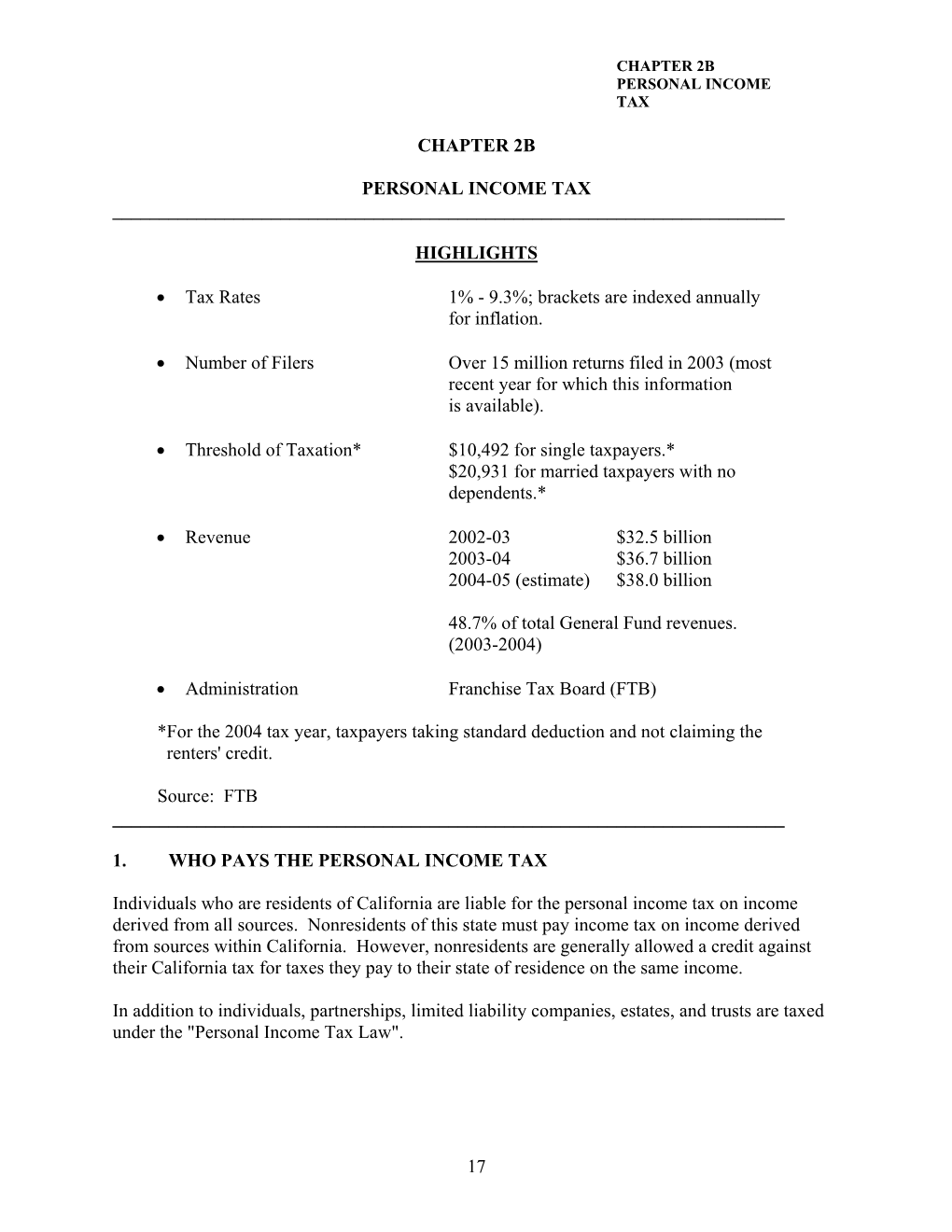

Chapter 2B Personal Income Tax

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Strategies for Selling Your Company by David Boatwright and Agnes Gesiko Latham & Watkins LLP

