TELEFLEX INCORPORATED (Exact Name of Registrant As Specified in Its Charter) Delaware 23-1147939 (State Or Other Jurisdiction of (I.R.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rosuvastatin Calcium Patent Litigation

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE IN RE: ROSUVASTATIN CALCIUM MDL No. 08-1949-JJF PATENT LITIGATION, ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-805-JJF-LPS MYLAN PHARMACEUTICALS INC., Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-806-JJF-LPS SUN PHARMACEUTICAL INDUSTRIES LTD. , Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-807-JJF-LPS SANDOZ INC., Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-808-JJF-LPS PAR PHARMACEUTICALS INC., Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-809-JJF-LPS APOTEX CORP., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-810-JJF-LPS AUROBINDO PHARMA LTD. AND AUROBINDO PHARMA USA INC., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-811-JJF-LPS COBALT PHARMACEUTICALS INC. AND COBALT LABORATORIES INC., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 08-359-JJF-LPS AUROBINDO PHARMA LTD. AND AUROBINDO PHARMA USA INC., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. -

03.031 Socc04 Final 2(R)

STATEOF CENTER CITY 2008 Prepared by Center City District & Central Philadelphia Development Corporation May 2008 STATEOF CENTER CITY 2008 Center City District & Central Philadelphia Development Corporation 660 Chestnut Street Philadelphia PA, 19106 215.440.5500 www.CenterCityPhila.org TABLEOFCONTENTSCONTENTS INTRODUCTION 1 OFFICE MARKET 2 HEALTHCARE & EDUCATION 6 HOSPITALITY & TOURISM 10 ARTS & CULTURE 14 RETAIL MARKET 18 EMPLOYMENT 22 TRANSPORTATION & ACCESS 28 RESIDENTIAL MARKET 32 PARKS & RECREATION 36 CENTER CITY DISTRICT PERFORMANCE 38 CENTER CITY DEVELOPMENTS 44 ACKNOWLEDGEMENTS 48 Center City District & Central Philadelphia Development Corporation www.CenterCityPhila.org INTRODUCTION CENTER CITY PHILADELPHIA 2007 was a year of positive change in Center City. Even with the new Comcast Tower topping out at 975 feet, overall office occupancy still climbed to 89%, as the expansion of existing firms and several new arrivals downtown pushed Class A rents up 14%. For the first time in 15 years, Center City increased its share of regional office space. Healthcare and educational institutions continued to attract students, patients and research dollars to downtown, while elementary schools experienced strong demand from the growing number of families in Center City with children. The Pennsylvania Convention Center expansion commenced and plans advanced for new hotels, as occupancy and room rates steadily climbed. On Independence Mall, the National Museum of American Jewish History started construction, while the Barnes Foundation retained designers for a new home on the Benjamin Franklin Parkway. Housing prices remained strong, rents steadily climbed and rental vacancy rates dropped to 4.6%, as new residents continued to flock to Center City. While the average condo sold for $428,596, 115 units sold in 2007 for more than $1 million, double the number in 2006. -

