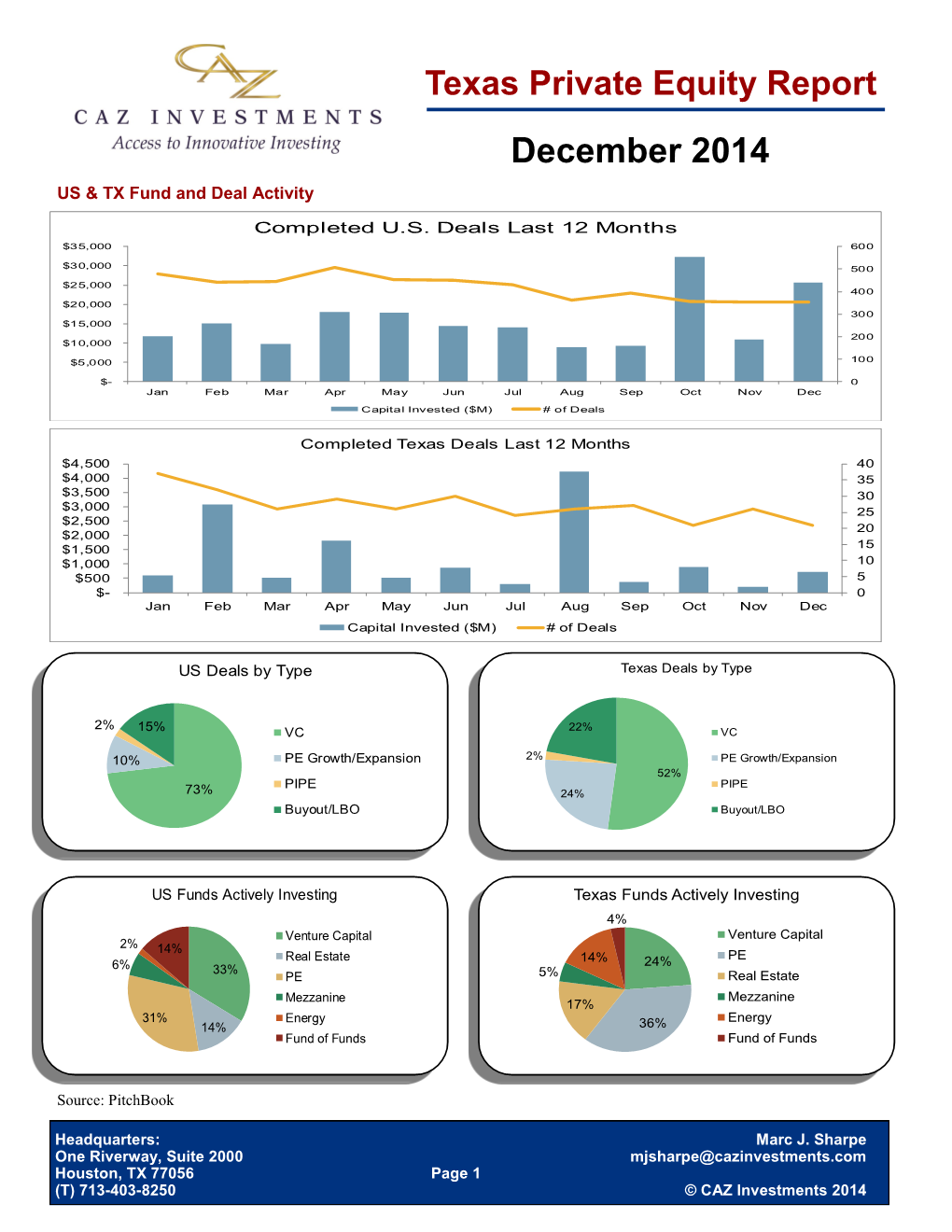

Texas Private Equity Report December 2014 US & TX Fund and Deal Activity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oil and the Financial Sector; Private Equity Perspective Gary R