Tax Strategies For Selling Your Company By David Boatwright and Agnes Gesiko Latham & Watkins LLP The tax consequences of an asset sale by an entity can be very different than the consequences of a sale of the outstanding equity interests in the entity, and the use of buyer equity interests as acquisition currency may produce very different tax consequences than the use of cash or other property. This article explores certain of those differences and sets forth related strategies for maximizing the seller’s after-tax cash flow from a sale transaction. Taxes on the Sale of a Business The tax law presumes that gain or loss results upon the sale or exchange of property. This gain or loss must be reported on a tax return, unless a specific exception set forth in the Internal Revenue Code (the “Code”) or the Treasury Department’s income tax regulations provide otherwise. When a transaction is taxable under applicable principles of income tax law, the seller’s taxable gain is determined by the following formula: the “amount realized” over the “adjusted tax basis” of the assets sold equals “taxable gain.” If the adjusted tax basis exceeds the amount realized, the seller has a “tax loss.” The amount realized is the amount paid by the buyer, including any debt assumed by the buyer. The adjusted tax basis of each asset sold is generally the amount originally paid for the asset, plus amounts expended to improve the asset (which were not deducted when paid), less depreciation or amortization deductions (if any) previously allowable with respect to the asset. -

Form IT-399:2020:New York Depreciation Schedule:It399

Department of Taxation and Finance New York State Depreciation Schedule IT-399 Name(s) as shown on return Identifying number as shown on return Mark an X in one box to show the income tax return you are filing and submit this form with that return. IT-201, Resident IT-203, Nonresident and part-year resident IT-204, Partnership IT-205, Fiduciary Part 1 – Depreciation information for property (except for Internal Revenue Code (IRC) section 280F property) placed in service inside or outside New York State in tax years beginning after December 31, 1980, but before January 1, 1985, and if you elect to continue using IRC section 167 depreciation for property placed in service outside New York State in tax years beginning after December 31, 1984, but before January 1, 1994 (see instructions) A B C D E F G Description of property Date placed Depreciable Depr. Life or New York Federal ACRS (submit schedule if needed) in service basis method rate depreciation deduction (mmddyyyy) .00 .00 .00 .00 .00 .00 .00 .00 .00 1 Enter column F and column G totals ................................................................ 1 .00 .00 Transfer the column F total to: Transfer the column G total to: Form IT-225, line 10, Total amount column and enter Form IT-225, line 1, Total amount column and enter subtraction modification S-210 in the Number column. addition modification A-205 in the Number column. Estates and trusts: If the amount computed is attributable to items reflected in the federal distributable net income, transfer the amounts as stated above. If the amount is not reflected in federal distributable net income, see instructions. -

Identifying Section 1231, 1245 and 1250 Gains, 0% Bracket and Form 4797

FOR LIVE PROGRAM ONLY Fundamentals of Capital Gains: Identifying Section 1231, 1245 and 1250 Gains, 0% Bracket and Form 4797 TUESDAY, JANUARY 21, 2020, 1:00-2:50 pm Eastern IMPORTANT INFORMATION FOR THE LIVE PROGRAM This program is approved for 2 CPE credit hours. To earn credit you must: • Participate in the program on your own computer connection (no sharing) – if you need to register additional people, please call customer service at 1-800-926-7926 ext. 1 (or 404-881-1141 ext. 1). Strafford accepts American Express, Visa, MasterCard, Discover. • Listen on-line via your computer speakers. • Respond to five prompts during the program plus a single verification code. • To earn full credit, you must remain connected for the entire program. WHO TO CONTACT DURING THE LIVE PROGRAM For Additional Registrations: -Call Strafford Customer Service 1-800-926-7926 x1 (or 404-881-1141 x1) For Assistance During the Live Program: -On the web, use the chat box at the bottom left of the screen If you get disconnected during the program, you can simply log in using your original instructions and PIN. Tips for Optimal Quality FOR LIVE PROGRAM ONLY Sound Quality When listening via your computer speakers, please note that the quality of your sound will vary depending on the speed and quality of your internet connection. If the sound quality is not satisfactory, please e-mail [email protected] immediately so we can address the problem. Fundamentals of Capital Gains: Identifying Section 1231, 1245 and 1250 Gains, 0% Bracket and Form 4797 January 21, 2020 -

PERSONAL INCOME TAX LAW (Updated Text*)

