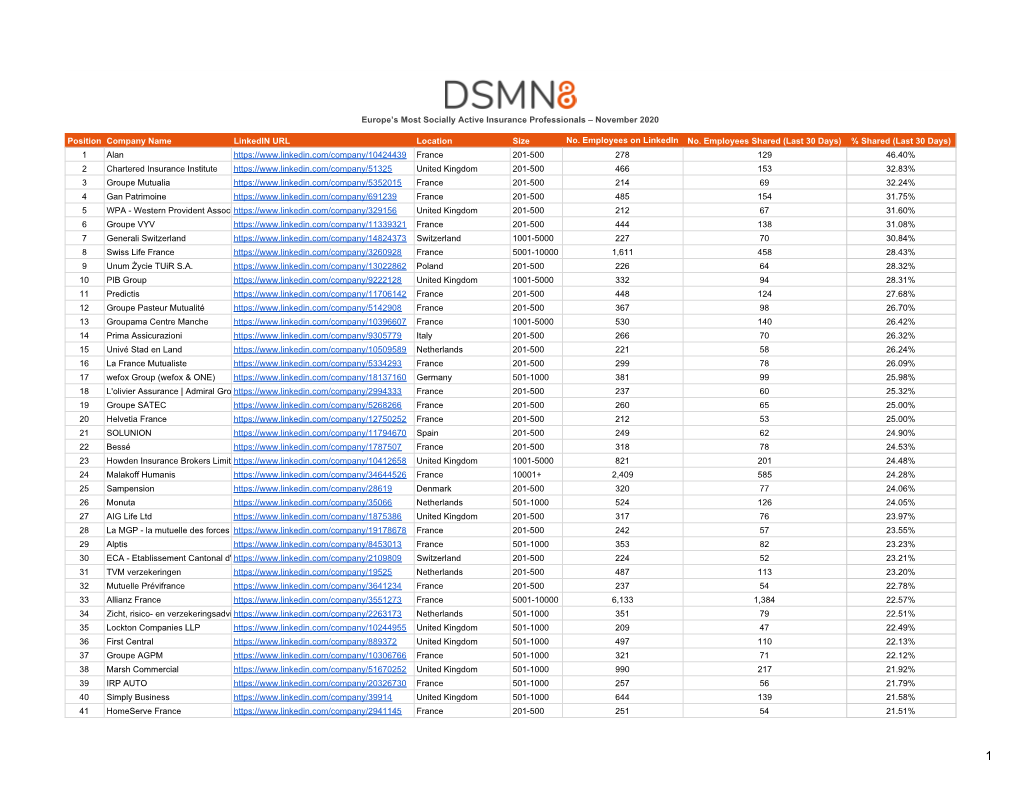

Most Socially Active Professionals

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Eea Authorised Insurers As Compiled by the Bank of England As at 01 October 2020

LIST OF EEA AUTHORISED INSURERS AS COMPILED BY THE BANK OF ENGLAND AS AT 01 OCTOBER 2020 Non-Life Class of Business Life Class of Business Reinsurance Accident & Motor vehicle Fire and other Marine, aviation General liability Credit and Other Classes Life and annuity Marriage and Linked long Permanent Tontines Capital Pension fund Collective Social Life Non-Life Sickness liability and damage to and railway suretyship birth term health redemption management insurance insurance other motor property rolling stock vehicle Firm Name Country of Inc. Directive Branch / Service insurance 1 & 2 3, 7 & 10 8 & 9 4, 5, 6, 7, 11 & 13 14 & 15 16, 17 & 18 I II III IV V VI VII VIII IX 12 Belfius Assurances BELGIUM Solvency II Directive S X - - - - - - X - X - - - - - - - - HSBC ASSURANCES VIE FRANCE Solvency II Directive S - - - - - - - X - X - - X - - - - - ''Bulgarian Export Insurance Agency'' / BAEZ / EAD BULGARIA Solvency II Directive S - - - - - X X - - - - - - - - - - - AA Underwriting Insurance Company Limited GIBRALTAR Solvency II Directive S - X X - X - - - - - - - - - - - - - Abeille Assurances FRANCE Solvency II Directive S - X X X X - - - - - - - - - - - - - Acadia International Insurance dac IRELAND Solvency II Directive S - X X X X - X - - - - - - - - - - - Acasta European Insurance Company Limited GIBRALTAR Solvency II Directive S X - X - X X X - - - - - - - - - - - Accelerant Insurance Limited MALTA Solvency II Directive S X X X X X X X - - - - - - - - - - - Accredited Insurance (Europe) Ltd MALTA Solvency II Directive B X X X X X X X - - - - - - - - - - - Accredited Insurance (Europe) Ltd MALTA Solvency II Directive S X X X X X X X - - - - - - - - - - - Ace Europe Life SE FRANCE Solvency II Directive B X - - - - - - X - - - - - - - - - - Ace Europe Life SE FRANCE Solvency II Directive S X - - - - - - X - - - - - - - - - - Achmea Schadverzekeringen N.V. -

