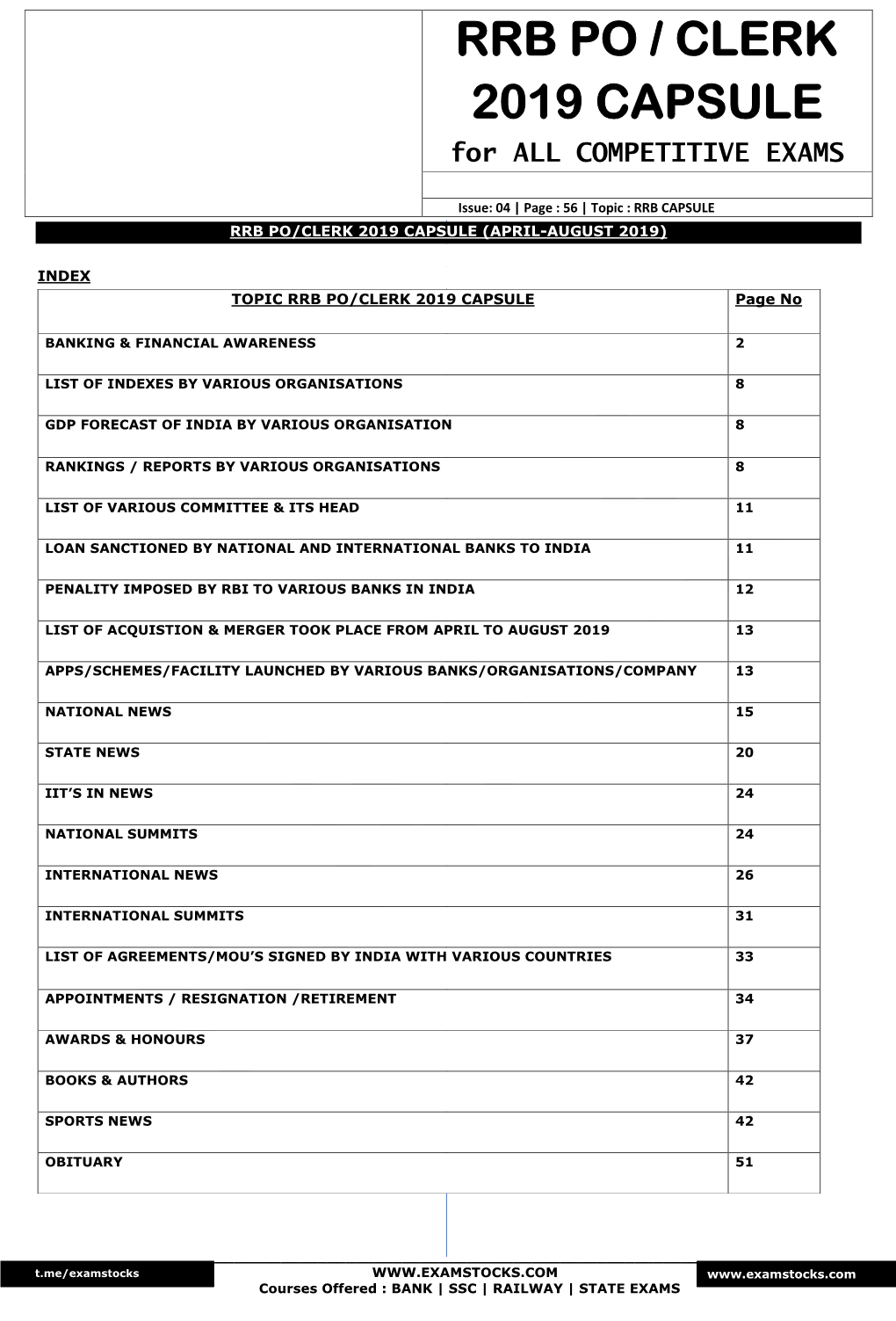

RRB PO / CLERK 2019 CAPSULE for ALL COMPETITIVE EXAMS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sanchaar Media Reference Guide – English

