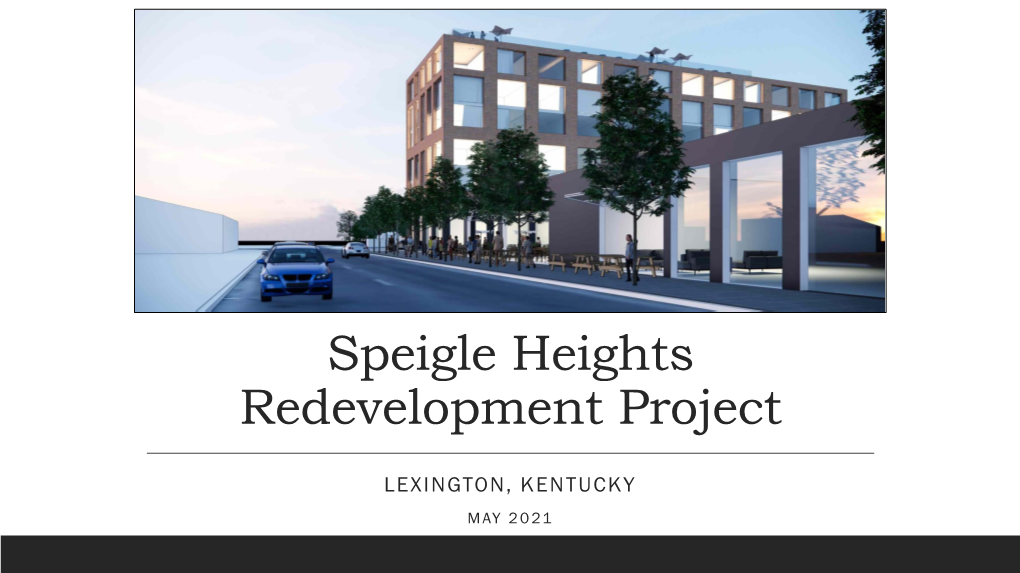

Speigle Heights Redevelopment Project

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

June 2021 | Volume Xxix, Issue Vi

BUSINESS FOCUS \\\ OFFICIAL PUBLICATION OF COMMERCE LEXINGTON INC. | JUNE 2021 | VOLUME XXIX, ISSUE VI POLICY OVER LUNCH Congressman Barr to Address Business Community July 8th - See Page 10 INSIDE THIS ISSUE: Commerce Lex. Among Top Economic Development Groups Nationally Leadership Central Kentucky 2021-22 Applications Due by June 14th Nominate a Small Business for the 2021 Salute to Small Business Awards www.CommerceLexington.com BUSINESS FOCUS June 2021: Volume XXIX, Issue VI INSIDE THIS ISSUE: ECONOMIC DEVELOPMENT: Association of Chamber of Commerce Executives 4-5 Commerce Lex. Among Top E.D. Groups Nationally 2016 Chamber Investment Promotion Agencies Work Toward Recovery of the Year Manufacturers’ Network Group to Meet In-Person STAT: Lexington Among Best Cities for College Grads Business Focus is published once a month for a total of 12 issues per year by Commerce Lex- ington Inc., 330 East Main Street, Suite 100, SMALL BUSINESS ASSISTANCE: Lexington, KY 40507. Phone: (859) 226-1600. LFUCG’s Small Business Economic Recovery Grants 6 2021 Chair of the Board: Ray Daniels, President Equity Solutions Group EVENTS: Publisher: 10-11 Register Now for Austin, Texas Leadership Visit Robert L. Quick, CCE, President & CEO Policy Over Lunch Features Congressman Andy Barr Commerce Lexington Inc. Emerging Leaders of the BG Continues Programming Editor: Mark E. Turner Communications Specialist: Liz Bennett CONNECT: Printing: Post Printing 12-15 Leadership Central Kentucky Visits Clark County Mail Service: SouthEast Printing & Mailing Service, LLC (2610 Palumbo Drive) Leadership Lexington Economic Development Day Leadership Central Kentucky Applications Due June 14 Subscriptions are available for $12 and are in- Welcome New Commerce Lexington Inc. -

