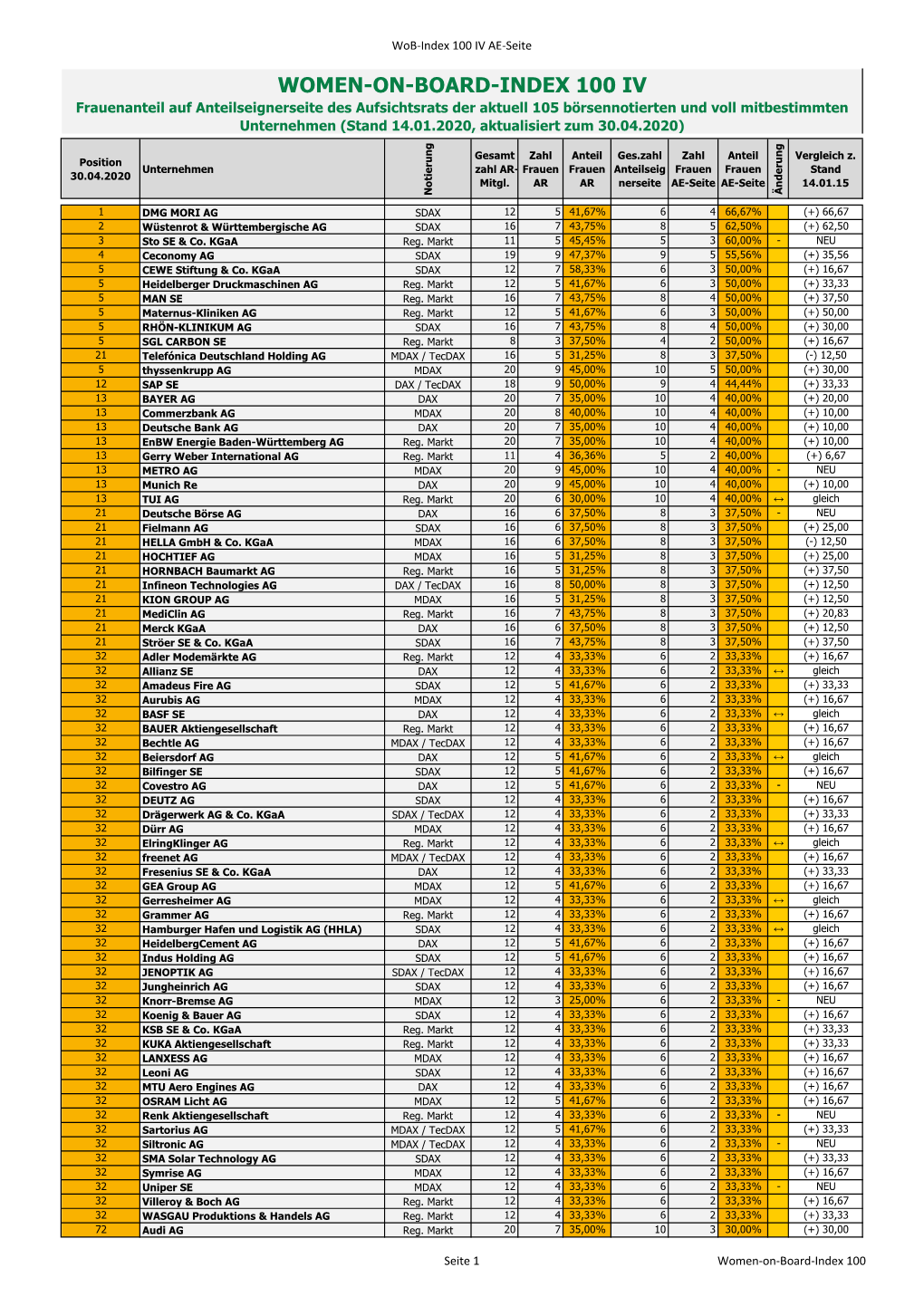

Women-On-Board-Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JUNGHEINRICH 4.0 Annual Report 2016 Contents

