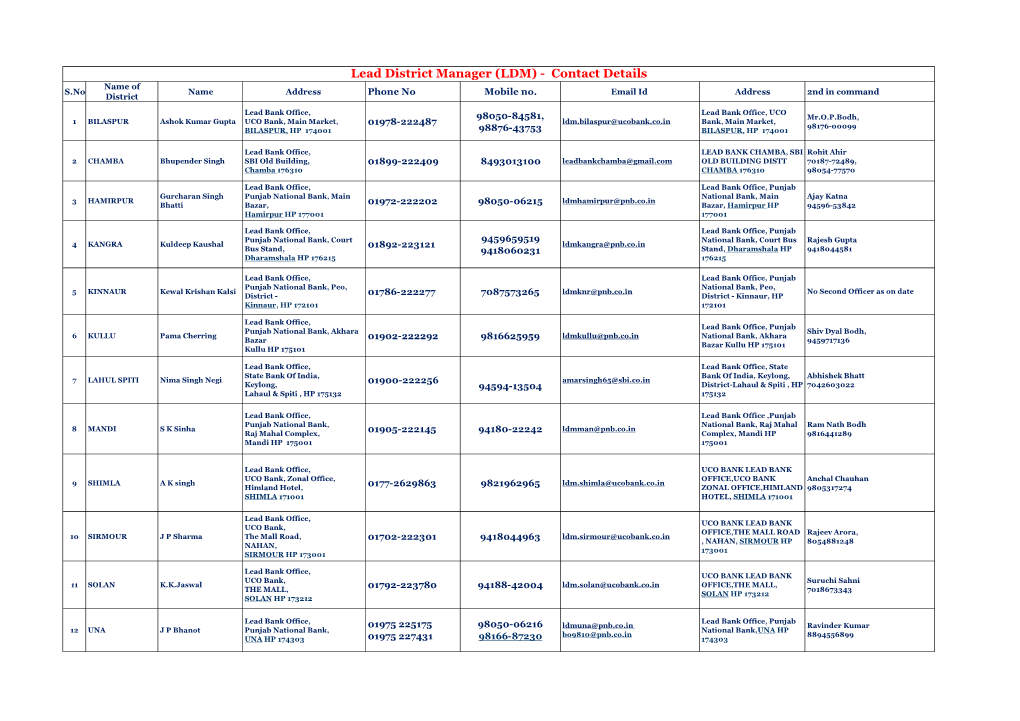

Lead District Manager (LDM) - Contact Details Name of S.No Name Address Phone No Mobile No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Institute of Cost Accountants of India

THE INSTITUTE OF Telephones : +91-33- 2252-1031/1034/1035 COST ACCOUNTANTS OF INDIA + 91-33-2252-1602/1492/1619 (STATUTORY BODY UNDER AN ACT OF PARLIAMENT) + 91-33- 2252-7143/7373/2204 CMA BHAWAN Fax : +91-33-2252-7993 12, SUDDER STREET, KOLKATA – 700 016. +91-33-2252-1026 +91-33-2252-1723 Website : www.icmai.in DAILY NEWS DIGEST BY BFSI BOARD, ICAI July 4, 2021 EDs in Public Sector Banks: Banks Board Bureau recommends 10 candidates in 2021-22: The Banks Board Bureau (BBB) has recommended ten candidates to the panel that will be used for filling vacancies of Executive Directors in various Public Sector Banks (PSBs) in the year 2021-22. These names have been shortlisted after the BBB, which is the head hunter for the government for filling top level posts in PSBs, insurance companies and other financial institutions, interfaced with 40 candidates (chief general managers and general managers) from various PSBs on July 2 and 3 for the position of Executive Directors, sources close to the development said. The ten names that have been recommended (in the order of merit) for the Panel are Rajneesh Karnatak; Joydeep Dutta Roy; Nidhu Saxena, Kalyan Kumar; Ashwani Kumar; Ramjass Yadav, Asheesh Pandey, Ashok Chandra; A V Rama Rao and Shiv Bajrang Singh. This panel will be operated in the financial year 2021–22, subject to availability of vacancies in the panel year 2021–22, sources said. https://www.thehindubusinessline.com/money-and-banking/eds-in-public-sector-banks-banks-board- bureau-recommends-10-candidates-in-2021-22/article35125016.ece Supreme Court seeks response of Centre, RBI on plea of PNB against disclosure of info under RTI: The Supreme Court has refused to grant interim stay on the RBI’s notice asking Punjab National Bank to disclose information such as defaulters list and its inspection reports under the RTI Act, and sought responses from the Centre, federal bank and its central public information officer. -