Who's Hiring in Kentucky Report

Updated: 8/17/2021 Who’s Hiring in Kentucky Report May - Current ↻ denotes a Fair Chance Employer. Any stipulations are listed. AGRICULTURE Fayette County Godolphin, LLC – Lexington o Groom o Full time | 2 positions available Apply by emailing resume to [email protected] Shadwell Farm, LLC – Lexington o Nightwatch / Security o Full time | 2 positions available DMV check - Background check Apply by emailing resume to [email protected] Graves County Pilgrim’s – Mayfield ↻ o Hourly Production o Full time | 100 positions available Apply online at https://www.pilgrims.com/pilgrims-jobs/ or in person at 2653 State Route 1241, Hickory, KY 42051 Pilgrim’s – Mayfield o Class A CDL Driver o Full time | 2 positions available Apply online at https://www.pilgrims.com/pilgrims-jobs/ COMMERCIAL/RESIDENTIAL CLEANING Boone County Updated: 8/17/2021 Sanitech – Florence ↻ o Night Janitor/Porter (6pm-2am) o Full time | 2 positions available No theft-related offenses Apply online at https://www.indeed.com/jobs?q=night%20porter&l&vjk=47ca63ecde9feb03&advn=946004867 7932545 o Delivery Driver (Weekday Shifts) o Full time, Part time | 1 position available No theft-related offenses Apply online at https://www.indeed.com/viewjob?cmp=Sanitech- LLC&t=Delivery%20Driver&jk=87002410dedb8729&sjdu=QwrRXKrqZ3CNX5W- O9jEveSQZ7GKHDhe4DOKT4RZwSnzh1HVV5M0LD3NNiH1LBS3u-zJhnsU1iAiJLIKLQgzsxHr6q6or- lOuzndkYPZzpA&tk=1fb77c6rkt5m5800&adid=368673228&ad=- 6NYlbfkN0AJgkCHOwHGkZ9TNzIT2kC4mm5P8F3Y9ewbWxgM82K3cJ9UFl1UbPyCgjo4KMCxYYyR 1nBz6o82Run1e12e_FZ7-IMHWIn2tLbQjCMlW7koHKJrHx_GM- -

CITY CENTER Term Sheet

A Development of The Webb Companies and The Greer Companies THE OFFICES AT CITY CENTER April 2, 2020 TERM SHEET Ken Michul Executive Vice President, Brokerage and Leasing 250 West Main Street, Suite 3000 (859) 281-5632 Direct Dial www.thewebbcompanies.com [email protected] 1 AN OPPORTUNITY TO: JOIN A COMMUNITY / RIDE TO WORK / GET OUTSIDE / WALK TO LUNCH / ENJOY DOWNTOWN Offices at City Center Lobby Offices at City Center 2 THE INTERSECTION OF ENERGY, ACTIVITY, CULTURE, AND ART Fifth Third Pavilion Historic Courthouse- Breeders’ Cup • Across from 21c Museum Hotel • Located in the heart of downtown • Proximity to the vibrant Fifth Third Pavilion at Cheapside, which offers a large range of programming and events throughout the year including Farmer’s Market and Thursday Night Live • 40 + restaurants and retail offerings within walking distance • Located in the center of Lexington’s professional, financial, hospitality and entertainment district • Steps from Limestone Hall at the Historic Courthouse • State of the art Proof Fitness Center • 365 room Hyatt Regency • 300 room Hilton • Rupp Arena at Central Bank Center • Central Bank Center • Lexington Visitors Center ….. Proof Fitness 3 TRANSPORTATION Rupp Arena at Central Bank Center University of Transylvania Distillery District Keeneland Jefferson Street WALK Kentucky University 24 min 126 min 15 min 14 min 18 min 1.2 miles 6.3 miles 0.7 miles 0.7 miles 0.9 miles University of Transylvania Distillery District Keeneland Jefferson Street BIKE Kentucky University 7 min 35 min 8 min 4 min 6 min 1.2 miles 6.3 miles 0.9 miles 0.7 miles 0.9 miles University of Airport Keeneland I-75 Jefferson Street CAR Kentucky 14 min 16 min 6 min 9 min 4 min 5.9 miles 6.3 miles 1.1 miles 3.9 miles 0.9 miles 4 SURROUNDING AMENITIES . -

