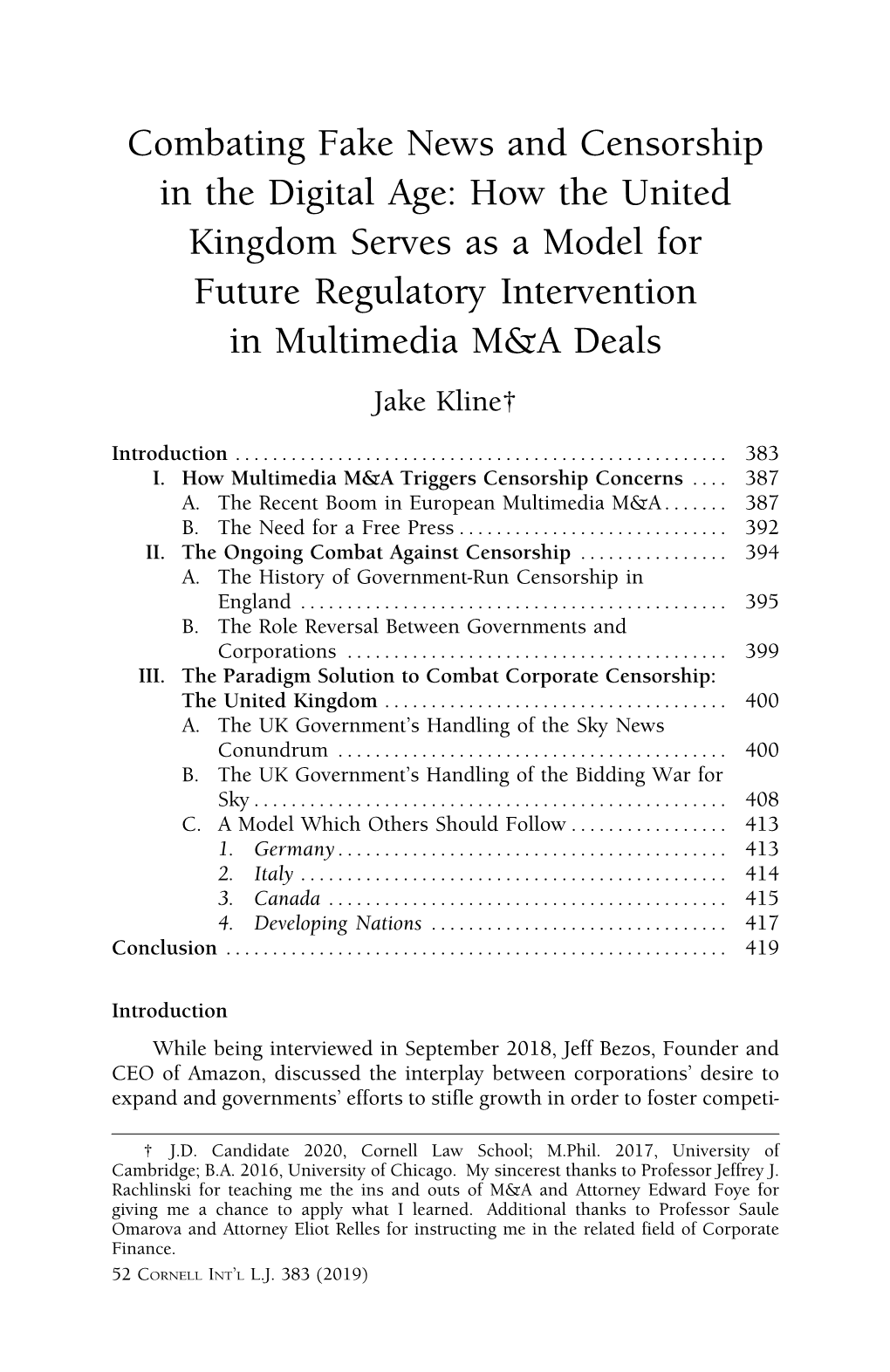

Combating Fake News and Censorship In

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Amazon's Antitrust Paradox

LINA M. KHAN Amazon’s Antitrust Paradox abstract. Amazon is the titan of twenty-first century commerce. In addition to being a re- tailer, it is now a marketing platform, a delivery and logistics network, a payment service, a credit lender, an auction house, a major book publisher, a producer of television and films, a fashion designer, a hardware manufacturer, and a leading host of cloud server space. Although Amazon has clocked staggering growth, it generates meager profits, choosing to price below-cost and ex- pand widely instead. Through this strategy, the company has positioned itself at the center of e- commerce and now serves as essential infrastructure for a host of other businesses that depend upon it. Elements of the firm’s structure and conduct pose anticompetitive concerns—yet it has escaped antitrust scrutiny. This Note argues that the current framework in antitrust—specifically its pegging competi- tion to “consumer welfare,” defined as short-term price effects—is unequipped to capture the ar- chitecture of market power in the modern economy. We cannot cognize the potential harms to competition posed by Amazon’s dominance if we measure competition primarily through price and output. Specifically, current doctrine underappreciates the risk of predatory pricing and how integration across distinct business lines may prove anticompetitive. These concerns are height- ened in the context of online platforms for two reasons. First, the economics of platform markets create incentives for a company to pursue growth over profits, a strategy that investors have re- warded. Under these conditions, predatory pricing becomes highly rational—even as existing doctrine treats it as irrational and therefore implausible. -

We Need Net Neutrality As Evidenced by This Article to Prevent Corporate

We need Net Neutrality as evidenced by this article to prevent corporate censorship of individual free speech online, whether its AOL censoring DearAOL.com emails protesting their proposed email fee for prioritized email delivery that evades spam filters, AT&T censoring Pearl Jam which this article is about, or Verizon Wireless censoring text messages from NARAL Pro Choice America. If the FCC won't reclassify broadband under Title II the FTC should regulate Net Neutrality, also the DOJ should investigate corporations engaging in such corporate censorship and if they are violating competition laws break them up. Pearl Jam came out in favor of net neutrality