Corporate Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

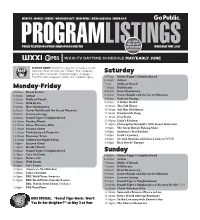

WXXI Program Guide | May 2021

WXXI-TV | WORLD | CREATE | WXXI KIDS 24/7 | WXXI NEWS | WXXI CLASSICAL | WRUR 88.5 SEE CENTER PAGES OF CITY PROGRAMPUBLIC TELEVISION & PUBLIC RADIO FOR ROCHESTER LISTINGSFOR WXXI SHOW MAY/EARLY JUNE 2021 HIGHLIGHTS! WXXI-TV DAYTIME SCHEDULE MAY/EARLY JUNE PLEASE NOTE: WXXI-TV’s daytime schedule listed here runs from 6:00am to 7:00pm. The complete prime time television schedule begins on page 2. Saturday The PBS Kids programs below are shaded in gray. 6:00am Mister Roger’s Neighborhood 6:30am Arthur 7vam Molly of Denali Monday-Friday 7:30am Wild Kratts 6:00am Ready Jet Go! 8:00am Hero Elementary 6:30am Arthur 8:30am Xavier Riddle and the Secret Museum 7:00am Molly of Denali 9:00am Curious George 7:30am Wild Kratts 9:30am A Wider World 8:00am Hero Elementary 10:00am This Old House 8:30am Xavier Riddle and the Secret Museum 10:30am Ask This Old House 9:00am Curious George 11:00am Woodsmith Shop 9:30am Daniel Tiger’s Neighborhood 11:30am Ciao Italia 10:00am Donkey Hodie 12:00pm Lidia’s Kitchen 10:30am Elinor Wonders Why 12:30pm Christopher Kimball’s Milk Street Television 11:00am Sesame Street 1:00pm The Great British Baking Show 11:30am Pinkalicious & Peterrific 2:00pm America’s Test Kitchen 12:00pm Dinosaur Train 2:30pm Cook’s Country 12:30pm Clifford the Big Red Dog 3:00pm Second Opinion with Joan Lunden (WXXI) 1:00pm Sesame Street 3:30pm Rick Steves’ Europe 1:30pm Donkey Hodie 2:00pm Daniel Tiger’s Neighborhood Sunday 2:30pm Let’s Go Luna! 6:00am Mister Roger’s Neighborhood 3:00pm Nature Cat 6:30am Arthur 3:30pm Wild Kratts 7:00am Molly -

MOLLY of DENALI Episode Descriptions and Curriculum Episodes #101-139

MOLLY OF DENALI Episode Descriptions and Curriculum Episodes #101-139 NOTE: EPISODE NUMBERS ARE NOT IN BROADCAST ORDER EPISODE 101: Grandpa’s Drum Molly finds an old photo of Grandpa as a child and is shocked to see him singing and drumming—Grandpa never sings. When Grandpa tells her he lost his songs when he gave his drum away, Molly goes on a mission to find his drum and return his songs to him. Curriculum: IT Learning Goals: To compare texts and integrate information across multiple textual sources when reading or researching (this could, but need not, lead to writing or developing a presentation). Molly and Tooey look at landmarks in a photo taken in the past and compare them to how the landmarks look in the present. To use a variety of language, navigational, structural, and graphical text features (like a photograph) to help access (read, listen to, and/or view) or convey (write, speak, and/or present, including visually) meaning (which vary depending upon the type of informational text). Graphical Feature: Photograph. Molly and Tooey examine an old photograph to find clues that help them discover what town the photograph was taken in. Social Studies: Collect and examine photographs of the past and compare with similar, current images. Classify events as belonging to past or present. Molly compares an old photograph to new images of towns in Alaska to discover what town the photograph was taken in. Alaska Native Value: Honoring your elders. Knowing who you are — you are an extension of your family. Continuing the practice of Native traditions. -

