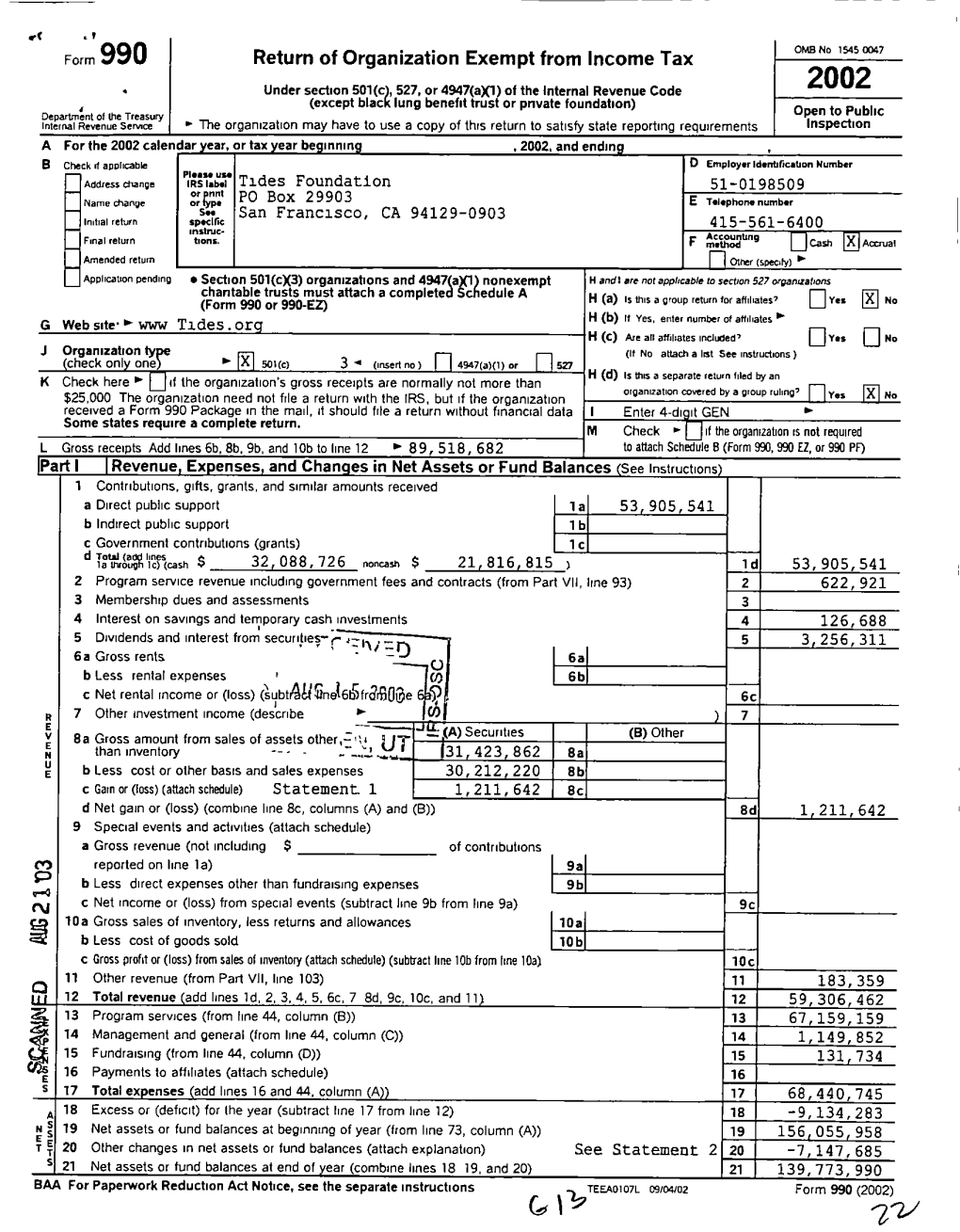

Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WARN Report Summary by Received Date 07/01/2019 - 06/30/2020 State Fiscal Year No

