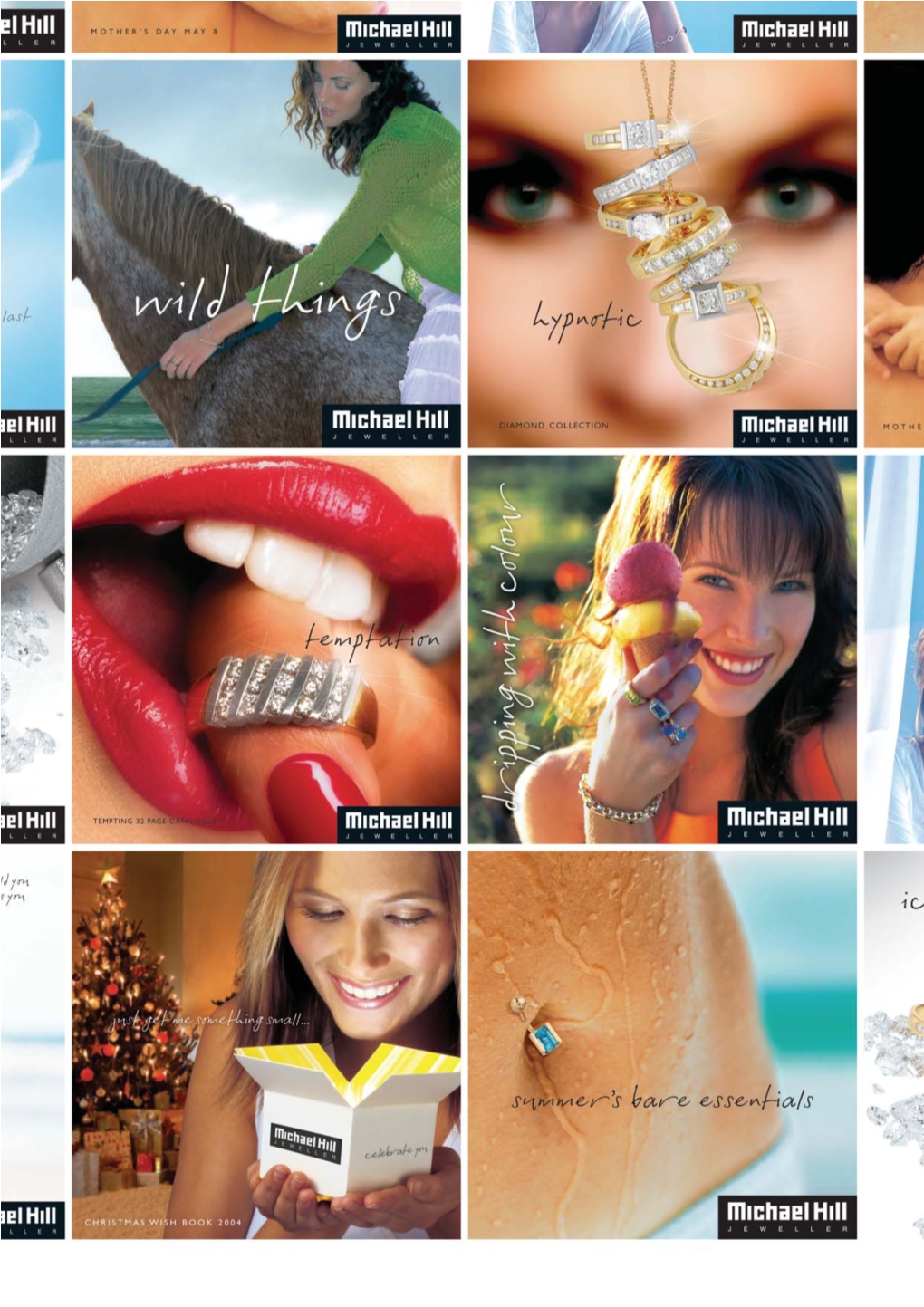

2005 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ngs Super Portfolio Holdings Disclosure