Annual Report 2009 ERGO Insurance Group

ERGO 48 (50022335) GROUP ANNUAL REPORT 2009 REPORT GROUP ANNUAL Overview of ERGO Insurance Group 2009 2008 Change previous year (%) Total premiums € million 19,050 17,711 7.6 Gross premiums written € million 17,470 16,578 5.4 Expenses for claims and benefits € million 16,114 13,893 16,0 Investment result € million 4,401 2,871 53.3 Result before impairment losses of goodwill € million 734 929 – 21.0 Consolidated result € million 173 73 135.6 Investments € million 113,277 108,191 4.7 Technical provisions (net) € million 109,197 101,809 7.3 Equity € million 3,857 3,568 8.1 Full-time representatives 21,963 21,709 1.2 Salaried employees 33,152 31,508 5.2 Group earnings per share in accordance with IFRS € 2.14 0.76 183.0 Dividend per share € 0.60 –– With premium income of € 19bn, ERGO is one of the ERGO has the right sales channel for every client: major insurance groups in Europe. Worldwide, ERGO almost 22,000 self-employed full-time insurance agents, is represented in more than 30 countries and concen- staff working in direct sales, as well as insurance bro- trates on Europe and Asia. In Europe, ERGO is no. 1 in kers and strong cooperation partners – both in Ger- the health and legal expenses insurance segments, many and abroad – look after clients. In addition, and is among the market leaders in its home market of ERGO maintains a far-reaching sales partnership with Germany. More than 50,000 people work for the Group, the major European bank UniCredit Group, both in either as salaried employees or as full time self- Germany as well as in Central and Eastern Europe. -

Corporate Responsibility Report 2010/2011

MUNICH RE CORPORATE RESPONSIBILITY Contents Page Strategy and challenges 2 Statement by the CEO 4 Guiding concept and mission 5 Fields of action and objectives 6 Milestones 8 Stakeholder dialogue 12 Challenges 14 Management 20 Responsible corporate governance 21 Sustainable investments 29 Responsibility towards staff 36 Our environmental awareness 50 Solutions 58 Strategic approach 59 Reinsurance 60 Primary insurance 67 Munich Health 72 Asset management 75 Commitments 77 New corporate citizenship concept 78 Focal areas – Investing in the future 79 Foundations – Making a difference 85 Facts and figures 89 About the corporate responsibility portal 90 Key performance indicators 91 GRI and Global Compact Communication on Progress 99 SRI-Indices and awards 134 Partnerships, initiatives and foundations 136 MUNICH RE Corporate Responsibility Contact Privacy Statement Legal Notice Imprint CORPORATE RESPONSIBILITY MUNICH RE STRATEGY AND CHALLENGES MANAGEMENT SOLUTIONS COMMITMENT FACTS AND FIGURES Corporate Responsibility in Figures STRATEGY AND CHALLENGES Munich Re is committed to its corporate responsibility. To ensure that we meet 28,000 this commitment, responsible action is a mainstay of our strategy, firmly ingrained in our organisation, and thus addresses the major challenges of our More than 28,000 entries are time. » more tracked within NatCatSERVICE, our collection of natural catastrophe database. » more STATEMENT BY THE CEO CURRENT NEWS Quick Links » Statement by the CEO EARNING TRUST 08.08.2011 » Guiding concept and mission Project cooperation on corporate responsibility » A forward-looking and responsible approach has Sustainable investments between Munich University of Applied » been focused by Munich Re for many years. Responsibility towards staff Sciences and Munich Re » Corporate Responsibility is and has always been Foundations » an integral part of Munich Re’s Group strategy. -