Thunderbird Entertainment Group Inc

Thunderbird Entertainment Group Inc. Management’s Discussion and Analysis For the three and nine months ended March 31, 2021 (“Q3 2021”) and March 31, 2020 (“Q3 2020”) GENERAL This Management’s Discussion and Analysis (“MD&A”) dated May 26, 2021 should be read in conjunction with the unaudited interim condensed consolidated financial statements of Thunderbird Entertainment Group Inc. (“Thunderbird” or “the Company”) for the three months ended March 31, 2021 and 2020 and accompanying notes which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB"). Thunderbird is a public company whose common voting shares are traded on the TSX Venture Exchange (“TSX-V”) under the ticker “TBRD” and the OTCQX® Best Market under the symbol “THBRF”. Unless otherwise indicated, all dollar amounts are expressed in thousands of Canadian dollars. FORWARD-LOOKING STATEMENTS Thunderbird’s public communications may include written or oral “forward-looking statements” and “forward- looking information” as defined under applicable Canadian securities legislation. All such statements may not be based on historical facts that relate to the Company’s current expectations and views of future events and are made pursuant to the “safe harbour” provisions of applicable securities laws. Forward-looking statements or information may be identified by words such as “anticipate”, “continue”, “estimate”, “expect”, “forecast”, “may”, “will”, “plan”, “project”, “should”, “believe”, “intend”, or similar expressions concerning matters that are not historical facts. These statements represent management’s current beliefs and are based on information currently available to management and inherently involve numerous risks and uncertainties, both known and unknown. -

Spring 2020 Newsletter

THE Wadhams Free Library Spring 2020 NEWS We’re reaching out to our library community to share some resources that may be useful or enjoyable - - and as a way to exchange ideas and give each other something else to think about. We hope that you and your loved ones are safe and well. Please contact us if we can help answer questions or provide resources. Have something you’d like to share? Call or e-mail us. 518-962-8717 [email protected] we’re so sorry to miss our Spring Sourdough Waffle & Frittata Extravaganza we look forward to seeing you when we can Please support our local businesses! If you can’t visit them now, consider buying a gift certificate. virus resources - here’s a place to start - there are many more - and remember to watch out for scams https://www.coronavirus.gov https://coronavirus.health.ny.gov/home https://www.co.essex.ny.us/Health/ a few of the many reading and information resources available online: https://cefls.org Clinton Essex Franklin Library System’s home page Click on the USE YOUR LIBRARY tab, then click on EBOOKS AND MORE or RESEARCH AND LEARNING TOOLS or KIDS & TEENS There’s a lot there to explore! https://www.myon.com myON digital reading resources for kids are free during the current school closures. Click login at the top of the screen. School name: New York Reads - Username: read - Password: books https://www.gutenberg.org/ free downloadable books Do you need your library card number and PIN in order to access e-books and other digital resources? Ask us! We’re expecting a delivery of new books and we’re thinking about how we might be able to hand out books - - separately! - - safely! - - cleanly! We’ll let you know what we come up with. -

Wskg Hdtv Daytime Condensed Guide

12:30pm Clifford The Big Red Adventure/Neighborhood Dog Nutcracker Things That Go Bump/Sherlock 10am Donkey Hodie Bones Growing The Ungrowdenia/Camp 1pm Let's Go Luna! Buddy Buddy A Prickly Pear/Turkish Delight 10:30am Elinor Wonders Why WSKG-HDTV 1:30pm Hero Elementary Backyard Soup/Colorful and Tasty A Leg Up / Sneezitis Solution 11am Sesame Street June 2021 2pm Nature Cat A Recipe for Dance Stop and Hear The 11:30am Pinkalicious & Peterrific DAYTIME Cicadas/Cold-Blooded Sweet Pea Pixie/Pink Piper condensed guide 2:30pm Odd Squad 12pm Dinosaur Train Other Olympia/Total Zeros Underwater Race/Buddy Wants to 3pm Wild Kratts Fly 1 Tuesday Cheeks The Hamster 12:30pm Clifford The Big Red 6am Ready Jet Go! 3:30pm Cyberchase Dog Just The Right Distance from the The Creech Who Would Be Coming Soon!/Fire Dog Tucker Sun/Solar Power Rover Crowned 1pm Let's Go Luna! 6:30am Arthur 4pm SciGirls Bob The Plant/Aren't We A Pair? Arthur Loses His Marbles/Friday Flower Power 1:30pm Hero Elementary The 13th 4:30pm Into The Outdoors Kite Delight / Little Lost Horse 7am Molly of Denali Plant Diversities 2pm Nature Cat Sap Season/Book of Mammoths 5pm Dishing with Julia Child Plants Got The Moves/Magnet 7:30am Wild Kratts The Potato Show Mania Cheeks The Hamster 5:30pm Samantha Brown's 2:30pm Odd Squad 8am Hero Elementary Places to Love Trials and Tubulations A Leg Up / Sneezitis Solution Quebec City, Canada 3pm Wild Kratts 8:30am Xavier Riddle and the 2 Wednesday Panda Power Up! Secret Museum 6am Ready Jet Go! 3:30pm Cyberchase I Am Albert Einstein/I Am Carol Souped-Up Saucer/Pet Sounds The Grapes of Plath Burnett 6:30am Arthur 4pm SciGirls 9am Curious George The Tattletale Frog/D.W. -