WARN Report Summary by Received Date 07/01/2019 - 06/30/2020 State Fiscal Year No. Of Notice Date Effective Date Received Date Company City County Employees Layoff/Closure 06/10/2020 06/09/2020 06/30/2020 Harbor Bay Club, Inc Alameda Alameda County 80 Layoff Temporary 03/20/2020 03/20/2020 06/30/2020 MD2 Industries, LLC Long Beach Los Angeles County 109 Closure Temporary 06/30/2020 08/21/2020 06/30/2020 NBCUniversal Media, LLC - Digital Lab Unit Universal City Los Angeles County 28 Layoff Temporary 04/22/2020 06/22/2020 06/30/2020 House of Blues Anaheim Anaheim Orange County 8 Closure Temporary 06/29/2020 08/01/2020 06/30/2020 ADESA California, LLC dba ADESA/AFC Los Mira Loma Riverside County 71 Layoff Permanent Angeles 06/17/2020 06/17/2020 06/30/2020 K&N Engineering, Inc. Riverside Riverside County 44 Layoff Permanent 06/29/2020 07/28/2020 06/30/2020 Benchmark Arrowhead, LLC dba Lake Lake Arrowhead San Bernardino County 114 Layoff Permanent Arrowhead Resort and Spa 06/18/2020 07/06/2020 06/30/2020 HOWMET Aerospace Fontana San Bernardino County 75 Layoff Temporary 06/18/2020 06/16/2020 06/30/2020 Bahia Resort Hotel San Diego San Diego County 47 Layoff Permanent 06/18/2020 06/16/2020 06/30/2020 Catamaran Resort Hotel and Spa San Diego San Diego County 46 Layoff Permanent 06/18/2020 06/16/2020 06/30/2020 The Lodge Torrey Pines La Jolla San Diego County 84 Layoff Permanent 06/18/2020 06/18/2020 06/30/2020 Bahia Resort Hotel San Diego San Diego County 33 Layoff Temporary 06/18/2020 06/18/2020 06/30/2020 Catamaran Resort Hotel and Spa San Diego San Diego County 33 Layoff Temporary 06/18/2020 06/18/2020 06/30/2020 The Lodge Torrey Pines La Jolla San Diego County 37 Layoff Temporary 06/08/2020 03/30/2020 06/30/2020 SmartCareMD Escondido San Diego County 38 Layoff Permanent 06/29/2020 08/31/2020 06/30/2020 Stryker Employment Company Menlo Park San Mateo County 33 Layoff Permanent 06/29/2020 08/29/2020 06/30/2020 Nitto, Inc. -

Faculty Research, Scholarship, and Creative Activity 2017

STATE UNIVERSITY OF NEW YORK AT FREDONIA FACULTY RESEARCH, SCHOLARSHIP, AND CREATIVE ACTIVITY 2017 fredonia.edu/academicaffairs STATE UNIVERSITY OF NEW YORK AT FREDONIA FACULTY RESEARCH, SCHOLARSHIP, AND CREATIVE ACTIVITY 2017 TABLE OF CONTENTS A MESSAGE FROM THE PRESIDENT .........................4 A MESSAGE FROM THE PROVOST ...........................5 COLLEGE OF EDUCATION ....................................6 CURRICULUM AND INSTRUCTION ................................... 7 LANGUAGE, LEARNING, AND LEADERSHIP ........................... 8 COLLEGE OF LIBERAL ARTS AND SCIENCES ................ 10 BIOLOGY .............................................................. 11 CHEMISTRY AND BIOCHEMISTRY ................................... 13 COMMUNICATION DISORDERS AND SCIENCES ..................... 14 COMMUNICATION .................................................... 14 COMPUTER AND INFORMATION SCIENCES ......................... 16 ENGLISH .............................................................. 17 HISTORY .............................................................. 18 MATHEMATICAL SCIENCES ........................................... 19 PHILOSOPHY ........................................................ 20 PHYSICS ............................................................... 21 POLITICS AND INTERNATIONAL AFFAIRS ........................... 22 PSYCHOLOGY ....................................................... 23 SOCIOCULTURAL AND JUSTICE SCIENCES ......................... 25 COLLEGE OF VISUAL AND PERFORMING ARTS .............26 MUSIC -