JUNGHEINRICH 4.0 Annual Report 2016 Contents 02 Members of the Board of Management and To our shareholders 04 Jungheinrich 4.0 30 To our shareholders 30 Report of the Supervisory Board 33 Corporate governance report 36 Members of the Supervisory Board 38 Jungheinrich share 43 Group management report 44 Group fundamentals 50 Economic report 66 Legal disclosure 67 Risk and opportunity report 73 Forecast report 75 Consolidated financial statements 76 Consolidated statement of income 77 Consolidated statement of comprehensive income (loss) 78 Consolidated balance sheet 80 Consolidated statement of cash flows 81 Consolidated statement of changes in shareholders’ equity 82 Notes to the consolidated financial statements 140 Additional information 140 Responsibility statement 141 Independent auditor’s report 142 Jungheinrich worldwide 144 2016 quarterly overview Cover Key figures at a glance Five-year overview Financial calendar, Imprint, Contact Company profile Established in 1953, Jungheinrich ranks among the world’s leading intralogistics companies. Drawing on a balanced portfolio of material handling equipment, logistics systems and services, Jungheinrich offers its customers comprehensive solutions from a one-stop shop. The Group‘s strategy is designed to generate sustainable, profitable growth and thus increase the company‘s value. Our goal is to become the No. 1 intralogistics brand on all European markets and to rank among the top 3 global suppliers worldwide over the long term. Key figures at a glance Jungheinrich Group 2016 2015 Change -

Women-On-Board-Index

WOMENONBOARDINDEX III Aufsichtsräte (Stand 14.01.2012) powered by FidAR Zahl Anteil WoB-Index Posit Zahl AR- Unternehmen Notierung Frauen Frauen nur ion Mitgl. AR AR Aufsichtsräte 1 Douglas Holding AG MDAX 16 8 50% 50,00% 2 Kabel Deutschland Holding AG MDAX 12 5 42% 41,67% 3 Deutsche Bank AG DAX 20 8 40% 40,00% 4 Amadeus Fire AG SDAX 11 4 36% 36,36% 5 Bechtle AG TecDAX 12 4 33% 33,33% 5 Beiersdorf AG DAX 12 4 33% 33,33% 5 Bertrandt AG SDAX 6 2 33% 33,33% 5 Biotest AG SDAX 6 2 33% 33,33% 5 centrotherm photovoltaics AG TecDAX 3 1 33% 33,33% 5 comdirect bank AG SDAX 6 2 33% 33,33% 5 HAMBORNER REIT SDAX 9 3 33% 33,33% 5 TAG Immobilien AG SDAX 6 2 33% 33,33% 13 Deutsche Post AG DAX 20 6 30% 30,00% 13 GfK SE SDAX 10 3 30% 30,00% 15 Sky Deutschland AG MDAX 7 2 29% 28,57% 16 Commerzbank AG DAX 20 5 25% 25,00% 16 Fielmann AG MDAX 16 4 25% 25,00% 16 Fraport AG MDAX 20 5 25% 25,00% 16 Henkel AG & Co. KGaA DAX 16 4 25% 25,00% 16 Merck KGaA DAX 16 4 25% 25,00% 16 Q-CELLS SE TecDAX 8 2 25% 25,00% 16 Software AG TecDAX 12 3 25% 25,00% 16 Symrise AG MDAX 12 3 25% 25,00% 24 Axel Springer AG MDAX 9 2 22% 22,22% 24 STADA Arzneimittel AG MDAX 9 2 22% 22,22% 26 ADVA AG Optical Networking TecDAX 5 1 20% 20,00% 26 Deutsche Telekom AG DAX 20 4 20% 20,00% 26 Hawesko Holding AG SDAX 5 1 20% 20,00% 26 Münchener Rück AG DAX 20 4 20% 20,00% 26 RHÖN-KLINIKUM AG MDAX 20 4 20% 20,00% 26 Siemens AG DAX 20 4 20% 20,00% 26 ThyssenKrupp AG DAX 20 4 20% 20,00% 33 Praktiker Bau- und Heimwerkermärkte SDAX 16 3 19% 18,75% 33 TUI AG MDAX 16 3 19% 18,75% 35 adidas AG DAX 12 -