PERSONAL INCOME TAX LAW (updated text*) PART ONE GENERAL PROVISIONS Article 1 This Law introduces the personal income tax and regulates the taxation procedure of the civilian's personal income. Article 2 Personal income tax (hereinafter: income tax) is paid annually for the sum of the net revenue from all sources, except for the revenues that are tax exempt by this Law. Article 3 The following types of revenues earned in the country and abroad are included in the income according to which the tax base is determined: 1) personal income from employment, pensions and disability pensions; 2) income from agriculture; 3) personal income from financial and professional activities; 4) income from property and property rights; 5) other types of revenues. All revenues under paragraph 1 of this article which are paid in cash, paid in kind or through other means, are subject to taxation. Article 4 For the different types of revenues under article 3 of this Law, an advance payment of the income tax is calculated throughout the fiscal year, which is paid by deduction from each salary payment or based on the decision of the public revenue authorities, unless otherwise determined by this Law. The amount of the compensated tax under paragraph 1 of this article is deducted from the estimated annual income tax, while the tax reductions are accepted in the amount approved with the advance estimation. _________________________________ *)The Law is published in the " Official Gazette of Republic of Macedonia",No.80/93, and the amendment and supplement in 70/94,71/96 and 28/97 Article 5 The annual amount of the income tax and the amounts of the advance payments and tax reductions that are deducted from the annual taxation are determined by the regulations that are valid on January 1 in the taxable year, unless otherwise determined by this Law. -

Dividends and Capital Gains Information Page 1 of 2

Dividends and Capital Gains Information Page 1 of 2 Some of the dividends you receive and all net long term capital gains you recognize may qualify for a federal income tax rate As noted above, for purposes of determining qualified dividend lower than your federal ordinary marginal rate. income, the concept of ex-dividend date is crucial. The ex- dividend date of a fund is the first date on which a person Qualified Dividends buying a fund share will not receive any dividends previously declared by the fund. A list of fund ex-dividend dates for each Qualified dividends received by you may qualify for a 20%, 15% State Farm Mutual Funds® dividend paid with respect to 2020, or 0% tax rate depending on your adjusted gross income (or and the corresponding percentage of each dividend that may AGI) and filing status. For single filing status, the qualified qualify as qualified dividend income, is provided below for your dividend tax rate is 0% if AGI is $40,000 or less, 15% if AGI is reference. more than $40,000 and equal to or less than $441,450, and 20% if AGI is more than $441,450. For married filing jointly Example: status, the qualified dividend tax rate is 0% if AGI is $80,000 or You bought 10,000 shares of ABC Mutual Fund common stock less, 15% if AGI is more than $80,000 and equal to or less than on June 8, 2020. ABC Mutual Fund paid a dividend of 10 cents $496,600, and 20% if AGI is more than $496,600. -

Form 309 Instructions

Arizona Form 2018 Credit for Taxes Paid to Another State or Country 309 For information or help, call one of the numbers listed: those taxes that qualify for a credit under Internal Phoenix (602) 255-3381 Revenue Code (IRC) §§ 901 and 903. From area codes 520 and 928, toll-free (800) 352-4090 NOTE: To claim a credit for taxes paid to a foreign country, Tax forms, instructions, and other tax information you must complete Form 309. You must complete Form 309 If you need tax forms, instructions, and other tax information, even if you did not have to complete federal Form 1116 to go to the department’s website at www.azdor.gov. claim a credit on your federal return. Income Tax Procedures and Rulings You may not claim this credit for the following: These instructions may refer to the department’s income tax • income taxes paid to any city or county, and procedures and rulings for more information. To view or print • interest or penalties paid to another state or country. these, go to our website and click on Reports and Legal NOTE: If you file an amended return after you claim this Research then click on Legal Research and select a document and category type from the drop down menus. credit, be sure to recalculate the credit, if required. Publications Application of Credit To view or print the department’s publications, go to our Claim this credit only if the income was subject to tax in both website and click on Reports and Legal Research then click Arizona and the other state or country in the same tax year. -

Income Tax Basics

International Student Taxes Information compiled by International Student Services International Student Taxes • The Basics • Specific Tax Scenarios • What You Can Do Now • Resolving Tax Issues • Top Ten Tax Myths • Tax Resources THE BASICS Tax Basics • Taxes – What are they? – A financial charge imposed by a governing body upon a taxpayer in order to collect funds – Collected funds are used to carry out a variety of functions – There are many types of taxes • Income Tax – A financial charge imposed on income earned by an individual or business – Income can be taxed at the local, state and federal (i.e. national) level. – This session primarily focuses on Federal Income Taxes • Internal Revenue Service (IRS) – The unit of the U.S. federal government responsible for administering and enforcing tax laws – www.irs.gov • Tax Year – January 1 – December 31 • Why should you care about taxes? – Paying income taxes and filing the appropriate paperwork with the IRS is required by law in the U.S. – Failure to comply can result in serious immigration, financial, and legal consequences Income Tax Basics • How are Income Taxes paid? – It is the taxpayer’s (i.e. YOUR) responsibility to pay tax obligation to IRS – Most common process: 1. Portion of your income is withheld from each paycheck throughout the year by your employer 2. Employer pays the withheld income to IRS on your behalf during the year 3. Each year, you file tax return to summarize tax obligations and payments for the prior tax year • What is a tax return? – A report that YOU file with the IRS to… 1. -