Thunderbird Entertainment Group Inc

Thunderbird Entertainment Group Inc. Management’s Discussion and Analysis For the three and six months ended December 31, 2019 (“Q2 2020”) and December 31, 2018 (“Q2 2019”) GENERAL This Management’s Discussion and Analysis (“MD&A”) dated February 27, 2020 should be read in conjunction with the unaudited interim condensed consolidated financial statements of Thunderbird Entertainment Group Inc. (“Thunderbird” or “the Company”) for the three and six months ended December 31, 2019 and 2018 and accompanying notes which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB"). Thunderbird is a public company whose common voting shares are traded on the TSX Venture Exchange (“TSX‐V”) under the ticker “TBRD”. Unless otherwise indicated, all dollar amounts are expressed in thousands of Canadian dollars. FORWARD‐LOOKING STATEMENTS Thunderbird’s public communications may include written or oral “forward‐looking statements” and “forward‐ looking information” as defined under applicable Canadian securities legislation. All such statements may not be based on historical facts that relate to the Company’s current expectations and views of future events and are made pursuant to the “safe harbour” provisions of applicable securities laws. Forward‐looking statements or information may be identified by words such as “anticipate”, “continue”, “estimate”, “expect”, “forecast”, “may”, “will”, “plan”, “project”, “should”, “believe”, “intend”, or similar expressions -

Children's Catalog

PBS KIDS MAKES AN IMPACT! Emotions & Social Skills Character Self-Awareness Literacy Math Science Source: Marketing & Research Resources, Inc. (M&RR,) January 2019 2 A Word From Linda Simensky, Head of Content at PBS KIDS “PBS KIDS characters are curious about the world and genuinely excited about discovery new things. They are positive role models that ask questions, investigate, and experience the fun of learning something new. Our stories engage kids with humor, surprise, and authentic situations that they find in their everyday lives. Interwoven are themes of inclusion, diversity, kindness, and exploration.” 3 Seven in ten children Research shows ages 2-8 watch PBS that PBS KIDS makes an in the U.S. – that’s impact on early † childhood 19 million children learning** * Source: Nielsen NPower, 1/1/2018--12/30/2018, L+7 M-Su 6A-6A TP reach, 50% unif., 1-min, LOH18-49w/c<6, LOH18-49w/C<6 Hispanic Origin. All PBS Stations, children’s cable TV networks ** Source: Hurwitz, L. B. (2018). Getting a Read on Ready to Learn Media: A Meta-Analytic Review of Effects on Literacy. Child Development. Dol:10.1111/cdev/f3043 † Source: Marketing & Research Resources, Inc. (M&RR), January 2019 4 Exploring Nature’s Ingenious Inventions This funny and engaging show follows a curious bunny named Facts: Elinor as she asks the questions in • Co-created by Jorge Cham and every child’s mind and discovers Daniel Whiteson, authors of We the wonders of the world around Have No Idea: A Guide to the her. Each episode encourages Unknown Universe and creators of children to follow their curiosity the podcast Daniel & Jorge Explain the Universe. -

TV & Radio Program Guide

TV & Radio Program Guide JUNE 2020 THIS MONTH BEECHAM HOUSE Sunday, June 14 @ 9 p.m. ICONIC WOMEN OF COUNTRY Tuesday, June 2 @ 7 p.m. PREHISTORIC ROAD TRIP Wednesday, June 17 @ 9 p.m. CONTENTS TV - KIDS ..............................................1 TV - CREATE ..................................... 3 TV - KAKM June 1 - 7 ............................................. 6 June 8 - 15 .......................................... 8 ON THE COVER June 16 - 22 ......................................10 June 23 - 30 .....................................12 BEECHAM HOUSE RADIO .................................................15 Sunday, June 14 @ 9 p.m. ABOUT ALASKA PUBLIC MEDIA Gurinder Chadha’s (Bend it Like Beckham) drama Beecham House is set in 19th century Delhi before the British ruled in that region. Tom Bateman steps into the role of John Beecham, a handsome former soldier who has purchased the mansion, Beecham House, to begin a new life. ICONIC WOMEN OF COUNTRY Tuesday, June 2 @ 7 p.m. Join Kathy Mattea, Trisha Yearwood, Wynonna Judd and more as they pay tribute Alaska Public Media harnesses the power to the legends who inspired them. From of multiple media platforms to make a Dolly to Tammy to Patsy to Loretta, this is an more informed and connected life possible intimate look at iconic female artists and their for all Alaskans. We produce and present timeless music. news and content that provides lifelong learning opportunities in public affairs, health and leisure, science and nature, PREHISTORIC ROAD TRIP economic and social development, civic Wednesday, June 17 @ 9 p.m. engagement and world events. Join host Emily Graslie on the road for a fun and fascinating journey around Located in Southcentral Alaska, we are the Dakotas, Montana, Wyoming and comprised of KSKA radio, KAKM-TV, Create Nebraska to explore 2.5 billion years of TV, PBS KIDS, and alaskapublic.org. -