SANCHAAR Media Guide: A Recommended Language Manual For Improved Reporting On Sexual Minorities In India SANCHAAR Media Guide A Recommended Language Manual for Improved Reporting On Sexual Minorities in India SANCHAAR PROJECT 2015 The Humsafar Trust was supported by India HIV/AIDS Alliance, through Pehchan Innovations Fund GFATM Round 9 © The Humsafar Trust : First Edition. Year 2015. Version 1.0. The Humsafar Trust Page 1 SANCHAAR Media Guide: A Recommended Language Manual For Improved Reporting On Sexual Minorities In India FOREWORD The lexicon of same-sex relations in the human is sparsely populated. And that is not only because it was not understood but because it was stigmatised by religion and mainstream heterosexual society. Even today, the term “sodomy” and “catamites” are used in many legal documents and discourses in the USA and these were derived from Biblical texts. The first stirrings of movement on a rational basis to describe same-sex relations started in Europe a little before the region plunged into what are called World War I and World War II. Both were really wars fought by European Nation States and drew in both resources and knowledge from the colonies. Thus Edward Carpenter in England, Magnus Hirschfield in Germany, Havelock Ellis is Austria, all tried their hand at “naming” this phenomenon which was ancient in that they find mention in all human societies across the globe obviously making it a cross=species sexual behaviour. However, as the Upanishads say: “Defining reality or verbalising it – the’Vakas it is called in Sanskrit, took a very long time in secular sciences. -

Additional Players to Watch Players to Watch

USTA PRO CIRCUIT PLAYER INFORMATION PLAYERS TO WATCH Prakash Amritraj (IND) pg. 2 Kevin Kim pg. 6 Kevin Anderson (RSA) Evan King Carsten Ball (AUS) Austin Krajicek Brian Battistone Alex Kuznetsov Dann Battistone Jesse Levine Alex Bogomolov Jr. pg. 3 Michael McClune pg. 7 Devin Britton Nicholas Monroe Chase Buchanan Wayne Odesnik Lester Cook Rajeev Ram Ryler DeHeart Bobby Reynolds Amer Delic pg. 4 Michael Russell pg. 8 Taylor Dent Tim Smyczek Somdev Devvarman (IND) Vince Spadea Alexander Domijan Blake Strode Brendan Evans Ryan Sweeting Jan-Michael Gambill pg. 5 Bernard Tomic (AUS) pg. 9 Robby Ginepri Michael Venus Ryan Harrison Jesse Witten Scoville Jenkins Michael Yani Robert Kendrick Donald Young ADDITIONAL PLAYERS TO WATCH Jean-Yves Aubone pg. 10 Nick Lindahl (AUS) pg. 12 Sekou Bangoura Eric Nunez Stephen Bass Greg Ouellette Yuki Bhambri (IND) Nathan Pasha Alex Clayton Todd Paul Jordan Cox Conor Pollock Benedikt Dorsch (GER) Robbye Poole Adam El Mihdawy Tennys Sandgren Mitchell Frank Raymond Sarmiento Bjorn Fratangelo Nate Schnugg Marcus Fugate pg. 11 Holden Seguso pg. 13 Chris Guccione (AUS) Phillip Simmonds Jarmere Jenkins John-Patrick Smith Steve Johnson Jack Sock Roy Kalmanovich Ryan Thacher Bradley Klahn Nathan Thompson Justin Kronauge Ty Trombetta Nikita Kryvonos Kaes Van’t Hof Denis Kudla Todd Widom Harel Levy (ISR) Dennis Zivkovic ** All players American unless otherwise noted. * All information as of February 1, 2010 P L A Y E R S T O W A T C H Prakash Amritraj (IND) Age: 26 (10/2/83) Hometown: Encino, Calif. 2009 year-end ranking: 215 Amritraj represents India in Davis Cup but has strong ties—with strong results—in the United States. -

The Legal, Colonial, and Religious Contexts of Gay and Lesbian Mental Health in India Tanushree Mohan Submitted in Partial Fulfi