Statement of Unpaid and Unclaimed Dividend Amount for FY 2018-19

SR. No. Due Amount DPID-Client ID- Instrument No Name of the Payee Registered Bank Investment Type Propose date of Is the Investment under Is the shares Account No transfer to IEPF litigation transferred from unpaid suspense A/c FY 2018-19 Amount for unclaimed and 1 0.12 1203320005311836 103833 MANMOHAN KUMAR ORIENTAL BANK OF COMMERCE unpaid dividend 27-10-2026 No No Amount for unclaimed and 2 12.00 IN30236510307646 103777 GURMIT RAM STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 3 0.60 IN30114310890533 103834 KARAN SINGLA STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 4 60.00 1201320000425029 103779 PURNIMA MISHRA . STATE BANK OF INDIA unpaid dividend 27-10-2026 No No Amount for unclaimed and 5 12.00 IN30011810990050 103780 RICHH PAL SINGH IDBI BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 6 1.20 1202420000605238 103781 VIJAY MOHAN PAINULI PUNJAB NATIONAL BANK unpaid dividend 27-10-2026 No No Amount for unclaimed and 7 18.00 1202420000168896 103782 TARSEM LAL MAHAJAN STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 8 6.00 1201210100496051 103784 VIKAS MAHARISHI STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 9 3.60 1301760000657165 103785 REENA JAIN BANK OF RAJASTHAN LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 10 1.20 1203320000858515 103786 MAHAVEER CHAND CHHAJED BALOTRA URBAN CO OP BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 11 -

Retail User Guide

Retail User Guide User Guide for Retail Internet Banking Users Punjab National Bank introduces the upgraded version of Internet Banking for its esteemed Retail Customers. Experience a convenient, simple and secure way of banking & e-commerce at your comfort with PNB Internet Banking Services. Start using now!!! Page 1 CONTENTS Topic Page 1. How to get user ID/Password 3 2. How to use internet banking 3 3. My Accounts 4 4. Transactions 5 5. Value Added Services 6 6. Personal Settings 7 7. Other Services 8 8. Mail and Messages 9 9. Security Features 9 10. Safeguard 10 11. Contact Us 10 Page 2 1. How to get User ID/Password 1.1 On-line Registration for Internet Banking facility: Customers can avail Retail Internet Banking facility by getting themselves registered online using debit card credentials. Follow the steps as under: Visit http://www.netpnb.com On Home Page, Click on the link –> Register Here Enter Account Number & Select Registration Type. Select Type of facility View Only or View & Transaction Both Click on “Verify” Enter OTP received on Registered Mobile Number in “One Time Password” field. After verification of OTP, enter account details/ ATM credentials. On successful validation of entered details, you can set the passwords. Once these processes are successfully completed, you will be shown success message with regard to your registration process. After completing this process, user will be enabled immediately. 1.2 Registration through PNB ATMs: Customers can submit request for Internet Banking registration through PNB ATMs: 1.3 Submitting request on Form no. PNB-1063 in branch: Customers may download the IBS Registration form from the link DownloadFormsPNB 1063 and submit the same to any PNB branch after entering required details. -

Sustainability and Ethical Banking: a Case Study of Punjab National Bank

Volume 4 Issue 1 2019 AJCG Amity Journal of Corporate Governance 4 (1), (15-27) ©2019 ADMAA Sustainability and Ethical Banking: A Case Study of Punjab National Bank Amrish Dogra & Manu Dogra Guru Nanak Dev University, Amritsar, Punjab, India Abstract In the field of banking and finance, Ethical banking is a business model that responds to emerging approaches to sustainable economy based on the principles of corporate social responsibility. Ethical banking is also known as ‘sustainable banking’ or ‘civic banking’ or ‘clean banking’. ‘Transparency in reporting’ is a major value integrated in the fundamentals of ethical banking (Barcelona, 2012). The recent disclosure of mega scam in Punjab National Bank has violated this fundamental norm of ethical banking. Besides, the surmounting non- performing assets in banks pose a threat to the sustainability of these banks. The present study focusses upon these two areas of CSR by forecasting NPAs of PNB in 2025 and by highlighting the present case of mega scam in the bank. The study has forecasted the non-performing assets of PNB on the basis of quarterly data from 2010 to 2017. Basel II guidelines regarding better supervisory review, market discipline via certain disclosure requirements and minimum regulatory capital were introduced in an advanced manner in India in 2010. Hence, quarterly data relating to repo rate, gross domestic product, inflation rate and loans and advances from 2010 to 2017 has been considered. The second major objective of the study aims at highlighting the recently revealed scam relating to Punjab National Bank. Coincidentally, the PNB scam also lasted seven years from 2010 to 2017. -