March 2020 | Volume Xxviii, Issue Iii

BUSINESS FOCUS \\\ OFFICIAL PUBLICATION OF COMMERCE LEXINGTON INC. | MARCH 2020 | VOLUME XXVIII, ISSUE III Join Us for Opportunity Exchange on March 19th [SEE PAGE 11] INSIDE THIS ISSUE: 2020 International Trip Features Imperial Russia September 3 - 11 Summer Youth Job Training Program Gearing Up for 2020 Legislative Session Update www.CommerceLexington.com BUSINESS FOCUS March 2020: Volume XXVIII, Issue III INSIDE THIS ISSUE ECONOMIC DEVELOPMENT: Association of Chamber of Commerce Executives 4 Fresh Bourbon Distilling Co. to Create 25 Jobs 2016 Chamber Richmond, Kentucky Economic Development Tour of the Year STAT: Attracting Talent for the Future of Business Business Focus is published once a month for a total of 12 issues per year by Commerce Lex- PUBLIC POLICY: ington Inc., 330 East Main Street, Suite 100, Lex- 6 Legislative Session Update: Lawmakers Focused on ington, KY 40507. Phone: (859) 226-1600. Crafting State Budget 2020 Chair of the Board: Ray Daniels, President Equity Solutions Group EVENTS: 8-13 @330 Series: Propel Your Business to the Next Level Publisher: Robert L. Quick, CCE, President & CEO Pella Windows & Doors Hosts Business Link April 22 Commerce Lexington Inc. Forcht Bank Presents EMERGE Conference March 4th Next Opportunity Exchange Event is March 19th Editor: Mark E. Turner 2020 International Trip Features Imperial Russia Communications Specialist: Liz Bennett Printing: Post Printing Austin Leadership Visit is May 11-13, 2020 Mail Service: SouthEast Printing & Mailing 2020 Annual Dinner Recap and Photos Service, LLC (2610 Palumbo Drive) Subscriptions are available for $12 and are in- cluded as a direct benefit of Commerce Lexing- CONNECT: ton Inc. membership. -

2019 Annual Report Working to Strengthen Every Community We Serve

2019 ANNUAL REPORT WORKING TO STRENGTHEN EVERY COMMUNITY WE SERVE. Central Bank & Trust Co. • Central Insurance Services • Central Investment Center, Inc. OUR SENSE OF COMMUNITY IS AS STRONG INSIDE OUR BANK AS OUTSIDE OF IT. In 2020, the Kentucky Chamber of Commerce and the Kentucky Society for Human Resource Management (KYSHRM) named Central Bank one of the Best Places to Work in Kentucky – for the 13th time. The competition encourages and motivates Kentucky-based companies to improve their workplace environments, resulting in improved profi tability and employee satisfaction. MISSION STATEMENT The mission of Central Bancshares is to become Kentucky’s leading, high-performing, community banking company by empowering our staff to deliver consistently superior service and value to our customers, shareholders and communities. We will be successful because Central Bankers are our greatest resource and our most sustainable advantage. CONTENTS Financial Highlights 1 Consolidated Statements of Comprehensive Income 16 Community 2 Consolidated Statements of Changes Letter to our Shareholders, Customers and Communities 4 in Shareholders’ Equity 16 Management’s Discussion and Analysis of Financial Consolidated Statements of Cash Flows 17 Condition and Results of Operations 6 Notes to Consolidated Financial Statements 18 Independent Auditor’s Report 13 Boards of Directors 44 Consolidated Balance Sheets 14 O f fi c e r s 4 6 Consolidated Statements of Income 15 Refer to Marketing for copies: Central Bank & Trust Co., 300 West Vine Street, Lexington, -

Marketing Flyer

The Offices at City Center FOR LEASE Share the excitement of Downtown! 100 West Main Street Lexington, Kentucky 40507 • 9 floors 146,361 rentable square feet of Class A office space + Luxury residential condominiums on the top 3 floors of the 12 story Offices at City Center tower • Marriott Hotel with 218 rooms and 5,000 square feet of meeting & event space • Residence Inn by Marriott with 119 guest suites + Infinity, a rooftop restaurant and bar • Proximity to the vibrant Fifth Third Pavilion, which offers a large range of programming and events throughout the year including Thursday Night Live and Lexington Farmers Market • 40 + restaurants, hotels and retail offerings within walking distance • Located in the center of Lexington’s professional, financial, hospitality Full-service Leases and entertainment district Annual Base Rental Rate starting at $27.50/RSF Office suites starting at 2,500± rentable square feet. Ken Michul, Principal Broker Executive Vice President 250 West Main Street, Suite 3000 Lexington, Kentucky 40507 (859) 253-0000 [email protected] www.thewebbcompanies.com The information herein is deemed to be accurate, but is not warranted. Price and availability are subject to change at any time without notice. Other terms and conditions may apply. The Offices at City Center FOR LEASE Share the excitement of Downtown! 100 West Main Street Lexington, Kentucky 40507 • Jeff Ruby’s Steakhouse • Keeneland Mercantile • Starbucks • 700-space onsite below ground parking garage • Nearby Proof Fitness • Across from 21c Museum -