Pressemitteilung Der SMA Technologie AG

SMA Solar Technology AG—Press Release SMA to deliver operations and maintenance services for TerraForm Power’s North American solar fleet Niestetal, Germany, November 27, 2019—SMA America, the U.S. subsidiary of SMA Solar Technology AG (SMA/FWB: S92), has signed a 10-year framework agreement with TerraForm Power for SMA to provide operations and maintenance (O&M) services for TerraForm Power’s North American solar fleet. Starting in early 2020, the companies will enter into long-term project-level service agreements and transition operations to SMA. The 10-year agreement covers approximately 1 gigawatt of TerraForm Powers’ existing solar portfolio. “We are pleased that TerraForm Power has selected SMA as the O&M services partner for its North American solar fleet. With this award SMA is strengthening its position among the top providers of O&M services,” said Jürgen Reinert, Chief Executive Officer of SMA. “As a leading inverter repowering specialist SMA offers solutions that can replace obsolete inverters thereby enhancing plant performance. This includes repowering of defunct inverters when original equipment manufacturers no longer support equipment. Our nationwide service footprint and global presence give us an additional advantage.” SMA is uniquely qualified to serve as the custodian of Terraform Power’s assets given its knowledge of inverter technology and more than 35-year experience in photovoltaics technology. SMA’s expertise reduces TerraForm Power’s operational risk and aligns with the latter company’s objective to maximize production and improve reliability. “We are pleased to sign an innovative framework agreement with SMA to oversee O&M activities for our North American solar fleet and believe this agreement will prove to be an important operational milestone for TerraForm Power,” said John Stinebaugh, Chief Executive Officer of TerraForm Power. -

SMA Consumer Faqs

SMA Consumer FAQs • When was SMA founded? What’s your history, and how have you grown? o SMA was founded in 1981 in Germany. As a leading global specialist in photovoltaic system technology, SMA is setting the standards today for the decentralized, digital and renewable energy supply of tomorrow. More than 3,000 SMA employees in 18 countries have devoted themselves to this task. Our innovative solutions for every type of photovoltaic application offer people and companies worldwide greater independence in meeting their energy needs. In collaboration with our partners and customers, we are helping people transition to a self-sufficient, decentralized and renewable energy supply. SMA inverters with a total output of more than 100 gigawatts have been installed in more than 190 countries worldwide. SMA’s multi- award-winning technology is protected by more than 1,600 patents and utility models. Since 2008, the Group’s parent company, SMA Solar Technology AG, has been listed on the Prime Standard of the Frankfurt Stock Exchange (S92) and is listed in the SDAX index. • Where is SMA headquartered? o SMA is headquartered in Niestetal, Germany. • What’s your company’s mission? o By continuous further developments and innovations in system technology, we will make the installation and operation of photovoltaic power plants even simpler, more reliable, safer, and above all, more cost-effective. We want to increase technical progress and the worldwide spread of photovoltaics with our work. • How does SMA’s Sunny Boy inverter compare to the other options available on the market? o The Sunny Boy produces more energy on an annual basis than competing models using traditional optimizers. -

RTL Group Sells Shareholding in Broadbandtv

PRESS RELEASE RTL Group sells shareholding in BroadbandTV Luxembourg/Cologne, 28 October 2020 – RTL Group today announced that it has completed the sale of its entire shareholding in Vancouver-based BroadbandTV to BBTV Holdings Inc., effective 28 October 2020, for €102 million (C$158.8 million). The sale is consistent with RTL Group’s three-priority strategy – core, growth, alliances & partnerships – which includes continuously reviewing the Group’s portfolio and growing its European digital assets in the areas of streaming, advertising technology and digital video. In 2013, RTL Group acquired a 51 per cent shareholding1 in BroadbandTV for €27 million. Following this initial investment, RTL Group injected further capital into BroadbandTV amounting to €19.8 million (C$30.9 million) in the form of convertible notes. These notes, including accrued interest, will be replaced by a new promissory note of the newly listed entity BBTV Holdings Inc. with a December 2021 maturity date. For further information please contact: RTL Group Media & Investor Relations Oliver Fahlbusch Irina Mettner-Isfort Phone: +352/2486 5200 Phone: +49/221 456 56410 [email protected] [email protected] About RTL Group RTL Group is a leader across broadcast, content and digital, with interests in 68 television channels, nine streaming platforms and 31 radio stations. RTL Group also produces content throughout the world and owns digital video networks. The television portfolio of Europe’s largest broadcaster includes RTL Television in Germany, M6 in France, the RTL channels in the Netherlands, Belgium, Luxembourg, Croatia, Hungary and Antena 3 in Spain. RTL Group’s families of TV channels are either the number one or number two in eight European countries. -