State Individual Income Tax Federal Starting Points

STATE PERSONAL INCOME TAXES: FEDERAL STARTING POINTS (as of January 1, 2021) Federal Tax Base Used as Relation to Federal Starting Point to Calculate STATE Internal Revenue Code State Taxable Income ALABAMA --- --- ALASKA no state income tax --- ARIZONA 1/1/20 adjusted gross income ARKANSAS --- --- CALIFORNIA 1/1/15 adjusted gross income COLORADO Current taxable income CONNECTICUT Current adjusted gross income DELAWARE Current adjusted gross income FLORIDA no state income tax --- GEORGIA 3/27/20 adjusted gross income HAWAII 3/27/20 adjusted gross income IDAHO 1/1/20 taxable income ILLINOIS Current adjusted gross income INDIANA 1/1/20 adjusted gross income IOWA Current adjusted gross income KANSAS Current adjusted gross income KENTUCKY 12/31/18 adjusted gross income LOUISIANA Current adjusted gross income MAINE 12/31/19 adjusted gross income MARYLAND Current adjusted gross income MASSACHUSETTS 1/1/05 adjusted gross income MICHIGAN Current (a) adjusted gross income MINNESOTA 12/31/18 adjusted gross income MISSISSIPPI --- --- MISSOURI Current adjusted gross income MONTANA Current adjusted gross income NEBRASKA Current adjusted gross income NEVADA no state income tax --- NEW HAMPSHIRE on interest & dividends only --- NEW JERSEY --- --- NEW MEXICO Current adjusted gross income NEW YORK Current adjusted gross income NORTH CAROLINA 5/1/20 adjusted gross income NORTH DAKOTA Current taxable income OHIO 3/27/20 adjusted gross income OKLAHOMA Current adjusted gross income OREGON 12/31/18 taxable income PENNSYLVANIA --- --- RHODE ISLAND Current adjusted gross income SOUTH CAROLINA 12/31/19 taxable income SOUTH DAKOTA no state income tax --- TENNESSEE on interest & dividends only --- TEXAS no state income tax --- UTAH Current adjusted gross income VERMONT 12/31/19 adjusted gross income VIRGINIA 12/31/19 adjusted gross income WASHINGTON no state income tax --- WEST VIRGINIA 12/31/19 adjusted gross income WISCONSIN 12/31/17 adjusted gross income WYOMING no state income tax --- DIST. -

Employment, Personal Income and Gross Domestic Product)

South Dakota e-Labor Bulletin February 2013 February 2013 Labor Market Information Center SD Department of Labor & Regulation How is South Dakota faring in BEA Economic Indicators? (Employment, Personal Income and Gross Domestic Product) From the January 2013 South Dakota e-Labor Bulletin Employment Data from BEA The U.S. Bureau of Economic Analysis (BEA) publishes employment data for state and local areas. The data includes an estimate of the total number of jobs, including both full- and part-time jobs and detailed by place of work. (Full- and part-time jobs are counted at equal weight.) Employees, sole proprietors and active partners are all included, but unpaid family workers and volunteers are not. Proprietors are those workers who own and operate their own businesses and are reported as either farm or nonfarm workers. The number of workers covered by unemployment insurance is a key component of the employment data published by the BEA and in information compiled by the U.S. Bureau of Labor Statistics (BLS). For more information regarding covered workers, see the South Dakota Covered Workers & Annual Pay 2011 Annual Summary on our website at www.sdjobs.org/lmic/menu_covered_workers2011.aspx. The chart on the following page shows annual employment change during the 2000-2011 period. Comparative data is included for the United States, South Dakota and the Plains Region (Iowa, Kansas, Missouri, Nebraska, North Dakota and South Dakota). (continued on next page) Page 1 of 23 South Dakota e-Labor Bulletin February 2013 For the 2010-2011 period, which reflects economic recovery, South Dakota attained a total employment growth rate of 1.2 percent, compared to a growth rate of 1.1 percent for the Plains Region and 1.3 percent for the nation. -