NGS SUPER PORTFOLIO HOLDINGS DISCLOSURE PROPERTY – INCOME Effective date: 31 DEC 2020 PROPERTY 1 FARRER PLACE, SYDNEY 1 HEYINGTON AVENUE, THOMASTOWN 1 O’CONNELL STREET, SYDNEY 10 SPRING STREET, SYDNEY 101 SECOND STREET SAN FRANCISCO 1101 WESTLAKE AVENUE SEATTLE 131-137 SPRING STREET NEW YORK 139 SPRING STREET, NEW YORK 14-30 PETERKIN STREET, ACACIA RIDGE 15-31 AMERICAIN WAY, DANDENONG SOUTH 16 SPRING STREET, SYDNEY 1776 WILSON1776 WILSON BOULEVARD WASHINGTON DC 1800 LARIMER, DENVER 1937 IPSWICH ROAD, ROCKLEA 206 BELL STREET, SEATTLE 22 BOSTON WHARF RD, BOSTON 2270 BROADWAY AVE. SF EAST BAY 25 CONSTITUTION AVENUE, CANBERRA 25 NORTH, 14901 WASHINGTON STREET, DENVER 2642-2666 IPSWICH ROAD, DARRA 27-39 WHARF ROAD, PORT MELBOURNE 28-40 VELLA DRIVE, SUNSHINE 31-33 CARTER WAY, DANDENONG SOUTH 33 TEHAMA ST SAN FRANCISCO 35 BOUNDARY STREET, SOUTH BRISBANE 407 FIRST AVENUE, NEW YORK 4-10 BRIDGE STREET, PYMBLE 41-71 BESSEMER DRIVE, DANDENONG SOUTH Issued by NGS Super Pty Limited ABN 46 003 491 487 AFSL No 233 154 the trustee of NGS Super ABN 73 549 180 515 ngssuper.com.au 1300 133 177 NGS SUPER – PORTFOLIO HOLDINGS DISCLOSURE 1 PROPERTY – INCOME Effective date: 31 DEC 2020 430 WEST 15TH STREET, 430 W 15TH STREET, NEW YORK 46-50 WIRRAWAY DRIVE, PORT MELBOURNE 485 LA TROBE STREET, MELBOURNE 495-501 BLACKBURN ROAD, MOUNT WAVERLEY 4TH & COLORADO, 407 COLORADO AVENUE, LOS ANGELES 50 JAYCO DRIVE, DANDENONG SOUTH 51ST STREET SELF STORAGE, 1000 50TH STREET, AUSTIN 5250 PARK, 8500 NW 52ND AVE, MIAMI 55 CAMBRIDGE PARKWAY BOSTON 55 KIRBY STREET, RYDALMERE 6 CLARENDON STREET, ARTARMON 631 HOWARD631 HOWARD ST. -