Company Profile 2021

THE SÜDZUCKER GROUP PROFILE 2021 Contents 1. SÜDZUCKER GROUP 5.4. Sites 7.4 BioWanze SA 1.1 Overview 5.5 Südzucker AG 7.5 Ryssen AlcoolsSAS 1.2 Segment overview 5.5.1 Assortment for households 7.6 Ensus UK Ltd. 1.3 The range of Südzucker products 5.5.2 Assortment for processing industries 7.7 CT Biocarbonic 5.5.3 Co-products 2. STRATEGY & GUIDING PRINCIPLES 5.5.4 Wheat starch 8. STARCH SEGMENT 2.1 Company profile 5.6 Südzucker Polska 8.1 Overview 2.2 Group strategy 5.7 Südzucker Moldova 2.3 Guiding principle 5.8 Raffinerie Tirlemontoise 9. FRUIT SEGMENT 2.4 Strategic directions 5.9 Saint Louis Sucre 9.1 Overview 5.10 AGRANA 9.2 Figures 3. PEOPLE & FIGURES 5.11 ED&F Man 9.3 Fruit preparations 3.1 Group figures 5.12 Farms 9.4 Fruit juice concentrates 3.2 Segment figures 5.13 Bodengesundheitsdienst 3.3 Employees 10. RESEARCH & DEVELOPMENT 3.4 Executive board 6. SPECIAL PRODUCTS SEGMENT 3.5 Supervisoryboard 6.1 Overview 6.2 Figures 11. SUSTAINABILITY 6.3 BENEO 4. SHARE & CAPITAL MARKET 12. SÜDZUCKER HISTORY 4.1 Overview 6.4 Freiberger 6.5 PortionPack Europe 4.2 Share price movement 13. SUGAR MARKET 4.3 Shareholder structure 7. CROPENERGIES SEGMENT 12.1 German & Global sugar market 12.2 German sugar sales 5. SUGAR SEGMENT 7.1 Overview 7.2 Figures 5.1 Overview 14. SUGAR PRODUCTION 5.2 Figures 7.3 CropEnergies Bioethanol GmbH 5.3 Campaign 2020/21 July 2021 1.1 Overview Südzucker Group — One of the leading food industry companies — Segments sugar, special products, CropEnergies, starch and fruit1) — In the traditional sugar business, the group is Europe‘s number one supplier of sugar products — About 17,900 employees2) — About € 6.7 billion annual revenues — More than 100 production locations worldwide — About 31 million tonnes of agricultural raw materials processed — Sugar productions: 3.7 million tonnes — Fiscal year: 1 March to 28/29 February — Member of the German SDAX® — Formation 1926 — Legal form: stock corporation under German law 1) New segment structure as of fiscal 2021/22; 2) Based on full-time equivalents. -