The Legal, Colonial, and Religious Contexts of Gay and Lesbian Mental Health in India Tanushree Mohan Submitted in Partial Fulfillment of the Prerequisite for Honors in Women’s and Gender Studies under the advisement of Nancy Marshall April 2018 © 2018 Tanushree Mohan ACKNOWLEDGEMENTS I would first like to thank my thesis advisor, Nancy Marshall, for offering her constant support throughout not just this thesis, but also the duration of my entire Women and Gender Studies Major at Wellesley College. Thank you for all of your insightful comments, last minute edits, and for believing in my capabilities to do this thesis. Next, I would like to thank the seven people who agreed to be interviewed for the purposes of this thesis. Although I can only refer to you as Interviewees A, B, C, D, E, F and G, I would like to state that I am very grateful to you for your willingness to trust me and speak to me about this controversial topic. I would also like to thank Jennifer Musto, whose seminar, “Transnational Feminisms”, was integral in helping me formulate arguments for this thesis. Thank you for speaking to me at length about this topic during your office hours, and for recommending lots of academic texts related to “Colonialism and Sexuality” that formed the foundation of my thesis research. I am deeply grateful to The Humsafar Trust, and Swasti Health Catalyst for providing their help in my thesis research. I am also thankful to Ashoka University, where I interned in the summer of 2016, and where I was first introduced to the topic of LGBTQIA mental health, a topic that I would end up doing my senior thesis on. -

Download February 2014 Current Affair Study Material

www.QualifyGate.com February 2014 Current Affairs Study Material INTERNATIONAL Libya Destroyed All Chemical Weapons Libya has completely destroyed the chemical arsenal it inherited from Moamer Kadhafi, 10 years after the now slain dictator signed the Chemical Weapons Convention, Foreign Minister Mohamed Abdelaziz announced on 5 February.Now the Libya has become totally free of usable chemical weapons that might present a potential threat to the security of local communities, the environment and neighbouring areas. Matteo Renzi Named new Italian Prime Minister The leader of Italy’s centre-left Democratic Party (PD), Matteo Renzi, was appointed as the country’s new prime minister on 17 February. Renzi, who at 39 would be the country’s youngest-ever prime minister, was summoned by Italian President Giorgio Napolitano at Quirinale presidential palace and given a mandate to try to form a new cabinet after the resignation of Enrico Letta as prime minister on 14 February. Ugandan President Signed Anti Gay Law Uganda’s President Yoweri-Museveni has signed a controversial anti-gay bill on 24 February that allows harsh penalties for homosexual offences, calling them mercenaries and prostitutes.Yoweri Museveni signed the bill, which holds that homosexuals be jailed for long terms, outlaws the promotion of homosexuality and requires people to denounce gays. Arseniy Yatsenyuk Elected As Ukrain Interim PM The Ukrainian parliament has on 27 February elected former opposition leader Arseniy Yatsenyuk as the country’s Interim Prime Minister.He was backed by 371 of 417 participating deputies in the Parliament. INDIA & WORLD India and Germany Signed Two Agreements On Financial and Technical Co-operation India and Germany have signed two umbrella agreements for financial and technical co- operation under Indo German bilateral Development Cooperation framework.The Umbrella Agreements were signed by Finance Minister P Chidambaram and German Federal Minister for Economic Cooperation and Development Gerd Mueller during their bilateral meeting on 5 February in New Delhi. -

VICTOR ESTRELLA BURGOS (Dom) DATE of BIRTH: August 2, 1980 | BORN: Santiago, Dominican Republic | RESIDENCE: Santiago, Dominican Republic

VICTOR ESTRELLA BURGOS (dOm) DATE OF BIRTH: August 2, 1980 | BORN: Santiago, Dominican Republic | RESIDENCE: Santiago, Dominican Republic Turned Pro: 2002 EmiRATES ATP RAnkinG HiSTORy (W-L) Height: 5’8” (1.73m) 2014: 78 (9-10) 2009: 263 (4-0) 2004: T1447 (3-1) Weight: 170lbs (77kg) 2013: 143 (2-1) 2008: 239 (2-2) 2003: T1047 (3-1) Career Win-Loss: 39-23 2012: 256 (6-0) 2007: 394 (3-0) 2002: T1049 (0-0) Plays: Right-handed 2011: 177 (2-1) 2006: 567 (2-2) 2001: N/R (2-0) Two-handed backhand 2010: 219 (0-3) 2005: N/R (1-2) Career Prize Money: $635,950 8 2014 HiGHLiGHTS Career Singles Titles/ Finalist: 0/0 Prize money: $346,518 Career Win-Loss vs. Top 10: 0-1 Matches won-lost: 9-10 (singles),4-5 (doubles) Challenger: 28-11 (singles), 4-7 (doubles) Highest Emirates ATP Ranking: 65 (October 6, 2014) Singles semi-finalist: Bogota Highest Emirates ATP Doubles Doubles semi-finals: Atlanta (w/Barrientos) Ranking: 145 (May 25, 2009) 2014 IN REVIEW • In 2008, qualified for 1st ATP tournament in Cincinnati (l. to • Became 1st player from Dominican Republic to finish a season Verdasco in 1R). Won 2 Futures titles in Dominican Republic in Top 100 Emirates ATP Rankings after climbing 65 places • In 2007, won 5 Futures events in U.S., Nicaragua and 3 on home during year soil in Dominican Republic • Reached maiden ATP World Tour SF in Bogota in July, defeating • In 2006, reached 3 Futures finals in 3-week stretch in the U.S., No. -