Best and Less

BEST AND LESS AS AT 16.03.2016 STORE NSW STORE NSW NO. NAME OF STORE ADDRESS NO. NAME OF STORE ADDRESS 26 BALLINA BALLINA FAIR SHOPPING CENTRE 886 FORSTER STOCKLAND FORSTER 02 6681 1621 SHOP M3 02 6557 6916 SHOP T89 CNR. KERR & FOX STREETS BREESE PARADE BALLINA, NSW 2478 FORSTER, NSW 2428 92 BANKSTOWN CENTRO BANKSTOWN 563 GLENDALE GLENDALE SUPER CENTRE 02 9790 4900 STORE A20A 02 4956 8629 389 LAKE ROAD NORTH TERRACE GLENDALE, NSW 2285 BANKSTOWN, NSW 2200 853 BATEAU BAY STOCKLAND BAY VILLAGE 432 GOROKAN LAKE HAVEN SHOPPING CENTRE 02 4332 3635 SHOP 94-95 02 4392 7877 SHOP 17 CENTRAL COAST HIGHWAY LAKE HAVEN DRIVE BATEAU BAY, NSW 2261 GOROKAN, NSW 2263 803 BATHURST BATHURST CITY CENTRE 131 GOSFORD IMPERIAL SHOPPING CENTRE 02 6332 9075 SHOP MM02 02 4324 2101 SHOP 52 210 HOWICK STREET 171 MANN STREET BATHURST, NSW 2795 GOSFORD, NSW 2250 301 BLACKTOWN WESTPOINT SHOPPINGTOWN 772 GOULBURN CENTRO GOULBURN SHOPPING CENTRE 02 9621 4990 SHOP T58B 02 4821 3933 SHOP T 49A 17 PATRICK STREET 217 AUBURN STREET BLACKTOWN, NSW 2148 GOULBURN, NSW 2580 911 BROKEN HILL CENTRO WESTSIDE 466 GRAFTON 84 PRINCE STREET 08 8087 1399 SHOP 3 02 6643 1421 GRAFTON, NSW 2460 5 GALENA STREET BROKEN HILL, NSW 2880 107 CASTLE HILL CASTLE HILL TOWERS 671 GREENHILLS THE HUNTER AT GREENHILLS 02 9634 2013 SHOP 378 02 4934 1611 1 MOLLY MORGAN DRIVE OLD CASTLE HILL ROAD EAST MAITLAND, NSW 2323 CASTLE HILL, NSW 2154 521 CESSNOCK CNR. COOPER & 689 GRIFFITH CNR. BANNA & JONDANYAN AVENUE 02 4991 3062 CHARLTON STREETS 02 6962 9599 GRIFFITH, NSW 2680 CESSNOCK, NSW 2325 513 CHARLESTOWN CHARLESTOWN SQUARE 837 GUNNEDAH SHOP 232-234 02 4943 5656 SHOP 56 02 6742 3091 CONADILLY STREET PEARSON STREET GUNNEDAH, NSW 2380 CHARLESTOWN, NSW 2290 157 DUBBO 95 MACQUARIE STREET 34 HURSTVILLE WESTFIELD SHOPPINGTOWN 02 6882 5977 DUBBO, NSW 2830 02 9579 5110 SHOP 402 CNR. -

Victorian PROPERTY INDUSTRY

Victorian PROPERTY INDUSTRY THE PROPERTY INDUSTRY IS VICTORIA’S BIGGEST EMPLOYER, ACCOUNTING FOR 12 .4% 331,000 $21.4 BILLION 12.4% ECONOMIC JOBS IN WAGES ACTIVITY IN VIC The industry spans across many different areas, including residential homes, shopping centres, retirement villages, industrial estates, offices, infrastructure and more. The Property Council of Australia is the leading voice representing Australia’s property industry. We champion the interest of our 2200-member companies, by helping change laws, policies and opinion relating to all things property. Our members represent the full spectrum of the sector including those who own, invest, manage and develop property. Furthermore, our members’ work creates landmark projects, precincts and even cities. We are committed to building a diverse and inclusive industry. This has resulted in the creation of nationwide diversity committees, the 500 Women in Property Program and the Girls in Property Program. Girls in PROPERTY Developed to raise awareness of the range of career paths the industry has to offer, the Girls in Property Program allows high school students to learn about various career opportunities, hear from property experts and make valuable connections. We hope this initiative assists more young women to choose a career in property, by showing them the full range of options that are available and how rewarding working in our industry can be. #VICGirlsinProperty FOLLOW US @GirlsinPropertyAU About FOY’S ARCADE ISPT have been exploring future trends, innovations and disruptors in the property industry for a long time. They recognised they needed a place to do this and partnered with Collective Social Intelligence (CSI) who build collaborative spaces globally to create Foy’s Arcade- a one of a kind truly immersive customer experience centre. -