Designated Sponsor Erfordernis D 20210526

Aktien der Liquiditätskategorie A* gültig ab 26. Mai 2021 ISIN Instrument XLM Umsatz AT0000A0E9W5 S+T AG O.N. 35.97 4,280,782.85 DE0005089031 UTD.INTERNET AG NA 16.07 7,772,202.57 DE0005111702 ZOOPLUS AG 51.91 4,208,078.51 DE0005140008 DEUTSCHE BANK AG NA O.N. 5.40 111,925,300.01 DE0005158703 BECHTLE AG O.N. 14.58 12,440,739.68 DE0005190003 BAY.MOTOREN WERKE AG ST 3.92 116,673,048.94 DE0005190037 BAY.MOTOREN WERKE VZO 28.08 5,185,694.74 DE0005200000 BEIERSDORF AG O.N. 6.23 32,370,380.77 DE0005313704 CARL ZEISS MEDITEC AG 16.63 13,469,738.82 DE0005408116 AAREAL BANK AG 25.45 5,802,419.24 DE0005408884 LEONI AG NA O.N. 73.50 3,114,435.16 DE0005419105 CANCOM SE O.N. 25.16 5,547,456.62 DE0005439004 CONTINENTAL AG O.N. 7.21 58,481,792.62 DE0005470306 CTS EVENTIM KGAA 21.36 7,096,059.32 DE0005470405 LANXESS AG 12.23 15,402,539.66 DE0005493365 HYPOPORT SE NA O.N. 60.33 3,344,480.07 DE0005545503 1+1 DRILLISCH AG O.N. 27.93 4,681,191.15 DE0005550636 DRAEGERWERK VZO O.N. 50.73 3,327,527.09 DE0005552004 DEUTSCHE POST AG NA O.N. 3.95 119,438,574.31 DE0005557508 DT.TELEKOM AG NA 3.70 154,511,909.75 DE0005565204 DUERR AG O.N. 22.09 7,100,402.33 DE0005659700 ECKERT+ZIEGLER AG O.N. 44.12 3,806,078.02 DE0005664809 EVOTEC SE INH O.N. -

Pressemitteilung Der SMA Technologie AG

SMA Solar Technology AG—Press Release Emission-free driving: The new SMA EV Charger combines solar power and e-mobility Niestetal, September 10, 2020 – According to forecasts, one million electric vehicles will be on Germany’s roads by 2022. Around 80% of these will be charged at home. Using solar power from your own roof has benefits not only for the environment, but also for your wallet. That is why SMA has developed the SMA EV Charger. The intelligent charging solution always charges electric vehicles in such a way that the maximum amount of self-generated solar power is used. Even when charging has to be done really quickly. Furthermore, the SMA EV Charger integrates seamlessly into the SMA Energy System Home, making installation and maintenance easier for installers. “Solar power makes e-mobility really worthwhile,” said Nick Morbach, Executive Vice President of the Home & Business Solutions business unit at SMA. “That's why we developed the SMA EV Charger. It enables electric car drivers to always charge conveniently and reliably while using the maximum available amount of cost-effective and CO2- neutral solar power. With the SMA EV Charger, we provide installers with a key component of an ‘all-in-one package’, because the SMA EV Charger is part of the SMA Energy System Home. All components, including communication for the domestic energy system, come from a single source, and there is only one contact point for questions regarding expansion, warranties or service.” Fast and reliable charging – with solar power, of course The SMA EV Charger enables fast, reliable and cost-effective charging and for this purpose has various charging modes. -

Bekanntmachung Freiverkehr (Open Market)