Iowa Personal Income and Wage/Salary Income

IOWA PERSONAL INCOME AND WAGE/SALARY INCOME Overview. Personal income includes wage and salary income and income earned through the operation of farms and other businesses, rent, interest, dividends, and government transfer income (Social Security, unemployment insurance, etc.). Iowa Wage and Salary Growth. Wage and salary income is a component of overall personal income. Over time, Iowa wage and salary income equals about 50.0% of total personal income. Wage and salary income is not as volatile as overall personal income. Since the end of the December 2007 U.S. recession in June 2009, annual Iowa wage and salary income growth has averaged about 3.2%. For the second quarter of calendar year (CY) 2021, wage and salary income increased 1.5% compared to the first quarter of CY 2021 and increased 11.2% compared to the same quarter of CY 2020. Iowa Personal Income Growth. Iowa personal income increased 1.3% for the second quarter of CY 2021 when compared to the same quarter of CY 2020. Income decreased 6.1% from the first quarter of CY 2021, due to a reduction in economic stimulus from the federal government. Personal income growth for the second quarter of CY 2020 was revised up to 11.9% from the originally released growth rate. Personal income growth is quite volatile over time, as is evident in Chart 2. In addition to quarterly volatility, reported personal income for Iowa suffers from significant revisions, usually related to changes in estimated farm income. Farm Proprietor Income. Since 2012, Iowa overall personal income has been growing more slowly than Iowa wage and salary income due to the decline in Iowa farm proprietor income. -

2021 Instructions for Form 6251

Note: The draft you are looking for begins on the next page. Caution: DRAFT—NOT FOR FILING This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information. Do not file draft forms and do not rely on draft forms, instructions, and publications for filing. We do not release draft forms until we believe we have incorporated all changes (except when explicitly stated on this coversheet). However, unexpected issues occasionally arise, or legislation is passed—in this case, we will post a new draft of the form to alert users that changes were made to the previously posted draft. Thus, there are never any changes to the last posted draft of a form and the final revision of the form. Forms and instructions generally are subject to OMB approval before they can be officially released, so we post only drafts of them until they are approved. Drafts of instructions and publications usually have some changes before their final release. Early release drafts are at IRS.gov/DraftForms and remain there after the final release is posted at IRS.gov/LatestForms. All information about all forms, instructions, and pubs is at IRS.gov/Forms. Almost every form and publication has a page on IRS.gov with a friendly shortcut. For example, the Form 1040 page is at IRS.gov/Form1040; the Pub. 501 page is at IRS.gov/Pub501; the Form W-4 page is at IRS.gov/W4; and the Schedule A (Form 1040/SR) page is at IRS.gov/ScheduleA. -

Tax Policy State and Local Individual Income Tax

TAX POLICY CENTER BRIEFING BOOK The State of State (and Local) Tax Policy SPECIFIC STATE AND LOCAL TAXES How do state and local individual income taxes work? 1/9 Q. How do state and local individual income taxes work? A. Forty-one states and the District of Columbia levy broad-based taxes on individual income. New Hampshire and Tennessee tax only individual income from dividends and interest. Seven states do not tax individual income of any kind. Local governments in 13 states levy some type of tax on income in addition to the state income tax. State governments collected $344 billion from individual income taxes in 2016, or 27 percent of state own-source general revenue (table 1). “Own-source” revenue excludes intergovernmental transfers. Local governments—mostly concentrated in Maryland, New York, Ohio, and Pennsylvania—collected just $33 billion from individual income taxes, or 3 percent of their own-source general revenue. (Census includes the District of Columbia’s revenue in the local total.) TABLE 1 State and Local Individual Income Tax Revenue 2016 Revenue (billions) Percentage of own-source general revenue State and local $376 16% State $344 27% Local $33 3% Source: Urban-Brookings Tax Policy Center, “State and Local Finance Initiative Data Query System.” Note: Own-source general revenue does not include intergovernmental transfers. Forty-one states and the District of Columbia levy a broad-based individual income tax. New Hampshire taxes only interest and dividends, and Tennessee taxes only bond interest and stock dividends. (Tennessee is phasing its tax out and will completely eliminate it in 2022.) Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not have a state individual income tax.