Oil and the Financial Sector; Private Equity Perspective Gary R. Petersen Managing Partner & Founder, EnCap Investments November 18, 2016 Overview of EnCap Investments • Leading provider of private growth capital across upstream and midstream oil and gas • Raised aggregate capital commitments of approximately ~$27 billion across 19 institutional funds since 1988 • Exceptional track record of 2.4x ROI and 52% IRR on 174 realized investments across 19 funds • Investment strategy revolves around partnering with seasoned oil and gas executives with demonstrable track records of success Upstream - EnCap Investments Midstream - EnCap Flatrock • Core funds started in 1988 Oklahoma City • 2nd business line started in 2008 • 16 funds totaling ~$21 billion • 3 funds totaling ~$6 billion Houston Office Dallas • 21 total employees • 49 Employees San Antonio Office Houston • 19 Investment Staff San Antonio • 11 Investment Staff • 5 Technical Professionals Oklahoma City Office Dallas Office • 3 Investment Staff • 16 Employees Houston Office • 11 Investment Staff • 2 Investment Staff • 1 Technical Professional Confidential 2 Fund History • Long history of helping companies grow and create shareholder value – Provided growth capital to 242 oil and gas companies – 174 realized investments EnCap Energy EnCap Energy EnCap Energy EnCap Energy Capital Fund III Capital Fund V Capital Fund VII Capital Fund IX $405,000,000 $815,000,000 $2,500,000,000 $5,000,000,000 August 1997 July 2004 December 2007 January 2013 Reserve Acquisition Mezz. Debt Funds I- EnCap -

Energy and Clean Technology Venture Forum Thursday, September 17, 2015 8:00 Am - 6:30 Pm Mcnair Hall, Rice University

13th Annual Energy & Clean Technology Venture Forum : Rice Alliance for Technology and Entrepreneurship - Rice University CONTACT US AUSTIN ALLIANCE JONES GRADUATE SCHOOL OF BUSINESS RICE UNIVERSITY Home About Events Business Plan Competition Membership Sponsorship News 13th Annual Energy and Clean Technology Venture Forum Thursday, September 17, 2015 8:00 am - 6:30 pm McNair Hall, Rice University Agenda Speakers Presenting Participating Companies Investors Testimonials September 17, 2015 Jones Graduate School of Business, Rice University Platinum Underwriters The Rice Alliance's 13th Annual Energy and Clean Technology Venture Forum on September 17, 2015 is the largest energy and clean technology venture capital conference in the southwest. This event represents an opportunity to learn about the latest emerging technologies, meet investors to seek funding, see promising companies, learn about investment opportunities, meet individuals from the energy & clean technology industry, learn about promising companies seeking to expand their management team, as well networking and learning opportunities for entrepreneurs, researchers, investment professional and business executives. This is a must-attend event for anyone involved in the energy and clean technology community in the region. The conference will include industry luminary speakers, investors, and promising startups from throughout the U.S. and beyond. Gold Underwriters Confirmed participating investors, venture capital, and industry participants include the following: 32 Degrees Capital -

Private Equity Portfolio Performance Report As Of

Water and Power Employees’ Retirement Plan (WPERP) Private Equity Portfolio Performance Report as of: June 30, 2011 Presented: November 9th, 2011 This report is solely for the use of client personnel. No part of it may be circulated, quoted, or reproduced for distribution outside the client organization without prior written approval from Pension Consulting Alliance, Inc. Nothing herein is intended to serve as investment advice, a recommendation of any particular investment or type of investment, a suggestion of the merits of purchasing or selling securities, or an invitation or inducement to engage in investment activity. Pension Consulting Alliance, Inc. Quarterly Report Q2-2011 Table of Contents Section Tab Executive Summary 2 Review of Investment Performance 5 Review of Portfolio Structure 9 Partnership Summaries 14 Private Equity Market Overview 15 Appendices Individual Partnership Pages A Health Benefits Fund Overview B 1 Quarterly Report Q2-2011 1.0 Executive Summary As of June 30, 2011, the Program had $205.5 million in commitments across nine partnerships. As of the end of the second quarter of 2011, $103.8 million in capital had been drawn down, $28.3 million in distributions had been made, and the Program had a reported value of $95.2 million. The net since inception internal rate of return (IRR) was 7.2% as of June 30, 2011, continuing to improve since year-end 2008. Portfolio Summary (as of June 30, 2011) Since Peer Vintage Committed Invested Distributed Reported Partnership Type Age Inception Median Year Capital Capital Capital Value 1 Net IRR IRR Lexington VI Secondary Fund-of-Funds 2006 5.0 yrs. -