Cherrypy Documentation Release 3.3.0

CherryPy Documentation Release 3.3.0 CherryPy Team August 05, 2016 Contents 1 What is CherryPy? 1 2 What CherryPy is NOT? 3 3 Contents 5 3.1 Why choose CherryPy?.........................................5 3.2 Installation................................................6 3.3 CherryPy License (BSD).........................................8 4 Tutorial 9 4.1 What is this tutorial about?........................................9 4.2 Start the Tutorial.............................................9 5 Programmer’s Guide 35 5.1 Features.................................................. 35 5.2 HTTP details............................................... 66 6 Deployment Guide 79 6.1 Applications............................................... 79 6.2 Servers.................................................. 79 6.3 Environment............................................... 87 7 Reference Manual 91 7.1 cherrypy._cpchecker ....................................... 91 7.2 cherrypy._cpconfig ........................................ 92 7.3 cherrypy._cpdispatch – Mapping URI’s to handlers...................... 94 7.4 cherrypy._cprequest ....................................... 96 7.5 cherrypy._cpserver ........................................ 101 7.6 cherrypy._cptools ........................................ 103 7.7 cherrypy._cptree ......................................... 105 7.8 cherrypy._cpwsgi ......................................... 107 7.9 cherrypy ................................................ 108 7.10 cherrypy.lib............................................... -

Pipenightdreams Osgcal-Doc Mumudvb Mpg123-Alsa Tbb

pipenightdreams osgcal-doc mumudvb mpg123-alsa tbb-examples libgammu4-dbg gcc-4.1-doc snort-rules-default davical cutmp3 libevolution5.0-cil aspell-am python-gobject-doc openoffice.org-l10n-mn libc6-xen xserver-xorg trophy-data t38modem pioneers-console libnb-platform10-java libgtkglext1-ruby libboost-wave1.39-dev drgenius bfbtester libchromexvmcpro1 isdnutils-xtools ubuntuone-client openoffice.org2-math openoffice.org-l10n-lt lsb-cxx-ia32 kdeartwork-emoticons-kde4 wmpuzzle trafshow python-plplot lx-gdb link-monitor-applet libscm-dev liblog-agent-logger-perl libccrtp-doc libclass-throwable-perl kde-i18n-csb jack-jconv hamradio-menus coinor-libvol-doc msx-emulator bitbake nabi language-pack-gnome-zh libpaperg popularity-contest xracer-tools xfont-nexus opendrim-lmp-baseserver libvorbisfile-ruby liblinebreak-doc libgfcui-2.0-0c2a-dbg libblacs-mpi-dev dict-freedict-spa-eng blender-ogrexml aspell-da x11-apps openoffice.org-l10n-lv openoffice.org-l10n-nl pnmtopng libodbcinstq1 libhsqldb-java-doc libmono-addins-gui0.2-cil sg3-utils linux-backports-modules-alsa-2.6.31-19-generic yorick-yeti-gsl python-pymssql plasma-widget-cpuload mcpp gpsim-lcd cl-csv libhtml-clean-perl asterisk-dbg apt-dater-dbg libgnome-mag1-dev language-pack-gnome-yo python-crypto svn-autoreleasedeb sugar-terminal-activity mii-diag maria-doc libplexus-component-api-java-doc libhugs-hgl-bundled libchipcard-libgwenhywfar47-plugins libghc6-random-dev freefem3d ezmlm cakephp-scripts aspell-ar ara-byte not+sparc openoffice.org-l10n-nn linux-backports-modules-karmic-generic-pae -

NASDAQ Stock Market LLC (“Nasdaq Exchange”), a Subsidiary of the Nasdaq Stock Market, Inc