STORE ADDRESS SUBURB STATE PCODE Airport West Westfield

STORE ADDRESS SUBURB STATE PCODE Airport West Westfield Shopping Centre AIRPORT WEST VIC 3042 Altona Cnr Blackshaws & Millers Roads ALTONA VIC 3018 Ararat Cnr High & Collings Streets ARARAT VIC 3377 Avondale Heights 67 Military Road AVONDALE HEIGHTS VIC 3034 Bacchus Marsh Gisborne Road BACCHUS MARSH VIC 3340 Bairnsdale 232 Main Street BAIRNSDALE VIC 3875 Ballan Westbound BP Service Centre, Western Highway BALLAN VIC 3342 Ballarat Bakery Hill 17 Victoria Street BAKERY HILL VIC 3350 Ballarat Sturt St 815-819 Sturt Street BALLARAT VIC 3350 Balwyn 318 Whitehorse Road BALWYN VIC 3103 Bass Cnr Soldiers Road & Bass Highway BASS VIC 3991 Bayswater North 296 Canterbury Road BAYSWATER NORTH VIC 3153 Benalla 127-129 Bridge Street(cnr Smyth Street) BENALLA VIC 3672 Bendigo 63 High Street BENDIGO VIC 3550 Berwick Cnr Clyde Road & Kangan Drive BERWICK VIC 3806 Berwick South Cnr Clyde & Homestead Roads BERWICK VIC 3806 Blackburn 127 Canterbury Road BLACKBURN SOUTH VIC 3130 Boronia 267 Dorset Road BORONIA VIC 3155 Bourke St Mall 341-345 Bourke Street MELBOURNE VIC 3000 Bourke St West 406 Bourke Street MELBOURNE VIC 3000 Box Hill Central Box Hill Central Shopping Centre BOX HILL VIC 3128 Box Hill North 506-510 Middleborough Road BLACKBURN NORTH VIC 3130 Braeside Cnr Boundary & Centre Dandenong Roads BRAESIDE VIC 3172 Bridgewater Midland Highway BRIDGEWATER TAS 7030 Broadmeadows 1171-1173 Pascoe Vale Road BROADMEADOWS VIC 3047 Brooklyn 2 Little Boundary Road BROOKLYN VIC 3025 Brunswick Shop 47 BRUNSWICK VIC 3056 Brunswick East Cnr Holmes & Albion Streets -

Page 1 of 10 K:\Affdocs\A&Sw\A&Sw001\A&Sw A&Sw001 006.Docx

Form G Commonwealth of Australia Competition and Consumer Act 2010 — subsection 93 (1) NOTIFICATION OF EXCLUSIVE DEALING To the Australian Competition and Consumer Commission: Notice is hereby given, in accordance with subsection 93 (1) of the Competition and Consumer Act 2010 , of particulars of conduct or of proposed conduct of a kind referred to subsections 47 (2), (3), (4), (5), (6), (7), (8) or (9) of that Act in which the person giving notice engages or proposes to engage. 1. Applicant (a) Name of person giving notice: A&S Wholesale Fruit & Vegetables Pty Ltd (ACN 006 598 796) ( A&S ) (b) Short description of business carried on by that person: A&S was started in 1986 by Arthur Kneebone. Together with his business partner, Stephen Fanous, Mr Kneebone built A&S to the stage where it now operates 9 fresh fruit and vegetable stores and 7 flower stores across metropolitan Melbourne. The stores are branded Market Place and sell quality of fresh produce and associated grocery items many of which are unavailable at the dominant supermarkets. Tragically, Mr Kneebone recently died leaving Mr Fanous to continue to operate the A&S business (including all sourcing for the Market Place retail stores. A&S now wishes to expand its operations and provide consumers with a greater access to wider range of fresh produce including fruit, vegetables, selected grocery items (including specialised ethnic ingredients) and flowers (collectively the Products) through a licensed stores model. A&S aims to convert its existing stores to an occupancy licensee model (the A&S Licensed Stores) and leverage the change in operational structure to lease additional retail sites across the Melbourne area. -