Triple Oak Power Llc Forms with Majority Investment Backing from Encap Investments L.P

FOR IMMEDIATE RELEASE TRIPLE OAK POWER LLC FORMS WITH MAJORITY INVESTMENT BACKING FROM ENCAP INVESTMENTS L.P. PORTLAND, Oregon – Oct. 7, 2020 – Triple Oak Power LLC (“TOP”) announced today its FormaHon, as well as underlying capital commitment From EnCap Investments L.P. (“EnCap”), a leading provider oF equity capital to the independent sector oF the U.S. energy industry. Yorktown Partners LLC (“Yorktown”), an energy-Focused private equity firm, Mercuria Energy and TOP management will also invest in the company by providing addiHonal growth capital. Headquartered in Portland, Oregon, TOP will Focus on developing high quality onshore wind and other compeHHve carbon-Free power to accelerate the U.S. transiHon to renewable energy and help shape a more diverse, reliable, and sustainable power grid. TOP’s root strategy lies in filling the gap between early stage volaHlity in the development process to delivering the certainty oF shovel-ready uHlity-scale wind FaciliHes. “Triple Oak Power’s deep, end-to-end experHse in the wind development value chain and unique strategic vision are a natural fit with the EnCap Energy TransiHon porXolio oF industry innovators,” said EnCap Energy TransiHon Managing Partner Kellie MetcalF. “We’re excited about TOP’s ability to develop wind projects that lead to cost- effecHve, high-capacity soluHons that will complement the conHnued growth oF solar and ba]ery storage.” TOP is taking a creaHve approach to a proven business model, delivering well-posiHoned wind energy projects at a Hme when low-cost clean energy and local economic development are especially criHcal. TOP’s three key goals are meeHng customers’ increasing demand For affordable zero carbon electricity, invesHng in rural economies seeking financial recovery and stability, and providing a plaXorm For established capital partners to directly parHcipate in the clean energy transiHon. -

Investor Relations Marketing & Communications Forum

Investor Relations Marketing & Communications Forum Virtual experience 2020 September 2-3 | Available anywhere The largest global event for PE Investor Relations, Marketing & Communications A new virtual experience Customize your agenda Available anywhere Industry leading IR and Mix and match 3 think tank Enjoy the Forum from the marketing content selections, 3 interactive comfort of your home office and The Forum’s in-depth sessions are discussion rooms, 12 breakouts on-demand access for up to 12 designed to help you formulate and panel sessions to your liking months after the event is over effective plans and develop crucial for a personalize event strategies to attract investors experience A new kind of networking Built-in calendar and Networking lounges Gain early access to the attendee automated reminders Explore and meet with industry list and start scheduling 1-to-1 Easily download and sync your service providers to discover the or small group meetings or direct event agenda with preferred latest trends and technologies message fellow attendees in tracks and 1-to-1 meetings to your advance own work calendar Speakers include Marilyn Adler Nicole Adrien Christine Anderson Mary Armstrong Michael Bane Managing Partner Chief Product Officer Senior Managing Senior Vice President, Head of US Investor Mizzen Capital and Global Head of Director, Global Head Global Head of Relations Client Relations of Public Affairs & Marketing and Ardian Oaktree Capital Marketing Communications Blackstone General Atlantic Devin Banerjee Charles Bauer Gina -