Computer Lnsurance Company NAIC Group Code.....0, 0 NAIC Gompany Code

r pflil nr rulililllil ryfllll|lü llrürJryil ilil !ilflil ilry QUARTERLY STATEMENT As of June 30, 2018 of the Condition and Affairs of the Computer lnsurance Company NAIC Group Code.....0, 0 NAIC Gompany Code..... 34711 Employe/s lD Number..... 05-0443418 (CunentPeriod) (Prior Period) OrganÞed underthe Laws of Rl State of Domicile or Port of Entry Rl Country of Domicile US lncorporated/Organized...,. January 1, 1989 Commenced Business..... July 1, 1989 Statutory Home Offtce ' 222 Jeffenon Boulevard, Suite 200.. Wanrvick.. Rl .. .. 02888 (&reet and llunber) þiA u Town, State, Country and Zip Code) Main Administrative Office 76 St. PaulStreet, Ste 500 .. Burlington .. W., .. 802-2644708 (Street and Number) (City u Town, &ab, Courtry and Z¡p Code) (Arca Code) (Telephone Number) Mail Address 76 St. Paul Street, Ste 500 .. Burlington .. W.. .. (&rcd aú llunberu P. O. Box) (City uToun, State, Cawfiy andZip Code) Primary Loætion of Books and Records 76 St. Paul Street, Ste 500 .. Burlington .. W .. .. 802-2644708 (&rcet and lluntr,r) (City u Town, $raÞ, Comtry and Zip Code) (Area Code) (Tel@rone Nunba) lntemet Web Site Address Statutory Statement Contact Shayne Millette 802-2644708 (Name) (Area Code) (felephone Nunbel @rtension) Shayne.Millette@aon. com 802-860-0440 (E lúail Address) (Fax Number) OFFICERS I'lame ïifle ilame Tiflè 1. Kenneth Kuhn # Vice President & Treasurer 2. David Brune # Chief Executive Officer & President 3. Angela Homm # Vice Præident & Chief Financial 4. Laura Hoensch # Genenal Counsel & Secretary Officer OTHER Andrew Rear # Chairman Stacey Eisenbraun # Vice President Mark Van Emburyh # Vice President Paul Wolfe # Vice President lgnacio Rivera # Assistant Secretary DIRECTORS OR TRUSTEES David Brune # Laura Hoensch # Ançla Homm # Andreas Kleiner # Kenneth Kuhn # Andrew Rear # Stateof....... -

Emerging-Risks-In-The-EU-The-Insurance-Market.Pdf

Public Disclosure Authorized 2019 Public Disclosure Authorized Emerging Risks in the EU – The Insurance Market Public Disclosure Authorized BACKGROUND INFORMATION AND DATA Public Disclosure Authorized FINANCE, COMPETITIVENESS & INNOVATION | EUROPE AND CENTRAL ASIA REGION Contents1 EUROPEAN SUPERVISORY BODIES ................................................................................................................ 2 European Insurance and Occupational Pensions Authority (EIOPA) ........................................................ 2 European Systemic Risk Board (ESRB) ...................................................................................................... 2 SUPERVISION AT THE EU LEVEL .................................................................................................................... 3 Insolvency ................................................................................................................................................. 4 Insurance Guarantee Schemes ................................................................................................................. 5 INSURANCE ASSOCIATIONS .......................................................................................................................... 6 International Association of Insurance Supervisors (IAIS) ........................................................................ 6 International Bureau of Assurance and Reassurances (BIPAR) ................................................................ 6 Global Federation -