Tour Schedule

National Retail Association TOUR SCHEDULE RETAILER TOURS & WORKSHOPS From March 2019, the National Retail Association (NRA) are conducting over 100 tours of shopping centres and precincts throughout Victoria to assist retailers transitioning away from banned bags. Rather than group workshops which many retailers don’t have time to attend, the NRA tour each area, visiting as many retailers as possible in their stores. To request a specific visit during these tours, please contact the NRA at [email protected]. Please note: this schedule may be subject to change. Please check https://vicbagban.com.au/workshops/ for the most current schedule. Date Centre/strip precinct Suburb Thursday, 21 March 2019 Dandenong Hub Arcade Dandenong Thursday, 21 March 2019 Palm Plaza Dandenong Friday, 22 March 2019 South Melbourne - Coventry St South Melbourne Friday, 22 March 2019 South Melbourne - York St South Melbourne Friday, 22 March 2019 South Melbourne Central South Melbourne Friday, 22 March 2019 The Clarendon Centre South Melbourne Friday, 22 March 2019 St Kilda - Fitzroy St St Kilda Friday, 22 March 2019 Balaclava - Carlisle St Balaclava Monday, 25 March 2019 Flinders Street Station Melbourne Monday, 25 March 2019 Main streets CBD - Elizabeth St Melbourne Monday, 25 March 2019 Galleria Melbourne Monday, 25 March 2019 Capitol Arcade Melbourne Wednesday, 27 March 2019 Main streets CBD - Swanston St Melbourne Thursday, 28 March 2019 Carlton - Rathdowne St Carlton Thursday, 28 March 2019 Carlton - Lygon St Carlton Friday, 29 March 2019 South Yarra -

20210119 Store List Landscape

FULL STORE LIST • NEW SOUTH WALES • VICTORIA • QUEENSLAND • SOUTH AUSTRALIA • A.C.T. • WESTERN AUSTRALIA • NORTHERN TERRITORY • TASMANIA 1/8 NEW SOUTH WALES AUBURN CHATSWOOD HURSTVILLE WESTFIELD Shop Q15, Auburn Central, Cnr Harrow Road 334 Victoria Avenue, Chatswood, NSW 2067 Shop 106 / 08, Westfield Hurstville, Cnr and Queen Street, Auburn, NSW 2144 TEL: (02) 9413 9686 Cross St and Park Rd, Hurstville, NSW 2220 TEL: (02) 8096 1443 TEL: (02) 9580 8132 CHATSWOOD EXPRESS Shop 16, Chatswood Interchange, 438 Victoria LIDCOMBE BANKSTOWN Shop G-005, Lidcombe Shopping Centre, 92 66 Bankstown City Plaza, Bankstown, NSW 2200 Avenue, Chatswood, NSW 2067 Parramatta Road, Lidcombe, NSW 2141 TEL: (02) 9708 1261 TEL: (02) 9412 1006 TEL: (02) 8386 5822 BROADWAY EASTGARDENS Shop G28, Broadway Shopping Centre, 1 Bay Shop 171, Westfield Eastgardens, 152 MACQUARIE CENTRE Shop 3504, Macquarie Centre, Cnr Herring Rd Street, Broadway, NSW 2037 Bunnerong Road, Eastgardens, NSW 2036 & Waterloo Rd, North Ryde, NSW 2113 TEL: (02) 9212 1700 TEL: (02) 9349 8848 TEL: (02) 9870 8208 CABRAMATTA EASTWOOD Shop 2-3, 90 John Street, Cabramatta, NSW Shop 3, 163 Rowe St, Eastwood, NSW 2122 PARRAMATTA Shops 5029, Level 5, Westfield Parramatta, 2166 TEL: (02) 9804 6188 159-175 Church Street, Parramatta, NSW 2150 TEL: (02) 9723 8879 TEL: (02) 9689 1888 GEORGE ST. CAMPSIE Shop 1, 815-825 George Street, Haymarket, Shop 19, Campsie Centre, 14-28 Amy Street, NSW 2000 PARRAMATTA EXPRESS Shops 1170, Level 1, Westfield Parramatta, Campsie, NSW 2194 TEL: (02) 9281 7689 159-175 Church Street, Parramatta, NSW 2150 TEL: (02) 9789 6522 TEL: (02) 8677 9215 HORNSBY CASTLE MALL Shop 1018, Westfield Hornsby, 236 Pacific HWY, Shop 109, Castle Mall Shopping Centre, 4-16 Hornsby, NSW 2077 REGENT PLACE Lot 22A, Level 10, Regent Place, 501 George Terminus Street, Castle Hill, NSW 2154 TEL: (02) 9477 2141 Street, Sydney, NSW 2000 TEL: (02) 8810 2813 TEL: (02) 9261 2688 *Please refer to store locator for opening hours. -

