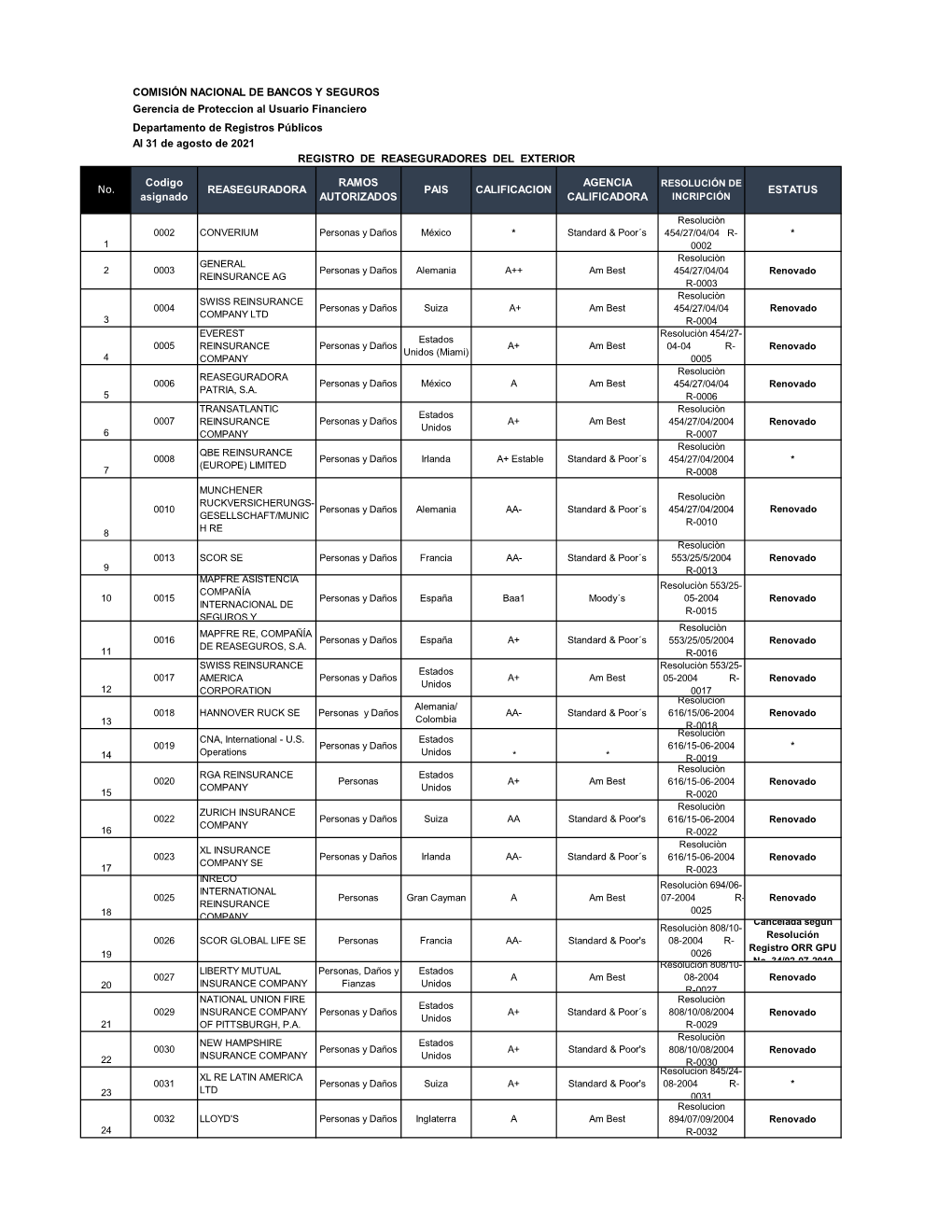

Reaseguradoras

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Insurance Stock Aggregate Email