GLOBAL HISTORY and NEW POLYCENTRIC APPROACHES Europe, Asia and the Americas in a World Network System Palgrave Studies in Comparative Global History

Foreword by Patrick O’Brien Edited by Manuel Perez Garcia · Lucio De Sousa GLOBAL HISTORY AND NEW POLYCENTRIC APPROACHES Europe, Asia and the Americas in a World Network System Palgrave Studies in Comparative Global History Series Editors Manuel Perez Garcia Shanghai Jiao Tong University Shanghai, China Lucio De Sousa Tokyo University of Foreign Studies Tokyo, Japan This series proposes a new geography of Global History research using Asian and Western sources, welcoming quality research and engag- ing outstanding scholarship from China, Europe and the Americas. Promoting academic excellence and critical intellectual analysis, it offers a rich source of global history research in sub-continental areas of Europe, Asia (notably China, Japan and the Philippines) and the Americas and aims to help understand the divergences and convergences between East and West. More information about this series at http://www.springer.com/series/15711 Manuel Perez Garcia · Lucio De Sousa Editors Global History and New Polycentric Approaches Europe, Asia and the Americas in a World Network System Editors Manuel Perez Garcia Lucio De Sousa Shanghai Jiao Tong University Tokyo University of Foreign Studies Shanghai, China Fuchu, Tokyo, Japan Pablo de Olavide University Seville, Spain Palgrave Studies in Comparative Global History ISBN 978-981-10-4052-8 ISBN 978-981-10-4053-5 (eBook) https://doi.org/10.1007/978-981-10-4053-5 Library of Congress Control Number: 2017937489 © The Editor(s) (if applicable) and The Author(s) 2018, corrected publication 2018. This book is an open access publication. Open Access This book is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made. -

$~ * in the High Court of Delhi at New Delhi + W.P.(C) 4514

$~ * IN THE HIGH COURT OF DELHI AT NEW DELHI + W.P.(C) 4514/2016 & CM APPLs. 18841/2016, 22426/2016 SUSHIL KUMAR ..... Petitioner Through Mr. Amit Sibal, Senior Advocate with Mr. Kaushik Moitra, Mr. Kumar Sudeep, Mr. Abhishek Malhotra, Mr. Namit Suri, Mr. Dron Parashar and Ms. Aahna Mehrotra, Advocates versus UNION OF INDIA & ORS ..... Respondents Through Ms. Monika Arora, CGSC with Mr. Jitendra Kumar Tripathi, Mr. Kushal Kumar and Mr. Harsh Ahuja, Advocates for R-1/UOI. Mr. Aditya Singh with Mr. Anshuman Tiwari, Advocates for R-2/IOA. Mr. Anil Grover with Ms. Noopur Singhal, Advocates for R-3/SAI. Mr. Pradeep Dewan, Senior Advocate with Ms. Anupam Dhingra, Advocate for R-4/WFI. Mr. Nidhesh Gupta, Senior Advocate with Mr. Tarun Gupta, Mr. Puneet Vrshney, Mr. Pramod Kumar, Mr. Arbind Yadav and Mr. Yasir Arafat, Advocates for R-5. Reserved on : 02nd June, 2016 % Date of Decision : 06th June, 2016 CORAM: HON'BLE MR. JUSTICE MANMOHAN W.P.(C) 4514/2016 Page 1 of 37 J U D G M E N T MANMOHAN, J: THE ISSUE 1. Petitioner's argument „All I am asking is a trial for Rio Games‟ makes interesting sound-bite, but the issue is whether this argument is legally tenable and in consonance with the facts of the case. ESSENTIAL FACTS 2. By way of the present writ petition, petitioner has challenged selection of respondent no.5 by respondent no.4-Wrestling Federation of India (hereinafter referred to as "respondent no. 4-WFI") for the 74 kg Men's Freestyle Wrestling event at the Rio Olympics Games 2016 commencing 5th August, 2016. -