Corporate Overview Transact with Ease: Solutions That Work for Everyone, Everywhere

Corporate Overview Transact with ease: Solutions that work for everyone, everywhere... Leading Payments Platform Provider One of India’s leading end-to-end banking and payments solution providers: Pan-India § 20 years proven track record presence in 27 States § 600+ banks are provided switching and & 3 UTs payment services § 15 million debit cards issued § 10 million transactions per day § 2500 ATMs, 5000 Micro ATMs deployed © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 2 Top NPCI Partner & ASP § First ASP certified by NPCI and a pioneer in 54% market share developing payment solutions on various in RuPay NFS sub- NPCI platforms membership § Leading end-to-end solution provider offering RuPay Debit cards, ATM, POS, ECOM, Micro ATM, IMPS, AEPS, UPI, BBPS Sarvatra Others © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 3 Leading in Co-operative Banking Sector India’s top provider of debit card platform, switching & payment services to co-op. banking sector. CO-OPERATIVE BANK TYPE SARVATRA CLIENTS Urban Cooperative Banks (UCBs) 395 State Cooperative Banks (SCBs) 14 District Central Cooperative Banks (DCCBs) 129 © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 4 One of India’s largest Debit Card Issuing platforms (hosted) © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 5 Top Private & Public Sector Banks as Customers § Our key enterprise customers in Private Sector Banks include ICICI Bank, Punjab National Bank, The Nainital Bank, Oriental Bank of Commerce, IDBI Bank, Bank of Maharashtra, NSDL Payments Bank. § Our Sponsor Banks (Partners for NPCI’s Sub-membership Model) include HDFC Bank, ICICI Bank, YES Bank, Axis Bank, IndusInd Bank, IDBI Bank, State Bank of India, Kotak Mahindra Bank. -

FAQ 1. What Is Sovereign Gold Bond (SGB)? Who Is the Issuer

स륍मान आपके वि�िास का HONOURS YOUR TRUST (Government of India Undertaking) FAQ 1. What is Sovereign Gold Bond (SGB)? Who is the issuer? SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India. 2. Why should I buy SGB rather than physical gold? What are the benefits? The quantity of gold for which the investor pays is protected, since he receives the ongoing market price at the time of redemption/ premature redemption. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewellery form. The bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip etc. 3. Are there any risks in investing in SGBs? There may be a risk of capital loss if the market price of gold declines. However, the investor does not lose in terms of the units of gold which he has paid for. 4. Who is eligible to invest in the SGBs? Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities, charitable institutions, etc. -

भारतीय जीवन बीमा ननगम Life Insurance Corporation of India

भारतीय जीवन बीमा ननगम LIFE INSURANCE CORPORATION OF INDIA प्रधानमंत्री जन धन योजना के तहत जन-धन ख़ाताधारकⴂ के लिये 셁.30,000/- के जीवन बीमा सरु क्षा के दावा ननपटारा हेतु प्रक्रिया PRADHAN MANTRI JAN DHAN YOJANA (PMJDY) PROCEDUREFOR CLAIM SETTLEMENT UNDER LIFE INSURANCE COVER OF Rs.30,000/- FOR PMJDY ACCOUNT HOLDER 1 CLAIM PROCESSING PROCEDURE FOR BANKS UNDER PRADHAN MANTRI JAN DHAN YOJANA ववषय सूची / CONTENTS A. Preamble B. Definitions C. Benefits under the Scheme D. Basic Eligibility Conditions E. Ineligible Categories F. Exit from Scheme G. Claim Settlement Procedure H. Procedure to be followed by Banks on receipt of Death Claim Intimation I. Procedure to be followed by LIC on receipt of claim intimation. J. List of Annexures 2 PMJDY claim procedure A. PREAMBLE The Hon’ble Prime Minister in his Independence Day Speech on 15th August, 2014 announced a comprehensive program of Financial Inclusion targeting the large number of people who are currently deprived of even rudimentary financial services. The PradhanMantri Jan DhanYojana (PMJDY) sets out to provide a basic Bank account to every family who till now had no account. The bank account comes with a RuPay debit card with a built-in accidental cover of Rs 1 lakh. During the launch of the PMJDY scheme on 28.08.14 in New Delhi, Hon’ble Prime Minister announced a life cover of Rs. 30,000/- with the RuPay Card for all those who subscribe to a bank account for the first time during the period 15th August, 2014 to 26th January, 2015. -