GLOBAL INSURANCE STOCK REVIEW INSURANCE STOCKS IN 2017 RETURNS BY SECTOR Index / Sector | # of Companies * Weighted Return Global insurance stocks performed in MSCI ACWI IMI | 9,475 25.50% line with overall world equity markets in 2017, with the IIS aggregate’s Insurance | 226 25.22% 25.2% gain falling just short of the MSCI index’s 25.5% advance. There P&C | 83 19.52% were significant variances, however, with respect to regional, size and L&H | 70 32.55% industry sector performance. Multi-line | 45 23.84% Large Market Capitalization insurance Reinsurance | 17 9.24% issues soared 33% last year, while Small Cap stocks added just 7%. Brokers | 11 22.65% Investors have shown a marked preference for the highly liquid shares 0% 10% 20% 30% 40% of larger companies, including RETURNS BY MARKET CAP insurance companies. Investors also Market Cap | # of Companies showed favor toward international insurers last year. The leading regions Small | 42 6.91% of the world for insurance stocks were Small/Medium | 43 19.77% Africa (+43%), Middle East (+38%) and Europe (+35%), while US issues Medium | 55 24.75% gained just 9%. Medium/Large | 46 23.12% Large | 40 33.33% 0% 10% 20% 30% 40% In terms of industry sectors, the top performing areas of the industry were RETURNS BY MARKET TYPE Life & Health, which gained 33% and Market Type | # of Companies Multi Line, up 24%. Nonlife related US | 92 9.12% issues had lower returns, with Property & Casualty up 20% and Developed | 83 31.27% catastrophe-plagued Reinsurers up only 9%. -

Press Release April 2021 P&C Renewals

Press Release April 15 , 2021 - N° 8 April 2021 P&C Renewals SCOR performs strongly at the April 1, 2021, renewals, growing reinsurance premiums by 14.3% and building on the continued firming of the market observed in January At the April 1, 2021, reinsurance renewals1, SCOR performed strongly, benefiting from the continued improvements in pricing and terms & conditions already seen during the January renewals. SCOR grew its gross premiums up for renewal by 14.3%2 at constant exchange rates3 to EUR 600 million, with a 4.3% overall increase in pricing. The technical profitability of the portfolio benefited from rate-on-rate compounding effects after last year’s price increases. These continued improvements in pricing and terms & conditions are fully in line with the positive outlook set in September 2020 at the Investor Day and already observed in January. The bulk of the portfolio renewed on April 1 (64%) is in the Asia-Pacific region, of which Japan and India are the most significant markets (each accounting for approximately 28-29% of total premiums up for renewal): • In Japan, SCOR grew premiums by 3% at constant exchange rates to EUR 156 million, benefiting from significant price increases, while partially redeploying its capacity away from frequency-affected layers. Fully leveraging its deep client relationships and the strength of its position on this market, SCOR benefited from price increases of 12.3% year-on-year on Japanese CAT excess-of-loss programs, accelerating its payback from the 2018 and 2019 typhoon losses. • Leveraging its Tier 1 position in India as well as positive market conditions in the country, SCOR achieved significant premium growth of +21% at constant exchange rates, reaching EUR 178 million. -