after AT&T censored a broadcast a performance they did in Chicago last Sunday. I guess AT&T didn?t like Pearl Jam?s anti-Bush message. I don?t know if Pearl Jam?s sudden embrace of net neutrality is out of ignorance, or if it?s retaliation. It doesn?t really matter because it should help bring some more awareness to the issue. Here?s the issue with net neutrality, in a nutshell. AT&T wants to charge companies like Amazon, eBay, and Google when people like you and me access their web pages. And if the companies don?t pay, AT&T will make the web sites slower. The idea is that if one company doesn?t pay the fees but a competitor does, AT&T customers will probably opt to use the faster services. IT"S WORTH NOTING: Without content, an Internet connection has no value. Proponents say AT&T built the infrastructure, so they have the right to charge whoever uses it. -

Edri Submission to UN Special Rapporteur David Kaye's Call on Freedom of Expression and the Private Sector in the Digital Age

EDRi submission to UN Special Rapporteur David Kaye's call on freedom of expression and the private sector in the digital age Introduction EDRi is a not-for-profit association of digital civil rights organisations. Our objectives are to promote, protect and uphold civil rights in the field of information and communication technology. European Digital Rights (EDRi) welcomes the UN Special Rapporteur on freedom of opinion and expression David Kaye’s public consultation on the role of ICT companies vis-à-vis freedom of expression in the digital environment to identify: I. the categories of actors in the ICT sector whose activities implicate the freedom of opinion and expression; II. the main legal issues raised for freedom of opinion and expression within the ICT sector; and III. the conceptual and normative work already done to develop corporate responsibility and human rights frameworks in these spaces, including governmental, inter-governmental, civil society, corporate and multistakeholder efforts. I. ICT actors with a potential to impact freedom of expression and opinion In order to communicate online, it is necessary to rely on a chain of different service providers, often based in different jurisdictions and with whom one may have no direct relationship at all. For example, if "zero-rating" or even data caps are imposed by Internet access providers in a country and you have no organisational and financial capacity to be "zero-rated", your ability to communicate with people that are using such restricted services is limited and there is no "leverage" with the ISPs that connect your intended audience with the Internet. -