Book-Board of Directors-November 9, 2012

UTIMCO BOARD OF DIRECTORS MEETING AGENDA November 9, 2012 UTIMCO 401 Congress Ave., Ste. 2800 Austin, Texas 78701 Time Item # Agenda Item Begin End 9:15 a.m. 9:20 a.m. 1 Call to Order/Discussion and Appropriate Action Related to Minutes of the Meeting held on October 11, 2012* 9:20 a.m. 9:25 a.m. 2 Discussion and Appropriate Action Related to Corporate Officer* 9:25 a.m. 10:10 a.m. 3 Report from Task Forces 10:10 a.m. 11:00 a.m. 4 Private Markets Update 11:00 a.m. 12:00 p.m. Recess for Briefing Session pursuant to Texas Education Code Section 66.08 (h)(2) related to Investments 12:00 p.m. 12:30 p.m. Lunch 12:30 p.m. 1:15 p.m. 5 Optimal Illiquidity Discussion 1:15 p.m. 1:30 p.m. 6 Report and Discussion and Appropriate Action Related to Items from Audit and Ethics Committee* 1:30 p.m. 1:40 p.m. 7 Report from Risk Committee 1:40 p.m. 1:50 p.m. 8 Report and Discussion and Appropriate Action Related to Items from Policy Committee*,** 1:50 p.m. 2:30 p.m. 9 Executive Session: Pursuant to Section 551.074, Texas Government Code, the Board of Directors will convene in Executive Session to Consider Individual Personnel Compensation Matters including Report of Compensation Committee Regarding Performance Incentive Awards for UTIMCO Compensation Program Participants for the Performance Period ended June 30, 2012. Reconvene into Open Session Report from Compensation Committee - Discussion and Appropriate Action Related to Designation of Employees in Eligible Positions as Participants in the UTIMCO Compensation Program for the 2012/2013 Performance Period* - Discussion and Appropriate Action Related to Performance Incentive Awards for UTIMCO Compensation Program Participants for the Performance Period ended June 30, 2012* 2:30 p.m. -

Private Equity En Fiscaliteit

Belastingdienst Private equity en fiscaliteit Belastingdienst, Platform Versterking Vaktechniek Onder redactie van mw. mr. C.M. Groot Inhoud 1 Inleiding 9 1.1 Rapport Private equity en fiscaliteit 9 1.2 Opzet van het rapport 9 1.3 Samenstelling projectgroep 9 1.4 Inhoud van het rapport 10 I Zicht op private equity 11 2 Wat is private equity? 12 2.1 Inleiding 12 2.1.1 Ontstaansgeschiedenis private equity 13 2.1.2 Rol van private equity in de Nederlandse economie 14 2.1.3 Recente ontwikkelingen 18 2.2 Een definitie van private equity 19 2.2.1 Private equity als vermogens beheerarrangement 20 2.2.2 Kapitaal bijeengebracht door investeerders 22 2.2.3 Fonds dat beheerd wordt door een participatie maatschappij 23 2.2.4 Participeren in niet-beursgenoteerde onder nemingen 25 2.2.5 Zeggenschap in de portfolio-onder neming 27 2.2.6 Realisatie op termijn 28 2.2.7 Leverage – het hefboom effect 29 2.2.8 Carried interest 30 2.2.9 Rol van de fonds managers 31 2.3 Afbakening: private equity ten opzichte van andere financieringsvormen 31 2.3.1 Informal investors 31 2.3.2 Hedgefondsen 32 2.3.3 Crowdfunding 33 2.4 Private equity als vorm van onder nemingsfinanciering 34 2.4.1 Venture capital 36 2.4.2 Financiering door middel van private equity bij volwassen ondernemingen 38 2.5 Private equity als vorm van belegging 42 2.5.1 Investeerders in private equity 43 2.5.2 Co-investeringen 46 2.6 Participatiemaatschappijen 48 2.6.1 Verschillende soorten participatie maatschappijen 48 2.6.2 Private-equityhuizen 49 2.6.3 Participatiemaatschappijen van banken of verzekeraars -