Summarized-Year-End-2020-LH.Pdf

Summarized Year-End 2020 Canadian Life/Health/Fraternal Insurance Results Dollar amounts in thousands of Canadian Dollars. Released March 22, 2021 msaresearch.com For extremely detailed year-end 2020 financial data on these companies please refer to the MSA Researcher Life/Health Software Platform by logging in at www.msaresearch.com YoY% YoY% Benefits and YoY% YoY% Comprehensive YoY% LICAT or LIMAT MSA Code Company Group Net Premiums Change Total Revenue Change Expenses Change Net Income Change Income Change Ratio FLC001 ACTRA Fraternal Benefit Society 17,914 4% 27,637 -7% 25,980 -2% 1,657 -49% 2,220 19% 187.69 LHB002 Aetna Life Insurance Company 20,975 20% 23,114 16% 20,817 26% 1,747 -39% 4,956 10% 644.00 LHB039 Allianz Life Insurance Company of North America 113 -12% 595 -16% 1,869 1068% -923 -314% -281 -137% 576.83 LHC002 Allstate Life Insurance Company of Canada Allstate 0 41 -2% 54 4% -13 -30% 22 16% LHB004 American Bankers Life Assurance Company of Florida 105,951 -1% 118,903 3% 93,443 -6% 19,379 53% 19,379 53% 644.00 LHB006 American Health and Life Insurance Company 12,520 -34% 13,627 -32% 8,857 -34% 3,621 -37% 4,977 -21% 576.83 LHB005 American Income Life Insurance Company 151,463 6% 171,775 7% 152,343 29% 19,389 -55% 51,603 -34% 164.53 LHC055 Assurant Life of Canada 256,525 -8% 475,501 -1% 449,348 -3% 19,175 48% 19,175 48% 151.39 LHB094 AWP Health & Life SA 10,808 7906% 11,053 3876% 12,104 2061% -1,122 -432% -886 -347% 265.27 LHB015 AXA Equitable Life Insurance Company 5,016 -13% 7,004 -9% -10,840 -377% 17,844 367% 20,654 302% -

Financial Condition Report 2019 Scor Switzerland Ag Contents

FINANCIAL CONDITION REPORT 2019 SCOR SWITZERLAND AG CONTENTS 01 06 MANAGEMENT SUMMARY 4 VALUATION 22 02 07 BUSINESS ACTIVITIES 6 CAPITAL MANAGEMENT 28 03 08 PERFORMANCE 8 SOLVENCY 30 3.1 Technical Result 9 8.1 Internal Model 31 3.2 Net Investment Income 10 8.2 Target Capital 32 3.3 Other Income and Expenses 11 8.3 Risk-Bearing Capital 34 8.4 Solvency Ratio 34 04 CORPORATE GOVERNANCE 09 AND RISK MANAGEMENT 12 APPENDICES 36 4.1 Corporate Governance 13 Appendix A: Annual Report 2019 SCOR Switzerland AG 4.2 Risk Management 14 including the Report of the Statutory Auditors 37 Appendix B: Quantitative Templates 37 05 RISK PROFILE 16 5.1 Insurance Risk 18 5.2 Market Risk 19 5.3 Credit Risk 19 5.4 Operational Risk 20 5.5 Risk concentrations 21 5.6 Reinsurance and Risk Mitigating Techniques 21 5.7 Other Risk 21 01 MANAGEMENT SUMMARY 4 SCOR Financial Condition Report 2019 - SCOR Switzerland AG MANAGEMENT SUMMARY 01 MANAGEMENT SUMMARY SCOR Switzerland AG (hereinafter “the Company”) is The outbreak of COVID-19 is a major global event that the legal operating entity of SCOR, an independent will have health, societal, and economic impacts. Even global tier-1 reinsurance company, in Switzerland. It is with appropriate macroeconomic policies through licensed and supervised by the Swiss Financial Market well-targeted stimulus and public policies with effi- Supervisory Authority (“FINMA”) and operates in the cient containment measures, the damage to overall Property & Casualty (P&C) reinsurance segment. economic growth will be significant. The Company reports a profit for the financial year There is considerable uncertainty about the potential 2019 of EUR 89.2 million as compared to EUR 74.9 impact of the pandemic on the company based upon million in 2018. -