Discovery, GOLFTV Und Tiger Woods Präsentieren Die 2. Staffel Der Exklusiven Serie “MY GAME: TIGER WOODS”

Discovery, GOLFTV und Tiger Woods präsentieren die 2. Staffel der exklusiven Serie “MY GAME: TIGER WOODS” • Vom Tee zum Grün: "MY GAME: TIGER WOODS - SHOTMAKING SECRETS" bietet den Fans ein einzigartiges Tutorial zu jedem Schlag des Golf-Superstars • Gefilmt im Juni diesen Jahres im Dye Preserve in Jupiter, Fla. • Die Serie ist bei GOLFTV powered by PGA TOUR abrufbar; die erste Episode ist am 20. August frei verfügbar Die 2. Staffel “MY GAME: TIGER WOODS” mit Golfstar Tiger Woods (© Discovery Golf) London/München, 17. August 2020 – Golffans können sich auf neue Folgen der exklusiven Masterclass-Serie “MY GAME: TIGER WOODS” freuen: Discovery Golf und GOLFTV powered by PGA TOUR geben heute bekannt, dass die zweiten Staffel am 20. August weltweit Premiere feiert. In zehn Episoden zeigt Tiger Woods seinen Fans zum ersten Mal seine „Shotmaking Secrets“. Bereits in der ersten Staffel (2019), “MY GAME: TIGER WOODS – INSIDE THE MIND OF A CHAMPION”, gewährt Tiger Woods seinen Fans noch nie gezeigte Einblicke in seine Gedankenwelt und sein Spiel. Nun können sich Golf-Enthusiasten auf noch mehr Inhalte, Trainingsmethoden und Tipps von der Golf-Ikone freuen. In der zweiten Staffel thematisiert der 15-fache Major-Champion seine unvergleichbare Schwungtechnik und verrät die Geheimnisse, die ihn zu einem der besten Spieler aller Zeiten gemacht haben. Die Inhalte der Serie werden den Fans klar und einprägsam vermittelt, sodass sie wertvolle Golf-Lektionen und -tipps erhalten, welche sie auf ihr eigenes Spiel anwenden können. “MY GAME: TIGER WOODS - SHOTMAKING SECRETS" wurde im Juni 2020 auf dem Golfkurs des Dye Preserve in Jupiter, Fla., gefilmt, wobei strenge Covid-19- Sicherheitsvorkehrungen für die Produktion getroffen wurden. -

Lucas Bjerregaard Debuterer På PGA TOUR

Foto: Richard Heathcote/Getty Images 2019-02-28 13:48 CET Lucas Bjerregaard debuterer på PGA TOUR Der er PGA TOUR-debut til Lucas Bjerregaard i denne uges The Honda Classic, hvor danskeren har fået en invitation, og dermed spiller i USA for første gang siden US Open i 2015. Hele turneringen kan ses på GOLFTV ”powered by PGA TOUR”, inklusiv fuld dækning af finalerunderne lørdag og søndag. GOLFTV er den nye streamingtjeneste, som giver adgang til live og on-demand dækning af PGA TOUR via computer, mobil, tablet og Chromecast. Der er dansk deltagelse blandt de 144 spillere i The Honda Classic på PGA National i Palm Beach Gardens, Florida. Efter sidste uges World Golf Championship (WGC) i Mexico har Bjerregaard fået en invitation til PGA TOUR. Det bliver Lucas Bjerregaards første start i en ”almindelig” PGA TOUR turnering, efter han tidligere har spillet US Open og World Golf Championship turneringer med deltagelse af hele verdenseliten. Bjerregaard skal op mod flere af verdens allerbedste spillere, blandt andet den forsvarende mester Justin Thomas, Brooks Koepka og Rickie Fowler. Tre af verdens 10 bedste spillere er således til start, men også sidste års nummer to og tre, Luke List og Alex Norén er med på PGA National i Palm Beach Gardens i Florida. The Honda Classic har otte tidligere vindere af turneringen med i feltet, deriblandt Ernie Els, der i sin rolle af kaptajn for det Internationale President’s Cup hold, også skal holde øje med andet end sit eget spil. Det får han også rig mulighed for de to første dage, hvor Els spiller sammen med australske Adam Scott og Thailands Kiradech Aphibarnrat, der begge kandiderer til holdet. -