March 2021 | Volume Xxix, Issue Iii

BUSINESS FOCUS \\\ OFFICIAL PUBLICATION OF COMMERCE LEXINGTON INC. | MARCH 2021 | VOLUME XXIX, ISSUE III Full Day of Professional Development Dynamic Keynotes Panel Discussions OPENING KEYNOTE: Denise Hamilton TUESDAY, MARCH 9th KEYNOTE SPEAKER: Justin Patton www.EmergeLexington.com INSIDE THIS ISSUE: Legislative Session Update @330 Series Presents “Mindset” Over Matter in Difficult Situations Winner’s Circle Campaign Concludes Member Mixers Help You Make Valuable Connections www.CommerceLexington.com BUSINESS FOCUS March 2021: Volume XXIX, Issue III INSIDE THIS ISSUE: ECONOMIC DEVELOPMENT: Association of Chamber of Commerce Executives 4 CLX E.D. Team Tours UK’s Cornerstone Project 2016 Chamber STAT OF THE MONTH: Unemployment Rates of the Year Business Focus is published once a month for PUBLIC POLICY: a total of 12 issues per year by Commerce Lex- 5-6 Central KY Legislative Day Provides Issue Updates ington Inc., 330 East Main Street, Suite 100, Lexington, KY 40507. Phone: (859) 226-1600. 2021 Kentucky Legislative Session Update 2021 Chair of the Board: Ray Daniels, President EVENTS: Equity Solutions Group Winner’s Circle Campaign Recap 8-11 Publisher: Schedule is Set for 2021 EMERGE on March 9th Robert L. Quick, CCE, President & CEO @330: “Mindset” Over Matter in Difficult Situations Commerce Lexington Inc. Emerging Leaders of the BG: March Lex Leader Talk Editor: Mark E. Turner Melia Realty Group Presents Upcoming Member Mixers Communications Specialist: Liz Bennett Printing: Post Printing Mail Service: SouthEast Printing & Mailing CONNECT: Service, LLC (2610 Palumbo Drive) 12-15 Leadership Central KY Studies Fayette County Issues Subscriptions are available for $12 and are in- Leadership Lexington Health & Human Services Day cluded as a direct benefit of Commerce Lexing- AMBASSADOR SPOTLIGHT: Luca Setti ton Inc. -

Vine Center Office Tower Term Sheet

333 West Vine Street VINE CENTER OFFICE TOWER April 8, 2020 TERM SHEET Ken Michul Executive Vice President, Brokerage and Leasing 250 West Main Street, Suite 3000 (859) 281-5632 Direct Dial www.thewebbcompanies.com [email protected] AN OPPORTUNITY TO: JOIN A COMMUNITY / RIDE TO WORK / GET OUTSIDE / WALK TO LUNCH / ENJOY DOWNTOWN THE INTERSECTION OF ENERGY, ACTIVITY, CULTURE, AND ART The Offices at City Center • Proximate to the new City Center mixed use development • Location in the heart of downtown • 35+ restaurants and retail offerings within walking distance • Across from Cheapside Park and home of the local Farmer’s Market and Thursday Night Live and offering a wide range of programming and events throughout the year • Historic Courthouse redevelopment • Central Bank and Trust Company • 6 hotels within walking distance ….. TRANSPORTATION University of Transylvania Distillery District Jefferson Street WALK Kentucky University 16 min 15 min 12 min 10 min University of Transylvania Distillery District Jefferson Street BIKE Kentucky University 5 min 13 min 3 min 4 min 0.8 miles 1.8 miles 0.5 miles 0.6 miles University of Airport I-75 Keeneland Kentucky CAR 13 min 6 min 9 min 13 min 5.8 miles 1.2 miles 3.8 miles 6.1 miles SURROUNDING AMENITIES .. RESTAURANT, RETAIL AND HOTEL HIGHLIGHTS WITHIN 1/2 MILE ON-SITE AND NEARBY AMENITIES • On-site Republic Bank and Trust Company • Pedway connection to the state-of-the-art Proof Fitness Center with men’s and women’s locker rooms each equipped with sauna and showers • Pedway connection to Hilton Downtown, Hyatt, The Square, Rupp Arena at Central Bank Center , Central Bank, Lexington Financial Center and more • Attached 470 space parking garage VINE CENTER OFFICE TOWER Term Sheet April 8, 2020 Building Ownership: MCV II, LLC (“Landlord”) Managing and Leasing The Webb Companies Agent: 250 West Main Street, Suite 3000 Lexington, Kentucky 40507 Building Profile: 333 West Vine Street, Lexington, KY 40507 consisting of 242,024 ± rentable square feet (“rsf”) of Class A office space on 18 floors (“Building”). -