Complaint in Action Manufacturing Co Inc Et Al

SDMS DocID 2037769 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF PENNSYLVANIA ACTION MANUFACTURING CO., INC., ALCOA INC. f/k/a ALUMINUM COMPANY OF AMERICA, ARMSTRONG WORLD INDUSTRIES, INC., CIVIL ACTION ABB INC. f/k/a FISCHER & PORTER COMPANY, NO. 02- BECKETT COMPANY, L.P., GENERAL ELECTRIC COMPANY/RCA, GENERAL MOTORS CORPORATION, HAMILTON TECHNOLOGIES, INC. (BULOVA TECHNOLOGIES, L.L.C.), HAMILTON WATCH COMPANY, INC. (SWATCH GROUP U.S., INC.), HANDY & HARMAN , HAYFORK, L.P. f7k/a HAMILTON PRECISION METALS, INC., TUBE CO., HERCULES INCORPORATED, J.W. REX, LAFRANCE CORPORATION, LUCENT TECHNOLOGIES INC., PENFLEX, INC., PLYMOUTH TUBE COMPANY, REILLY PLATING COMPANY, SIEMENS ENERGY & AUTOMATION, INC. f/k/a MOORE PRODUCTS, CO., SUNROC CORPORATION, SYNTEX (USA), INC., UNISYS CORPORATION, AND VIZ LIQUIDATION TRUST Plaintiffs, v. SIMON WRECKING COMPANY, SIMON WRECKING COMPANY, INC., SIMON RESOURCES, INC., MID-STATE TRADING COMPANY, INC., S & S INVESTMENTS, INC., SCHWAB-SIMON REALTY CORPORATION, TRENTON REALTY CORPORATION, QUAKER CITY CHEMICALS, INC., CENTRAL PENN CHEMICALS, CENTRAL PENNSYLVANIA CHEMICALS, QUAKER CITY, INC., AROOOOOI J & J SPILL SERVICE & SUPPLIES, INC., J & J TRANSPORT, INC., A & A SEPTIC SERVICE, INC., CONTINENTAL VANGUARD, INC., LIGHTMAN DRUM COMPANY, LIGHTMAN DRUM CO., INC., RESOURCE TECHNOLOGY SERVICES, INC. BISHOP TUBE CO., ELECTRALLOY CORP., MERCEGAGLIA USA, INC., AMP INCORPORATED, TYCO ELECTRONICS CORPORATION, TYCO INTERNATIONAL (US), INC., TYCO INTERNATIONAL LTD., PETROCON INC., ANTROL INDUSTRIES, INC. MCCLAPJN PLASTICS, INC., LAVELLE AIRCRAFT COMPANY, AMETEK, INC., LEEDS AND NORTHRUP COMPANY, CSS INTERNATIONAL CORP., CSS METAL FABRICATION CORPORATION, CSS MACHINE & TOOL CO., INC., ECOLOGY SYSTEMS EQUIPMENT MANUFACTURING CO., INC., TECHNITROL, INC., FBF INDUSTRIES, INC., FBF, INC., ARK PRODUCTS CO, INC., MALCO. -

Preferred Employer Program Companies*

Preferred Employer Program Companies* • 3M Company • AutoZone • Cintas • 7-Eleven • Avera Health • Cisco Systems • AAA - (Employees Only) • Avon Products • Citigroup • Abbott Laboratories • Bacardi USA • Citizens Financial Group • AbbVie Corp. • Bank of America Corp. • Cleveland Clinic Foundation • Accenture Ltd. • Baptist Health South Florida • Coca-Cola Bottling Co. • adidas America • Barclays Capital/Stifel Financial • Coldwell Banker Richard Ellis • Advanced Micro Devices • Bausch & Lomb • Compass Group USA • Aflac - (Employees Only) • Bayer Corp. • ConocoPhillips • Alcon Laboratories • Becton, Dickinson and Company • Continental General Tire • ALDI • Berkshire Hathaway • Corning • Allegheny Health Network • BI Worldwide • Costco • Allergan • Biogen Idec • Cowan Systems • Alliance Data • BioReference Labs • Cox Enterprises • Allianz Global Investors of America • Bloomin’ Brands • Credit Suisse Asset Mgmt. • Allstate Insurance Co. - (Employees Only) • Blue Cross Blue Shield - (Employees Only) • CSRA International • Altice • Blue Iron • Cumberland Farms • Amazon • Boehringer Ingelheim Pharmaceuticals • Curtiss-Wright Corp. • American Airlines Credit Union • Boeing Corp. • CVS • American Association of Physicians • Boston Scientific Corp. • Daimler Trucks North America of Indian Origin • BP • Dassault Systèmes • American Express Co. - (Employees Only) • Braintree Laboratories • DealerTrack Holdings • AMETEK • Bristol Myers Squibb • Del Monte Foods • Amgen • Broadcom • Dell • Analog Devices • Brown-Forman • Deloitte & Touche LLP • Anthem -