Protokoll Der 15. Sitzung Des Medienrats Am 11.04.2019

15. Sitzung des Medienrats der Bayerischen Landeszentrale für neue Medien am Donnerstag, dem 11. April 2019, 13:30 Uhr Vorsitz: Walter Keilbart Tagesordnung: Seite 1. Bericht des Vorsitzenden 1 2. Bericht des Präsidenten 2 3. Genehmigung der Niederschrift über die 14. Sitzung des Medienrats am 14.02.2019 5 4. Erlass von Satzungen und Richtlinien: Satzung zur Änderung der Finanzierungssatzung 5 5. Nachtrag zum Wirtschaftsplan 2019 6 6. Genehmigung von Angeboten und Zuweisung von Übertragungskapazi- täten: 10 6.1 Drahtloser Hörfunk Schweinfurt 10 6.2 Radio Schwabmünchen 11 6.3 7TV Joint Ventures GmbH – “7TV Sender/Fiction” (Arbeitstitel) 12 6.4 Discovery Communications Deutschland GmbH & Co. KG „HGTV”(Arbeitstitel) 13 6.5 AETN UK Germany GmbH – “Crime & Investigation EU” u. a. 14 6 6 Internetfernsehen “DeinLife” des JFF – Institut für Medienpädagogik 15 6.7 Lokales/regionales Fernsehen Unterfranken 16 6.8 Lokales/regionales Fernsehen Ingolstadt 20 7. Nachfolge in Senderechten 26 7.1 Radio Arabella 26 8. Positionspapier „Leitlinien Digitale Ethik“ 26 9. Bericht nach § 24 Abs. 2 der Geschäftsordnung 29 10. Verschiedenes 29 Die Sitzung ist öffentlich. * * * 15. Sitzung des Medienrats am 11.04.2019 Seite 1 Vorsitzender Keilbart eröffnet die 15. Sitzung des Medienrats und begrüßt den Vorsitzen- den des Verwaltungsrats, Herrn Nüssel, und alle Anwesenden. Er teilt mit, dass Herr Kust- ner, der den Bayerischen Bauernverband im Medienrat vertreten habe, zum Ende des Mo- nats April sein Amt nach sechs Jahren aus Alters- und gesundheitlichen Gründen niederle- gen wolle. Der Vorsitzende dankt Herrn Kustner für die zuverlässige und konstruktive Mit- arbeit im Medienrat und wünscht ihm für die Zukunft alles Gute. -

January 23, 2020 Volume 102 Number 03 the DUQUESNE DUKE PROUDLY SERVING OUR CAMPUS SINCE 1925

January 23, 2020 Volume 102 Number 03 THE DUQUESNE DUKE www.duqsm.com PROUDLY SERVING OUR CAMPUS SINCE 1925 Chuckle up: Comedy Club holds first event DU hosts workshops to help future entrepre- neurs River Chapdelaine staff writer Duquesne’s Small Business De- velopment Center, more com- monly known as SBDC, started its 2020 business workshops in early January. They are being hosted at Rockwell Hall Room 108 for anyone who is interested in starting up their own business and is curious to see what's need- ed in becoming an entrepreneur. SBDC is a non-profit organiza- tion that is federally funded by the Small Business Administra- tion (SBA) and, at the state level, by the Pennsylvania Department Griffin Sendek / Photo Editor of Community and Economic Sam Espirtu (far right), a senior music therapy major, performed at the Duquesne Comedy Club's event in the NiteSpot. Troy Smajda (standing middle) is the president of the Duquesne Comedy Club. This is their first event of the semester, with plans to hold one every month. see SBDC — page 2 Duquesne student helps Puerto Rican relief efforts the population of Puerto Rican Jessica Lincoln citizens at Duquesne is grow- staff writer ing extensively, and I think it’s important not only for us, the Ericka Correa was at home for Puerto Rican community here Christmas break when, on Dec. at Duquesne, to give back to our 28, her mother called her at- community on the island, but I tention to a story that had just think it’s important to spread broken on the Spanish-language awareness of what’s happening," news channels: a magnitude 4.7 Correa said. -