Financial Inclusion-Account Opening Form

FINANCIAL INCLUSION-ACCOUNT OPENING FORM Reference No.______________Date: ____________ Account No. Name of the Branch____________________ D No_________________ Customer ID No. Sub District/Block Name SSA Code/Ward No. Village Code/Town Code Name of Village/Town [as per census 2011] [as per census 2011] Applicant Details: Full Name Mr./Mrs./Ms. (In Capital Letters) First Middle Last Name Marital StatusMarried/Single Gender Male/Female Name of Spouse No. of Dependents: Name of Father Address City State Pin Code Nationality : Religion: Hindu/Muslim/Sikh/Christian/others Location Rural/ Semi-urban/Urban/Metro Category: General/OBC/SC/ST/Minority Type of Account Individual/Joint/ Sr Citizen Mode of Operation: Self/ Guardian/ Telephone & Mobile No. Date of Birth dd mm yyyy Aadhaar/ EID No. PAN /GIR No. Voter ID No; If available MNREGA JOB CARD NO: Occupation/Profession Agriculture/Service/Housewife/Business/Salaried/Retired/Student/Others Annual Income (ü ) Up to Rs.60000/- 60001/- to 1.5 lakh 1.5 lakh to 5.00 lakh > 5 lakhs Detail of Assets Owning House : Y/N No. of Animals : Owning Farm : Y/N Any other : Existing Bank A/c of family Y/N If yes Bank A/c No. members/household Kisan Credit Card Whether Eligible Y/N If already Issued ; Y/N I request you to issue me a Rupay Debit Card. I authorize UIDAI to share my e-KYC data with Punjab National Bank. I request you to sanction me an overdraft facility with the Limit of Rs. 5000/-(Rupees Five Thousand only) in the above account to meet my emergency/family needs. -

Faqs Answers

Amalgamation of Oriental Bank of Commerce and United Bank of India into Punjab National Bank S. No. FAQs Answers General Banking FAQs Will my account number change on 1. No, your existing account number will remain same. System Up gradation of my branch? Yes, your user ID may get changed. To know your user ID, please click on “Know your user ID” on login page of the Internet Banking Service option, then enter account no. -> enter DOB/PAN no. -> enter OTP received on registered mobile number. Does my Customer Identification 2. Number (CIF) change? In case your Customer ID is of 8 digits, For eOBC customers, please prefix alphabet „O‟ in customer ID. For eUNI customers, please prefix alphabet „U‟ in customer ID and then try. Yes. You can check it on www.pnbindia.in or you can contact your base branch or Customer Care Helpline No. 18001802222 or 18001032222 to know new IFSC and MICR Code of your Branch. Does my branch IFSC and MICR code Bank has already sent SMS carrying new IFSC and MICR Code of 3. change? your Branch to your registered mobile number. For e-OBC branches: https://www.pnbindia.in/downloadprocess.aspx?fid=dYhntQN3LqL12L04pr6fGg== For e-UNI branches: https://www.pnbindia.in/downloadprocess.aspx?fid=8dvm/Lo2L15cQp3DtJJIlA== There will not be any issues while maintaining accounts of e-OBC, What happen if I have accounts in both 4. e-UNI and PNB in PNB 2.0. However, you may need to merge your Oriental Bank of Commerce and Punjab accounts into one CIF/Cust Id. -

PUNJAB NATIONAL BANK RESOURCE MOBALISATION DIVISION HO: NEW DELHI FAQ's NRO Deposit Scheme 1. What Is NRO A/C?