Confirmed Attendees From

Confirmed Attendees From: 17Capital Eller Capital Partners Mizzen Capital 1843 Capital Empire Global Ventures Monroe Capital LLC Abbott Capital Management LLC EnCap Investments Nautic Partners Abris Capital Partners European Investment Bank Nebrodi Partners ABS Capital Partners Evercore Neuberger Berman Actis eVestment Private Markets New Mountain Capital Advent International Fairview Capital Group NewQuest Capital Partners Aero Equity Franklin Templeton Investments Nonantum Capital Partners Alcion Ventures Frazier Healthcare Partners Northleaf Capital Partners Allianz Real Estate Frog Capital Norwest Equity Partners Alpha Square Group Frontier Capital Oak HC/FT Altas Partners General Atlantic Oaktree Capital AIMA General Catalyst Partners One Equity Partners American Investment Council GenNx360 Orchard Global Asset Management American Securities Genstar Capital Paine Schwartz Partners LLC Angelo Gordon Global Infrastructure Partners Patria Arcus Infrastructure Partners Goodwell Investments Pictet Alternative Advisors SA Ardian Great Hill Partners Pine Brook Partners Argosy Capital GRESB Pomona Capital Arroyo Energy Investment Partners LLC Gryphon Investors Pritzker Private Capital Arsenal Capital Partners Hamilton Lane Prosek Partners Atlantic-Pacific Capital Harbor Group International Providence Equity LLC Audax Harrison Street Social Infrastructure Fund PSP Investments Audax Group Harvest Partners Quantum Energy Partners Azimuth Capital Management HCI Equity Partners Resmark Equity Partners BackBay Communications HGGC Rhone Group Battery -

TPG the Blackstone Group Kohlberg Kravis Roberts Goldman Sachs

TPG Themay 2012 Blackstone Group Kohlbergprivate equity international Kravis Roberts Goldman page 37 Sachs Principal Investment Area The Carlyle Group CVC Capital Partners Apax Partners Apollo Global Management Bain Capital Oaktree Capital Management Hellman & Friedman General Atlantic Providence Equity Partners Cerberus Capital Management Warburg Pincus Advent International First Reserve Corporation Silver Lake Lone Star Funds Riverstone Holdings Leonard Green & Partners Thomas H. Lee Partners Golden Gate Capital BC Partners JC Flowers & Co. Terra Firma Capital Partners American Capital Teachers’ Private Capital NGP Energy Capital Management Fortress Investment Group Clayton Dubilier & Rice CPP Investment Board Bridgepoint PAI Partners AXA Private Equity Mount Kellett Capital EQT Partners Marfin Investment Group EnCap Investments Abraaj Capital Citi Capital Advisors Onex International Petroleum Investment Company Stone Point Capital TA Associates Hony Capital Nordic Capital ArcLight Capital Partners Equistone Partners Europe CDH Investments HitecVision AS JP Morgan Asset Management Charterhouse Capital Partners American Securities Capital Partners Mubadala Development Company Summit Partners Tiger Global Management Avista Capital Partners AlpInvest Partners Dubai International Capital MatlinPatterson Global Advisers GI Partners New Mountain Capital Kelso & Co. Denham Capital Management Sun Capital Partners Ares Management Lion Capital Investcorp Bank BSC Lindsay Goldberg Pamplona Capital Management H.I.G. Capital Doughty Hanson Accel Partners Berkshire Partners Vista Equity Partners WL Ross & Co. Welsh Carson Anderson & Stowe Centerbridge Capital Partners Energy Capital Partners Intermediate Capital Group Cinven Oak Hill Capital Partners page 40 private equity international may 2012 pei 300 TPG still top of the class It’s a second consecutive year at the top in Indonesian manager Northstar Pacific for TPG, whose remarkable fundraising (as it looks to get a foot in the door of machine accumulated a cool $49.9 bil- another high-potential emerging market). -