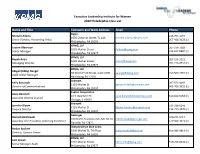

Name and Title Company and Work Address Email Phone 2020

Executive Leadership Institute for Women 2020 Philadelphia Class List Name and Title Company and Work Address Email Phone Cigna Michele Adams 215-761-1467 1601 Chestnut Street, TL 14A [email protected] Senior Director, Accounting Policy 267-418-3629 (c) Philadelphia, PA 19192 KPMG, LLP Lauren Albertson 267-256-3183 1601 Market Street [email protected] Senior Manager 215-817-0889 (c) Philadelphia, PA 07677 KPMG, LLP Rupali Amin 267-256-3221 1601 Market Street [email protected] Managing Director 267-210-4331 (c) Philadelphia, PA 07677 KPMG, LLP Abigail (Abby) Aungst 30 North Third Street, Suite 1000 [email protected] 717-507-7707 (c) Audit Senior Manager Harrisburg, PA 17101 Aramark Kelly Banaszak 267-671-4469 1101 Market St [email protected] Director of Communications 609-760-3332 (c) Philadelphia, PA 19107 Exelon Corporation Anne Bancroft 10 S. Dearborn St [email protected] 610-812-5454 (c) Associate General Counsel Chicago, IL 60603 Aramark Jennifer Bloom 215-238-8143 1101 Market St [email protected] Finance Director 215-779-1025 (c) Philadelphia, PA 19107 Geisinger Hannah Bobrowski 570-271-5417 100 North Academy Ave, MC 28-10 [email protected] Associate Vice President, Achieving Excellence 570-926-3071 (c) Danville, PA 17822 Independence Blue Cross Roslyn Boskett 1900 Market St, 7th Floor [email protected] 856-986-9814 (c) Director, Contact Center Philadelphia, PA 19103 KPMG, LLP Kelli Brown 1601 Market Street [email protected] 610-256-0628 (c) Senior Manager Audit Philadelphia, PA 07677 -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Wilmington Funds Holdings Template DRAFT

Wilmington Large-Cap Strategy Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS APPLE INC 4.97% MICROSOFT CORP 4.69% AMAZON.COM INC 3.45% FACEBOOK INC 1.99% ALPHABET INC 1.80% ALPHABET INC 1.77% BERKSHIRE HATHAWAY INC 1.48% JPMORGAN CHASE & CO 1.35% TESLA INC 1.20% JOHNSON & JOHNSON 1.12% UNITEDHEALTH GROUP INC 0.98% VISA INC 0.96% NVIDIA CORP 0.96% BANK OF AMERICA CORP 0.89% HOME DEPOT INC/THE 0.87% WALT DISNEY CO/THE 0.82% MASTERCARD INC 0.80% PAYPAL HOLDINGS INC 0.77% EXXON MOBIL CORP 0.68% PROCTER & GAMBLE CO/THE 0.67% COMCAST CORP 0.66% ADOBE INC 0.62% INTEL CORP 0.59% VERIZON COMMUNICATIONS INC 0.59% CISCO SYSTEMS INC 0.57% CHEVRON CORP 0.55% PFIZER INC 0.54% NETFLIX INC 0.54% AT&T INC 0.53% SALESFORCE.COM INC 0.53% ABBOTT LABORATORIES 0.51% ABBVIE INC 0.50% MERCK & CO INC 0.48% WELLS FARGO & CO 0.48% BROADCOM INC 0.47% THERMO FISHER SCIENTIFIC INC 0.47% ACCENTURE PLC 0.46% CITIGROUP INC 0.45% MCDONALD'S CORP 0.44% TEXAS INSTRUMENTS INC 0.44% COCA-COLA CO/THE 0.44% HONEYWELL INTERNATIONAL INC 0.44% LINDE PLC 0.43% MEDTRONIC PLC 0.43% NIKE INC 0.43% ELI LILLY & CO 0.42% PEPSICO INC 0.42% UNITED PARCEL SERVICE INC 0.41% WALMART INC 0.40% DANAHER CORP 0.40% UNION PACIFIC CORP 0.40% QUALCOMM INC 0.38% BRISTOL-MYERS SQUIBB CO 0.37% ORACLE CORP 0.37% LOWE'S COS INC 0.36% BLACKROCK INC 0.35% CATERPILLAR INC 0.35% AMGEN INC 0.35% BOEING CO/THE 0.35% MORGAN STANLEY 0.35% COSTCO WHOLESALE CORP 0.35% RAYTHEON TECHNOLOGIES CORP 0.34% STARBUCKS CORP 0.34% GOLDMAN SACHS GROUP INC/THE 0.34% GENERAL ELECTRIC -