2021 State of Downtown Report

STATE OF 2021 DOWNTOWN POSITIONED TO REBOUND 6.23.2021 | LexLive Presented by Republic Bank POSITIONED TO REBOUND STUDY AREA This is the third year that the State of Downtown Report has been prepared by the Downtown Lexington Partnership (DLP) with support from the Downtown Lexington Management District (DLMD). The report presents benchmarks of key economic indicators on the health of downtown and includes trends and comparisons. As you might expect, downtown’s health was significantly impacted bythe effect of the COVID-19 pandemic and the necessary social distancing restrictions. This will be seen in some of the benchmarks that we historically present. To bolster these traditional benchmarks, utilizing the Survey Monkey platform, DLP conducted two non-scientific surveys in May 2021. The first survey was of downtown street level merchant, bars, hospitality and food service businesses. The second one surveyed commercial office tenants. The goal was to assess the pandemic’s effect on downtown businesses, where businesses are currently and what businesses are planning for the next 12 months. Accordingly, the surveys asked respondents about three different time periods: y During Pandemic (March – December 2020) y Emerging from Pandemic (January – May 2021) y Post Pandemic (Next 12 months) More than 50 businesses participated in the survey. The report provides results and analysis of the surveys as well as related analysis of parking occupancies. In whole, the set of data in the State of Downtown Report shows that downtown was significantly affected by the pandemic but is well positioned to rebound and, in fact, has shown signs that recovery is already in progress by what businesses report since January 2021 and what they plan on doing in the next 12 months. -

Making Progress Despite the Pandemic

Lexington-Fayette Urban County Government OFFICE OF THE MAYOR Linda Gorton Mayor Jan. 26, 2021 Contact: Susan Straub Craig Cammack Office: 859-258-3111 Office: 859-258-3117 Cell: 859-576-2564 Cell: 859-608-7911 State of the City/County Making progress despite the pandemic By Mayor Linda Gorton Thank you, Liz. Councilmembers and citizens of Lexington. Because of COVID-19 safety measures, I’m here today in the Government Center, speaking to you through a live broadcast, rather than holding an in-person event. Thank you to the members of the Lexington Forum for continuing your tradition of sponsoring this speech, and congratulations to the winners of the Forum’s awards that were presented earlier. Normally at this time I would recognize our Councilmembers. This year they’re here on Zoom. It has been a really challenging year to be a councilmember. Zoom meetings are a poor substitute for in- person meetings. We all know we have to meet virtually to be safe, but we sure don’t have to like it. Although our Councilmembers could not attend in person today, I still want to recognize each of them, including four new members: Vice Mayor Steve Kay Council member-at-Large Richard Moloney Council member-at-Large Chuck Ellinger First District Councilmember James Brown 1 2 Second District Josh McCurn Third District Hannah LeGris, one of our new members Fourth District Susan Lamb A second new member, Fifth District Liz Sheehan Another new face, Sixth District Councilmember David Kloiber Seventh District Preston Worley Eighth District Fred Brown New Councilmember number four, the Ninth District’s Whitney Baxter Tenth District Amanda Mays Bledsoe Eleventh District Jennifer Reynolds and 12th District Councilmember Kathy Plomin. -