Program Information ING Bank N.V

Program Information ING Bank N.V. 1 PROGRAM INFORMATION Type of Information: Program Information Date of Filing: 29 March 2016 Company Name: ING Bank N.V. (the "Issuer" or "ING Bank") Name and Title of Representative: B.M. Iserief, Head of Long Term Funding Address of Registered Office: Bijlmerplein 888 1102 MG Amsterdam Zuid-Oost, The Netherlands Telephone: +31(20)541 8722 Liaison Contact: Attorney-in-Fact: Eiichi Kanda, Attorney-at-law Toshifumi Kajiwara, Attorney-at-law Clifford Chance Law Office (Gaikokuho Kyodo Jigyo) Address: Akasaka Tameike Tower, 6th Floor 17-7, Akasaka 2-Chome Minato-ku, Tokyo 107-0052 Telephone: 81-3-5561-6600 Type of Securities: Senior Bonds (the "Bonds") Expected Issuance Period: 30 March 2016 to 29 March 2017 Maximum Outstanding Issuance JPY 400,000,000,000 Amount: Address of Publication Website: http://www.jpx.co.jp/equities/products/tpbm/announcement/index .html Submission Status of Annual Yes Securities Reports or Issuer Filing Information: Notes to Investors 1. TOKYO PRO-BOND Market is a market for professional investors, etc. and bonds and other instruments listed on the market ("Listed Bonds") may involve a higher investment risk. Investors should act with responsibility and be aware of the listing qualification, timely disclosure requirements that apply to issuers of Listed Bonds in the TOKYO PRO-BOND Market and associated risks such as the fluctuation of market prices. Prospective investors should make an investment judgment only after having carefully considered the contents of this Program Information. 2. The regulatory framework for TOKYO PRO-BOND Market is different in certain fundamental respects from the regulatory framework applicable to existing exchange markets in Japan. -

Analysis of the Insurance Market in the Netherlands 2019

Analysis of the insurance market in the Netherlands 2019 December 2020 _____ kpmg.nl General notes to the This document comprises an analysis of the insurance market in the Netherlands conducted by analysis of the insurance KPMG Financial Services. market in the Netherlands The data published by DNB on 30 September 2020 served as input for the analysis. The DNB data comprise the QRT statements of all insurers in the Netherlands supervised by DNB for the years 2016-2019. Reader’s guide for SCR calculations Below you will find information on the SCR calculations. The following calculations were used: — Market risk, counterparty default risk, life, health or non- Contact life underwriting risk, intangible asset risk divided by the BSCR -/- diversification (100%) — Diversification divided by the BSCR -/- diversification If you have any questions about the analysis or would like to (100%) receive a personalised version, please contact — Operational risk divided by the SCR (100%) Ton Reijns (email: [email protected]). — LACDT divided by the BSCR plus operational risk Appendices: I. Our support II. Antitrust, confidentiality and conflicts of interests © 2020 KPMG Advisory N.V. All rights reserved. Analysis of the insurance market in the Netherlands in 2019 | 2 Contents 1. Key trends 4 2. Overview of the insurance market in the Netherlands 5 3. The non-life insurance market in the Netherlands 7 4. The life insurance market in the Netherlands 11 5. The health insurance market in the Netherlands 18 6. Outlook to the future 24 © 2020 KPMG Advisory N.V. All rights reserved. Analysis of the insurance market in the Netherlands in 2019 | 3 Key trends Insurance market - Life Non-life Health general — The number of insurers supervised — Limited changes in numbers of — Limited change in numbers of — Limited changes in players and by DNB in the Netherlands players. -

Italy Travel Insurance Market by Insurance Cover

+44 20 8123 2220 [email protected] Italy Travel Insurance Market By Insurance Cover (Single-Trip Travel Insurance, Annual Multi-Trip Travel Insurance, and Long-Stay Travel Insurance), Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Insurance Aggregators), Distribution Mode (Business- to-Business (B2B), Business-to-Consumer (B2C), and Business-to-Business-to-Consumer (B2B2C), and End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, and Others): Opportunity Analysis and Industry Forecast, 2020–2027 https://marketpublishers.com/r/I28412A7ABCEN.html Date: July 2020 Pages: 134 Price: US$ 3,649.00 (Single User License) ID: I28412A7ABCEN Abstracts Travel insurance covers the cost incurred due to any problematic incidents while traveling. It includes trip cancellation losses, loss of baggage, medical treatment of patients, and loss of travel documents, evacuation, or deportation during an emergency, and other unavoidable conditions. In the coming years, the Italy travel insurance market is projected to grow at a significant rate owing to its low penetration rate and increase in the tourism industry. In addition, Italy is a unitary parliamentary republic in Europe, therefore demand for travel & tourism largely takes place in the country. The growth of the Italy travel insurance market is largely attributed to the growth in trends for availing travel insurance as a prerequisite for obtaining Visa in the country. In addition, depending on coverages, travel insurance providers in the country offer different plans by covering costs and losses associated with traveling. Further, several intermediaries in distribution channel such as insurance aggregators, banks, insurance Italy Travel Insurance Market By Insurance Cover (Single-Trip Travel Insurance, Annual Multi-Trip Travel Insur.. -