2019 Insurance Fact Book

2019 Insurance Fact Book TO THE READER Imagine a world without insurance. Some might say, “So what?” or “Yes to that!” when reading the sentence above. And that’s understandable, given that often the best experience one can have with insurance is not to receive the benefits of the product at all, after a disaster or other loss. And others—who already have some understanding or even appreciation for insurance—might say it provides protection against financial aspects of a premature death, injury, loss of property, loss of earning power, legal liability or other unexpected expenses. All that is true. We are the financial first responders. But there is so much more. Insurance drives economic growth. It provides stability against risks. It encourages resilience. Recent disasters have demonstrated the vital role the industry plays in recovery—and that without insurance, the impact on individuals, businesses and communities can be devastating. As insurers, we know that even with all that we protect now, the coverage gap is still too big. We want to close that gap. That desire is reflected in changes to this year’s Insurance Information Institute (I.I.I.)Insurance Fact Book. We have added new information on coastal storm surge risk and hail as well as reinsurance and the growing problem of marijuana and impaired driving. We have updated the section on litigiousness to include tort costs and compensation by state, and assignment of benefits litigation, a growing problem in Florida. As always, the book provides valuable information on: • World and U.S. catastrophes • Property/casualty and life/health insurance results and investments • Personal expenditures on auto and homeowners insurance • Major types of insurance losses, including vehicle accidents, homeowners claims, crime and workplace accidents • State auto insurance laws The I.I.I. -

Calificaciones Crediticias AM Best

AM Best Mayo 2021* Calificaciones Crediticias AM Best SINCE 1899 Contiene publicadas Best’s (re) calificaciones de seguros en más de 90 países, excluyendo Estados Unidos. *Las calificaciones de crédito incluidas son efectivas a partir del 30 de abril de 2021. Calificaciones Crediticias AM Best Total de Compañias Calificadas por PaÍs Alemania . 22 Kenia . 3 Anguila . 2 Kuwait . 5 Antigua y Barbuda . 1 Líbano . 3 Argelia . 1 Liechtenstein . 3 Argentina . 4 Luxemburgo . 12 Australia . 8 Macao . 4 Azerbaiyán . 1 Malasia . 8 Bahamas . 8 Malta . 6 Barbados . 21 Marruecos . 1 Baréin . 9 Mauricio . 1 Bélgica . 7 México . 34 Belize . 1 Micronesia, Estados Federados de . 1 Bermuda . 122 Mongolia . 1 Bosnia Herzegovina . 1 Mozambique . 1 Brasil . 8 Nigeria . 4 Canadá . 144 Noruega . 1 Catar . 3 Nueva Zelanda . 33 Chile . 1 Omán . 1 China . 14 Países Bajos . 2 Corea del Sur . 13 Pakistán . 3 Costa Rica . 2 Panamá . 11 Curazao . 1 Perú . 3 Ecuador . 1 Polonia . 1 Egipto . 5 Portugal . 1 El Salvador . 1 Puerto Rico . 27 Emiratos Árabes Unidos . 16 Reino Unido . 49 Eslovenia . 3 República Checa . 1 España . 12 República Dominicana . 1 Fiji . 1 Rusia . 4 Filipinas . 5 Serbia, Republic Of . 1 Francia . 12 Sierra Leone . 1 Ghana . 1 Singapur . 16 Gibraltar . 4 Sn . Maarten . 1 Guam . 6 St . Kitts e Nevis . 1 Guatemala . 5 Sta . Lucia . 1 Guernsey . 8 Sudáfrica . 1 Honduras . 1 Suecia . 3 Hong Kong . 18 Suiza . 17 India . 2 Tailandia . 5 Indonesia . 4 Taiwán . 7 Irlanda . 26 Togo . 1 Isla de Man . 1 Trinidad y Tobago . 4 Islas Caimán . 23 Túnez . 1 Islas Vírgenes Británicas . 1 Turks and Caicos . -