Media Oligarchs Go Shopping Patrick Drahi Groupe Altice

MEDIA OLIGARCHS GO SHOPPING Patrick Drahi Groupe Altice Jeff Bezos Vincent Bolloré Amazon Groupe Bolloré Delian Peevski Bulgartabak FREEDOM OF THE PRESS WORLDWIDE IN 2016 AND MAJOR OLIGARCHS 2 Ferit Sahenk Dogus group Yildirim Demirören Jack Ma Milliyet Alibaba group Naguib Sawiris Konstantin Malofeïev Li Yanhong Orascom Marshall capital Baidu Anil et Mukesh Ambani Rupert Murdoch Reliance industries ltd Newscorp 3 Summary 7. Money’s invisible prisons 10. The hidden side of the oligarchs New media empires are emerging in Turkey, China, Russia and India, often with the blessing of the political authorities. Their owners exercise strict control over news and opinion, putting them in the service of their governments. 16. Oligarchs who came in from the cold During Russian capitalism’s crazy initial years, a select few were able to take advantage of privatization, including the privatization of news media. But only media empires that are completely loyal to the Kremlin have been able to survive since Vladimir Putin took over. 22. Can a politician be a regular media owner? In public life, how can you be both an actor and an objective observer at the same time? Obviously you cannot, not without conflicts of interest. Nonetheless, politicians who are also media owners are to be found eve- rywhere, even in leading western democracies such as Canada, Brazil and in Europe. And they seem to think that these conflicts of interests are not a problem. 28. The royal whim In the Arab world and India, royal families and industrial dynasties have created or acquired enormous media empires with the sole aim of magnifying their glory and prestige. -

Information Commons - a Public Policy Report - by Nancy Kranich

- the - Information Commons - a public policy report - by Nancy Kranich THE FREE EXPRESSION POLICY PROJECT BRENNAN CENTER FOR JUSTICE at NYU SCHOOL OF LAW e Information Commons: A Public Policy Report © 2004. is report is covered by the Creative Commons “Attribution-No Derivs-NonCommercial” license; see http://creativecommons.org. It may be reproduced in its entirety as long as the Brennan Center for Justice, Free Expression Policy Project is credited, a link to the Project’s Web page is provided, and no charge is imposed. e report may not be reproduced in part or in altered form, or if a fee is charged, without our permission. Please let us know if you reprint. BRENNAN CENTER FOR JUSTICE at NYU SCHOOL OF LAW Democracy Program, Free Expression Policy Project 161 Avenue of the Americas, 12th floor New York NY 10013 Phone: (212) 998-6730 Web site: www.brennancenter.org Free Expression Policy Project: www.fepproject.org Author of the report: Nancy Kranich, Senior Research Fellow, Free Expression Policy Project, 2003-04 Editing: Marjorie Heins, Director, Free Expression Policy Project, 2000-04 Design: Jon Hecht table of contents EXECUTIVE SUMMARY............................................................................................ INTRODUCTION ....................................................................................................... I. OPPORTUNITIES AND CHALLENGES OF THE INFORMATION AGE.. Evolution of the Information Society................................................................... e Promise of the Internet and -