Deelnemers Materieel Per 1 Januari 2014 Goede Versie

Deelnemers buitengerechtelijke kosten materieel Deelnemer Algemene Motorrijtuigen Rechtsbijstand Aansprakelijkheid ABN AMRO Schadeverzekering N.V. X X X ARAG ACE Insurance S.A.-N.V. X X Achmea Schadeverzekering N.V. X X X St. Achmea RB (label) Interpolis Schade N.V. X X X Stichting RB (label) Interpolis Agro X X (label) Onderlinge Verzekeringen Overheid u.a. (OVO) X (label) Sterpolis Schadeverzekeringen N.V. X X X St. Sterpolis RB AEGON Schadeverzekering N.V. X X X SRK AIG Europe (Netherlands) N.V. X X Allianz Nederland Schadeverzekering N.V. X X X Amlin Europe X X Anker Rechtshulp b.v. (per 19-6-2012) X Ansvar Verzekeringsmaatschappij N.V. X X 2014-00000151/EWENT (label) “Neerlandia van 1880”, N.V. Verzekering- X X Maatschappij ARAG Rechtsbijstand X a.s.r. verzekeringen X X X DAS Bovemij, Schadeverzekering-Maatschappij N.V. X X X Centramed, Onderlinge Waarborg Maatschappij B.A. X Chubb Insurance Company of Europe N.V. X X DAS Nederlandse Rechtsbijstand Verzekering Maatschappij X N.V. Delta Lloyd Schadeverzekeringen N.V. X X X DAS (label) Erasmus N.V., Schadeverzekering Maatschappij X X X ARAG (label) OHRA Schadeverzekeringen N.V. X X X DAS Europeesche Verzekering Maatschappij N.V. X X X DAS GENERALI schadeverzekering maatschappij nv X X X DAS Goudse Verzekeringsmaatschappij N.V. X X X SRK (Label) Zeeuwse Verzekeringen, De: o Algemene Zeeuwse verzekering maatschappij X X X o Onderlinge Zeeuwse SRK 2014-00000151/EWENT 2. X X HDI-Gerling Verzekeringen N.V. X X ING Insurance Services N.V. X X SRK Klaverblad Schadeverzekeringsmaatschappij N.V. -

ERGO Austria International AG and the Operational Insurance Company ERGO Versicherung AG Are Part of the International ERGO Group AG Based in Dusseldorf

ERGO Austria Group Profile Status May 2021 . Content ERGO Austria . 1 ERGO in Austria 3 2 Key Facts ERGO Austria 9 3 Corporate Strategy 13 4 Key Facts ERGO Group AG 16 2 ERGO in Austria . ERGO in Austria Overview . • The holding company ERGO Austria International AG and the operational insurance company ERGO Versicherung AG are part of the international ERGO Group AG based in Dusseldorf. • ERGO Versicherung offers Life, Health, Property & Casualty and Accident Insurance. • The main sales and cooperation partners of ERGO Austria are Bank Austria/UniCredit, Volksbanken, ERGO Vorsorgemanagement GmbH, our tied agents as well as agencies and brokers. • D.A.S. Rechtsschutz Versicherung is a member of ERGO Group AG and is also represented in Austria as well as a branch of ERGO Versicherung AG Germany for the industrial business. 4 ERGO in Austria Development of ERGO in Austria from 2007-2012 ERGO in Österreich 2007 - 2010 2011 2012 2009 • Foundation of ERGO • Relocation of all ERGO • Acquisition of minority • Rebranding of Victoria- Austria International AG companies to ERGO interests of Volksbank in Volksbanken Versicherung to • Increase of share in Bank Center in Vienna’s 11th Viktoria-Volksbanken ERGO Versicherung AG Versicherung Austria Versicherung up to district • Establishment of ERGO 90% Industrial as a branch of • Transfer of Victoria- ERGO Versicherung AG, Volksbanken Germany Versicherungsgesellschaf- ten shares to ERGO Austria 5 ERGO in Austria Development of ERGO in Austria from 2013-2015 . 2013 2014 2015 • Acquisition of Austrian- • Merger of ERGO Direkt • Sale of Victoria- based ERGO Direkt Lebensversicherung AG Volksbanken Lebensversicherung AG into ERGO Versicherung Pensionskassen AG and • Merger of Bank Austria AG Vorsorgekasse AG Versicherung into ERGO Versicherung AG 6 ERGO in Austria Development of ERGO in Austria from 2016-2020 . -