NATIONAL GEOGRAPHIC CHANNEL Program Schedule July

Page 1 of 5 NATIONAL GEOGRAPHIC CHANNEL Program Schedule July (ET) 月曜日 2016/06/27 火曜日 2016/06/28 水曜日 2016/06/29 木曜日 2016/06/30 金曜日 2016/07/01 土曜日 2016/07/02 日曜日 2016/07/03 (ET) 4 04:00 Is It Real 3「Miracle 04:00 Car Sos III[Vive La 04:00 Doomsday Preppers 4 Cures」 Citroen] 2[Pain Is Good] 5 05:00 Sea Patrol 2「#7」 05:00 Supercar 05:00 Banged Up Abroad 7「#8 5 Megabuild[Aston Martin Black Palace of Horrors」 Vantage] 6 06:00 information 06:00 information 06:00 information 6 06:30 None of The 06:30 Monster Fish IV [Giant 06:30 Banged Up Abroad 9 Above[What Goes Up] Catfish] 「The Real Argo」 7 07:00 Animals Gone 7 Wild[Shock & Awe] 07:30 Highway Thru Hell 07:30 X: The Generation That 2[Suck It Up, Princess] Changed The World[Truth Be 8 08:00 Under World Inc. 2 Told] 8 「Organ Trade, The」 08:30 Car Sos II [Mg Miracle] 08:30 How To Win At Everything[#1] 9 09:00 information 09:00 None of The Above 9 Season 2[Blasts, Fire, And 09:30 Genius By Stephen 09:30 information 09:30 information Hawking 10 #6 10:00 Wicked Tuna: North Vs 10:00 Mine Kings 「Seven 10 South[From Rods To Riches] Sapphiresl」 10:30 Wwii's Greatest Raids[Mountain Massacre] 11 11:00 Banged Up Abroad 9 11:00 Big Fish, Texas「All Fish 11 「The Real Argo」 And No Play」 11:30 Blood Antiquities 12 12:00 Fearless Chef「Peru」 12:00 Genius By Stephen 12 Hawking 12:30 information #6 13 13:00 Air Crash Investigation 13:00 information 13:00 information 13 S13[Deadly Mission] 13:30 Mine Kings 「Dynamite 13:30 Search For The Head of Garnet」 John The Baptist 14 14:00 Air Crash Investigation 14 S13[Edge -

How to Make a Dog Sled Adventure Playset

1 How to Make a Dog Sled Adventure Playset Create your own dog sled adventure with Molly, Tooey, and Trini! Follow the steps on the next pages to make a dog sled out of paper, complete with dog team and passengers: Molly, Tooey, and Trini. Where will your imagination take them? Materials My dad races • Printouts of sled pieces, dog team, and passengers in the Iditarod. One day, I will too! • Crayons or markers • Scissors • Empty cereal box (or other heavy-weight paper or cardboard) • Glue or glue stick • Pencil • Tape • String or yarn Make Your Dog Sled 1. Color the sled pieces on page 3. 2. Cut the cereal box so that you have a piece of fl at cardboard. 3. Glue the printout with the sled pieces onto the printed side of the cereal box cardboard. Smooth out any bubbles. 4. Use the tip of a pencil to punch a hole in the dog sled where indicated. 5. When the glue is dry, cut out the sled, the brush bow, and the handlebar. 6. Fold up each side of the sled, with the colored sides facing out. 7. Use tape to attach the brush bow to the runners at the front of the sled. 8. Use tape to attach the handlebar to the top rail on each side of the sled. A dog sled is a sled pulled by specially trained dogs over ice or through snow. The Alaskan Husky is the most commonly used sled dog. Dog sleds come in many designs, shapes, and sizes. Traditionally, dog sleds have transported people and supplies and were a critical part of everyday life in the Arctic. -