Distribution List: GIRLFRIEND SPRING 2019

Distribution List: GIRLFRIEND SPRING 2019 Retail Group Outlet Description Address Suburb State Postcode Description 7-Eleven Direct 7-Eleven 4101C 91-97 Noosa Drive Noosa QLD 4101 7-Eleven Direct 7-Eleven 4096B 236 Napper Road Parkwood QLD 4214 7-Eleven Direct 7-Eleven 4016M 1957 Gold Cast Highway Burleigh Heads QLD 4220 7-Eleven Direct 7-Eleven 4026E Cnr Days & Kedron Brook Road Grange QLD 4051 7-Eleven Direct 7-Eleven 4058E 159-163 Beenleigh-Beaudesert Rd Windaroo QLD 4207 7-Eleven Direct 7-Eleven 4073C 118 Waller Road Heritage Park QLD 4118 7-Eleven Direct 7-Eleven 4077D Homemart Centre Tweed Heads South NSW 2486 7-Eleven Direct 7-Eleven 4081C 120 Edward Street Brisbane QLD 4000 7-Eleven Direct 7-Eleven 4061D 180 Fairfield Road Fairfield QLD 4103 7-Eleven Direct 7-Eleven 4083D SH 1 2058-2062 Mogill Road Kenmore QLD 4069 7-Eleven Direct 7-Eleven 4086C 11 Depot Street Deagon QLD 4017 7-Eleven Direct 7-Eleven 4197A Lot 4 Slatyer Avenue Southport QLD 4215 7-Eleven Direct 7-Eleven 4089E 400 Nerang Road Ashmore QLD 4214 7-Eleven Direct 7-Eleven 4075D 1505 Creek Road Carina QLD 4152 7-Eleven Direct 7-Eleven 4079D 721 Seventree Mile Rocks Road Jindalee QLD 4074 7-Eleven Direct 7-Eleven 4078W 10 City Road Beenleigh QLD 4207 7-Eleven Direct 7-Eleven 4095D 53 Aerodrome Road Maroochydore QLD 4558 7-Eleven Direct 7-Eleven 4112H 563 Fairfield Road Yeronga QLD 4104 7-Eleven Direct 7-Eleven 4111D 341 Hope Island Road Hope Island QLD 4212 7-Eleven Direct 7-Eleven 4118b 169 Algester Road Algester QLD 4115 Cnr Robina P'Way & Robina Town 7-Eleven Direct -

The Coffee Club Participating Bonus Brew* Stores - Melbourne

THE COFFEE CLUB PARTICIPATING BONUS BREW* STORES - MELBOURNE *Terms & conditions apply Brand Name Address Line 1 Address Line 2 City State PostCode Phone Number The Coffee Club Airport West Shop 93, Westfield Shopping Centre 29-35 Louis Street Airport West VIC 3042 03 9330 3811 The Coffee Club Bacchus Marsh Shop 23/24, Bacchus Marsh Village Shopping Centre 178-180 Main Street Bacchus Marsh VIC 3340 03 5300 4426 The Coffee Club Bay City K103 77 Mallop St Geelong VIC 3215 03 5223 3744 The Coffee Club Bayside Entertainment Centre Shop G009 Bayside Entertainment Centre 21 Wells St Frankston VIC 3199 03 9770 6981 The Coffee Club Bendigo CT2 cnr Edward & Queen Street Bendigo VIC 3550 03 5444 1234 The Coffee Club Casey Central F113 Westfield Casey Central, Littlecroft Avenue Narre Warren VIC 3805 03 9796 6786 The Coffee Club Chelsea Tenancy 4 & 5 Chelsea Beach Arcade Nepean Highway Chelsea VIC 3196 03 9772 1033 The Coffee Club Craigieburn Shop B00-15 Craigieburn Central 340 Craigieburn Road Craigieburn VIC 3064 03 9333 8740 The Coffee Club Cranbourne Park Shop SP150, Cranbourne Park Shopping Centre South Gippsland Highway Cranbourne VIC 3977 03 5995 9072 The Coffee Club DFO Essendon Shop 201 DFO Essendon 100 Bulla Road Strathmore VIC 3041 03 9379 6686 The Coffee Club DFO Spencer Street T213 Direct Factory Outlet 201 Spencer St Melbourne VIC 3000 03 9642 3053 The Coffee Club Doncaster Shop 1057 Westfield Shopping Centre 619 Doncaster Road Doncaster VIC 3108 03 9848 1804 The Coffee Club Eastlands Eastland Shopping Centre, 171-175 Maroondah Highway -