July 31, 2006 Nancy M. Morris, Esq. Secretary US Securities and Exchange Commission 100 F Street, NE Washington, DC 20549 RE: Request for Relief from § 12 of the Securities Exchange Act of 1934 Dear Ms. Morris: On January 13, 2006, the Securities and Exchange Commission (“SEC” or “Commission”) approved the application of The NASDAQ Stock Market LLC (“Nasdaq Exchange”), a subsidiary of The Nasdaq Stock Market, Inc. (“Nasdaq”), to register under Section 6 of the Securities Exchange Act of 1934 (“Act” or “Exchange Act”) as a national securities exchange.1 Nasdaq’s transition of its listing and trading activities to the Nasdaq Exchange will further Congress’s instruction to promote “fair competition . between exchange markets.”2 Absent the relief requested herein, however, Nasdaq’s transition to a national securities exchange would require approximately 3,200 Nasdaq Global Market3 and Capital Market issuers with securities registered pursuant to the Act, or exempt from registration under Section 12(g) of the Act,4 to file registration statements5 to register those securities under Section 12(b) of the Act.6 1 Securities Exchange Act Release No. 53128 (January 13, 2006), 71 FR 3550 (January 23, 2006) (the “Exchange Approval Order”). 2 Exchange Act Section 11A(a)(1)(C)(ii). 3 Effective July 1, 2006, Nasdaq renamed the Nasdaq National Market as the Nasdaq Global Market and created a new segment within the Global Market called the Global Select Market. References to the Nasdaq Global Market include those securities listed on the Nasdaq Global Market and the Nasdaq Global Select Market. See Securities Exchange Act Release No. -

Genesisgenethe Quarterly Magazine of St

GENESISGENEThe Quarterly Magazine of St. Ignatius College Preparatory,S San Francisco,I SummerS 2018 GENESIS A Report to Concerned Individuals Volume 55, Number 2, Summer 2018 Administration Rev. Edward A. Reese, S.J. President Mr. Patrick Ruff Principal Mr. Joseph A. Vollert ’84 Vice President for Advancement Mr. Ken Stupi ’78 Vice President, Finance & Administration Below: Director Ted Curry ’82 staged Legally Blonde for the spring musical. Top, from left: The Ms. Marielle Murphy Bos ’93 Director of Advancement Spring Pops Concert, the Cabaret performance and the Spring Dance Concert rounded out the season of performing arts at SI. Photos by Ariel ’02 & Sam Soto-Suver of Bowerbird Photography. Editorial Staff Mr. Paul J. Totah ’75 Director of Communications Ms. Anne Stricherz Sports Editor Mrs. Nancy Hess ’05 Layout & Design Jesuit Community Rev. John T. Mitchell, S.J. ’58 Superior Brother Douglas Draper, S.J. Minister GENESIS (USPS 899-060) is published quarterly by St. Ignatius College Preparatory, 2001 37th Avenue, San Francisco, CA 94116-1165. Periodicals Postage Paid at San Francisco, CA, and at additional mailing offices. POSTMASTER: Send address changes to GENE SIS, 2001 37th Avenue, San Francisco, CA 94116-1165. CONTACT US: You can send an e-mail to [email protected] or reach us at (415) 731-7500, ext. 5206. You can also read the issue on our website at www.siprep.org/genesis. ST. IGNATIUS, mindful of its mission to be witness to the love of Christ for all, admits students of any race, color and national and/or ethnic origin to all the rights, privileges, programs and activities generally accorded to or made available to students at this school. -

Network Notebook

Network Notebook Summer Quarter 2017 (July - September) A World of Services for Our Affiliates We make great radio as affordable as possible: • Our production costs are primarily covered by our arts partners and outside funding, not from our affiliates, marketing or sales. • Affiliation fees only apply when a station takes three or more programs. The actual affiliation fee is based on a station’s market share. Affiliates are not charged fees for the selection of WFMT Radio Network programs on the Public Radio Exchange (PRX). • The cost of our Beethoven and Jazz Network overnight services is based on a sliding scale, depending on the number of hours you use (the more hours you use, the lower the hourly rate). We also offer reduced Beethoven and Jazz Network rates for HD broadcast. Through PRX, you can schedule any hour of the Beethoven or Jazz Network throughout the day and the files are delivered a week in advance for maximum flexibility. We provide highly skilled technical support: • Programs are available through the Public Radio Exchange (PRX). PRX delivers files to you days in advance so you can schedule them for broadcast at your convenience. We provide technical support in conjunction with PRX to answer all your distribution questions. In cases of emergency or for use as an alternate distribution platform, we also offer an FTP (File Transfer Protocol), which is kept up to date with all of our series and specials. We keep you informed about our shows and help you promote them to your listeners: • Affiliates receive our quarterly Network Notebook with all our program offerings, and our regular online WFMT Radio Network Newsletter, with news updates, previews of upcoming shows and more. -