Chapter 2 China's Cars and Parts

Chapter 2 China’s cars and parts: development of an industry and strategic focus on Europe Peter Pawlicki and Siqi Luo 1. Introduction Initially, Chinese investments – across all industries in Europe – especially acquisitions of European companies were discussed in a relatively negative way. Politicians, trade unionists and workers, as well as industry representatives feared the sell-off and the subsequent rapid drainage of industrial capabilities – both manufacturing and R&D expertise – and with this a loss of jobs. However, with time, coverage of Chinese investments has changed due to good experiences with the new investors, as well as the sheer number of investments. Europe saw the first major wave of Chinese investments right after the financial crisis in 2008–2009 driven by the low share prices of European companies and general economic decline. However, Chinese investments worldwide as well as in Europe have not declined since, but have been growing and their strategic character strengthening. Chinese investors acquiring European companies are neither new nor exceptional anymore and acquired companies have already gained some experience with Chinese investors. The European automotive industry remains one of the most important investment targets for Chinese companies. As in Europe the automotive industry in China is one of the major pillars of its industry and its recent industrial upgrading dynamics. Many of China’s central industrial policy strategies – Sino-foreign joint ventures and trading market for technologies – have been established with the aim of developing an indigenous car industry with Chinese car OEMs. These instruments have also been transferred to other industries, such as telecommunications equipment. -

15.05.15 Sugar and Spice and All That's Nice I Like Sugar in My Mug Of

15.05.15 Sugar and spice and all that’s nice I like sugar in my mug of coffee. I can’t bear the thought of drinking the brew unsweetened. Hence, I am always on the lookout for natural sugars to use in place of the refined ones. I usually use jaggery in my coffee. But recently, my mother came across an interesting alternative. She promptly delivered the find to my home. It was in a neat pouch made of rough brown paper and that appealed to my sense of eco awareness. It had the words ‘Coconut Blossom Sugar’ printed on it. I have heard of this sugar, but I was under the impression that it was a sweetener and not a natural sugar. The suggestions of use on the package were intriguing and I decided to try it out. It resembles the Demerara sugar closely in colour and coarseness. The taste of it by itself is very clean and fresh, with an unmistakable sweetness of the elaneer. It is not overpoweringly sweet and when I added a little of it to my cold coffee, it tasted good. I noticed that it was free flowing and did not clump. To my knowledge, the coconut blossom sugar is obtained from the sap of the coconut flower. A cut is made at the base of the flower for and the sap that oozes out is collected, allowed to evaporate and the residue from that is the natural sugar. This is the technique followed in many parts of the world. However, at Farm Made, in Palladam, they do it differently. -

Ladakh Studies

INTERNATIONAL ASSOCIATION FOR LADAKH STUDIES LADAKH STUDIES _ 19, March 2005 CONTENTS Page: Editorial 2 News from the Association: From the Hon. Sec. 3 Nicky Grist - In Appreciation John Bray 4 Call for Papers: 12th Colloquium at Kargil 9 News from Ladakh, including: Morup Namgyal wins Padmashree Thupstan Chhewang wins Ladakh Lok Sabha seat Composite development planned for Kargil News from Members 37 Articles: The Ambassador-Teacher: Reflections on Kushok Bakula Rinpoche's Importance in the Revival of Buddhism in Mongolia Sue Byrne 38 Watershed Development in Central Zangskar Seb Mankelow 49 Book reviews: A Checklist on Medicinal & Aromatic Plants of Trans-Himalayan Cold Desert (Ladakh & Lahaul-Spiti), by Chaurasia & Gurmet Laurent Pordié 58 The Issa Tale That Will Not Die: Nicholas Notovitch and his Fraudulent Gospel, by H. Louis Fader John Bray 59 Trance, Besessenheit und Amnesie bei den Schamanen der Changpa- Nomaden im Ladakhischen Changthang, by Ina Rösing Patrick Kaplanian 62 Thesis reviews 63 New books 66 Bray’s Bibliography Update no. 14 68 Notes on Contributors 72 Production: Bristol University Print Services. Support: Dept of Anthropology and Ethnography, University of Aarhus. 1 EDITORIAL I should begin by apologizing for the fact that this issue of Ladakh Studies, once again, has been much delayed. In light of this, we have decided to extend current subscriptions. Details are given elsewhere in this issue. Most recently we postponed publication, because we wanted to be able to announce the place and exact dates for the upcoming 12th Colloquium of the IALS. We are very happy and grateful that our members in Kargil will host the colloquium from July 12 through 15, 2005. -