2002 Annual Report

ARAMARK 2002 ANNUAL REPORT ARAMARK CORPORATION ARAMARK TOWER 1101 MARKET STREET PHILADELPHIA, PA 19107 U.S.A. www.ARAMARK.com 2002 ANNUAL REPORT CONTENTS 2 Letter To Shareholders 6 ARAMARK At A Glance 8 Partnership Profiles 20 Community Service 21 Financial Review 61 Shareholder Information 62 Officers And Presidents Council 63 Board Of Directors BOARD OF DIRECTORS FINANCIAL HIGHLIGHTS (Dollars in thousands, except per share data) 2000 %* 2001 %* 2002 %* OPERATING RESULTS Sales $7,262,867 8% $7,788,690 7% $8,769,841 13% Earnings Before Interest and Income Taxes 419,583 12% 439,507 5% 560,267 27% Net Income 167,960 12% 176,496 5% 269,912 53% FINANCIAL POSITION Total Assets $3,199,383 11% $3,216,394 1% $4,259,302 32% Long-term Debt 1,777,660 10% 1,635,867 -8% 1,835,713 12% NET INCOME PER SHARE Basic $0.94 18% $1.03 10% $1.42 38% (Seated, left to right) Leonard Coleman, James Preston, Karl von der Heyden. (Standing, left to right) Ronald Davenport, James Ksansnak, Joseph Neubauer, Robert Callander, Thomas Kean, Lawrence Babbio, Patricia Barron. Diluted 0.88 19% 0.97 10% 1.34 38% * change over prior year JOSEPH NEUBAUER2,3 RONALD R. DAVENPORT 1,4,5 Chairman and Chief Executive Officer, Chairman, ARAMARK Sheridan Broadcasting Corporation LAWRENCE T. BABBIO, JR.2,3,4 THOMAS H. KEAN3,4 Vice Chairman and President, President, Drew University Verizon Communications, Inc. Former Governor of New Jersey PATRICIA C. BARRON1 JAMES E. KSANSNAK3 Professor, Leonard N. Stern School Retired Vice Chairman, of Business, New York University ARAMARK ROBERT J. -

The Food Industry Scorecard

THE FOOD INDUSTRY SCORECARD An evaluation of food companies’ progress making—and keeping— animal welfare promises humanesociety.org/scorecard Executive summary Most of the largest U.S. food companies have publicly pledged to eliminate certain animal abuses from their supply chains. But as countless consumers have asked: are they keeping their promises? For context, the vast majority of animals in our food system live Here’s the good news: that kind of radical view is out of in dismal conditions. Mother pigs are locked in gestation crates step with traditional American values. Agribusiness may see ani- so small they can’t turn around. Egg-laying hens are crammed mals as mere machines, but consumers don’t. into cages so tightly they can’t even spread their wings. And chickens in the poultry industry are bred to grow so large, so ɠ As the American Farm Bureau reports, nearly all consumers (95%) believe farm animals should be fast they suffer from agonizing leg disorders. treated well. It wasn’t always this way. Throughout history, animals hav- en’t been forced to endure such miserable lives. (And today, ɠ The Food Marketing Institute found that animal welfare is shoppers’ second most important social issue. there are certainly farmers who don’t use these abusive prac- tices.) But as agri-culture developed into agri-business, the ɠ The food industry analytics firm Technomic concluded industry’s relationship to animals became more severe. that for American restaurant patrons, concerns about animal cruelty outweigh those regarding the “Forget the pig is an animal,” urged Hog Farm Management environment, fair trade, local sourcing and other issues. -

It Is Undisputed That ARAMARK, Inc. (“ARAMARK”) Acquired Servicemaster and Assumed Its Contractual Obligations with Greyhound