MRM Newsletter Shareholders, Investors, Analysts

JULY 2013 MRM Newsletter Shareholders, investors, analysts In this issue of the MRM Newsletter: Dear readers and shareholders, Q Interview with Jacques Blanchard, Chief Executive It is with pleasure that I am writing to you for the first time in the MRM Officer of MRM Newsletter and have the opportunity to outline the new prospects opening up for your company. Q Recapitalisation of MRM and restructuring of its balance MRM’s successful recapitalisation operation and the arrival of SCOR SE sheet as majority shareholder were made possible thanks to the support of MRM Q MRM’s new governance shareholders and the participation of its bondholders. The interests of all parties concerned - including existing shareholders before the completion of the recapitalisation operation, bondholders turned into shareholders and SCOR SE - have now been aligned. For more information: Press releases of 29 May 2013 Coupled with the restructuring of the company’s bank debt carried out at the same time, the recapitalisation operation allowed us to reduce Q Successful recapitalisation MRM’s gearing significantly and improve its financial structure. I would like operation for MRM with to praise the work done by MRM’s Board of Directors, as well as the SCOR SE becoming energy applied by Jacques Blanchard in achieving this result. shareholder with a 59.9% stake On 29 May 2013, the Board of Directors met for the first time in its new configuration. New governance Q Appointment of François de principles have been adopted, including in particular the separation of the roles of Chairman of the Board Varenne as Chairman of and Chief Executive Officer of MRM, as well as the creation of a Strategic Committee. -

Insurance-Linked Securities Alternative Markets Find Growth Through Innovation

Aon Benfield Insurance-Linked Securities Alternative Markets Find Growth Through Innovation September 2016 Risk. Reinsurance. Human Resources. Aon Securities Inc. and Aon Securities Limited (collectively, “Aon Securities”) provide insurance and reinsurance clients with a full suite of insurance-linked securities products, including catastrophe bonds, contingent capital, sidecars, collateralized reinsurance, industry loss warranties, and derivative products. As one of the most experienced investment banking firms in this market, Aon Securities offers expert underwriting and placement of new debt and equity issues, financial and strategic advisory services, as well as a leading secondary trading desk. Aon Securities’ integration with Aon Benfield’s reinsurance operation expands its capability to provide distinctive analytics, modeling, rating agency, and other consultative services. Aon Benfield Inc., Aon Securities Inc. and Aon Securities Limited are all wholly-owned subsidiaries of Aon plc. Securities advice, products and services described within this report are offered solely through Aon Securities Inc. and/or Aon Securities Limited. Foreword It is my pleasure to bring to you the ninth edition of Aon Securities’ annual Insurance-Linked Securities (ILS) report. The study aims to offer an authoritative review and analysis of the ILS asset class, and an overview of mergers and acquisitions activity, which represent two key areas of focus for our team. Along with our quarterly ILS Updates, the report is intended to be an important and useful reference document, both for ILS market participants and those with an active interest in the sector. Unless otherwise stated, its analyses cover the 12-month period ending June 30, 2016, during which time substantial progress was made in the ILS market. -

Corporate Structuresof of Independent Independent – Continued Insurance Adjusters, Adjusters Inc

NEW YORK PENNSYLVANIANEW YORK New York Association of Independent Adjusters, Inc. PennsylvaniaNew York Association AssociationCorporate of of Independent Independent Structures Insurance Adjusters, Adjusters Inc. 1111 Route 110, Suite 320, Farmingdale, NY 11735 1111 Route 110,110 Suite Homeland 320, Farmingdale, Avenue NY 11735 E-Mail: [email protected] section presents an alphabetical listing of insurance groups, displaying their organizational structure. Companies in italics are non-insurance entities. The effective date of this listing is as of July 2, 2018. E-Mail:Baltimore, [email protected] MD 21212 www.nyadjusters.org www.nyadjusters.orgTel.: 410-206-3155 AMB# COMPANY DOMICILEFax %: OWN 215-540-4408AMB# COMPANY DOMICILE % OWN 051956 ACCC HOLDING CORPORATION Email: [email protected] AES CORPORATION 012156 ACCC Insurance Company TX www.paiia.com100.00 075701 AES Global Insurance Company VT 100.00 PRESIDENT 058302 ACCEPTANCEPRESIDENT INSURANCE VICECOS INC PRESIDENT 058700 AETNA INC. VICE PRESIDENT Margaret A. Reilly 002681 Acceptance Insurance Company Kimberly LabellNE 100.00 051208 Aetna International Inc CT 100.00 Margaret A. Reilly PRESIDENT033722 Aetna Global Benefits (BM) Ltd Kimberly BermudaLabell 100.00 033652 ACCIDENT INS CO, INC. HC, INC. 033335 Spinnaker Topco Limited Bermuda 100.00 012674 Accident Insurance Company Inc NM Brian100.00 Miller WEST REGIONAL VP 033336 Spinnaker Bidco Limited United Kingdom 100.00 058304 ACMATVICE CORPORATION PRESIDENT 033337 Aetna Holdco (UK) LimitedEXECUTIVEWEST REGIONAL SECRETARYUnited Kingdom VP 100.00 050756 ACSTAR Holdings Inc William R. WestfieldDE 100.00 078652 Aetna Insurance Co Ltd United Kingdom 100.00 010607 ACSTARDavid Insurance Musante Company IL 100.00 091442 Aetna Health Ins Co Europe DAC WilliamNorman R. -