Corporate Censorship and Its Troubling Implications for the First Amendment

DePaul Law Review Volume 55 Issue 1 Fall 2005 Article 3 Can You Hear Me Now?- Corporate Censorship and Its Troubling Implications for the First Amendment William A. Wines Terence J. Lau Follow this and additional works at: https://via.library.depaul.edu/law-review Recommended Citation William A. Wines & Terence J. Lau, Can You Hear Me Now?- Corporate Censorship and Its Troubling Implications for the First Amendment , 55 DePaul L. Rev. 119 (2005) Available at: https://via.library.depaul.edu/law-review/vol55/iss1/3 This Article is brought to you for free and open access by the College of Law at Via Sapientiae. It has been accepted for inclusion in DePaul Law Review by an authorized editor of Via Sapientiae. For more information, please contact [email protected]. CAN YOU HEAR ME NOW?-CORPORATE CENSORSHIP AND ITS TROUBLING IMPLICATIONS FOR THE FIRST AMENDMENT William A. Wines & Terence J. Lau1 "[M]oney doesn't talk, it swears." -Bob Dylan2 "The problem of power is ... how to get men of power to live for the public rather than off the public." 3 -Robert F. Kennedy "[A] profound national commitment to the principle that debate on public issues should be uninhibited, robust, and wide-open . .. ." 4 -Justice William Brennan INTRODUCTION The "profound national commitment" to "debate on public issues" that Justice Brennan lovingly described in 1964 has recently been forced on life support. 5 Take, for example, Bill Maher's talk show, Politically Incorrect, which appeared for a few years on the ABC net- work. His show was cancelled by ABC in the summer of 20026 when several advertisers pulled out after Mr. -

Two-Time U.S. Open Winner Retief Goosen to Make PGA TOUR Champions Debut at Oasis Championship

FOR IMMEDIATE RELEASE Two-Time U.S. Open Winner Retief Goosen To Make PGA TOUR Champions Debut At Oasis Championship BOCA RATON, Florida – Retief Goosen always had a sense of good timing. His ability to produce clutch shots at key moments helped him win a pair of U.S. Opens and earn induction into this year’s World Golf Hall of Fame class. Goosen also is fortunate he turns 50 on Sunday, just in time for the South African to become eligible for the PGA TOUR Champions’ first full-field event. Goosen will make his debut at next week’s Oasis Championship at The Old Course at Broken Sound. “I know I’m going to have a blast,” Goosen said. “I’ve been thinking about playing on this tour for a long time.” The Oasis Championship also received commitments from former British Open champions Darren Clarke and Tom Lehman, who won the PGA TOUR Champions’ season-opening event in Hawaii for his 12th career win on the 50-and-older circuit. Lehman won the 1996 British Open and captured the 2011 Oasis Championship at Broken Sound. Goosen has won 33 worldwide events – seven on the PGA TOUR -- and spent more than 260 weeks in the top 100 in the world rankings from 2001-07, reaching as high as No. 3 in 2006. He played in six Presidents Cup competitions for the International Team and would have won more had he not battled chronic back problems that are a thing of the past. Goosen is still basking in last year’s announcement he would be inducted into the World Golf Hall of Fame the week of the U.S. -

Internet Content Regulation in Liberal Democracies. a Literature Review

Internet content regulation in liberal democracies. A literature review. Yana Breindl (Institute of Political Science, Georg-August-Universität Göttingen) DH Forschungsverbund – Working Papers zu Digital Humanities 2 Die Working Papers zu den Digital Humanities werden erstellt von Verbundpartnern des Göttingen Research Campus aus dem „Digital Humanities Forschungsverbund“, einem vom Niedersächsischen Ministerium für Wissenschaft und Kultur (MWK) und der VW-Stiftung geförderten und vom Göttingen Centre for Digital Humanities (GCDH) geleiteten Verbundprojekt (Laufzeit: Jan. 2012 – März 2015). Erschienen März 2013 Online: http://www.gcdh.de/en/publications/ Institut für Politikwissenschaft der Georg-August-Universität Göttingen [email protected] Dieses Werk bzw. sein Inhalt steht unter einer Creative Commons Lizenz (Namensnennung – Weitergabe unter gleichen Bedingungen 2.0 Deutschland). Abstract: This paper presents an overview of the literature on Internet content regulation in general and Internet blocking in particular as part of the research project on “Internet blocking in liberal democracies” of the Digital Humanities Research Collaboration at the Göttingen Centre for Digital Humanities. It starts by presenting the main debates about Internet regulation and governance of the last twenty years. Scholars of Internet governance remain divided about the role played by the nation-state in the digital realm as well as the disruptive potential of the Internet for society and politics in general. There is however broad consensus that new forms of regulation (e.g. “code as law”) have emerged and that private actors play an important part in Internet regulation. The report then assesses the challenges and opportunities presented by digital content for policy-makers before reviewing various points and techniques of control that have been implemented to deal with problematic content.