International Trade Risks

International Trade Risks (Credit Insurance and Opportunity for Non Life Insurance Market in India) There are risks and costs to a program of action, but they are far less than the long-range risks and costs of comfortable inaction - John .F. Kennedy NAME: Manjunath Reddy .M BATCH: Fall Winter 2005-2007 REFERENCE NO: BF05F033. FACULTY GUIDE: Prof. Tareque Laskar - 1 - ACKNOWLEDGEMENT I take this opportunity to thank all those people who helped me to complete the thesis. Firstly, I would like to thank Mr.Jayachandran, Dean, The Indian Institute of Planning and Management, Bangalore, who provided us the opportunity to carry out this project report. I take this opportunity to express my profound gratitude to Professor Mr. Tareque Laskar and Mr. Samuel Jesurathinam, who had initiated me into this project and also guided us from time to time to fulfill the same, I am thankful to them for their continuous help and constructive criticism throughout the project and in bringing out this thesis. I am grateful to my ever encouraging friends and family members, without their support I would not have been able to complete this thesis work. - 2 - THE INDIAN INSTITUTE OF PLANING AND MANAGEMENT BANGALORE CERTIFICATE OF GUIDANCE This is to certify that the project report entitled “Credit Insurance and Non life insurance market in India ” submitted by the following student of Indian Institute of Planning and Management, Bangalore has been carried out under my guidance. The matter presented is their original work and has been submitted to the college as part of partial fulfillment of their MBA degree. -

Corporate Structuresof of Independent Independent – Continued Insurance Adjusters, Adjusters Inc

NEW YORK PENNSYLVANIANEW YORK New York Association of Independent Adjusters, Inc. PennsylvaniaNew York Association AssociationCorporate of of Independent Independent Structures Insurance Adjusters, Adjusters Inc. 1111 Route 110, Suite 320, Farmingdale, NY 11735 1111 Route 110,110 Suite Homeland 320, Farmingdale, Avenue NY 11735 E-Mail: [email protected] section presents an alphabetical listing of insurance groups, displaying their organizational structure. Companies in italics are non-insurance entities. The effective date of this listing is as of July 2, 2018. E-Mail:Baltimore, [email protected] MD 21212 www.nyadjusters.org www.nyadjusters.orgTel.: 410-206-3155 AMB# COMPANY DOMICILEFax %: OWN 215-540-4408AMB# COMPANY DOMICILE % OWN 051956 ACCC HOLDING CORPORATION Email: [email protected] AES CORPORATION 012156 ACCC Insurance Company TX www.paiia.com100.00 075701 AES Global Insurance Company VT 100.00 PRESIDENT 058302 ACCEPTANCEPRESIDENT INSURANCE VICECOS INC PRESIDENT 058700 AETNA INC. VICE PRESIDENT Margaret A. Reilly 002681 Acceptance Insurance Company Kimberly LabellNE 100.00 051208 Aetna International Inc CT 100.00 Margaret A. Reilly PRESIDENT033722 Aetna Global Benefits (BM) Ltd Kimberly BermudaLabell 100.00 033652 ACCIDENT INS CO, INC. HC, INC. 033335 Spinnaker Topco Limited Bermuda 100.00 012674 Accident Insurance Company Inc NM Brian100.00 Miller WEST REGIONAL VP 033336 Spinnaker Bidco Limited United Kingdom 100.00 058304 ACMATVICE CORPORATION PRESIDENT 033337 Aetna Holdco (UK) LimitedEXECUTIVEWEST REGIONAL SECRETARYUnited Kingdom VP 100.00 050756 ACSTAR Holdings Inc William R. WestfieldDE 100.00 078652 Aetna Insurance Co Ltd United Kingdom 100.00 010607 ACSTARDavid Insurance Musante Company IL 100.00 091442 Aetna Health Ins Co Europe DAC WilliamNorman R.