Private Equity SECTORS & MARKETS

SECTORS & MARKETS Private Equity SECTORS & MARKETS OVERVIEW We have been at the forefront of private equity deals almost since the invention of the leveraged buyout. With leading practices in both private “Provides really good equity funds and private equity transactions, we provide clients with an integrated service in all aspects of the private equity market. Our service, and is very unparalleled geographic footprint, coupled with our commitment to both mid-market and multi-billion-dollar deals, provides us with a global responsive and great perspective on structuring and executing private equity mandates. when we need things The private equity industry is rapidly changing and we are well-placed to keep up with the changes given that we act for many of the world’s done within a quick largest and most successful buyout firms. Across the globe, our clients know that, whatever the nature and scope of their fund or deal, they timeframe.” will obtain a first class service from our team of private equity lawyers who routinely advise market leading clients in multiple industries on Chambers Global every aspect of their largest and most complex transactions. Clients retain us again and again for our deep understanding of their needs, issues and goals. They rely on us to help them make the right deals on the right terms, thoughtfully assess risk and make appropriate trade-offs, and respond quickly to meet business demands. We have expertise on the ground in Bermuda, BVI, Cayman, Guernsey, Hong Kong, Isle of Man, Jersey, Mauritius and the Seychelles, and our services cover the whole life cycle of every fund and every investment, from fund formation and capitalisation of investment vehicles, through to public and private mergers and acquisitions, leveraged buyouts, group restructurings, refinancings, secured lending and transactional due diligence. -

Financial Statements and Review

Second quarter 2021 Financial statements and review Second quarter 2021 review Equinor second quarter 2021 results Equinor reports adjusted earnings of USD 4.64 billion and USD 1.58 billion after tax in the second quarter of 2021. IFRS net operating income was USD 5.30 billion and the IFRS net income was USD 1.94 billion. The second quarter of 2021 was characterised by: • Strong results due to higher prices, sustained value focus and strict capital discipline. • Solid operational performance and progress in the project portfolio, some projects impacted negatively by Covid-19. • Strong cash flow and significant improvement of adjusted net debt ratio(1) to 16.4%. • Cash dividend of USD 0.18 per share and launch of share buy-back programme. “We deliver a strong result in the second quarter. Solid operational performance and continued focus on value creation have enabled us to capture additional value from higher commodity prices. Strict capital discipline and a net cash flow of more than USD 4.5 billion, reduce our net debt ratio to 16.4 percent and make us robust for volatility in commodity prices going forward,” says Anders Opedal, President and CEO of Equinor ASA. “Systematic and sustained improvements on the NCS enable us to capture additional value in the quarter. We progressed our project portfolio with the Norwegian government’s approval of the development plan for Breidablikk, start-up of Martin Linge on NCS and the final investment decision on Bacalhau Phase 1 in Brazil. Projects in execution are progressing despite the impact of Covid-19,” says Opedal. -

Natural Resources in the US Alternative Assets

The Facts Natural Resources in the US alternative assets. intelligent data. Natural Resources in the US Using data from Preqin’s Natural Resources Online, this factsheet provides a comprehensive overview of the natural resources industry in the US, including fundraising, fund managers and investors in the country. Key Facts 1,007 $151bn 30% $6.5bn Number of US-based natural Aggregate capital raised by Texas-based natural resources Size of EnCap Energy Capital resources investors profiled on US-focused unlisted natural fund managers have raised Fund, the largest US-focused Natural Resources Online. resources funds since 2006. the largest proportion of natural resources fund closed capital since 2006. since 2006. Headquarters of US-Based Natural Resources Fund Managers WWAA MMNN 5 MMTT 4 NNHH 1 OORR 6 5 NNYY MMAA 6677 1122 IIAA PPAA NNJJ CCTT NNEE 1 OOHH 1177 8 1199 2 IILL IINN UUTT 3 CCOO 8 2 VVAA CCAA 1 KKSS 1133 MMOO KKYY 3 3377 2 2 2 NNCC MMDD TTNN 6 5 AAZZ OOKK 3 DDCC 2 1155 5 MMSS AALL GGAA 1 2 7 TTXX LLAA 111616 3 FFLL HHII 5 1 Source: Preqin Natural Resources Online Page 1 of 3 © 2016 Preqin Ltd. / www.preqin.com The Facts Natural Resources in the US alternative assets. intelligent data. Fig. 1: Annual US-Focused Natural Resources Fundraising, Fig. 2: US-Focused Natural Resources Fundraising by 2006 - 2016 YTD (As at 20 April 2016) Primary Strategy, 2014 - 2016 YTD (As at 20 April 2016) 35 33 60 50 30 50 27 27 25 41.8 24 24 25 23 40 21.0 No.