Ancient Universities in India

Ancient Universities in India Ancient alanda University Nalanda is an ancient center of higher learning in Bihar, India from 427 to 1197. Nalanda was established in the 5th century AD in Bihar, India. Founded in 427 in northeastern India, not far from what is today the southern border of Nepal, it survived until 1197. It was devoted to Buddhist studies, but it also trained students in fine arts, medicine, mathematics, astronomy, politics and the art of war. The center had eight separate compounds, 10 temples, meditation halls, classrooms, lakes and parks. It had a nine-story library where monks meticulously copied books and documents so that individual scholars could have their own collections. It had dormitories for students, perhaps a first for an educational institution, housing 10,000 students in the university’s heyday and providing accommodations for 2,000 professors. Nalanda University attracted pupils and scholars from Korea, Japan, China, Tibet, Indonesia, Persia and Turkey. A half hour bus ride from Rajgir is Nalanda, the site of the world's first University. Although the site was a pilgrimage destination from the 1st Century A.D., it has a link with the Buddha as he often came here and two of his chief disciples, Sariputra and Moggallana, came from this area. The large stupa is known as Sariputra's Stupa, marking the spot not only where his relics are entombed, but where he was supposedly born. The site has a number of small monasteries where the monks lived and studied and many of them were rebuilt over the centuries. We were told that one of the cells belonged to Naropa, who was instrumental in bringing Buddism to Tibet, along with such Nalanda luminaries as Shantirakshita and Padmasambhava. -

Table of Contents

www.toprankers.com Table of Contents 01. INTERNATIONAL NEWS 02. NATIONAL NEWS 03. SPORTS 04. SCIENCE AND TECHNOLOGY 05. OBITUARY 06. APPOINTMENTS AND RESIGNATIONS 07. IMPORTANT DAYS 08. SUMMITS AND MOU’S 09. AWARDS AND RECOGNITION 10. RANKING 11. BOOKS AND AUTHORS 12. BANKING AND ECONOMY www.toprankers.com INTERNATIONAL NEWS Russian supermodel Vodianova is new UN goodwill ambassador Russian supermodel and philanthropist Natalia Vodianova has become a United Nations goodwill ambassador, to promote the sexual and reproductive rights of women and girls and tackle stigmas surrounding their bodies. She will be a campaigner for the UN Population Fund, which now calls itself the UN”s sexual and reproductive health agency, known as UNFPA. Irakli Garibashvili as New Prime Minister of Georgia The Parliament of Georgia confirmed Irakli Garibashvili as Prime Minister along with a vote of confidence in the cabinet Garibashvili put forward. Garibashvili pledged to create a long- term development strategy for Georgia in his first one hundred days in office. First, on the agenda, Garibashvili will continue the essential work of the government to ably manage the pandemic and accelerate the focus on rebuilding the economy while continuing to strengthen Georgia’s security and democratic institutions. India, Australia and France hold trilateral dialogue with focus on Indo-Pacific A trilateral dialogue was held among India, France, and Australia on February 24, 2021, at the senior officials’ level, with a focus on further enhancing cooperation in the Indo-Pacific. The aim of this trilateral dialogue is to build strong bilateral relation among the three countries and synergies their respective strength to ensure a peaceful, secure, prosperous and rules-based Indo-Pacific region.