Bekanntmachung Freiverkehr (Open Market) Aussetzung und Einstellung der Preisfeststellung von Strukturierten Produkten: Wegen Eintretens des Knockout-Ereignisses wird die Preisfeststellung an der Frankfurter Wertpapierbörse für folgende Strukturierte Produkte ausgesetzt und mit folgendem Datum eingestellt: ISIN Emittent Basiswert Letzter Handelstag 1 DE000PD0GSJ7 BNP Paribas Em.-u.Handelsg.mbH Rheinmetall AG 17.12.2020 2 DE000PD0JR31 BNP Paribas Em.-u.Handelsg.mbH Dürr AG 18.12.2020 3 DE000PD0NC81 BNP Paribas Em.-u.Handelsg.mbH Brent Crude Futures 18.12.2020 4 DE000PD0ND23 BNP Paribas Em.-u.Handelsg.mbH Brent Crude Futures 18.12.2020 5 DE000PD0NFU7 BNP Paribas Em.-u.Handelsg.mbH Crude Oil Futures 18.12.2020 6 DE000PD0NGM2 BNP Paribas Em.-u.Handelsg.mbH Crude Oil Futures 18.12.2020 7 DE000PD0PTB3 BNP Paribas Em.-u.Handelsg.mbH RBOB Gasoline Futures (Physica 18.12.2020 8 DE000PD0TSM4 BNP Paribas Em.-u.Handelsg.mbH NIKE Inc. 18.12.2020 9 DE000PD0X4D5 BNP Paribas Em.-u.Handelsg.mbH Tesla Inc. 18.12.2020 10 DE000PD0X4E3 BNP Paribas Em.-u.Handelsg.mbH Tesla Inc. 18.12.2020 11 DE000PD0XHL1 BNP Paribas Em.-u.Handelsg.mbH Tesla Inc. 18.12.2020 12 DE000PD0XHM9 BNP Paribas Em.-u.Handelsg.mbH Tesla Inc. 18.12.2020 13 DE000PD0Y3X4 BNP Paribas Em.-u.Handelsg.mbH Nasdaq-100 18.12.2020 14 DE000PD0Y3Y2 BNP Paribas Em.-u.Handelsg.mbH Nasdaq-100 18.12.2020 15 DE000PF132E0 BNP Paribas Em.-u.Handelsg.mbH United Internet AG 18.12.2020 16 DE000PF13AG2 BNP Paribas Em.-u.Handelsg.mbH Adyen N.V. 18.12.2020 17 DE000PF141J0 BNP Paribas Em.-u.Handelsg.mbH United Internet AG 18.12.2020 18 DE000PF155F8 BNP Paribas Em.-u.Handelsg.mbH United Internet AG 18.12.2020 19 DE000PF155R3 BNP Paribas Em.-u.Handelsg.mbH Wacker Chemie AG 17.12.2020 20 DE000PF185E8 BNP Paribas Em.-u.Handelsg.mbH Palo Alto Networks Inc. -

Jungheinrich Pref. Buy EUR 41.00

Jungheinrich Pref. RESEARCH (SDAX, Capital Goods) Value Indicators : EUR Share data : Description : Buy (Suspended) DCF: 41.27 Bloomberg: JUN3 GR Producer of material handling Peer group KGX: 35.26 Reuters: JUNG_p equipment and warehousing EUR 41.00 ISIN: DE0006219934 technology. Market Snapshot : EUR m Shareholders : Risk Profile (WRe): 2019e Market cap: 3,060 Freefloat 100.0 % Beta: 1.2 EUR Price 30.00 No. of shares (m): 102 Deutsche Bank AG 5.0 % Price / Book: 2.1 x Upside 36.7 % EV: 3,413 DWS Investment 4.0 % Equity Ratio: 30 % Freefloat MC: 3,060 Net Fin. Debt / EBITDA: 0.2 x Ø Trad. Vol. (30d) : 3.74 m Net Debt / EBITDA: 0.6 x Uplift in e-commerce enabled by Jungheinrich As one of the top three intralogistics players worldwide, Jungheinrich is a one-stop shop offering new forklifts, rental business, fully integrated warehouse solutions and aftermarket activities. With strong exposure to e-mobility and a rising share of automated solutions in the scope of Industry 4.0, Jungheinrich is the second-largest player in its core market Europe after the KION Group. Barriers to entry should remain high in light of substantial size advantages for existing players, such as know-how, capital requirements, strong supplier and customer relationships. Within its peer group, Jungheinrich stands out with a high share of aftermarket revenues, leading to a high share of recurring revenues which provides a safety cushion in times of economic slowdown. Having outperformed economic growth by a factor of 1.5x in the past decade, the global market for intralogistics looks set to rise further, especially driven by a robust shift towards e-commerce, fuelling demand for warehouse equipment. -