Authorized Reinsurers-12312018.Xlsx

Captive Division, 89 Main Street, Montpelier, VT 05620 ‐ 3101 (p) 802‐828‐3304 http://www.dfr.vermont.gov/ STATE OF VERMONT ACCREDITED/*REINSURERS APPROVED FOR CAPTIVES As of 12/31/2018 REINSURER CITY STATE COUNTRY category * ABU DHABI NATIONAL INSURANCE COMPANY United Arab Emirates Captive Approved * AIG AUSTRALIA LIMITED Sydney Australia Captive Approved * AIG EUROPE LIMITED London England Captive Approved * AIOI NISSAY DOWA INSURANCE CO., LTD. Tokyo Japan Captive Approved * AIU INSURANCE COMPANY, LTD. Tokyo Japan Captive Approved * ALLIANZ FIRE AND MARINE INSURANCE JAPAN LIMITED Tokio Japan Captive Approved * ALLIANZ GLOBAL CORPORATE & SPECIALTY FRANCE Paris France Captive Approved * ALLIANZ GLOBAL CORPORATE & SPECIALTY SE Munich Germany Captive Approved * ALLIANZ RISK TRANSFER AG Zurich Switzerland Captive Approved * ALLIANZ VERSICHERUNGS‐AKTIENGESELLSCHAFT Munich Germany Captive Approved * ALLIED WORLD ASSURANCE COMPANY (EUROPE) LTD. Dublin Ireland Captive Approved ALLIED WORLD ASSURANCE COMPANY US, INC. Boston MA United States Accredited * ALLIED WORLD ASSURANCE COMPANY, LTD Hamilton Bermuda Captive Approved * ALPHA INSURANCE S.A. Brussels Brussels Captive Approved * AMERICAN EMPIRE SURPLUS LINES INSURANCE COMPANY Wilmington DE United States Captive Approved AMERICAN HALLMARK INSURANCE COMPANY OF TEXAS Forth Worth TX United States Accredited * AMERICAN INTERNATIONAL REINSURANCE CO. LTD. Hamilton Bermuda Captive Approved * AMERICAN SAFETY INDEMNITY COMPANY Atlanta GA United States Captive Approved * AMERICAN SAFETY REINSURANCE LTD. Hamilton Bermuda Captive Approved * AMLIN EUROPE N.V. Amstelveen Netherlands Captive Approved * ARCH INSURANCE COMPANY (EUROPE) LTD. London England Captive Approved * ARCH REINSURANCE EUROPE UNDERWRITING LTD. Dublin Ireland Captive Approved * ARCH SPECIALTY INSURANCE COMPANY Omaha NE United States Captive Approved * ARCHER INSURANCE LIMITED St. Peter Port Guernsey Captive Approved * ARGO RE. LTD. Hamilton Bermuda Captive Approved * ARIA (SAC) LTD. -