PUNJAB NATIONAL BANK RESOURCE MOBALISATION DIVISION HO: NEW DELHI F.A.Q.’s N.R.O. Deposit Scheme 1. What is NRO A/c? Non-Resident Ordinary Rupee Account (NRO Account) 2. Who can open NRO a/cs? Any person resident outside India may open NRO account with any branch for the purpose of putting through bona fide transaction in rupees. Opening of accounts by individual/ entities of Pakistan and entities of Bangladesh require prior approval of Reserve Bank of India. NRO (current/savings) account can also be opened by a foreign national of non-Indian origin visiting India/ foreign national students. - Foreign Nationals on Non-Indian origin (for period not exceeding 6 Months). 3. Who is Non-resident Indian / Persons of Indian origin? - Those Indian residents, who are in employment, studying and staying permanently abroad and foreign nationals (except of Pakistan and Bangladesh), with their origin in India. -Students proceeding abroad for higher studies are treated as Non-residents. 4. Which type of accounts can be opened under NRO? - NRO accounts may be opened / maintained in the form of current, savings, recurring or fixed deposit accounts. 5. In which currency these a/cs are maintained in the Banks? Account should be denominated in Indian Rupees. 6. These accounts can be opened with which funds? - The accounts can also be opened with / out of the funds received as foreign inward remittances in convertible currency through normal banking channel. The Foreign Currency Travellers Cheques / Notes may be accepted during temporary visits of the NRI, for credit to account. - The accounts can also be opened with the Legitimate local dues denominated in Indian Rupees viz. -

DEBIT CARD POLICY 1. Debit Card a Debit Card Is a Plastic Card That

DEBIT CARD POLICY 1. Debit Card A debit card is a plastic card that provides the cardholder electronic access to his/her bank account(s). It is an instrument that can be used to: Avail of banking services such as cash withdrawal, balance enquiry etc., from any ATM and Micro ATM. Make payments to merchants against purchase, withdrawal of cash at POS or both within the prescribed limit by RBI at merchant outlets. e-Commerce transactions. 2. Understanding a Debit Card. a) Card Number: It is a 16 or 19 digit number linked to customer’s bank account. First 6 digits represent Bank’s identification no., next 4 digits represent Branch Sol ID. Remaining digits indicates serial number of the cards issued by that particular branch. Currently Bank issue debit cards with 16 digit length. b) Name of the Person: Person authorized to use the card. This field is present only on personalized card. c) Valid Date: It is in mm/yy format. The card is valid till the last day of the month. d) Card Verification Value (CVV) /CVV2: A 03 (Three) digit number printed on the back side of every debit card. This is used for validation of online transactions. e) Magnetic Strip: Important information regarding the debit card is stored in electronic format here and hence any kind of scratches or exposure to magnetic fields will cause damage to the card. f) EMV Chip Card: EMV stands for Europay, MasterCard and Visa. EMV is a global standard for credit and debit payment cards based on chip card technology. -

Sr.No . Ward Name Father/Husband Adhar Bank Name Accountno

Sr.No Ward Name Father/Husband Adhar Bank name Accountno. present address . Mobile 1 1 rinku devi dablu sonkar Available union bank Available chillupar barhalganj Available 2 1 baby devi jaswant sonkar Available union bank Available chillupar barhalganj Available 3 1 surenddra sonkar ramdas Available oriental bank Available chillupar barhalganj Available 4 1 mannu devi nebulal sonkar Available oriental bank Available chillupar barhalganj Available 5 1 chinta devi rajesh sonkar Available purvanchal bank Available chillupar barhalganj Available 6 1 laliya gulab sonkar Available union bank Available chillupar barhalganj Available 7 1 viraju babulal Available union bank Available chillupar barhalganj Available 8 1 dileep kumar somkar babulal sonkar Available union bank Available chillupar barhalganj Available 9 1 patiya sonkar munib sonkar Available union bank Available chillupar barhalganj Available 10 1 radha devi amarnath Available indian overseas bank Available chillupar barhalganj Available 11 1 Anil Sonkar shiv prakash Sonkar Available punjab national bank Available tahsil chauraha Available 12 1 arun kumar maddhesia anmol prasad Available bank of baroda Available mahadeva muhalla Available 13 1 shakeel ahmad vakil ahmad ansari Available purvanchal bank Available kasab tola barhalganj Available 14 1 suresh chand varma ramashankar Available punjab national bank Available kasab tola barhalganj Available 15 1 geeta devi nandlal verma Available purvanchal bank Available purana gola muhalla Available 16 1 Leelawati Devi Sonkar Phoolchand