Shopping Centres in Australia Location Map 19Th Ave Shopping

Shopping Centres in Australia This GPS POI file is available here: https://www.gps-data-team.info/poi/australia/store_locator/Shopping_Centre-AU.html Location Map 19th Ave Shopping Centre Map Aberfoyle Hub Shopping Centr Map Albany Plaza Map Albion Arc Map Albion Park Rail Map Allambie Heights Shopping Ce Map Altona Gate Shopping Centre Map Amberly Park Estate Map Arana Hills Kmart Plaza Map Armadale Shopping Centre Map Arundel Plaza Map Ashfield Mall Shopping Centr Map Auburn Central Map Australia Fair Shopping Cent Map Bacchus Marsh Shopping Centr Map Bakery Hill Map Ballina Fair Shopping Centre Map Bankstown Sq Map Bathurst City Centre Map Bay Plaza Map Bayside Shopping Centre Map Beaumaris City Shopping Cent Map Bellarine Village Map Bellpost Shopping Centre Map Belmont Forum Shopping Centr Map Belridge Shopping Centre Map Bendigo Marketplace Map Bentons Square Shopping Cent Map Berowra Village Shopping Cen Map Berwick Markeplace Map Big Bear Shopping Centre Map BiLo Shopping Centre Map Bilo Sq Map Blackburn North Shopping Cen Map Bonnyrigg Plaza Map Booval Fair Shopping Centre Map Boronia Junction Shopping Ce Map Borrack Square Map Box Hill Central Map Brandon Park Shopping Centre Map Page 1 Location Map Brentford Square Map Bridgepoint Shopping Centre Map Brighton Shopping Centre Map Brimbank Central Shopping Ce Map Broadmeadows Shopping Centre Map Brookside Shopping Centre Map Buderim Marketplace Map Bull Creek Shopping Centre Map Bulleen Plaza Map Bunbury Centrepoint Map Bunbury Forum Shopping Centr Map Buranda Plaza Map Burnside -

New South Wales • Victoria • Queensland • South Australia • Act • Western Australia • Northern Territory • Tasmania