NT International Value - TF

NT International Value - TF Schedule of Investments as of 2021-06-30 (Unaudited) Holding Shares/Principal Amount Market Value ($) TotalEnergies SE 560,387 25,356,399 Rio Tinto PLC 277,828 22,832,589 Daimler AG 255,296 22,797,491 Allianz SE 85,225 21,254,669 Cie Generale des Etablissements Michelin SCA 114,437 18,253,108 Aviva PLC 3,075,738 17,246,603 Novartis AG 186,082 16,974,560 Banco Bilbao Vizcaya Argentaria SA 2,662,762 16,508,819 Schneider Electric SE 103,456 16,278,306 Randstad NV 210,184 16,077,090 KDDI Corp 506,600 15,815,560 Brenntag SE 167,771 15,602,414 Investor AB 666,816 15,379,695 Toyota Motor Corp 167,100 14,618,804 DBS Group Holdings Ltd 659,109 14,616,902 Koninklijke Ahold Delhaize NV 488,674 14,528,529 BHP Group PLC 479,903 14,121,091 Kuehne + Nagel International AG 40,966 14,031,304 United Overseas Bank Ltd 722,300 13,874,264 Cie de Saint-Gobain 206,668 13,612,164 Tenaris SA 1,245,397 13,575,815 Evraz PLC 1,656,302 13,545,543 Siemens AG 84,240 13,348,667 Mitsubishi Electric Corp 898,800 13,058,068 Barclays PLC 5,396,655 12,757,354 Bayerische Motoren Werke AG 120,022 12,711,858 Wolters Kluwer NV 126,396 12,698,936 BOC Hong Kong Holdings Ltd 3,645,500 12,369,403 Brother Industries Ltd 596,900 11,922,942 Vodafone Group PLC 7,075,864 11,860,927 Partners Group Holding AG 7,816 11,850,624 Publicis Groupe SA 181,558 11,613,802 Iida Group Holdings Co Ltd 434,700 11,201,388 Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen 40,891 11,199,374 Legrand SA 103,218 10,925,980 Sony Group Corp 111,900 10,903,672 Royal Dutch -

2019 SOA China Symposium Attendee List by Company Name

2019 SOA China Symposium Attendee List by Company Name As of June 11, 2019 Dennis Wang Jack Lee Jack Hsu ABC Life Insurance Company Aegon Asia Aegon THTF Beijing, BEIJING China Hong Kong, Hong Kong Shanghai, Hong Kong Gongqiang Hu Xijun Ji Zenghuang Zheng Aegon THTF Life Insurance Co.,Ltd Aegon THTF Life Insurance Co.,Ltd Aegon THTF Life Insurance Shanghai City, SHANGHAI China Shanghai City, SHANGHAI China Company Shanghai, SHANGHAI China Jianrong Chen Frank Fu Hua Su AEGON-CNOOC Life Insurance Co Aegonthtf Aegonthtf Life Insurance Co. Ltd Shanghai, SHANGHAI China Shanghai City, SHANGHAI China Shanghai City, China Haihua Du Zizi Zhang Hai Chen Aetna International AIA AIA China Shanghai City, SHANGHAI China Shanghai, SHANGHAI China Shanghai City, SHANGHAI China Heng Chen Pengzhi Geng Sherry Huang AIA China AIA China AIA China Shanghai City, SHANGHAI China Shanghai City, SHANGHAI China Shanghai, SHANGHAI China Leo Ng Youquan Qi John Wei AIA China AIA China AIA China Shanghai City, SHANGHAI China Shanghai City, SHANGHAI China Shanghai City, SHANGHAI China Feixiang Xu Janet Yu Ken Zhan AIA China AIA China AIA China Shanghai City, SHANGHAI China Shanghai City, SHANGHAI China Shanghai, SHANGHAI China Yong Zhang Guangsheng Wei Benny Zhang AIG Business Consulting American International Assurance American International Assurance Beijing City, BEIJING China Co Ltd Co Ltd Shanghai, SHANGHAI China Shanghai, SHANGHAI China Zhi Yong ZhiYong Sifang Zhang Chen Li Anbang Insurance Company Aon Beijing Life Insurance CO.,LTD. Beijing, BEIJING China Causeway