Professor, Department of Broadcast and Electronic Communication Arts

ABBREVIATED CURRICULUM VITAE MICHELLE A. WOLF Professor, Department of Broadcast and Electronic Communication Arts San Francisco State University 1600 Holloway Avenue San Francisco, California 94132 415/338-1334 [office] 415/648-1810 [home] [email protected] Education PhD in Communication-Mass Communication Theory, The University of Texas at Austin, 1984. Dissertation: How children process the production and narrative conventions of television. MA in Communication Theory and Mass Communication Studies, University of Massachusetts at Amherst, 1979. PROFESSIONAL ACHIEVEMENT AND GROWTH Publications Wolf, M. A., Krakow-Schulte, M., & Taff, R. (2012). Women with physical disabilities, body image, media, and self-conception. In R. A. Lind (Ed.), Race/Gender/Media: Considering diversity across audiences, content, and producers (3rd ed.) (pp. 50-56). New York, NY: Allyn & Bacon. Ibrahim, D., & Wolf, M. A. (2011). Television news, Jewish youth, and self-conception. In S. D. Ross & P. M. Lester (Eds.), Images that injure: Pictorial stereotypes in the media (3rd ed.). (2011). Westport, CT: Greenwood Publishing Group. Wolf, M. A., Decelle, D., & Nichols, S. 2009. Body image, mass media, self-concept. In R. A. Lind (Ed.), Race/gender/media: Considering diversity across audiences, content and producers (2nd ed.) (pp. 36-44). Boston, MA: Allyn & Bacon. Wolf, M. A. & Briley, K. 2007. Negotiating body image. In Nowakj, A, Abel, S., & Ross, K. (Eds.). Rethinking media education: Critical pedagogy and identity politics (pp. 131-148). Cresskill, NJ: Hampton Press. Wolf, M. A., & Ibrahim, D. (2110). The impact of television news on identity construction and self-conception of Jewish Diaspora. In [add editors] Images that injure: Pictorial stereotypes in the media (3rd ed.) (2010). -

Spring Python - Reference Documentation

Spring Python - Reference Documentation Version 1.0.1.BUILD-20101109171136 Copyright © 2006-2009 Greg Turnquist Copies of this document may be made for your own use and for distribution to others, provided that you do not charge any fee for such copies and further provided that each copy contains this Copyright Notice, whether distributed in print or electronically. Table of Contents Preface................................................................................................................................................ 1.Overview........................................................................................................................................ 1.1.KeyFeatures.........................................................................................................................1 1.2.WhatSpringPythonisNOT .................................................................................................. 2 1.3.Support.................................................................................................................................2 1.3.1.ForumsandEmail ......................................................................................................2 1.3.2.IRC ...........................................................................................................................2 1.4.Downloads/SourceCode ......................................................................................................2 1.5.Licensing..............................................................................................................................3 -