FULL STORE LIST • NEW SOUTH WALES • VICTORIA • QUEENSLAND • SOUTH AUSTRALIA • A.C.T. • WESTERN AUSTRALIA • NORTHERN TERRITORY • TASMANIA 1/8 NEW SOUTH WALES AUBURN CHATSWOOD HURSTVILLE WESTFIELD Shop Q15, Auburn Central, Cnr Harrow Road 334 Victoria Avenue, Chatswood, NSW 2067 Shop 106 / 08, Westfield Hurstville, Cnr and Queen Street, Auburn, NSW 2144 TEL: (02) 9413 9686 Cross St and Park Rd, Hurstville, NSW 2220 TEL: (02) 8096 1443 TEL: (02) 9580 8132 CHATSWOOD EXPRESS Shop 16, Chatswood Interchange, 438 Victoria LIDCOMBE BANKSTOWN Shop G-005, Lidcombe Shopping Centre, 92 66 Bankstown City Plaza, Bankstown, NSW 2200 Avenue, Chatswood, NSW 2067 Parramatta Road, Lidcombe, NSW 2141 TEL: (02) 9708 1261 TEL: (02) 9412 1006 TEL: (02) 8386 5822 BROADWAY EASTGARDENS Shop G28, Broadway Shopping Centre, 1 Bay Shop 171, Westfield Eastgardens, 152 MACQUARIE CENTRE Shop 3504, Macquarie Centre, Cnr Herring Rd Street, Broadway, NSW 2037 Bunnerong Road, Eastgardens, NSW 2036 & Waterloo Rd, North Ryde, NSW 2113 TEL: (02) 9212 1700 TEL: (02) 9349 8848 TEL: (02) 9870 8208 CABRAMATTA EASTWOOD Shop 2-3, 90 John Street, Cabramatta, NSW Shop 3, 163 Rowe St, Eastwood, NSW 2122 PARRAMATTA Shops 5029, Level 5, Westfield Parramatta, 2166 TEL: (02) 9804 6188 159-175 Church Street, Parramatta, NSW 2150 TEL: (02) 9723 8879 TEL: (02) 9689 1888 HORNSBY CAMPSIE Shop 1018, Westfield Hornsby, 236 Pacific HWY, Shop 19, Campsie Centre, 14-28 Amy Street, Hornsby, NSW 2077 PARRAMATTA EXPRESS Shops 1170, Level 1, Westfield Parramatta, Campsie, NSW 2194 TEL: (02) 9477 2141 159-175 Church Street, Parramatta, NSW 2150 TEL: (02) 9789 6522 TEL: (02) 8677 9215 GEORGE ST. -

Ngs Super Portfolio Holdings Disclosure

NGS SUPER PORTFOLIO HOLDINGS DISCLOSURE DIVERSIFIED - INCOME Effective date: 31 DEC 2020 AUSTRALIAN SHARES A2 MILK COMPANY LTD ABACUS PROPERTY GROUP AINSWORTH GAME TECHNOLOGY LIMITED ALTIUM ALUMINA LIMITED AMCOR PLC AMP LIMITED AMPOL LIMITED ANSELL LIMITED APA GROUP APPEN LTD ARB CORPORATION LIMITED ARISTOCRAT LEISURE LIMITED ASALEO CARE LTD ATLAS ARTERIA AUSNET SERVICES LIMITED AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED AUSTRALIAN VINTAGE LTD BELLEVUE GOLD LIMITED BHP GROUP LTD BRAMBLES LIMITED BWP TRUST CAPRAL LIMITED CASH CHALLENGER LIMITED CHARTER HALL GROUP CHARTER HALL RETAIL REIT CHORUS LIMITED CLEANAWAY WASTE MANAGEMENT LTD Issued by NGS Super Pty Limited ABN 46 003 491 487 AFSL No 233 154 the trustee of NGS Super ABN 73 549 180 515 ngssuper.com.au 1300 133 177 NGS SUPER – PORTFOLIO HOLDINGS DISCLOSURE 1 DIVERSIFIED - INCOME Effective date: 31 DEC 2020 COCA-COLA AMATIL LIMITED COLES GROUP LTD COMMONWEALTH BANK OF AUSTRALIA CONTACT ENERGY LIMITED CROWN RESORTS LIMITED CSL LIMITED CSR LIMITED DERIVATIVES DOMINO'S PIZZA ENTERPRISES LIMITED ELDERS LIMITED EVENT HOSPITALITY & ENTERTAINMENT LTD EVOLUTION MINING LIMITED FAR LTD FISHER & PAYKEL HEALTHCARE CORPORATION LIMITED FLETCHER BUILDING LIMITED FLIGHT CENTRE TRAVEL GROUP LIMITED G.U.D. HOLDINGS LIMITED G8 EDUCATION LIMITED GOODMAN GROUP HARVEY NORMAN HOLDINGS LTD HEALIUS LIMITED HOME CONSORTIUM HT&E LTD IGO LIMITED IMPEDIMED LIMITED INCITEC PIVOT LIMITED INGHAMS GROUP LTD INSURANCE AUSTRALIA GROUP LIMITED IPH LTD JAMES HARDIE INDUSTRIES PLC JB HI-FI LIMITED KATHMANDU HOLDINGS