Christopher Tyler Nickel Has Made a Name for Himself As a Successful Writer of Concert Music, Music for the Theatre, As Well As Film and Television Music

CChhrriiissttoopphheerr TTyyllleerr NNiiicckkeelll -- CCoommppoosseerr FFeeaattuurree FFiiilllmmss // TTVV MMoovviiieess THE CHRISTMAS AUNT 2020 Prod: Christian Bruyère Lifetime Television Dir: Tibor Takács THE STORY OF US 2019 Prod: Charles Cooper, Harvey Kahn, Sunta Izzicupo The Hallmark Channel, Front Street Pictures Dir: Scott Smith A WINTER PRINCESS 2019 Prod: T. Pehme, Kim C. Roberts. F. Szew, H. Pillemer The Hallmark Channel Dir: Allan Harmon COOKING WITH LOVE 2018 Prod: S. Battro, T. Berry, G. LaPlante, A. Licht, Reel One Ent., The Hallmark Channel R.M. Murphy, S. Stabler, Dir: Jem Garrard ROCKY MOUNTAIN CHRISTMAS 2017 Prod: Harvey Kahn, Michael G. Larkin Hallmark Movies & Mysteries Dir: Tibor Takács CHRISTMAS PRINCESS 2017 Prod: J. Schwartz, J. Ritchie, C. Harmon, I. Pincus, Really Real Films, Entertainment One J. Hamilton, R.D. Clemmer, Dir: Allan Harmon MOONLIGHT IN VERMONT 2017 Prod: Beth Grossbard, Harvey Kahn Crown Media Prods, The Hallmark Channel Dir: Mel Damski LOVE STRUCK CAFE 2017 Prod: Kim Arnott, Ivan Hayden, John Prince, Crown Media Prods, The Hallmark Channel Dir: Mike Robe A GIFT TO REMEMBER 2017 Prod: M. Futerman, A. Mancuso, G. LaPlante, Reel One Ent., The Hallmark Channel Dir: Kevin Fair THE CHRISTMAS CALENDAR 2017 Prod: Allan Harmon, Cynde Harmon, Jordan Ninkovich, Really Real Films, MarVista Entertainment Dir: Allan Harmon THE BIRTHDAY WISH 2017 Prod: J. Abounader, P. DeLuise, H. Kahn, C. Kretz, Front Street Pictures, The Hallmark Channel M. Young, Dir: Peter DeLuise COLD ZONE 2017 Prod: Costa Vassos 5Digital Media Dir: John MacCarthy RING OF DECEPTION 2017 Prod: T. Berry, D. DeCrane, N. Reid, G. LaPlante, Reel One International, Lifetime Television Dir: Scott Belyea PSYCHO WEDDING CRASHER 2017 Prod: T. -

To Download The

4 x 2” ad EXPIRES 10/31/2021. EXPIRES 8/31/2021. Your Community Voice for 50 Years Your Community Voice for 50 Years RRecorecorPONTE VEDVEDRARA dderer entertainmentEEXTRATRA! ! Featuringentertainment TV listings, streaming information, sports schedules,X puzzles and more! E dw P ar , N d S ay ecu y D nda ttne August 19 - 25, 2021 , DO ; Bri ; Jaclyn Taylor, NP We offer: INSIDE: •Intimacy Wellness New listings •Hormone Optimization and Testosterone Replacement Therapy Life for for Netlix, Hulu & •Stress Urinary Incontinence for Women Amazon Prime •Holistic Approach to Weight Loss •Hair Restoration ‘The Walking Pages 3, 17, 22 •Medical Aesthetic Injectables •IV Hydration •Laser Hair Removal Dead’ is almost •Laser Skin Rejuvenation Jeffrey Dean Morgan is among •Microneedling & PRP Facial the stars of “The Walking •Weight Management up as Season •Medical Grade Skin Care and Chemical Peels Dead,” which starts its final 11 starts season Sunday on AMC. 904-595-BLUE (2583) blueh2ohealth.com 340 Town Plaza Ave. #2401 x 5” ad Ponte Vedra, FL 32081 One of the largest injury judgements in Florida’s history: $228 million. (904) 399-1609 4 x 3” ad BY JAY BOBBIN ‘The Walking Dead’ walks What’s Available NOW On into its final AMC season It’ll be a long goodbye for “The Walking Dead,” which its many fans aren’t likely to mind. The 11th and final season of AMC’s hugely popular zombie drama starts Sunday, Aug. 22 – and it really is only the beginning of the end, since after that eight-episode arc ends, two more will wrap up the series in 2022.