Download Monsignor Quixote Penguin Classics Pdf Book By

Download Monsignor Quixote Penguin Classics pdf ebook by Graham Greene You're readind a review Monsignor Quixote Penguin Classics book. To get able to download Monsignor Quixote Penguin Classics you need to fill in the form and provide your personal information. Ebook available on iOS, Android, PC & Mac. Gather your favorite ebooks in your digital library. * *Please Note: We cannot guarantee the availability of this ebook on an database site. Book Details: Original title: Monsignor Quixote (Penguin Classics) Series: Penguin Classics 224 pages Publisher: Penguin Classics; First Edition Thus edition (September 30, 2008) Language: English ISBN-10: 0143105523 ISBN-13: 978-0143105527 Product Dimensions:5.1 x 0.6 x 7.8 inches File Format: PDF File Size: 11665 kB Description: When Father Quixote, a local priest of the Spanish village of El Toboso who claims ancestry to Cervantes’ fictional Don Quixote, is elevated to the rank of monsignor through a clerical error, he sets out on a journey to Madrid to purchase purple socks appropriate to his new station. Accompanying him on his mission is his best friend, Sancho, the Communist... Review: This particular novel was chosen by the Spirituality Book Group at my church. It had been recommended by the Rector. We are in the process of discussing it thoroughly over a period of time. We are particularly enjoying the discussions between Fr Quixote and the former local communist mayor, whom he calls Sancho, about the spirit of Christianity and... Book File Tags: monsignor quixote pdf, graham greene pdf, -

Writing Great Documentation

Writing Great Documentation Jacob Kaplan-Moss [email protected] Photo by Alexandru Ilie2012 - http://flic.kr/p/pMp415 Co-BDFL Director of Security My premise: great documentation drives adoption. Python web: 2004 Albatross Nevow Spark Aquarium PSE Spyce Cheetah PSP Twisted CherryPy Pyroxide Wasp Cymbeline Quixote Webware Enamel SkunkWeb Zope Python web: 2014 Albatross Nevow Spark Aquarium PSE Spyce Cheetah PSP Twisted CherryPy Pyroxide Wasp Cymbeline Quixote Webware Enamel SkunkWeb Zope 81 121,000 lines of English In Search of Lost Time 1,500,000 Django 566,000 Infinite Jest 484,000 New Testament 180,000 Your first manuscript 60,000 “The documentation and community are second to none.” “[W]e’ve found that people …can get up-to-speed relatively quickly thanks to the excellent documentation…” “Django … provides an excellent developer experience, with great documentation and tutorials…” “Our initial choice … was based on the strength of the Django community and documentation…” “Productive development, good documentation, flexibility, and it just works.” “Wow, if the documentation is this good, the product must be awesome!” Why do people read documentation? Why do people read documentation? Who should write documentation? Why do people read documentation? Who should write documentation? What should we document? Why do people read documentation? Who should write documentation? What should we document? First contact - new users. First contact - new users. Education - new & existing users. First contact - new users. Education - new & existing users. Support - experienced users. First contact - new users. Education - new & existing users. Support - experienced users. Troubleshooting - annoyed users. First contact - new users. Education - new & existing users. Support - experienced users. -

Annual Report 2001-2002

Global Community Global Justice TIDES FOUNDATION Annual Report 2001/2002 TIDES FOUNDATION Tides Foundation actively promotes change toward a healthy society—one founded on principles of social justice, equal economic Our Vision ] opportunity, a robust democratic process and environmental sustainability. We believe healthy societies rely fundamentally upon respect for human rights, the vitality of communities and a celebration of diversity. Tides Foundation partners with donors to increase and organize resources for social change. Our Mission ] We facilitate effective grantmaking programs, create opportunities for learning, and build community among donors and grantees. As a public charity, we strengthen community-based nonprofit organizations and the progressive movement by providing an innovative and cost-effective Our Method ] framework for your philanthropy. We bring together people, resources and vision through Tides donor advised funds, Tides Initiatives, funding collaboratives, gatherings and learning opportunities, family foundation and institutional management services, comprehensive and customized program services and more. cover and back photos: Sebastião Salgado/Amazonas Images Table of Contents Letter from the Executive Director 2 Global Community, Global Justice: 2001 International Highlights 3 Tides Foundation Partner Highlight: Urgent Action Fund for Women’s Human Rights 6 Tides Foundation Initiatives: Building a Progressive Philanthropic Community 8 International Giving with Tides Foundation 10 Values. Vision. Strategy: Tides Philanthropic Services 12 Board of Directors 14 Staff 15 Information for Grantseekers 17 2001 Grants List 17 2001 Financial Statements 28 [ Global Community, Global Sustainability, Global Justice “In this year’s annual The world did seem to change during the past 12 months. report, we are going to Most generations believe that their particular era is a time of great change and import.