Who's Hiring in Kentucky Report

Updated: 8/31/2021 Who’s Hiring in Kentucky Report May - Current ↻ denotes a Fair Chance Employer. Any stipulations are listed. AGRICULTURE Fayette County Godolphin, LLC – Lexington o Groom o Full time | 2 positions available Apply by emailing resume to [email protected] Shadwell Farm, LLC – Lexington o Nightwatch / Security o Full time | 2 positions available DMV check - Background check Apply by emailing resume to [email protected] Graves County Pilgrim’s – Mayfield ↻ o Hourly Production o Full time | 100 positions available Apply online at https://www.pilgrims.com/pilgrims-jobs/ or in person at 2653 State Route 1241, Hickory, KY 42051 Pilgrim’s – Mayfield o Class A CDL Driver o Full time | 2 positions available Apply online at https://www.pilgrims.com/pilgrims-jobs/ COMMERCIAL/RESIDENTIAL CLEANING Boone County Updated: 8/31/2021 Sanitech – Florence ↻ o Night Janitor/Porter (6pm-2am) o Full time | 2 positions available No theft-related offenses Apply online at https://www.indeed.com/jobs?q=night%20porter&l&vjk=47ca63ecde9feb03&advn=946004867 7932545 o Delivery Driver (Weekday Shifts) o Full time, Part time | 1 position available No theft-related offenses Apply online at https://www.indeed.com/viewjob?cmp=Sanitech- LLC&t=Delivery%20Driver&jk=87002410dedb8729&sjdu=QwrRXKrqZ3CNX5W- O9jEveSQZ7GKHDhe4DOKT4RZwSnzh1HVV5M0LD3NNiH1LBS3u-zJhnsU1iAiJLIKLQgzsxHr6q6or- lOuzndkYPZzpA&tk=1fb77c6rkt5m5800&adid=368673228&ad=- 6NYlbfkN0AJgkCHOwHGkZ9TNzIT2kC4mm5P8F3Y9ewbWxgM82K3cJ9UFl1UbPyCgjo4KMCxYYyR 1nBz6o82Run1e12e_FZ7-IMHWIn2tLbQjCMlW7koHKJrHx_GM- -

Lexington Financial Center for LEASE Share the Excitement of Downtown! 250 West Main Street Lexington, Kentucky 40507

Lexington Financial Center FOR LEASE Share the excitement of Downtown! 250 West Main Street Lexington, Kentucky 40507 Within a short walk to: • Major Hotels and Office Buildings • Rupp Arena at Central Bank Center • Central Bank Center • Great Restaurants • The Courthouse District • City Hall • Triangle Park & Phoenix Park • Lexington Public Library • Downtown Lofts • Historic Residential Neighborhoods • The Square • Fifth Third Pavilion Available Space: 2,648 ± rsf located on the 25th floor. 11,577 ± rsf located on the 22nd floor. 718-7,847 ± rsf located on the 19th floor. 1,475 ± rsf located on the 11th floor. 11,570 ± rsf located on the 6th floor. 11,318 ± rsf located on the 5th floor. 1,119 ± rsf located on the 1st floor. Annual Base Rental Rate starting at $20.95/RSF Ken Michul, Principal Broker Executive Vice President 250 West Main Street, Suite 3000 Lexington, Kentucky 40507 (859) 253-0000 [email protected] www.thewebbcompanies.com The information herein is deemed to be accurate, but is not warranted. Price and availability are subject to change at any time without notice. Other terms and conditions may apply. Lexington Financial Center FOR LEASE Share the excitement of Downtown! 250 West Main Street Lexington, Kentucky 40507 Other Amenities: • On-site building management & security • Professional quality finishes • Ideal for technology and insurance companies, banks, governmental agencies, accounting and law firms • Proof on Main state of the art fitness center on-site • Adjoining covered parking structure • Pedway connection to Rupp Arena at Central Bank Center, area hotels and major office buildings • Equipped to meet today’s electrical and internet needs • Full Service Leases • Spectacular views • Prestigious tenant mix Ken Michul, Principal Broker Executive Vice President 250 West Main Street, Suite 3000 Lexington, Kentucky 40507 (859) 253-0000 [email protected] www.thewebbcompanies.com The information herein is deemed to be accurate, but is not warranted.