Investor Relations Newsletter Half-Year

Investor Relations Half-year Newsletter 2021 BayWa Group generates record-breaking half-year results The BayWa Group’s consolidated reve- sales rise across the entire product range. nues stood at roughly €9.3 billion after The Agriculture Segment also recorded Highlights the first six months of the current financial earnings growth, with both international year, up 13.3% year on year. Earnings and domestic product trading benefiting before interest and tax (EBIT) improved by from the positive price trend on grain • Full-year guidance raised €90.8 million to a total of €144.6 million. markets. All three operating segments – Energy, • Higher earnings in all Agriculture and Building Materials – re- “All operating segments contributed to three operating segments: corded a significant year-on-year increase this dynamic rise in earnings,” says Chief – Energy (>+100%) in earnings (EBIT) in the first half of 2021. Executive Officer Prof. Klaus Josef Lutz. – Building Materials “Thanks to its diversified business portfo- (+95.3%) The Energy Segment posted the largest lio, BayWa is positioned with an eye to improvement in earnings, more than tri- the future and is crisis-resilient.” – Agriculture (+43.3%) pling its EBIT compared to the same peri- od in the previous year due to the comple- Based on the segments’ operating earn- • Above-average second tion of major project sales and sustained ings in the first half of 2021, the Board quarter high demand in trade activities involving of Management has now raised its fore- • Participation in Bavarian PV components. In the Building Materials cast increase in the BayWa Group’s COVID-19 vaccination Segment, EBIT almost doubled compared full-year operating result for 2021 from project to the previous year. -

Women-On-Board-Index

WOMEN‐ON‐BOARD‐INDEX III Aufsichtsräte (Stand 30.06.2011) powered by FidAR Zahl Anteil WoB-Index Posit Zahl AR- Unternehmen Notierung Frauen Frauen nur ion Mitgl. AR AR Aufsichtsräte 1 Biotest AG SDAX 6 3 50% 50,00% 1 Douglas Holding AG MDAX 16 8 50% 50,00% 3 HAMBORNER REIT SDAX 10 4 40% 40,00% 4 Deutsche Bank AG DAX 20 7 35% 35,00% 5 Amadeus Fire AG SDAX 6 2 33% 33,33% 5 Bechtle AG TecDAX 12 4 33% 33,33% 5 Beiersdorf AG DAX 12 4 33% 33,33% 5 centrotherm photovoltaics AG TecDAX 3 1 33% 33,33% 5 TAG Immobilien AG SDAX 6 2 33% 33,33% 10 Deutsche Post AG DAX 20 6 30% 30,00% 10 GfK SE SDAX 10 3 30% 30,00% 12 Commerzbank AG DAX 20 5 25% 25,00% 12 Fielmann AG MDAX 16 4 25% 25,00% 12 Fraport AG MDAX 20 5 25% 25,00% 12 Henkel AG & Co. KGaA DAX 16 4 25% 25,00% 12 Kabel Deutschland Holding AG MDAX 12 3 25% 25,00% 12 Merck KGaA DAX 16 4 25% 25,00% 12 Software AG TecDAX 12 3 25% 25,00% 12 Symrise AG MDAX 12 3 25% 25,00% 20 Axel Springer AG MDAX 9 2 22% 22,22% 20 Q-CELLS SE TecDAX 9 2 22% 22,22% 20 Sky Deutschland AG MDAX 9 2 22% 22,22% 20 STADA Arzneimittel AG MDAX 9 2 22% 22,22% 24 comdirect bank AG SDAX 5 1 20% 20,00% 24 Deutsche Telekom AG DAX 20 4 20% 20,00% 24 Hawesko Holding AG SDAX 5 1 20% 20,00% 24 Münchener Rück AG DAX 20 4 20% 20,00% 24 RHÖN-KLINIKUM AG MDAX 20 4 20% 20,00% 24 Siemens AG DAX 20 4 20% 20,00% 30 Praktiker Bau- und Heimwerkermärkte MDAX 16 3 19% 18,75% 30 TUI AG MDAX 16 3 19% 18,75% 32 adidas AG DAX 12 2 17% 16,67% 32 ADVA AG Optical Networking TecDAX 6 1 17% 16,67% 32 AIXTRON SE TecDAX 6 1 17% 16,67% 32 BASF SE DAX 12 2 17%