Case 2:06-cv-03049-LDD Document 39 Filed 01/16/09 Page 1 of 7 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF PENNSYLVANIA SELWYN NIEVES : CIVIL ACTION : v. : NO. 06-3049 : GREYHOUND LINES, INC., et al. : MEMORANDUM AND ORDER Kauffman, J. January 16, 2009 Now before the Court is the Motion for Summary Judgment (the “Motion”) of Defendant Servicemaster, TBS Division (“Servicemaster”). For the reasons discussed below, the Motion will be granted. I. BACKGROUND This action arises from a workplace injury sustained by Plaintiff Selwyn M. Nieves (“Plaintiff”) on July 4, 2004. As alleged in the Complaint, Defendant/Third-Party Plaintiff Mount Corporation (“Mount”) was, at all times relevant to this action, the owner of a maintenance facility (the “Greyhound Maintenance Center”) located at 710 N. Delaware Avenue in Philadelphia. Compl. ¶ 3. Pursuant to a written service agreement (the “Agreement”) with Defendant/Third-Party Plaintiff Greyhound Lines, Inc. (“Greyhound”), Servicemaster was responsible for maintaining the premises of the Greyhound Maintenance Center. Id. ¶ 4.1 1 It is undisputed that ARAMARK, Inc. (“ARAMARK”) acquired Servicemaster and assumed its contractual obligations with Greyhound. However, Plaintiff contends that ARAMARK did not assume Servicemaster’s contractual obligations until after the accident at issue in this case. -1- Case 2:06-cv-03049-LDD Document 39 Filed 01/16/09 Page 2 of 7 Plaintiff alleges that on July 4, 2004, “there existed a dangerous condition on certain concrete steps situated in the Greyhound Maintenance Center, to wit, a slippery substance which was allowed and permitted . to be on the steps with no warnings, barricades or similar precautions.” Id. -

Securities and Exchange Commission Washington, D.C

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ----------------- FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2001 Commission file number 1-1398 UGI UTILITIES, INC. (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) Pennsylvania 23-1174060 (STATE OR OTHER JURISDICTION (I.R.S. EMPLOYER IDENTIFICATION NO.) OF INCORPORATION OR ORGANIZATION) 100 Kachel Boulevard, Suite 400, Green Hills Corporate Center Reading, PA 19607 (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) (ZIP CODE) (610) 796-3400 (REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE) SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: None SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None INDICATE BY CHECK MARK WHETHER THE REGISTRANT (1) HAS FILED ALL REPORTS REQUIRED TO BE FILED BY SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 DURING THE PRECEDING 12 MONTHS (OR FOR SUCH SHORTER PERIOD THAT THE REGISTRANT WAS REQUIRED TO FILE SUCH REPORTS) AND (2) HAS BEEN SUBJECT TO SUCH FILING REQUIREMENTS FOR THE PAST 90 DAYS. YES X . NO . ----- ---- Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X] At December 1, 2001 there were 26,781,785 shares of UGI Utilities Common Stock, par value $2.25 per share, outstanding, all of which were held, beneficially and of record, by UGI Corporation. -

Date: July 1, 2019 Mission Fast Facts the Mission of St

ST. JOSEPH’S PREPARATORY SCHOOL PHILADELPHIA, PENNSYLVANIA PRINCIPAL START DATE: JULY 1, 2019 WWW.SJPREP.ORG Mission Fast Facts The mission of St. Joseph’s Prep — as a • Year established: 1851 Catholic, Jesuit, urban, college preparatory • Total enrollment: 902 school — is to develop the minds, hearts, • Student/teacher ratio: 13:1 souls and characters of young men in their • Total faculty: 71 pursuit of becoming men for and with others. • Faculty with advanced degrees: 97% • Average faculty tenure: 17 years • Students receiving financial aid: 56% Motto of the Society of Jesus Ad maiorem Dei gloriam – “For the greater glory of God” OVERVIEW Founded in 1851 by the Society of Jesus, St. Joseph’s Preparatory School (the Prep) is an independent, Catholic, college-preparatory school for boys. Located in North Philadelphia, it is the only Jesuit high school in the Delaware Valley and one of 62 Jesuit Secondary Schools in the United States. The school serves approximately 900 students and is dedicated to providing a robust educational experience to its students while balancing its highly-regarded classical program with extensive offerings of athletics, theater, music, and club opportunities. Even more important is the school’s commitment to produce graduates who are “men for and with others” and who will serve their families, churches, and communities. A sense of pride, enthusiasm, and “Brotherhood” permeates the campus at all levels. Students, parents, alumni, faculty, and administration fully embrace the Ignatian mission. The school is devoted to maintaining its commitment to diversity, service, and academic excellence. Enrollment is strong and steady, the Board is visionary and supportive, the faculty is talented and dedicated, there is a formidable strategic plan in place, and the reputation of the school is stellar.